The BBVA share

Global economy is being severely affected by the COVID-19 pandemic, which has spread to most countries around the world and is affecting their economies in stages due to the lockdown measures, that restrict business, and impact consumer and business confidence. Although many countries in East Asia and Europe now seem to be over the worst of the pandemic and have reopened their economies, it is still spreading in much of the American continent. Governments and central banks have generally implemented fiscal and monetary stimulus measures, which are helping to mitigate the economic impact, but this will not prevent the global economy from entering in a recession throughout the year.

During the second quarter of 2020, the financial markets have generally remained stable due to the actions of the central banks in the developed countries (announcements of asset purchases, lending facilities, interest rate reductions) and various fiscal stimulus packages announced by governments. In addition, the relaxing of the lockdown taking place in most countries and the corresponding upturn in economic activity have contributed to improving economic confidence and activity. With respect to the latter, the indicators generally show that the contraction until April was sharper than expected, but that the improvement since May has been robust and relatively widespread, especially in the developed economies where support through the policies has been more significant and effective.

In terms of global growth, BBVA Research expects a V-shaped recovery in economic activity, although without reaching pre-crisis GDP levels. This recovery will be slower than expected and will vary across the different regions. BBVA Research's baseline scenario is based on the assumption that there will be further waves of infections until a vaccine or treatment for COVID-19 becomes available, without it resulting in strict lockdown measures. As a result, growth forecasts have been revised downward in 2020 and upward in 2021, with a higher cumulative loss of GDP over the two-year period, especially in emerging countries. More specifically, BBVA Research has adjusted its global growth forecast from -2.4% to around -3.1% in 2020 and from 4.8% to 5.1% in 2021. However, one should keep in mind that epidemiological, economic, financial and geopolitical factors will lead to uncertainty remaining at exceptionally high levels and this will be a source of risk to economic forecasts.

With regard to the banking system, in an environment in which much of the economic activity has been at a standstill for several months, banking services have played an essential role, fundamentally for two reasons: first, the banks have ensured the proper functioning of collections and payments for households and companies, thereby contributing to the maintenance of economic activity; second, the granting of new lending or the renewal of existing lending has reduced the impact of the economic slowdown on households and business incomes. In the current situation, it is very important to ensure that the temporary liquidity problems faced by companies do not become solvency problems, thus jeopardizing their survival and the jobs they create. As a result, the support provided by the banks during the months of lockdown and the public guarantees have been essential, as the banks have been the only source of financing for most of the companies.

Although in terms of profitability, European and Spanish banks are still far from the levels seen before the crisis, due mainly to their accumulation of capital and the low interest rate environment we have been experiencing for some time now, the financial institutions are facing this challenge from a healthy position since their solvency has been constantly improving since the 2008 crisis, with increased capital and liquidity buffers and therefore a greater capacity to lend.

The main stock market indexes had a positive performance during the second quarter of 2020, after the significant drop in March, due to the irruption of the COVID-19 global crisis. In Europe, the Stoxx Europe 600 index increased by 12.6% during the second quarter and in Spain, the Ibex 35 rose 6.6%. In the United States, the S&P 500 index rose by 20.0%, recovering most of the fall of the first quarter.

With regard to the banking sector indexes, they also have shown a positive performance in the second quarter of the year. The Stoxx Europe 600 Banks index, which includes banks in the United Kingdom, and the Euro Stoxx Banks, the banks index for the Eurozone, rose by 7.2% and 15.5%, respectively. In the United States, the S&P Regional Banks Select Industry Index increased by 17.8% during the quarter.

For its part, the BBVA share price increased by 5.1% in the quarter, closing June at €3.06. It is important to highlight that during the quarter, the BBVA share has discounted the 16 cents final dividend for the 2019 fiscal year. Including this dividend, the share would have risen by 10.6%.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-19)

BBVA

Stoxx Europe 600

Stoxx Banks

The BBVA share and share performance ratios

| 30-06-20 | 31-03-20 | |

|---|---|---|

| Number of shareholders | 891,944 | 876,785 |

| Number of shares issued (millions) | 6,668 | 6,668 |

| Closing price (euros) | 3.06 | 2.92 |

| Book value per share (euros) | 6.57 | 6.80 |

| Tangible book value per share (euros) | 5.87 | 5.78 |

| Market capitalization (millions of euros) | 20,430 | 19,440 |

| Yield (dividend/price; %) (1) | 8.5 | 8.9 |

(1) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

In terms of shareholder remuneration, on March 27th the European Central Bank recommended that at least until October 1,2020, credit institutions should refrain from distributing dividends or from making irrevocable commitments of paying them, as well as from buying back shares to remunerate shareholders. Consequently, the Board of Directors of BBVA resolved to modify for the financial year corresponding to 2020, the Dividend Policy of the Group, announced in the relevant event dated February 1,2017, determining as new Policy for 2020 not to pay any dividend amount corresponding to 2020 until uncertainties caused by COVID-19 disappear and, in any case, never before the end of such fiscal year.

Shareholder remuneration

(Euros per share)

Cash

As of June 30, 2020, the number of BBVA shares remained at 6.668 billion, held by 891,944 shareholders, of which 44.04% are Spanish residents and the remaining 55.96% are non-residents.

BBVA shares are included on the main stock market indexes, including the Ibex 35, and the Stoxx Europe 600 index, with a weighting of 5.4% and 0.3%, respectively at the closing of June of 2020. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 4.0% and the Euro Stoxx Banks index for the Eurozone with a weighting of 7.7%.

Finally, BBVA maintains a significant presence on a number of international sustainability indexes or Environmental, Social and Governance (ESG) indexes, which evaluate companies' performance in these areas. In September of 2019, BBVA continued to be included in the Dow Jones Sustainability Index (DJSI), the markets leading benchmark index, which measures the economic, environmental and social performance of the most valuables companies by market capitalization of the world, achieving the highest score in financial inclusion and occupational health and safety and the highest score in climate strategy, environmental reporting and corporate citizenship and philanthropy.

Group information

- Growth in operating income of 7.6% in the first six months (up 19.2% at constant exchange rates) driven by the net trading income (NTI) and a significant reduction in operating expenses, as a result of containment plans and the lower expenses derived from the lockdown. The result of the above was a significant improvement in the efficiency ratio.

- Impairment on financial assets increased mainly due to the deterioration of the macroeconomic scenario, resulting mostly from the impacts of COVID-19.

- As a result of the valuation of the goodwill of its subsidiaries, the Group estimated that there was an impairment in the United States, which was recorded under the heading "Other results" of the consolidated income statement as of March 31, 2020. This impairment represented an impact of -€2,084m in the net attributable profit and is mainly due to the negative impact from the updating of the macroeconomic scenario affected by the COVID-19 pandemic. This impact does not affect the tangible net equity, capital, or liquidity of the BBVA Group.

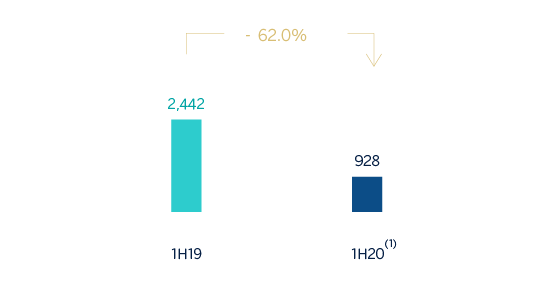

- Finally, the cumulative net attributable loss as of the close of June 2020 was -€1,157m. If the goodwill impairment in the United States is excluded from the year-on-year comparison, the Group's net attributable profit, compared to the same period of 2019, fell by 62.0% in the first half of 2020, to stand at €928m. In the second quarter of the year, net attributable profit, excluding the goodwill impairment in the United States, was €636m (up 118.0% quarter-on-quarter).

Net attributable profit (Millions of Euros)

(1) Excluding the goodwill impairment in the United States.

(1) Excluding the goodwill impairment in the United States.

Net attributable profit breakdown (Percentage. 1H20)

(1) Excludes the Corporate Center.

(1) Excludes the Corporate Center.

- The figure for loans and advances to customers (gross) was 1.5% higher compared to December 31, 2019, thanks to the government support programs to boost the financing of the real economy implemented in the different geographical areas.

- Customer funds grew by 2.2% in the half year, as a result of customers placing the larger liquidity provisions in the bank.

- The availability of substantial liquidity buffers in each of the geographical areas in which the BBVA Group operates and their management have allowed internal and regulatory ratios to be maintained well above the minimums required.

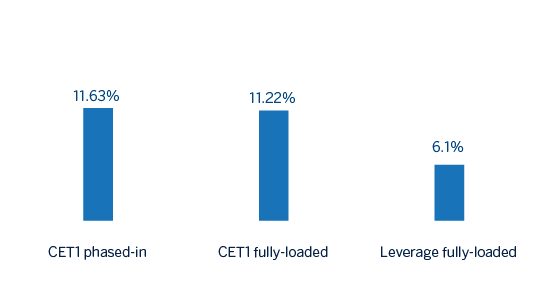

- The BBVA Group has set the objective to maintain a buffer on its fully-loaded CET1 ratio requirement (currently, at 8.59%) between 225 and 275 basis points. As of June 30, 2020, the CET1 fully-loaded ratio stood at 11.22%, in the upper part of the target management buffer.

Capital and leverage ratios (Percentage as of 30-06-20)

- The calculation of the expected credit losses at the end of the first half of 2020 incorporates:

- The update of the forward looking information in the IFRS 9 models in order to reflect the circumstances created by the COVID-19 pandemic in the macroeconomic environment, which is characterized by a high degree of uncertainty regarding its intensity, duration and speed of recovery.

- The granting of relief measures in the form of temporary payment deferrals for customers affected by the pandemic, as well as the option to grant lending with a public guarantee facility.

NPL and NPL coverage ratios and cost of risk (Percentage)

- BBVA's Purpose, to bring the age of opportunity to everyone, is more relevant than ever, as are our values: customer comes first, we think big and we are one team. This crisis has revealed the correct decision to opt for digitization, which has allowed the Bank to be closer to customers when they have needed it most, and reinforces our strategy. Therefore, our priorities remain unchanged; improve the financial health of customers, help them in the transition to a sustainable future, to grow in customers, seeking operational excellence and having the best and most committed team and the use of technology and data, will continue to be so the pillars on which the Group's strategy is based.

From the outset, BBVA has adopted a series of measures to support its main stakeholders. The main business continuity measures taken are:

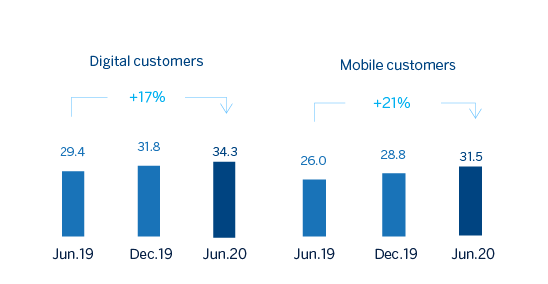

- In order to serve customers, and since financial services are legally considered an essential service in most of the countries in which the Group operates, the branch network remains operational, with dynamic management of the network and with information about branches and opening times on the website. In addition, the recommendation was for customers to operate through the digital channels and their remote agents, with the aim of minimizing the staff needed to serve customers in the branches, trying to reduce the risk of contagion and protect the health of its employees, customers and society in general. The data indicates that the COVID-19 crisis is accelerating digitization: At Group level, during the month of June 2020, digital sales (measured in units) rose sharply to 63.2% of the total, compared to 59.9% in February. Also at the end of June, BBVA's digital customers accounted for 60% of the total and customers operating with the bank through their cell phones accounted for 56% across the entire Group.

Digital and mobile customers (Millions)

- With employees, the measures established by the health authorities have been implemented, including taking an early stance on promoting working from home. The priority in BBVA's return plan is the health and safety of its employees, their families and its customers, as well as ensuring business continuity, always following the recommendations of the health authorities. This return plan will be dynamic and adapted to the situation in each geographical area, and will be modulated on the basis of the data available at each moment on the evolution of the pandemic, the evolution of the business and the service to the customers.

Other support and responsibility measures taken are the following:

- The banks are a key part of the solution to the COVID-19 crisis. Specifically, BBVA has activated support initiatives with a focus on the most affected customers, regardless of whether they are companies, SMEs, self-employed workers or private individuals. The following are just some of those initiatives:

- In Spain, support for SMEs, the self-employed and companies through lines of credit and lines guaranteed by the ICO, advance payment of pensions and unemployment benefits to its customers, ICO-backed loans for rent payments, and the deferral of both insurance and credit card payments and grace periods on loans to affected individuals or companies.

- In the United States, flexibility in the repayment of loans for small business and for consumer finance, elimination of some fees and commissions for individual customers and the development of an online application that allowed companies benefiting from the Paycheck Protection Program (PPP) to apply for assistance just three days after the launch of the program.

- In Mexico, a repayment deferment on various credit products, fixed payment plan to reduce monthly credit card charges and suspension of Point of Sale (POS) fees to support retailers with lower turnover, as well as different support plans aimed at each situation for larger business customers;

- In Turkey, delay of loan repayments, interests and amortizations;

- In South America, some countries such as Argentina have given micro-SMEs and SMEs access to credit facilities to purchase teleworking equipment and funding facilities for the payment of salaries; Colombia has frozen the repayment of loans for individuals and companies for up to six months, and is offering a special working capital facility for companies; and in Peru, several measures were approved to support the SMEs and customers with consumer loans or credit cards.

- To support society in this fight against the COVID-19 pandemic, BBVA has donated €35m to purchase medical supplies, support vulnerable groups and promote research.

Business areas

Spain

€2,900 Mill.*

+4.6%

Millions of euros and year-on-year changes. Balances as of 30-06-20.

Highlights

- Growth in activity, partly driven by government support programs.

- Significant improvement in operating income due to an increase in recurring income and a decrease in operating expenses.

- Contained risk indicators.

- Net attributable profit affected by the significant increase in the impairment on financial assets.

Results

Net interest income

1,793Gross income

2,900Operating income

1,371Net attributable profit

88Activity (1)

Performing loans and advances to customers under mangement

+0.6%Customers funds under management

+4.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

The United States

€1,607 Mill.*

-2.9%

Millions of euros and year-on-year changes at constant exchange rate. Balances as of 30-06-20.

Highlights

- Increase in loans focused on the commercial portfolios, whereas retail segments have been affected by the lockdown. Strong increase in customer deposits.

- Contained risk indicators.

- Net interest income affected by the Fed’s rate cuts. Positive evolution of fees and commissions and NTI.

- Net attributable profit affected by the significant increase in the impairment on financial assets line.

Results

Net interest income

1,133Gross income

1,607Operating income

648Net attributable profit

26Activity (1)

Performing loans and advances to customers under mangement

+12.7%Customers funds under management

+17.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rate.

Mexico

€3,550 Mill.*

+0.4%

Millions of euros and year-on-year changes at constant exchange rate. Balances as of 30-06-20.

Highlights

- Evolution of activity is supported by the good performance of the wholesale portfolio.

- Growth of gross income thanks to the increase in NTI.

- Stability in operating income.

- Net attributable profit affected by the significant increase in the impairment on financial assets line.

Results

Net interest income

2,717Gross income

3,550Operating income

2,349Net attributable profit

654Activity (2)

Performing loans and advances to customers under mangement

+8.5%Customers funds under management

+11.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(2) Excluding repos.

(1) Year on year changes at constant exchange rate.

Turkey

€1,957 Mill.*

+31.3%

Millions of euros and year-on-year changes at constant exchange rate. Balances as of 30-06-20.

Highlights

- Activity impacted by the support programs and lockdown.

- Good performance of net interest income and NTI.

- Efficiency ratio improvement.

- Net attributable profit affected by the significant increase in the impairment on financial assets line.

Results

Net interest income

1,534Gross income

1,957Operating income

1,394Net attributable profit

266Activity (1)

Performing loans and advances to customers under mangement

+22.9%Customers funds under management

+21.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rate.

South America

€1,664 Mill.*

+1.7%

Millions of euros and year-on-year changes at constant exchange rates. Balances as of 30-06-20.

Highlights

- Activity affected by the support programs and the lockdown.

- Year-on-year net interest income growth.

- Reduction in NTI and net fees and commissions.

- Net attributable profit affected by the increase in the impairment on financial assets line.

Results

Net interest income

1,443Gross income

1,664Operating income

945Net attributable profit (3)

159Activity (1)

Performing loans and advances to customers under mangement

+14.5%Customers funds under management

+21.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rates.

Rest of Eurasia

€268 Mill.*

+22.1%

Millions of euros and year-on-year changes. Balances as of 30-06-20.

Highlights

- Good performance of lending activity.

- Improved risk indicators.

- Increased recurring income resulting from positive evolution of the transactional and investment banking and good performance of NTI.

- Reduction of operating expenses.

Results

Net interest income

102Gross income

268Operating income

131Net attributable profit

66Activity (1)

Performing loans and advances to customers under mangement

+28.7%Customers funds under management

+7.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

* Gross income

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email