Solvency

Capital base

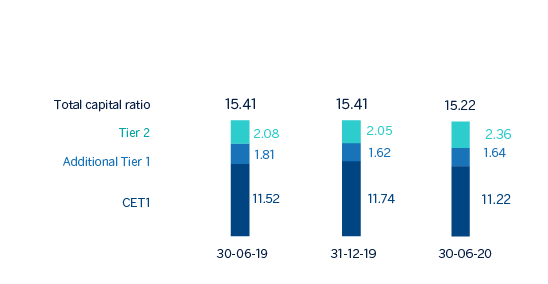

BBVA's fully-loaded CET1 ratio stood at 11.22% at the end of June 2020, which represents a significant improvement of 38 basis points over the previous quarter. As of June 30, the fully-loaded CET1 management buffer would be 263 basis points with respect to the minimum requirement for CET1 (8.59%), a level that is in the upper part of the target management buffer (225-275 points basic).

Financial markets stability in the second quarter, driven largely by the economic stimulus measures announced by the different national and supranational authorities, has allowed for a partial recovery from the shocks produced in the price of assets and has reduced the volatility. This has led to a positive contribution of approximately 14 basis points in the CET1 fully-loaded ratio during the quarter.

In addition, the approval by the European Parliament and the European Council of Regulation 2020/873 (known as "CRR Quick Fix"), which amends both Regulation 575/2013 (Capital Requirement Regulation (CRR)) and Regulation 2019/876 (Capital Requirement Regulation 2 (CRR2)) has contributed positively to the capital adequacy ratios. Those measures that can be applied on June 30 include the application of new SME and infrastructure support factors and the extension of the IFRS 9 transitional treatment (the latter only impacts phased-in ratios).

Demand for lending continues to contribute to the growth of exposures but mitigated, in terms of the calculation of risk-weighted assets (RWAs), by the public guarantee programs implemented by the different authorities. Likewise, the reduction in volatility has also allowed for lower capital requirements in those components of RWAs that are more sensitive to these factors such as those related to regulatory requirements for market risk. Finally, the application of the "CRR Quick Fix" - as previously mentioned - has had a positive effect allowing a reduction in capital requirements in those affected exposures.

As a result of all aforementioned, risk-weighted assets fully-loaded (RWAs) decreased by approximately €6,400m over the quarter, while isolating the effect of the exchange rate, the reduction was approximately €2,100m. In the first half of the year, RWAs, affected by the evolution of the exchange rates, fell by around €2,500m; isolating this effect, RWAs grew by around €13,800m.

Fully-loaded Additional Tier 1 capital (AT1) stood at 1.64% at the end of June 2020, remaining at similar levels to the previous quarters.

In this regard, in July 2020, BBVA completed the first green convertible bond (CoCo) ever issued by a financial institution worldwide in the amount of €1,000m, with a coupon of 6% and an option for early amortization in five and a half years, with demand exceeding the initial offer by a factor of three. This issuance will be included in the capital adequacy ratios for the third quarter with an estimated impact on AT1 of +28 basis points, which will allow to complete the total requirements at this level, including those from the tiering of Pillar II and, therefore, increasing the distance to MDA.

The Tier 2 fully-loaded ratio stood at 2.36% as of June 30, representing an increase of 31 basis points over the level of December 2019 explained by the evolution of subordinated emissions and other items eligible as Tier 2 capital during the semester. During the first half of the year, BBVA, S.A. issued €1,000m of Tier 2 subordinated debt over a ten-year period, with an option for early amortization in the fifth year, and a coupon of 1% in January 2020. Regarding the rest of the Group's subsidiaries, Garanti BBVA made a Tier 2 issue for 750 million Turkish liras in February to TLREF (Turkish Lira Overnight Reference Rate) plus 250 basis points already considered in the Group's adequacy ratios from the first quarter.

Finally, it should be noted that in July, another Tier 2 issue has been made for 300 million of sterling pounds, over an 11-year period with an early amortization option from the sixth year and a 3.104% coupon, thus reinforcing the ratio, diversifying the investment base and improving the price compared to an equivalent issue in euros. This issue will be included in the capital adequacy ratios for the third quarter with an estimated impact on Tier 2 of +9 basis points which allows to efficiently cover the capital requirements after the tiering of Pillar II also at this level.

Moreover, at the supervisory level, the ECB, in its announcement on March 12, has allowed the banks to use additional Tier 1 and Tier 2 capital instruments to meet the Pillar II Requirements (P2R) what is known as “tiering of Pillar II”. These measures are reinforced by the relaxation of the Countercyclical Capital Buffer (CCyB) announced by various national macroprudential authorities and by other complementary measures published by the ECB. All of this has resulted in a reduction of 68 basis points in the fully-loaded CET1 requirement for BBVA, with that requirement standing at 8.59%. The reduction in the requirement at the total ratio level is only around 2 basis points, as a result of the lower applicable countercyclical buffer.

As a result, it was agreed in the first quarter to modify the CET1 capital target to reflect this new situation, which is determined as a management buffer of between 225 and 275 basis points over the CET1 requirements. This distance is the one used as reference for determining the previous CET1 capital target (when considering the fully-loaded aspect) of between 11.5% and 12%, so the new target maintains an equivalent distance in terms of CET1. At the end of June, the fully-loaded CET1 management buffer would be 263 basis points.

The phased-in CET1 ratio stood at 11.63% at the end of June 2020, taking into account the transitory effect of the IFRS 9 standard. Tier 1 capital stood at 1.68% and Tier 2 at 2.58% resulting in a total capital ratio of 15.89%.

Regarding shareholder remuneration, on April 9 a cash payment was made for a supplementary dividend for the 2019 financial year for the gross amount of 0.16 euros per share, in line with that approved at the Annual General Meeting on March 13. This amounted to €1,067m. Thus, the total dividend for the 2019 financial year amounts to 0.26 euros gross per share. This had no impact on the evolution of the capital ratio as it was already accrued at the end of 2019. On April 30, 2020 BBVA Group has communicated to the market that the Board of Directors of BBVA has agreed to modify, for the financial year 2020, the Group's shareholder remuneration policy announced through the material fact notification of February 1, 2017, establishing a new policy for 2020 of not making any dividend payments for the 2020 financial year until the uncertainties caused by COVID-19 disappear and, in any case, not before the end of the tax year.

SHAREHOLDER STRUCTURE (30-06-2020)

| Shareholders | Shares | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 500 | 367,033 | 41.1 | 68,887,974 | 1.0 |

| 501 to 5,000 | 411,784 | 46.2 | 720,940,830 | 10.8 |

| 5,001 to 10,000 | 60,308 | 6.8 | 424,731,790 | 6.4 |

| 10,001 to 50,000 | 47,441 | 5.3 | 910,473,571 | 13.7 |

| 50,001 to 100,000 | 3,493 | 0.4 | 238,382,195 | 3.6 |

| 100,001 to 500,000 | 1,594 | 0.2 | 287,296,713 | 4.3 |

| More than 500,001 | 291 | 0,0 | 4,017,173,507 | 60.2 |

| Total | 891,944 | 100.0 | 6,667,886,580 | 100.0 |

FULLY-LOADED CAPITAL RATIOS (PERCENTAGE)

CAPITAL BASE (MILLIONS OF EUROS)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 30-06-20 (1) (2) | 31-12-19 | 30-06-19 | 30-06-20 (1) (2) | 31-12-19 | 30-06-19 | |

| Common Equity Tier 1 (CET 1) | 42,118 | 43,653 | 42,329 | 40,646 | 42,856 | 41,520 |

| Tier 1 | 48,185 | 49,701 | 48,997 | 46,600 | 48,775 | 48,047 |

| Tier 2 | 9,345 | 8,304 | 7,944 | 8,553 | 7,464 | 7,514 |

| Total Capital (Tier 1 + Tier 2) | 57,531 | 58,005 | 56,941 | 55,153 | 56,240 | 55,561 |

| Risk-weighted assets | 362,050 | 364,448 | 360,069 | 362,388 | 364,942 | 360,563 |

| CET1 (%) | 11.63 | 11.98 | 11.76 | 11.22 | 11.74 | 11.52 |

| Tier 1 (%) | 13.31 | 13.64 | 13.61 | 12.86 | 13.37 | 13.33 |

| Tier 2 (%) | 2.58 | 2.28 | 2.21 | 2.36 | 2.05 | 2.08 |

| Total capital ratio (%) | 15.89 | 15.92 | 15.81 | 15.22 | 15.41 | 15.41 |

- (1) As of June 30, 2020, the difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR) and the subsequent amendments introduced by the Regulation (EU) 2020/873.

- (2) Provisional data.

Regarding the MREL (Minimum Requirement for own funds and Eligible Liabilities) requirements, BBVA has continued its issuance plan during 2020 by closing two public issues of non-preferred senior debt, one in January 2020 for €1,250m over seven years and a coupon of 0.5%, and another in February 2020 for CHF 160m over six and a half years and a coupon of 0.125%. In May 2020, the first issuance of a COVID-19 social bond by a private financial institution in Europe was completed, with excellent market acceptance. Demand exceeded initial supply by a factor of almost five, which allowed the initial indicative interest rate to be reduced by 33 basis points to mid-swap plus 112 basis points. This is a 5-year senior preferred bond, for €1,000m and a coupon of 0.75%.

The Group finds that the present structure of shareholders' funds and admissible liabilities, together with the proposed plan for issuances, should enable it to comply with the MREL by the date of entry into force of the requirement.

Finally, the Group's leverage ratio maintained a solid position, at 6.1% fully loaded (6.2% phased-in), which remains the highest among its peer group. These figures do not include the effect of the new July AT1 issuance, which would mean an improvement of +13 basis points, as well as the temporary exclusion of certain positions with the central bank considered in the "CRR-Quick fix" awaiting the pertinent declaration of the competent authorities for its application.

Ratings

The economic uncertainty caused by the COVID-19 pandemic has made the rating agencies to take several actions about the ratings which they assign to financial institutions of different countries during the second quarter of 2020. On June 22, Fitch downgraded by one notch the rating assigned to BBVA’s senior preferred debt to A- with a stable perspective, after having changed it to Rating Watch Negative (RWN) on March 27 in a joint action that affected the Spanish banking groups and assigned them also RWN or negative outlook. On April 29, S&P confirmed BBVA’s rating and its outlook in a joint action with the rest of the Spanish banks and assigned a negative outlook to the majority of the domestic banks. Meanwhile, DBRS confirmed the A (high) rating of BBVA with stable outlook and on April 1 and Moody’s has maintained without changes BBVA’s rating at A3 with a stable outlook. These ratings, together with their corresponding outlooks, are shown in the following table:

Ratings

| Rating agency | Long term (1) | Short term | Outlook |

|---|---|---|---|

| Axesor Rating | A+ | n/a | Stable |

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s | A3 | P-2 | Stable |

| Standard & Poor’s | A- | A-2 | Negative |

- (1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating respectively, to BBVA’s long term deposits.