The share

In 2021, the global economy grew significantly, recovering in part from the crisis caused by the pandemic, which caused a sharp fall in global GDP in 2020. The significant upturn in global growth has been due to the progress in vaccination against COVID-19 and the significant economic stimuli adopted by public authorities.

Activity indicators show, however, that the economic recovery process has lost momentum since the middle of last year, while inflation has risen significantly, in an environment where the effects of the emergence of new variants of the COVID-19 have contributed to reinforcing the problems in global supply chains observed since the beginning of 2021.

The recent outbreak of the war between Ukraine and Russia and the sanctions it has unleashed represent a significant supply shock to the world economy, which is likely to reinforce the trend towards growth moderation and accentuate the current inflationary pressures, mainly in European countries, due to their relatively significant economic ties with Ukraine and Russia. The economic effects are expected to come mainly through higher commodity prices, but also through financial and confidence channels, as well as a further deterioration of problems in global supply chains.

Despite the current high uncertainty, the central scenario that BBVA Research uses in its estimates considers that the recovery process of the global economy is expected to continue in the coming months, albeit at a slightly slower pace than expected in autumn 2021. According to BBVA Research, after increasing 6.1% in 2021, global GDP will grow 4.0% in 2022, four tenths below what was expected three months ago. GDP growth in 2022 is expected to remain relatively high in the United States and China (3.1% and 5.2%, respectively), and to a lesser extent also in Europe (around 2.0%) where the impact of the war in Ukraine would be somewhat cushioned by new fiscal stimuli measures.

Against the background of higher commodity prices and additional constraints on global supply chains, inflation, which currently stands above 7% in both the United States and the Eurozone, is expected to remain high in 2022, around 6% on average, in both geographical areas, while it will remain more contained in China, according to BBVA Research's estimates.

Despite the likely negative impact of the war on the economic activity, the major central banks are expected to remain focused on rising inflation and continue to implement their plan to withdraw monetary stimuli. In the United States, the Federal Reserve initiated the process of normalizing monetary policy interest rates in March, which, according to BBVA Research, could converge towards around 2% by the end of 2022. In the Eurozone, the ECB completed the pandemic emergency purchase program (PEPP). Although the asset purchase program (APP) is maintained, asset purchases will be moderated over the coming months, paving the way for monetary policy interest rate hikes starting in the last quarter of 2022.

Risks on this economic scenario are significant and are biased downwards in the case of activity. These include, among others, (i) a deterioration of the war between Ukraine and Russia and a further escalation of sanctions; (ii) an economic recession and financial turbulence caused by the withdrawal of monetary stimuli and (iii) higher mobility restrictions in China due to the increasing cases of COVID- 19.

The main stock market indexes have declined during the first quarter of 2022, impacted by negative effects of Russia’s invasion of Ukraine at the end of February. In Europe, the Stoxx Europe 600 index decreased by -6.5% compared to the end December 2021, and in Spain the Ibex 35 fell by -3.1% in the same period, showing a better relative performance. In the United States, the S&P 500 index also decreased by -4.9% in the quarter.

With regard to the banking sector indexes, their performance during the first quarter was in line with the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, decreased by -5.8% and -9.6% respectively, while in the United States, the S&P Regional Banks sector index showed a better relative performance, decreasing by -2.8% in the period.

The BBVA share price fell slightly in the quarter, by -0.8%, showing a better performance than its sectoral index, closing the month of March at €5.21 euros.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-21)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 31-03-22 | 31-12-21 | |

|---|---|---|

| Number of shareholders | 815,233 | 826,835 |

| Number of shares issued (millions) | 6,668 | 6,668 |

| Closing price (euros) | 5.21 | 5.25 |

| Book value per share (euros) (1) | 6.92 | 6.86 |

| Tangible book value per share (euros) (1) | 6.56 | 6.52 |

| Market capitalization (millions of euros) | 34,740 | 35,006 |

| Yield (dividend/price; %) (2) | 2.7 | 2.6 |

(1) As of 31-03-22, 290 million shares acquired from the start of the share buyback program to the end of the period and the estimated number of shares pending from buyback as of March 31, 2022 of the first segment of the second buyback program (€1,000m), in process at the end of that date, have been included. As of 31-12-21, 112 million shares acquired from the beginning of the share buyback program to the end of the period and the estimated number of shares pending from buyback as of December 31, 2021 of the first tranche (€1,500m), in process at the end of that date, have been considered.

(2) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

Regarding shareholder remuneration, on April 8, 2022, a cash payment of €0.23 (gross) per share was made, as approved by resolution of the General Shareholders’ Meeting held on March 18, 2022. Thus, the total cash distribution for the year 2021 was €0.31 (gross) per share, the highest in the last 10 years.

Thus, BBVA’s payout was 43% of the consolidated profits at year-end 2021, aligned with the Group’s shareholder remuneration policy that sets a distribution between 40% and 50% of the consolidated profits of each year.

The total remuneration to the shareholders also includes the extraordinary remuneration resulting from the share buyback program of up to the 10% of BBVA’s share capital for a maximum amount of 3,500 million euros. As for the first tranche, on March 3, 2022, BBVA announced the completion of its execution for a maximum monetary amount of 1,500 million.

As of March 31, 2022, the number of BBVA shares was 6,668 billion, and the number of shareholders reached 815,233. By type of investor, 62.38% of the capital is held by institutional investors and the remaining 37.62% by retail shareholders.

BBVA shares are included on the main stock market indexes. At the closing of March 2022, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 7.54%, 1.18% and 0.34%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 4.66% and the Euro Stoxx Banks index for the eurozone with a weighting of 8.21%. Moreover BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

Russia's invasion of Ukraine, the largest military attack on a European state since World War II, has had an immediate impact on global geopolitics and economy. There has also been an increase in the level of uncertainty, which remains high at the date of elaboration of this report. The European Union, the United States, the United Kingdom and other governments have imposed harsh sanctions against Russia and Russian interests. The impact of these measures, as well as the potential response by Russia, are currently uncertain and could negatively affect the Entity's business, financial position and results, although the Group's direct exposure to Ukraine and Russia is limited.

The Group observes the events with particular concern and unease because of the human tragedy that they entail. In this regard, the Entity has contributed to respond to the humanitarian emergency in Ukraine with a donation of €1m, a campaign among customers and employees, that has raised, until April 19, 2022, €2.1m, in addition to the possibility of free transfers from individuals to Ukraine. Finally, BBVA joined a declaration signed by more than 50 companies from around the world to provide support to people fleeing Ukraine and to attend their immediate needs. Thus, the Group has offered the Ministry of Inclusion, Social Security and Migration of the Government of Spain 200 homes for the reception of refugees and, in order to facilitate the financial inclusion of the refugees, the Basic Payment Account has been made available to them, so that they can have a free account and a card, which allows them to access basic banking services.

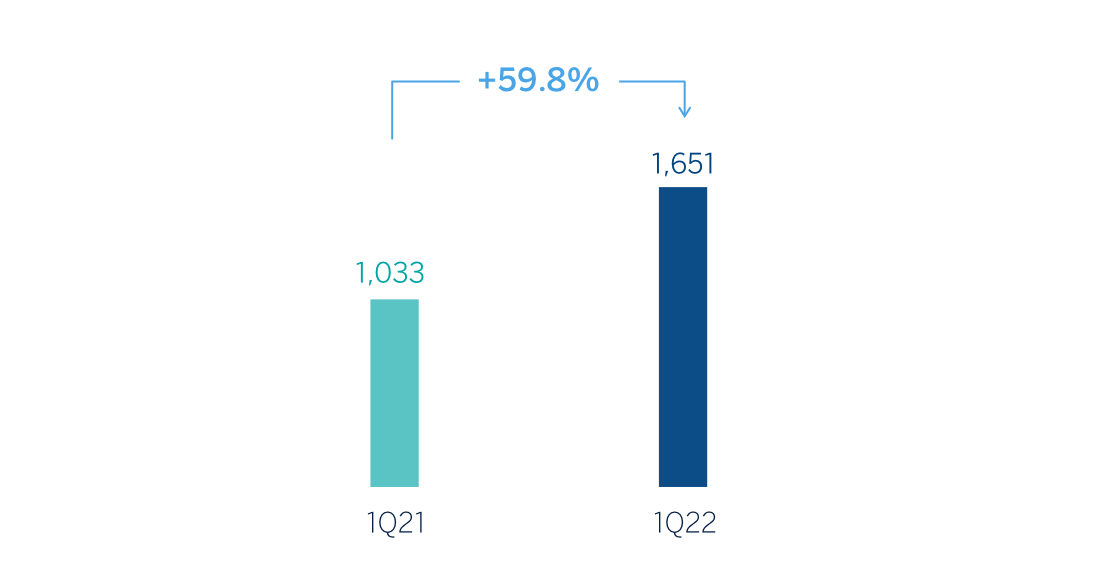

The BBVA Group generated a net attributable profit of €1,651m in the first quarter of 2022, representing a year-on-year variation of +36.4%. Excluding non-recurring impacts in the first quarter of 2021, namely €177m from the results of discontinued operations and corresponding to BBVA USA and the rest of the companies sold to PNC on June 1, 2021, the Group's net attributable profit registered a year-on-year increase of 59.8%.

In a complex environment marked by a high level of uncertainty, the results generated by the Group in the first quarter of 2022 were characterized by the good performance in recurring income from the banking business, which continued to grow for the fifth consecutive quarter. This favorable trend in net interest income and net fees and commissions, together with lower provisions for impairment on financial assets and provisions, largely explain the positive year-on-year performance of the Group’s income statement.

Operating expenses increased at Group level (+8.5% in year-on-year terms and excluding the exchange rate effect), in an inflationary environment in all countries in which BBVA operates.

Notwithstanding the above, thanks to the remarkable growth in gross income, the efficiency ratio stood at 40.7% as of March 31, 2022, with an improvement of 528 basis points in constant terms, compared to the ratio at the end of December 2021, placing BBVA, once again, in a leading position among its European peer group1 . Thus, BBVA seeks to offer an excellent customer experience at an efficient cost through a relational model leveraged on digitization.

The provisions for impairment on financial assets decreased (-17.9% in year-on-year terms and at constant exchange rates), mainly due to the good performance of the underlying asset, highlighting the decrease in Spain, Mexico and South America.

In the first quarter of 2022, provisions were lower (-70.0% at constant exchange rates) than the previous year.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: 1Q21 excludes BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021.

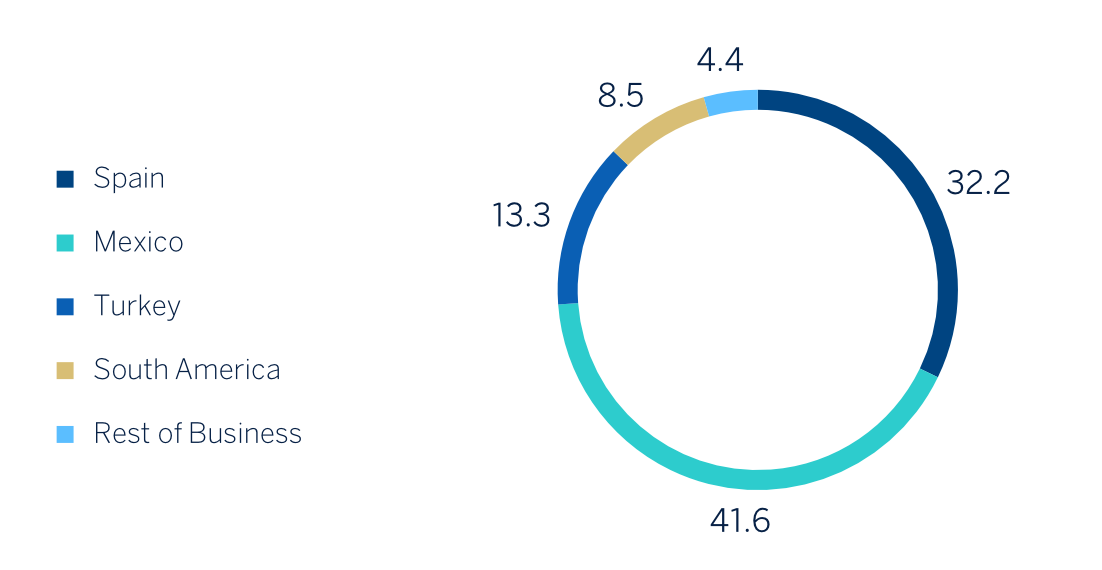

NET ATTRIBUTABLE PROFIT BREAKDOWN (1) (PERCENTAGE. 1Q22)

(1) Excludes the Corporate Center.

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, data at the end of December 2021.

Loans and advances to customers recorded a growth of 5.0% compared to the end of December 2021, strongly favored by the evolution of business loans (+7.7%) in all business areas and, to a lesser extent, by the dynamism of retail loans.

Customer funds showed an increase of 2.2% compared to the end of December 2021, thanks to the contribution of demand deposits (+2.8%) and, to a lesser extent, of time deposits (+5.7%).

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2021)

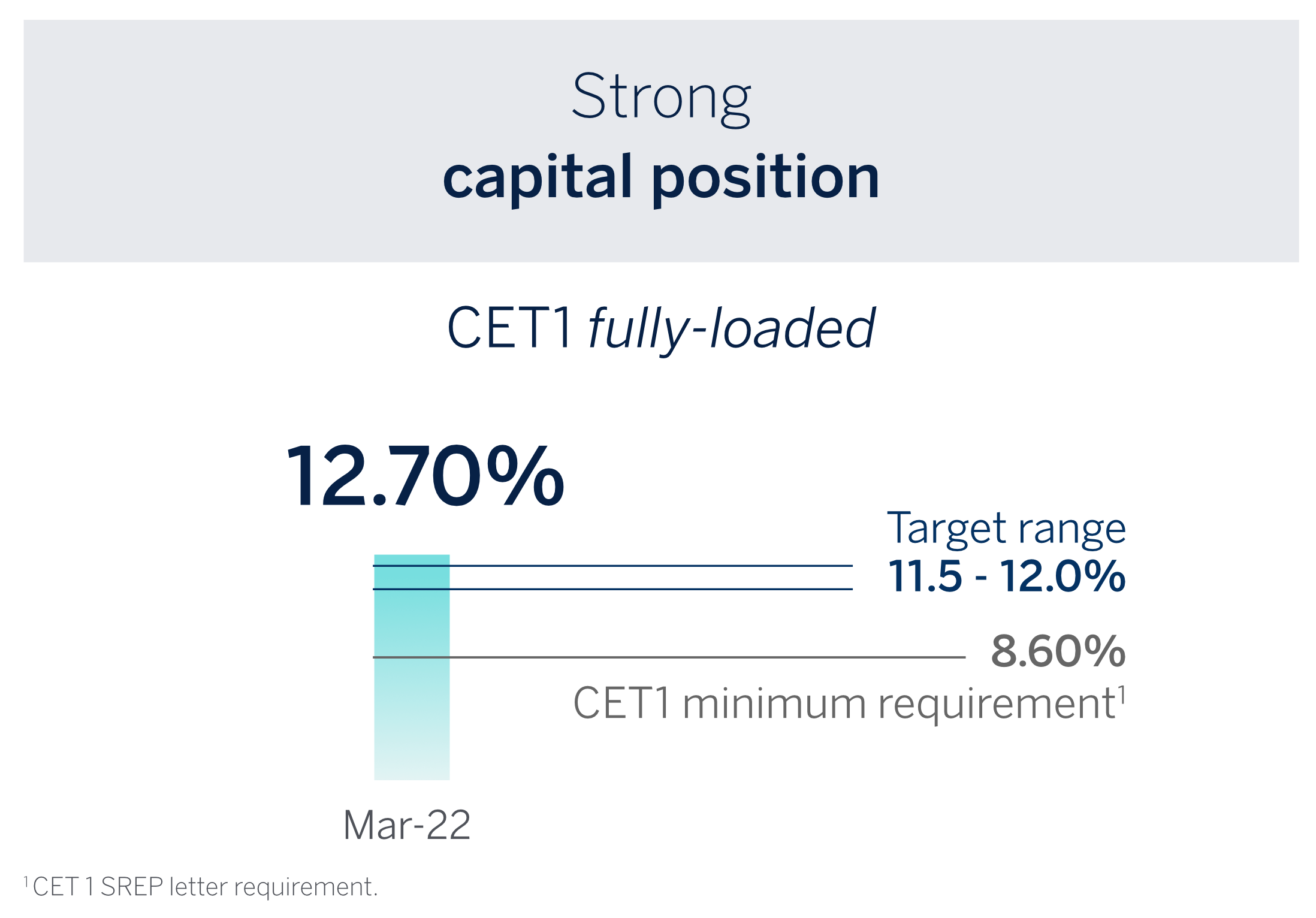

The Group's CET1 Fully-loaded ratio stood at 12.70% as of March 31, 2022, which allows to maintain a large management buffer over the Group's CET1 requirement (8.60%), also standing above the Group's target management range established at 11.5-12% of CET1. This CET1 level includes the deduction of the total amount of the share buyback program authorized by the supervisor, amounting to maximum €3.500m that were already registered at the end of December 2021.

On April 8, 2022, a cash payment of €0.23 gross against voluntary reserves was made for each outstanding share of BBVA entitled to receive this amount as additional shareholder remuneration for the year 2021, approved by the Annual General Meeting held on March 18, 2022. Thus, the total amount of cash distributions for the year 2021 was €0.31 gross per share, the largest distribution in 10 years.

The total shareholder remuneration includes, in addition to the aforementioned cash payments, the extraordinary remuneration resulting from the execution of the program scheme announced on October 29, 2021 for the buyback of own shares up to a maximum amount of €3,500m. Regarding the first tranche of the share buyback program, BBVA announced on March 3, 2022 the completion of the program, having reached the maximum monetary amount of €1,500m disclosed in the inside information of November 19, 2021. The total number of own shares acquired was 281,218,710 shares. Additionally, the Bank announced on March 16, 2022 the execution of the first segment of the second tranche up to a maximum amount of €1,000m or a maximum number of shares of 356,551,306. This first segment is being externally executed by Goldman Sachs International thorough Kepler Cheuvreux, S.A. as broker. Upon full execution of the first segment, a second segment will be executed up to the remaining amount or remaining number of shares for the complete execution of the program scheme. From March 16 to March 31, 2022 and from April 1 to April 21, 2022, Goldman Sachs International, acting as lead manager for the first segment through the broker Kepler Cheuvreux, S.A., has acquired 8,540,302 and 60,285,015 BBVA shares respectively.

In February 2022, BBVA announced the investment of approximately $300m in Neon Payments Limited for the acquisition of 21.7% of its share capital. This investment adds up to others performed by BBVA in the digital Atom Bank in the United Kingdom or Solarisbank in Germany, and offers the Group enormous strategic options in a highly attractive market with great potential. For its part, on April 19, 2022, BBVA announced an investment of $20m in Lowercarbon Capital, one of the few venture capital funds specializing in companies that develop technologies in the climate change and decarbonization fields. In addition, on 20 April 2022, BBVA announced an investment of €15m in the Leadwind venture capital fund to support companies with a high technological component in accelerated growth. BBVA continues its strong commitment to the entrepreneurial ecosystem through selective investments in digital banks, investments through venture capital vehicles or the launch of a purely digital bank in Italy, among others.

On April 1, 2022, BBVA informed Merlin Properties, SOCIMI, S.A., among other aspects, that it had accepted the proposal to purchase 100% of the shares of Tree Inversiones Inmobiliarias Socimi, S.A. for a total amount of €1,987m. This company also owns 662 offices sold by BBVA between 2009 and 2010.This deal gives BBVA greater flexibility in the management of its network of offices in Spain and it is expected to generate economic savings once the transaction, subject to the prior approval by the National Commission on Markets and Competition in Spain, will be closed.

Business areas

Spain

€1,663 Mill.*

+1.9%

Highlights

- Growth in lending activity despite the usual seasonality in the first quarter of the year

- Favorable year-on-year evolution of the main margins

- Significant improvement in the efficiency ratio

- Lower impairment on financial assets and good performance of risk indicators

Results

(Millions of euros)

Net interest income

859Gross income

1,663Operating income

950Net attributable profit

601Activity (1)

Variation compared to 31-12-21.

Balances as of 31-03-22.

Performing loans and advances to customers under mangement

+0.5%

Customers funds under management

-1.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

Mexico

€2,245 Mill.*

+19.5%

Highlights

- Growth in lending activity and customer funds in the quarter

- Improved customer spread, which is already partly reflected in the net interest income

- Significant improvement in the efficiency ratio

- Impairment on financial assets related to the macroeconomic environment with a good performance of the loan portfolio

Results

(Millions of euros)

Net interest income

1,746Gross income

2,245Operating income

1,488Net attributable profit

777Activity (1)

Variation compared to 31-12-21.

Balances as of 31-03-22.

Performing loans and advances to customers under mangement

+4.2%

Customers funds under management

+3.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

1,027 Mill.*

+116.4%

Highlights

- Activity growth in the quarter driven by Turkish lira loans and deposits

- Year-on-year growth in recurring revenue and NTI

- Solid risk indicators

- Improved efficiency ratio

Results

(Millions of euros)

Net interest income

706Gross income

1,027Operating income

797Net attributable profit

249Activity (1)

Variation compared to 31-12-21.

Balances as of 31-03-22.

Performing loans and advances to customers under mangement

+15.2%

Customers funds under management

+12.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€881 Mill.*

+27.4%

Highlights

- Growth in lending activity and customer funds in the quarter

- Outstanding boost in recurring income

- Improvement in the efficiency ratio despite the growth in expenses in an inflationary environment

- Good performance of risk indicators

Results

(Millions of euros)

Net interest income

809Gross income

881Operating income

469Net attributable profit

158Activity (1)

Variation compared to 31-12-21.

Balances as of 31-03-22.

Performing loans and advances to customers under mangement

+1.9%

Customers funds under management

+0.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€202 Mill.*

-14.8%

Highlights

- Increase in lending activity and customer funds in the first quarter of 2022

- Good performance of net interest income and controlled expenses

- Solid risk indicators

- Increased performance in Europe and the New York branch

Results

(Millions of euros)

Net interest income

75Gross income

202Operating income

87Net attributable profit

81Activity (1)

Variation compared to 31-12-21.

Balances as of 31-03-22.

Performing loans and advances to customers under mangement

+16.2%

Customers funds under management

+4.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

Data at the end of March 2022. Those countries in which BBVA has no legal entity or the volume of activity is not significant, are not included.

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain generated a net attributable profit of €601m during the first quarter of 2022, up 62.3% from the result achieved between January and March of the previous year, due to the good performance of gross income, driven by commissions, the significant reduction in personnel expenses, as well as lower write-offs and provisions.

- In Mexico, BBVA achieved a net attributable profit of €777m between January and March 2022, representing an increase of 49.0% compared to the first quarter of 2021, mainly as a result of the good performance of recurring revenues, favored especially by the dynamism of the net interest income and lower loan-loss provisions, which compensated the increase in operating expenses.

-

Turkey generated a net attributable profit of €249m in the first quarter of 2022, 129.6% higher than the same period of the previous year, supported by strong growth in recurring income, especially on the net interest income side, and higher contribution from NTI. Taking into account the effect of the depreciation of the Turkish lira over the period, the results generated by Turkey increased by 30.6%.

With regard to this business area and the voluntary takeover bid, submitted by the BBVA Group for the entire share capital of Garanti BBVA not already owned, BBVA announced on March 31, 2022 that the securities market supervisor of Turkey had approved the information memorandum for the bid. The period of acceptance of the offer began on April 4, 2022 and on April 25, 2022, BBVA has reported the increase in the offered price per share, from the initially announced (12.20 Turkish liras) to 15.00 Turkish liras. As a consequence of this price increase, the last day of the offer acceptance period has been extended until May 18, 2022. - South America generated €158m in the first quarter of 2022, representing a year-on-year variation of +68.2%, mainly due to the improved performance of recurring income (+30.6%) and NTI (+28.2%), which more than offset the higher impact of inflation in Argentina and the growth of expenses.

-

Rest of Business achieved a net attributable profit of €81m accumulated at the end of the first quarter of 2022, 5.4% less than in the first quarter of the previous year, mainly due to the lower performance of the Group's broker dealer in the United States.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email