The share

Economic growth remained at relatively high levels during the first half of 2022. The savings previously accumulated, the normalization of activity following the restrictions and disruptions generated by the COVID-19 pandemic, as well as the dynamism of labor markets, have contributed significantly to the performance of private consumption and the service sector.

However, the global economy is showing increasing signs of slowdown, in an environment affected by strong inflationary pressures, an aggressive tightening of monetary conditions, the negative impact of the war in Ukraine and the slower growth in China.

Inflation remains high and continues to surprise on the upside. In annual terms, in September inflation reached 9.9% in the Eurozone and 8.2% in the United States. Many commodity prices and disruptions in global supply chains have moderated in recent months, to some extent due to the expected lower global demand, although they remain relatively high. The significant increase in the price of gas, caused by supply restrictions by Russia, has reinforced the pressure on prices, mainly in Europe. In addition to showing greater persistence, inflationary pressures have also spread to more types of goods and services in recent months.

Against this backdrop, central banks have launched a process of tightening monetary conditions, more aggressive than expected by most analysts. In particular, the US Federal Reserve (“the Fed”) has raised policy rates by 300 basis points since the beginning of the year 2022 up to 3.25% in September and has started selling assets to reduce the size of its balance sheet. The Fed has also announced that interest rates will continue to rise in the coming months. According to BBVA Research, interest rates are expected to reach around 4.75% by the beginning of 2023. In the Eurozone, the ECB has raised official interest rates by 125 basis points in recent months. Refinancing rates are expected to converge to levels close to 2.75% in the coming months. Therefore, both in the Eurozone and in the United States, it is most likely than not that interest rates will soon converge to clearly contractionary levels, given the commitment by central banks to control inflation despite the eventual negative effects on economic activity.

In a context of high uncertainty, BBVA Research's central scenario estimates that the global economy will slow down significantly in the near future, with possible episodes of recession in the Eurozone and the United States. The tightening of monetary conditions would be the main driver of this slowdown, in a environment where commodity prices and supply disruptions will continue to negatively weight on activity.

According to BBVA Research, after rising 6.2% in 2021, global GDP will grow 3.2% in 2022 and 2.4% in 2023, down 0.2 and 0.1 percentage points, respectively, from the previous estimate three months ago. In the US, growth would slow to 1.7% in 2022 and 0.5% in 2023, when strong monetary tightening is expected to cause a mild recession. In the Eurozone, GDP is expected to slightly fall in the coming quarters, mainly due to the disruptions caused by the war in Ukraine, including high gas prices. Annual growth in the region would be 3.1% in 2022 and -0.1% in 2023. China's economy is expected to grow at 3.6% in 2022 and 5.2% in 2023. However, the continued implementation of strict measures to contain the spread of Coronavirus which could lead to further restrictions on mobility in the future, and the financial strains caused by imbalances in real estate markets could trigger lower-than-expected economic growth.

The risks around this central scenario are significant and have a downward bias on BBVA Research's growth forecasts. In particular, sustained inflation could trigger even stronger interest rates hikes and therefore, a deeper and more widespread recession, as well as financial volatility scenario.

The main indexes continued to show declines during the third quarter of 2022. In Europe, the Stoxx Europe 600 index decreased by -4.8% compared to the end of June 2022, and in Spain the Ibex 35 fell by -9.0% in the same period, showing a worse relative performance. In the United States, the S&P 500 index also decreased in the quarter by –5.3%.

With regard to the banking sector indexes, the fall in the quarter was slightly lower than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, decreased by -4.7% and -1.9% respectively, while in the United States, the S&P Regional Banks sector index showed a better relative performance, rising by +1.3% in the period.

For its part, the BBVA share price rose by +6.7% during the quarter, closing the month of September 2022 at €4.62 euros.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-21)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 30-09-22 | 30-06-22 | |

|---|---|---|

| Number of shareholders | 813,683 | 821,537 |

| Number of shares issued (millions) | 6,030 | 6,387 |

| Closing price (euros) | 4.62 | 4.33 |

| Book value per share (euros) (1) | 7.68 | 7.55 |

| Tangible book value per share (euros) (1) | 7.31 | 7.19 |

| Market capitalization (millions of euros) | 27,862 | 27,657 |

| Yield (dividend/price; %) (2) | 6.7 | 7.2 |

(1) For more information, see Alternative Performance Measures at the end of the quarterly report.

(2) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

Regarding shareholder remuneration, on September 29, 2022, the Board of Directors approved the distribution in cash of an interim dividend for the 2022 fiscal year, for an amount of €0.12 (gross) per share, which was paid on October 11, 2022.

In addition, on August 19, 2022, BBVA announced the completion of the execution of its share buyback program once the maximum number of shares set in the terms and conditions announced on November 19, 2021 had been reached. BBVA has thus successfully completed its €3.16 billion share buyback program.

On September 30, 2022, it was announced that the shares acquired under the last tranche of the buyback program had been redeemed, and the number of BBVA shares was set at 6,030 million. On the other hand, the number of shareholders reached 813,683, and by type of investor, 57.78% of the capital belonged to institutional investors and the remaining 42.22% was in the hands of retail shareholders.

BBVA shares are included on the main stock market indexes. At the closing of September 2022, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 7.54%, 1.12% and 0.33%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 4.40% and the Euro Stoxx Banks index for the eurozone with a weighting of 7.82%. Moreover BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

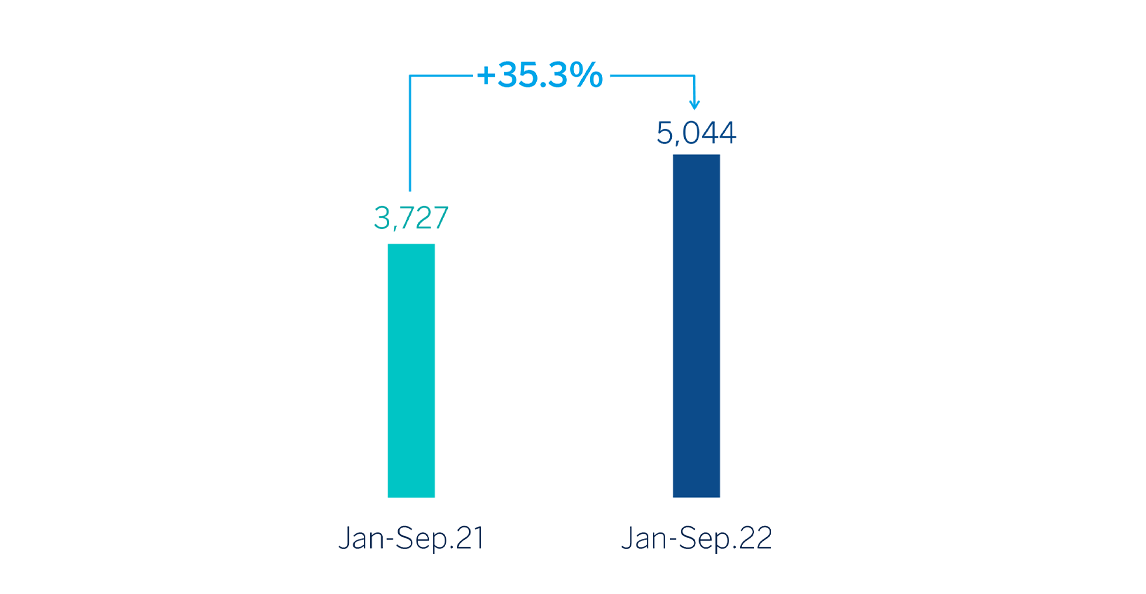

The BBVA Group generated a net attributable profit excluding non-recurring impacts of €5,044m in the first nine months of 2022, representing a year-on-year variation of +35.3%. Including those non-recurring impacts, i.e. €-201m from the purchase of offices in Spain from Merlin in June 2022 and €-416m from the results of discontinued operations corresponding to BBVA USA and the companies sold to PNC on June 1, 2021, together with the net cost related to the restructuring process of the same year, the Group's net attributable profit increased by 46.2% year-on-year.

Recurring income from banking activity (net interest income and commissions) continues to show an excellent performance, reflecting the good performance of activity and improvement in the customer spread, fostered by a more favorable interest rate environment.

Operating expenses increased at Group level (+12.8%, in an environment of high inflation in all countries in which BBVA operates.Notwithstanding the above, thanks to the remarkable growth in gross income, higher than that of expenses, the efficiency ratio stood at 42.9% as of September 30, 2022, with an improvement of 249 basis points in constant terms, compared to the ratio as of September 30, 2021, placing BBVA once again, in a leading position among its European peer group1.

The provisions for impairment on financial assets increased (+6.4% in year-on-year terms and at constant exchange rates),with higher provisions in Turkey and Mexico.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: Jan-Sep.22 excludes net impact arisen from the purchase of offices in Spain. Jan-Sep.21 excludes BBVA USA and the rest of the companies in the United States sold to PNC and the net cost of the restructuring process.

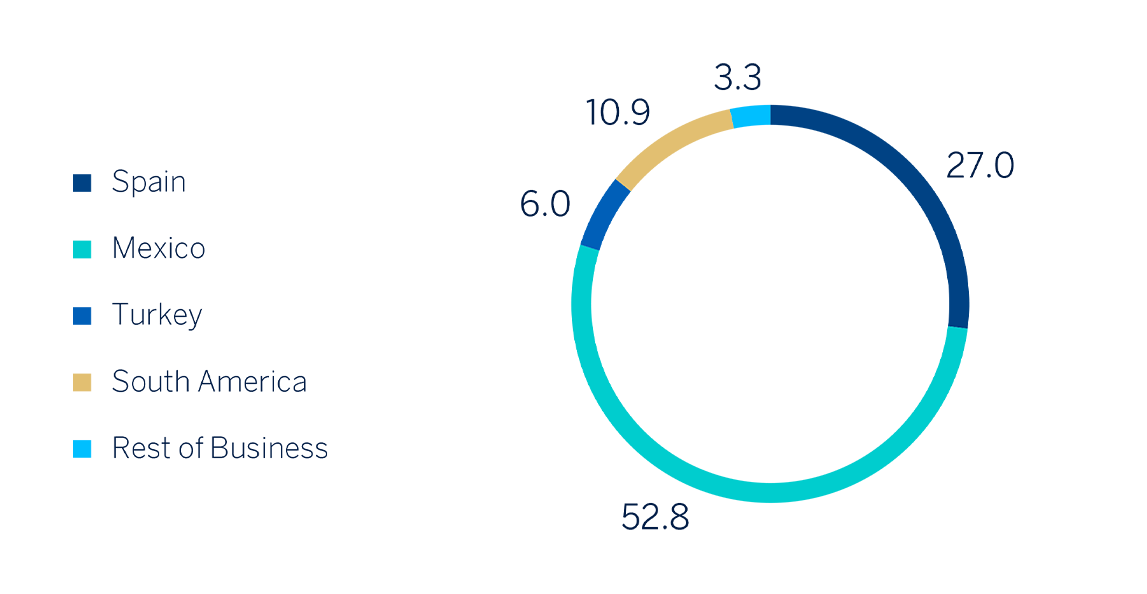

NET ATTRIBUTABLE PROFIT BREAKDOWN (1) (PERCENTAGE. JAN.-SEP. 2022)

(1) Excludes the Corporate Center and net impact arisen from the purchase of offices in Spain.

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, data at the end of June 2022.

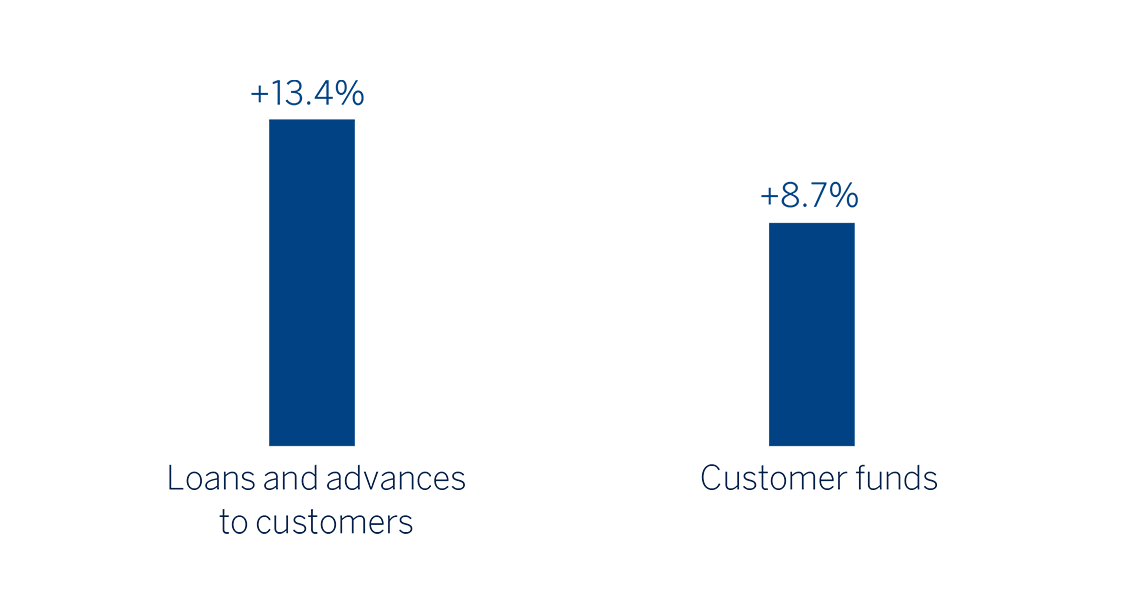

Loans and advances to customers grew by 13.4% compared to the end of December 2021, strongly favored by the evolution of corporate loans in all business areas and, to a lesser extent, by the dynamism of retail loans.

Customer funds increased by 8.7% compared to the end of December 2021, thanks to the contribution of demand deposits (+7.4%) and time deposits (+32.6%), showing an outstanding growth in the quarter.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2021)

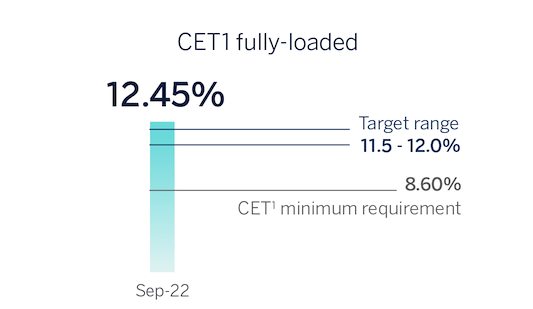

The Group's CET1 Fully-loaded ratio stood at 12.45% as of September 30, 2022, which allows to maintain a large management buffer over the Group's CET1 requirement (8.60%), and also above the Group's established target management range of 11.5-12.0% of CET1.

CAPITAL POSITION above the target range

1 CET 1 SREP letter requirement.

Regarding shareholder remuneration, on April 8, 2022 and as approved by the Annual General Meeting held on March 18, 2022 on the second item of the agenda, a cash gross payment of €0.23 was made against voluntary reserves for each outstanding share of BBVA as an additional shareholder remuneration for the year 2021. Thus, the total amount of cash distributions for the year 2021 was €0.31 gross per share, the largest distribution in 10 years. Similarly, on September 29, 2022, BBVA informed that its Board of Directors approved the payment in cash of €0.12 gross per share, which was paid on October 11, 2022. This dividend is already considered in the Group's capital adequacy ratios.

The total shareholder remuneration includes, in addition to the aforementioned cash payments, the extraordinary remuneration resulting from the execution of the program scheme for the buyback of own shares announced on October 29, 2021 (the “Program Scheme”).

On August 19, 2022 BBVA announced the end of the execution of its share buyback program once the maximum number of shares established in the terms and conditions announced on November 19, 2021 had been reached. Thus, the Bank has successfully concluded its share buyback program, having acquired a total of 637,770,016 shares, for an amount of €3,160m.

On September 30, 2022, the redemption of the 356,551,306 shares acquired by the Bank in execution of the second tranche of the share buyback program was announced.

EXECUTION OF THE PROGRAM FOR THE BUYBACK OF SHARES

| Tranche | Segment | Completion date | Number of shares | % of share capital* | Disbursement |

|---|---|---|---|---|---|

| FIRST TRANCHE | March 3 | 281,218,710 | 4.2 | 1,500 | |

| SECOND TRANCHE | First segment | May 16 | 206,554,498 | 3.1 | 1,000 |

| Second segment | August 19 | 149,996,808 | 2.3 | 660 | |

| Total | 637,770,016 | 9.6 | 3,160 |

- * As of the date tranche closure

REDEMPTION OF SHARE

| Tranche | Date | Number of redeemed shares |

|---|---|---|

| FIRST TRANCHE | June 15 | 281,218,710 |

| SECOND TRANCHE | September 30 | 356,551,306 |

| Total | 637,770,016 |

Channeling sustainable financing

SUSTAINABLE FINANCING BREAKDOWN (PERCENTAGE. TOTAL AMOUNT CHANNELED 2018-SEPTEMBER 2022)

BBVA has channeled a total of €124,000m in sustainable business between 2018 and September 2022. Close to €13,000m were channeled this quarter, which represents an increase of nearly 60% compared to the same period in 2021.

Within the channeling of sustainable business, which aims to promote the fight against climate change, the contribution of loans and the funding of projects stands out, which account for 78% of the amount channeled at the end of September 2022. It should be considered that these products have had a standard amortization rate since the beginning of their channeling. Third-party bond brokerage, a business activity that is registered off-balance sheet, represents 18% of the channeled business linked to the fight against climate change. Finally, mutual funds and other off-balance sheet products such as insurance and pension funds, represent 4%.

For its part, within the channeling of sustainable business, which aims to promote inclusive growth, loans and project financing account for 59% of the total amount channeled at the end of September 2022, showing a standard amortization rate since the beginning of its channeling. Third-party bond brokerage represents 14%, while mutual funds and other off-balance sheet products such as insurance and pension funds represent 6%. Finally, the activity of the Microfinance Foundation (BBVAMF), not recorded in the BBVA Group's balance sheet, whose objective is to support entrepreneurs with micro-credits, represent 21%.

The good performance of retail business related to energy efficiency stands out, which has doubled in the third quarter of 2022 compared to the same quarter of the previous year. The role of Spain stands out, doubling the funds directed to energy efficiency compared to the same quarter last year. The increase of 43% in retail business related to sustainable mobility has also been relevant, with financing lines for the acquisition of hybrid and electric vehicles, which has already exceeded that of the same quarter of the previous year and where Colombia has been crucial by channeling a quarter of the total amount. In corporate business, financing related to energy-efficient buildings stands out, multiplying its channeling by three compared to the same quarter of the previous year, where Mexico has been key by increasing its channeling in this line by 60%.

In inclusive growth, great progress has also been made, highlighting the financing of social housing or healthcare infrastructures, quadrupling the financing of the latter compared to the same quarter of the previous year. Financing the business segment plays a relevant role as it contributes more than half of the total channeling, with Spain standing out, which represents approximately 50% of it.

Finally, in corporate business, channeling has also increased by more than 130% compared to the same quarter of the previous year. Likewise, Project Finance activity multiplied by two compared to the same quarter of the previous year, highlighting wind farm projects, which account for almost a quarter of the channeling in Project Finance and where the United States is a key player, accounting for almost 80% of the channeling.

Relevant advances in sustainability matters

- Sustainable business goal

BBVA has raised up its sustainable business goal to €300,000m. This figure places BBVA as one of the European banks with the greatest ambition in its goal of channeling sustainable financing, and it is a tangible example of the bank's commitment to sustainability, one of its strategic priorities. This new target, which was just made public in October, means raising the goal announced in July 2021 by 50%, when BBVA updated its sustainable financing roadmap. In addition, it triples the initial aspiration, detailed in February 2018.

- Strategy

BBVA updates its Sustainability General Policy by adding the General Policy on Corporate Social Responsibility and updating the Group's sustainability goals. The three new objectives are: increase the growth of the Group's business through sustainability, achieve neutrality in greenhouse gas emissions and to promote integrity in the relationship with stakeholders. In addition, natural capital is incorporated as a focus of action to be prepared for the challenges ahead.

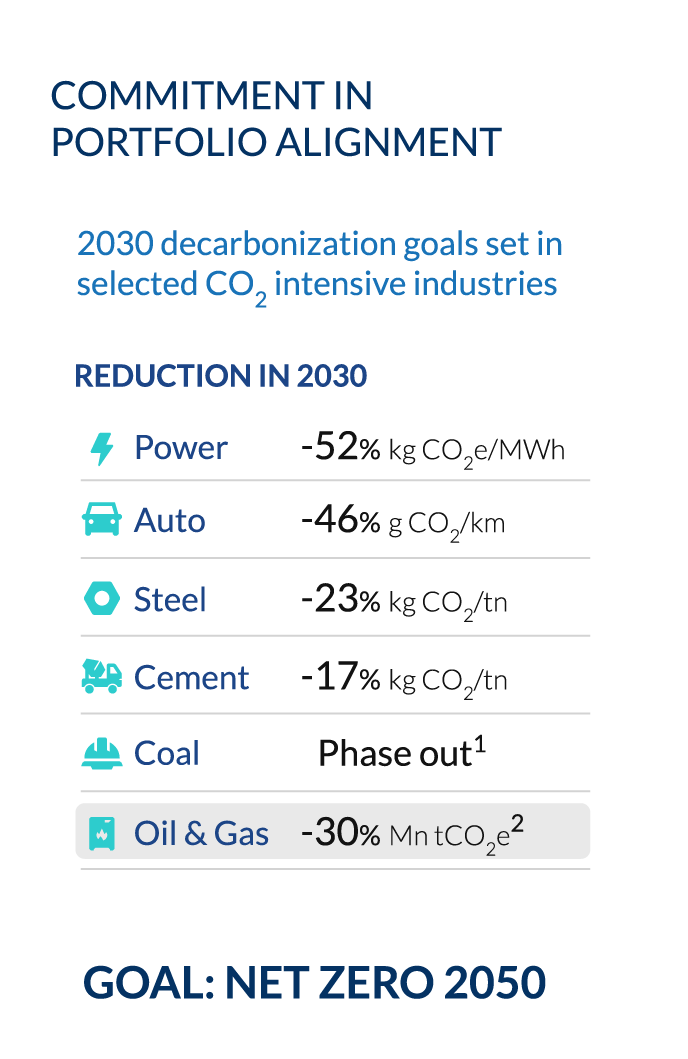

- Decarbonization goals

BBVA wants to accompany the energy sector in its transition and it is committed to clean energies. The Group is making progress in its commitment to be a carbon neutral Entity in 2050, not only through its own activity, already achieved since 2020, but also through the activity of the customers that it finances. Therefore, it has announced that it will reduce the emissions of its oil and gas portfolio by 30% before 2030. BBVA will align its balance sheet in the oil and gas sector according to the scenario of net zero emissions in 2050 following the absolute emissions metric. This commitment is in addition to the Group's 2021 targets in four other carbon-intensive sectors (see table below) and the decision to stop financing coal companies, in line with the zero net emissions banking alliance (NZBA).

(1) 2030 for developed countries and in 2040 for emerging countries.

(2) For upstream related financing.

- Innovation

BBVA's strategic priorities are innovation and sustainability, as evidenced by the creation of a new "water footprint" loan for wholesale customers. This loan, a pioneer in the market, focuses on the customers' water footprint, being of special interest for both, companies that make intensive use of water in their production process, as well as those that operate in the energy, food and beverages, agriculture, textiles or packaging sectors, among others. With this new product, customers benefit from their efforts to reduce their water footprint, not only in terms of price, but also in terms of reputation and differentiation from competitors.

- Carbon markets

BBVA has joined the Carbonplace global platform as a founding member. The platform, which will be operational by the end of 2022, aims to simplify access to carbon credits for all those customers committed to decarbonization. It is an innovative global carbon credit transaction platform that allows the safe, simple and transparent exchange of certified carbon credits, in accordance with recognized international standards. Through this technological solution, BBVA will offer its customers around the world direct access to carbon credits to offset their emissions. BBVA is the first Spanish bank to join this platform integrated into the voluntary carbon market.

- Training

BBVA wants to “make the opportunities of this new era available to everyone”, which is why it has launched the free online course “The ABC of Sustainability” open to the public on the Coursera platform. Within the course, it is described how sustainability is applicable to daily situations in the population, the use of natural resources, its application in the global economy and its interaction with the biosphere, as well as social aspects such as a fair transition, equity, equality, diversity , human rights, education and health.

In addition, since World Environment Day, the educational program "Learning Together" is transformed into "Learning Together 2030". This change sets the beginning of a new stage in the BBVA initiative that will strengthen and expand its global commitment to people and the planet. The program is the largest educational platform in Spanish, it already has more than seven million subscribers and its videos have more than 1,800m views.

Business areas

Spain

€4,646 Mill.*

+2.9%

Highlights

- Growth in lending activity in the year

- Significant improvement in efficiency

- Favorable evolution of net interest income and improvement in the customer spread

- Solid risk indicators with a decrease in the balance of non-performing loans and the NPL ratio

Results

(Millions of euros)

Net interest income

2,695Gross income

4,646Operating income

2,489Net attributable profit (3)

1,514Activity (1)

Variation compared to 31-12-21.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+3.1%

Customers funds under management

-0.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

(3) The net attributable profit excludes the net

impact arisen from the purchase of offices in Spain.

Including this impact, the net attributable profit

stands at €808m, representing a year-on-year increase

of 11.5%.

Mexico

€7.754 Mill.*

+24.9%

Highlights

- Balanced investment growth in the first nine months

- Good performance of recurring income and NTI

- Significant improvement in the efficiency ratio

- Excellent net attributable profit in the quarter

Results

(Millions of euros)

Net interest income

5,921Gross income

7,754Operating income

5,284Net attributable profit

2,964Activity (1)

Variation compared to 31-12-21 at constant exchange

rate.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+12,6%

Customers funds under management

+2,6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

1,163 Mill.*

+104.2%

Highlights

- Growth in activity, again driven by loans and deposits in Turkish lira

- Lower hyperinflation adjustment in the quarter

- Strength of risk indicators

- Year-on-year growth in net attributable profit

Results

(Millions of euros)

Net interest income

1,976Gross income

2,357Operating income

1,567Net attributable profit

Resultado atribuido

336Activity (1)

Variation compared to 31-12-21 at constant exchange

rate.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+41.6%

Customers funds under management

+48.3%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€3,167 Mill.*

+38.9%

Highlights

- Growth in lending activity and customer funds

- Improvement of the NPL ratio and coverage stability

- Favorable behavior of net interest income and NTI in the quarter

- Stability of the efficiency ratio in the quarter despite the growth of expenses in an inflationary environment

Results

(Millions of euros)

Net interest income

3,074Gross income

3,167Operating income

1,674Net attributable profit

614Activity (1)

Variation compared to 31-12-21 at constant exchange

rates.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+10.2%

Customers funds under management

+12.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€585 Mill.*

-8.7%

Highlights

- Growth in lending activity and in customer funds in the first nine months of 2022

- Strong net interest income, which grows at double-digit

- Increase in operating expenses

- The cost of risk remains at low levels

Results

(Millions of euros)

Net interest income

244Gross income

585Operating income

217Net attributable profit

183Activity (1)

Variation compared to 31-12-21 at constant exchange

rates.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+26.2%

Customers funds under management

+27.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) Net attributable profit excludes the net impact of the acquisition of offices in Spain. Including this impact, net attributable profit came to 1,312 million euros, an increase of 10.2% year-on-year.

(2) At constant exchange rates.

(3) At constant exchange rates.

Data at the end of September 2022. Those countries in which BBVA has no legal entity or the volume of activity is not significant, are not included.

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain generated a net attributable profit of €1,514m between January and September of 2022, up 27.1% from the result achieved in the same period of the previous year, due to the dynamism of recurring income from banking activity (net interest income and fees) and net trading income (NTI), which together with lower operating expenses and provisions, have driven the year-on-year evolution. This result does not include the net impact of €-201m from the purchase of Merlin Properties, SOCIMI, S.A. (hereinafter Merlin) of 100% of the shares of Tree Inversiones Inmobiliarias Socimi, S.A. (hereafter Tree), owner of 662 offices leased to BBVA. Including this impact, the area's net attributable profit amounts to €1,312m, an increase of 10.2% compared to the net attributable profit of the same period of the previous year.

- In Mexico, BBVA achieved a net attributable profit of €2,964m between January and September 2022, representing an increase of 47.5% compared to the first nine months of 2021, mainly as a result of the dynamism of the net interest income.

- Turkey generated a net attributable profit of €336m between January and September 2022, which includes the application of hyperinflation accounting in Turkey, with effect from January 1, 2022.

- South America generated a net attributable profit of €614m in the first nine months of 2022, which represents a year- on-year variation of +98.3%, mainly due to the improved performance of recurring income (+50.0%) and NTI.

-

Rest of Business achieved a net attributable profit of €183m accumulated at the end of the first nine months of 2022, 24.8% less than in the first nine months of the previous year, mainly due to the performance of the Group's businesses in the United States.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email