Solvency

Capital base

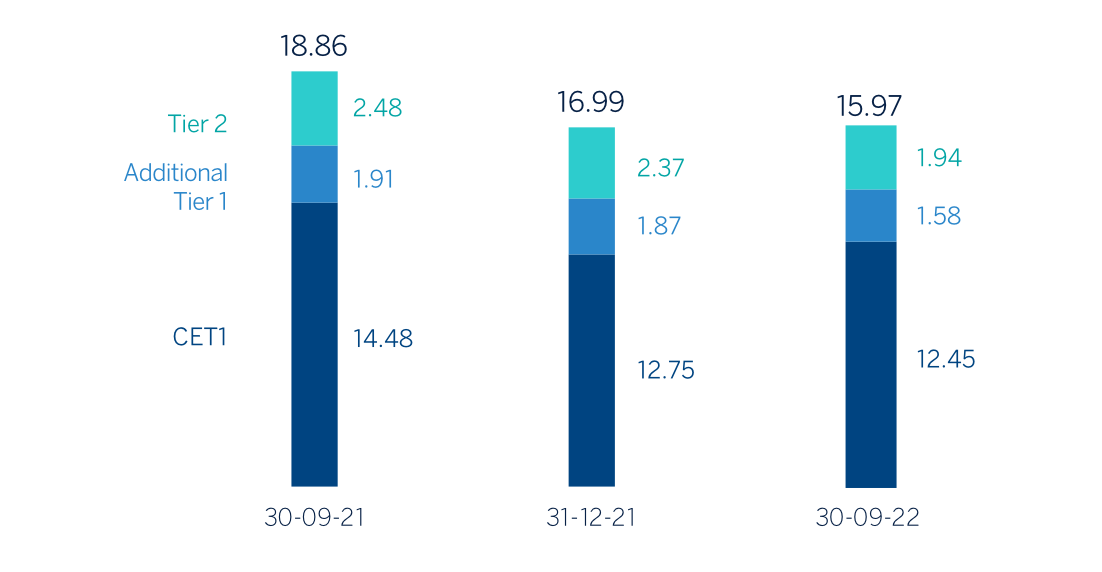

The Group's CET1 fully-loaded ratio stood at 12.45% as of September 30, 2022, maintaining a large management buffer over the Group's CET1 requirement (8.60%), and also above the Group's established target management range of 11.5-12.0% of CET1.

During the third quarter of the year, the CET1 ratio remained at the level of the previous quarter. The generation of profit, net of dividends and remuneration of equity instruments, contributed 26 basis points to the CET1 ratio. This growth, together with the offset in equity of the effects of hyperinflation on earnings and the reversal of approximately 10 basis points of the effect on capital of the share buyback program, which was completed for an amount lower than previously deducted, mitigated the effect of market volatility and the growth of risk-weighted assets (RWA).

Fully-loaded risk-weighted assets (RWA) increased approximately €10,800 million euros in the quarter, mainly as a result of the organic generation and the currency effect mainly due to the appreciation of the US dollar and the Mexican peso.

The consolidated fully-loaded additional Tier 1 capital (AT1) stood at 1.58% as of September 30, 2022, resulting in a 1 basis point decrease from the previous quarter.

The consolidated fully-loaded Tier 2 ratio at the end of September stood at 1.94%, with a decrease of 13 basis points in the quarter. The total fully-loaded capital adequacy ratio stands at 15.97%.

Following the latest SREP (Supervisory Review and Evaluation Process) decision, received in February 2022 and with entry into force as from March 1, 2022, the ECB informed the Group that the Pillar 2 requirement remains unchanged at 1.5% (of which at least 0.84% must be fulfilled with CET1). Therefore, BBVA must maintain a CET1 capital ratio of 8.60% and a total capital ratio of 12.76% at the consolidated level.

The phased-in CET1 ratio at the consolidated level stood at 12.55% as of September 30, 2022, considering the transitory effect of the IFRS 9 standard. AT1 reached 1.58% and Tier 2 reached 1.94%, resulting in a total capital adequacy ratio of 16.07%.

FULLY-LOADED CAPITAL RATIOS (PERCENTAGE)

CAPITAL BASE (MILLIONS OF EUROS)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 30-09-22 (1) (2) | 31-12-21 | 30-09-21 | 30-09-22 (1) (2) | 31-12-21 | 30-09-21 | |

| Common Equity Tier 1 (CET 1) | 42,895 | 39,949 | 44,558 | 42,513 | 39,184 | 43,793 |

| Tier 1 | 48,300 | 45,686 | 50,329 | 47,918 | 44,922 | 49,564 |

| Tier 2 | 6,614 | 7,383 | 7,770 | 6,613 | 7,283 | 7,491 |

| Total Capital (Tier 1 + Tier 2) | 54,914 | 53,069 | 58,098 | 54,531 | 52,205 | 57,055 |

| Risk-weighted assets | 341,685 | 307,795 | 303,002 | 341,455 | 307,335 | 302,542 |

| CET1 (%) | 12.55 | 12.98 | 14.71 | 12.45 | 12.75 | 14.48 |

| Tier 1 (%) | 14.14 | 14.84 | 16.61 | 14.03 | 14.62 | 16.38 |

| Tier 2 (%) | 1.94 | 2.40 | 2.56 | 1.94 | 2.37 | 2.48 |

| Total capital ratio (%) | 16.07 | 17.24 | 19.17 | 15.97 | 16.99 | 18.86 |

- (1) As of September 30, 2022, the difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS 9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR and the subsequent amendments introduced by the Regulation (EU) 2020/873).

- (2) Preliminary data.

Regarding shareholder remuneration, on April 8, 2022 and as approved by the Annual General Meeting held on March 18, 2022 on the second item of the agenda, a cash gross payment of €0.23 was made against voluntary reserves for each outstanding share of BBVA as an additional shareholder remuneration for the year 2021. Thus, the total amount of cash distributions for the year 2021 was €0.31 gross per share, the largest distribution in 10 years. Similarly, on September 29, 2022, BBVA informed that its Board of Directors approved the payment in cash of €0.12 gross per share, which was paid on October 11, 2022. This dividend is already considered in the Group's capital adequacy ratios.

The total shareholder remuneration includes, in addition to the aforementioned cash payments, the extraordinary remuneration resulting from the execution of the program scheme for the buyback of own shares announced on October 29, 2021 (the “Program Scheme”).

Specifically, regarding the Program Scheme, on November 19, 2021, BBVA notified by means of Inside Information the execution of a first tranche (the "First Tranche"), for a maximum amount of 1,500 million euros, with a maximum number of shares to be acquired in the amount of 637,770,016 treasury shares, representing approximately 9.6% of BBVA's share capital. By means of Other Relevant Information dated March 3, 2022, BBVA communicated the completion of the execution of the First Tranche as the maximum monetary amount had been reached, having acquired 281,218,710 own shares in execution of the First Tranche, representing approximately 4.22 % of BBVA's share capital as of that date. On June 15, 2022, BBVA notified the partial execution of the share capital reduction resolution adopted by the Annual General Shareholders’ Meeting of BBVA held on March 18, 2022, through the redemption of the 281,218,710 own shares acquired by the Bank in execution of the First Tranche and the consequent reduction in BBVA's share capital by a nominal amount of 137,797,167.90 euros.

On February 3, 2022, BBVA notified by means of Inside Information that its Board of Directors had agreed, within the scope of the Program Scheme, to carry out a second buyback program for the repurchase of own shares (the “Second Tranche”) for a maximum amount of €2,000 million and a maximum number of shares to be acquired equal to the result of subtracting from 637,770,016 own shares (9.6% of BBVA’s share capital at that date) the number of own shares finally acquired in execution of the First Tranche.

In this regard, on March 16, 2022, BBVA informed by means of Inside Information that it had agreed to execute the Second Tranche: i) through the execution of a first segment for an amount of up to €1,000 million, and with a maximum number of shares to be acquired of 356,551,306 treasury shares (the "First Segment"); and (ii) once execution of the First Segment has been completed, through the execution of a second segment that would complete the Framework Program (the "Second Segment").

By means of Other Relevant Information dated May 16, 2022, BBVA announced the completion of the execution of the First Segment upon reaching the maximum monetary amount of €1,000 million, having acquired 206,554,498 own shares in execution of the First Segment, representing, approximately, 3.1% of BBVA's share capital as of said date.

On June 28, 2022, BBVA communicated through Inside Information the agreement to complete the Program Scheme by executing the Second Segment, for a maximum amount of €1,000 million and a maximum number of BBVA shares to be acquired of 149,996,808. By means of Other Relevant Information dated August 19, 2022, BBVA announced the completion of the execution of the Second Segment of the Second Tranche upon reaching the maximum number of shares of 149,996,808, representing, approximately, 2.3% of BBVA's share capital as of said date (amounted to approximately €660 million). On September 30, 2022, BBVA notified, by means of Other Relevant Information, an additional partial execution of the share capital reduction resolution adopted by the Annual General Shareholders’ Meeting of BBVA held on March 18, 2022, through the redemption of the 356,551,306 own shares acquired by the Bank in execution of the First Segment and the Second Tranche and the consequent reduction of BBVA's share capital by a nominal amount of 174,710,139.94 euros.

After the redemptions of the shares acquired in execution of the First and Second Tranche indicated, BBVA's share capital has been set at 2,954,757,116.36 euros, represented by 6,030,116,564 shares with a nominal value of €0.49 each.

SHAREHOLDER STRUCTURE (30-09-22)

| Shareholders | Shares issued | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 500 | 333,186 | 40.9 | 62,482,925 | 1.0 |

| 501 to 5,000 | 375,474 | 46.1 | 668,177,029 | 11.1 |

| 5,001 to 10,000 | 56,346 | 6.9 | 396,753,650 | 6.6 |

| 10,001 to 50,000 | 43,826 | 5.4 | 838,576,011 | 13.9 |

| 50,001 to 100,000 | 3,126 | 0.4 | 212,751,997 | 3.5 |

| 100,001 to 500,000 | 1,429 | 0.2 | 255,872,320 | 4.2 |

| More than 500,001 | 296 | 0.04 | 3,595,502,632(1) | 59.6 |

| Total | 813,683 | 100 | 6,030,116,564 | 100 |

- (1) The number of shares issued takes into account the redemption of 356,551,306 shares, corresponding to the second tranche of the share buyback program.

With regard to MREL (Minimum Requirement for own funds and Eligible Liabilities) requirements, BBVA must maintain, from January 1, 2022, an amount of own funds and eligible liabilities equal to 21.46% of the total RWAs of its resolution group, at a sub- consolidated3 level (hereinafter, the "MREL in RWAs"). This MREL in RWA does not include the combined capital buffer requirement which, according to applicable regulations and supervisory criteria, would currently be 3.26%, and it is currently the most restrictive requirement for BBVA. Given the structure of own funds and admissible liabilities of the resolution group, as of September 30, 2022, the MREL ratio in RWAs stands at 26.18%4,5, complying with the aforementioned requirement.

With the aim of reinforcing compliance with these requirements, during 2022, BBVA has made the following debt issues: (i) senior non-preferred bond for an amount of €1,000m , with a maturity of 7 years and the option for early redemption in the sixth year, with a coupon of 0.875%; (ii) senior preferred issue in May, 2022 for €1,250m at a fixed rate of 1.750% over three and a half years; (iii) senior preferred issue in May, 2022 for an amount of €500m at a floating rate of 3-months Euribor plus a spread of 64 basis points (leaving a coupon of 3-months Euribor plus 100 basis points) at three years and a half; (iv) senior preferred issue in May, 2022 at two-year terms for €100m at a fixed 1% rate; (v) senior preferred issue in July for an initial amount of €400m at the 3-months Euribor floating rate plus 70 basis points, which was increased in amount on 3 occasions, reaching a total amount of 865 million euros; (vi) USD1 billion senior non-preferred issue in September, 2022 with a four-year maturity and a coupon of 5.862%; (vii) USD750 million senior non- preferred issue in September, 2022 with a maturity of six years and a coupon of 6.138%; (viii) senior preferred issue in September, 2022 for an amount of 1,250 million euros, maturing in five years and a coupon of 3.375%; (ix) preferred senior green issue in October, 2022 for a term of seven years and a coupon of 4.375%, whose aim is to finance the growth of commercial activity and meet the Group's objective of making at least one green or social issue per year; and (x) senior preferred issue in October, 2022 for €100m over 12 years and a coupon of 4.25%.

Lastly, as of September 30, 2022, the Group's fully-loaded leverage ratio stood at 6.3% (6.3% phased-in)6.

Ratings

During the first nine months of 2022, BBVA’s rating has continued to show its stability and all agencies have maintained their rating in the A category. In March, S&P changed the outlook of BBVA's rating from negative to stable (affirming the rating at A), after taking a similar action in the Spanish sovereign rating. Following annual reviews of BBVA, Fitch and DBRS Morningstar affirmed their ratings at A- (May) and A (high) (March), respectively, both with a stable outlook. For its part, Moody's has kept BBVA's rating unchanged in the period at A3 (with a stable outlook). The following table shows the credit ratings and outlook assigned by the agencies:

Ratings

| Rating agency | Long term (1) | Short term | Outlook |

|---|---|---|---|

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s | A3 | P-2 | Stable |

| Standard & Poor’s | A | A-1 | Stable |

(1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating, respectively, to BBVA’s long term deposits.

3 In accordance with the resolution strategy MPE (“Multiple Point of Entry”) of the BBVA Group, established by the SRB, the resolution group is made up of Banco Bilbao Vizcaya Argentaria, S.A. and subsidiaries that belong to the same European resolution group. As of June 30, 2021, the total RWAs of the resolution group amounted to €190,377m and the total exposure considered for the purpose of calculating the leverage ratio amounted to €452,275m.

4 Own resources and eligible liabilities to meet, both, MREL and the combined capital buffer requirement applicable.

5 As of September 30, 2022, the MREL ratio in Leverage Ratio stands at 10.59% and the subordination ratios in terms of RWAs and in terms of exposure of the leverage ratio, stand at 21.95% and 8.88%, respectively, being preliminary data.

6 The Group’s leverage ratio is provisional at the date of release of this report. On April, 1st 2022 ended the period of temporary exclusion of certain positions with central banks.