The share

The global economy has decelerated throughout the course 2022, in an environment marked by strong inflationary pressures, an aggressive tightening of monetary conditions, the adverse impact of the war in Ukraine and slower growth in China.

Despite the slowing trend, economic growth showed some resilience and was generally higher than expected by most analysts. This was due to previously accumulated savings, the process of normalization of activity after the restrictions and disruptions generated by the COVID-19 pandemic, and the dynamism of the labor markets, which contributed to an improvement in private consumption and the service sector.

Inflation remained at elevated levels in 2022. However, after surprising on the upside for most of the year, it started to moderate in recent months. This is in line with the slowing trend in aggregate demand, the recent moderation in energy prices and normalization in global supply chains. At year-end, annual inflation stood at 6.5% in the United States and 9.2% in the Eurozone.

Against this backdrop of still elevated inflationary pressures, central banks continued to tighten monetary policy. The U.S. Federal Reserve ("the Fed") raised benchmark interest rates to 4.5% in December (a level 425 basis points higher than at the beginning of 2022) and kept up asset sales to reduce the size of its balance sheet. Further, the Fed indicated that interest rate hikes will continue in the coming months, albeit at a slower pace. In the Eurozone, the ECB has raised interest rates for its refinancing operations to 2.5% in December (a level 250 basis points higher than at the start of 2022). In addition, the central bank has tightened the conditions of its liquidity supply to banks through the TLTRO operations (targeted long-term refinancing operations) and has indicated that it will soon initiate a program to sell its assets. In a context of high uncertainty, BBVA Research's central scenario estimates that the global economy will continue to slow down in the near future, with possible episodes of recession in the Eurozone and the United States. This slowdown in growth will be mainly due to the significant tightening of monetary conditions (interest rates are expected to reach close to 5.0% in the United States and 3.75% in the Eurozone in the coming months; these are clearly contractionary levels, which will remain unchanged until at least the final months of the year 2023) and inflationary pressures are still significant, despite the prospects for moderation.

According to BBVA Research, after growing by 6.3% in 2021 and around 3.3% in 2022, global GDP will grow by only 2.3% in 2023. In the United States, growth would slow to 1.9% in 2022 and 0.5% in 2023, as strong monetary tightening is expected to cause a downward adjustment on growth. In the Eurozone, GDP is expected to slightly fall in the coming quarters, primarily due to the disruptions created by the war in Ukraine, including still high gas prices. The annual growth in the region would be 3.2% in 2022 and -0.1% in 2023. In China, the growth would reach 3,0% in 2022 and 5,0% in 2023, but the wider spread of COVID-19 infections following the financial strains caused by imbalances in real estate markets could trigger slower-than-expected economic growth.

The uncertainty remains at high levels and the risks could have a downward bias on growth. Specifically, sustainable inflation could trigger even stronger interest rate hikes and therefore, a deeper and more widespread recession, as well as higher financial volatility.

The main indexes have shown a negative performance in the year 2022. In Europe, the Stoxx Europe 600 index decreased by 12.9% compared to the end of December of the previous year, and in Spain the Ibex 35 fell by 5.6% in the same period, showing a better relative performance. In the United States, the S&P 500 index also decreased by 19.4%.

With regard to the banking sector indexes, their performance during 2022 was better than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, decreased by 3.2% and 4.6% respectively, while in the United States, the S&P Regional Banks sector index fell by 17.0% in the period.

The BBVA share price increased by 7.3% during the year, closing the month of December 2022 at €5.63.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-21)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 31-12-22 | 30-09-22 | |

|---|---|---|

| Number of shareholders | 801,216 | 813,683 |

| Number of shares issued (millions) | 6,030 | 6,030 |

| Closing price (euros) | 5.63 | 4.62 |

| Book value per share (euros) (1) | 7.80 | 7.68 |

| Tangible book value per share (euros) (1) | 7.44 | 7.31 |

| Market capitalization (millions of euros) | 33,974 | 27,862 |

| Yield (dividend/price; %) (2) | 6.2 | 6.7 |

(1) For more information, see Alternative Performance Measures at the end of the quarterly report.

(2) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.31 per share on April as final dividend of 2022 and the execution of a Share Buyback Program of BBVA for an amount of €422m, subject to the correspond regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2022 will reach €3,015m, 47% of the net attributable profit, which represents €0.50 per share, and also includes the payment in cash of €0.12 per share paid on October 2022 as interim dividend of the year.

After the redemption of the shares acquired in the execution of the First and Second Tranche within the executed Program Scheme during 2021 and 2022 (281,218,710 and 356,551,306 own shares of BBVA, respectively), BBVA's share capital as of December 31, 2022, has been set at 2,954,757,116.36 euros, represented by 6,030,116,564 shares with a nominal value of €0.49 each.

For its part, on December 31, 2022, the number of shareholders reached 801,216, and by type of investor, 58.83% of the capital belonged to institutional investors and the remaining 41.17% was in the hands of retail shareholders.

BBVA shares are included on the main stock market indexes. At the closing of December 2022, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 7.8%, 1.2% and 0.4, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 4.5% and the Euro Stoxx Banks index for the eurozone with a weighting of 7.9%. In addition to these indexes, BBVA forms part of the main sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good and theMSCI ESG Indexes.

Group's information

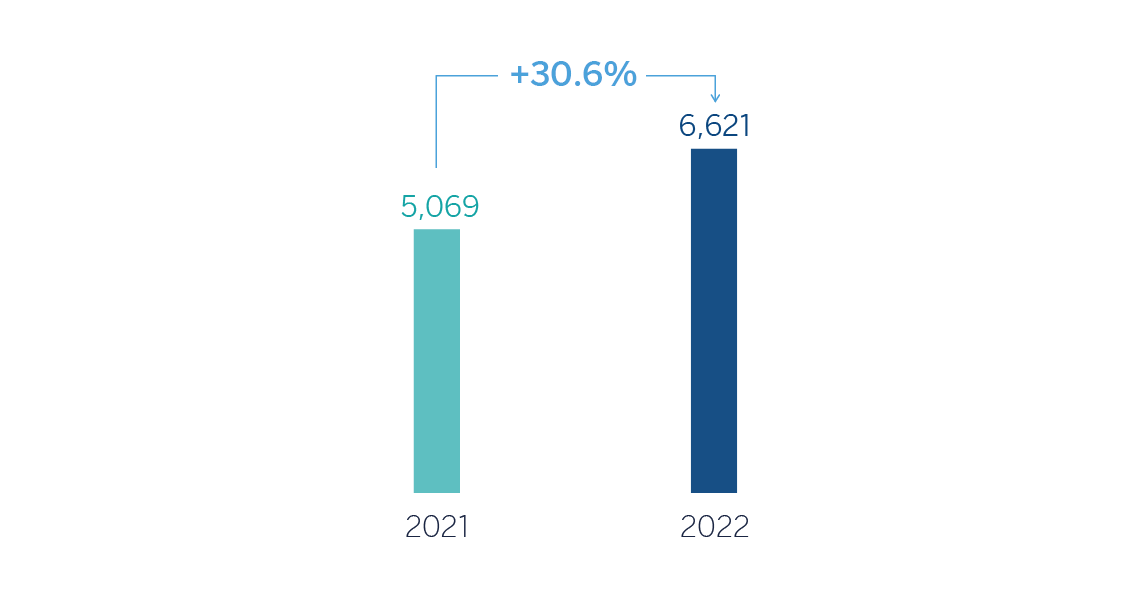

The BBVA Group generated a net attributable profit excluding non-recurring impacts of €6,621m in the year 2022, which represents an increase of 30.6% compared to the previous year, and the highest result ever. Including the non-recurring impacts, i.e. the net impact for an amount of €-201m from the purchase of offices in Spain from Merlin in June 2022 and €-416m from the results of discontinued operations corresponding to BBVA USA and the rest of the companies sold to PNC on June 1, 2021, together with the net cost related to the restructuring process of the same year, the net attributable profit increased by 38.0% in year-on-year terms to €6,420m.

Recurring income from banking activity (net interest income and commissions) continues to show an excellent performance, reflecting the good performance of activity and improvement in the customer spread, fostered by a more favorable interest rate environment.

Operating expenses increased by 12.9% at the Group level, below the average inflation rate in all countries in which BBVA operates. Notwithstanding the above, thanks to the remarkable growth in gross income, higher that the growth in expenses, the efficiency ratio stood at 43.2% as of December 31, 2022, with an improvement of 277 basis points in constant terms, compared to the ratio as of December 31, 2021, placing BBVA once again, in a leading position among its European peer group1.

The provisions for impairment on financial assets increased (+12.9% in year-on-year terms and at constant exchange rates), with higher provisions in South America and Turkey.

The Group's excellent performance in 2022 has also allowed it to accelerate value creation, as reflected in the growth of the tangible book value and dividends, which at year-end 2022 was 19.5% above the previous year.

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, comparable peer data as of the end of September 2022.

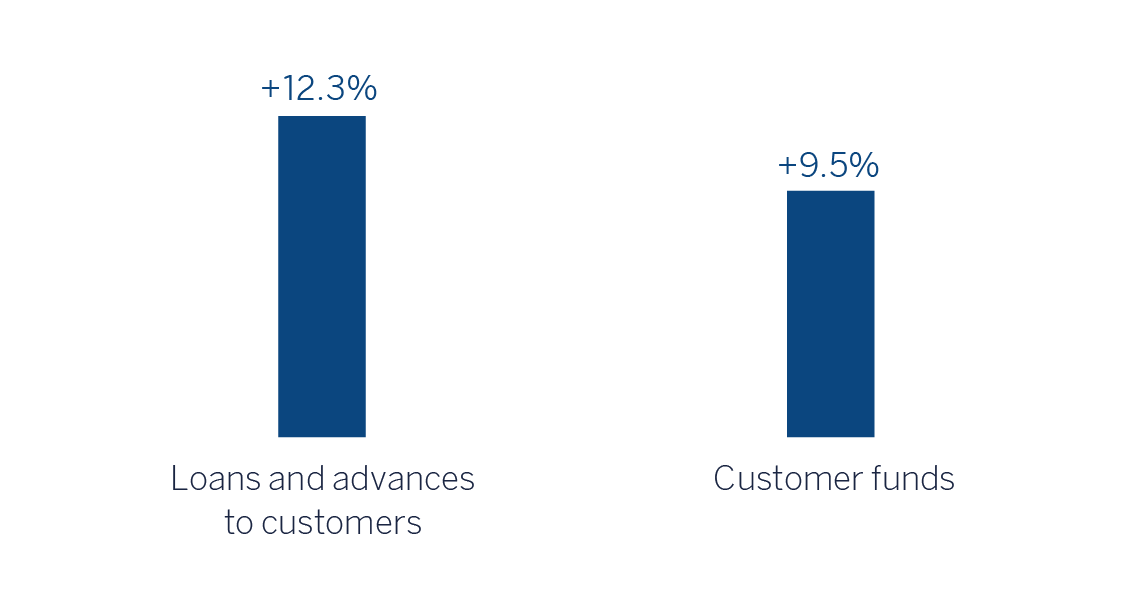

Loans and advances to customers grew by 12.3% compared to the end of December 2021, strongly favored by the evolution of business loans in all business areas and, to a lesser extent, by the performance of retail loans.

Customer funds increased by 9.5% compared to the end of December 2021 thanks to the good performance of customer deposits, which increased in all geographical areas, with increases in both demand deposits and time deposits.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2021)

The Group's CET1 Fully-loaded ratio stood at 12.61% as of December 31, 2022, maintaining a large management buffer over the Group's CET1 requirement (8.60%),2 and also above the Group's established target management range of 11.5-12.0% of CET1.

2 From 1st January 2023, BBVA’s SREP requirement is 8.72% at the consolidated level.

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.31 per share on April as final dividend of 2022 and the execution of a Share Buyback Program of BBVA for an amount of €422m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2022 will reach €3,015m, 47% of the net attributable profit, which represents €0.50 per share, and also includes the payment in cash of €0.12 per share paid on October 2022 as interim dividend of the year.

Business areas

Spain

€6,145 Mill.*

+4.3%

Highlights

- Lending growth in the most profitable segments in 2022

- Double-digit operating income growth

- Significant improvement in efficiency in the year

- Solid risk indicators, with a reduction of both the non-performing loans balance and the NPL ratio in 2022

Results

(Millions of euros)

Net interest income

3,784Gross income

6,145Operating income

3,226Net attributable profit

1,678Activity (1)

Variation compared to 31-12-21.

Balances as of 31-12-22.

Performing loans and advances to customers under mangement

+1.8%

Customers funds under management

+2.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

Mexico

€10,839 Mill.*

+25.9%

Highlights

- Balanced and double-digit growth in both the wholesale and retail portfolio in the year

- Very positive performance of recurring income due to increased activity and improved customer spreads

- Risk indicators improvement and outstanding performance of the efficiency ratio

- Constant increase in the quarterly net attributable profit

Results

(Millions of euros)

Net interest income

8,378Gross income

10,839Operating income

7,406Net attributable profit

4,182Activity (1)

Variation compared to 31-12-21 at constant exchange

rate.

Balances as of 31-12-22.

Performing loans and advances to customers under mangement

+16.5%

Customers funds under management

+8.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

3,185 Mill.*

+76.9%

Highlights

- Acceleration of local currency portfolio and reduction of exposure to foreign currency portfolios

- Lower hyperinflation adjustment in the quarter

- Strength of risk indicators

- Quarterly growth in net attributable profit

Results

(Millions of euros)

Net interest income

2,631Gross income

3,185Operating income

2,119Net attributable profit

509Activity (1)

Variation compared to 31-12-21 at constant exchange

rate.

Balances as of 31-12-22.

Performing loans and advances to customers under mangement

+59.2%

Customers funds under management

+63.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€4,261 Mill.*

+45.1%

Highlights

- Growth in lending activity and customer funds

- NPL and NPL coverage ratio improvement in the quarter

- Favorable behavior of recurring income in the quarter

- Improvement of the efficiency ratio

Results

(Millions of euros)

Net interest income

4,137Gross income

4,261Operating income

2,284Net attributable profit

734Activity (1)

Variation compared to 31-12-21 at constant exchange

rates.

Balances as of 31-12-22.

Performing loans and advances to customers under mangement

+13.7%

Customers funds under management

+14.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€790 Mill.*

-1.1%

Highlights

- Growth in lending activity and in customer funds in 2022

- Strong net interest income, which grows at double-digit

- Risk indicators improvement in the year

- Cost of risk at very low levels

Results

(Millions of euros)

Net interest income

332Gross income

790Operating income

276Net attributable profit

240Activity (1)

Variation compared to 31-12-21 at constant exchange

rates.

Balances as of 31-12-22.

Performing loans and advances to customers under mangement

+36.5%

Customers funds under management

+47.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

Data at the end of December 2022. Those countries in which BBVA has no legal entity or the volume of activity is not significant, are not included.

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

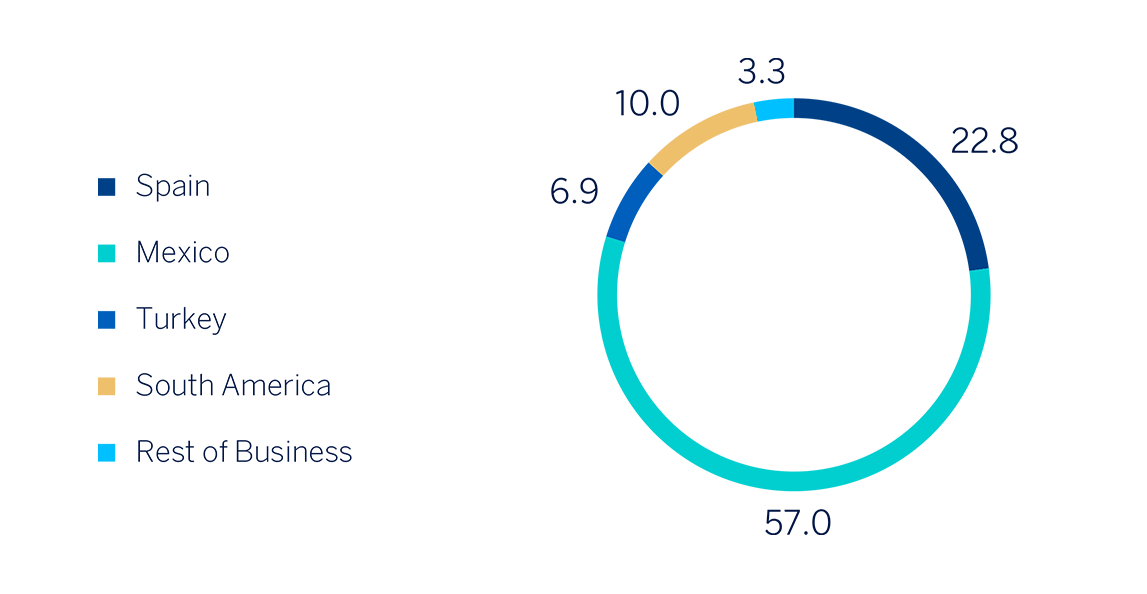

- Spain generated a net attributable profit of €1,678m in the year 2022, up 8.4% from the result achieved in the previous year, due to the dynamism of net interest income and the higher net trading income (NTI), which together with lower operating expenses and provisions, have driven the year-on-year evolution. This result includes the net impact of €-201m from the purchase of offices from Merlin, recorded in the second quarter of the year. Excluding this impact, the cumulative net attributable profit of the area at the end of the year 2022 stands at €1,879m, 21.4% above the net attributable profit of the previous year.

- In Mexico, BBVA achieved a net attributable profit of €4,182m during 2022, representing an increase of 44.8% compared to the year 2021, mainly as a result of the increase in recurring income (net interest income and commissions), due to the strong dynamism of lending activity and the continued improvement in customer spreads, which more than offset the expenses increase in a context of growth and strong activity.

- Turkey generated a net attributable profit of €509m in the year 2022, which includes the impact of hyperinflation accounting in Turkey, with effect from January 1, 2022, partially offset by good business dynamics.

- South America generated a net attributable profit of €734m in the year 2022, which represents a year-on-year variation of +80.0%, mainly due to the improved performance of recurring income (+54.3%) and NTI.

-

Rest of Business achieved a net attributable profit of €240m accumulated at the end of 2022, 15.1% less than in the previous year.

The Corporate Center recorded a net attributable loss of €922m in the year 2022. This result compares to the loss of €938m recorded in the same period of the previous year, which included the net costs associated with the restructuring process in Spain carried out by the Group in 2021, in addition to the results generated by the Group's businesses in the United States until their sale to PNC on June 1, 2021.

Lastly and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €1,736m in 2022. These results, which do not include the application of hyperinflation accounting, represent an increase of 47.1% on a year-on-year basis, due to the growth in recurring income and NTI, which comfortably offset the higher expenses and provisions for impairment on financial assets. It should also be noted that all business lines of the CIB area recorded double-digit growth compared to the year 2021, both in revenues and net attributable profit.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

General note: 2022 excludes net impact arisen from the purchase of offices in Spain. 2021 excludes BBVA USA and the rest of the companies in the United States sold to PNC and the net cost related to the restructuring process.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 2022)

(1) Excludes the Corporate Center.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email