Solvency

Capital base

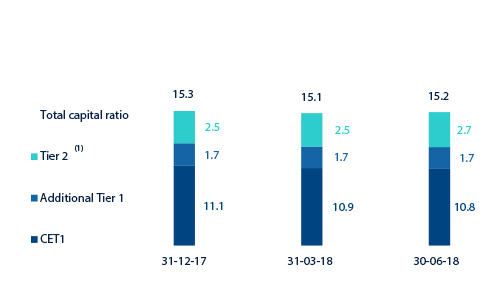

BBVA ended the first half of 2018 with a fully-loaded CET1 ratio of 10.8%, impacted by the turbulent market situation during the second quarter of 2018. The pro forma fully-loaded CET1 ratio would be 11.4%, taking into account the expected positive impact, of approximately 55 basis points, resulting from the announced corporate operations (sale of BBVA Chile completed in July, and of the real-estate assets to Cerberus, pending closure). Additionally, the Group has reiterated its goal of reaching a fully-loaded CET1 capital ratio of 11%.

Risk-weighted assets (RWAs) decreased slightly since the end of 2017, largely explained by the depreciation of currencies against the euro. Regarding securitizations, the Group carried out two in the first half of 2018: a traditional one in June, of an auto loan portfolio of consumer finance for €800m, which has had a positive impact on capital of €324m (due to the release of RWAs); and a synthetic one in March, on which the European Investment Fund (EIF, a subsidiary of the European Investment Bank), issued a financial guarantee on an intermediate tranche of a €1.95 billion portfolio of loans to SMEs. Thanks to this guarantee, BBVA released €443m of RWAs. During the second quarter, BBVA received authorization from the European Central Bank (ECB) to update the calculation of RWAs for structural exchange-rate risk under standard model.

Evolution of fully-loaded capital ratios (1) (Percentage)

(1) As of 30-06-18, it includes the Tier 2 private issuance of BBVA S.A. on the second quarter 2018; pending approval by ECB for the purpose of computability in the Group's capital ratios.

Capital base (1) (Million euros)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 30-06-18(1) | 31-03-18 | 31-12-17 | 30-06-18(1) | 31-03-18 | 31-12-17 | |

| Common Equity Tier 1 (CET 1) | 39,550 | 39,877 | 42,341 | 38,746 | 38,899 | 40,061 |

| Tier 1 | 45,717 | 46,006 | 46,980 | 44,685 | 44,794 | 46,316 |

| Tier 2 (2) | 9,499 | 9,032 | 9,134 | 9,520 | 9,091 | 8,891 |

| Total Capital (Tier 1 + Tier 2) (2) | 55,216 | 55,038 | 56,114 | 54,205 | 53,885 | 55,207 |

| Risk-weighted assets | 356,985 | 358,386 | 361,686 | 357,205 | 356,847 | 361,686 |

| CET1 (%) | 11.1 | 11.1 | 11.7 | 10.8 | 10.9 | 11.1 |

| Tier 1 (%) | 12.8 | 12.8 | 13.0 | 12.5 | 12.6 | 12.8 |

| Tier 2 (%) (2) | 2.7 | 2.5 | 2.5 | 2.7 | 2.5 | 2.5 |

| Total capital ratio (%) (2) | 15.5 | 15.4 | 15.5 | 15.2 | 15.1 | 15.3 |

- General note: as of June 30 and March 31, 2018, the main difference between the phased-in and fully loaded ratios arises from the temporary treatment of the impact of IFRS9 to which the BBVA Group has adhered voluntarily (in accordance with Article 473bis of the CRR).

- (1) Preliminary data.

- (2) It includes the Tier 2 private issuance of BBVA S.A. on the second quarter 2018; pending approval by ECB for the purpose of computability in the Group's capital ratios.

Regarding the issuance of capital, at the Tier 1 level the Group computes its US$ 1 billion AT1 capital issuance carried out in November 2017. However, the AT1 US$1.5 billion issuance of May 2013 was cancelled early, as announced to the market. At the Tier 2 level, BBVA S.A. closed a private placement of US$300m at 5.25% with a 15-year maturity, while BBVA Bancomer issued US$1 billion. Moreover, the Group completed two public issuances of senior non-preferred debt, for a total of €2.5 billion: one of €1.5 billion at a floating rate (Libor three months plus 60 basis points) and five-year maturity, which will be used to meet the MREL (minimum required eligible liabilities) requirements, published as a Significant Event by the National Securities Market Commission (CNMV, for its acronym in Spanish) last May, 23.

According to the provisions of the SRB, the MREL requirement that BBVA must meet starting on January 1, 2020 will be 15.08% of the total eligible liabilities and shareholders’ funds of its resolution group (BBVA S.A. and its subsidiaries, which belong to the same European resolution group), with figures as of December 31, 2016 (28.04% expressed in RWA terms). The Group estimates that it currently meets this MREL requirement.

As regards shareholder remuneration, on April, 10 BBVA paid the final cash dividend against 2017 earnings, amounting to €0.15 gross per share.

As of 30-June-2018, the phased-in CET1 ratio stood at 11.1%, taking into account the impact of the initial implementation of IFRS 9. In this context the European Commission and Parliament have established temporary arrangements that are voluntary for the institutions, adapting the impact of IFRS 9 on capital ratios. BBVA has informed the supervisory body of its adherence to these arrangements. Tier 1 capital stood at 12.8% and Tier 2 at 2.7%, including Tier 2 private issuance of US$300m, resulting in a total capital ratio of 15.5%. These levels are above the requirements established by the regulator in its SREP letter and the systemic buffers applicable in 2018 for BBVA Group. Since January 1, 2018, the requirement has been established at 8.438% for the phased-in CET1 ratio and 11.938% for the total capital ratio. The change with respect to 2017 is due to the steady implementation of the capital conservation buffers and the capital buffer applicable to other systemically important banks. The regulatory requirement for 2018 in fully-loaded terms remains unchanged (CET1 of 9.25% and total ratio of 12.75%) compared with the previous year.

Finally, the Group maintained a sound leverage ratio: 6.4% under fully-loaded criteria (6.5% phased-in), which continues to be the highest in its peer group.

Ratings

During the first six months of the year, Moody's, S&P and DBRS upgraded BBVA's rating to A3, A- and A (high), respectively, all with a stable outlook, thus recognizing the strength and robustness of BBVA’s business model. Following these upgrades, all the agencies now assign BBVA a rating in the "A" category, something that had not occurred since mid-2012.

Ratings

| Rating agency | Long term | Short term | Outlook |

|---|---|---|---|

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s (1) | A3 | P-2 | Stable |

| Scope Ratings | A+ | S-1+ | Stable |

| Standard & Poor’s | A- | A-2 | Stable |

- (1) Additionally, Moody’s assigns an A2 rating to BBVA’s long term deposits.