Relevant events

Results

- Generalized increase of recurring revenue items (net interest income plus net fees and commissions), which, in constant terms, grow in all business areas.

- Higher contribution from the NTI, which compensates the lower contribution of the other operating income and expenses line.

- Contained growth in the operating expenses and improvement of the efficiency ratio.

- Impairment on financial assets increased 4.3% year-on-year, mainly as a result of higher loan-loss provisions in the United States.

- Following the annual evaluation of its goodwills, BBVA has recorded a goodwill impairment in the United States goodwill of €1,318m, mainly due to the evolution of interest rates in the country and the slowdown in the economy. This impact does not affect the tangible net equity, the capital, or the liquidity of BBVA Group and is included in the Corporate Center in the line of other gains (losses) of the income statement.

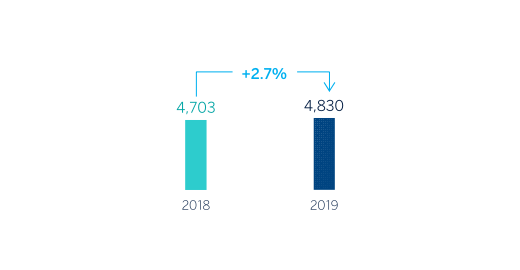

- In 2019, the net attributed profit stood at €3,512m, 35.0% less than in 2018. If BBVA Chile (the results contributed up to its sale and the capital gains generated by the operation) and the goodwill impairment in the United States are excluded from the year-on-year comparison, the Group's net attributable profit grew by 2.7% compared to 2018.

Net attributable profit(1)

(Millions of euros)

(1) Excluding BBVA Chile in 2018 and the goodwill impairment in the United States in 2019.

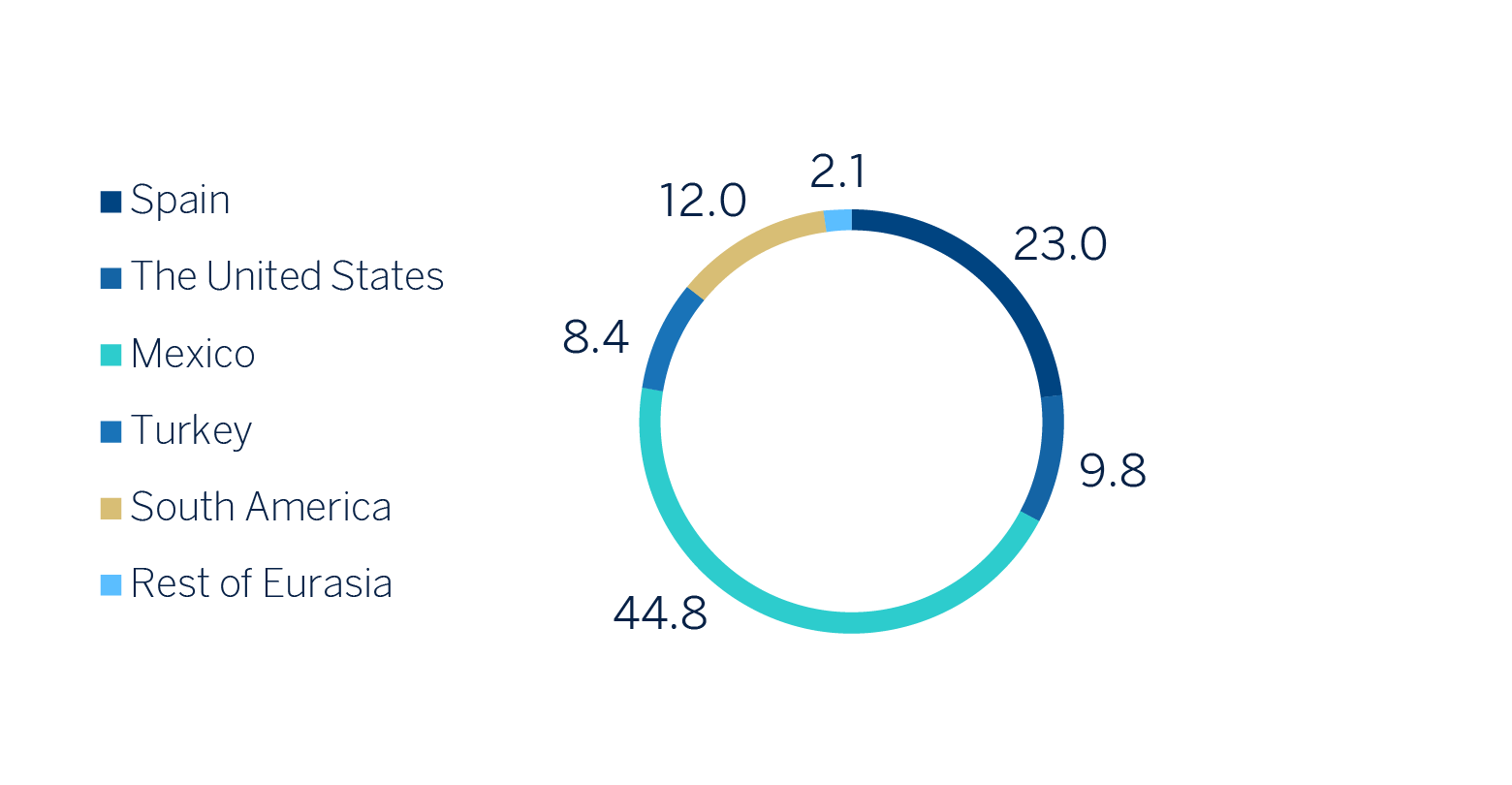

Net attributable profit breakdown (1)

(Percentage. 2019)

(1) Excludes the Corporate Center.

Balance sheet and business activity

- The number of loans and advances to customers (gross) registered a growth of 2.2% during 2019, with increases in the business areas of Mexico, and to a lesser extent, in the United States, South America and Rest of Eurasia.

- Good performance of customer funds (up 3.8% year-on-year) thanks to the evolution of demand deposits, mutual funds and pension funds.

Solvency

- As a result of the supervisory review and evaluation process (SREP) carried out by the European Central Bank (ECB), BBVA received a communication on December 4, that it is required to maintain, on a consolidated basis and as of January 1, 2020, a CET1 capital ratio of 9.27% and a total capital ratio of 12.77%. On December 31, 2019, the fully-loaded CET1 ratio stood at 11.74%, up 51 basis points in the year (excluding the impact of IFRS 16 standard’s implementation). Thus, BBVA's capital adequacy ratios at the end of 2019 remained above the regulatory requirements applicable as of January 1, 2020.

Capital and leverage ratios

(Percentage as of 31-12-19)

Risk management

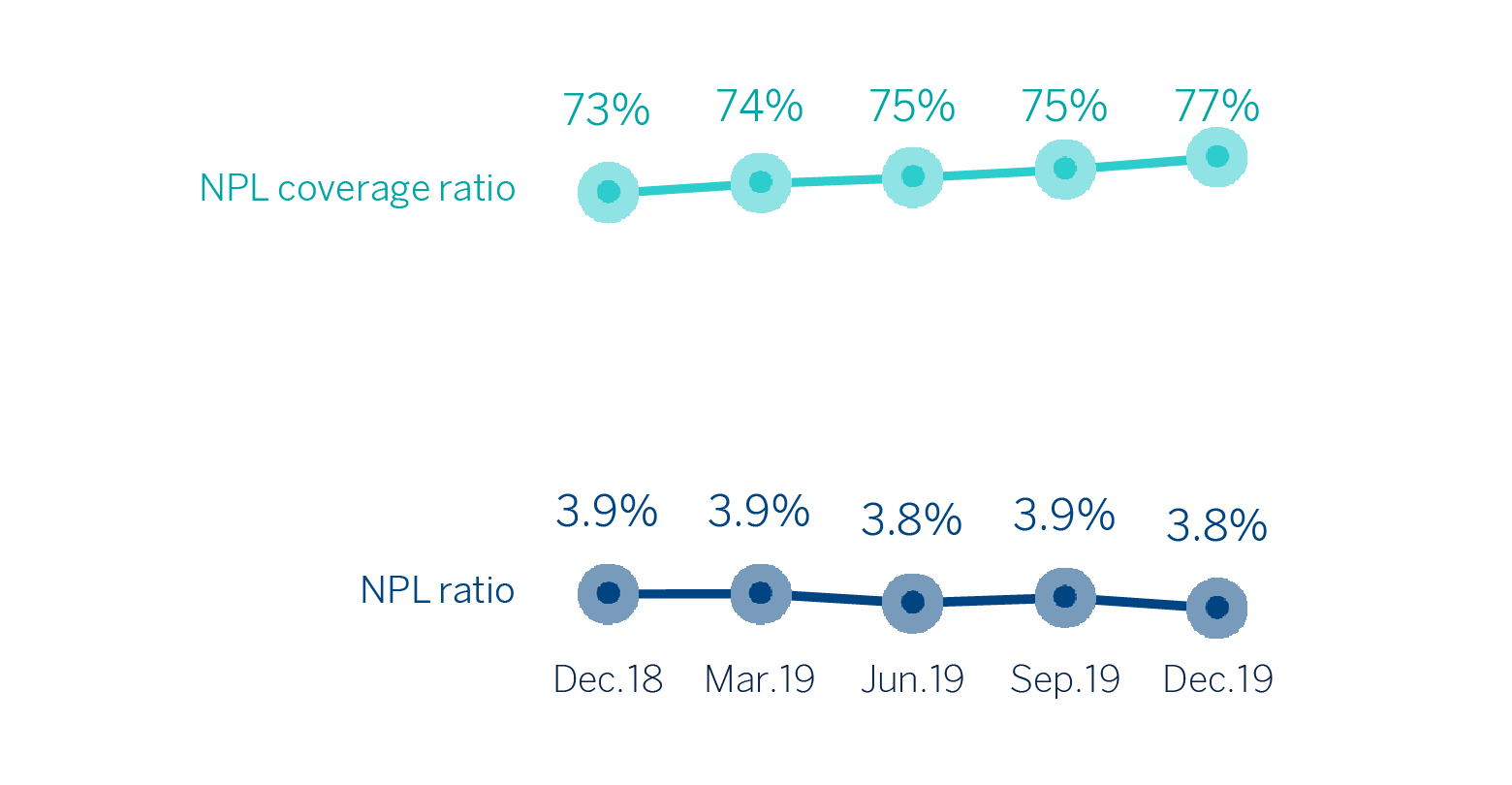

- Positive performance of the risk metrics. Non-performing loans showed a downward trend similar to previous years. The NPL ratio stood at 3.8%, the NPL coverage ratio at 77% and the cost of risk at 1.04%.

NPL and NPL coverage ratios (Percentage)

Transformation

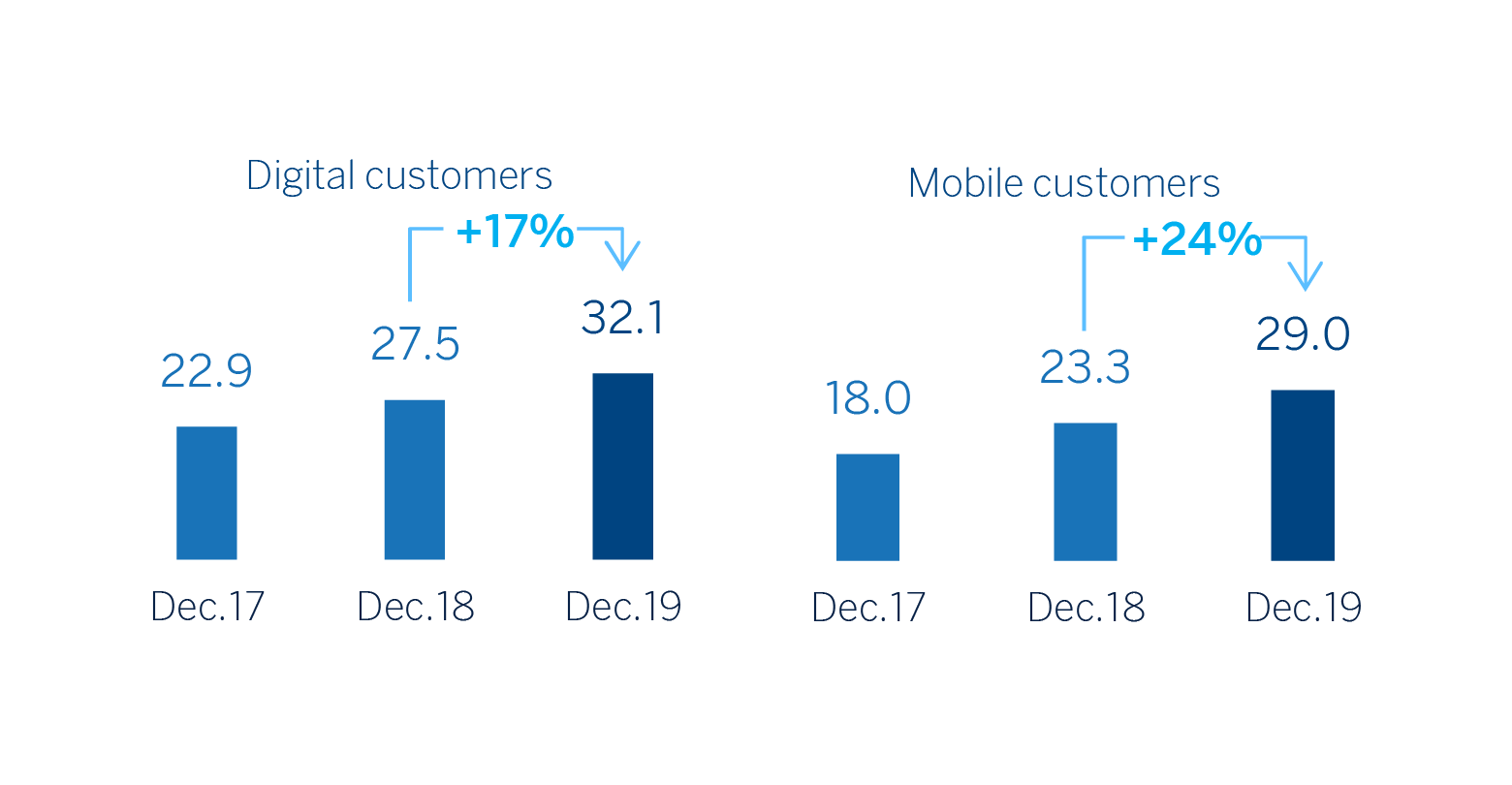

- The Group's digital and mobile customer base continues to grow, with more than 50% of customers operating through mobile channels. Digital sales also evolved positively in 2019.

Digital and mobile customers (Millions)

Other matters of interest

- During the 2019 financial year, two restatements of consolidated information were made:

- As a result of the implementation of IAS 29 "Financial information in hyperinflationary economies", and in order to make the 2019 information comparable to that of 2018, the balance sheets, the income statements and ratios for the Group's first three quarters of the 2018 financial year and the South American business area, were restated to reflect the impacts of hyperinflation in Argentina in the quarter in which they were generated. This impact was recorded for the first time in the third quarter of 2018, but with accounting effects as of January 1, 2018.

- The amendment to IAS 12 "Income Tax" has meant that the tax impact of the distribution of generated benefits must be recorded in the "Expense or income for taxes on the profits of the continuing activities" of the consolidated income statement for the year, when previously recorded as "Net equity". So, in order for the information to be comparable, the information for the years shown above has been restated in such a way that a payment of €76 million and a charge of €5 million have been recorded in the consolidated profit and loss accounts for the years 2018 and 2017, respectively, against "Less: Interim dividends." This reclassification has no impact on the consolidated net assets.

- On August 7, 2019, BBVA reached an agreement with Banco GNB Paraguay S.A., for the sale of its stake in Banco Bilbao Vizcaya Argentaria Paraguay, S.A. (hereinafter BBVA Paraguay), which amounts to 100% of its share capital. As a result of the above, all items in BBVA Paraguay's balance sheet have been reclassified into the category of “Non-current assets (liabilities) and disposal groups held for sale”(hereinafter NCA&L).

- On January 1, 2019, IFRS 16 “Leases” entered into force, which requires the lessee to recognize the assets and liabilities arising from the rights and obligations of lease agreements. The main impacts are the recognition of an asset through the right of use and a liability based on future payment obligations. The impact of the first implementation was €3,419m and €3,472m, respectively, resulting in a decrease of 11 basis points of the CET1 capital ratio.