Business areas

Spain

€5,734 Mill.*

-3.9%

Millions of euros and year-on-year changes

Highlights

- Activity affected by the seasonality of the third quarter.

- Net Interest income influenced by lower ALCO contribution and the impact of IFRS 16.

- Continued decrease in operating expenses.

- Positive impact of the sale of non-performing and write-off portfolios on loan loss provisions and risk indicators.

Results

Net interest income

3,645Gross income

5,734Operating income

2,480Net attributable profit

1,386Activity (2)

Performing loans and advances to customers under mangement

-1.4%Customers funds under management

+1.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

The United States

€3,223 Mill.*

+2.3%

Millions of euros and year-on-year changes at constant exchange rate

Highlights

- Moderation of the activity growth rate.

- Good performance of the recurring revenue items.

- Continued improvement of the efficiency ratio.

- Net attributable profit affected by the impairment on financial assets.

Results

Net interest income

2,395Gross income

3,223Operating income

1,257Net attributable profit

590Activity (2)

Performing loans and advances to customers under mangement

+2.1%Customers funds under management

+3.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rate.

Mexico

€8,029 Mill.*

+6.0%

Millions of euros and year-on-year changes at constant exchange rate

Highlights

- Good performance of the lending activity, boosted by growth in the retail portfolio.

- Positive trend of customer funds especially in time deposits and off-balance sheet funds.

- Net interest income growing in line with the activity.

- NTI recovery in the third quarter.

- Higher provisions due to the increase in loan portfolios mainly in consumer.

Results

Net interest income

6,209Gross income

8,029Operating income

5,384Net attributable profit

2,699Activity (2)

Performing loans and advances to customers under mangement

+7.6%Customers funds under management

+7.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(2) Excluding repos.

(1) Year on year changes at constant exchange rate.

Turkey

€3,590 Mill.*

+2.6%

Millions of euros and year-on-year changes at constant exchange rate

Highlights

- Recovery of the activity in Turkish lira.

- Good performance of the net interest income.

- Operating expenses growth below the inflation rate.

- Positive evolution of the recurring revenue items offset by higher loan-loss provisions on financial assets.

Results

Net interest income

2,814Gross income

3,590Operating income

2,375Net attributable profit

506Activity (2)

Performing loans and advances to customers under mangement

+6.7%Customers funds under management

+16.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rate.

South America

€3,850 Mill.*

+14.3%

Millions of euros and year-on-year changes at constant exchange rates

Highlights

- Positive evolution of activity in the main countries: Argentina, Colombia and Peru.

- Improved efficiency ratio, supported by the growth in net interest income and the reduction in operating expenses.

- Higher contribution from the NTI in the third quarter due to the positive performance of foreign currencies operations.

- Net attributable profit impacted by Argentina's inflation adjustment.

- Positive contribution of the main countries to the Group's attributable profit.

Results

Net interest income

3.196Gross income

3.850Operating income

2.276Net attributable profit (3)

721Activity (2)

Performing loans and advances to customers under mangement

+7.0%Customers funds under management

+7.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rates.

Rest of Eurasia

€454 Mill.*

+9.6%

Millions of euros and year-on-year changes

Highlights

- Good performance in lending.

- Positive trend of net interest income, in an environment of negative interest rates.

- Controlled growth of operating expenses.

- Improved risk indicators.

Results

Net interest income

175Gross income

454Operating income

161Net attributable profit

127Activity (2)

Performing loans and advances to customers under mangement

+18.7%Customers funds under management

-1.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

* Gross income

This section presents and analyzes the most relevant aspects of the Group's different business areas. Specifically, for each one of them, it shows a summary of the income statement and balance sheet, the business activity figures and the most significant ratios.

In 2019, BBVA Group’s business areas reporting structure of the BBVA Group's business areas differs from the one presented at the end of 2018, as a result of the integration of the Non-Core Real Estate business area into Banking Activity in Spain, now reported as “Spain”. In order to make the 2019 information comparable to 2018, the figures for this area have been re-expressed.

BBVA Group's business areas are summarized below:

- Spain mainly includes the banking and insurance businesses that the Group carries out in this country.

- The United States includes the financial business activity that BBVA carries out in the country and the activity of the BBVA, S.A branch in New York.

- Mexico includes banking and insurance businesses in this country as well as the activity that BBVA Mexico carries out through its branch in Houston.

- Turkey reports the activity of BBVA Garanti group that is mainly carried out in this country and, to a lesser extent, in Romania and the Netherlands.

- South America basically includes banking and insurance businesses in the region. With respect to the agreement reached with Banco GNB Paraguay, S.A., for the sale of BBVA Paraguay, it is estimated that the closing will take place during the first quarter of 2020, once all the required authorizations are obtained.

- Rest of Eurasia includes the banking business activity carried out in Asia and in Europe, excluding Spain.

The Corporate Center contains the centralized functions of the Group, including: the costs of the head offices with a corporate function; management of structural exchange rate positions; some equity instruments issuances to ensure an adequate management of the Group's global solvency. It also includes portfolios whose management is not linked to customer relationships, such as industrial holdings; certain tax assets and liabilities; funds due to commitments to employees; goodwill and other intangible assets.

In addition to these geographical breakdowns, supplementary information is provided for the wholesale business carried out by BBVA, i.e. Corporate & Investment Banking (CIB), in the countries where it operates. This business is relevant to have a broader understanding of the Group's activity and results due to the important features of the type of customers served, products offered and risks assumed.

The information by business area is based on units at the lowest level and/or companies that comprise the Group, which are assigned to the different areas according to the main region or company group in which they carry out their activity.

As usual, in the case of the different business areas in America, in Turkey and in CIB, the results of applying constant exchange rates are given as well as the year-on-year variations at current exchange rates.

Major income statement items by business area (Millions of euros)

| Business areas | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| BBVA Group |

Spain | The United States |

Mexico | Turkey | South America |

Rest of Eurasia |

∑ Business areas | Corporate Center | ||

| 2019 | ||||||||||

| Net interest income | 18,202 | 3,645 | 2,395 | 6,209 | 2,814 | 3,196 | 175 | 18,435 | (233) | |

| Gross income | 24,542 | 5,734 | 3,223 | 8,029 | 3,590 | 3,850 | 454 | 24,880 | (339) | |

| Operating income | 12,639 | 2,480 | 1,257 | 5,384 | 2,375 | 2,276 | 161 | 13,933 | (1,294) | |

| Profit/(loss) before tax | 6,398 | 1,878 | 705 | 3,691 | 1,341 | 1,396 | 163 | 9,173 | (2,775) | |

| Net attributable profit | 3,512 | 1,386 | 590 | 2,699 | 506 | 721 | 127 | 6,029 | (2,517) | |

| 2018 (1) | ||||||||||

| Net interest income | 17,591 | 3,698 | 2,276 | 5,568 | 3,135 | 3,009 | 175 | 17,860 | (269) | |

| Gross income | 23,747 | 5,968 | 2,989 | 7,193 | 3,901 | 3,701 | 414 | 24,167 | (420) | |

| Operating income | 12,045 | 2,634 | 1,129 | 4,800 | 2,654 | 1,992 | 127 | 13,336 | (1,291) | |

| Profit/(loss) before tax | 8,446 | 1,840 | 920 | 3,269 | 1,444 | 1,288 | 148 | 8,910 | (463) | |

| Net attributable profit (2) | 5,400 | 1,400 | 736 | 2,367 | 567 | 578 | 96 | 5,743 | (343) | |

- (1) The income statements for 2018 were reexpressed due to changes in the reallocation of some expenses related to global projects and activities between the Corporate Center and the business areas incorporated in 2019.

- (2) As a result of the amendment to IAS 12 "Income Taxes", and in order to make the information comparable, the 2018 income statement has been restated.

Gross income (1), operating income (1) and net attributable profit (1) breakdown

(Percentage.2019)

(1) Excludes the Corporate Center.

Major balance-sheet items and risk-weighted assets by business area (Millions of euros)

| Business areas | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| BBVA Group |

Spain | The United States |

Mexico | Turkey | South America |

Rest of Eurasia |

∑ Business areas | Corporate Center | Deletions | NCA&L(1) | |

| 31-12-19 | |||||||||||

| Loans and advances to customers |

382,360 | 167,341 | 63,162 | 58,081 | 40,500 | 35,701 | 19,660 | 384,445 | 813 | (1,692) | (1,205) |

| Deposits from customers | 384,219 | 182,370 | 67,525 | 55,934 | 41,335 | 36,104 | 4,708 | 387,976 | 308 | (2,598) | (1,467) |

| Off-balance sheet funds | 107,803 | 66,068 | - | 24,464 | 3,906 | 12,864 | 500 | 107,803 | - | - | - |

| Total assets/ liabilities and equity | 698,690 | 365,374 | 88,529 | 109,079 | 64,416 | 54,996 | 23,248 | 705,641 | 6,787 | (12,018) | (1,721) |

| Risk-weighted assets | 364,448 | 104,925 | 65,170 | 59,299 | 56,642 | 45,674 | 17,975 | 349,684 | 14,765 | - | - |

| 31-12-18 | |||||||||||

| Loans and advances to customers |

374,027 | 170,438 | 60,808 | 51,101 | 41,478 | 34,469 | 16,598 | 374,893 | 990 | (1,857) | - |

| Deposits from customers | 375,970 | 183,414 | 63,891 | 50,530 | 39,905 | 35,842 | 4,876 | 378,456 | 36 | (2,523) | - |

| Off-balance sheet funds | 98,150 | 62,559 | - | 20,647 | 2,894 | 11,662 | 388 | 98,150 | - | - | - |

| Total assets/ liabilities and equity | 676,689 | 354,901 | 82,057 | 97,432 | 66,250 | 54,373 | 18,834 | 673,848 | 16,281 | (13,440) | - |

| Risk-weighted assets | 348,264 | 104,113 | 64,175 | 53,177 | 56,486 | 42,724 | 15,476 | 336,151 | 12,113 | - | - |

- (1) Non-current assets and liabilities held for sale of BBVA Paraguay.

Since 2019, a column has been included in the balance sheet, which includes the deletions and balance adjustments between different business areas, especially in terms of the relationship between the areas in which the parent company operates, i.e. Spain, Rest of Eurasia and Corporate Center. In previous years, these deletions were allocated to the different areas, mainly in Banking Activity in Spain. Accordingly, the figures from the previous year have been re-expressed to show comparable series.

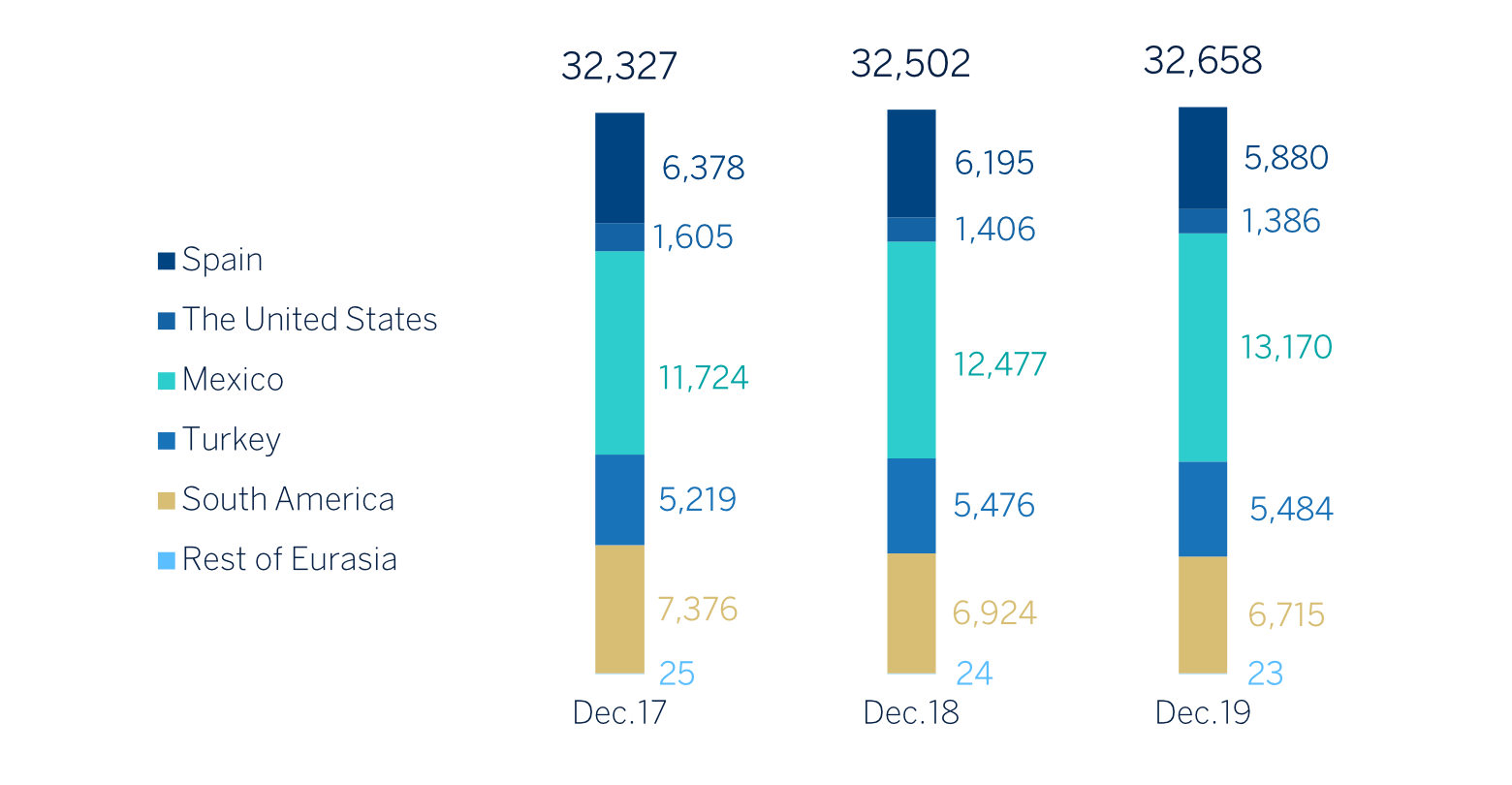

Number of employees

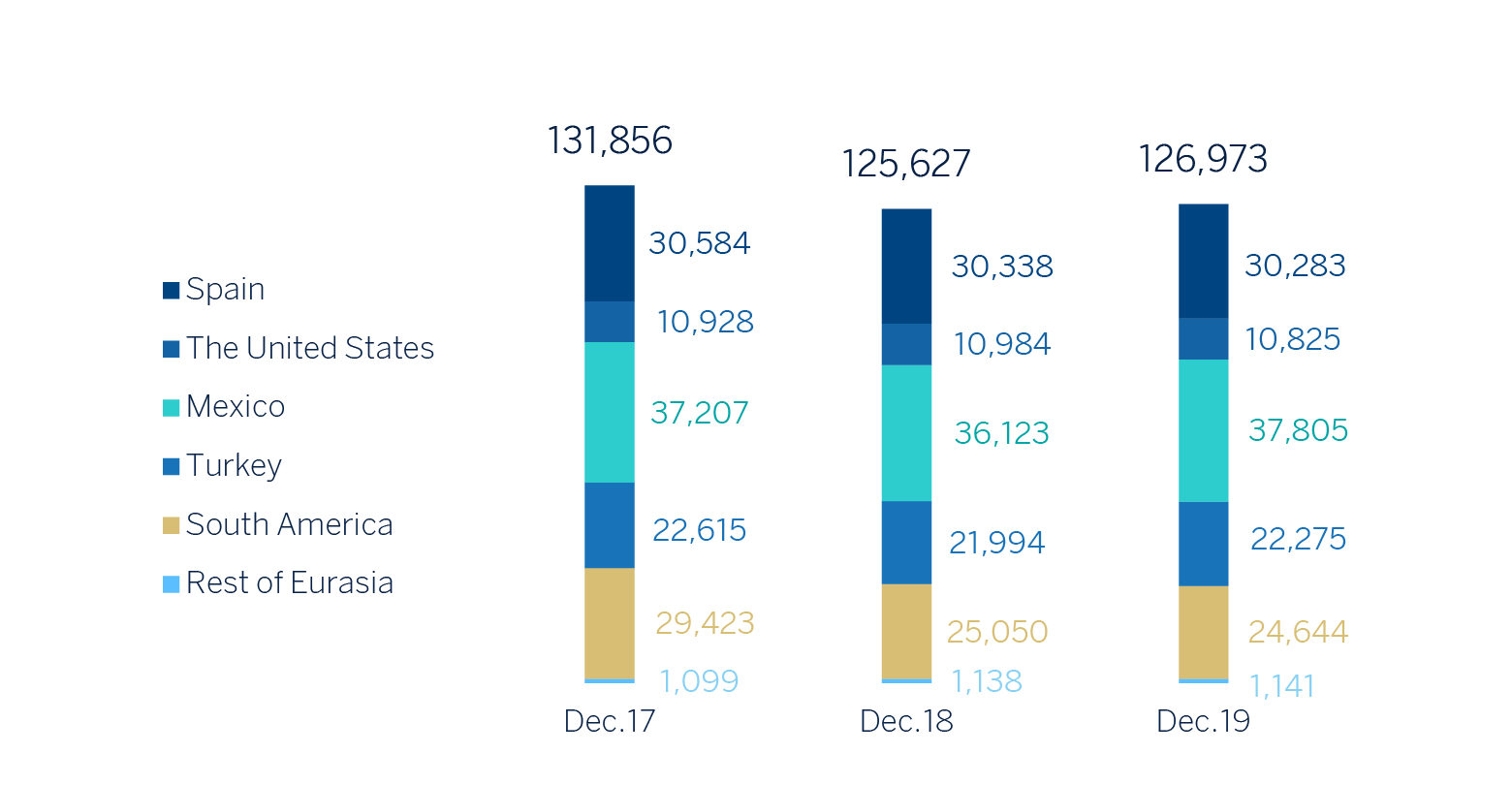

Number of branches

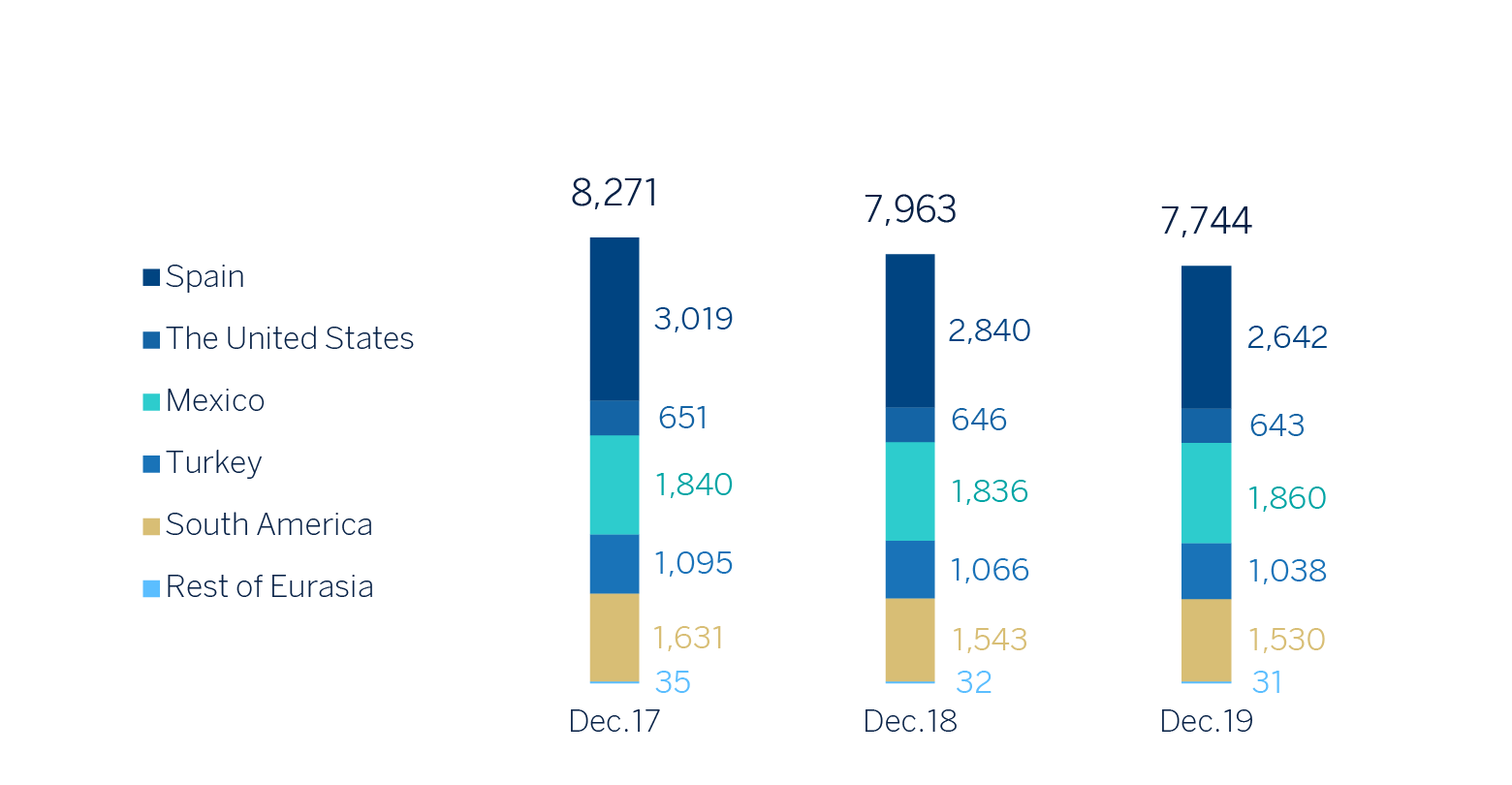

Number of ATMs