Relevant events

Results

- Good performance of gross income, with year-on-year growth in all its components: recurring income (net interest income and fees and commissions), which grew in most geographical areas, net trading income (NTI), and the other operating income and expenses line.

- Operating expenses closed in line with the same quarter of the previous year.

- As a result of the above, the efficiency ratio improved.

- Impairment on financial assets increased mainly due to the deterioration of the macroeconomic scenario resulting mostly from the impacts of COVID-19, which have amounted to €-1,433m at the Group level.

- As a result of the valuation of the goodwill of its subsidiaries, the Group has estimated that there is an impairment in the United States which has been recorded in the line item “Other results” of the Consolidated income statement as of March 31, 2020. This impairment represents an impact of €-2,084m in the net attributable profit and is mainly due to the negative impact of the update of the macroeconomic scenario affected by the COVID-19 pandemic. This impact does not affect the tangible net equity, the capital, or the liquidity of BBVA Group and is included in the line item other gains (losses) of the income statement of the Corporate Center.

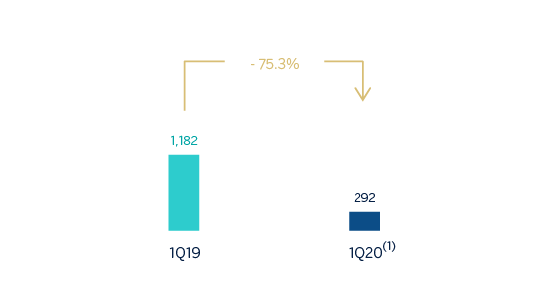

- Finally, the net attributable loss stood at €-1,792m. If the goodwill impairment in the United States is excluded from the year-on-year comparison, the Group's net attributable profit decreased 75.3% compared to the first quarter of 2019 and stood at €292m.

Net attributable profit (Millions of euros)

(1) Excluding the goodwill impairment in the United States.

Balance sheet and business activity

- The figure for loans and advances to customers (gross) remained stable compared to December 2019 (up 0.3%), with increases in the commercial portfolio which offsets the deleveraging in the rest of the portfolios.

- Customer funds fell in the quarter (down 2.1%) as a result of the negative impact on mutual and pension funds due to the market instability caused by COVID-19.

Liquidity

- The availability of ample liquidity buffers in each of the geographical areas in which the BBVA Group operates and their management have allowed internal and regulatory ratios to remain comfortably above the minimum levels required.

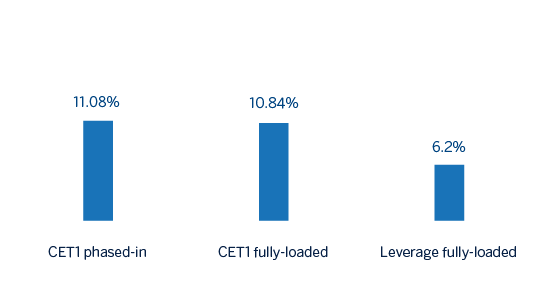

Solvency

- The BBVA Group has set the objective to maintain a buffer on its CET1 capital ratio requirement (currently, at 8.59%) between 225 and 275 basis points. As of March 31, 2020, the CET1 fully-loaded ratio stood at 10.84%.

Capital and leverage ratios and cost of risk (Percentage as of 31-03-20)

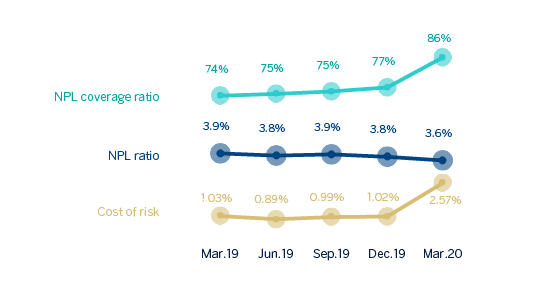

Risk management

- The calculation of the expected credit losses at the end of March includes the update of the forward looking information in the models under IFRS 9 in order to reflect the circumstances created by the COVID-19 pandemic in the macroeconomic environment, which is characterized by a high degree of uncertainty regarding its intensity and duration.

NPL and NPL coverage ratios and cost of risk (Percentage)

Dividend

- On April 9, a cash payment was made for the supplementary dividend for the 2019 financial year for a gross amount of €0.16 per share, in line with that approved at the General Shareholders’ Meeting held on March 13. Thus, the total dividend for the 2019 financial year amounts to €0.26 gross per share.

Bancassurance agreement

- On April 27, 2020, BBVA reached an agreement with Allianz, Compañía de Seguros y Reaseguros, S.A. in order to create a bancassurance partnership, for the purpose of developing the non-life insurance business in Spain, excluding the health insurance line, by establishing a newly-incorporated insurance company. On the closing date of the transaction, BBVA Seguros will transfer 50% plus one share of this new company to Allianz for an initial fixed price of approximately €277m, which will be adjusted based on the variation in the company’s shareholders equity between signing and closing date. Excluding a variable part of the price (up to €100m related to achieving specific business goals and certain milestones), it is estimated that the transaction will generate a profit net of taxes amounting to approximately €300m, and that the positive impact on the fully-loaded CET1 capital ratio of the BBVA Group will be approximately 7 basis points. The closing of the transaction is subject to obtaining the required regulatory authorizations.

Security, business continuity and support measures taken by BBVA

In response to the COVID-19 pandemic, BBVA has focused on guaranteeing the security and the continuity of the business operations as a priority, and on closely monitoring the impact on the Group’s business and risks. Additionally, BBVA adopted from the outset a number of measures to support its main stakeholders, acting with the utmost responsibility and taking a step forward. The main business continuity measures taken are:

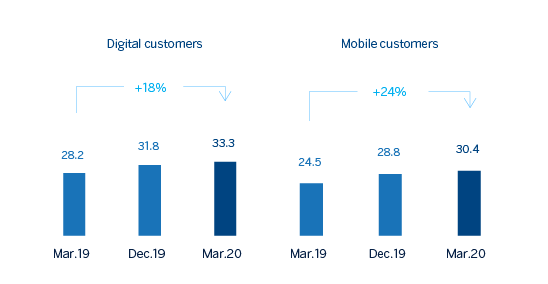

- In order to serve customers, and since financial services are legally considered an essential service in most of the countries where the Group operates, the branch network remains operational, with dynamic management of the network and with information about branches and opening times on the website. In addition, customers are using the digital channels and their remote agents as the recommended option. BBVA is therefore trying to minimize the number of employees who need to provide services at the branches, trying to limit the risk of contagion as much as possible and protecting the health of its employees, customers and society in general.

Digital and mobile customers (Millions)

- With employees, the measures established by the health authorities have been implemented, including taking an early stance on promoting working from home. At the beginning of April 2020, the proportion of the Group’s employees working remotely stood at 95% for central service employees and 71% for the branch network.

Other support and responsibility measures taken are the following:

- The banks are a key part of the solution to the COVID-19 crisis. Specifically, BBVA has activated support initiatives with a focus on the most affected customers, regardless of whether they are companies, SMEs, self-employed workers or private individuals. The following are just some of those initiatives:

- In Spain, credit facilities for SMEs and self-employed workers of up to €25,000m, deferment of mortgage loan repayments for individuals and self-employed workers, and early payment of pensions, with free cash withdrawals for pensioners at the nearest ATM;

- In the United States, flexibility in the repayment of loans for small businesses and for consumer finance, and the removal of certain fees for individual customers;

- In Mexico, a repayment deferment of up to four months on various credit products, fixed payment plan to reduce monthly credit card charges and interruption of Point of Sale (POS) fees to support retailers with lower turnover;

- In Turkey, delay of loan repayments, penalty-free interest and repayments for individual customers, and deferment for up to six months of loan capital repayments for companies;

- In South America, some countries such as Argentina have provided a credit facility for micro-SMEs to help them purchase remote work equipment; Colombia has frozen repayments for up to six months on loans to individuals and companies, and is offering a special working capital facility for companies; and in Peru, a loan facility has been approved to support SMEs.

- To support society in its fight against the COVID-19 pandemic, BBVA is committed to making a global donation of €35m to support the health authorities and social organizations and to promote scientific research.

Pronouncements of regulatory bodies and supervisors

- With the aim of mitigating the impact of COVID-19, various European and international bodies have made pronouncements aimed at allowing greater flexibility in the implementation of the accounting and prudential frameworks. The BBVA Group has taken these pronouncements into consideration when preparing this report.

- With regard to the payment of dividends, on March 27 the European Central Bank recommended that credit institutions should refrain from distributing dividends or making irrevocable commitments to distribute them, and from repurchasing shares to remunerate shareholders, until October 1, 2020 at the earliest. Consequently, the Board of Directors of BBVA has agreed to modify, for the financial year 2020, the Group’s shareholder remuneration policy, which was announced through the Relevant Event notification of February 1, 2017, establishing a new policy for 2020 of not making any dividend payment for the 2020 financial year until the uncertainties caused by COVID-19 are resolved and, in any case, not before the end of the financial year.