Results

The BBVA Group generated a net attributable profit, excluding non-recurring impacts, of €2,327m between January and June 2021, with a year-on-year increase of 145.6%. Including these impacts —namely €+280m from the results of discontinued operations and €-696m for the net cost related to the restructuring process— the Group's net attributable profit amounts to € +1,911m, which compares very positively with the €-1,157m in the same period of the previous year, which was severely affected by the effects of the COVID-19 pandemic. With regards to the recording of these restructuring costs, it should be noted that, solely for management purposes and for the purpose of the comments provided in this report, these are included in the income statement line "Net cost related to the restructuring process". The financial information is presented to the Group's Senior Management using this approach. This report includes a reconciliation between the management approach and the Condensed Interim Consolidated Financial Statements.

Despite the complex environment and at constant exchange rates, good performance in recurring income (i.e. net interest income and fees), the evolution of net trading income (NTI) and lower provisions for impairment on financial assets were particularly notable.

CONSOLIDATED INCOME STATEMENT: QUARTERLY EVOLUTION (MILLIONS OF EUROS)

| 2021 | 2020 | |||||

|---|---|---|---|---|---|---|

| 2Q | 1Q | 4Q | 3Q | 2Q | 1Q | |

| Net interest income | 3,504 | 3,451 | 3,477 | 3,553 | 3,537 | 4,024 |

| Net fees and commissions | 1,182 | 1,133 | 1,042 | 1,023 | 934 | 1,124 |

| Net trading income | 503 | 581 | 175 | 357 | 470 | 544 |

| Other operating income and expenses | (85) | (11) | (147) | 46 | (80) | 86 |

| Gross income | 5,104 | 5,155 | 4,547 | 4,980 | 4,862 | 5,778 |

| Operating expenses | (2,294) | (2,304) | (2,264) | (2,163) | (2,182) | (2,477) |

| Personnel expenses | (1,187) | (1,184) | (1,186) | (1,124) | (1,113) | (1,272) |

| Other administrative expenses | (800) | (812) | (766) | (725) | (754) | (860) |

| Depreciation | (307) | (309) | (312) | (315) | (316) | (345) |

| Operating income | 2,810 | 2,850 | 2,282 | 2,817 | 2,679 | 3,300 |

| Impairment on financial assets not measured at fair value through profit or loss | (656) | (923) | (901) | (706) | (1,408) | (2,164) |

| Provisions or reversal of provisions | (23) | (151) | (139) | (88) | (219) | (300) |

| Other gains (losses) | (7) | (17) | (82) | (127) | (103) | (29) |

| Profit/(loss) before tax | 2,124 | 1,759 | 1,160 | 1,895 | 950 | 807 |

| Income tax | (591) | (489) | (337) | (515) | (273) | (204) |

| Profit/(loss) for the period | 1,533 | 1,270 | 823 | 1,380 | 678 | 603 |

| Non-controlling interests | (239) | (237) | (110) | (312) | (162) | (172) |

| Net attributable profit excluding non-recurring impacts | 1,294 | 1,033 | 713 | 1,068 | 516 | 431 |

| Profit/(loss) after tax from discontinued operations (1) | 103 | 177 | 302 | 73 | 120 | (2,224) | Corporate operations (2) | - | - | 304 | - | - | - |

| Net cost related to the restructuring process | (696) | - | - | - | - | - |

| Net attributable profit/(loss) | 701 | 1,210 | 1,320 | 1,141 | 636 | (1,792) |

| Earning per share excluding non-recurring impacts (3) | 0.18 | 0.14 | 0.09 | 0.15 | 0.06 | 0.05 |

| Earning per share (euros) (3) | 0.09 | 0.17 | 0.18 | 0.16 | 0.08 | (0.29) |

- General note: the results generated by BBVA USA and the rest of Group's companies in the United States sold to PNC on June 1, 2021, are presented in a single line as "Profit/ (loss) after tax from discontinued operations".

- (1) Profit/(loss) after tax from discontinued operations includes the goodwill impairment in the United States registered in the first quarter of 2020 for an amount of €2,084m.

- (2) Net capital gain from the sale to Allianz of the half plus one share of the company created to jointly develop the non-life insurance business in Spain, excluding the health insurance line.

- (3) Adjusted by additional Tier 1 instrument remuneration.

CONSOLIDATED INCOME STATEMENT (MILLIONS OF EUROS)

| 1H 2021 | ∆% | ∆% at constant exchange rates |

1H 2020 | |

|---|---|---|---|---|

| Net interest income | 6,955 | (8.0) | 0.9 | 7,561 |

| Net fees and commissions | 2,315 | 12.5 | 19.7 | 2,058 |

| Net trading income | 1,084 | 6.9 | 14.8 | 1,014 |

| Other operating income and expenses | (95) | n.s. | n.s. | 6 |

| Gross income | 10,259 | (3.6) | 4.9 | 10,639 |

| Operating expenses | (4,598) | (1.3) | 5.1 | (4,660) |

| Personnel expenses | (2,371) | (0.6) | 6.2 | (2,385) |

| Other administrative expenses | (1,612) | (0.1) | 6.4 | (1,614) |

| Depreciation | (615) | (7.0) | (1.9) | (661) |

| Operating income | 5,661 | (5.3) | 4.7 | 5,980 |

| Impairment on financial assets not measured at fair value through profit or loss | (1,580) | (55.8) | (52.3) | (3,572) |

| Provisions or reversal of provisions | (174) | (66.4) | (65.1) | (518) |

| Other gains (losses) | (24) | (81.7) | (81.1) | (132) |

| Profit/(loss) before tax | 3,883 | 120.9 | 164.1 | 1,757 |

| Income tax | (1,080) | 126.6 | 167.7 | (477) |

| Profit/(loss) for the period | 2,803 | 118.8 | 162.8 | 1,281 |

| Non-controlling interests | (476) | 42.7 | 94.8 | (333) |

| Net attributable profit/(loss) excluding non-recurring impacts | 2,327 | 145,6 | 183,0 | 947 |

| Profit/(loss) after tax from discontinued operations (1) | 280 | n.s. | n.s. | (2,104) |

| Net cost related to the restructuring process | (696) | n.s. | n.s. | _ |

| Net attributable profit/(loss) | 1,911 | n.s. | n.s. | (1,157) |

| Earning per share excluding non-recurring impacts (2) | 0.32 | 0.11 | ||

| Earning per share (euros) (2) | 0.26 | (0.20) |

- General note: the results generated by BBVA USA and the rest of Group's companies in the United States sold to PNC on June 1, 2021, are presented in a single line as "Profit/ (loss) after tax from discontinued operations".

- (1) Profit/(loss) after tax from discontinued operations includes the goodwill impairment in the United States registered in the first quarter of 2020 for an amount of €2,084m.

- (2) Adjusted by additional Tier 1 instrument remuneration.

Unless expressly indicated otherwise, to better understand the changes under the main headings of the Group's income statement, the year-on-year rates of change provided below refer to constant exchange rates. When comparing two dates or periods in this report, the impact of exchange rate variations against the euro for the currencies of the countries in which BBVA operates is sometimes excluded, assuming that the exchange rates remain constant. In doing so, with regard to income statement amounts, average exchange rates of the most recent period are used for each currency in the geographic areas where the Group operates for both periods. With regard to balance sheet and business activity amounts, the exchange rates at the close of the most recent period are used.

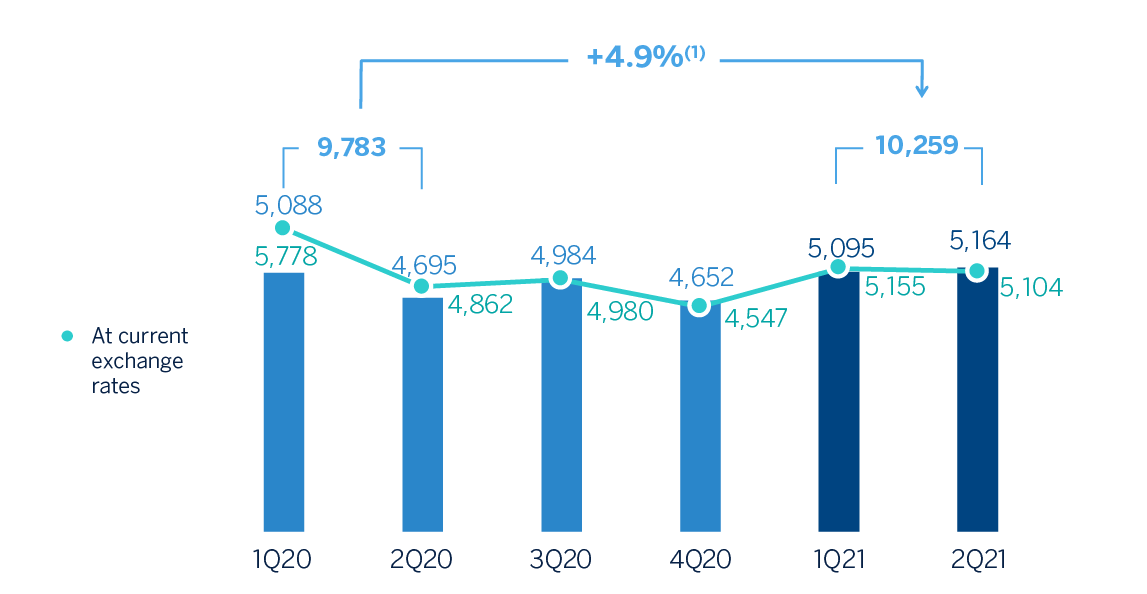

Gross income

Gross income experienced a year-on-year growth of 4.9%, underpinned by the favorable evolution of fees and NTI as well as the improved performance of net interest income between April and June 2021 (+3,9% in the quarter). In contrast, the other operating income and expenses line was down compared to the first half of 2020.

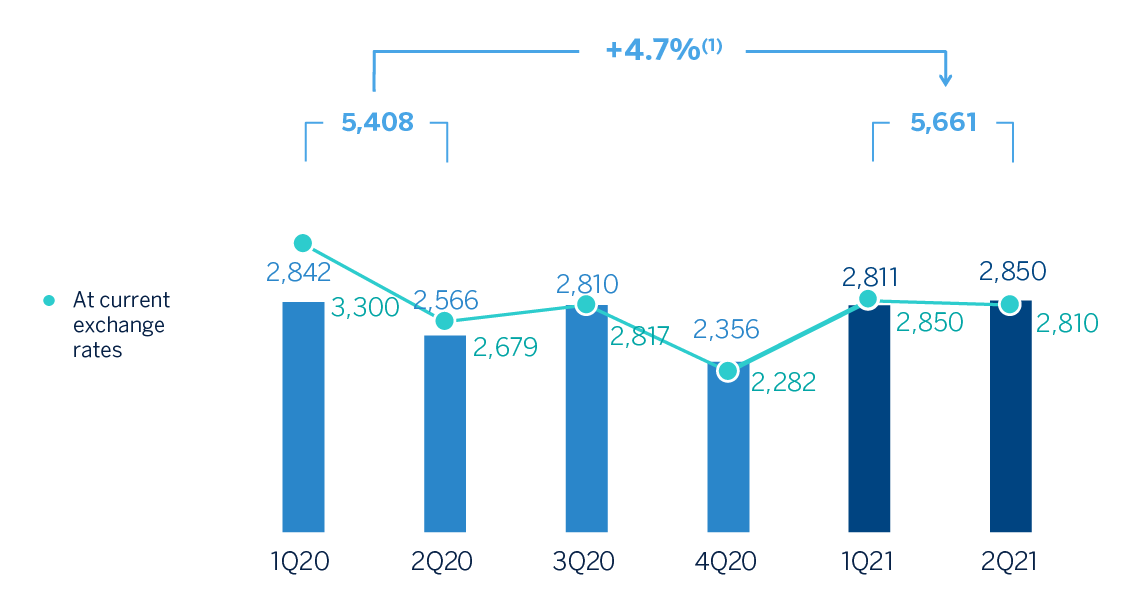

GROSS INCOME (MILLIONS OF EUROS)

(1) At constant exchange rates: +3.6%.

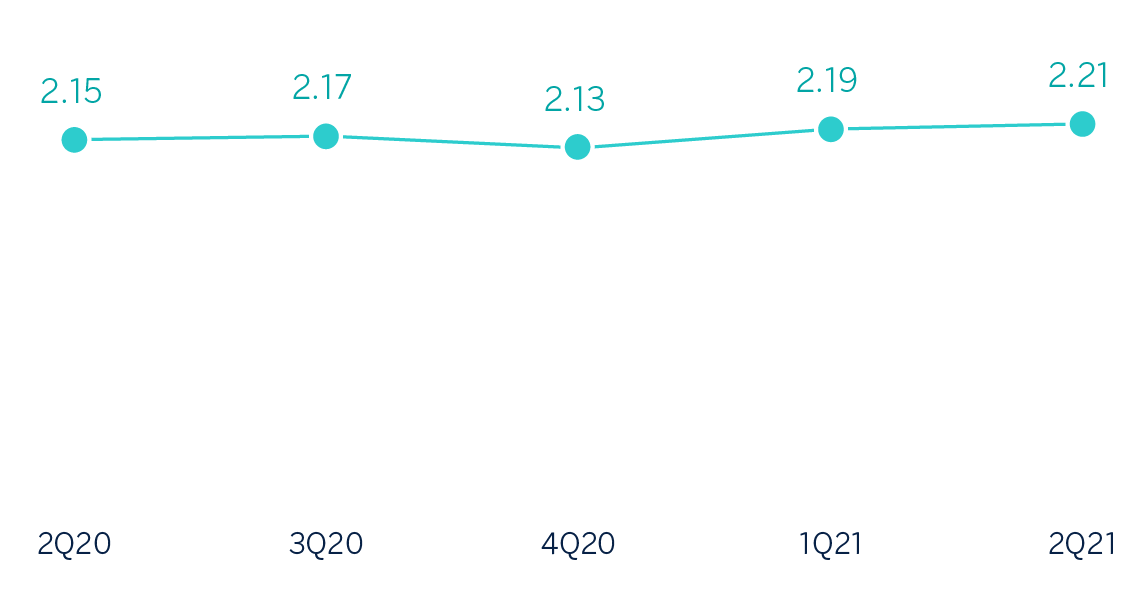

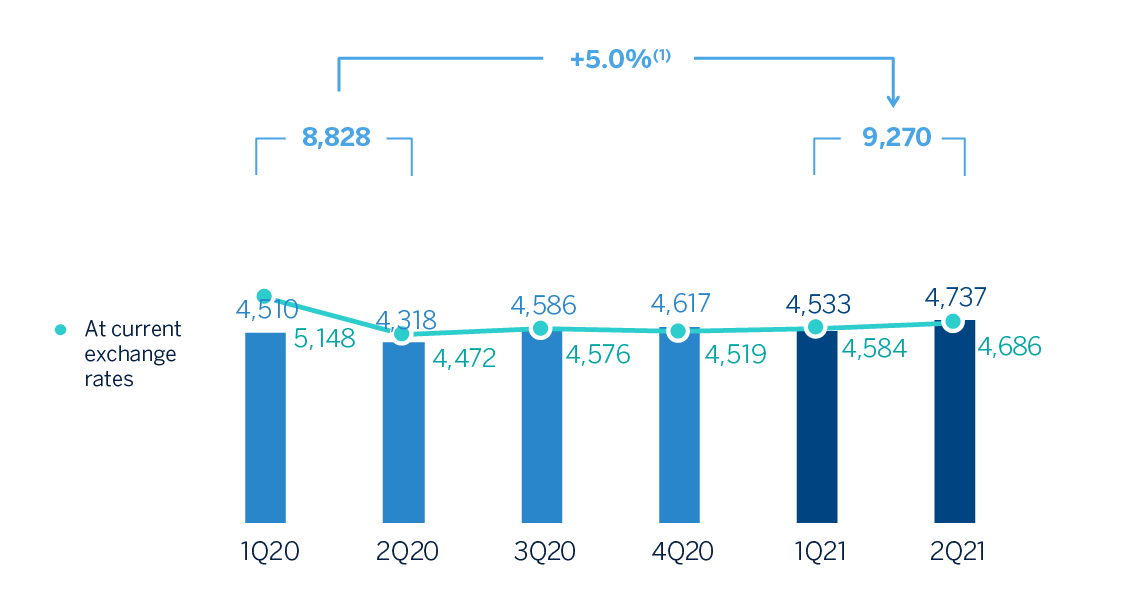

Net interest income as of June 30, 2021 closed slightly higher than in the same period of the previous year (+0.9%), due to the good performance in South America and Mexico, which offset the poorer performance in other areas.

The main geographical areas, with the exception of Rest of Business, showed good performance in the net fees and commissions line compared to the first half of 2020 (up 19.7%), when it was affected by lower activity due to lockdown measures during the second quarter of 2020 in the different countries where the Group operates, as well as cancellation of the collection of certain fees as a measure to support customers during the worst moments of the pandemic.

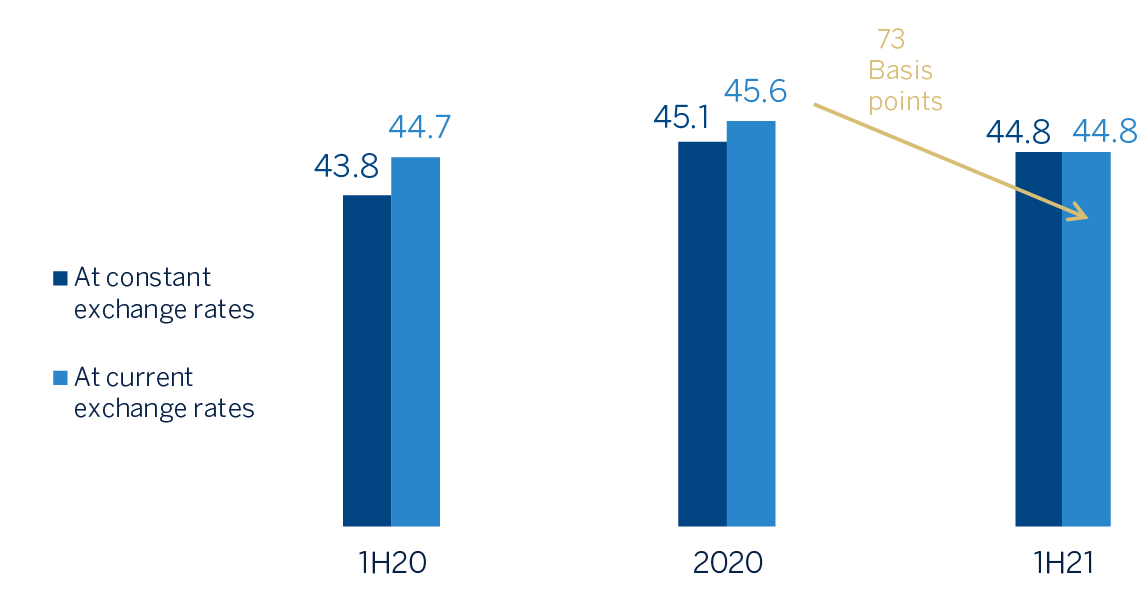

NET INTEREST INCOME/ATAS(1) (PERCENTAGE)

(1) Excluding BBVA USA and the rest of the Group's companies in the United States sold to PNC on June 1, 2021.

NET INTEREST INCOME PLUS FEES AND COMMISSIONS (MILLIONS OF EUROS)

(1) At constant exchange rates: +0.5%.

NTI showed a year-on-year increase of 14.8%, mainly due to the performance of the Global Markets unit in Spain and the revaluations of the Group stake on industrial and financial portfolio.

The other operating income and expenses line closed the first half of the year at €-95m compared to €+6m in the same period last year, due to BBVA's greater annual contribution in Spain to the Single Resolution Fund (hereinafter SRF), the higher adjustment for inflation in Argentina and the lower contribution of the insurance business in Spain, due to the bancassurance operation with Allianz, and in Mexico, due to increased claims as a result of the pandemic.

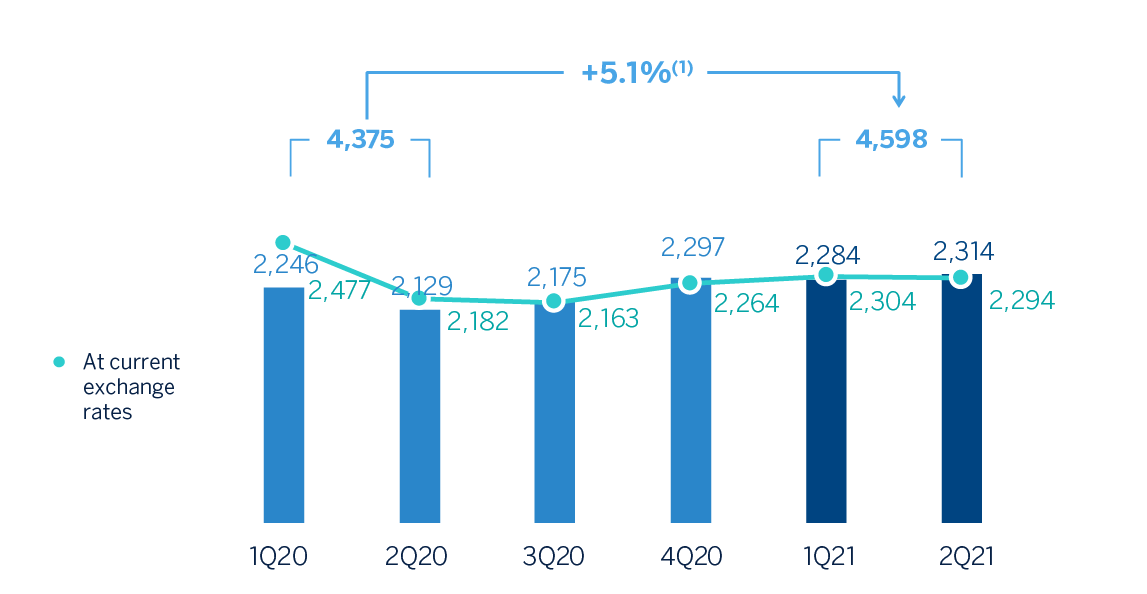

Operating income

Operating expenses grew by 5.1% year-on-year, with an increase in all geographical areas except Spain, where they decreased.

OPERATING EXPENSES (MILLIONS OF EUROS)

(1) At constant exchange rates: -1.3%.

As a result, the operating income totaled €5,661m, representing a year-on-year growth of 4.7%.

The efficiency ratio stood at 44.8% as of June 30, 2021, in line with the ratio achieved in the first half of the previous year (44.7%), with an improvement of 73 basis points over the ratio as of the end of December 2020.

EFFICIENCY RATIO (PERCENTAGE)

OPERATING INCOME (MILLIONS OF EUROS)

(1) At constant exchange rates: -5.3%.

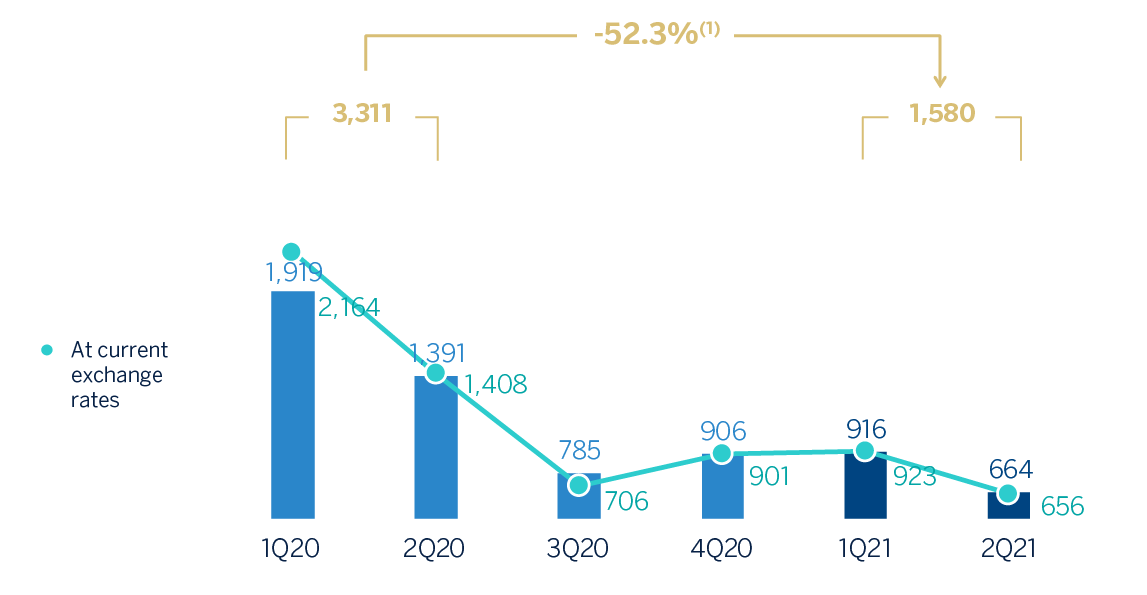

Provisions and other

Impairment on financial assets not measured at fair value through profit or loss (impairment on financial assets) closed the six- month period with a negative balance of €-1,580, significantly lower than the previous year (down 52.3%) mainly due to the negative impact of provisions for COVID-19 in the first half of 2020.

IMPAIRMENT ON FINANCIAL ASSESTS (MILLIONS OF EUROS)

(1) At constant exchange rates: -55.8%.

The provisions or reversal of provisions line (hereinafter "provisions") closed the six-month period with a negative net balance of €-174m (down 65.1% compared to the net figure at the close of June last year), mainly due to provisions for potential claims in Spain and, to increased provisions for special funds and contingent risk and commitments in Turkey, in both cases registered in the first half of 2020.

The other gains (losses) line showed a negative balance of €24m at the end of June 2021, -81.1% below the figure reached the previous year (€-132m), mainly due to improved results achieved by Garanti BBVA's subsidiaries in Turkey.

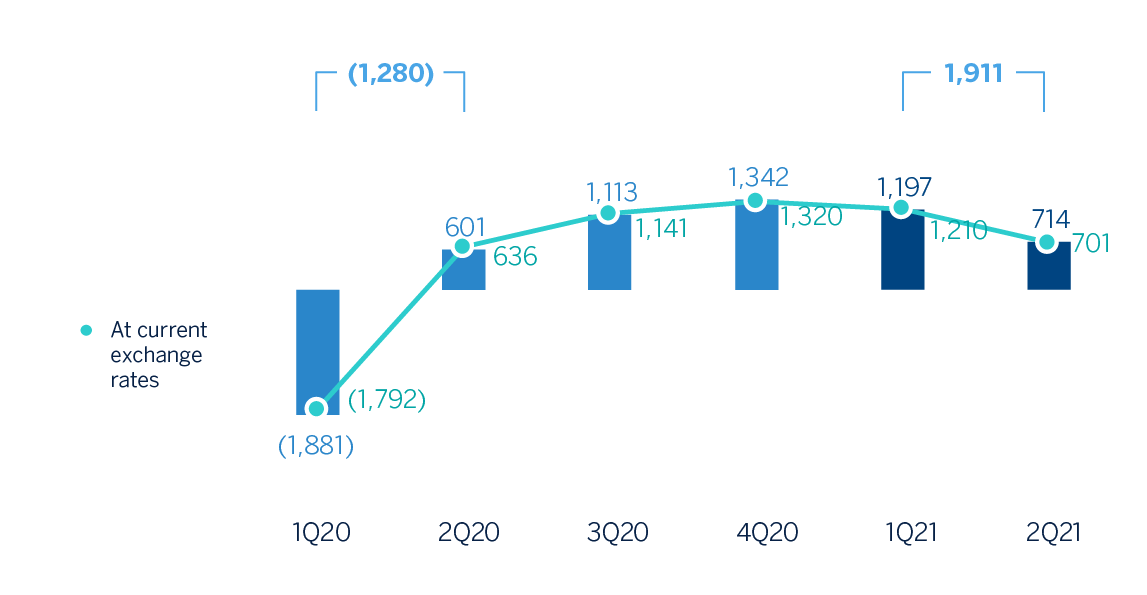

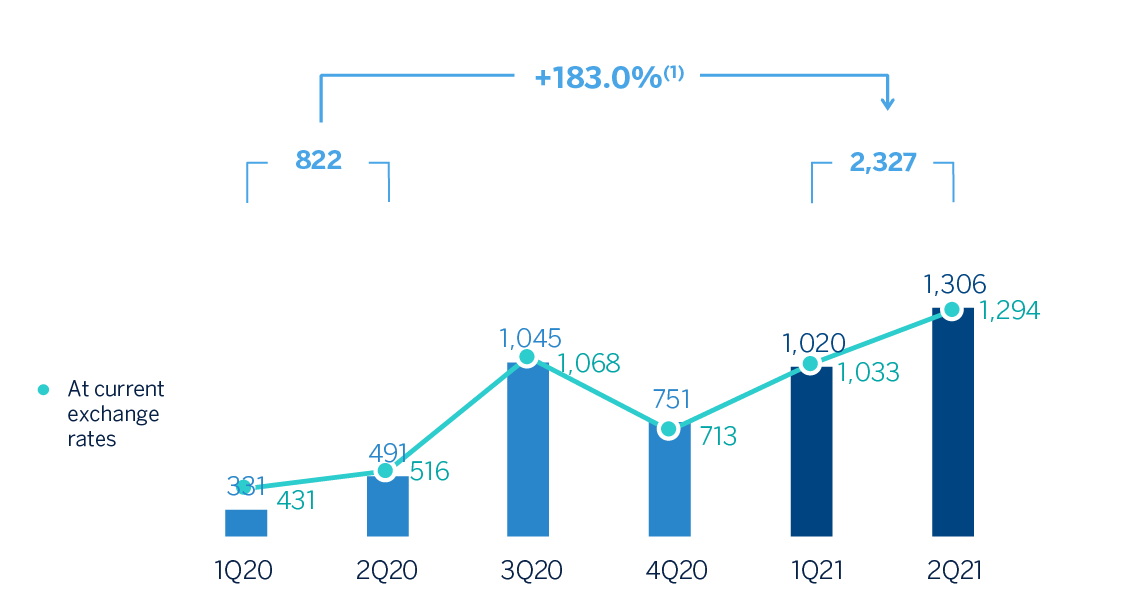

Results

As a result, the BBVA Group generated a net attributable profit, excluding non-recurring impacts, of €2,327m between January and June 2021, representing a year-on-year increase of 183.0%. These non-recurring impacts include:

- The results generated by the Group's business in the United States (the sale of which to PNC materialized on June 1, 2021) and classified as discontinued operations, which generated €+280m in 2021 until the closing of the sale, contrasting very positively with the negative result of €2,104m in the first half of 2020, which included the impact of the goodwill impairment in the country. These results are recorded in the "Profit/(loss) after tax from discontinued operations" line of the Corporate Center's income statement.

- The net cost related to the restructuring process in Spain has amounted to €-696m, of which, before taxes, €-754m correspond to collective redundancies and €-240m to the closing of branches.

Taking into account both impacts, the Group's net attributable profit in the first half of 2021 totaled €1,911m, comparing very positively with the negative result of €-1,157m in the same period of the previous year, which was severely affected by the effects of the COVID-19 pandemic.

The cumulative net attributable profits, in millions of euros, at the close of June 2021 for the various business areas that make up the Group were as follows: 745 in Spain, 1,127 in Mexico, 384 in Turkey, 218 in South America and 145 in Rest of Business.

NET ATTRIBUTABLE PROFIT (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

NET ATTRIBUTABLE PROFIT EXCLUDING NON-RECURRING IMPACTS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

General note: non-recurring impacts include: (I) BBVA USA and the rest of the Group´s companies in the United States sold to PNC on June 1, 2021 in all periods;

(II) the net cost related to the restructuring process as of 2Q21; and (III) the net capital gain from the bancassurance operation with Allianz as of 4Q20.

(1) At current exchange rates:+145.6%

TANGIBLE BOOK VALUE PER SHARE AND DIVIDENDS (1) (EUROS)

(1) Replenishing dividends paid in the period.

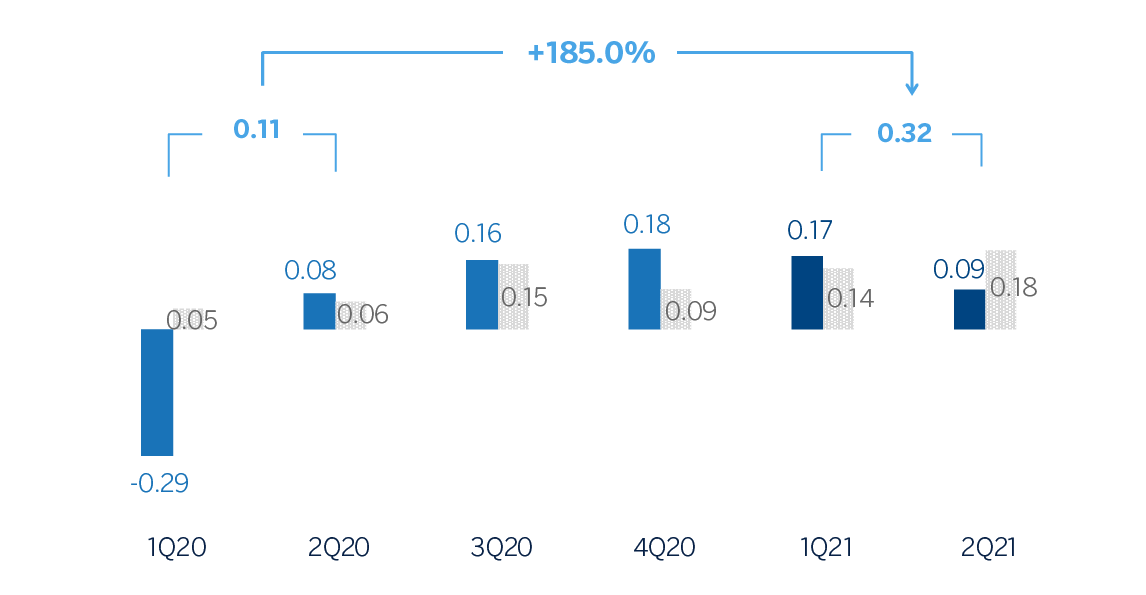

EARNING PER SHARE (1) AND ADJUSTED EARNING PER SHARE (1)(EUROS)

General note: adjusted earning per share Excludes: (I) BBVA USA and the rest of the Group's companies in the United States sold to PNC on June 1, 2021, in all periods; (II) the net cost related to the restructuring process as of 2Q21; and (III) the net capital gain from the sale to Allianz of the half plus one share of the company created to jointly promote non-life insurance business in Spain, excluding the health insurance line as of 4Q20.

(1) Adjusted by additional Tier 1 instrument remuneration.

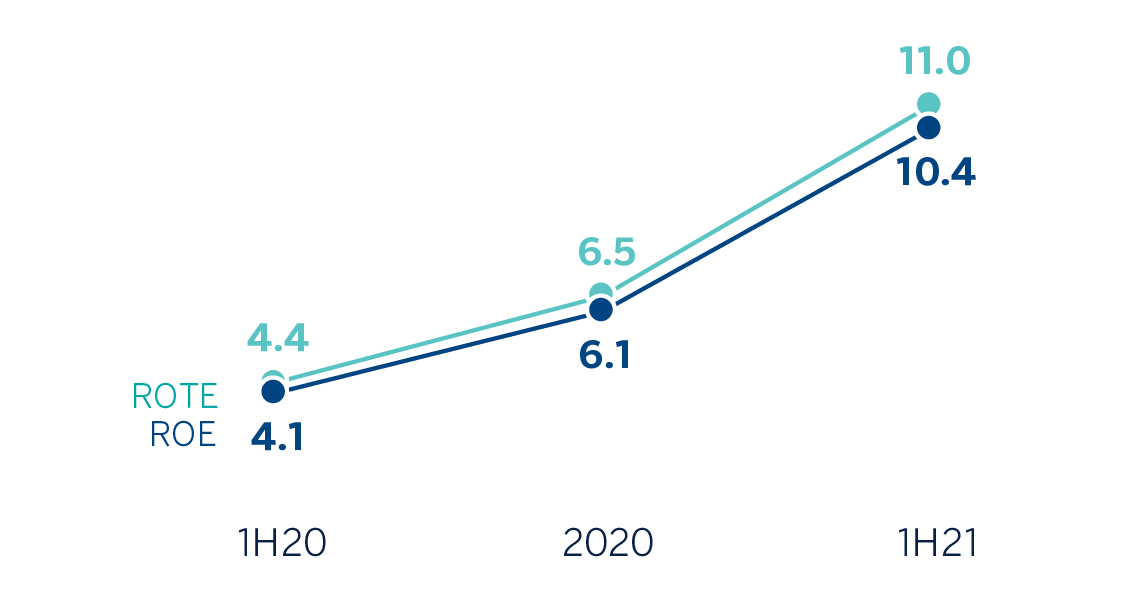

ROE AND ROTE (1) (PERCENTAGE)

(1) Excludes: (I) BBVA USA and the rest of the Group's companies in the United States sold to PNC on June 1, 2021, as of 1H21, 2020 and 1H20; (II) the net cost related to the restructuring process as of 1H21; and (III) the net capital gain from the sale to Allianz of the half plus one share of the company created to jointly promote non-life insurance business in Spain, excluding the health insurance line as of 2020.

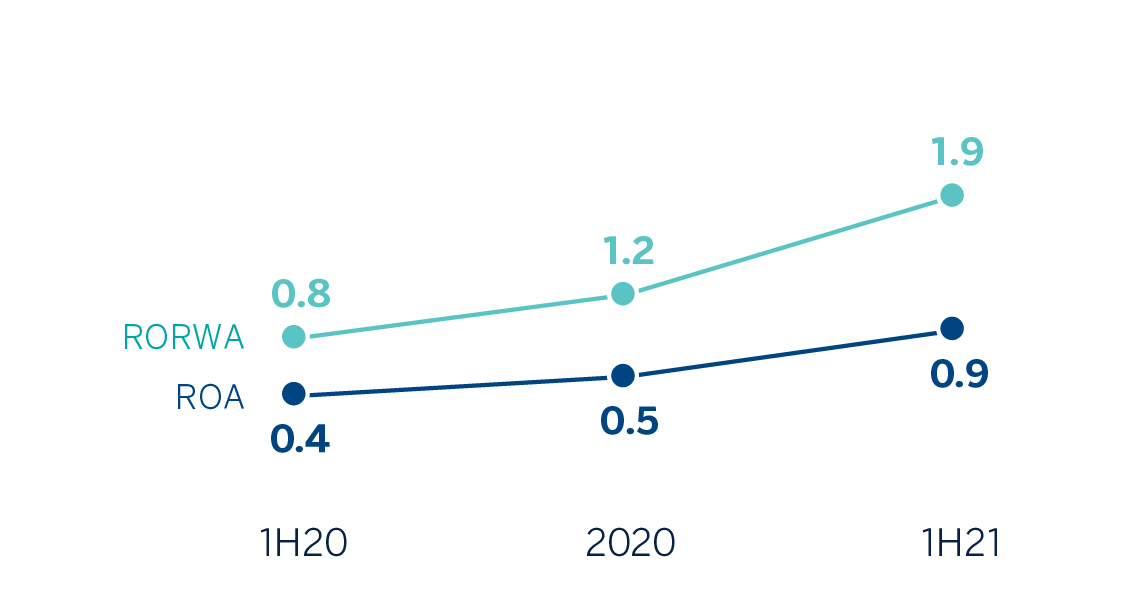

ROA AND RORWA (1) (PERCENTAGE)

(1) Excludes: (I) BBVA USA and the rest of the Group's companies in the United States sold to PNC on June 1, 2021, as of 1H21, 2020 and 1H20; (II) the net cost related to the restructuring process as of 1H21; and (III) the net capital gain from the sale to Allianz of the half plus one share of the company created to jointly promote non-life insurance business in Spain, excluding the health insurance line as of 2020.