Highlights

Results and business activity

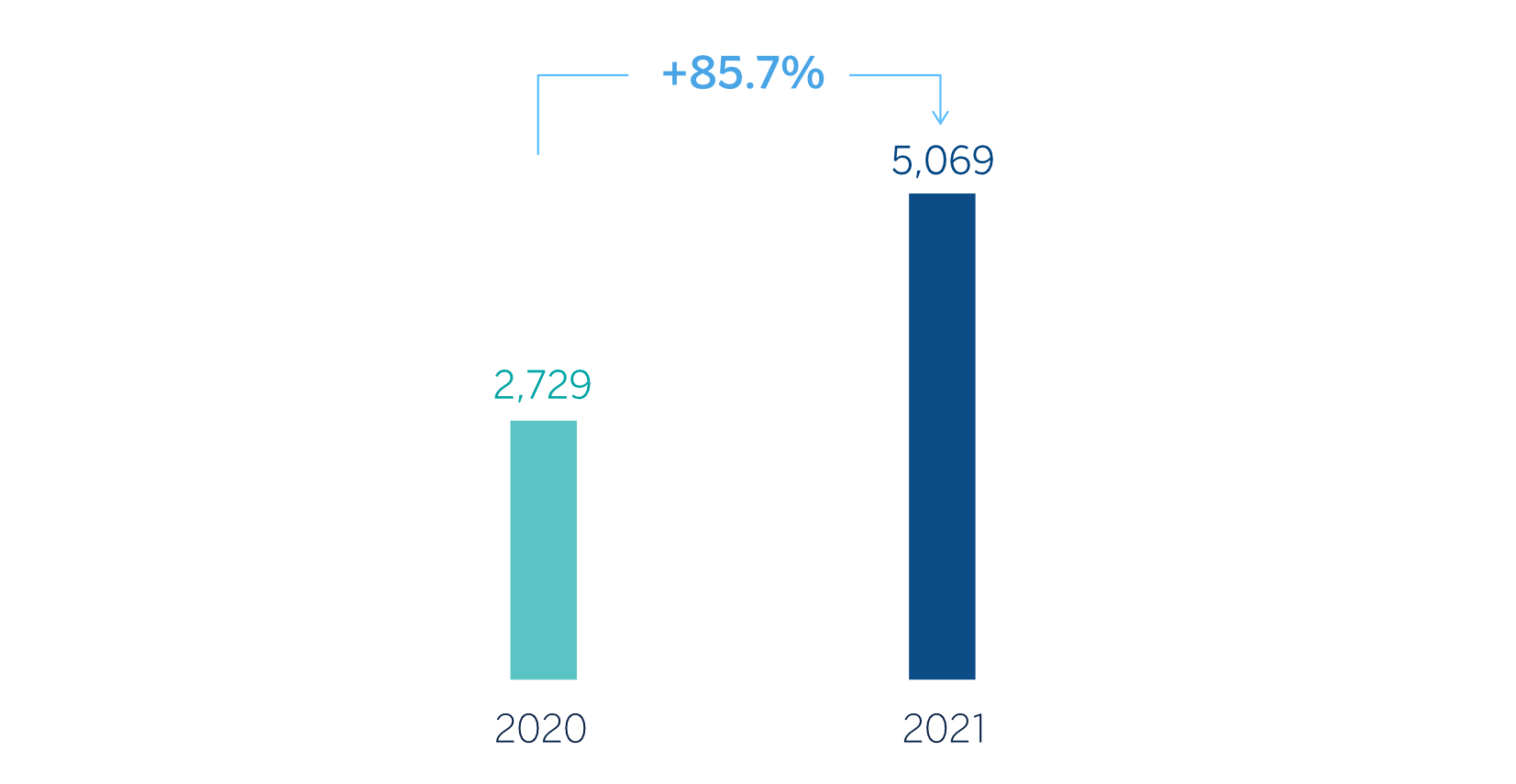

The BBVA Group generated a net attributable profit, excluding non-recurring impacts, of €5,069m in 2021, representing a year-on- year increase of +85.7%.

Taking into account the non-recurring impacts —namely the €280m corresponding to the profit generated by BBVA USA and the rest of companies included in the sale agreement to PNC until the closing date of the operation on June 1, 2021, and the €-696m of net costs related to the restructuring process— the Group's net attributable profit amounted to €4,653m, which compares very positively with the €1,305m in the same period of the previous year, which included the capital gains of €304m from the implementation of the bancassurance agreement reached with Allianz, in addition to the result generated by BBVA USA in 2020.

In a complex environment, the Group's results in 2021 were influenced by the good performance in recurring income from the banking business, i.e. net interest income and net fees and commissions, as well as by a higher contribution of net trading income (NTI), so that gross income closed the year with a growth of 9.7%, at constant exchange rates.

Operating expenses increased (+8.5% in year-on-year terms) and excluding the exchange rate effect in all areas except Spain, where they remained contained and Rest of Business, where they decreased. This growth is framed within an environment of activity recovery and high inflation.

Thus, the efficiency ratio stood at 45.2% as of December 31, 2021, with an improvement of 53 basis points compared to the figure at the end of December 2020, placing BBVA in a leading position among its European peer group 1.

The lower provisions for impairment on financial assets stand out (-38.7% in year-on-year terms and at constant exchange rates), mainly due to the strong impact of provisions for COVID-19 in 2020.

In 2021, provisions were lower (-62.8% at constant exchange rates) than the previous year, due to provisions made in 2020 in Spain and Turkey.

Finally, in terms of results, the other gains line closed 2021 with a positive balance, which is an improvement over the previous year, which reflected the impairment of investments in subsidiaries, joint ventures or associates.

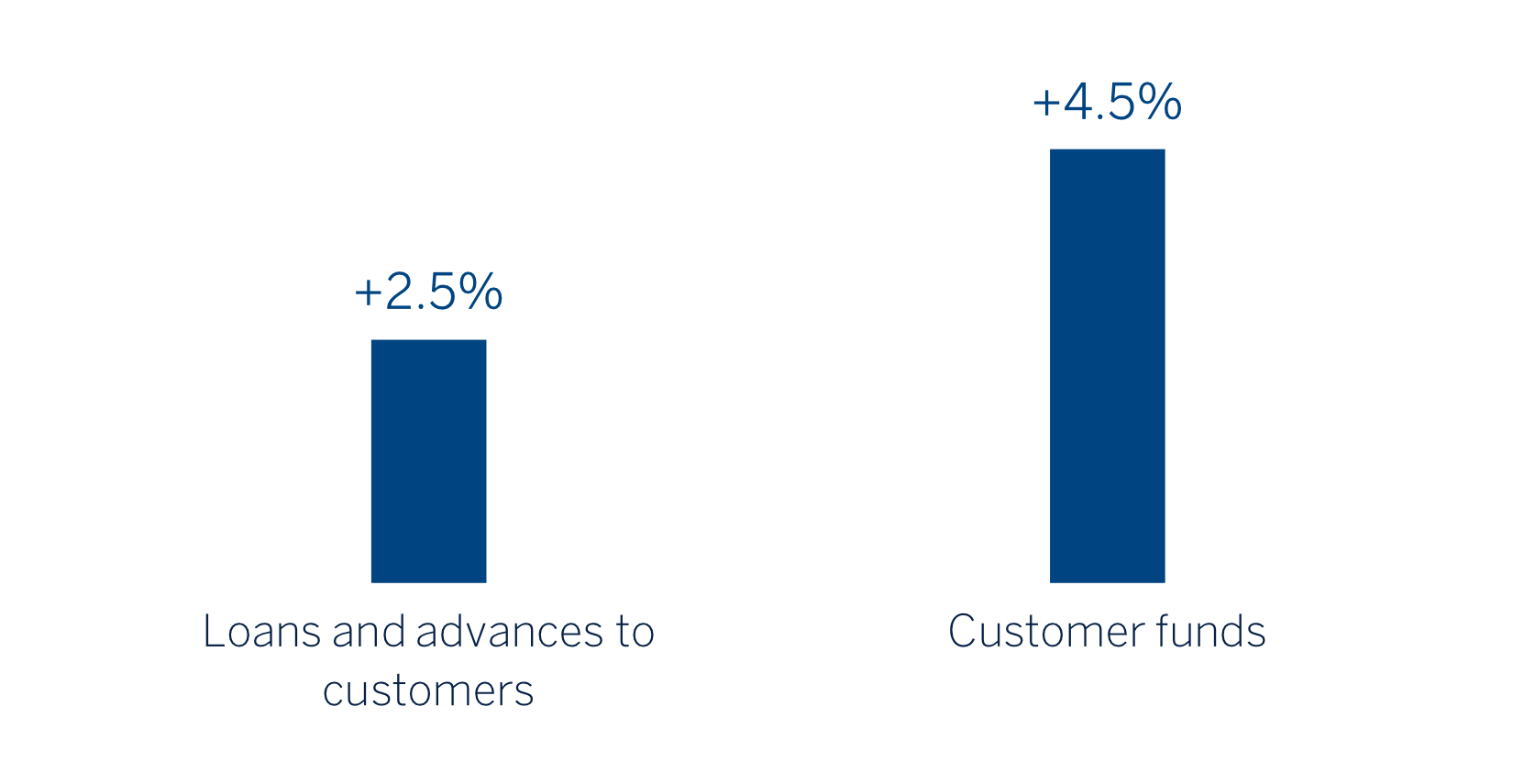

Loans and advances to customers recorded a growth of 2.5% compared to the end of December 2020, mainly due to the performance of business loans (+3.0%) and, to a lesser extent, loans to individuals (+1.5% in the year), which were strongly supported by consumer loans and credit cards (+5.7 overall).

Customer funds showed an increase of 4.5% compared to the end of December 2020, thanks to the good performance of both deposits from customers (+2.1%) and off-balance sheet funds (+12.5%). The interest rate situation has led to customers' preference for demand deposits and mutual funds (which grew by 15.3% compared to the end of the previous year) over time deposits (which decreased by 27.2% compared to December 2020).

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-20)

Business areas

As for the business areas, the provisions for impairment on financial assets decreased in all of them, compared to 2020 which was impacted by the outbreak of the pandemic. In addition, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

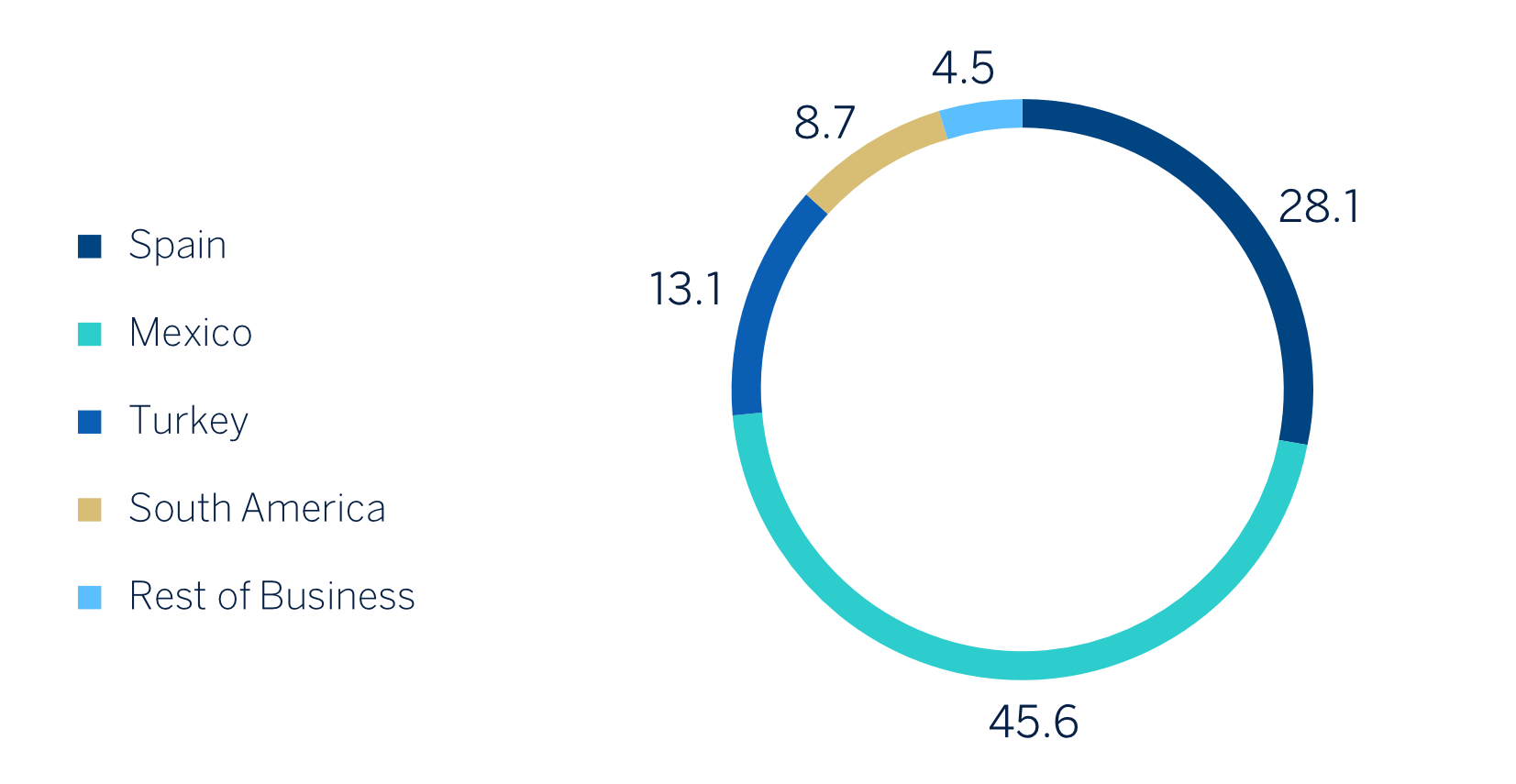

- Spain: BBVA in Spain achieved a net attributable profit of €1,581m in 2021, with a year-on-year increase of +142.6%, mainly due to the growth in recurring income from net fees and commissions and NTI in 2021

- Mexico: BBVA in Mexico generated a net attributable profit of €2,568m during 2021, representing an increase of 42.6% compared to 2020. This evolution is driven by a 6.4% growth in recurring income and by the strength of the operating income (+3.3%).

- Turkey: The net attributable profit generated by Turkey in 2021 stood at €740m, 71.4% above the figure achieved in the previous year, supported by a higher contribution from recurring income and NTI.

With regard to this business area, on November 18, 2021, BBVA Group submitted to the Capital Markets Board of Turkey the application for authorization of the voluntary takeover bid (hereinafter referred to as the Voluntary Takeover Bid) for the entire share capital of Garanti BBVA not already owned, once all relevant regulatory approvals have been obtained. Given the deadlines and the need to receive approval from all relevant regulatory bodies, BBVA estimates that the closing of the Voluntary Takeover Bid will take place in the first quarter of 2022. - South America: All the countries of the region where BBVA has a presence generated a cumulative net attributable profit of €491m in 2021, which, excluding BBVA Paraguay in 2020, represents a year-on-year variation of +30.3%, due to a better evolution of recurring income in 2021 (+21.0%), partially offset by a higher inflation adjustment in Argentina in 2021.

- Rest of Businesses: This area, which mainly incorporates the Group's wholesale business developed in Europe (excluding Spain) and in the United States, as well as the banking business developed through the BBVA branches in Asia, achieved a net attributable profit of €254m (+13.2% year-on-year) in 2021.

Corporate Center: the net attributable loss of the Corporate Center includes the aforementioned non-recurring impacts of the Group, and at the close of December 2021 was €-980m, representing an improvement compared to the previous year (€-2,339m).

Lastly and to allow a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. Thus, the CIB area generated a net attributable profit of €1,248m in 2021, which represents a 45.3% increase in year-on-year terms, thanks to the growth in the recurring income and the NTI.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: excludes (I) BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021; (II) the net cost related to the restructuring process in 2021; and (III) the net capital gain from the bankassurance operation with Allianz in 2020.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 2021)

(1) Excludes the Corporate Center.

Solvency

The Group's CET1 Fully-loaded ratio stood at 12.75% as of December 31, 2021, which represents a decrease in in the quarter (-173 basis points), although it maintains a large management buffer on the Group's capital requirements and is above the management target, which is to be within the range of 11.5-12% CET1. This CET1 level includes the deduction of the total amount of the share buyback program authorized by the supervisor, amounting to maximum €3.500m and representing an impact of approximately -130 basis points. For more information on the Group' share buyback program, please see "Other highlights" at the end of the "Highlights" section.

Shareholder remuneration

Regarding shareholder remuneration, on October 12, 2021, a payment in cash of €0.08 per share was made, as gross interim dividend against 2021 results. In addition, on February 3, 2022 it was announced that a cash distribution in the amount of €0.23 gross per share was expected to be submitted to the relevant governing bodies for consideration. If approved, the total cash distributions would amount to €0.31 gross per share. Therefore, the total shareholder remuneration will be the result of the cash payments discussed and the share buyback programs described in "Other highlights".

Other highlights

Regarding the Group’s shareholder remuneration policy, on November 18, 2021, the Group announced that the Board of Directors of BBVA has agreed to modify the Group’s shareholder distribution policy in force at that time, establishing a new policy consisting in an annual distribution of between 40% and 50% of the consolidated ordinary profit of each year (excluding amounts and items of an extraordinary nature included in the consolidated profit and loss account), compared to the previous policy of distributing between 35% and 40%.

This policy will be implemented through the distribution of an interim dividend for the year (expected to be paid in October of each year) and a final dividend (to be paid once the year has ended and the allocation of the year-end profit has been approved, expected to take place in April of each year), with the possibility of combining cash distributions with share buybacks (the execution of the shares buyback program is considered to be an extraordinary shareholder distribution and is therefore not included in the scope of the policy), all subject to the relevant authorizations and approvals applicable at any given time.

-

On October 26, 2021, BBVA received the required authorization from the ECB for the buyback of up to 10% of its share capital for a maximum sum of €3,500m, in one or several tranches.

Upon receiving the authorization from the ECB, BBVA Board of Directors at its meeting of October 28, 2021, resolved to carry out a framework share buyback program, to be executed in various tranches up to a maximum amount of €3.5 billion, with the aim of reducing BBVA's share capital as well as to carry out a first share buyback program within the framework program, the first tranche, which was notified as Privileged Information on October 29, 2021.

With regard to the first tranche, BBVA announced on November 19, 2021, that it would be implemented externally through a lead manager (J. P. Morgan AG) and would have a maximum amount of €1.500m, with a maximum number of shares to be acquired equal to 637,770,016 own shares, representing approximately 9.6% of BBVA’s current share capital, and that the opening of the first tranche would take place on November 22, 2021 and shall end not earlier than February 16, 2022, and not later than April 5, 2022, and, in any event, when the maximum monetary amount is reached or the maximum number of shares is acquired within that period2 . With regard to the operations carried out in the context of the implementation of the first tranche, between November 22 and December 31, J. P. Morgan AG, as lead manager, acquired 112,254,236 BBVA shares covered by the share buyback program. Between January 1 and January 31, 2022, it acquired 58.951.275.

In addition, BBVA announced on February 3, 2022 that BBVA Board of Directors has agreed, within the framework program, to carry out a second program for the buyback of shares aimed at reducing BBVA’s share capital, for a maximum amount of 2,000 million Euros and a maximum number of shares to be acquired equal to the result of subtracting from 637,770,016 own shares (9.6% of BBVA’s share capital at this date) the number of own shares finally acquired in execution of the first tranche. The implementation of the second tranche, which will also be executed externally, through a lead-manager, will begin after the end of the implementation of the first tranche and shall end no later than October 15, 2022. BBVA will carry out a separate communication prior to the commencement of the execution of the Second Tranche with its specific terms and conditions.

-

In June 2021, BBVA and the majority of the labor union representatives reached an agreement on the restructuring plan of BBVA S.A. in Spain, which includes redundancies of 2,935 employees in total (divided into 2,725 layoffs and 210 leaves of absence, about 10% of the Group's total workforce in Spain) and an outplacement program for all interested employees. The process has been characterized by an attitude of dialogue between the parties and it has been carried out with a clear interest in voluntary acceptance. As of December 31, 2021, a total of 2,888 employees have already signed the exit of BBVA S.A. (some of them effectively left the Bank on January 1, 2022). Additional employee departures from the branches are expected to occur during January and February to complete the full scope of the agreement, which could be extended until March 31, 2022. Regarding the branches, most of the 480 included in the agreement were closed by the end of 2021.

For management information purposes, as it is considered a strategic decision, the impacts of the process have been assigned to the Corporate Center. The savings generated by this process have started to materialize in the last months of 2021, but most of them will materialize starting in 2022

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS, Unicredit. Data of European peer group at the end of September 2021. BBVA data at the end of December 2021.

2 However, the Company reserves the right to temporarily suspend the First Tranche or to early terminate it in the event of any circumstance that so advises or requires.