Highlights

Invasion of Ukraine

Russia's invasion of Ukraine, the largest military attack on a European state since World War II, has had an immediate impact on geopolitics and the global economy. There has also been an increase in the level of uncertainty and tensions, which remains high at the date of elaboration of this report. The European Union, the United States, the United Kingdom and other governments have imposed harsh sanctions against Russia and Russian interests, and additional sanctions and controls cannot be ruled out. The impact of these measures, as well as the potential response by Russia, are currently uncertain and could negatively affect the Bank's business, financial position and results, although the Group's direct exposure to Ukraine and Russia is limited.

The Group observes this events with particular concern and unease because of the human tragedy that they entail.

Results and business activity

The BBVA Group generated a net attributable profit excluding non-recurring impacts of €5,044m in the first nine months of 2022, representing a year-on-year variation of +35.3%%. Including those non-recurring impacts, i.e. €-201m from the purchase of offices in Spain from Merlin in June 2022 and €-416m from the results of discontinued operations corresponding to BBVA USA and the companies sold to PNC on June 1, 2021, together with the net cost related to the restructuring process of the same year, the Group's net attributable profit increased by 46.2% year-on-year.

Recurring income from banking activity (net interest income and commissions) continues to show an excellent performance, reflecting the good performance of activity and improvement in the customer spread, fostered by a more favorable interest rate environment.

Operating expenses increased at Group level (+12.8%, in an environment of high inflation in all countries in which BBVA operates. Notwithstanding the above, thanks to the remarkable growth in gross income, higher than that of expenses, the efficiency ratio stood at 42.9% as of September 30, 2022, with an improvement of 249 basis points in constant terms, compared to the ratio as of September 30, 2021, placing BBVA once again, in a leading position among its European peer group1.

The provisions for impairment on financial assets increased (+6.4% in year-on-year terms and at constant exchange rates), with higher provisions in Turkey and Mexico.

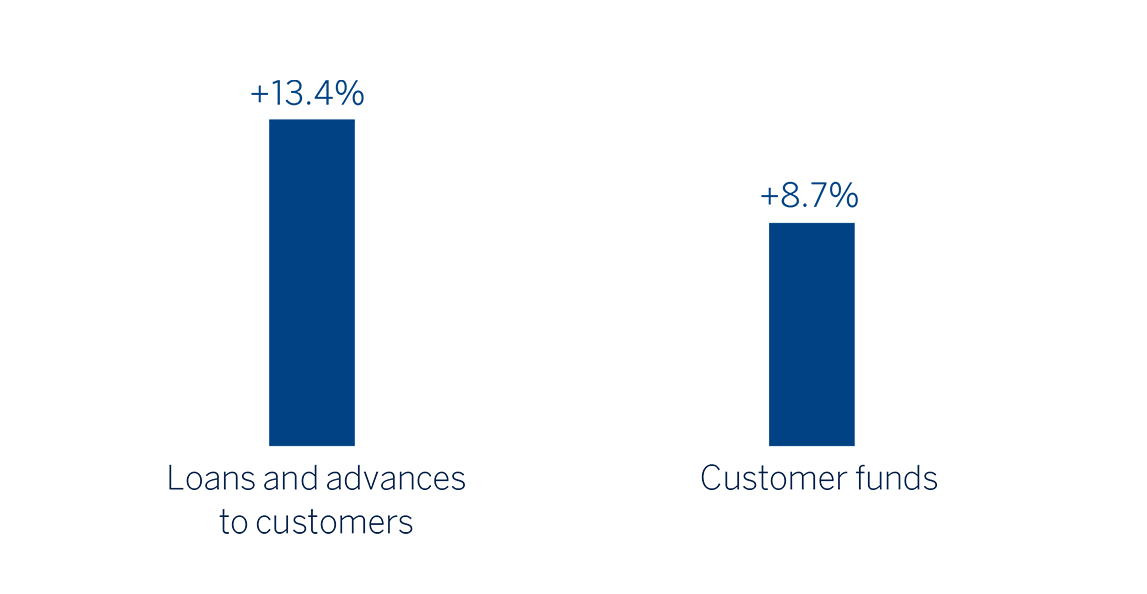

- Loans and advances to customers grew by 13.4% compared to the end of December 2021, strongly favored by the evolution of corporate loans in all business areas and, to a lesser extent, by the dynamism of retail loans.

- Customer funds increased by 8.7% compared to the end of December 2021, thanks to the contribution of demand deposits (+7.4%) and time deposits (+32.6%), showing an outstanding growth in the quarter.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2021)

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, data at the end of June 2022.

Business areas

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

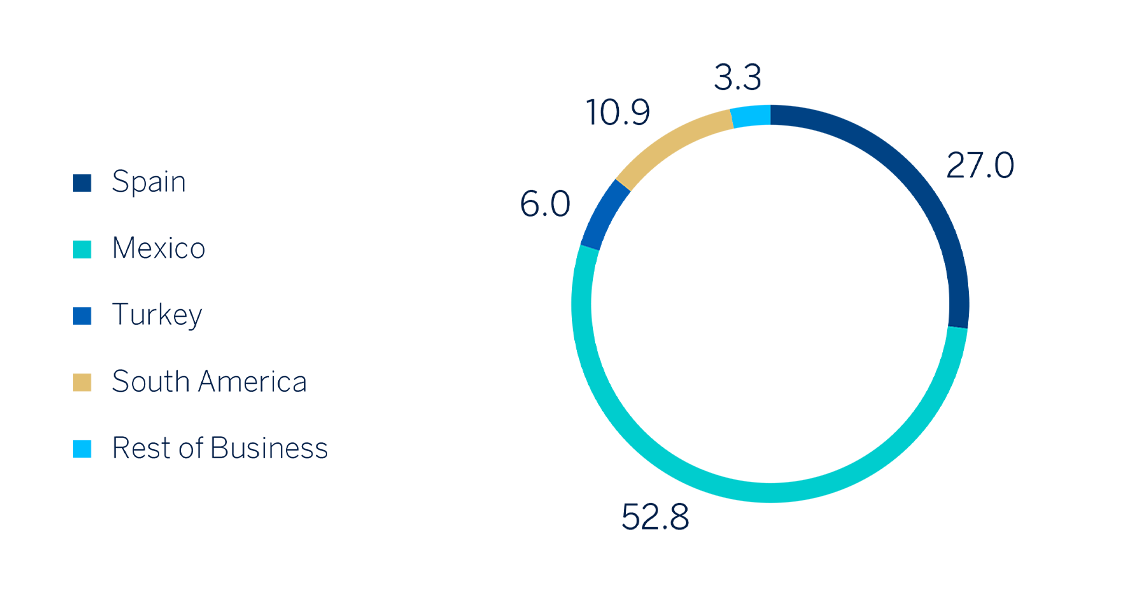

- Spain generated a net attributable profit of €1,514m between January and September of 2022, up 27.1% from the result achieved in the same period of the previous year, due to the dynamism of recurring income from banking activity (net interest income and fees) and net trading income (NTI), which together with lower operating expenses and provisions, have driven the year-on-year evolution. This result does not include the net impact of €-201m from the purchase of Merlin Properties, SOCIMI, S.A. (hereinafter Merlin) of 100% of the shares of Tree Inversiones Inmobiliarias Socimi, S.A. (hereafter Tree), owner of 662 offices leased to BBVA. Including this impact, the area's net attributable profit amounts to €1,312m, an increase of 10.2% compared to the net attributable profit of the same period of the previous year.

- In Mexico, BBVA achieved a net attributable profit of €2,964m between January and September 2022, representing an increase of 47.5% compared to the first nine months of 2021, mainly as a result of the dynamism of the net interest income.

- Turkey generated a net attributable profit of €336m between January and September 2022, which includes the application of hyperinflation accounting in Turkey, with effect from January 1, 2022.

- South America generated a net attributable profit of €614m in the first nine months of 2022, which represents a year-on- year variation of +98.3%, mainly due to the improved performance of recurring income (+50.0%) and NTI.

- Rest of Business achieved a net attributable profit of €183m accumulated at the end of the first nine months of 2022, 24.8% less than in the first nine months of the previous year, mainly due to the performance of the Group's businesses in the United States.

The Corporate Center recorded a net attributable loss of €-566m in the first nine months of 2022. This result compares positively to €-817m recorded in the same period of the previous year, although it should be taken into account that this figure included the net costs associated with the restructuring process in Spain carried out by the Group in 2021, in addition to the results generated by the Group's businesses in the United States until their sale to PNC on June 1, 2021.

Lastly and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €1,353m in the first nine months of 2022. These results, which do not include the application of hyperinflation accounting, represent an increase of 45.5% on a year-on-year basis, due to the growth in recurring income and NTI, which comfortably offset the higher expenses and provisions for impairment on financial assets. It should also be noted that all business lines of the CIB area recorded growth compared to the first nine months of 2021, both in revenues and net attributable profit.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: Jan-Sep.22 excludes net impact arisen from the

purchase of offices in Spain. Jan-Sep.21 excludes BBVA USA and

the rest of the companies in the United States sold to PNC and

the net cost of the restructuring process.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. JAN.-SEP. 2022)

(1) Excludes the Corporate Center and net impact arisen

from the purchase of offices in Spain.

Solvency

The Group's CET1 Fully-loaded ratio stood at 12.45% as of September 30, 2022, which allows to maintain a large management buffer over the Group's CET1 requirement (8.60%), and also above the Group's established target management range of 11.5-12.0% of CET1.

Share buyback program

- On August 19, 2022 BBVA announced the end of the execution of its share buyback program once the maximum number of shares established in the terms and conditions announced on November 19, 2021 had been reached. Thus, the Bank has successfully concluded its share buyback program, having acquired a total of 637,770,016 shares, for an amount of €3,160m.

- On September 30, 2022, the redemption of the 356,551,306 shares acquired by the Bank in execution of the second tranche of the share buyback program was announced.

EXECUTION OF THE PROGRAM FOR THE BUYBACK OF SHARES

| Tranche | Segment | Completion date | Number of shares | % of share capital* | Disbursement |

|---|---|---|---|---|---|

| FIRST TRANCHE | March 3 | 281.218.710 | 4,2 | 1.500 | |

| SECOND TRANCHE | First segment | May 16 | 206,554,498 | 3.1 | 1,000 |

| Second segment | August 19 | 149,996,808 | 2.3 | 660 | |

| Total | 637,770,016 | 9.6 | 3,160 |

- * As of the date tranche closure

REDEMPTION OF SHARES

| Tranche | Date | Number of redeemed shares |

|---|---|---|

| FIRST TRANCHE | June 15 | 281,218,710 |

| SECOND TRANCHE | September 30 | 356,551,306 |

| Total | 637,770,016 |

Dividend

- On September 29, 2022, BBVA informed that its Board of Directors approved the payment in cash of €0.12 gross per share, as gross interim dividend against 2022 results, which was paid on October 11, 2022.

Sustainability

Channeling sustainable financing

SUSTAINABLE BUSINESS BREAKDOWN

(PERCENTAGE. TOTAL AMOUNT CHANNELED 2018-SEPTEMBER 2022)

*Socially responsible investing

BBVA has channeled a total of €124,000m in sustainable business between 2018 and September 2022. Close to €13,000m were channeled this quarter, which represents an increase of nearly 60% compared to the same period in 2021.

Within the channeling of sustainable business, which aims to promote the fight against climate change, the contribution of loans and the funding of projects stands out, which account for 78% of the amount channeled at the end of September 2022. It should be considered that these products have had a standard amortization rate since the beginning of their channeling. Third-party bond brokerage, a business activity that is registered off-balance sheet, represents 18% of the channeled business linked to the fight against climate change. Finally, mutual funds and other off-balance sheet products such as insurance and pension funds, represent 4%.

For its part, within the channeling of sustainable business, which aims to promote inclusive growth, loans and project financing account for 59% of the total amount channeled at the end of September 2022, showing a standard amortization rate since the beginning of its channeling. Third-party bond brokerage represents 14%, while mutual funds and other off-balance sheet products such as insurance and pension funds represent 6%. Finally, the activity of the Microfinance Foundation (BBVAMF), not recorded in the BBVA Group's balance sheet, whose objective is to support entrepreneurs with micro-credits, represent 21%.

The good performance of retail business related to energy efficiency stands out, which has doubled in the third quarter of 2022 compared to the same quarter of the previous year. The role of Spain stands out, doubling the funds directed to energy efficiency compared to the same quarter last year. The increase of 43% in retail business related to sustainable mobility has also been relevant, with financing lines for the acquisition of hybrid and electric vehicles, which has already exceeded that of the same quarter of the previous year and where Colombia has been crucial by channeling a quarter of the total amount. In corporate business, financing related to energy-efficient buildings stands out, multiplying its channeling by three compared to the same quarter of the previous year, where Mexico has been key by increasing its channeling in this line by 60%.

In inclusive growth, great progress has also been made, highlighting the financing of social housing or healthcare infrastructures, quadrupling the financing of the latter compared to the same quarter of the previous year. Financing the business segment plays a relevant role as it contributes more than half of the total channeling, with Spain standing out, which represents approximately 50% of it.

Finally, in corporate business, channeling has also increased by more than 130% compared to the same quarter of the previous year. Likewise, Project Finance activity multiplied by two compared to the same quarter of the previous year, highlighting wind farm projects, which account for almost a quarter of the channeling in Project Finance and where the United States is a key player, accounting for almost 80% of the channeling.

Relevant advances in sustainability matters

- Sustainable business goal

BBVA has raised up its sustainable business goal to €300,000m. This figure places BBVA as one of the European banks with the greatest ambition in its goal of channeling sustainable financing and it is a tangible example of the bank's commitment to sustainability, one of its strategic priorities. This new target, which was just made public in October, means raising the goal announced in July 2021 by 50%, when BBVA updated its sustainable financing roadmap. In addition, it triples the initial aspiration, detailed in February 2018.

- Strategy

BBVA updates its Sustainability General Policy by adding the General Policy on Corporate Social Responsibility and updating the Group's sustainability goals. The three new objectives are: increase the growth of the Group's business through sustainability, achieve neutrality in greenhouse gas emissions and to promote integrity in the relationship with stakeholders. In addition, natural capital is incorporated as a focus of action to be prepared for the challenges ahead.

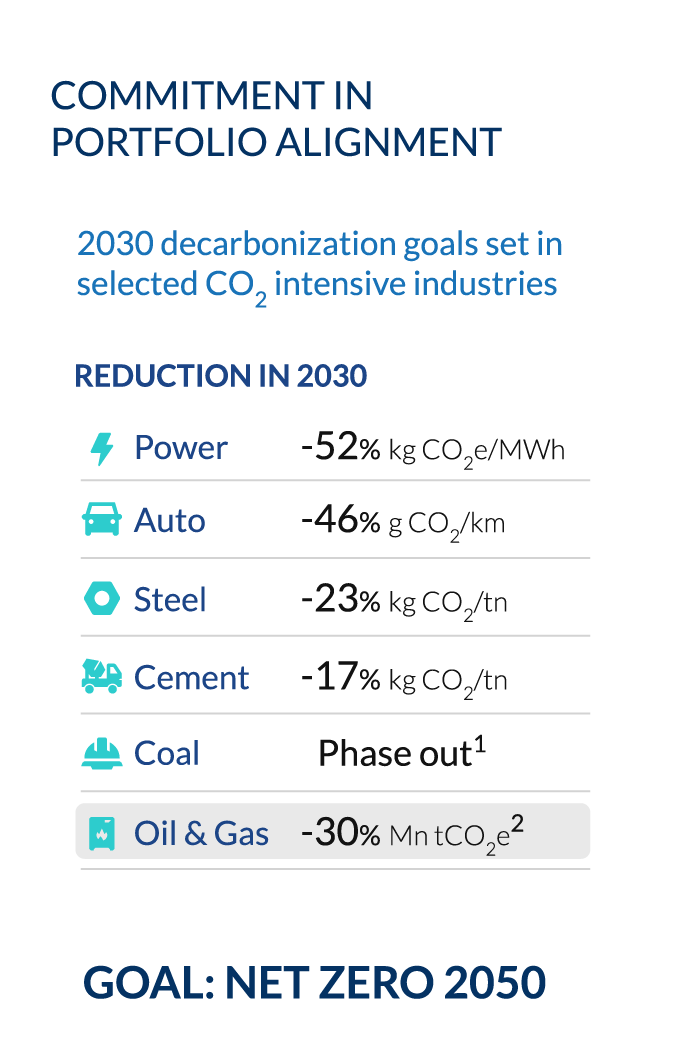

- Decarbonization goals

BBVA wants to accompany the energy sector in its transition and it is committed to clean energies. The Group is making progress in its commitment to be a carbon neutral Entity in 2050, not only through its own activity, already achieved since 2020, but also through the activity of the customers that it finances. Therefore, it has announced that it will reduce the emissions of its oil and gas portfolio by 30% before 2030. BBVA will align its balance sheet in the oil and gas sector according to the scenario of net zero emissions in 2050 following the absolute emissions metric. This commitment is in addition to the Group's 2021 targets in four other carbon-intensive sectors (see table below) and the decision to stop financing coal companies, in line with the zero net emissions banking alliance (NZBA).

(1) 2030 for developed countries and in 2040 for emerging countries.

(2) For upstream related financing.

- Innovation

BBVA's strategic priorities are innovation and sustainability, as evidenced by the creation of a new "water footprint" loan for wholesale customers. This loan, a pioneer in the market, focuses on the customers' water footprint, being of special interest for both, companies that make intensive use of water in their production process, as well as those that operate in the energy, food and beverages, agriculture, textiles or packaging sectors, among others. With this new product, customers benefit from their efforts to reduce their water footprint, not only in terms of price, but also in terms of reputation and differentiation from competitors.

- Carbon markets

BBVA has joined the Carbonplace global platform as a founding member. The platform, which will be operational by the end of 2022, aims to simplify access to carbon credits for all those customers committed to decarbonization. It is an innovative global carbon credit transaction platform that allows the safe, simple and transparent exchange of certified carbon credits, in accordance with recognized international standards. Through this technological solution, BBVA will offer its customers around the world direct access to carbon credits to offset their emissions. BBVA is the first Spanish bank to join this platform integrated into the voluntary carbon market.

- Training

BBVA wants to “make the opportunities of this new era available to everyone”, which is why it has launched the free online course “The ABC of Sustainability” open to the public on the Coursera platform. Within the course, it is described how sustainability is applicable to daily situations in the population, the use of natural resources, its application in the global economy and its interaction with the biosphere, as well as social aspects such as a fair transition, equity, equality, diversity , human rights, education and health.

In addition, since World Environment Day, the educational program "Learning Together" is transformed into "Learning Together 2030". This change sets the beginning of a new stage in the BBVA initiative that will strengthen and expand its global commitment to people and the planet. The program is the largest educational platform in Spanish, it already has more than seven million subscribers and its videos have more than 1,800m views.

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, data at the end of June 2022.