Business areas

Spain

€4,646 Mill.*

+2.9%

Highlights

- Growth in lending activity in the year

- Significant improvement in efficiency

- Favorable evolution of net interest income and improvement in the customer spread

- Solid risk indicators with a decrease in the balance of non-performing loans and the NPL ratio

Results

(Millions of euros)

Net interest income

2,695Gross income

4,646Operating income

2,489Net attributable profit (3)

1,514Activity (1)

Variation compared to 31-12-21.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+3.1%

Customers funds under management

-0.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

(3) The net attributable profit excludes the net

impact arisen from the purchase of offices in Spain.

Including this impact, the net attributable profit

stands at €808m, representing a year-on-year increase

of 11.5%.

Mexico

€7.754 Mill.*

+24.9%

Highlights

- Balanced investment growth in the first nine months

- Good performance of recurring income and NTI

- Significant improvement in the efficiency ratio

- Excellent net attributable profit in the quarter

Results

(Millions of euros)

Net interest income

5,921Gross income

7,754Operating income

5,284Net attributable profit

2,964Activity (1)

Variation compared to 31-12-21 at constant exchange

rate.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+12,6%

Customers funds under management

+2,6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

1,163 Mill.*

+104.2%

Highlights

- Growth in activity, again driven by loans and deposits in Turkish lira

- Lower hyperinflation adjustment in the quarter

- Strength of risk indicators

- Year-on-year growth in net attributable profit

Results

(Millions of euros)

Net interest income

1,976Gross income

2,357Operating income

1,567Net attributable profit

Resultado atribuido

336Activity (1)

Variation compared to 31-12-21 at constant exchange

rate.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+41.6%

Customers funds under management

+48.3%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€3,167 Mill.*

+38.9%

Highlights

- Growth in lending activity and customer funds

- Improvement of the NPL ratio and coverage stability

- Favorable behavior of net interest income and NTI in the quarter

- Stability of the efficiency ratio in the quarter despite the growth of expenses in an inflationary environment

Results

(Millions of euros)

Net interest income

3,074Gross income

3,167Operating income

1,674Net attributable profit

614Activity (1)

Variation compared to 31-12-21 at constant exchange

rates.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+10.2%

Customers funds under management

+12.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€585 Mill.*

-8.7%

Highlights

- Growth in lending activity and in customer funds in the first nine months of 2022

- Strong net interest income, which grows at double-digit

- Increase in operating expenses

- The cost of risk remains at low levels

Results

(Millions of euros)

Net interest income

244Gross income

585Operating income

217Net attributable profit

183Activity (1)

Variation compared to 31-12-21 at constant exchange

rates.

Balances as of 30-09-22.

Performing loans and advances to customers under mangement

+26.2%

Customers funds under management

+27.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) Net attributable profit excludes the net impact of the acquisition of offices in Spain. Including this impact, net attributable profit came to 1,312 million euros, an increase of 10.2% year-on-year.

(2) At constant exchange rates.

(3) At constant exchange rates.

Data at the end of September 2022. Those countries in which BBVA has no legal entity or the volume of activity is not significant, are not included.

This section presents the most relevant aspects of the Group's different business areas. Specifically, for each one of them, it shows a summary of the income statements and balance sheets, the business activity figures and the most significant ratios.

The structure of the business areas reported by the BBVA Group as of September 30, 2022, is identical with the one presented at the end of 2021.

The composition of BBVA Group business areas is summarized below:

- Spain mainly includes the banking and insurance businesses that the Group carries out in this country, including the proportional share of the results of the company created from the bancassurance agreement reached with Allianz at the end of 2020.

- Mexico includes banking and insurance businesses in this country, as well as the activity that BBVA Mexico carries out through its branch in Houston.

- Turkey reports the activity of the group Garanti BBVA that is mainly carried out in this country and, to a lesser extent, in Romania and the Netherlands.

- South America mainly includes banking and insurance activity conducted in the region.

- Rest of Business mainly incorporates the wholesale activity carried out in Europe (excluding Spain) and in the United States, as well as the banking business developed through BBVA’s branches in Asia.

The Corporate Center contains the centralized functions of the Group, including: the costs of the head offices with a corporate function; structural exchange rate positions management; portfolios whose management is not linked to customer relations, such as financial and industrial holdings; stakes in Funds & Investment Vehicles in tech companies; certain tax assets and liabilities; funds due to commitments to employees; goodwill and other intangible assets as well as such portfolios and assets' funding. Additionally, the results obtained by BBVA USA and the rest of the companies included in the sale agreement to PNC until the closing of the transaction on June 1, 2021, are presented in a single line of the income statements called “Profit (loss) after taxes from discontinued operations”. Finally, the costs related to the BBVA, S.A. restructuring process carried out in Spain during the first half of the year 2021, are included in this aggregate and are recorded in the line "Net cost related to the restructuring process".

In addition to these geographical breakdowns, supplementary information is provided for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. This business is relevant to have a broader understanding of the Group's activity and results due to the important features of the type of customers served, products offered and risks assumed.

The information by business areas is based on units at the lowest level and/or companies that make up the Group, which are assigned to the different areas according to the main region or company group in which they carry out their activity. With regard to the information related to the business areas, in the first quarter of 2022 the Group changed the allocation criteria for certain expenses related to global technology projects between the Corporate Center and the business areas, therefore, to ensure that year-on-year comparisons are homogeneous, the figures corresponding to the financial year 2021 have been restated, which did not affect the consolidated financial information of the Group. Also in the first quarter of 2022, an equity team from the Global Markets unit was transferred from Spain to New York, with the corresponding transfer of the costs associated with this relocation from the Spain area to the Rest of Business area.

Regarding the shareholders' funds allocation, in the business areas, a capital allocation system based on the consumed regulatory capital is used.

Finally, it should be noted that, as usual, in the case of the different business areas, that is, Mexico, Turkey, South America and Rest of Business, and, additionally, CIB, in addition to the year-on-year variations applying current exchange rates, the variations at constant exchange rates are also disclosed.

Main income statement line items by business area (Millions of euros)

| Business areas | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| BBVA Group |

Spain | Mexico | Turkey | South America |

Rest of Business |

∑ Business areas | Corporate Center | ||

| Jan.-Sep. 22 | |||||||||

| Net interest income | 13,811 | 2,695 | 5,921 | 1,976 | 3,074 | 244 | 13,908 | (97) | |

| Gross income | 18,366 | 4,646 | 7,754 | 2,357 | 3,167 | 585 | 18,510 | (144) | |

| Operating income | 10,494 | 2,489 | 5,284 | 1,567 | 1,674 | 217 | 11,232 | (737) | |

| Profit (loss) before tax | 7,909 | 2,120 | 3,962 | 1,211 | 1,129 | 229 | 8,651 | (741) | |

| Net attributable profit (loss) excluding non-recurring impacts(1) |

5,044 | 1,514 | 2,964 | 336 | 614 | 183 | 5,610 | (566) | |

| Net attributable profit (loss) | 4,842 | 1,312 | 2,964 | 336 | 614 | 183 | 5,408 | (566) | |

| Jan.-Sep. 21 (2) | |||||||||

| Net interest income | 10,708 | 2,634 | 4,280 | 1,651 | 2,061 | 211 | 10,836 | (128) | |

| Gross income | 15,589 | 4,514 | 5,558 | 2,414 | 2,294 | 605 | 15,384 | 206 | |

| Operating income | 8,613 | 2,259 | 3,592 | 1,679 | 1,204 | 278 | 9,012 | (398) | |

| Profit (loss) before tax | 6,182 | 1,616 | 2,534 | 1,503 | 649 | 294 | 6,595 | (413) | |

|

Net attributable profit (loss) excluding non-recurring impacts(1) |

3,727 | 1,191 | 1,799 | 583 | 327 | 229 | 4,129 | (401) | |

| Net attributable profit (loss) | 3,311 | 1,191 | 1,799 | 583 | 327 | 229 | 4,129 | (817) | |

- (1) Non-recurring impacts include: (I) the net impact arisen from the purchase of offices in Spain in 2022; (II) the net costs related to the restructuring process; and (III) the profit (loss) after tax from discontinued operations derived from the sale of BBVA USA and the rest of the companies in the United States to PNC on June 1, 2021.

- (2) Restated balances.

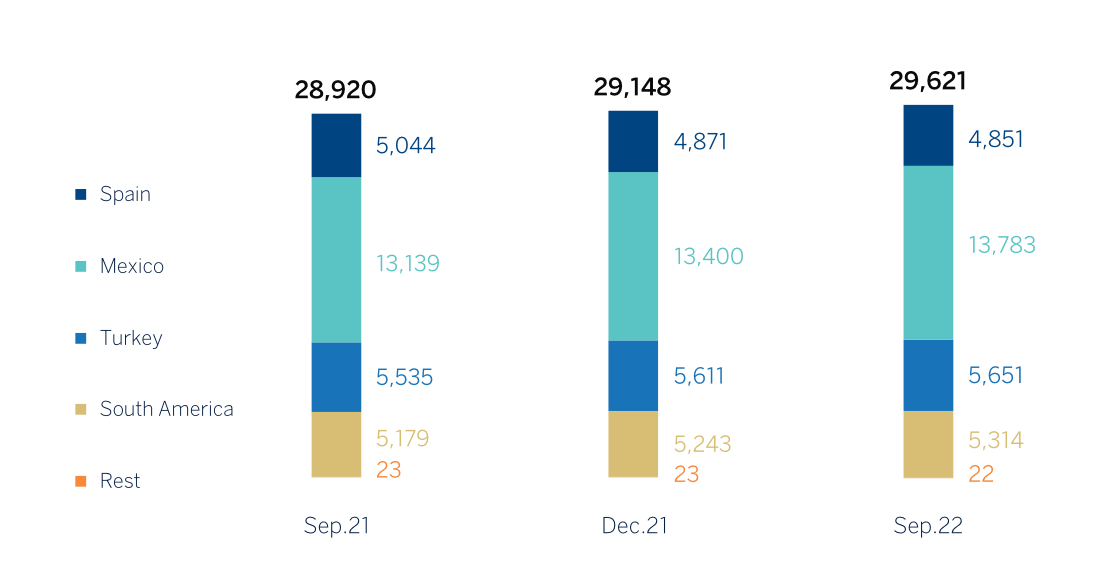

GROSS INCOME(1), OPERATING INCOME(1) AND NET ATTRIBUTABLE PROFIT(1) BREAKDOWN (PERCENTAGE. 1H22)

(1) Excludes the Corporate Center and the net impact arisen from the purchase of offices in Spain.

MAIN BALANCE-SHEET ITEMS AND RISK-WEIGHTED ASSETS BY BUSINESS AREA (MILLIONS OF EUROS)

| Business areas | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| BBVA Group |

Spain | Mexico | Turkey | South America |

Rest of business |

∑ Business areas | Corporate Center | Deletions | ||

| 30-09-22 | ||||||||||

| Loans and advances to customers |

361,731 | 176,152 | 73,530 | 36,898 | 41,017 | 35,319 | 362,917 | 161 | (1,347) | |

| Deposits from customers | 389,705 | 212,863 | 76,623 | 47,198 | 44,547 | 8,751 | 389,981 | 185 | (461) | |

| Off-balance sheet funds | 150,504 | 85,181 | 40,251 | 5,571 | 18,976 | 524 | 150,502 | 3 | - | |

| Total assets/ liabilities and equity | 738,680 | 437,454 | 152,096 | 68,404 | 69,097 | 47,532 | 774,583 | 21,508 | (57,411) | |

| RWAs | 341,685 | 108,733 | 80,491 | 53,435 | 51,484 | 35,559 | 329,702 | 11,983 | - | |

| 31-12-21 | ||||||||||

| Loans and advances to customers |

318,939 | 171,081 | 55,809 | 31,414 | 34,608 | 26,965 | 319,877 | 1,006 | (1,945) | |

| Deposits from customers | 349,761 | 206,663 | 64,003 | 38,341 | 36,340 | 6,266 | 351,613 | 175 | (2,027) | |

| Off-balance sheet funds | 147,192 | 94,095 | 32,380 | 3,895 | 16,223 | 597 | 147,190 | 2 | - | |

| Total assets/ liabilities and equity | 662,885 | 413,430 | 118,106 | 56,245 | 56,124 | 40,328 | 684,233 | 30,835 | (52,182) | |

| RWAs | 307,795 | 113,797 | 64,573 | 49,718 | 43,334 | 29,280 | 300,703 | 7,092 | - | |

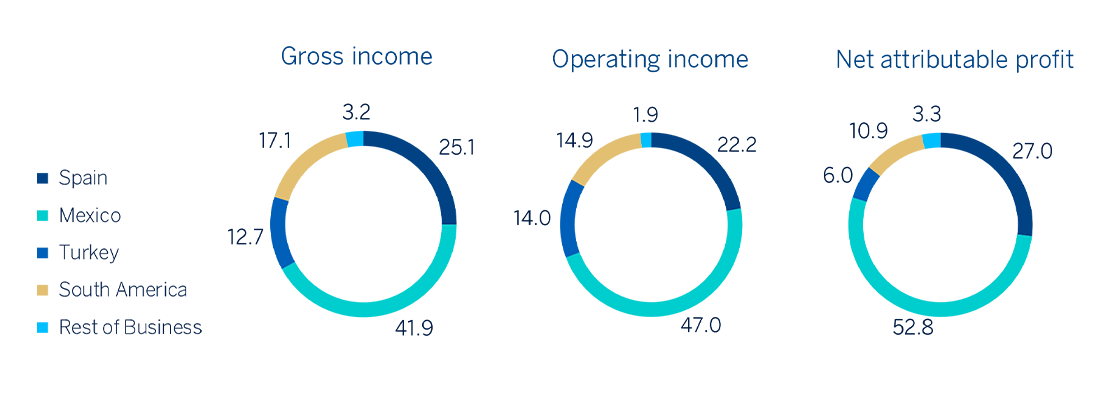

Number of employees

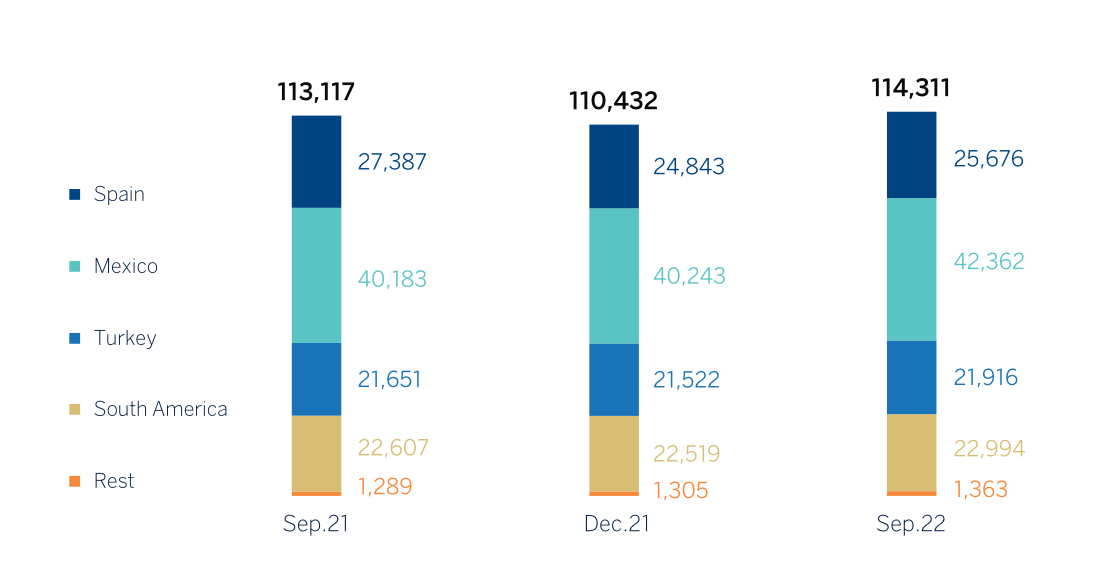

Number of branches

Number of ATMs