Business areas

Spain

€5,833 Mill.*

+26.3%

Highlights

- Growth in consumer loans, SMEs and public sector during the year

- Net interest income dynamism continues

- Very significant improvement of the efficiency ratio

- Cost of risk remains at low levels

Results

(Millions of euros)

Net interest income

4,053Gross income

5,833Operating income

3,532Net attributable profit

2,110Activity (1)

Variation compared to 31-12-22.

Balances as of 30-09-23.

Performing loans and advances to customers under management

-0.5%Customer funds under management

-0.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

Mexico

€10,475 Mill.*

+22.3%

Highlights

- Lending activity acceleration in the quarter, with greater dynamism of the retail segment

- Net interest income continues to grow at double digit rates

- Favorable evolution of the efficiency ratio

- Quarterly net attributable profit continues at high levels

Results

(Millions of euros)

Net interest income

8,164Gross income

10,475Operating income

7,300Net attributable profit

3,987Activity (1)

Variation compared to 31-12-22 at constant exchange

rate.

Balances as of 30-09-23.

Performing loans and advances to customers under mangement

+8.0%Customer funds under management

+6.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

2,210 Mill.*

+184.0%

Highlights

- The dedollarization of the balance sheet continues in the quarter

- Improvement of the NPL ratio and NPL coverage ratio

- The cost of risk remains at low levels

- Net attributable profit of the third quarter negatively impacted by the hyperinflation adjustment and the increase in the tax rate

Results

(Millions of euros)

Net interest income

1,581Gross income

2,310Operating income

1,264Net attributable profit

367Activity (1)

Variation compared to 31-12-22 at constant exchange

rate.

Balances as of 30-09-23.

Performing loans and advances to customers under mangement

+46.7%Customer funds under management

+59.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€3,577 Mill.*

+52.9%

Highlights

- Growth in lending activity

- Excellent evolution of the net interest income

- Favorable NTI evolution

- Higher adjustment for hyperinflation in Argentina

Results

(Millions of euros)

Net interest income

3,892Gross income

3,577Operating income

1,900Net attributable profit

496Activity (1)

Variation compared to 31-12-22 at constant exchange

rates.

Balances as of 30-09-23.

Performing loans and advances to customers under mangement

+6.9%Customer funds under management

-9.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€852 Mill.*

+48.6%

Highlights

- Recovery in lending activity during the quarter

- Dynamism in recurring income and NTI in the year

- NPL ratio and cost of risk remain at low levels

- Efficiency improvement continues in year-on-year terms

Results

(Millions of euros)

Net interest income

405Gross income

852Operating income

424Net attributable profit

322Activity (1)

Variation compared to 31-12-22 at constant exchange

rates.

Balances as of 30-09-23.

Performing loans and advances to customers under mangement

+0.8%Customer funds under management

+2.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

This section presents the most relevant aspects of the Group's different business areas. Specifically, for each one of them, it shows a summary of the income statements and balance sheets, the business activity figures and the most significant ratios.

The structure of the business areas reported by the BBVA Group as of September 30, 2023, is the same as the one presented at the end of 2022.

The composition of BBVA Group's business areas is summarized below:

- Spain mainly includes the banking, insurance and asset management activities that the Group carries out in this country.

- Mexico includes banking, insurance and asset management activities in this country, as well as the activity that BBVA Mexico carries out through its agency in Houston.

- Turkey reports the activity of the group Garanti BBVA that is mainly carried out in this country and, to a lesser extent, in Romania and the Netherlands.

- South America includes banking, financial, insurance and asset management activities conducted, mainly, in Argentina, Chile, Colombia, Peru, Uruguay and Venezuela.

- Rest of Business mainly incorporates the wholesale activity carried out in Europe (excluding Spain), the United States, and BBVA’s branches in Asia.

The Corporate Center contains the centralized functions of the Group, including: the costs of the head offices with a corporate function; structural exchange rate positions management; portfolios whose management is not linked to customer relations, such as financial and industrial holdings; stakes in Funds & Investment Vehicles in tech companies; certain tax assets and liabilities; funds due to commitments to employees; goodwill and other intangible assets as well as such portfolios and assets' funding. Finally, in the description of this aggregate, it is worth mentioning that the Corporate Center tax expense includes the difference between the effective tax rate in the period of each business area and the expected tax rate of the Group for the year as a whole.

In addition to these geographical breakdowns, supplementary information is provided for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. This business is relevant to have a broader understanding of the Group's activity and results due to the important features of the type of customers served, products offered and risks assumed.

The information by business areas is based on units at the lowest level and/or companies that make up the Group, which are assigned to the different areas according to the main region or company group in which they carry out their activity.

Regarding the shareholders' funds allocation, in the business areas, a capital allocation system based on the consumed regulatory capital is used.

Finally, it should be noted that, as usual, in the case of the different business areas, that is, Mexico, Turkey, South America and Rest of Business, and, additionally, CIB, in addition to the year-on-year variations applying current exchange rates, the variations at constant exchange rates are also disclosed.

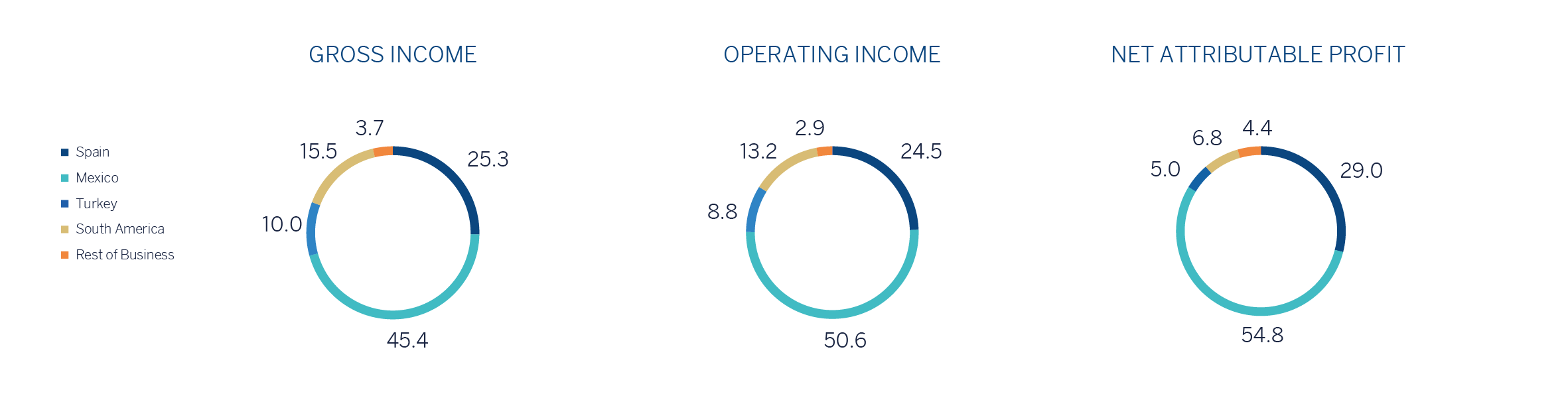

GROSS INCOME (1), OPERATING INCOME (1) AND NET ATTRIBUTABLE PROFIT (1) BREAKDOWN (PERCENTAGE. JAN.-SEP. 2023)

(1) Excludes the Corporate Center.

Main income statement line items by business area (Millions of euros)

| Business areas | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| BBVA Group |

Spain | Mexico | Turkey | South America |

Rest of Business |

∑ Business areas | Corporate Center | ||

| Jan.-Sep. 23 | |||||||||

| Net interest income | 17,843 | 4,053 | 8,164 | 1,581 | 3,892 | 405 | 18,096 | (253) | |

| Gross income | 22,104 | 5,833 | 10,475 | 2,310 | 3,577 | 852 | 23,047 | (943) | |

| Operating income | 12,863 | 3,532 | 7,300 | 1,264 | 1,900 | 424 | 14,420 | (1,557) | |

| Profit (loss) before tax | 9,487 | 3,053 | 5,472 | 1,089 | 1,021 | 410 | 11,044 | (1,558) | |

| Net attributable profit (loss) excluding non-recurring impacts | 5,961 | 2,110 | 3,987 | 367 | 496 | 322 | 7,282 | (1,321) | |

| Net attributable profit (loss) | 5,961 | 2,110 | 3,987 | 367 | 496 | 322 | 7,282 | (1,321) | |

| Jan.-Sep. 22 (1) | |||||||||

| Net interest income | 13,790 | 2,687 | 5,922 | 1,961 | 3,074 | 243 | 13,887 | (97) | |

| Gross income | 18,255 | 4,620 | 7,661 | 2,347 | 3,186 | 584 | 18,399 | (144) | |

| Operating income | 10,428 | 2,477 | 5,218 | 1,561 | 1,693 | 217 | 11,166 | (737) | |

| Profit (loss) before tax | 7,844 | 2,107 | 3,896 | 1,205 | 1,148 | 229 | 8,585 | (741) | |

| Net attributable profit (loss) excluding non-recurring impacts (2) | 4,997 | 1,505 | 2,918 | 333 | 625 | 182 | 5,563 | (566) | |

| Net attributable profit (loss) | 4,795 | 1,304 | 2,918 | 333 | 625 | 182 | 5,361 | (566) | |

(1) Balances restated according to IFRS 17 - Insurance contracts.

(2) Non-recurring impacts includes the net impact arisen from the purchase of offices in Spain in the second quarter of 2022.

MAIN BALANCE-SHEET ITEMS AND RISK-WEIGHTED ASSETS BY BUSINESS AREA (MILLIONS OF EUROS)

| Business areas | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| BBVA Group |

Spain | Mexico | Turkey | South America |

Rest of business |

∑ Business areas | Corporate Center | Deletions | ||

| 30-09-23 | ||||||||||

| Loans and advances to customers |

376,336 | 173,619 | 86,727 | 37,466 | 42,119 | 37,862 | 377,794 | 129 | (1,587) | |

| Deposits from customers | 403,861 | 212,725 | 86,373 | 51,104 | 44,535 | 10,204 | 404,942 | 191 | (1,272) | |

| Off-balance sheet funds | 160,485 | 93,024 | 52,741 | 7,894 | 6,345 | 480 | 160,484 | 1 | - | |

| Total assets/liabilities and equity | 757,736 | 437,757 | 173,017 | 69,272 | 67,136 | 55,740 | 802,923 | 22,671 | (67,858) | |

| RWAs | 357,972 | 117,112 | 88,290 | 53,056 | 50,255 | 35,087 | 343,799 | 14,173 | - | |

| 31-12-22 (1) | ||||||||||

| Loans and advances to customers |

357,351 | 173,971 | 71,231 | 37,443 | 38,437 | 37,375 | 358,456 | 278 | (1,383) | |

| Deposits from customers | 394,404 | 221,019 | 77,750 | 46,339 | 40,042 | 9,827 | 394,978 | 187 | (760) | |

| Off-balance sheet funds | 150,172 | 86,759 | 38,196 | 6,936 | 17,760 | 520 | 150,170 | 2 | - | |

| Total assets/liabilities and equity | 712,092 | 427,116 | 142,557 | 66,036 | 61,951 | 49,952 | 747,613 | 22,719 | (58,239) | |

| RWAs | 337,066 | 114,474 | 71,738 | 56,275 | 46,834 | 35,064 | 324,385 | 12,682 | - | |

(1) Balances restated according to IFRS 17 - Insurance contracts.

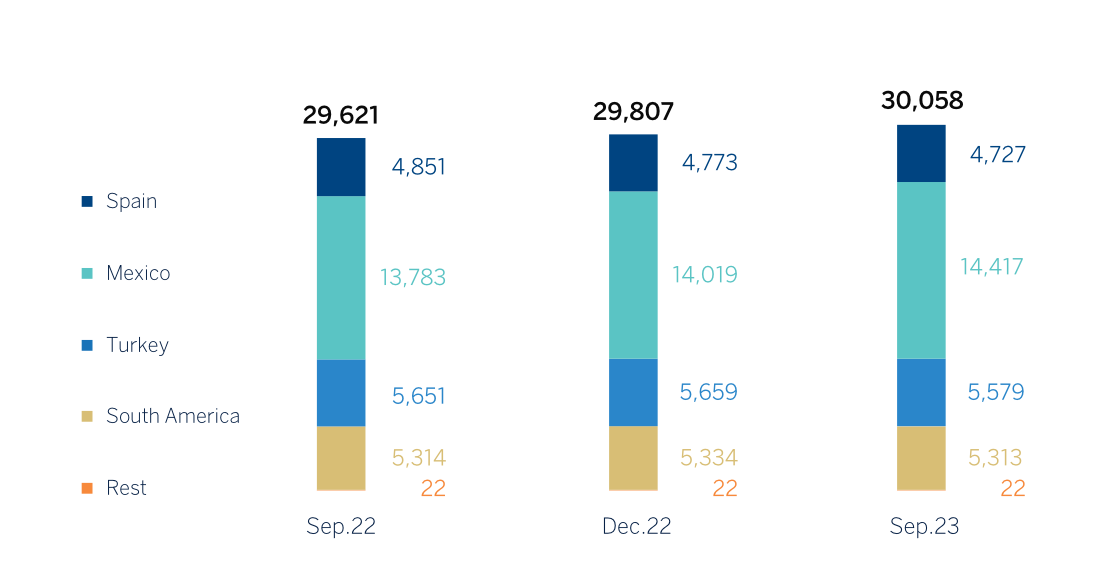

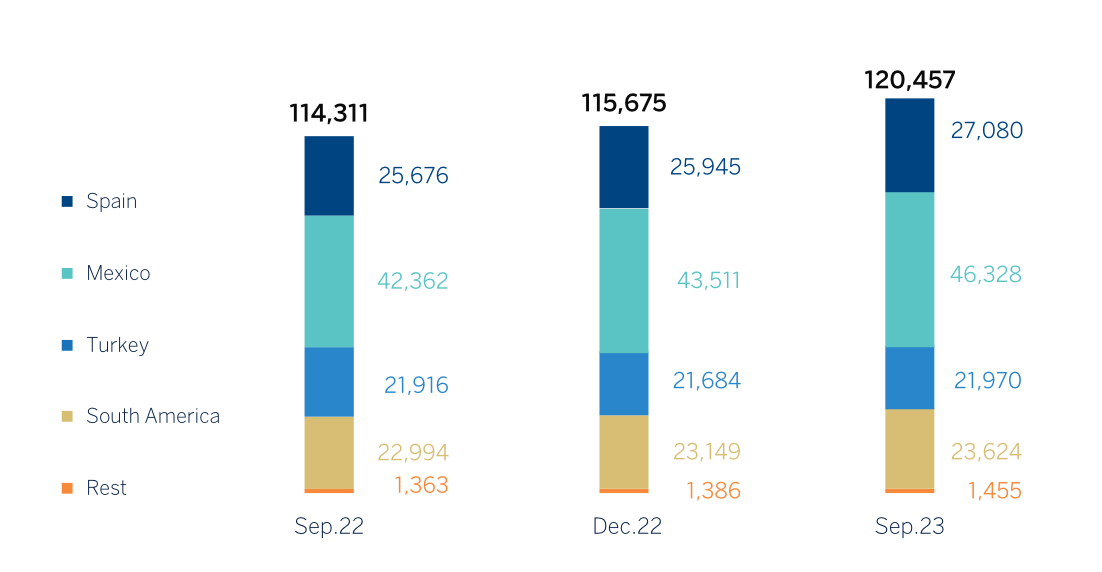

Number of employees

Number of branches

Number of ATMs