Spain

Highlights

- Growth in consumer loans, SMEs and public sector during the year

- Favorable evolution of core revenues

- Very relevant improvement of the efficiency ratio during the year

- Cost of risk remains at low levels

Business activity (1)

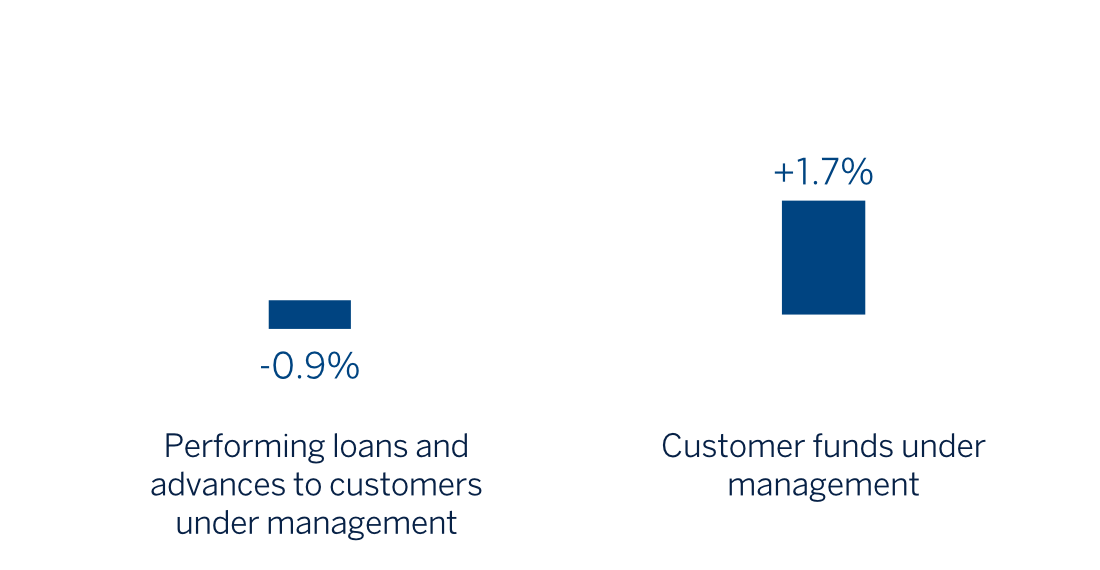

(VARIATION COMPARED TO 31-12-22)

(1) Excluding repos.

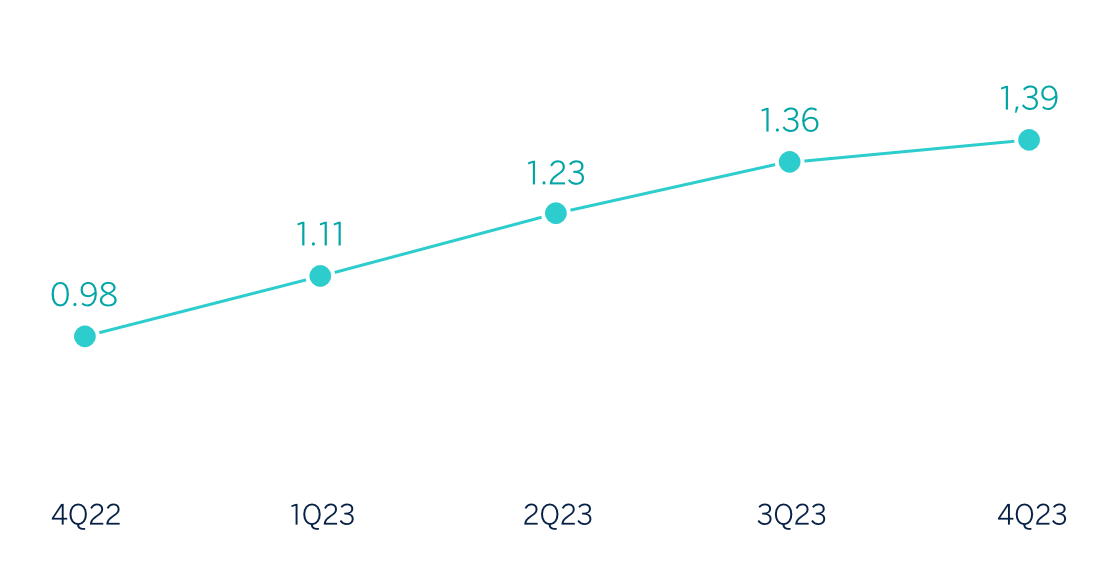

Net interest income / AVERAGE TOTAL ASSETS

(Percentage)

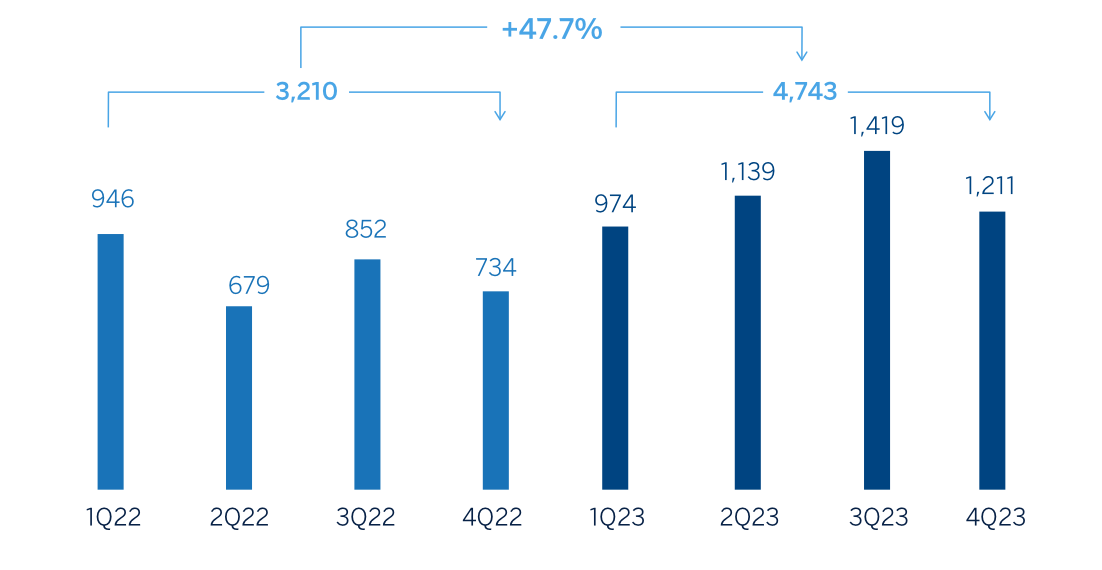

Operating income (Millions of euros)

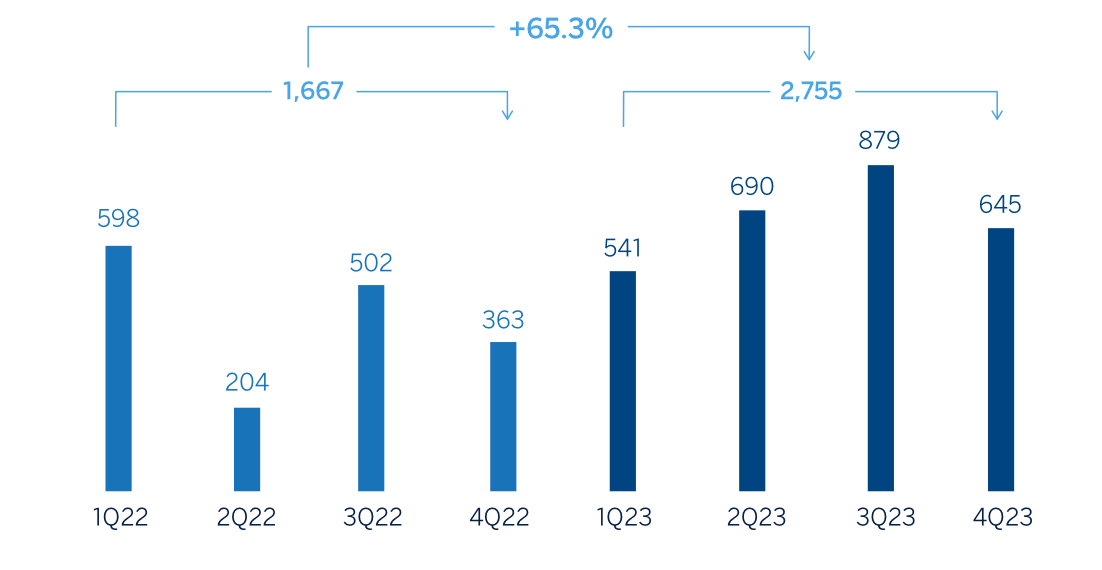

Net attributable profit (LOSS) (Millions of euros)

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 2023 | ∆% | 2022 (1) |

|---|---|---|---|

| Net interest income | 5,620 | 48.9 | 3,774 |

| Net fees and commissions | 2,164 | 0.4 | 2,156 |

| Net trading income | 409 | 3.4 | 396 |

| Other operating income and expenses | (305) | 42.5 | (214) |

| Of which: Insurance activities | 360 | 1.3 | 355 |

| Gross income | 7,888 | 29.1 | 6,112 |

| Operating expenses | (3,145) | 8.4 | (2,901) |

| Personnel expenses | (1,778) | 10.6 | (1,608) |

| Other administrative expenses | (984) | 10.6 | (889) |

| Depreciation | (383) | (5.1) | (404) |

| Operating income | 4,743 | 47.7 | 3,210 |

| Impairment on financial assets not measured at fair value through profit or loss | (651) | 24.5 | (522) |

| Provisions or reversal of provisions and other results | (145) | 86.6 | (78) |

| Profit (loss) before tax | 3,947 | 51.2 | 2,610 |

| Income tax | (1,190) | 61.1 | (739) |

| Profit (loss) for the period | 2,757 | 47.3 | 1,872 |

| Non-controlling interests | (2) | (31.9) | (3) |

| Net attributable profit (loss) excluding non-recurring impacts | 2,755 | 47.5 | 1,868 |

| Net impact arisen from the purchase of offices in Spain | — | — | (201) |

| Net attributable profit (loss) | 2,755 | 65.3 | 1,667 |

| Balance sheets | 31-12-23 | ∆% | 31-12-22 (1) |

|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 44,653 | (9.2) | 49,185 |

| Financial assets designated at fair value | 146,136 | 15.6 | 126,413 |

| Of which: Loans and advances | 70,265 | 67.6 | 41,926 |

| Financial assets at amortized cost | 216,334 | 5.8 | 204,528 |

| Of which: Loans and advances to customers | 173,169 | (0.5) | 173,971 |

| Inter-area positions | 42,919 | 10.3 | 38,924 |

| Tangible assets | 2,884 | (3.5) | 2,990 |

| Other assets | 4,697 | (7.5) | 5,076 |

| Total assets/liabilities and equity | 457,624 | 7.1 | 427,116 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 112,738 | 33.2 | 84,619 |

| Deposits from central banks and credit institutions | 43,694 | (15.5) | 51,702 |

| Deposits from customers | 216,198 | (2.2) | 221,019 |

| Debt certificates | 51,472 | 26.2 | 40,782 |

| Inter-area positions | — | — | — |

| Other liabilities | 18,629 | 17.4 | 15,870 |

| Regulatory capital allocated | 14,892 | 13.5 | 13,124 |

| Relevant business indicators | 31-12-23 | ∆% | 31-12-22 |

|---|---|---|---|

| Performing loans and advances to customers under management (2) | 169,712 | (0.9) | 171,209 |

| Non-performing loans | 8,189 | 3.8 | 7,891 |

| Customer deposits under management (2) | 214,968 | (2.3) | 220,140 |

| Off-balance sheet funds (3) | 97,253 | 12.1 | 86,759 |

| Risk-weighted assets | 121,779 | 6.4 | 114,474 |

| Efficiency ratio (%) | 39.9 | 47.5 | |

| NPL ratio (%) | 4.1 | 3.9 | |

| NPL coverage ratio (%) | 55 | 61 | |

| Cost of risk (%) | 0.37 | 0.28 |

(1) Balances restated according to IFRS 17 - Insurance contracts

(2) Excluding repos.

(3) Includes mutual funds, customer portfolios and pension funds.

Macro and industry trends

According to the latest estimate from BBVA Research, GDP growth would converge to around 2.4% in 2023 (unchanged from the previous forecast) and 1.5% in 2024 (30 basis points lower than previously expected). Despite the relative resilience of activity, largely related to the dynamism of the services sector and the labor market, as well as the effect of the European recovery funds, growth is expected to continue to moderate in the next months, in line with the slowdown in growth in the Eurozone, in a context of higher uncertainty about internal policies. Annual inflation, which fell from particularly high values in 2022 to 3.1% in December 2023, is expected to remain close to this level during 2024.

As for the banking system, data at the end of October 2023 showed that the volume of credit to the private sector declined by 3.7% year-on-year. At the November close, household and non-financial corporate loan portfolios fell by 2.3% and 5.6% year-on-year, respectively. Customer deposits fell by 1.2% year-on-year as of the end of November 2023, due to a 6.2% reduction in demand deposits. This was not offset by the growth in time deposits (+81.1% year-on-year). The NPL ratio stood at 3.6% in October 2023, 16 basis points below the figure of the same month of the previous year. Furthermore, the system maintains comfortable solvency and liquidity levels.

Activity

The most relevant aspects related to the area's activity during 2023 were:

- Lending balances registered a slight decrease of 0.9% mainly due to the evolution of mortgage loans (-2.2%) and the deleveraging by large corporations (-5.4%). This evolution was partially offset by the performance of loans to the public sector (+7.8%), consumer loans (+5.9%, including credit cards) and loans to SMEs (+3.6%).

- Total customer funds grew in the year (+1.7%). Lower demand deposit balances (-5.1%) were partially offset mainly by off-balance sheet funds growth (mutual and pension funds and managed portfolios, +12.1% overall), which increased mainly as a result of net contributions during the year and the effect of the market evolution.

The most relevant aspects related to the area's activity during the fourth quarter of 2023 were:

- Lending activity remained stable compared to the previous quarter (-0.3%) mainly due to the reduction in loans to large corporations (-3.0%), partially offset by the consumer loans (+1.6%, including credit cards), loans to the public sector (+1.3%) and to SMEs (+1.2%). On the other hand, mortgage loans remained flat during the quarter.

- Regarding credit quality, the NPL ratio increased by 13 basis points compared to the previous quarter and stands at 4.1%. The increase during the quarter is concentrated in the retail portfolio, although with fewer entries than in previous quarters, mitigated by a decrease in the wholesale portfolio. The NPL coverage ratio remains stable during the quarter at 55%.

- Total customer funds increased in the last quarter of the year (+2.5%), with a growth of both customer deposits (+1.6%), favored by the time deposits increase, and specially the off-balance sheet funds (+4.5%) , mainly due to the impact of the market evolution.

Results

Spain generated a net attributable profit of €2,755m in 2023, 65.3% higher than in the previous year, which included the net impact arisen from the purchase of offices to Merlin (-201 millions of euros). In 2023, the favorable evolution of the net interest income stands out, which continued to boost the gross income growth and comfortably offset the increase in expenses.

The most relevant aspects of the year-on-year changes in the area's income statement at the end of December 2023 were:

- Net interest income grew by 48.9% favored by the improvement in customer spreads derived from the successive interest rate hikes carried out by the ECB between July 2022 and September 2023 as well as and the cost of deposits, which remains contained.

- Net fees and commissions were in line with those of the previous year (+0.4%), favored by the contribution of the income linked to asset management, which offset the lower contribution of banking services fees.

- Increase in the year-on-year NTI contribution (+3.4%) driven by the favorable evolution of Global Markets.

- Other operating income and expenses compares negatively with the same period of the previous year, due to the €215m recorded on this line, corresponding to the total annual amount paid for the temporary tax on credit institutions and financial credit establishments. This was partially offset by a lower contribution to the public schemes of bank deposits guarantee, this is, to the Single Resolution Fund and to the Deposits Guarantee Fund (hereinafter FUR and FGD, both for their acronym in Spanish, respectively), which was lower than in the previous year overall. Lastly, the performance of the insurance business, also considered under this line item, improved compared to 2022.

- Operating expenses continued to increase (+8.4%), although well below the growth of gross income (+29.1%), which allowed a very significant improvement of the efficiency ratio by 760 basis points in the last year. The increase in expenses is due to both higher fixed remuneration to personnel, with additional measures that improve those of the sectoral wage increase agreement for 2023, and higher general expenses, affected by the inflation, especially higher IT expenses.

- Impairment on financial assets increased by 24.5% due to higher loan-loss provisions, mainly in the retail portfolio, which were affected by a higher rate environment, and together with some positive non-recurring items recorded on 2022. As a result of the above, the cumulative cost of risk at the end of December 2023 increased to 0.37%, which is 6 basis points above the cumulative figure at the end of the third quarter.

In the fourth quarter of 2023, Spain generated a net attributable profit of €645m, which represents a decline of 26.7% compared to the previous quarter, mainly due to the contribution to the FGD during the last three months of 2023. On the other hand, the net income evolution continued to be favorable in the quarter once again (+3.8%), and the income from commissions increased supported by asset management commissions. All this was offset by the increase in operating expenses as a result of the increase of variable remuneration to employees, in line with the performance of the area in 2023, as well as loan-loss provisions, including higher requirements derived from the annual review exercise of models parameters for the losses estimation, as well as higher provisions.