5.3.1. Scope of application

For the purposes of calculating capital as approved by the Bank of Spain, the scope of application of the internal market risk model extends to BBVA S.A. and BBVA Bancomer Trading Floors.

Below are the items on the consolidated balance sheet (for accounting purposes) of the above entities subject to market risk, indicating the part whose measurement falls within the internal VaR models:

TABLE 47: Trading Book. Items on the balance sheet subject to market risk under internal model

(Million of euros)

|

|

Main market risk metrics | |

|---|---|---|

| 2014 Items on the Group’s consolidated balance sheet subject to market risk |

VaR | Other* |

| Assets subject to market risk |

|

|

| Trading book | 74,744 | 825 |

| Available-for-sale financial assets | 99 | 62,007 |

| Of which: Equity instruments | - | 6,373 |

| Hedging derivatives | 404 | 1,890 |

| Liabilities subject to market risk |

|

|

| Trading book | 50,457 | 2,675 |

| Hedging derivatives | 1,085 | 979 |

The trading book subject to the internal model (BBVA S.A. and Bancomer) represents a gross amount of 116,000 million, accounting for 83% of the Group's total trading book.

5.3.2. Features of the models used

The measurement procedures are established in terms of the possible impact of negative market conditions, both under ordinary circumstances and in situations of tension, on the trading book of the Group's Global Markets units.

The standard metric for measuring market risk is Value at Risk (VaR), which indicates the maximum losses that may be incurred in the portfolios at a given confidence level (99%) and time horizon (one day).

This statistic is widely used in the market and has the advantage of summarizing in a single metric the risks inherent in trading activity, taking into account the relations between all of them, and providing the forecast of the losses that the trading book might incur as a result of price variations in equity markets, interest rates, exchange rates and commodities. In addition, for certain positions, other risks also need to be considered, such as credit spread risk, basis risk, volatility and correlation risk.

With respect to the risk measurement models used in BBVA Group, the Bank of Spain has authorized the use of the internal model for the calculation of capital for the risk positions in the trading book of BBVA, S.A. and BBVA Bancomer which, together, contribute more than 80% of the market risk of the Group's trading book.

The model used estimates the VaR in accordance with the "historical simulation" methodology, which involves estimating the losses and gains that would have been incurred in the current portfolio if the changing market conditions that occurred over a given period of time were repeated. Based on this information, it infers the maximum foreseeable loss in the current portfolio with a given level of confidence. The model has the advantage of accurately reflecting the historical distribution of the market variables and of not requiring any specific distribution assumption. The historical period used in this model is two years.

VaR figures are estimated following two methodologies:

- VaR without smoothing, which awards equal weight to the daily information for the previous two years. This is currently the official methodology for measuring market risks vis-à-vis limits compliance.

- VaR with smoothing, which weighs more recent market information more heavily. This metric is supplementary to the one above.

VaR with smoothing adapts itself more swiftly to the changes in financial market conditions, whereas VaR without smoothing is, in general, a more stable metric that will tend to exceed VaR with smoothing when the markets show less volatile trends, but be lower when they present upturns in uncertainty.

Furthermore, and following the guidelines established by Spanish and European regulators, BBVA incorporates additional VaR metrics to fulfill the regulatory requirements issued by the Bank of Spain for the purpose of calculating capital for the trading book. Specifically, the new measures incorporated in the Group since December 2011 (which follow the guidelines set out by Basel 2.5) are as follows:

- VaR: In regulatory terms, the charge for VaR Stress is added to the charge for VaR and the sum of both (VaR and VaR Stress) is calculated. This quantifies the loss associated with movements in the risk factors inherent in market operations (interest rate, FX, RV, credit, etc.). Both VaR and VaR Stress are rescaled by a regulatory multiplier set at three and by the square root of ten to calculate the capital charge.

- Specific Risk: IRC. Quantification of non-performing risk and downgrade risk in the rating of some positions held in the portfolio, such as bonds and credit derivatives. The specific risk capital for IRC is a charge used exclusively for geographical areas with an approved internal model (BBVA S.A. and Bancomer). The capital charge is determined based on the associated losses (at 99.9% over a time horizon of 1 year under the assumption of constant risk) resulting from the rating migration and/or default status of the asset's issuer. Also included is the price risk in sovereign positions for the indicated items.

- Specific Risk: Securitizations and Correlation Portfolios. Capital charge for the securitizations and the correlation portfolio for potential losses associated with the rating level of a given credit structure (rating). Both are calculated using the standardized approach. The perimeter of the correlation portfolios is referred to FTD-type market operations and/or market CDO tranches, and only for positions with an active market and hedging capacity.

Validity tests are performed periodically on the risk measurement models used by the Group. They estimate the maximum loss that could have been incurred in the positions assessed with a given level of probability (backtesting), as well as measurements of the impact of extreme market events on the risk positions held (stress testing). Backtesting is performed at the trading desk level as an additional control measure in order to carry out a more specific monitoring of the validity of the measurement models.

The current market risk management structure includes the monitoring of limits. This monitoring consists of a system of limits based on VaR (Value at Risk) and economic capital (based on VaR measurements) and VaR sub-limits, as well as stop-loss limits for each of the Group’s business units. The global limits are proposed by the market risk unit and approved by the Executive Committee on an annual basis, once they have been submitted to the GRMC and the Risk Committee. This limits structure is developed by identifying specific risks by type, trading activity and trading desk. Moreover, the market risk unit maintains consistency between the limits. The control structure in place is supplemented by limits on loss and a system of alert signals to anticipate the effects of adverse situations in terms of risk and/or result.

5.3.2.1. Market risk in 2014

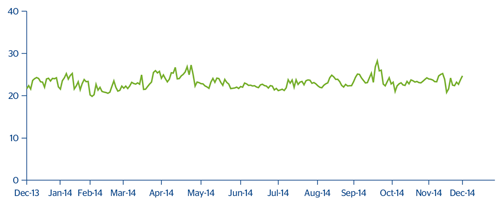

The average VaR for 2014 stood at €23 million, as in 2013, with a maximum level in the year reached on October 16, which amounted to €28 million and was due to the uncertainty about the recovery of the Greek economy.

The following tables show VaR without smoothing by risk factor for the Group:

CHART 19: Trading Book. Trends in VaR without smoothing

TABLE 48: Trading Book. VaR without smoothing by risk factors

(Millons of euros)

| VaR by risk factors | Interest-rate and spread risk | Exchange-rate risk | Equity risk | Vega/correlation risk | Diversification effect (*) | Total |

|---|---|---|---|---|---|---|

| 2014 |

|

|

|

|

|

|

| Average VaR for the period |

|

|

|

|

|

23 |

| Maximum VaR for the period | 31 | 6 | 4 | 10 | (22) | 28 |

| Minimum VaR for the period | 24 | 4 | 3 | 11 | (23) | 20 |

| VaR at end of period | 30 | 5 | 2 | 7 | (20) | 25 |

| 2013 |

|

|

|

|

|

|

| Average VaR for the period |

|

|

|

|

|

23 |

| Maximum VaR for the period | 39 | 4 | 2 | 13 | (24) | 34 |

| Minimum VaR for the period | 19 | 3 | 2 | 11 | (18) | 17 |

| VaR at end of period | 22 | 4 | 3 | 11 | (18) | 22 |

By type of market risk assumed by the Group's trading book, the main risk factor in the Group continues to be the one linked to interest rates, with a weight of 67% of the total at the end of 2014 (this figure includes the spread risk), with the relative weight increasing compared to the close of 2013 (55%). The exchange-rate risk accounts for 12%, increasing on the figure for the same date the previous year (10%), while the equity and volatility and correlation risks are down, with a weight of 5% and 16, respectively, at the close of 2014 (8% and 27% at the close of 2013).

In accordance with article 455 e) of the solvency regulations –corresponding to the breakdown of information on internal market risk models–, the elements comprising the capital requirements referred to in articles 364 and 365 of those regulations are presented below.

TABLE 49: Trading Book. Market risk. Regulatory capital

2014

(Millons of euros)

|

|

REGULATORY CAPITAL | ||

|---|---|---|---|

| Type of Risk | Item | GM Europe, NY and Asia | GM Bancomer |

| Market Risk BIS II | VaR / CeR | 102 | 83 |

| Market Risk BIS II.5 | VaR Stress | 140 | 209 |

| IRC | 95 | 82 | |

| of which securitizations | 23 | 7 | |

| of which correlation | 70 | 0 | |

| Total Market Risk |

|

337 | 375 |

2013

|

|

REGULATORY CAPITAL | ||

|---|---|---|---|

| Type of Risk | Item | GM Europe, NY and Asia | GM Bancomer |

| Market Risk BIS II | VaR / CeR | 84 | 79 |

| Market Risk BIS II.5 | VaR Stress | 106 | 154 |

| IRC | 97 | 95 | |

| of which securitizations | 5 | 2 | |

| of which correlation | 12 | 0 | |

| Total Market Risk |

|

287 | 328 |

The change is due mainly to the increase in exposure in internal models, specifically an increase in positioning in the bond portfolio and a slight increase in credit spreads.

5.3.2.2. Stress testing

All the tasks associated with stress, methodologies, scenarios of market variables or reports are undertaken in coordination with the Group’s Risk Areas.

Different stress test exercises are performed on the BBVA Group's trading portfolios. Both local and global historical scenarios are used, which replicate the behavior of a past extreme event, for example, the collapse of Lehman Brothers or the Tequila crisis. These stress exercises are supplemented with simulated scenarios which aim to generate scenarios that have a significant impact on the different portfolios, but without being restricted to a specific historical scenario.

Lastly, for certain portfolios or positions, fixed stress test exercises are also prepared that have a significant impact on the market variables that affect those positions.

Historical scenarios

The base historical stress scenario in BBVA Group is that of Lehman Brothers, whose sudden collapse in September 2008 had a significant impact on the behavior of financial markets at a global level. The most relevant effects of this historical scenario include:

1) Credit shock: reflected mainly in the increase in credit spreads and downgrades of credit ratings.

2) Increased volatility in most financial markets (giving rise to much variation in the prices of the different assets (currencies, equity, debt)).

3) Liquidity shock in the financial systems, reflected in major fluctuations in interbank curves, particularly in the shortest sections of the euro and dollar curves.

TABLE 50: Trading Book. Impact on earnings in Lehman scenario

(Millons of euros)

|

|

Impact on earnings in Lehman scenario | |

|---|---|---|

|

|

2014-12-31 | 2013-12-31 |

| GM Europe | -29 | -23 |

| GM Bancomer | -50 | -67 |

| GM Argentina | -2 | -5 |

| GM Chile | -5 | -6 |

| GM Colombia | -2 | -2 |

| GM Peru | -13 | -7 |

| GM Venezuela | -3 | -3 |

Simulated scenarios

Unlike the historical scenarios, which are fixed and, thus, do not adapt to the composition of portfolio risks at any given time, the scenario used to perform the economic stress exercises is based on the resampling method. This methodology is based on the use of dynamic scenarios that are recalculated on a regular basis according to what the main risks in the trading portfolios are. A simulation exercise is carried out in a data window wide enough to include different stress periods (data is taken from 1-1-2008 until today) by the re-sampling of historical observations. This generates a distribution of gains and losses that allows an analysis of the most extreme events in the selected historical window. The advantage of this methodology is that the stress period is not pre-established, but rather a function of the portfolio held at any given time; and the large number of simulations (10,000) means that the expected shortfall analysis can include richer information than that available in scenarios included in the VaR calculation.

The main features of this methodology are as follows:

a) The simulations generated follow the data correlation structure

b) It provides flexibility in terms of including new risk factors

c) It enables a great deal of variability to be introduced (which is desirable for considering extreme events)

The impact of the stress tests by simulated scenarios (Stress VaR 95% at 20 days, Expected Shortfall 95% at 20 days and Stress VaR 99% at 1 day - 30/06/2014) is shown below.

TABLE 51: Trading Book. Stress resampling

(Millons of euros)

|

|

EUROPA | BANCOMER | PERU | VENEZUELA | ARGENTINA | COLOMBIA | CHILE |

|---|---|---|---|---|---|---|---|

| Expected Shortfall | -56 | -35 | -30 | -9 | -2 | -3 | -9 |

|

|

Stress VaR 95 20 D |

Expected shortfall 95 20 D | Stress Period | Stress VaR 1D 99% Resampling |

|---|---|---|---|---|

| TOTAL | -73.1 | -96.1 | 02/01/2008 - 07/10/2010 | -35.0 |

| GM Europa, NY and Asia | -34.1 | -43.6 | 02/01/2008-02/12/2009 | -17.8 |

| GM Bancomer | -39.0 | -52.5 | 09/10/2008 - 07/10/2010 | -17.2 |

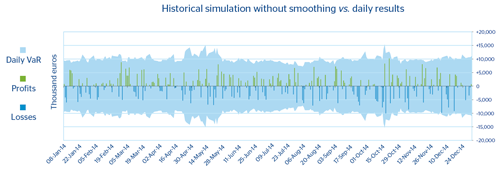

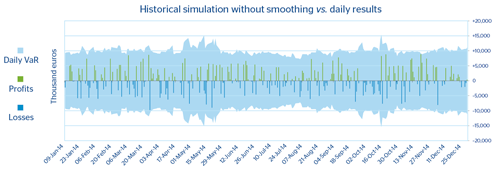

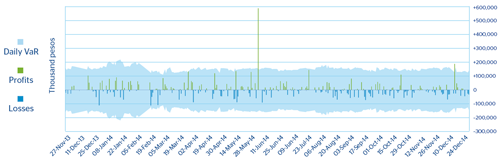

5.3.2.3. Back-testing

The Group’s market risk measurement model needs to have a backtesting or self-validation program that assures that the risk measurements being made are appropriate.

The internal market risk model is validated on a regular basis by backtesting in both BBVA S.A. and Bancomer.

The purpose of backtesting is to validate the quality and accuracy of the internal model used by BBVA Group to estimate the maximum daily loss for a portfolio, for a 99% confidence level and a time horizon of 250 days, by comparing the Group's results and the risk measures generated by the model.

These tests confirmed that the internal market risk model used by BBVA S.A. and Bancomer is adequate and accurate.

Two types of backtesting were performed in 2014:

1. "Hypothetical" backtesting: the daily VaR is compared with the results obtained without taking into account the intraday results or the changes in the portfolio's positions. This validates that the market risk metric is appropriate for the end-of-day position.

2. "Real" backtesting: the daily VaR is compared with the total results, including intraday operations, but deducting any possible allowances or commissions generated. This type of backtesting incorporates the intraday risk in the portfolios.

In addition, each of these two types of backtesting was performed at risk factor or business type level, thus providing a more in-depth comparison of results versus risk measures.

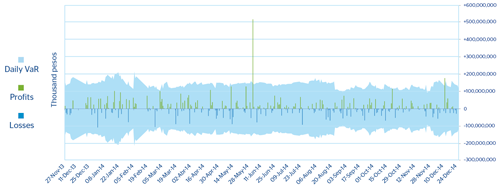

CHART 20: Trading Book. Validation of the Market Risk Measurement model for BBVA S.A. Hypothetical backtesting

CHART 21: Trading Book. Validation of the Market Risk Measurement model for BBVA S.A. Real backtesting

CHART 22: Trading Book. Validation of the Market Risk Measurement model for BBVA Bancomer. Hypothetical backtesting

CHART 23: Trading Book. Validation of the Market Risk Measurement model for BBVA Bancomer. Real backtesting

The atypical value shown in the chart corresponds to June 5, coinciding with Banxico's decision to reduce the reference interest rate by 50 basis points, with impacts seen in the domestic governmental and interbank curves, which fell on average by 37 and 38 basis points, both within 1 month.

5.3.3. Characteristics of the risk management system

The Group has a risk management system in place which is appropriate for the volume of risks managed, complying with the functions set out in the Corporate Policies on Market Risks in Market Activities.

The risk units must have:

- A suitable organization (means, resources and experience) in line with the nature and complexity of the business.

- Segregation of functions and independence in decision-making.

- Performance under integrity and good governance principles, driving the best practices in the industry and complying with the rules, both internal (policies, procedures) and external (regulation, supervision, guidelines).

- The existence of channels for communication with the relevant corporate bodies at local level according to their corporate governance system, as well as with the Corporate Area.

- All market risks existing in the business units that carry out their activity in markets must be adequately identified, measured and assessed, and procedures must be in place for their control and mitigation.

- The Global Market Risk Unit (GMRU), as the unit responsible for managing market risk at Group level, must promote the use of objective and uniform metrics for measuring the different types of risks.

The Group uses internal audit and validation procedures for the risk measurement model that are independent of the model development process.