Banco Bilbao Vizcaya Argentaria Group (the “Group” or “BBVA Group”) is an internationally diversified financial group with a significant presence in traditional retail banking, asset management and wholesale banking.

Diversification is essential for ensuring resilience in any environment. The Group's structure is very well balanced in terms of geographical areas, businesses and segments. This means it can maintain a high level of recurring revenue despite the environment and economic cycles.

The Group's strategy is based on managing solid franchises, with a sufficient critical customer mass and leading positions in their respective markets. The Group analyzes the market continuously to detect attractive and profitable investment opportunities, within its policy of active portfolio management aimed at generating maximum shareholder value. The execution of this strategy in the medium and long term has led BBVA to reach agreements in 2014 on a number of operations, which are explained in section 1.1.4 of this report.

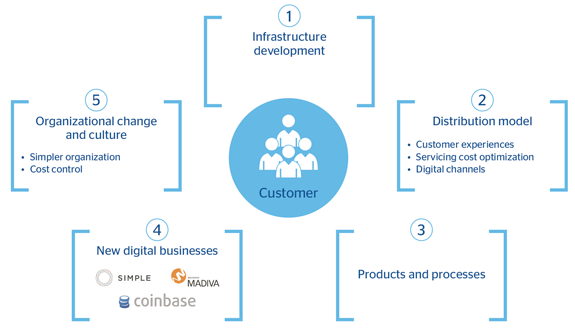

Finally, BBVA continues to make progress in its digital transformation process, closing 2014 with 9 million digital customers who interact with the Bank via the Internet on their cell phones.

The above is manifested in the milestones that the Group has achieved in 2014:

Milestones of the transformation in 2014

In addition to the operations it carries out directly, the Bank heads a group of subsidiaries, jointly-controlled businesses and associate institutions which perform a wide range of activities and which, together with the Bank, constitute BBVA Group. This allows BBVA Group to achieve a high level of geographical diversification, which is one of the levers of sustainable growth and organic generation of highly satisfactory earnings.

The year 2014 closed with positive growth in different performance areas, on both the cost management side and generation of income. As a result, the solvency position in the market was improved.

With respect to liquidity, the wholesale finance markets have continued buoyant, and BBVA and its franchises have accessed the markets frequently. In addition, the new targeted longer-term refinancing operations (TLTROs) announced by the European Central Bank (ECB), combined with the growing weight of retail deposits, have continued to strengthen the Group's liquidity position and improve its funding structure, thus maintaining very favorable liquidity ratios in terms of LTD (Loan to Deposits) and LCR (Liquidity Coverage Ratio).

In credit risk, there has been a reduction of the NPA ratio, as well as an increase in the coverage ratios, thus strengthening still further the entity's good credit risk position.

With respect to solvency, BBVA has increased its phased-in and fully-loaded capital ratios, thanks to organic generation of earnings and capital increases carried out over the year. This has maintained its capital levels far above the minimum required with a leverage ratio (fully loaded) that is very favorable compared with the rest of its peer group. This will all be described in greater detail throughout this report.