1. BBVA in brief

1.1 Who we are

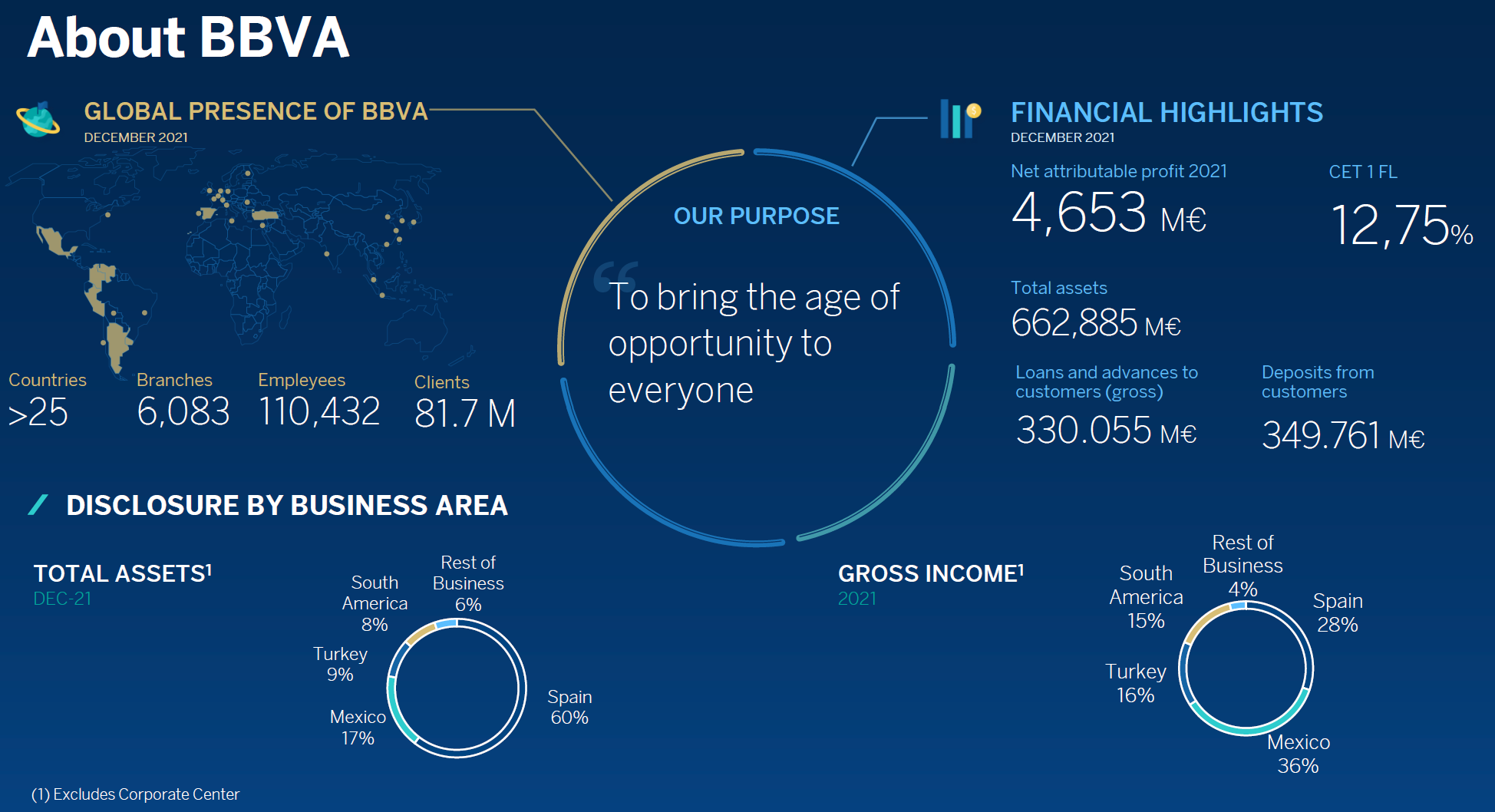

BBVA is a global financial group founded in 1857, with an extensive international presence and leading franchises in very attractive markets. It has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, and has leading franchises in Turkey and South America.

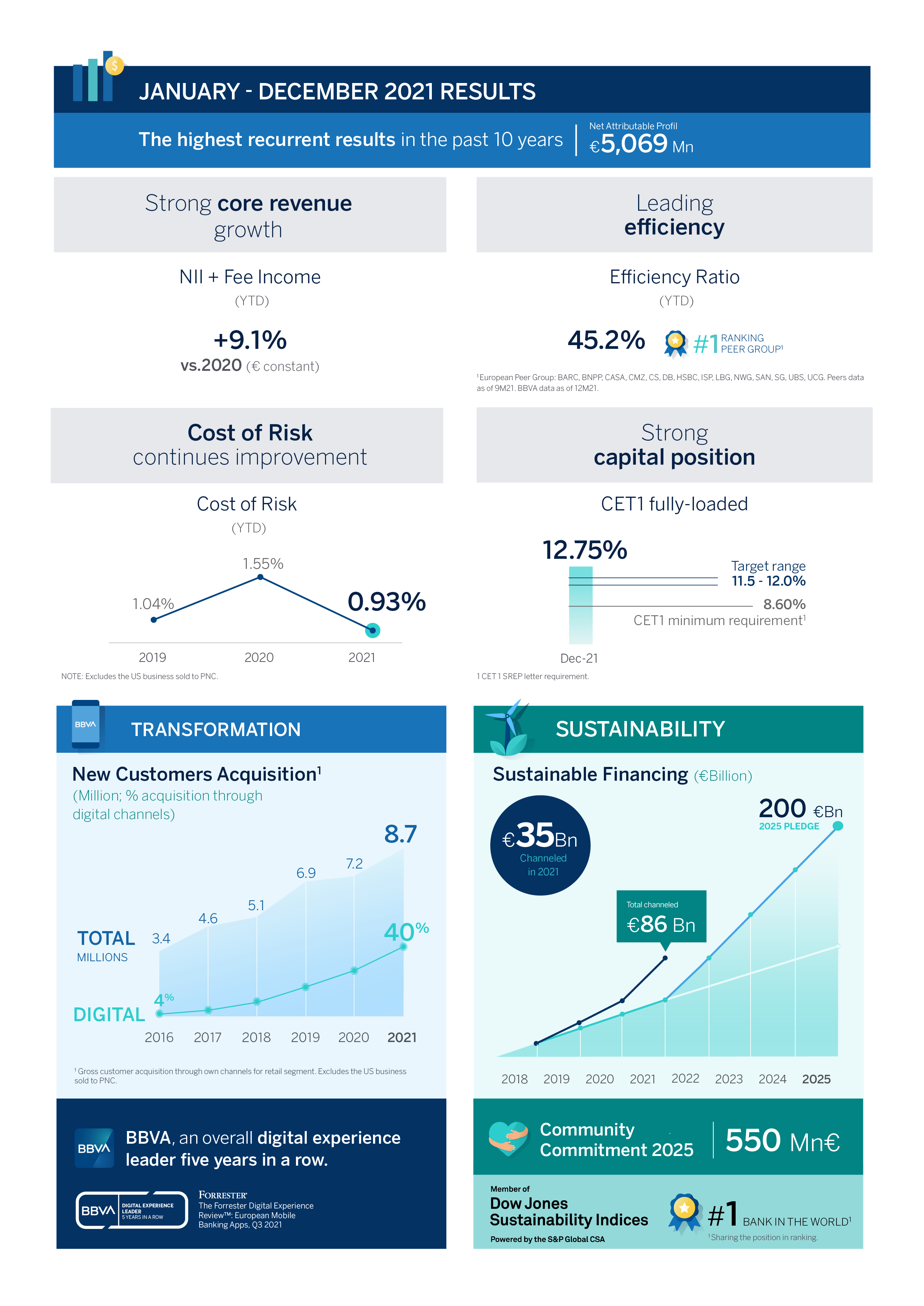

In its over 160 years of history, BBVA has stood out for its commitment to innovation and leadership in the transformation of its industry. The Bank has been a pioneer and a model at global level in the digitalization of the sector. It has been recognized a leader in digital mobile banking experience in Europe for the fifth year in a row and has developed leading apps in practically all the geographies where it operates, leading to an increase in digital sales, now accounting for over 70% of the total.

Likewise, BBVA is a pioneer in its commitment to sustainability. In 2021, BBVA has obtained the highest score among World banks1 in the Dow Jones Sustainability Index (DJSI), which measures the performance of the largest companies by market capitalization in economic, environmental and social matters. In 2018 it assumed the commitment to channel €100 billion to sustainable finance through 2025. This target has been doubled in 2021 to €200 billion. BBVA is also committed to be carbon neutral by 2050, for which it is managing its direct impacts and has set targets for a reduction in exposure of its loan portfolio in some of the most greenhouse- gas intensive sectors.

BBVA is guided by a clear purpose: "To bring the age of opportunity to everyone." BBVA wants to help people, families, entrepreneurs, the self-employed and businesspeople, employees and society in general to take advantage of the opportunities brought by innovation and technology. To do so, it has a committed team with a distinctive culture and way of thinking, and values that provide a boost to be better every day.

All this results in solid financial metrics, far above those of its peers in terms of efficiency and profitability. BBVA also stands out for its capacity to reassign capital efficiently, and its solid financial position to continue to invest in profitable growth of our business and increase shareholder remuneration.

1 Shared ranking position

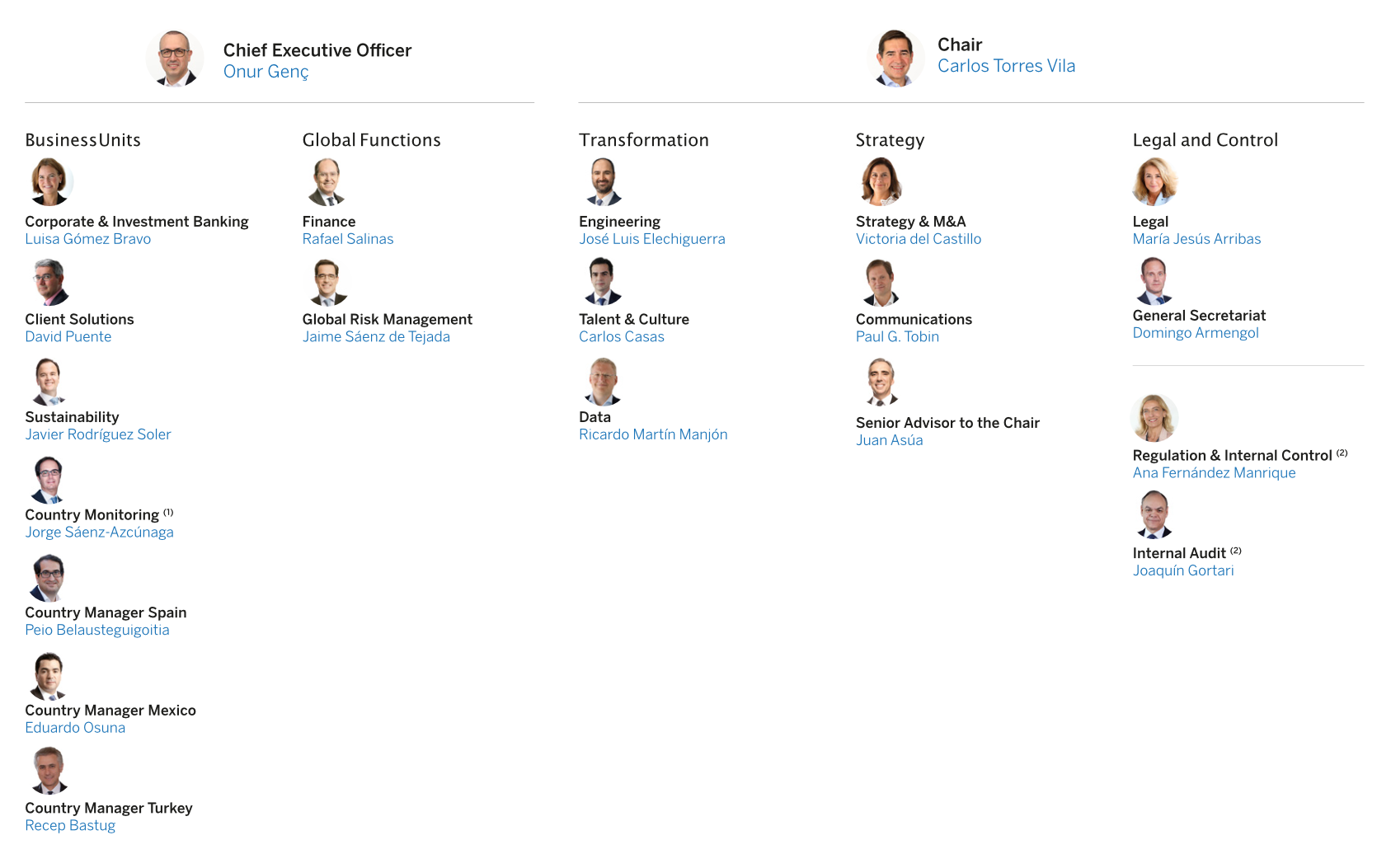

The Group’s Organizational Chart

(1) Reporting channel to CEO for Argentina, Colombia, Peru, Venezuela and Uruguay, as well as monitoring of all countries, including Spain, Mexico and Turkey.

(2) Reporting to the Board of Directors.

1.2 Highlights

BBVA offers its clients a differential value proposition, leveraged on technology and data, helping them improve their financial health with personalized advice on financial decision-making and also helping them in their transition towards a more sustainable future.

This value proposition has led the Bank to break a historical record in attracting customers, which has stood at 8.7 million new customers in 2021. In addition, the development of its digital capabilities has meant that 40% of these new customers have accessed the Bank through this type of channel.

In 2021, the Group has continued to evolve its value proposition with the aim of continuing to develop global solutions around financial health. These advances have led it to be recognized as a leader in digital experience in Europe for the fifth consecutive year, according to the report 'The Forrester Digital Experience Review TM: European Mobile Banking Apps, Q3 2021'.

Likewise, BBVA makes it a priority to help its customers in their transition towards a more sustainable future. To do this, it incorporates sustainability into its day-to-day activities, not only in its relationship with clients, but also in its internal processes. In 2021 BBVA has created the Global Sustainability area, thus raising this priority to the highest executive level of the organization.

It is also important to note that BBVA has channeled €35.4 billion in 2021, making a total of €85.8 billion allocated to sustainable activities since 2018.

Results and other financial aspects

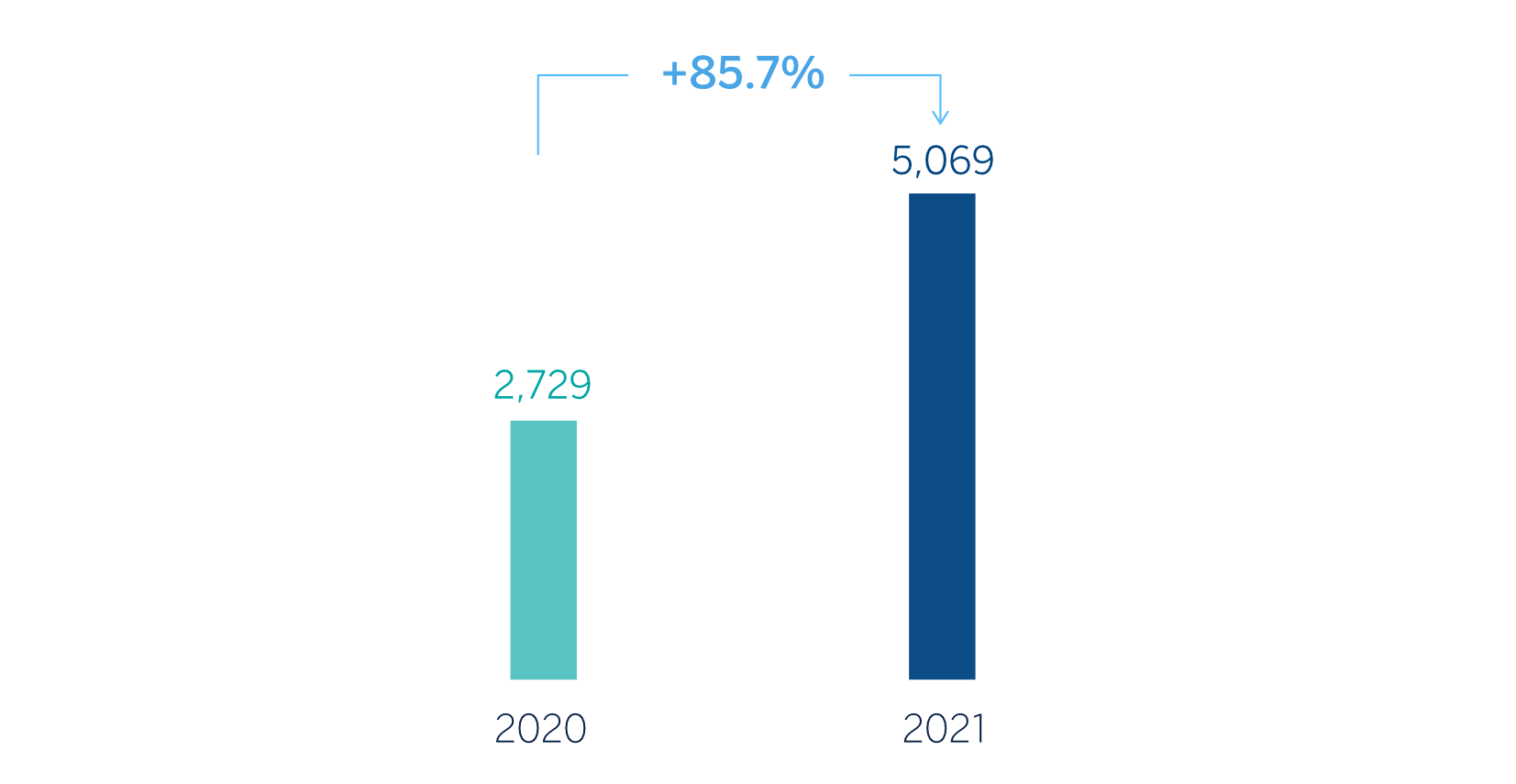

BBVA Group’s results in 2021, excluding non-recurring impacts, were €5,069m, representing a year-on-year increase of 85.7%. It should be noted that in 2021, there was a positive non-recurring impact of €280m, corresponding to the profit generated by BBVA USA and the rest of companies included in the sale agreement to PNC until the closing date of the operation on June 1, 2021, and a negative non-recurring impact of €-696m of the net costs related to the restructuring process. Taking these impacts into account, the Group's net attributable profit amounted to €4,653m, which compares very positively with the €1,305m in the same period of the previous year, which included the capital gains of €304m from the implementation of the bancassurance agreement reached with Allianz, in addition to the result generated by BBVA USA in 2020.

The Group's CET1 Fully-loaded ratio stood at 12.75% as of December 31, 2021, which is above the management target, located in the 11.5-12% range of CET1, amply covering the Group's capital requirements, even after the share buyback mentioned below.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: excludes (I) BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021; (II) the net cost related to the restructuring process in 2021; and (III) the net capital gain from the bankassurance operation with Allianz in 2020.

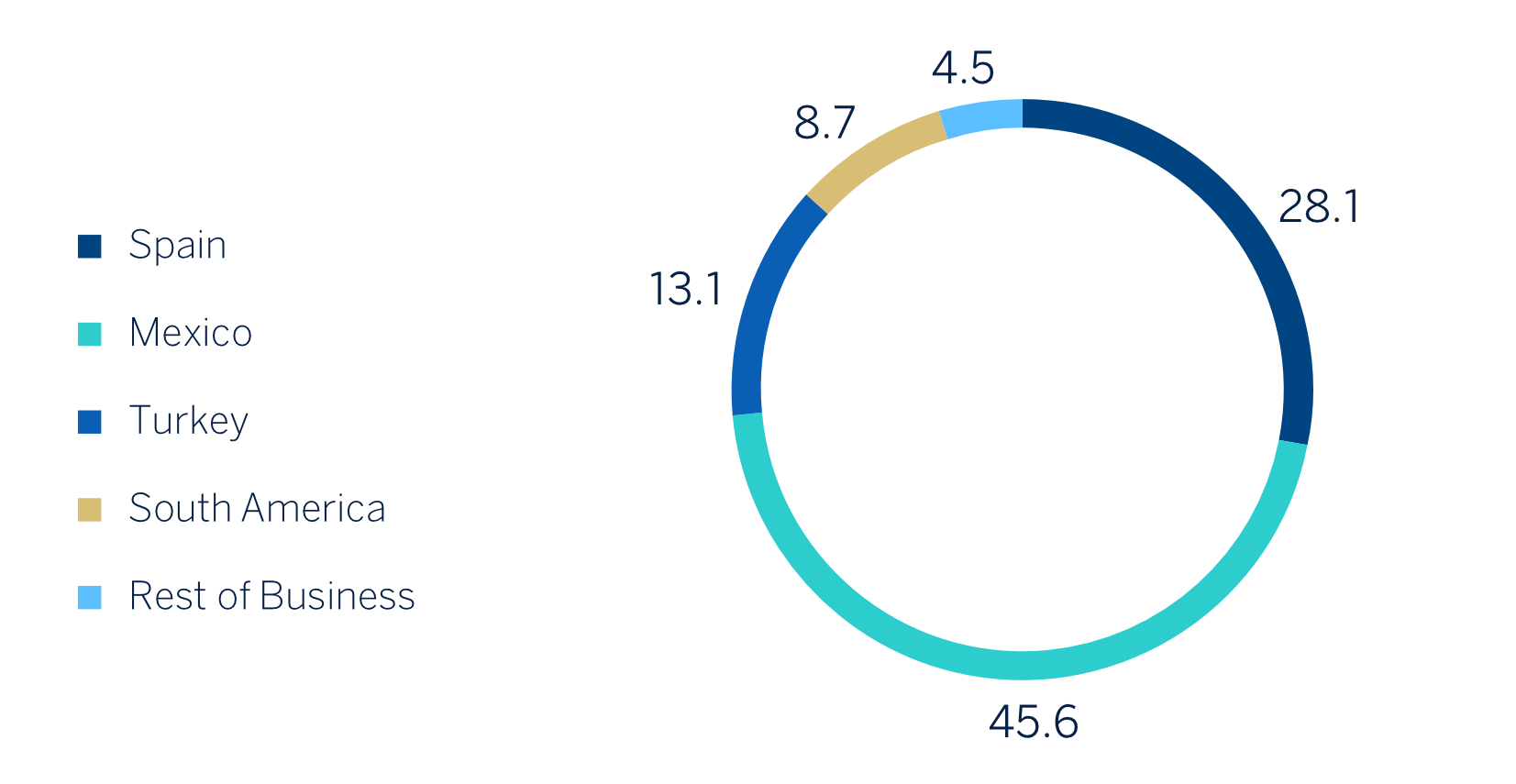

NET ATTRIBUTABLE PROFIT BREAKDOWN (1) (PERCENTAGE. 2021)

(1) Excludes the Corporate Center.

In 2021, the Group modified the shareholder distribution policy of distributing between 35% and 40% of the consolidated ordinary profit of each year2. This policy will be implemented through the distribution of an interim dividend for the year and a final dividend, with the possibility of combining cash distributions with share buybacks. In this regard, the share buyback program was launched in 2021 and is described in the section “The BBVA share” in the chapter “Financial Information – Group” of this report.

In 2021, it is worth highlighting the removal of the United States as a business area, derived from the sale agreement reached with PNC and closed on June 1, 2021, once the pertinent mandatory authorizations were obtained. However, BBVA continues to have a presence in the United States, mainly through the wholesale business which the Group develops in the New York branch.

On the other hand, 2021 stands out for the announcement made on November 18, 2021, that BBVA Group submitted to the Capital Markets Board of Turkey the application for authorization of the voluntary takeover bid (hereinafter referred to as the Voluntary Takeover Bid) for the entire share capital of Garanti BBVA not already owned, once all relevant regulatory approvals have been obtained. Given the deadlines and the need to receive approval from all relevant regulatory bodies, BBVA estimates that the closing of the Voluntary Takeover Bid will take place in the first quarter of 2022.

1 Shared ranking position

2 Excluding amounts and items of an extraordinary nature included in the consolidated profit and loss account.