2. Non-financial Information Report

Pursuant to the Commercial Code and the Capital Companies Law, the consolidated Non-financial information report includes, but is not limited to: the information needed to understand the performance, results, and position of the Group, and the impact of its activity on environmental, social, respect for human rights, and the fight against corruption and bribery matters, as well as employee matters.

Reporting of the non-financial key performance indicators included (KPI) in this consolidated non-financial information report is performed using the GRI (Global Reporting Initiative) guide as an international reporting framework in its exhaustive option as well as Communication from the Commission of July 5, 2017 on Guidelines on non-financial reporting (methodology for reporting non-financial information, 2017/C 215/01). For easier location of these indicators, the tables related to compliance with the requirements of Law 11/2018 and the GRI, with reference to each of the sections of this Non-financial information report where the information is disclosed, are included in the chapter "5.2 Compliance tables" of section "5. Other information".

The information included in the consolidated non-financial information report is verified by KPMG Auditores, S.L., in its capacity as independent provider of verification services.

Additionally, it should be noted that this consolidated "Non-financial information report" includes indicators that are in line with those required by other international standards, as detailed in the section "Alignment of BBVA Group's non-financial information to WEF-IBC and SASB standards” of the chapter “2.4 Additional information”.

2.1 Strategy

2.1.1 Strategic priorities

At the end of 2019, BBVA approved its current strategic plan, which anticipated many of the main global trends that have been accelerated by the pandemic. These trends include the mass digitalization of all sectors and activities, boosted by the change in consumer habits. Beyond the use of digital and remote channels, there has been an unprecedented wave of disruptions encouraged by technology and data. It is an era of real opportunities supported by new technologies such as artificial intelligence, cloud processing, quantum computation, blockchain technology, etc., which are transforming the economy and will have a major impact on economic growth and productivity.

The decarbonization of the economy to limit the effects of climate change is the main and most important disruption of all. The challenge of achieving the net zero emissions target by 2050 requires a drastic modification of habits and behaviour, together with the deployment of non-carbon emission technologies in all sectors, not only energy. Unprecedented levels of innovation and investment are required to achieve this; according to some estimates3 , in the order of 5% of global GDP until approximately 2050.

The acceleration of these trends validates the strategy pursued by BBVA. It is a strategy based on a single purpose: "to bring the age of opportunity to everyone." Thanks to innovation and technology, the Bank provides access to products, advice and solutions that help customers make better decisions on their finances and achieve their life and business goals.

Guided by this purpose, BBVA's strategy is built around six strategic priorities:

1. Improving our clients’ financial health

BBVA aspires to be its clients’ trusted financial partner, helping them to improve their financial health by offering personalized advice based on technology and the use of data.

Money management is one of the greatest concerns for people. BBVA wants to help its customers improve their financial health in two ways:

- - First, by supporting them in the day-to-day management of their finances, helping them understand and be aware of their income and expenses, management of future needs, capacity to save, etc.

- - Second, by advising them how to achieve their life and business goals in the medium and long term.

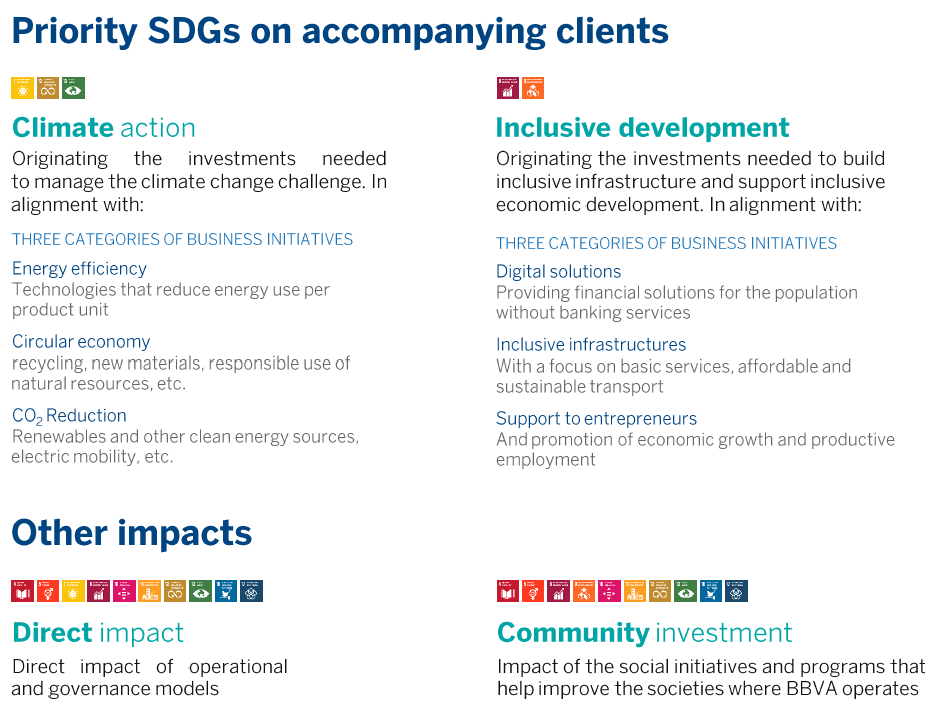

2. Helping our clients transition toward a sustainable future

BBVA wants to help its clients transition toward a more sustainable future with finance, advice and innovative solutions, with the focus primarily on two areas:

- - Climate action: mobilizing the appropriate resources to manage the challenge of climate change.

- - Inclusive growth: mobilizing the investments needed to build inclusive infrastructures and support inclusive economic development in an equitable way that leaves no one behind.

BBVA considers that the commitment to sustainability is not only a challenge that requires an urgent response, but also an important opportunity for business. The energy transition, in particular, will require major investments over the coming decades to replace fossil fuels with other cleaner and more efficient sources of energy. This will have an impact on practically all industries, and also on how people move, consume or arrange their homes.

3. Reaching more clients

Scale is increasingly critical in the banking business. BBVA aims to accelerate profitable growth, supporting itself through its own channels and where the customers are (in third-party channels), with a special focus on digital and more profitable segments.

In this respect, the focus of profitable growth for BBVA over the coming years will be activities such as payments, insurance, asset management, value segments such as SMEs and private banking, as well as the activities of Corporate and Investment Banking (CIB).

4. Driving operational excellence

BBVA is committed to providing the best experience possible and is transforming its model of customer relations to adapt to changes in client behavior. To do so, it provides access to its products and services through simple processes. The role of the commercial network is increasingly more focused on transactions of greater added value for customers. Interactions of lower added value are redirected to self-service channels, thus reducing unit costs and increasing productivity.

The transformation of the relational model is accompanied by a change in the operational model, focused on process reengineering in the search for greater automation and improved productivity, as well as speedy delivery to the market of new products and functionalities.

This is without forgetting disciplined management of both financial and non-financial risks and optimized use of capital.

5. The best and most engaged team

The team continues to be a strategic priority for the Group. A diverse and empowered team, with an outstanding culture, guided by the BBVA purpose and values and driven by a model of talent development which provides growth opportunities for all.

6. Data and technology

Data and technology are obvious accelerators to achieve our strategy. The commitment to developing advanced data analysis capacities, together with secure and reliable technology, allows the creation of outstanding high-quality solutions

The use of data and new technologies also generates the opportunity for increasingly global processes which can be used in the different geographies and are easily scalable, thus reducing the unit cost of the processing.

BBVA continues to make progress in the development of an increasingly robust model of security and privacy (cybersecurity, business processes, fraud and data security).

To monitor progress in the execution of the strategic priorities, a set of strategic metrics or key performance indicators (KPIs) have been defined.

These indicators are linked to financial ones , such aso the net attributable profit, the tangible book value per share (TBV) or the efficiency ratio, as well as to non-financial ones, such as those referring to customer satisfaction (NPS), the channeling of sustainable finance or the digital sales.

These strategic KPIs are integrated into the different management processes of the Group, such as the planning and budget process, in the prioritization of resources and investments, as well as for the purposes of the variable remuneration system.

3 OECD/The World Bank/UN Environment (2018), Financing Climate Futures: Rethinking Infrastructure, OECD Publishing, Paris

2.1.2 Our objectives

The goal of executing this strategy is:

- - To be a larger and more profitable bank.

- - To be a different bank that stands out for its outstanding value proposition.

- - To continue to be the leader in efficiency.

In line with the strategic priorities and to monitor closely the level of progress in their execution, BBVA has defined ambitious financial and business targets over the coming years in terms of efficiency, profitability, creation of shareholder value, customer growth and the channeling of sustainable finance. These objectives were communicated on the Investor Day held on November 18, 2021.

2.1.3 Main advances in the execution of the strategy

A larger scale and more profitable bank

BBVA looks to grow by being where the customers are. That is why the Group pays particular attention to attracting customers, whether through its own or third-party channels. The Group attracted 8.7 million new customers in 2021. As a result of the improvement in digital capacities, customer attraction through digital channels has increased steadily over recent years, and in 2021 reached an all-time high at over 3.5 million, accounting for 40% of all new customers.

Digital customers at the close of 2021 accounted for 69.4% of the total, at 41.8 million (up 37% from December 2019). Mobile customers have grown by 42% since December 2019 over the year to 39.7 million and account for 66% of the total. Digital sales now amount to 73% of the total units sold 4.

A key aspect to increasing scale and competitiveness is investment and innovation in new technologies and disruptive business models. The Group invests in the development of universal digital banking solutions to respond to the changing needs of customers, with a focus on new and attractive markets. For example, in 2021 the Group completed the launch of its 100% digital business in Italy. It is a milestone that BBVA has achieved with the support of the Bank’s infrastructure in Spain and its mobile app which is a leader in Europe.

To search for profitable growth, BBVA focuses on the acquisition of customers in the high-value and relevant vertical product segments, to boost the Group's results:

- - Small and medium sized enterprises (SMEs)

In 2021, the income generated in the SME segment has provided 13% of gross income, making it a key segment for the Group. In 2021 the Group has worked to implement measures to improve remote capacity and boost this segment further. Specifically, it has extended its catalog, with a 100% digital product offering in all key products, and has made progress in the development of risk models, allowing it to make more proactive offerings to customers. At the close of 2021 around one out of every three BBVA customers received a proactive offer.

- - International corporate banking

BBVA Pivot was launched in 2021, renewing the offer of services for multinationals with a digital solution that facilitates the management of the daily activity of companies. This unique solution operates in 15 countries via a centralized system, allowing the activation of cash management services in all necessary markets and via the channel of choice for payments, collections, supply chain finance, unique account position, syndicated loans, settlement of expenses and cards, etc. The service operates for companies active in South America (Argentina, Peru, Colombia, Uruguay, Venezuela and Chile), Spain, Turkey, Belgium, France, Portugal and the United Kingdom, and also in Mexico, the United States and Hong Kong.

- - Payments

BBVA wants to be a key partner for retailers, allowing them to sell more and more securely. This implies having payment solutions in the real world, but also with accessible and innovative e-commerce solutions. To do so, BBVA offers not only traditional payment products, but also high-value solutions at the point of sale (buy now, pay later or BNPL), and finance linked to revenues from the point-of-sale (POS) terminal.

In Mexico, BBVA has Openpay, the biggest cash payment processing platform in the country with the broadest cover. In addition, Openpay is available in Colombia and Peru, and will be soon in Argentina.

In the segment of individuals, BBVA has also made innovative products available to its customers. One example is the Aqua card, a more secure and smarter card, with no embossed numbers and a dynamic card verification value (CVV) that offers the highest level of security in online purchases.

- - Insurance

BBVA has strengthened its capacities by reaching agreements with the main global insurance groups to enable its customers to receive modern products and services. In 2021 some alliances were strengthened in Spain and Peru and new agreements were reached in Argentina, Mexico and Colombia. The Group's aim is to have the best capacities in each geographical area for its customers.

- - Private banking

BBVA offers its Private Banking customers personalized, comprehensive and increasingly global specialized advice with an innovative value offering, in which ESG factors play a very important role. As a result, in 2021 BBVA was named best private bank in the world in responsible investment by Global Finance. Moreover, in 2021 the Private banking unit in Spain was recognized as the best private bank in the world in digital customer service by PWM/Financial Times Group.

In addition, BBVA continues with its firm commitment to the entrepreneurial ecosystem by:

- - Investments through risk capital vehicles such as Propel Venture Partners and Sinovation Ventures, which help position the Bank in new markets with potential for significant growth. Propel, with an independent management located in San Francisco, is a vehicle for investment and also a way of gaining knowledge of the fintech ecosystem. It has invested in over 40 companies, 6 of which have reached the status of unicorn and 2 of them (Coinbase and Docusign) have had successful stock market launches. Sinovation is a leading manager in China focused on developing the next generation of high-technology Chinese companies based on artificial intelligence.

- - BBVA thus offers support to companies with high growth potential in innovative sectors related to new technologies in all markets in which it operates, with specific products, advice and finance to cover their needs across the whole life cycle.

A different bank that stands out for its differential value proposition

BBVA offers its customers a unique value proposition, providing advice for making the best financial decisions and helping them in their transition towards a more sustainable future. This value proposition gives a premium experience which has a direct impact on customer satisfaction.

In fact, BBVA occupies the leading positions in the NPS5, as reflected in its retention figures, which show a positive trend in the levels of customer drop-outs (retail and SMEs), and a greater commitment from digital customers, whose drop-out rate is 7.4% lower than that of non-digital customers.

As of December 31, 2021, BBVA was once more leader in the retail NPS indicator in Spain and Mexico. In Turkey, it ranks second, maintaining its position with respect to 2020. In Argentina the plans implemented in 2020 and driven by Senior Management have reversed the situation of the previous year and recovered customer perception and trust. In Colombia, Peru and Uruguay, it has lost its leadership, but plans have been implemented to recover it.

In 2021, BBVA has placed a special focus on helping small and medium-sized companies recover from the impact of the pandemic, with a close and personalized service model that has positioned BBVA as the leader in the segment in Mexico, Turkey, Colombia, Peru and Uruguay, as well as Spain second, improving its position.

Meanwhile, in the commercial NPS indicator BBVA maintained its leading position in two countries: Mexico and Peru, maintaining second position in Argentina and Colombia. In Spain, BBVA has dropped from second to third position.

At the cutting edge of digitalization

Digitalization has been one of the pillars of the BBVA strategy for more than a decade, and during this time its value proposition has evolved. Initially, the Group focused on improving customer service through digital channels to make self-service systems available which allow transactions to be carried out and contracts arranged in a simple and agile way with a single click. Later on, the Group focused on the development of the necessary capacities to increase digital sales and attract new customers through remote channels. The Bank now also aims to advise its customers via data and artificial intelligence, to ensure they make the best financial decisions. In 2021 BBVA has worked to continue developing global financial health solutions.

The scope of financial health is tackled from two angles: day-to-day control; and the achievement of medium- and long-term objectives:

- First, supporting customers in their day-to-day financial concerns, helping them to have a greater understanding and awareness of their income and expenses, with solutions (such as classification and prediction of expenses, and even financial wealth) and proactive notifications in with respect to relevant events which, as far as possible, allow them to have greater control of their savings. A significant number of these solutions are already available in the BBVA geographical areas.

- And second, by advising them how to achieve their medium- and long-term goals. People's needs change over time: from the purchase of a home to saving for your children's university or planning retirement, there are long-term objectives that require support until they are achieved. Giving the advice needed to achieve these objectives is also within the scope of financial health.

Help in day-to-day control is relevant for all customers, regardless of their income and expenses. Generic rules geared to control income and expenses or review debt levels are relevant bases for managing the day-to-day of all customers, who are always given personalized recommendations. According to the financial status of the customers, the advice on the customers' financial health is also personalized.

As well as offering a personalized experience, BBVA wishes to be a trusted partner for its customers by supporting them with a proactive experience. Its goal is for customers to have peace of mind, so when an important event occurs which impacts their finances, the Bank informs them automatically.

In addition, through proactive experiences (over 50 available at the end of 2021), customers receive simple proposals which allow them to solve or mitigate these challenges if possible: for example, to make a transfer from another account if a credit card payment is expected to lead to an overdraft in the main account.

All this has made the Bank a leader in digital experience in Europe for the fifth consecutive year, according to the recent report “The Forrester Digital Experience Review TM: European Mobile Banking Apps, Q3 2021." This report identifies the leaders in mobile banking functionality and user experience, and shares the best practices from which professionals can learn. BBVA is the only Spanish bank which is a leader in the digital mobile banking experience.

Pioneers in sustainability

BBVA incorporates sustainability as part of its daily activities and everything it does, not only in relations with customers but also in internal processes. In other words, the definition and execution of the strategy, which includes sustainability and climate change as one of its priorities, cuts across the whole organization.

In 2021 BBVA created the Global Sustainability area to boost its strategy, raising sustainability to the highest executive level in the Organization. The area reports to the Chief Executive Officer and the Group Executive Chairman on matters referring to the Group's sustainability strategy.

Sustainability represents a business opportunity and is a key lever for BBVA's growth. BBVA's unique offer of sustainable products, together with its capacity for advice, give the Group a competitive advantage over other entities.

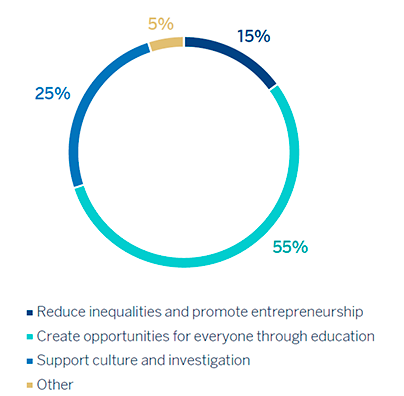

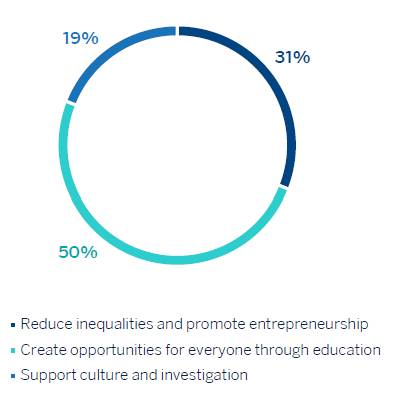

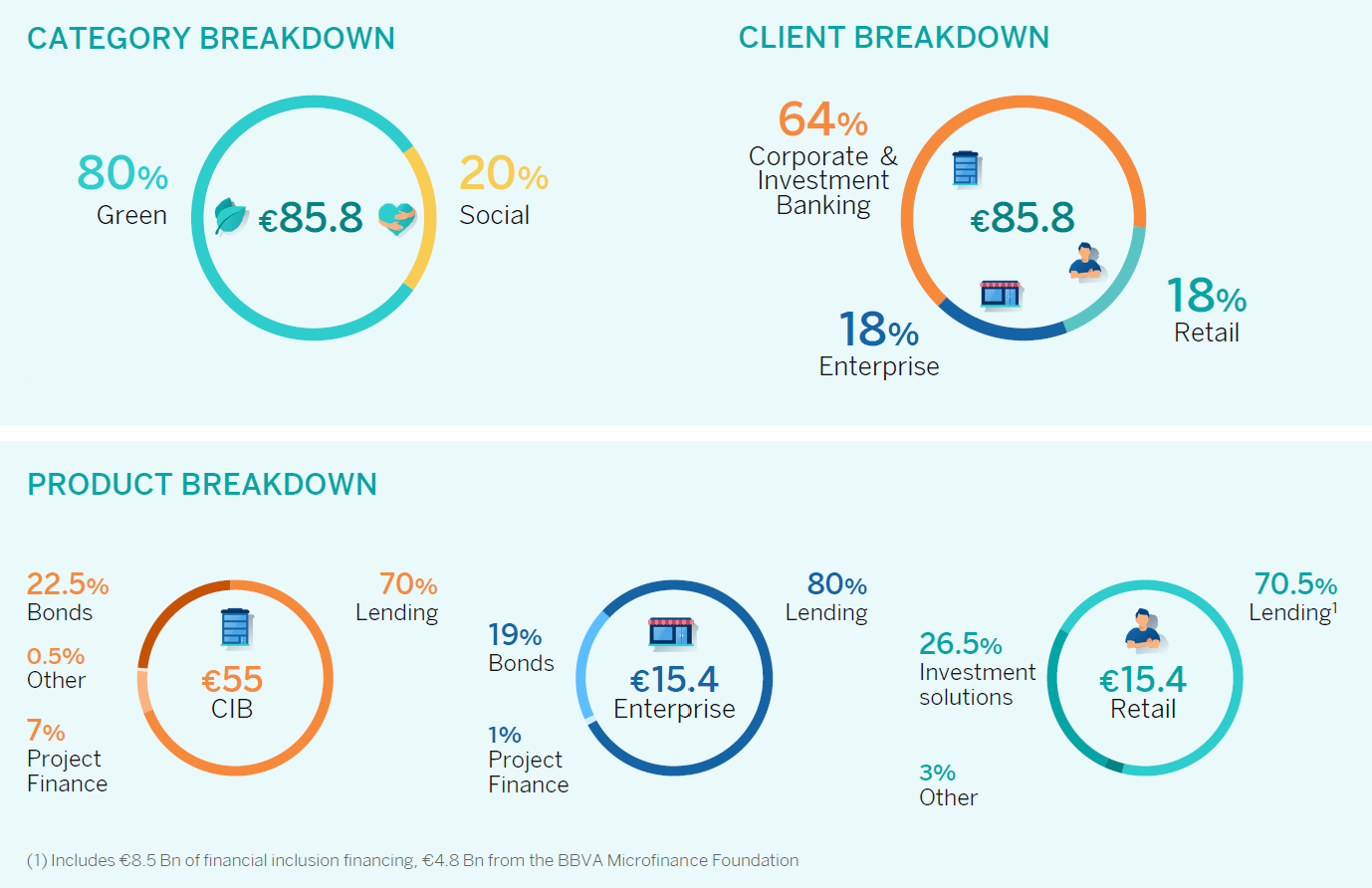

In 2021, out of the total new origination of business at Group level, 12% of new businesses have been linked to sustainability. Between 2018 and 2021, BBVA channeled a total of €85,817m into sustainable activities6. Of these, around 20% were an incremental business for the Bank.

This represents 43% of the target for channeling initially set in its Commitment 2025, which BBVA has doubled in 2021 to €200 billion through 2025.

FUNDS MOBILIZED THROUGH THE 2025 PLEDGE (MILLIONS OF EUROS) (1)

| Production 2021 | (%) | Production 2020 | (%) | |

|---|---|---|---|---|

| Climate action | 30,640 | 87 | 15,341 | 75 |

| Inclusive growth | 4,737 | 13 | 5,175 | 25 |

| Total | 35,377 | 100 | 20,516 | 100 |

| Total 2025 Pledge (accumulated to 2021) | 85,817 | 43 | 50,440 |

(1) To the production of each financial year, the fixing exchange rate has been applied.

ASSETS UNDER MANAGEMENT WITH SOCIALLY RESPONSIBLE INVESTMENT (SRI) CRITERIA (BBVA ASSET MANAGEMENT. MILLIONS OF EUROS)

| 2021 | 2020 | |

|---|---|---|

| Total assets under management | 119,307 | 109,355 |

| SRI strategy applied | ||

| Exclusion (1) | 119,307 | 109,355 |

| Vote (2) | 111,160 | 72,376 |

| Integration (3) | 80,981 | 9,053 |

(1) The exclusion strategy applies to 100% of the assets under management.

(2) The vote strategy applies to 100% of the assets under management in Europe for those instruments, in BBVA AM portfolios, that generate voting rights and their issuers are in the European geographical area.

(3) The integration strategy is applied in SRI pension plans and mutual funds of the Europe business.

Climate change

In 2021, BBVA has led the issuance of green, social, sustainable bonds and bonds linked to environmental indicators for clients in several countries, which have represented a total volume disintermediated by BBVA of €6,683m. In addition, BBVA has continued to be very active in the field of sustainable corporate loans and in the financing of sustainable projects.

In 2021, BBVA achieved its commitment in Spain of offering a sustainable alternative to all its products in the retail segment. Also in Spain, in 2021 BBVA became the first entity to use data analytics to calculate the carbon footprint of all its individual customers and companies, obtaining an approximate estimate of CO2 emissions into the atmosphere based on gas and light bills and payments for fuel.

Inclusive growth

In 2021, BBVA mobilized €4.737m as financial inclusive growth, of which €2.868m were allocated to financing social infrastructure and €1,869m were dedicated to financial inclusion and entrepreneurship.

Additionally, the Group has also strengthened its community engagement to support inclusive growth in countries where it operates, for which €550m will be allocated directly and through its support to foundations between 2021 and 2025. For more information about the commitment to the community, see the section "Community Commitment" in the chapter "Our stakeholders" in this report.

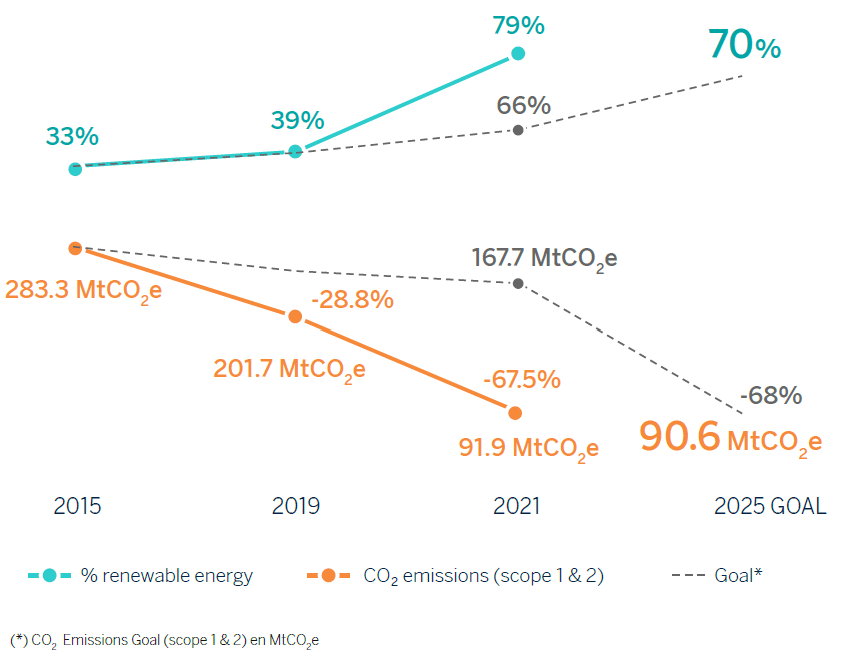

Alignment of activity to achieve net zero emissions in 2050

With respect to the alignment of its activity, BBVA has been neutral in net emissions from its direct activity since 2020 (on the management of direct impacts, see the section "Direct environmental impact management" of the chapter "Report on climate change and other environmental and social questions" in this report). The Bank has also pledged that its indirect activity, in other words through its loan and investment portfolio, will also be neutral in net greenhouse gas emissions by 2050. In April 2021, BBVA was one of the founding members of the Net-Zero Banking Alliance (NZBA).

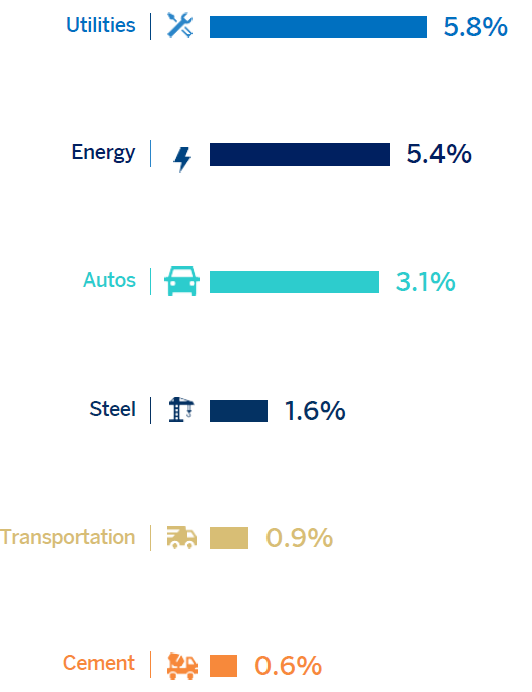

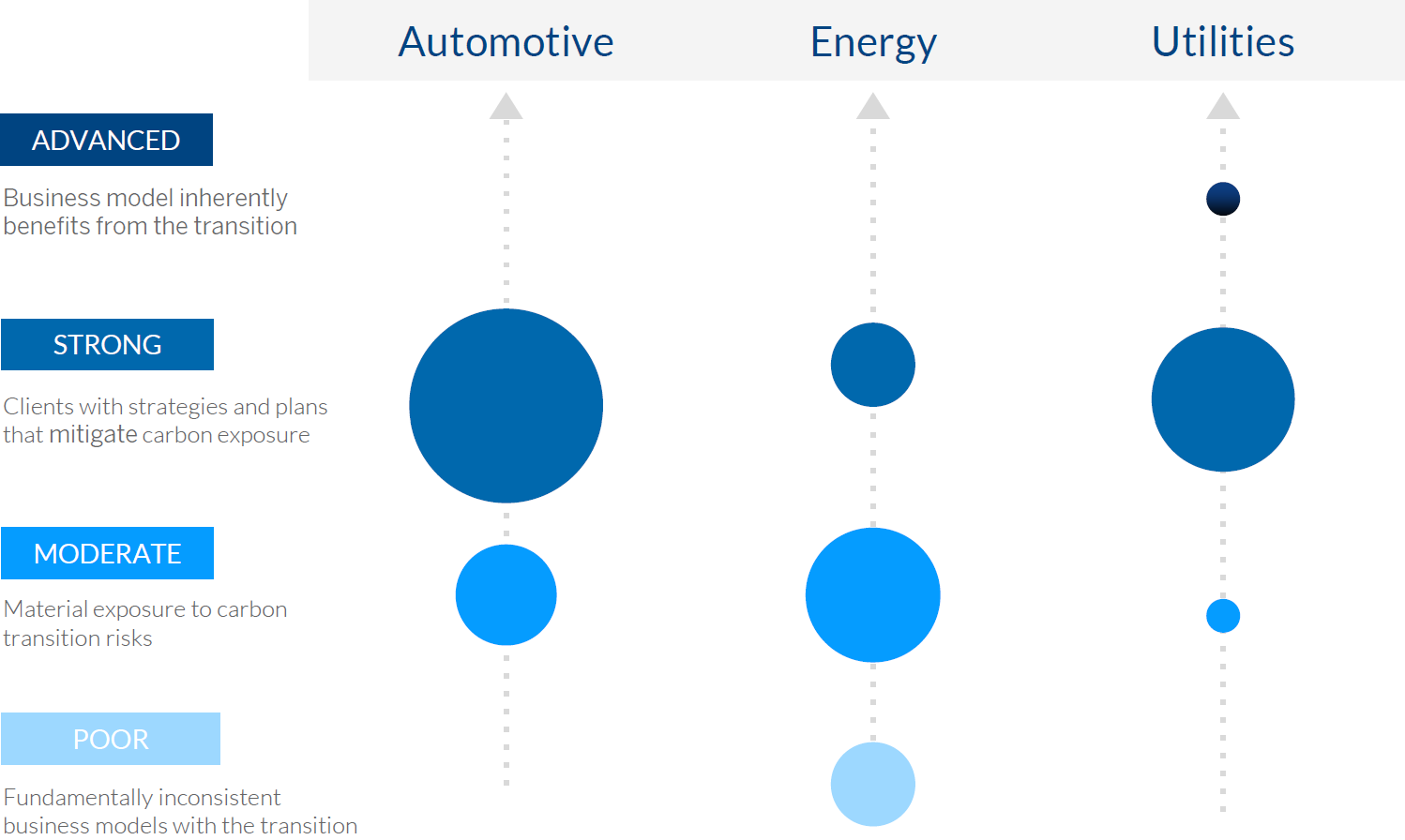

To this end, in 2021 BBVA has continued to make progress in decarbonizing its portfolio. It has announced its intention of reducing its exposure to coal-related activities to zero, and stopping the finance of companies in these activities by 2030 in developed countries and by 2040 in the rest of the countries where it operates.

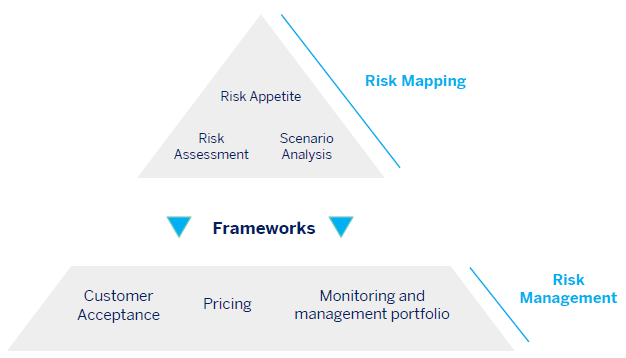

It has also set intermediate goals to decarbonize its portfolio in four emission-intensive industries, such as electricity generation, automotive, steel and cement: these sectors account for 60% of global emissions. To do so, the Bank will focus its efforts on supporting customers with finance, advice and innovative solutions in a joint effort of decarbonization. For more information, see the section "Identification, Measurement and Integration of climate change into risk management" in the "Report on climate change and other environmental issues" of this report.

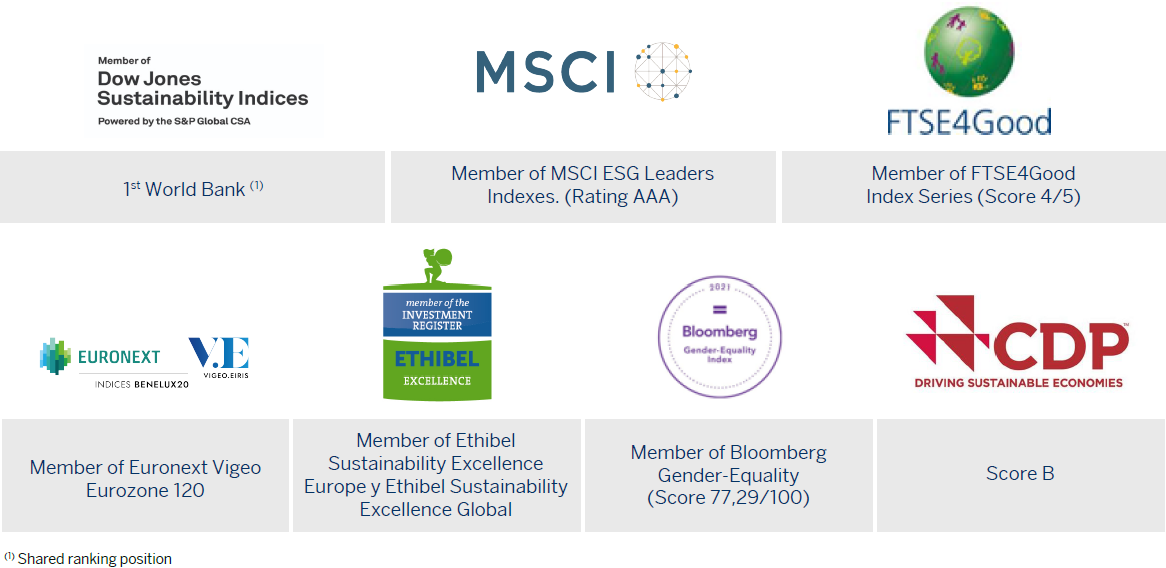

A global benchmark

In 2021, BBVA has obtained the highest score (89 points) among world banks7 in the DJSI, which measures the performance of the largest companies by market capitalization in economic, environmental and social matters. The Group has achieved the highest score (100 points) in the sections on financial inclusion, environmental and social information, development of human capital, materiality and tax strategy.

BBVA has also been included for the fourth consecutive year in the Bloomberg Gender Equality Index, which represents recognition of its commitment to create trusting work environments, where all employees' professional development and equal opportunities are guaranteed, regardless of their gender.

BBVA is a member of the main sustainability indices (see the section "Sustainability indices").

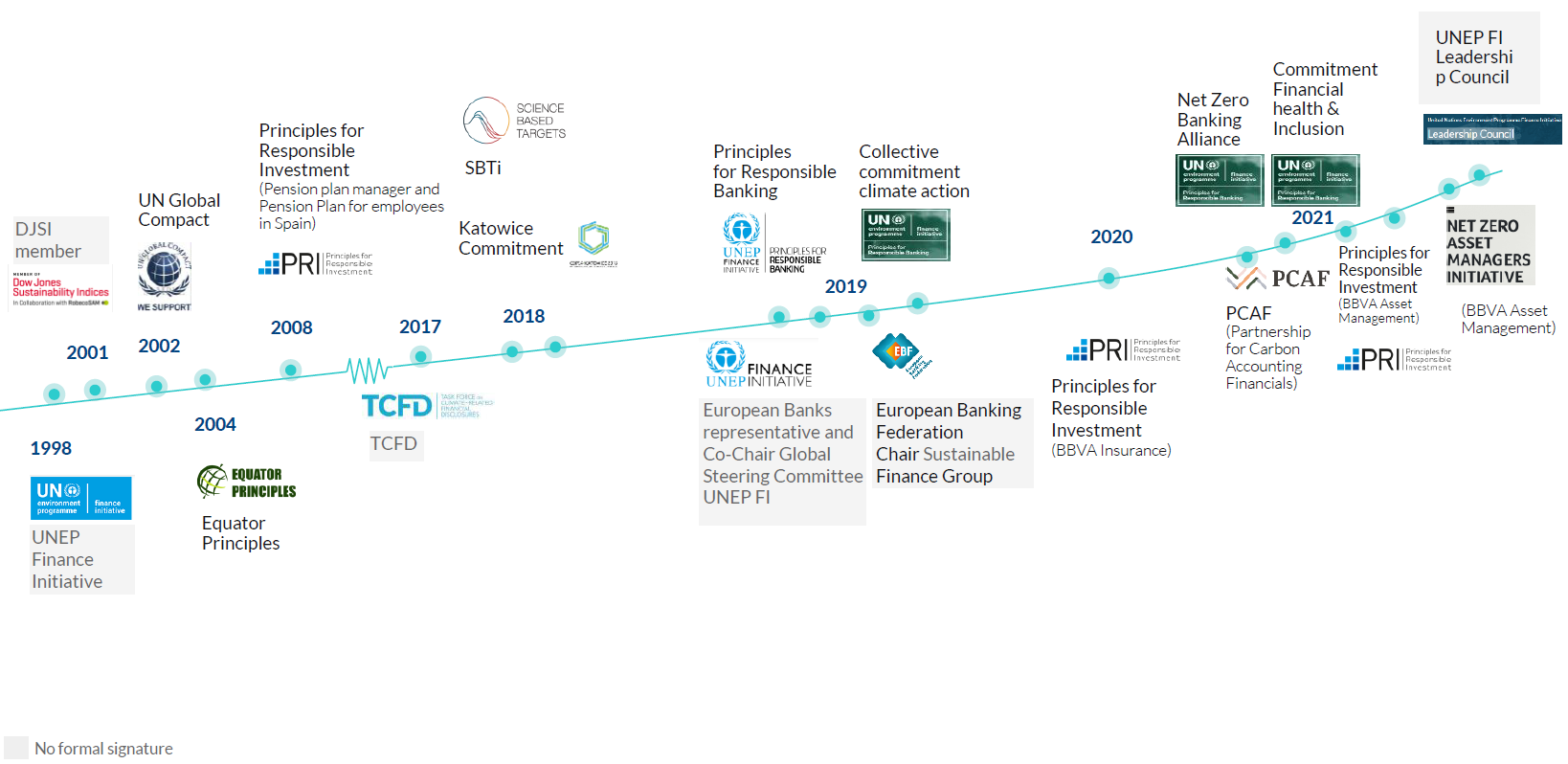

All this is recognition of BBVA's work over more than 20 years, with its active involvement in various supranational initiatives. BBVA seeks to continue leading the international agenda on inclusion and the fight against climate change by manifesting its commitment to a number of initiatives (see the section "Participation in international initiatives").

BBA is committed to transparency. That is why, together with this non-financial information, it publishes an annual TCFD (Task Force on Climate-Related Financial Disclosures) report following the recommendations of the Financial Stability Board (FSB), as well as additional disclosures on sustainability in line with two of the most advanced market standards: the expanded WEF-IBC metrics, and the Sustainability Accounting Standards Board (SASB) Mortgage Finance and Consumer Finance standards.

Continue to lead in efficiency

BBVA works to optimize its model of customer relations and acquisition, with the aim of reaching more customers at a reduced cost. The Group aims to make available to its clients a self-service model, and thus respond to changes in consumer habits, which are increasingly digital. This is demonstrated in the growth of 24% in digital transactions on the 2020 figure, while transactions in branches fell by 20%.

This new reality implies serving more customers and generating more growth, optimizing the cost structure, with a direct and positive impact on the productivity of networks and efficiency. In this way, in 2021 the ratio of customers to branches increased by 22% and sales per network employee increased by 25% on 2019. Moreover, the Agile methodology which has been steadily implemented in the Group over recent years enables the quick and efficient creation of improved products and services for our customers. By way of example, the functionalities made available to customers via the mobile app in Spain have tripled since 2016. Another example is that the number of days it takes a work team to design a functionality, from starting the design to implementation, has fallen by 50% in Mexico over the same period. This way of banking leads to more productive and more engaged teams.

Likewise, BBVA aims to lever globalization and develop more efficient products and solutions which provide answers to customer needs. To this end, the Group has focused in recent years on increasing the reuse of technological developments and digital solutions across countries. Two examples are the mobile app for retail customers in which it has reused 75% of the programming code; and the mobile app for companies, which has been developed in less than a year by reusing 80% of the components.

This focus on operational excellence has led us to consolidate our leading position in terms of efficiency for one more year. The efficiency ratio stood at 45.2% at the close of 2021 (53 basis points better than in 2020, in constant terms) while the average of our European competitors was 62% at the close of September 2021 (the latest data available).

Optimum capital allocation is another key component of operational excellence. Here, BBVA prioritizes capital allocation to the most profitable business opportunities. Moreover, the Bank has a model through which it allocates capital individually for each operation, and the allocation is linked to a system of dynamic pricing. Thus, for each loan granted by the Group, the transaction must exceed the minimum thresholds of previously determined capital return. This distinct way of banking, where the search for profitability is present in the transaction, has had an immediate effect on the Bank's figures. Specifically, the adjusted return on risk-weighted assets (RORWA) a the close of 2021 was 2.01%, 85 basis points above the level at the close of the previous year. For more information, see section “Alternative Performance Measures (APMs)” within the chapter “Other information” of this report.

4 Data excludes the United States, Paraguay, Chile and Venezuela.

5 The internationally recognized Net Promoter Score (NPS, Net Recommendation Index) methodology, measures customers’ willingness to recommend a company and therefore, the level of satisfaction of BBVA’s customers with its products, channels and services. The index is based on a survey that measures on a scale of zero to ten whether a bank’s customers are promoters (a score of nine or ten), passives (a score of seven or eight) or detractors (a score of zero to six) when asked if they would recommend their bank, a specific channel or a specific customer journey to a friend or family member. This information is vital for checking for alignment between customer needs and expectations and the initiatives that have been implemented, establishing plans that eliminate detected gaps and providing the best experiences

6 As a benchmark for meeting its objectives under its Pledge 2025, BBVA uses the activities included in the section "Additional information on the Group's sustainability standards and frameworks" the Green Bond Principles and the Social Bond Principles, the Sustainability-Linked Bond Principles of the International Capital Markets Association, as well as the Green Loan Principles, Social Loan Principles, Sustainability-Linked Loan Principles of the Loan Market Association and best market practices.

7 Shared ranking position.

2.2 Our stakeholders

BBVA seeks to have a positive impact on the lives of people, companies and the society as a whole through its activity. For this reason, the Group has a responsible banking model and is committed to creating long-term value for all stakeholders.

A banking model governed by the following general principles:

- - Generation of positive impact on society.

- - Respect for the dignity of people and the rights that are inherent to them.

- - Investment in the community.

- - Involvement as an agent of social change.

This way of doing banking responsibly is extended to all the entities that are part of the Group and its principles are integrated into the relationship that BBVA maintains with all its stakeholders (customers, employees, shareholders and investors, suppliers, regulators and supervisors and society), as well as in its relationship with the environment and social development, its fiscal responsibility, the prevention of conduct contrary to regulations, human rights and its participation in international initiatives.

This is reflected in the different policies of the Bank and especially in the Corporate Social Responsibility Policy (hereinafter, CSR). The CSR Policy was approved in 2008 and last updated by the Board of Directors in 2020 with the aim of adapting it to the Bank's strategy and is available for consultation on the Group's shareholders and investors website

2.2.1 Materiality analysis: the most relevant issues for stakeholders and BBVA

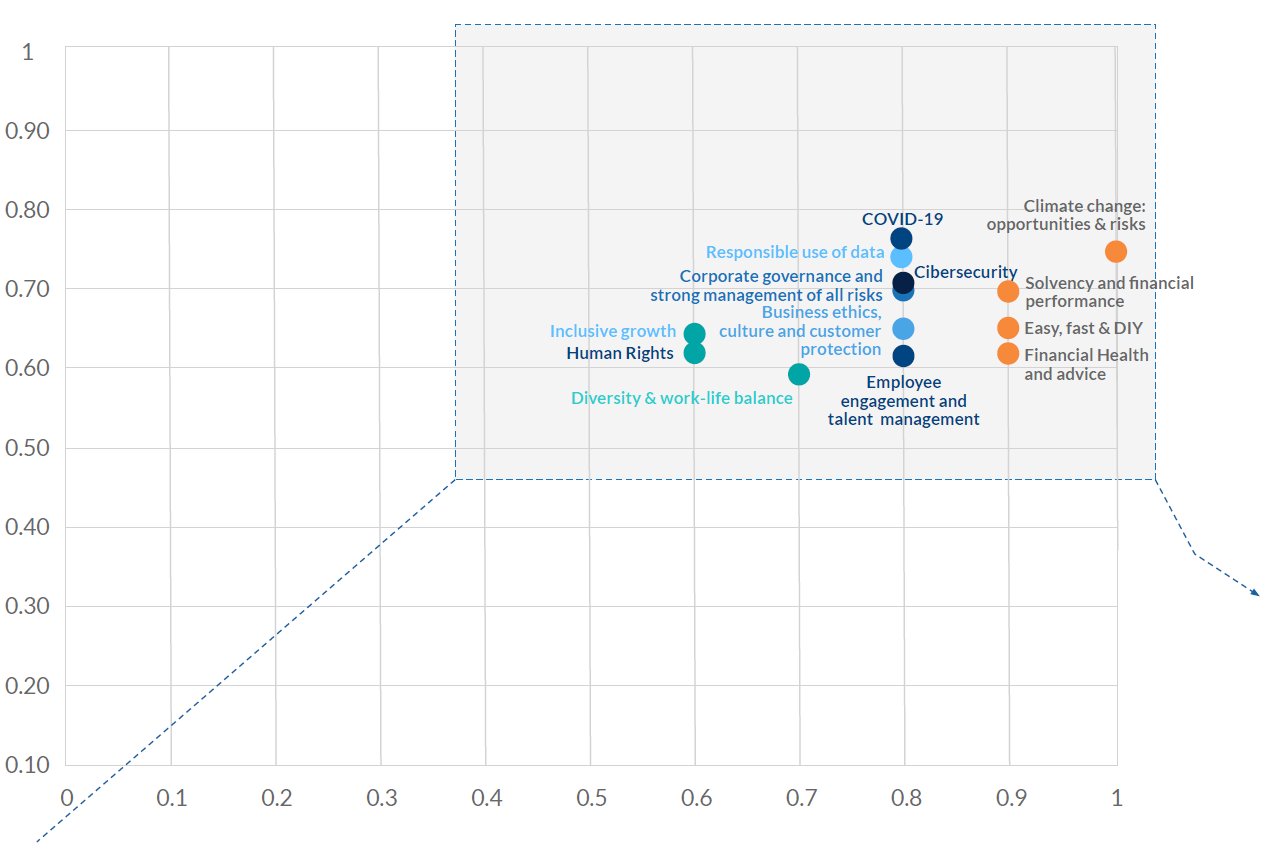

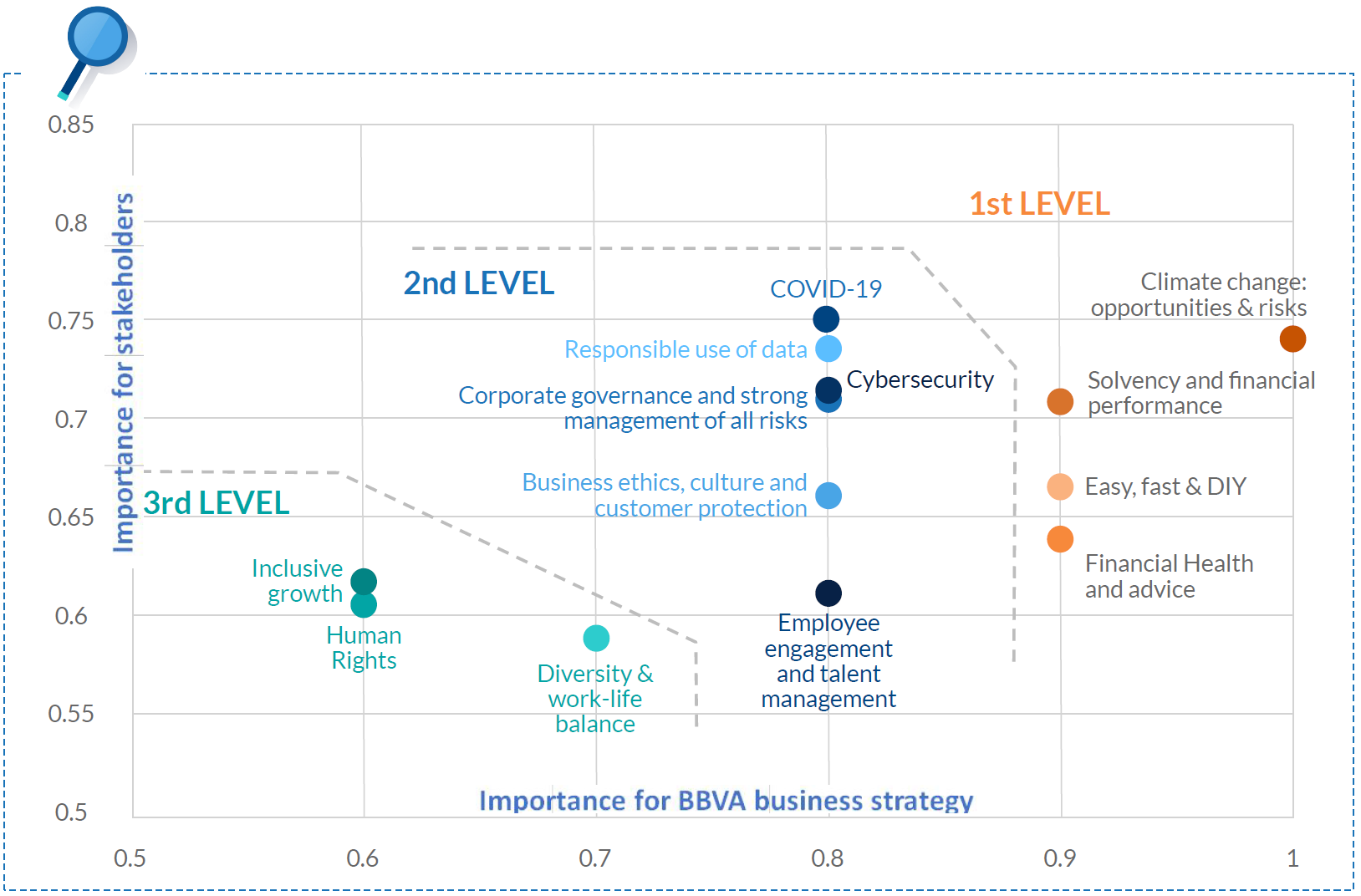

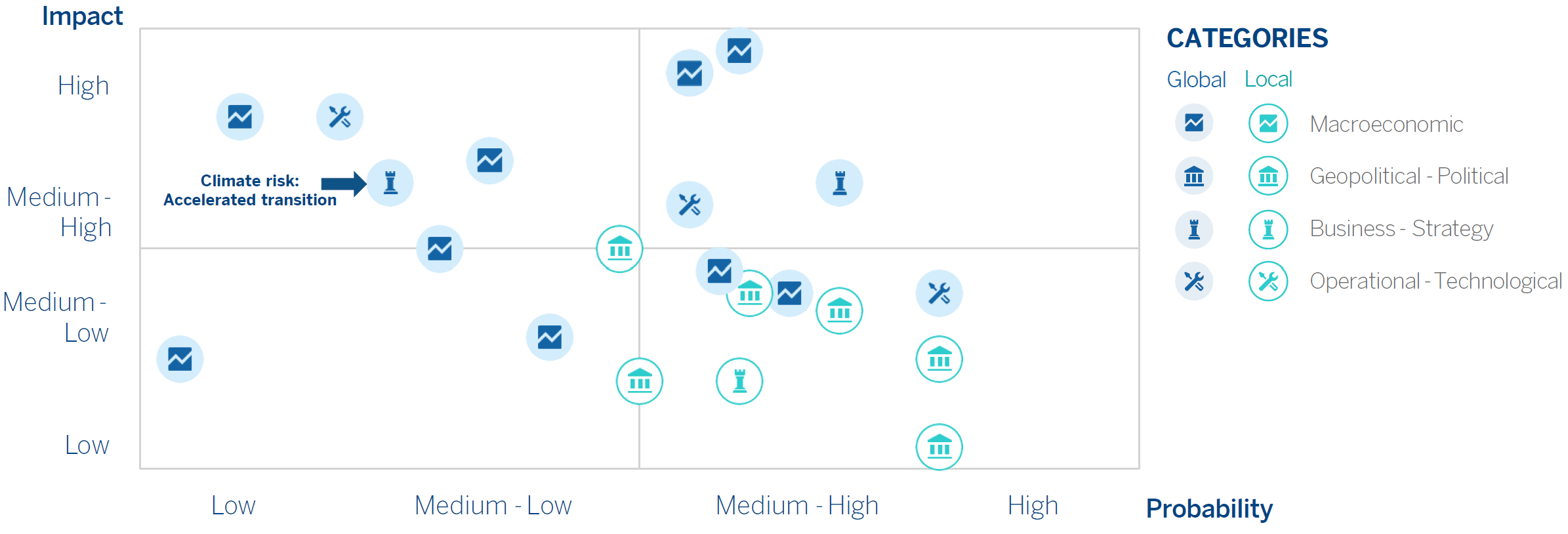

To generate value for its stakeholders, BBVA carries out a regular analysis called the "Materiality analysis" which helps prioritize the most relevant issues for both, stakeholders and BBVA. The materiality analysis was carried out in 2020, and its main conclusions were valid for 2021. It includes the point of view of the stakeholders in the main countries in which BBVA operates: Spain, Mexico, Turkey, Argentina, Colombia and Peru 8.

The results of the analysis are reflected in the following matrix:

The four material issues with greatest importance now and over a longer time horizon, for both stakeholders and BBVA's business strategy, are as follows:

- - Climate change: Climate change is among the main concerns for stakeholders, and they hope that BBVA will contribute to an ordered transition toward a low-emission economy. This requires an adequate management of risks and opportunities.

- - Solvency and financial results: Stakeholders expect BBVA to be a robust and solvent bank, thus contributing to the stability of the system. They also expect BBVA to generate good results over time. In other words, they demand a sustainable business model in the current ecosystem.

- - Easy, fast and do it yourself (DIY) service for customers: Stakeholders expect BBVA to continue to put technology and digitalization at the service of customers and the business, so they can operate in a simple and agile way at any time and in any place (mobile banking, fully digital contracts, etc.).

- - Financial health and personalized advice to customers: Stakeholders expect the Bank to get to know its customers and propose personalized solutions and recommendations to manage their finances better and achieve their vital objectives, all this proactively and with an increasing level of automation.

The information on how these relevant issues were handled by the Group in 2021 is explained in the different chapters of this management report.

For more information on the methodology and objectives as well as the level of progress in the material issues for BBVA and its stakeholders, see "Other information on Materiality" in the "Additional information" chapter of this report.

8 In 2021, the United States was still within the scope of consolidation, given that the subsidiary remained in BBVA during the first half of the year.

2.2.2 Customers

The Bank puts customers at the heart of its activity and aims to establish a responsible relation with them, helping them to make better financial decisions to achieve their life and professional objectives.

In this sense, there are some basic pillars linked to the Group's compliance system with which BBVA aspires to be the partner of trust for its customers, in both management and control of their finances, based on personalized advice and with the aim of improving the financial health of its customers.

Information security must also be a key pillar to guarantee the operational resilience of any organization. That is why the Group has established policies, procedures and controls for the security of global infrastructures, digital channels and payment methods, with a holistic approach based on intelligence in the face of challenges.

Customer experience

Consumers are increasingly demanding, and expect agile and personalized attention. BBVA is working to satisfy their needs and exceed their expectations with the aim of guaranteeing a new standard in customer experience.

Customer satisfaction

As commented above, BBVA occupies the leading positions in the Net Promoter Score (NPS), as reflected in its retention figures, which show a positive trend in the levels of customer drop-outs (retail and SMEs), and a greater commitment from digital customers, whose drop-out rate is 7.4% lower than that of non-digital customers.

The internationally recognized Net Promoter Score (NPS, Net Recommendation Index) methodology measures customers’ willingness to recommend a company and therefore, the level of satisfaction of BBVA’s customers with its products, channels and services. The index is based on a survey that measures on a scale of zero to ten whether a bank’s customers are promoters (a score of nine or ten), passives (a score of seven or eight) or detractors (a score of zero to six) when asked if they would recommend their bank, a specific channel or a specific customer journey to a friend or family member. This information is vital for checking for alignment between customer needs and expectations and the initiatives that have been implemented, establishing plans that eliminate detected gaps and providing the best experiences.

The Group’s consolidation and application of this methodology over the last ten years provides a common language both internally and with customers that facilitates everyone’s involvement and the integration of the voice of customers in everything the Bank does, from the beginning. This has led to a steady increase in customers’ level of trust, as they recognize BBVA to be one of the most secure and recommendable banking institutions in every country where it operates.

Transparency, Clarity and Accountability (TCR)

The relationship of the Bank with its customers must be based on transparency, clarity and responsibility. That is why BBVA integrates these three principles (TCR) systematically into the design and implementation of the main solutions, deliverables and experiences for its customers. The objective pursued is to help them make good life choices, and to maintain and increase their trust in the Bank.

Three work lines have been developed to turn these principles into reality:

- - Implementing the TCR principles in new digital solutions through the participation of TCR experts in the conceptualization and design of these solutions, especially in massive impact digital solutions for retail customers.

- - Incorporating the TCR principles into the creation and maintenance of key content for customers (product sheets, contracts, sales scripts. responses to customer letters, communication regarding COVID-19, etc.).

- - TCR awareness-raising and training throughout the Group, through a virtual community, on-site workshops and online activities. Since 2014, more than 30,000 training interactions have been carried out online, of which 1,820 were in 2021.

In 2021, the Group has placed particular emphasis on designing TCR solutions for people who have some type of visual, hearing, motor or cognitive disability, making progress in making all the digital solutions available in the different countries. With this aim, a process has been defined so that new global designs and developments are accessible, extending them globally as they are reused in the different geographical areas. BBVA has organized global accessibility sessions with more than 1,300 people attending.

BBVA has an indicator to measure its TCR performance: the Net TCR Score (NTCRS), which is calculated following the same methodology. Based on the same survey, the NTCRS measures the degree to which customers perceive BBVA as a transparent and clear bank in comparison with its peers, in the main countries where the Group operates.

According to December 2021 data, BBVA is a leader in NTCRS in Spain, Mexico, Peru and Uruguay, and in second place in Turkey, third in Colombia and fifth in Argentina. The Group is working on plans to improve customer perceptions9 in Colombia and Argentina.

Behavior with customers

BBVA has a Code of Conduct that establishes guidelines for conduct with customers in line with the values of the Group. It has also established policies and procedures for governance which establish the principles to be followed when assessing the characteristics and risks of products and services, as well as defining their conditions for their distribution and monitoring. Thus, based on customer insight, their interests should be taken into account at all times, and products and services should be offered in accordance with their financial needs. Moreover, any customer protection regulations applicable must always be complied.

BBVA has also implemented processes geared toward the prevention, or, when this has not been possible, the management of potential conflicts of interest that may arise in the marketing of its products.

In 2021, BBVA has continued to evolve and strengthen its internal regulation, as well as the frameworks of mitigation, control and monitoring within the scope of protection of the customers, also considering the priorities of regulators and supervisors. In this respect, the following main lines of action should be highlighted:

- - The update of standards in customer protection at Group level, covering also aspects related to the creation and distribution of sustainable products, within the framework of the protection of vulnerable customers and the processes of granting loans and credit responsibly.

- - The changing indicators in customer conduct, to identify early the possible indications of inadequate sales practices, applying for this purpose advanced data analysis techniques

- - Monitoring of the measures promoted by the regulators and governments on occasion of the crisis derived from the pandemic, as well as those proposed for exit from it, advising the business units on their implementation and carrying out the corresponding monitoring.

Moreover, the Bank has continued to work to incorporate the vision of customer protection into the development of new products and businesses, both retail and wholesale, from the moment of its design and creation.

Customer security and protection

For BBVA security of information is one of the key aspects of its digital transformation. Information security is organized into three fundamental pillars: cybersecurity, data security and security in the business and fraud processes. For each of them, a program has been designed with the aim of reducing the risks to which the Group is exposed. These programs, which take into account security industry best practices established in internationally accepted security standards, are periodically reviewed to evaluate the progress and the effective impact on these risks.

In 2021, the measures adopted have been strengthened to guarantee effective protection of the information and assets which support the Entity's business processes from a global perspective and an integrated approach, i.e. considering not only the technological area but also the areas of people, processes and security governance.

Among these measures are those designed to: (I) ensure end-to-end protection of business processes, considering logical and physical security, privacy and fraud management; (II) ensure compliance of the principles of security and privacy by design for new products and services; and (III) improve access and authentication control for customers associated with the provision of online services, both from the point of view of security and customer experience.

Below are some of the initiatives carried out during the year that are now implemented in the Group to improve customer security and protection:

- - Use of biometrics to sign transactions on the BBVA app, which improves the user experience and prevents SIM duplication and smishing attacks.

- - Strengthening security measures implemented in all the business processes with greatest risk of fraud.

- - Implementation of behavioral biometrics and malware protection for digital clients to reinforce analytical and fraud detection capabilities in mobile channels.

- - Use of advanced analytics models to protect the funds of BBVA customers.

- - Enhancement of the section with security advice to make customers aware of the main cybersecurity risks they are exposed to, so that they can prevent or act against possible threats.

In addition, robust customer authentication mechanisms have been employed in e-commerce and the security of cards has been improved to prevent possible fraudulent use of their data. One example is the Aqua card, which is the first card without a number or printed CVV, and with a dynamic CVV.

Additionally, BBVA has continued performing the training and awareness initiatives related to security and privacy, including training actions and awareness campaigns for BBVA’s employees, clients and society in general.

Other lines of action also include periodic performance of global and local simulation exercises in order to raise the level of training and awareness of key BBVA personnel and ensure an immediate and effective response in case of a security incident.

Governance

BBVA has implemented a model of governance for information security, including the work of the Information Security Steering Committee, responsible for the approval and monitoring of the information security strategy execution and the effective implementation of the different programs designed for each of the three pillars that compose it.

Also, the Corporate Security function is organized by a system of committees and working groups to manage the different areas related to information security: security in transactions, security associated with technology, physical security, security in business processes, security related to personnel, etc.

There are also committees responsible for information protection and fraud management, where both the Corporate Security function and the rest of the areas involved in the Bank participate.

Lastly, BBVA has a Technology and Cybersecurity Commission, whose functions include the supervision of technology and cybersecurity strategy and cybersecurity risk management. This Commission assists the Board of Directors in monitoring the technological risks to which the Bank is exposed, current cybersecurity and technology trends, and any relevant technological security event that could affect the Group.

Data protection

The main initiatives performed in this area are related to the adoption of measures to ensure that all BBVA´s information assets are properly protected, limiting their use to related processes and controlling access to them, considering the security guidelines established by the Group. All the initiatives are performed guaranteeing compliance with the security and privacy regulatory requirements applicable, especially those related to personal data protection.

All activities related to the data protection program are reviewed by the Data Protection Committee, where all relevant stakeholders of the organization are represented.

During 2021 there has been no incident that has had a significant economic impact on the BBVA Group.

For more information about personal data protection, see the section “Personal data protection” in the "Compliance" chapter of this report.

Cybersecurity

The COVID-19 pandemic has increased the scope of social engineering attacks through e-mail, SMS, instant messaging systems and social media. It has also contributed to the emergence of new risks and challenges for companies, like the ones related to security in telework, security in cloud environments and the increase in the attack surface. As a result, as cyberattacks evolve and become more sophisticated, BBVA has strengthened its prevention and monitorization efforts.

The Global Computer Emergency Response Team (CERT) is the Group’s first line of detection and response to cyberattacks aimed at global users and the Group’s infrastructure, combining information on cyber threats from our Threat Intelligence Unit. The Global CERT, which is based in Madrid, operates 24/7 and provides services in all countries where BBVA operates, under a scheme of managed security services.

In 2021, the monitoring capacity of the systems has increased, in particular with respect to the critical assets which support business processes. Incident prevention, detection and response capabilities have also been strengthened through the use of integrated information sources, improved analytical capabilities and automated platforms. Moreover, work is being done on the development of new artificial intelligence and machine learning models which can predict and prevent cyberattacks against bank infrastructure, providing a more secure experience for customers.

Measures implemented have improved information security management from a predictive and proactive approach, based on the use of digital intelligence and advanced analytical capabilities. The main objective of these measures is to ensure an immediate and effective response to any security incident that may occur, with the coordination of different business and support areas involved, reduce the possible negative impact and, if necessary, report in a timely manner to the corresponding supervisory or regulatory authorities.

BBVA also routinely reviews, reinforces and tests its security processes and procedures through simulation exercises in the areas of physical security and digital security. Specialized teams periodically perform technical security tests in order to detect and correct possible security vulnerabilities.

In 2020 and 2021, the Group detected an increase in the number of attacks in a number of countries, accentuated by the presence of organized crime groups specialized in the banking sector.

Security in business processes and fraud

Cybersecurity processes are always undertaken in close coordination with fraud prevention processes, so there are considerable interactions and synergies between the relevant teams. As part of the efforts to monitor fraud and to actively support the deployment of adequate anti-fraud policies and measures, a Corporate Fraud Committee has been created to oversee the evolution of all external and internal fraud types in all countries where the Group operates.

Among the functions of this committee are: (I) actively monitor fraud risk and mitigation plans; (ii) assess their impact on Group businesses and customers; and (III) monitor the relevant fraud facts, events and trends.

Both the Bank and the rest of the Group's subsidiaries have cybersecurity and fraud insurance policies, subject to certain loss limits, applicable deductions and exclusions, as the case may be.

Business Continuity

In 2021 and 2020, Business Continuity continued to be reinforced from a holistic perspective, paying special attention to the Group’s resilience. As a result thereof, a shift from a model basically geared to ensuring the uninterrupted delivery of products and services in situations of great impact which are infrequent but plausible, toward a model in which the organization has been provided with the ability to absorb and adapt to situations with an operational impact due to disruptions of various kinds (pandemics, cybersecurity incidents, natural disasters or technological failures), has been consolidated. This has been reflected in an intense activity by the Business Resilience Office, which together with the Crisis Management Committees and Group Continuity has played a very important role in the management of the crisis resulting from COVID-19 in the numerous areas it has impacted.

Customer care

BBVA has a complaints model based on two key aspects: the agile resolution of claims and, most importantly, the analysis and eradication of their causes at root. This model constitutes a contribution of great value for improving customer experience.

In 2021 the Group’s claims units worked to reduce attention times which, due to the health provisions imposed by the global COVID-19 pandemic, were significantly affected in 2020; as well as the proactive identification of potential new problems and the eradication of the root causes of the most common types of claims. All this with the aim of generating peace of mind and consolidating customer trust, giving a swift resolution to their problems, through a simple and agile experience and with a clear and personalized response.

MAIN INDICATORS OF CLAIMS (BBVA GROUP)(1)

| 2021 | 2020 | |

|---|---|---|

| Number of claims before the banking authority for each 10.000 active customers | 10 | 13 |

| Average time for setting claims (natural days) | 5 | 11 |

| Claims settled by First Contact Resolution (FCR) (% over total claims) | 10 | 19 |

(1) Due to the sale of BBVA USA, during 2021 claims in this country have been monitored until May 31, 2021 only.

The country that registers the largest number of claims before the banking authority per 10,000 active customers is Colombia.

CLAIMS BEFORE THE BANKING AUTHORITY BY COUNTRY (NUMBER FOR EACH 10.000 ACTIVE CUSTOMERS) (1)

| 2021 | 2020 | |

|---|---|---|

| Spain | 1.86 | 1.38 |

| The United States (2) | 4.51 | 4.70 |

| Mexico | 9.19 | 12.16 |

| Turkey | 12.77 | 16.51 |

| Argentina | 0.13 | 0.45 |

| Colombia | 62.45 | 97.56 |

| Peru | 2.04 | 2.02 |

| Venezuela | 0.09 | 0.03 |

| Uruguay | 0.29 | 0.31 |

| Portugal | 21.90 | 17.45 |

Scope: BBVA Group.

(1) The banking authority refers to the external body in which the customers can complain against BBVA.

(2) Due to the sale of BBVA USA, during 2021 claims in this country have been monitored until May 31, 2021 only.

The Group’s average claim resolution time was 5.46 days in 2021, which represents a reduction in all countries compared with 2020 (higher times as a result of the health provisions that were established as a result of the pandemic).

AVERAGE TIME FOR SETTING CLAIMS BY COUNTRY (NATURAL DAYS) (1)

| 2021 | 2020 | |

|---|---|---|

| Spain | 11 | 9 |

| The United States (2) | 6 | 6 |

| Mexico | 4 | 6 |

| Turkey | 4 | 6 |

| Argentina | 7 | 9 |

| Colombia | 5 | 10 |

| Peru | 7 | 35 |

| Venezuela | 8 | 8 |

| Uruguay | 16 | 7 |

| Portugal | 6 | 6 |

Scope: BBVA Group.

(1) The banking authority refers to the external body in which the customers can complain against BBVA.

(2) Due to the sale of BBVA USA, during 2021 claims in this country have been monitored until May 31, 2021 only.

Claims settled by the First Contact Resolution (FCR) model, which consists in the resolution of the claim at the time it is filed, account for 10% of total claims, thanks to the fact that the management and handling of these claims aims to reduce resolution times and increase the service quality, thus improving the customer experience.

CLAIMS SETTLE BY FIRST CONTACT RESOLUTION (FCR. PERCENTAGE OVER TOTAL CLAIMS)

| 2021 | 2020 | |

|---|---|---|

| Spain (1) | n.a. | n.a. |

| The United States (3) | 32 | 36 |

| Mexico | 10 | 19 |

| Turkey (2) | 38 | 29 |

| Argentina (4) | 3 | 45 |

| Colombia (2) | 21 | 25 |

| Peru | 1 | 1 |

| Venezuela (1) | n.a. | n.a. |

| Uruguay | 16 | 7 |

| Portugal (1) | n.a. | n.a. |

n.a. = not applicable.

(1) In Spain, Portugal and Venezuela this type of management is currently not applied.

(2) In Colombia and Turkey, the first level resolution is considered FCR, that is, by the front in less than 48 hours.

(3) Due to the sale of BBVA USA, during 2021 claims in this country have been monitored until May 31, 2021 only.

(4) In Argentina, the criteria has been modified in 2021, homogenizing it with the rest of the countries (Mexico, Uruguay, Peru and the United States). The 2020 data responds to local criteria.

The justified claims related to violations of privacy and loss of customer data filed before the corresponding banking authorities in the countries, account for 0.05% of the total claims as a result of preventive policies and risk control measures.

The total volume of claims in 2021, which breakdown is shown in the following table, represents a reduction of 2% in the volume of claims with respect to the figure in 2020, as a result of the improvements in the claims management process in the Group.

TOTAL VOLUME OF CLAIMS (BBVA GROUP. MILLIONS)

| 2021 | 2020 | |

|---|---|---|

| Spain | 0.2 | 0.12 |

| The United States (1) | 0.02 | 0.05 |

| Mexico | 1.04 | 1.05 |

| Turkey | 0.18 | 0.23 |

| Argentina | 0.23 | 0.24 |

| Colombia | 0.11 | 0.14 |

| Peru | 0.32 | 0.34 |

| Venezuela | 0.014 | 0.019 |

| Uruguay | 0.012 | 0.018 |

| Portugal | 0.0001 | 0.0001 |

(1) Due to the sale of BBVA USA, during 2021 claims in this country have been monitored until May 31, 2021 only.

For more information on the Customer Care Service and the Customer Ombudsman see the section "Additional information on customer complaints" in the chapter "Additional information" of this report.

9 Own work. The study has considered the main peers of BBVA in Argentina, Colombia, Spain, Mexico, Peru, Turkey and Uruguay.

2.2.3 Employees

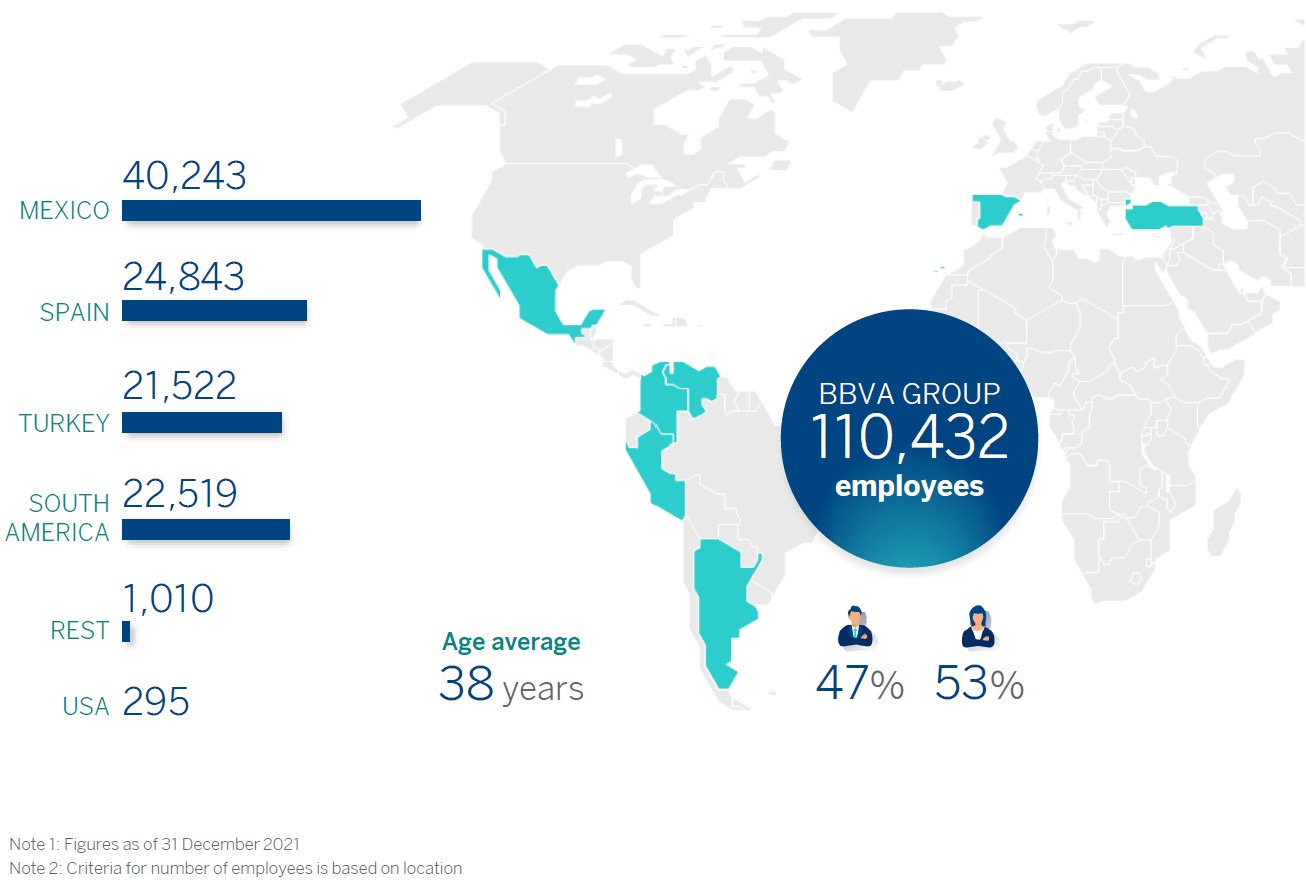

The team is one of the accelerators of growth and a strategic lever for the Group. BBVA has a diverse and empowered team with a distinct culture, which is guided by the corporate purpose and values.

As of December 31, 2021, the BBVA Group had 110,432 employees located in more than 25 countries, 53% of whom were women and 47% were men. The average age of the staff was 37.7 years. The average length of service in the organization was 10.7 years, with aturnover of 6.5% in 2021.

BBVA Group's workforce fell by 10% in 2021. Among the main changes were the exit of BBVA USA and of the rest of the Group's companies in the United States included in the agreement following their sale to the PNC Financial Services Group, Inc on June 1, 2021 and restructuring plan of the Bank in Spain.

Culture & Values

BBVA’s values and behaviors are the action guidelines for the Group in its day-to-day decision-making and help it accomplish its purpose "to bring the age of opportunity to everyone." The values and behaviors are the hallmark of everyone working in the Group and define the DNA of BBVA.

The values form part of the main levers for the Bank’s transformation and in the Talent & Culture processes: from the selection of new employees to the procedures for allocating roles, people development, training, and incentives for achieving goals

The values also boost commitment at BBVA. The Group carries out annually the Employee Commitment Survey10, managed by Gallup. In 2021, 93.1% of employees participated. The most outstanding aspect is the significant improvement of the Grand Mean, the strategic KPI with which the progress of the strategic priority "The best and most committed team" is measured and which is obtained by averaging the twelve main questions of the survey. Thus, in 2021 a value of 4.26 out of 5 has been achieved, which represents an improvement over last year (4.25 points).

By age groups, this year's results were: 4.42 points out of 5 among employees under 25 years of age; 4.34 points for the range of 25 to 34 years; 4.23 points from 35 to 44 years old; 4.22 points from 45 to 54 years; and 4.15 in the case of employees over 55 years of age. By gender, the result has been the same between men and women (4.27).

Similarly, BBVA's employee engagement index, which is calculated by dividing the percentage of engaged employees by the percentage of actively disengaged employees, improved in 2021 to 10.50 (10.17 in 2020).

BBVA has been granted with the Gallup Exceptional Workplace Award for being one of the 40 best organizations in the world which has worked most on engagement in 2021. Moreover, the most notable aspect is that 76% of teams have launched action plans to improve engagement (over 24,000 plans).

BBVA has expressed its will to reinforce its corporate culture of social and environmental engagement, facilitating the conditions for its employees to carry out volunteer work. For further information on volunteer work, see the "Volunteer work" section below in this chapter.

People Management

BBVA continues to boost its employees' commitment and performance, accompanying its transformation process with a variety of initiatives in questions related to staff, such as:

- - Transformation and development of the employee relations model: fostering a more accessible model and driving enterprise, empowerment and responsibility; providing the different areas in the Group with the advice to boost talent management based on their objectives and the employees with support for the development of their professional careers; the search for opportunities and the reinforcement of their role with more personal advice from the employee's supervisor

- - Maintenance of the Agile model of organization with the digital factories formed by multi-disciplinary teams which share the same objective and work with autonomy and capacity for execution with the aim of improving quality, productivity, the launch period and commitment

- - Launch of a solution to improve the mass training of employees. This solution represents a radical transformation for the employees of their training experience, introducing modern learning techniques based on an attractive training journey, and allowing them to manage this enormous challenge while generating the incentives for them to adopt it.

- - The strengthening of a corporate culture of collaboration and entrepreneurship, which revolves around the set of values and behaviors described above and which generate certain identity traits that differentiate it from other entities.

Professional development

In 2021, work continued on BBVA's model of professional development by the consolidation of an ecosystem in which the employees have available certain elements through three different modules that allow them to know themselves better, improve, grow and explore new pathways.

Talent attraction

BBVA aims to offer its employees a unique value proposition, through a common brand, in line with a global and digital company. In 2021, BBVA has launched a talent attraction program whose aim is to hire key talent with the potential to support BBVA Group's transformation process and provide an outstanding program for their training and international development.

Thanks to brand positioning actions and the promotion of professional opportunities available at BBVA through various channels, it was possible to attract over 175,000 candidates in 2021. All this is carried out under a global reference model for attracting talent, with clear policies that strengthen transparency, trust and flexibility for all stakeholders involved in the process.

BBVA also has a global scorecard to measure compliance levels with each of the internal mobility policies, ensuring follow-up and commitment to compliance in each of the geographical and global areas in which BBVA operates.

In 2021, 13,810 professionals joined the Group following this initiative to attract, select and incorporate profiles with new skills necessary for BBVA in its transformation process.

RECRUITMENT OF EMPLOYEES BY GENDER (BBVA GROUP. NUMBER)

| 2021 | 2020 | |||||

|---|---|---|---|---|---|---|

| Total | Male | Female | Total | Male | Female | |

| Spain | 1,133 | 476 | 657 | 1,776 | 715 | 1,061 |

| Mexico | 10,567 | 5,700 | 4,867 | 4,706 | 2,435 | 2,271 |

| Turkey | 2,377 | 1,075 | 1,302 | 1,500 | 697 | 803 |

| South America | 3,226 | 1,562 | 1,664 | 1,479 | 677 | 802 |

| The United States | 630 | 271 | 359 | 1,837 | 792 | 1,045 |

| Rest | 83 | 50 | 33 | 102 | 65 | 37 |

| Total | 18,016 | 9,134 | 8,882 | 11,400 | 5,381 | 6,019 |

| Of which new hires are (1): | ||||||

| Spain | 422 | 231 | 191 | 593 | 340 | 253 |

| Mexico | 7,945 | 4,318 | 3,627 | 5,050 | 2,560 | 2,490 |

| Turkey | 2,366 | 1,070 | 1,296 | 1,481 | 690 | 791 |

| South America | 2,391 | 1,271 | 1,120 | 1,191 | 597 | 594 |

| The United States | 617 | 260 | 357 | 1,839 | 793 | 1,046 |

| Rest | 69 | 43 | 26 | 92 | 57 | 35 |

| Total | 13,810 | 7,193 | 6,617 | 10,246 | 5,037 | 5,209 |

(1) Including hires through consolidations.

Development

The professional development model is based on a 360º assessment process. For the first time, in 2021 employees know their position on the BBVA Group talent map; in other words how they compare with other professionals who occupy similar positions to theirs. This allows them to identify their development plan and access the tools that BBVA makes available to them to help them achieve their objectives.

Moreover, BBVA's professional development has been enriched in 2021 through the incorporation of tools that allow employee growth: Project Review linked to the implementation of Agile organizational models and an internal coaching program. These tools complement those already in place in the professional development model, such as Open Mentoring, BBVA Campus, Mobility and Opportunity, whose impulse has been a priority in 2021.

The percentage of vacant positions filled with internal candidates stood at 56.7% in 2021 (69.4% in 2020) and signals the commitment to the global policy of prioritizing internal versus external talent. 2020 was a very restrictive year in terms of both internal and external hiring. There was a freezing in Central Areas for 9 months in almost all countries to limit movements facing the COVID crisis. In 2021, activity was resumed in most countries, promoting internal movements stopped the previous year.

Training

BBVA's training model gives employees a leading role in their own development and provides them with the autonomy to decide their learning pathways. In this way, the employees no longer have to wait to be invited to a training action; they now have the means to decide themselves on their learning pathways and how to grow professionally. This commitment to decentralization allows the employees themselves to generate knowledge and share it with their colleagues. Sessions of this type have involved the participation of 86,878 employees from all geographies to assess the usefulness of the content.

The solidity and level of implementation of the training model across the Group is allowing to be proactive and guarantee that knowledge (internal or external) is obtained which the Bank needs at any time and continuously for the growth of its professionals.

In 2021, with the aim of reinforcing this commitment, BBVA launched a program to accelerate the acquisition of new competencies and develop the competencies needed within the same post or profile (up/reskilling). In this way, employees will be able to focus on their growth in knowledge that is a priority for BBVA.

To meet this challenge, BBVA's training model has been transformed to continue boosting a culture of "learning skills" which allow professionals to have the capacities required at any time and thus improve their employability. In the context of a changing environment, it is not only necessary to be flexible and adaptable to change; it is also essential for employees to update their knowledge all the time (continuous learning).

As a result, BBVA has been recognized in recent years as an extremely innovative entity in the training world, with a deep-rooted culture of online learning (in the last 4 years, over 70% of the training has been online and in 2021 it was 74%) and a wide-ranging digital training offer for its employees channeled through its global training platform BBVA Campus.

This training platform provides employees with over 20,000 training resources (MOOCs, podcast, videos, blogs, practice communities, portals structured by knowledge area, simulators, etc.), specific experiences geared at specialized technical profiles and links to external training platforms of recognized prestige at global level or courses offered by key educational institutions.

For this reason all employees have been offered 14 expeditions through The Camp (one for each strategic knowledge area), structured into 3 different levels of increasing specialization, providing a response to Strategic People Planning, on which the capacities required by the Group for the bank of the future have been defined.

Through these expeditions, the professionals have focused on extending their knowledge and training on more strategic subjects for the Group. In 2021, more than 83,271 professionals have completed 1,169,700 hours of training on subjects related to sustainability, cybersecurity, data, Agile, design and the behavioral economy. The average satisfaction score is 4.7 (out of 5).

Another extremely relevant line of training for professionals has been the knowledge required for the transformation of the business, transforming their current and future capacities. It is also worth noting that BBVA continued to boost the certification of its professionals' knowledge in 2021. Thanks to internal or official external certifications, employees have been able to accredit specialized knowledge in the main business subjects.

Specifically, training in sustainability has taken a leading role in helping to boost knowledge related to this strategic priority across the whole Group. In 2021, 179,012 hours of training were completed (165% more than in 2020) and over 57,210 professionals have participated in a sustainability-related training initiative. Moreover, 5,516 employees have exceeded the EFPA-ESG (European certifier) and IASE ISF1 (international certifier) certifications.

BASIC TRAINING DATA (BBVA GROUP)

| 2021 | 2020 | |

|---|---|---|

| Total investment in training (millions of euros) | 36.0 | 31.8 |

| Investment in training per employee (euros)(1) | 326 | 258 |

| Hours of training per employee (2) | 44.8 | 41.4 |

| Employees who received training (%) | 97.9 | 92 |

| Satisfaction with the training (rating out of 10) | 9.5 | 9.3 |

| Average participations per employee | 30.8 | 33 |

| Amounts received from FORCEM for training in Spain (millions of euros) | 1,5 | 1,2 |

(1) Ratio calculated considering the Group ́s workforce at the end of each year ( 110,432 in 2021 and 123,174 in 2020).

(2) Ratio calculated considering the workforce of BBVA with access to the training platform.

TRAINING DATA BY PROFESSIONAL CATEGORY AND GENDER (BBVA GROUP. 2021)

| Number of employees with training | Training hours | |||||

|---|---|---|---|---|---|---|

| Total | Male | Female | Total | Male | Female | |

| Management team (1) | 3,030 | 2,042 | 988 | 91,222 | 59,939 | 31,283 |

| Middle controls | 8,547 | 4,509 | 4,038 | 296,065 | 163,543 | 132,522 |

| Specialists | 39,684 | 19,730 | 19,954 | 1,626,500 | 789,266 | 837,234 |

| Sales force | 37,763 | 15,991 | 21,772 | 1,917,627 | 826,829 | 1,090,798 |

| Base positions | 19,118 | 8,504 | 10,614 | 1,020,459 | 411,971 | 608,488 |

| Total | 108,142 | 50,776 | 57,366 | 4,951,873 | 2,251,548 | 2,700,325 |

(1) The management team includes the highest range of the Group ́s management.

TRAINING DATA BY PROFESSIONAL CATEGORY AND GENDER (BBVA GROUP. 2020)

| Number of employees with training | Training hours | |||||

|---|---|---|---|---|---|---|

| Total | Male | Female | Total | Male | Female | |

| Management team (1) | 3,077 | 2,098 | 979 | 64,826 | 43,126 | 21,700 |

| Middle controls | 9,768 | 5,162 | 4,606 | 255,076 | 137,242 | 117,834 |

| Specialists | 36,692 | 17,648 | 19,044 | 1,242,055 | 572,230 | 669,825 |

| Sales force | 43,487 | 18,745 | 24,742 | 2,192,527 | 968,162 | 1,224,365 |

| Base positions | 20,559 | 8,747 | 11,812 | 1,348,223 | 511,307 | 836,916 |

| Total | 113,583 | 52,400 | 61,183 | 5,102,707 | 2,232,066 | 2,870,641 |

(1) The management team includes the highest range of the Group ́s management.

EMPLOYEE TRAINING 2021 (BBVA GROUP. NUMBER, PERCENTAJE)

| Number | % | |

|---|---|---|

| Investment in training as a percentage (%) of payroll (1) | 0.91 | |

| Effectiveness of the training and development through increased revenue, productivity gains, employee engagement and/or internal hire rates(2) | 355.92 |

(1) Investment in training / Wages and salaries.

(2) Human Capital Return on Investment; a. Total Revenue (EUR) - Gross Margin; b. Total Operating Expenses (EUR)- Administration Expenses; c. Total training related expenses (EUR); d. Resulting HC ROI (a - (b-c)) / c.

Diversity, inclusion and different capacities

At BBVA, diversity and inclusion are firmly aligned with its purpose and consistent with its values. BBVA is committed to diversity in its workforce as one of the key elements in attracting and retaining the best talent and offering the best possible service to its customers. In 2018 a global diversity plan was designed with several lines of action, focused mainly on gender diversity, but without forgetting other aspects of diversity such as ethnic, inter-generation, different capacities and sexual orientation. Since then, the plan has been improved and updated.

With respect to gender diversity, a number of initiatives have been developed since 2018 whose aim is to facilitate the professional growth of women in BBVA and accelerate their access to positions of responsibility. Among these initiatives implemented in 2021 are:

- - Setting gender diversity targets at area and country level. A target has been set for the percentage of women to be promoted to categories of greater responsibility over the next five years. This target is supported by a specific diversity plan developed by each of the areas, which is revised quarterly and must ensure compliance with the plan.

- - New initiatives favoring female talent that speed up the professional growth of women in BBVA, ensuring equity and neutrality in the selection and professional growth processes.

- - Improved capacity to identify the women in BBVA with the greatest potential through the Talent Map tool. Within this line of work are the extension of the Rooney Rule to more levels of the Organization, improvement of training, mentoring targeted at women with high potential and the introduction of the gender component in the succession plans (line-up plan) to positions of high responsibility.

- - Continuing work on a flexible working environment in which men can assume their family responsibilities to the same extent as women, and where maternity does not represent a professional obstacle for women (the Work Better, Enjoy Life initiative). A hybrid work model has been implemented for this purpose to balance personal and professional life better. Paternity leave has also been extended in a number of geographical areas

Initiatives include the creation of the Employee Resource Group (hereinafter, ERG), a form of intrapreneurship in which employees themselves decide to get together to promote diversity and foster personal relations between people with common interests; and the support to a variety of organizations and initiatives working for diversity and equal opportunities between men and women, such as participation in the fight against the gender gap in science, technology, engineering and maths, or collaboration with initiatives such as Inspiring Girls, the Girls' Olympiad in Informatics and Technovation for Girls.

In terms of gender diversity, women represent 33% of the members of the board of directors of BBVA, S.A.,26.8% of senior management and 36.1% of management positions, 31.5% of technology and engineering positions and 57.4% of business and profit generation positions (31.6%, 43.4%, 32.2% and 57.4%, respectively, in 2020).

As for LGTBI+ diversity, a guide was prepared in 2021 called "Trans Diversity, Meeting Point." It is a manual which includes guidelines and protocols focused on supporting transexual or transgender employees or customers. BBVA was elected president of the Business Network for Diversity and LGTBI inclusion (REDI), the first business association in Spain created to promote an inclusive and respectful environment in organizations. Over 95 Spanish companies form part of this organization. In 2021, two global events were held for BBVA employees related to diversity and inclusion: the International LGTBI+ Pride Day and the Diversity Days, which are internal days held for the second year in a row to share the significant progress made in terms of diversity and inclusion and to create a learning space.

BBVA's leadership in diversity issues has led to it being included for the fourth consecutive year in the Bloomberg Gender-Equality Index, a ranking that includes the 100 global companies with the best gender diversity practices. The Bank has also been finalist in the Euromoney awards as Best Global Diversity and Inclusion Bank; and in the LinkedIn Talent Awards in the Diversity Champions category. Moreover, Gartner published a study praising the Bank's global strategy in terms of diversity and inclusion.

Regarding the statement "BBVA always values diversity" in the Employee Engagement Survey, managed by Gallup, in 2021 the Bank obtained a score of 4.53 out of 5, slightly more than the 2020 results (4.52).

All the Group companies in the different countries have protocols for preventing sexual harassment, expressly stating their rejection of any conduct of a sexual nature or with a sexual connotation that has the purpose or effect of violating a person's dignity, and they undertake to apply this agreement as a means of preventing, detecting, correcting and punishing this type of conduct within the company.

With respect to different capacities, BBVA has expressed its commitment to the social integration of individuals with different capacities. It has an ERG related to different capacities which organizes talks to raise awareness of this issue.