Not including corporate operations, income from continuing operations is up 43.2% YoY to 2,277 million euros.

BBVA's net attributable profit reached 1,929 million euros, or 37.3% less than in the same period in 2013, when the sale of non-strategic assets accounted for capital gains.

The soundness of recurring revenues, cost control and the decline in loss provisioning have driven operating profit. Between July and September, net interest income – the best measure of the traditional banking business – was the Group’s highest since 2012, and has increased YoY across all business areas.

The bank has maintained its cost strategy divided by areas: there was cost containment in developed countries, while expansion was supported in emerging markets. As a result, quarterly operating income was 2,418 million euros (up 10.9%).

In Q3, BBVA allocated 1,245 million euros for loan-loss and real-estate provisions, clearly below those reported in 2013 (on average 1,662 million euros per quarter) and 2012 (on average 2,357 million euros per quarter).

Geographical diversification

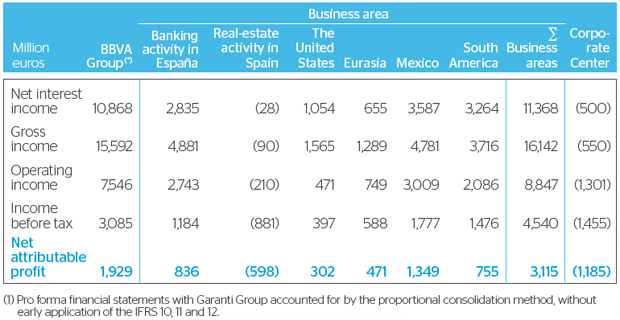

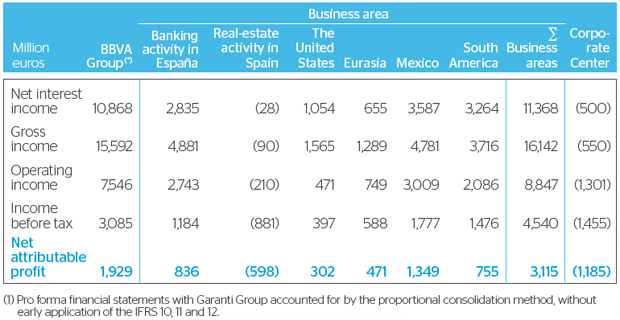

Banking activity in Spain: There has been and incipient recovery in the demand for loans; however, this is still insufficient to increase the loan stock. Also, there is a downward trend for deposits. Operating expenses remain in check and have fallen 6.2% over the last 12 months, due to the digitization and transformation process implemented across the Group. Risk indicators have improved: the NPA ratio stood at 6.2% and the coverage ratio at 44%. Net attributable profit from banking activity was 836 million euros.

Real-estate activity in Spain: Reduction in net exposure to the sector (down 10.3 YoY) and gradual recovery of demand. The area cut losses by 29.1% year-on-year, with net attributable profit of –598 million euros.

Main items on the income statement by business area (1H14)

United States: Strong activity thanks to the major commercial effort and the new digital offering being developed. Exceptional asset quality (0.9% NPA ratio and 164% coverage ratio). It earned 302 million euros (down 2.3%(l)). BBVA Compass has issued 1,000 million dollars in senior debt, with an excellent uptake from investors.

Eurasia: Once again Turkey played a key role thanks to its strong activity and increased revenues from the banking business. The area earned 471 million euros (up 24.5%a)).

Mexico: Maintained strong business activity, in both lending (+11.3%), which grew above the figure for the banking system as a whole, and in customer funds (8.7%). Sound income statement based on strong net interest income. Differential risk indicators with a 3.2% NPA ratio and 112% coverage ratio. The area generated net attributable profit of 1,349 million euros (up 11.5% (1)).

South America: Strong rate of growth both in loan-book (+24.4%) and customer funds (24.1%), especially in the Andes region. The NPA ratio fell to 2.1% while the coverage ratio stands at 137%. Net attributable profit was 755 million euros (up 14.5% a)).

(1) Constant exchange rates.

Solvency and liquidity

BBVA's capital percentages remain well above the minimum required levels.

The results of the assessment of European banks conducted by the ECB were published on October 26. According to this assessment, in 2016 BBVA would reach a fully-loaded CET1 capital ratio (which assumes the future impact of the regulation) of 8.2% in the adverse scenario. BBVA is one of the three major European banks exceeding the 8% threshold in this test.

For the third quarter in a row there has been an improvement in the NPA ratio (4.3%), with a 64% coverage ratio, excluding real-estate activity. Taking into account all the portfolios, the NPA ratio stood at 6.1%, 28 basis points less than on June 30, and with a 63% coverage ratio. Furthermore, the balance of non-performing assets decreased by 7.9% year-on-year at

(1) Real-estate activity in Spain excluded.

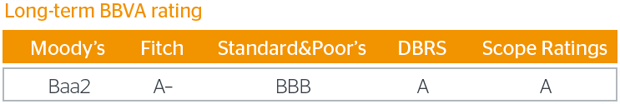

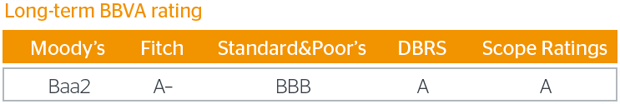

Credit rating agencies

Following the announcement of the acquisition of Catalunya Banc, the main agencies have confirmed BBVA's ratings. The upgrades in BBVA's ratings in the first half of 2014 have thus been maintained.

Highlights of the quarter