The share

The Global economy is being strongly affected by the COVID-19 pandemic. Supply, demand and financial factors caused an unprecedented fall in GDP in the first half of 2020. Underpinned by strong fiscal and monetary policy measures, as well as greater control over the spread of the virus, global growth rebounded significantly in the second half of the year. Global GDP, however, fell by around 3.3% in 2020.

Although the pandemic is likely to continue to adversely affect activity in the short term, the process of economic recovery is expected to continue. According to BBVA Research, global GDP will expand by around 5.9% in 2021 and 4.8% in 2022, in line with the expected accelerated rollout of the Coronavirus vaccine, and the gradual lifting of restrictions and economic stimulus measures. In this regard, the strong fiscal stimuli announced in the United States at the end of 2020 and the beginning of 2021, as well as the sustained accommodative stance of monetary conditions by the Federal Reserve (hereinafter the Fed) and other major central banks, have reinforced the global economy's prospects for recovery; this recovery will be led by the United States, where GDP could grow around 6.2% in 2021 and 5.1% in 2022, according to BBVA Research estimates. That being said, various epidemiological, financial, economical and geopolitical factors are contributing to the exceptionally high uncertainty.

With regard to the banking system, in an environment in which much of the economic activity has been at a standstill for several months, the services it provides have played an essential role. There are two main reasons for this: first, the banks have ensured the proper functioning of collections and payments for households and companies, thereby contributing to the maintenance of economic activity; second, the granting of new credit or the renewal of existing credit has reduced the impact of the economic slowdown on household and business incomes. The support provided by the banks over the months of lockdown and public guarantees have been essential in softening the impact of the crisis on companies' liquidity and solvency, meaning that banking has become the main source of funding for most companies.

In terms of profitability, European and Spanish banks have deteriorated from the outset of the crisis, primarily because many entities recorded high provisions for impairment on financial assets in the first two quarters of 2020 as a result of the worsening macroeconomic environment following the pandemic outbreak. Furthermore, the accumulation of capital by banks since the previous crisis and the current very low interest-rate environment in which we have been since several years, will continue to put pressure on bank profitability. Nevertheless, the banks are facing this situation from a position of strength and with solvency that has been constantly increasing since the 2008 crisis, with reinforced capital and liquidity buffers and, therefore, with a greater capacity to lend.

The main stock market indexes continued their positive performance shown at the end of the year 2020. In Europe, the Stoxx Europe 600 index increased by 7.7% during the first quarter 2021, and in Spain the Ibex 35 rose 6.3%. In the United States, the S&P 500 index increased by 5.8% in the period.

With regard to the banking sector indexes, its performance was better than the general market indexes during the first quarter of 2021. In Europe, the Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, the Eurozone bank index, increased by 19.1% and 19.4% respectively, while in the United States, the S&P Regional Banks sectorial index rose by 27.6% in the period.

For its part, the BBVA share price increased by 9.7% during the quarter and closed the month of March at €4.43.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-20)

BBVA

Stoxx Europe 600

Stoxx Banks

The BBVA share and share performance ratios

| 31-03-21 | 31-12-20 | |

|---|---|---|

| Number of shareholders | 869,378 | 879,226 |

| Number of shares issued (millions) | 6,668 | 6,668 |

| Closing price (euros) | 4.43 | 4.04 |

| Book value per share (euros) | 6.80 | 6.70 |

| Tangible book value per share (euros) | 6.15 | 6.05 |

| Market capitalization (millions of euros) | 29,512 | 26,905 |

| Yield (dividend/price; %) (1) | 3.6 | 4.0 |

(1) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

Regarding shareholder remuneration, on December 15, 2020 the European Central Bank (ECB) adopted a new recommendation on dividend distribution during the COVID-19 pandemic, which will be maintained until the end of September 2021, and derogates the previous one. The decision continues along the lines of recommending that credit institutions exercise extreme prudence in distributing profits to remunerate shareholders, either in cash dividends or share buybacks, so that any remuneration remains below 15% of the accumulated profit for 2019 and 2020 and, in any case, not higher than 20 basis points of the Common Equity Tier 1 (CET1) ratio.

According to this ECB recommendation, on April 29, 2021 BBVA paid a cash dividend in a gross amount of €0.059 per share against the share premium account, as approved at the Annual General Meeting held on April 20, 2021.

As of March 31, 2021, the number of BBVA shares was 6,668 billion, and the number of shareholders reached 869,378. By type of investor, 59.74% of the capital is held by institutional investors and the remaining 40.26% by retail shareholders.

BBVA shares are included on the main stock market indexes, including the Ibex 35, and the Stoxx Europe 600 index, with a weighting of 6.40% and 0.31%, respectively at the closing of December 2020. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 4.22% and the Euro Stoxx Banks index for the eurozone with a weighting of 7.83%.

Finally, BBVA maintains a significant presence on a number of international sustainability indexes or Environmental, Social and Governance (ESG) indexes, which evaluates companies' performance in these areas. For further information, refer to the chapter “Sustainability and Responsible Banking” of the Quarterly Report 1Q21.

Group's information

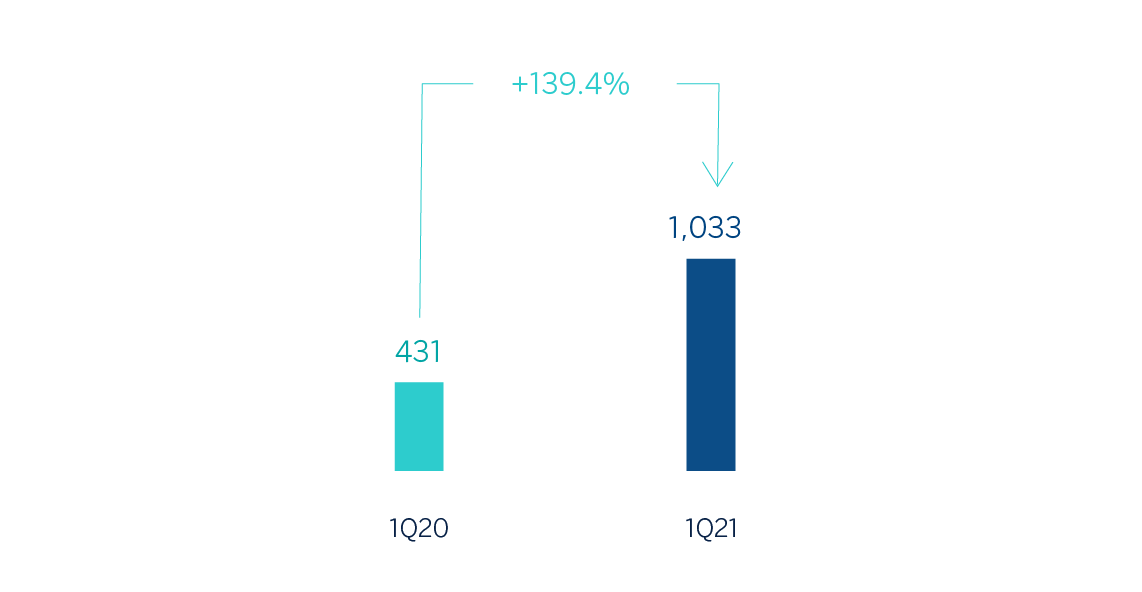

- The Group’s net attributable profit for the first three months of 2021, excluding the results from discontinued operations (i.e. without considering the results generated by the Group’s businesses in the United States subject to the agreement with PNC), amounted to €1,033m, with a year-on-year growth of 139.4%.

- The BBVA Group generated a net attributable profit of €1,210m during the first three months of 2021, which compares very positively with the accumulated losses in March2020, when the outbreak of the pandemic resulted in strong provisions for impairment on financial assets, as well as the goodwill impairment in the United States amounting to €-2,084m.

- Despite the complex environment and at constant exchange rates, the good performance in commissions and fees, the evolution of net trading income (NTI) and lower provisions for impairment on financial assets are noteworthy.

Net attributable profit (1)(Millions of Euros)

(1) Excluding the goodwill impairment in the United States, registered in 2019 and 2020 and the net capital gain from the bancassurance operation in 2020.

(1) Excluding the goodwill impairment in the United States, registered in 2019 and 2020 and the net capital gain from the bancassurance operation in 2020.

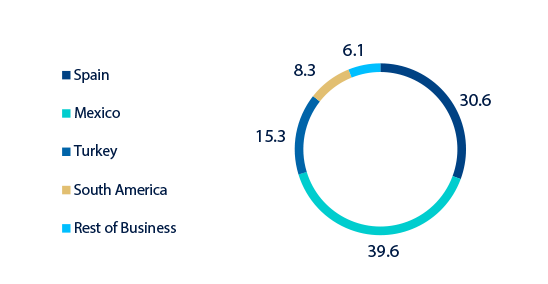

Net attributable profit breakdown (1) (Percentage. 1Q21)

(1) Excludes the Corporate Center.

(1) Excludes the Corporate Center.

- The figure for loans and advances to customers (gross) registered a slight decrease of 0.1%, mainly as a result of Spain´s deleveraging.

- Customer funds fell by 1.7%, due to the performance of customer deposits, which contracted by 3.4% in the quarter.

- The availability of substantial liquidity buffers in each of the geographical areas in which the BBVA Group operates and their management, have allowed, once again, internal and regulatory ratios to be maintained well above the minimums required.

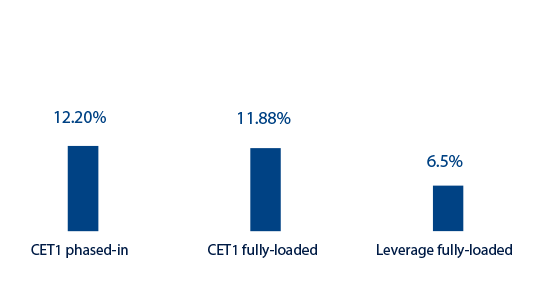

- BBVA’s CET1 fully-loaded ratio stood at 11.88% at the end of March 2021, within the Group’s management target which is to maintain the ratio between 11.5% and 12.0%, increasing the distance to the minimum requirement (currently at 8.59%) to 329 basis points. This ratio does not include the positive impact of the sale of BBVA USA and other companies in the United States with activities related to this banking business, which according to the current estimate and taking as a reference the capital level as of March 2021, would place the CET1 fully-loaded ratio at 14.58%.

Capital and leverage ratios (Percentage as of 31-03-21)

- On April 20, 2021, BBVA Group held its Annual General Meeting in a fully-remote format, in light of the exceptional circumstances brought about by the COVID-19 pandemic and in order to protect the health and safety of shareholders, employees and all other individuals involved. With respect to shareholder’s remuneration, on April 29, 2021, BBVA distributed a cash amount of €0.059 per share from BBVA’s share premium account, as approved by the Annual General Meeting held on April 20, 2021. In addition, and with the aim of effectively implementing a repurchase program of ordinary shares, BBVA has approved the reduction of the outstanding share capital up to a maximum of 10% through the redemption of own shares purchased by BBVA and by any mechanism for the purpose of being redeemed, being subject the aforementioned repurchase program to the provisions of the legislation or regulation in force, as well as the share price, among other factors.

- The calculation of expected credit losses accumulated in the first quarter of 2021 incorporates:

- The update of the forward-looking information in the IFRS 9 models in order to reflect the circumstances created by the COVID-19 pandemic.

- The granting of relief measures and guarantee lines or public guarantee facilities for customers affected by the pandemic, as well as the option to grant lending with a public guarantee facility. In addition, quantitative management adjustments are included in order to take into account issues that might imply a potential impairment which due to its nature is not included in the model and which will be assigned to specific operations in case this impairment materializes (e.g, sectors and collectives more affected by the crisis).

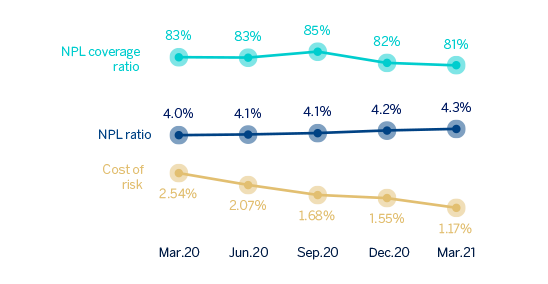

- • The behaviour of the main credit risk indicators of the Group, excluding the balances of discontinued operations, at the end of the first quarter of 2021 were:

- The NPL ratio stood at 4.3%.

- The NPL coverage ratio closed at 81%.

- The cumulative cost of risk at the end of March stood at 1.17%.

NPL and NPL coverage ratios and cost of risk (Percentage)

From the outset, BBVA has adopted a series of measures to support its main stakeholders. The main business continuity measures taken are:

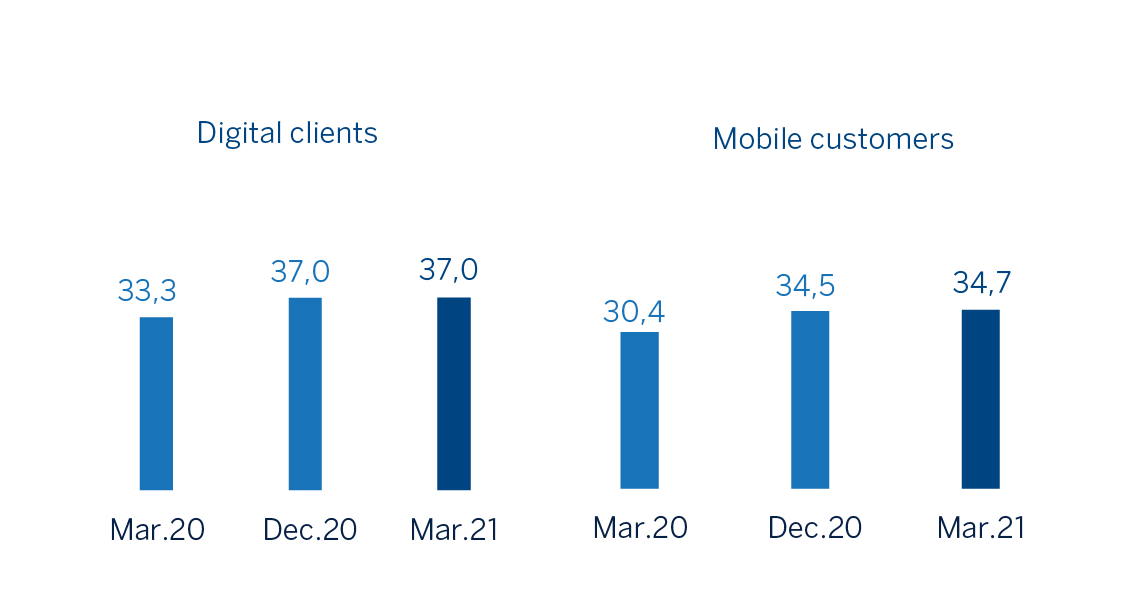

- In order to serve customers, and since financial services are legally considered an essential service in most of the countries in which the Group operates, BBVA maintains its branch network operational, with dynamic management considering the evolution of the pandemic and activity. In addition, digital channels have been reinforced, given the increasing preference of customers for these channels. The data indicates that the COVID-19 crisis is accelerating digitization: At Group level, excluding the United States, and in cumulative terms, digital sales (measured in units) stood at 67.8% in December 2020, and at 69.5% at the end of March 2021. Also, at the end of the first quarter of 2021, BBVA's digital customers, excluding the United States, accounted for 64.7% of the total and customers operating with the bank through their mobile phones accounted for 60.7% across the entire Group.

Digital and mobile customers (Millions)

- With employees, recommendations from health authorities have been followed, including taking an early stance on promoting working from home. The priority for BBVA is to protect the health of the employees, customers and society in general. The crisis is being handled dynamically; adapting the procedures in each geographical area which the Group is present to the current situation, based on the latest data available regarding the evolution of the pandemic, the business and the level of customer service, in addition to the guidelines set by local authorities.

- In terms of cybersecurity, the increase in remote work and digital transactions as a result of the coronavirus crisis has led to an increase in the risk of cyber attacks. To ensure data and corporate information protection, BBVA has established the appropriate measures and continues to strengthen its prevention and monitoring efforts, thus mitigating the possible associated risks.

- The banks are a key part of the solution to the COVID-19 crisis and BBVA will continue to support its customers throughout the pandemic and also during the recovery phase.

Business areas

Spain

€1,646 Mill.*

+8.9%

Year on year changes. Balances as of 31-03-21.

Highlights

- Decrease in lending activity and customers funds.

- Improved efficiency ratio.

- Favorable year-on-year evolution for the main margins.

- Sustainable alternative for all products.

Results

Net interest income

867Gross income

1,646Operating income

893Net attributable profit

381Activity (1)

Performing loans and advances to customers under mangement

-1.2%

Customers funds under management

-3.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

Mexico

€1,761 Mill.*

-1.9%

Year on year changes. Balances as of 31-03-21.

Highlights

- Activity increased in the quarter: lending activity recovered and customer funds showed growth.

- Net interest income impacted by the interest rate environment.

- NPL ratio improvement during the quarter.

- Year-on-year comparison influenced at the net attributable profit level by the increase in the impairment of financial assets line in March 2020 due to the outbreak of the pandemic.

Results

Net interest income

1,366Gross income

1,761Operating income

1,138Net attributable profit

493Activity (2)

Performing loans and advances to customers under mangement

+1.5%

Customers funds under management

+3.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(2) Excluding repos.

(1) Year on year changes at constant exchange rate.

Turkey

€834 Mill.*

+2.8%

Year on year changes. Balances as of 31-03-21.

Highlights

- Activity growth driven by Turkish lira loans and deposits.

- Outstanding performance of NTI and net fees.

- Operating expenses growth in line with the average inflation.

- Net attributable profit growth driven by lower impairment losses on financial assets in a comparative affected by the outbreak of the pandemic.

Results

Net interest income

530Gross income

834Operating income

569Net attributable profit

191Activity (1)

Performing loans and advances to customers under mangement

+5.2%

Customers funds under management

+4.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rate.

South America

€714 Mill.*

+2.6%

Year on year changes. Balances as of 31-03-21.

Highlights

- Lending activity influenced by the completion of the Plan Reactiva in Peru and lockdowns in the first quarter of 2021.

- Reduction in higher-cost resources.

- Favorable year-on-year evolution of recurrent income and NTI.

- Net attributable profit year-on-year comparison influenced by the increase in the impairment on financial assets line in March 2020 due to the outbreak of the pandemic.

Results

Net interest income

660Gross income

714Operating income

377Net attributable profit

104Activity (1)

Performing loans and advances to customers under mangement

+0.9%

Customers funds under management

+0.5%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rates.

Excludes BBVA Paraguay.

Rest of business

€218 Mill.*

+7.0%

Year on year changes. Balances as of 31-03-21.

Highlights

- Slight increase in lending and a decrease in customers funds in the quarter.

- NPL ratio contained.

- Net interest income growth and good performance of NTI.

- Reduction of operating expenses.

Results

Net interest income

72Gross income

218Operating income

103Net attributable profit

75Activity (1)

Performing loans and advances to customers under mangement

+0.7%

Customers funds under management

-27.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

* Gross income

(1) Excludes BBVA Paraguay.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email