Results

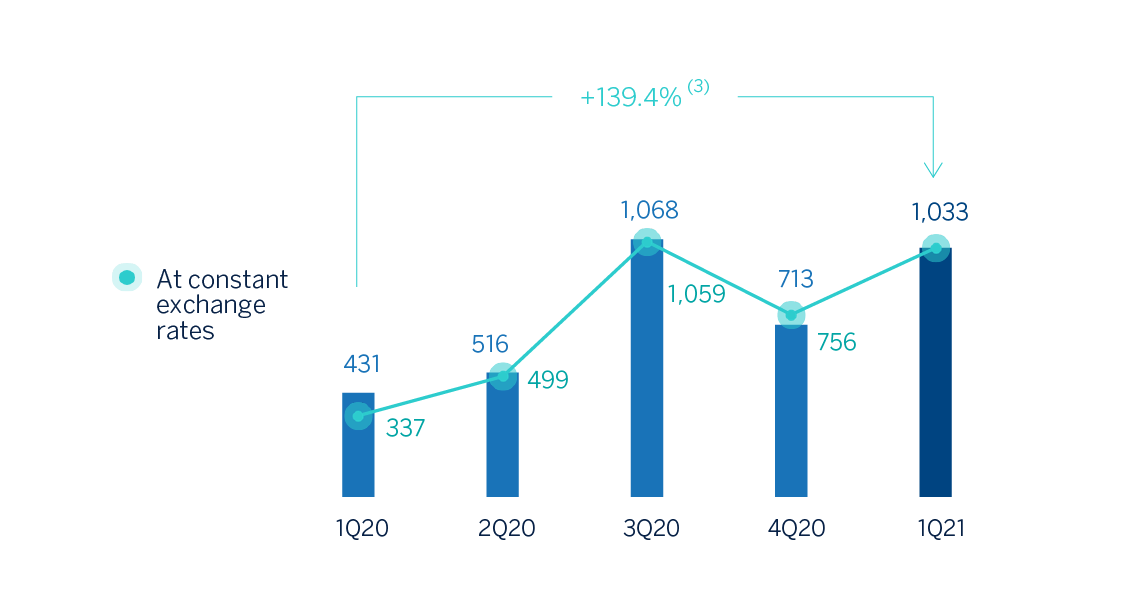

The Group's net attributable profit generated during the first three months of 2021, excluding the results from discontinued operations (i.e. excluding the results generated by the Group's business in the United States included in the sale agreement with PNC), amounted to €1,033m, a year-on-year growth of 139.4%. Taking into account the result from discontinued operations, the BBVA Group generated a net attributable profit of €1,210m at the end of the first quarter of 2021, which contrasts very positively with the losses accumulated in March 2020, when the outbreak of the pandemic resulted in strong provisions for impairment on financial assets, as well as in the goodwill impairment in the United States of €-2,084m.

Despite the complex environment and at constant exchange rates, the good performance in fees, the evolution of net trading income (NTI) and the lower provisions for impairment on financial assets are noteworthy.

CONSOLIDATED INCOME STATEMENT: QUARTERLY EVOLUTION (MILLIONS OF EUROS)

| 2021 | 2020 | ||||

|---|---|---|---|---|---|

| 1Q | 4Q | 3Q | 2Q | 1Q | |

| Net interest income | 3,451 | 3,477 | 3,553 | 3,537 | 4,024 |

| Net fees and commissions | 1,133 | 1,042 | 1,023 | 934 | 1,124 |

| Net trading income | 581 | 175 | 357 | 470 | 544 |

| Other operating income and expenses | (11) | (147) | 46 | (80) | 86 |

| Gross income | 5,155 | 4,547 | 4,980 | 4,862 | 5,778 |

| Operating expenses | (2,304) | (2,264) | (2,163) | (2,182) | (2,477) |

| Personnel expenses | (1,184) | (1,186) | (1,124) | (1,113) | (1,272) |

| Other administrative expenses | (812) | (766) | (725) | (754) | (860) |

| Depreciation | (309) | (312) | (315) | (316) | (345) |

| Operating income | 2,850 | 2,282 | 2,817 | 2,679 | 3,300 |

| Impairment on financial assets not measured at fair value through profit or loss | (923) | (901) | (706) | (1,408) | (2,164) |

| Provisions or reversal of provisions | (151) | (139) | (88) | (219) | (300) |

| Other gains (losses) | (17) | (82) | (127) | (103) | (29) |

| Profit/(loss) before tax | 1,759 | 1,160 | 1,895 | 950 | 807 |

| Income tax | (489) | (337) | (515) | (273) | (204) |

| Profit/(loss) after tax from continued operations | 1,270 | 823 | 1,380 | 678 | 603 |

| Profit/(loss) after tax from discontinued operations (1) | 177 | 302 | 73 | 120 | (2,224) |

| Corporate operations (2) | - | 304 | - | - | - |

| Profit/(loss) for the year | 1,447 | 1,430 | 1,454 | 798 | (1,621) |

| Non-controlling interests | (237) | (110) | (312) | (162) | (172) |

| Net attributable profit/(loss) | 1,210 | 1,320 | 1,141 | 636 | (1,792) |

| Of which: | |||||

| Discontinued operations | 177 | 302 | 73 | 120 | (2,224) |

| Corporate operations | - | 304 | - | - | - |

| Net attributable profit excluding discontinued and corporate operations | 1,033 | 713 | 1,068 | 516 | 431 |

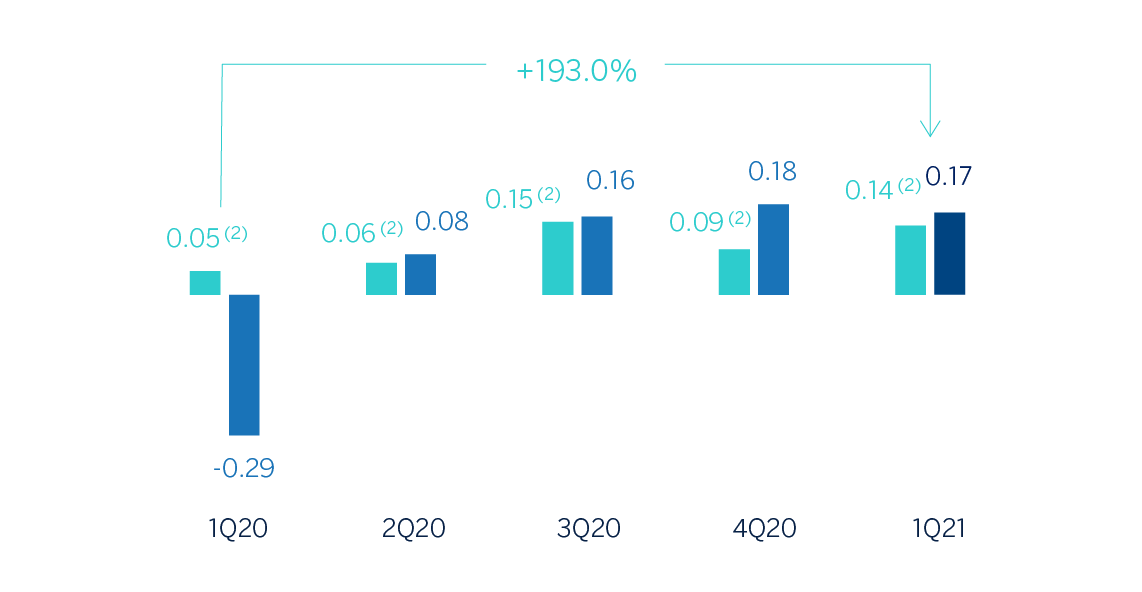

| Earning per share (euros) (3) | 0.17 | 0.18 | 0.16 | 0.08 | (0.29) |

| Earning per share excluding discontinued and corporate operations (3) | 0.14 | 0.09 | 0.15 | 0.06 | 0.05 |

- General note: the results generated by BBVA USA and the rest of Group's companies in the United States included in the sale agreement signed with PNC are presented in a single line as "Profit/(loss) after tax from discontinued operations".

- (1) Profit/(loss) after tax from discontinued operations includes the goodwill impairment in the United States registered in the first quarter of 2020 for an amount of €2,084m.

- (2) Include the net capital gain from the sale to Allianz the half plus one share of the company created to jointly develop the non-life insurance business in Spain, excluding the health insurance line.

- (3) Adjusted by additional Tier 1 instrument remuneration.

CONSOLIDATED INCOME STATEMENT (MILLIONS OF EUROS)

| 1Q 2021 | ∆% | ∆% at constant exchange rates |

1Q 2020 | |

|---|---|---|---|---|

| Net interest income | 3,451 | (14.2) | (2.3) | 4,024 |

| Net fees and commissions | 1,133 | 0.8 | 10.0 | 1,124 |

| Net trading income | 581 | 6.8 | 16.1 | 544 |

| Other operating income and expenses | (11) | n.s. | n.s. | 86 |

| Gross income | 5,155 | (10.8) | 0.2 | 5,778 |

| Operating expenses | (2,304) | (7.0) | 1.8 | (2,477) |

| Personnel expenses | (1,184) | (6.9) | 1.7 | (1,272) |

| Other administrative expenses | (812) | (5.6) | 4.0 | (860) |

| Depreciation | (309) | (10.7) | (3.3) | (345) |

| Operating income | 2,850 | (13.6) | (1.0) | 3,300 |

| Impairment on financial assets not measured at fair value through profit or loss | (923) | (57.3) | (52.4) | (2,164) |

| Provisions or reversal of provisions | (151) | (49.6) | (47.8) | (300) |

| Other gains (losses) | (17) | (41.4) | (42.1) | (29) |

| Profit/(loss) before tax | 1,759 | 117.9 | 183.2 | 807 |

| Income tax | (489) | 139.7 | 212.3 | (204) |

| Profit/(loss) after tax from continued operations | 1,270 | 110.5 | 173.4 | 603 |

| Profit/(loss) after tax from discontinued operations(1) | 177 | n.s. | n.s. | (2,224) |

| Profit/(loss) for the year | 1,447 | n.s. | n.s. | (1,621) |

| Non-controlling interests | (237) | 37.8 | 85.8 | (172) |

| 1,210 | n.s. | n.s. | (1,792) | |

| Of which: | ||||

| Discontinued operations | 177 | n.s. | n.s. | (2,224) |

| Net attributable profit excluding discontinued operations | 1,033 | 139.4 | 206.5 | 431 |

| Earning per share (euros) (2) | 0.17 | (0.29) | ||

| Earning per share excluding discontinued operations (2) | 0.14 | 0.05 |

- General note: the results generated by BBVA USA and the rest of Group's companies in the United States included in the sale agreement signed with PNC are presented in a single line as "Profit/(loss) after tax from discontinued operations".

- (1) Profit/(loss) after tax from discontinued operations includes the goodwill impairment in the United States registered in the first quarter of 2020 for an amount of €2,084m.

- (2) Adjusted by additional Tier 1 instrument remuneration.

Unless expressly indicated otherwise, to better understand the changes under the main headings of the Group's income statement, the year-on-year percentage changes provided below refer to constant exchange rates.

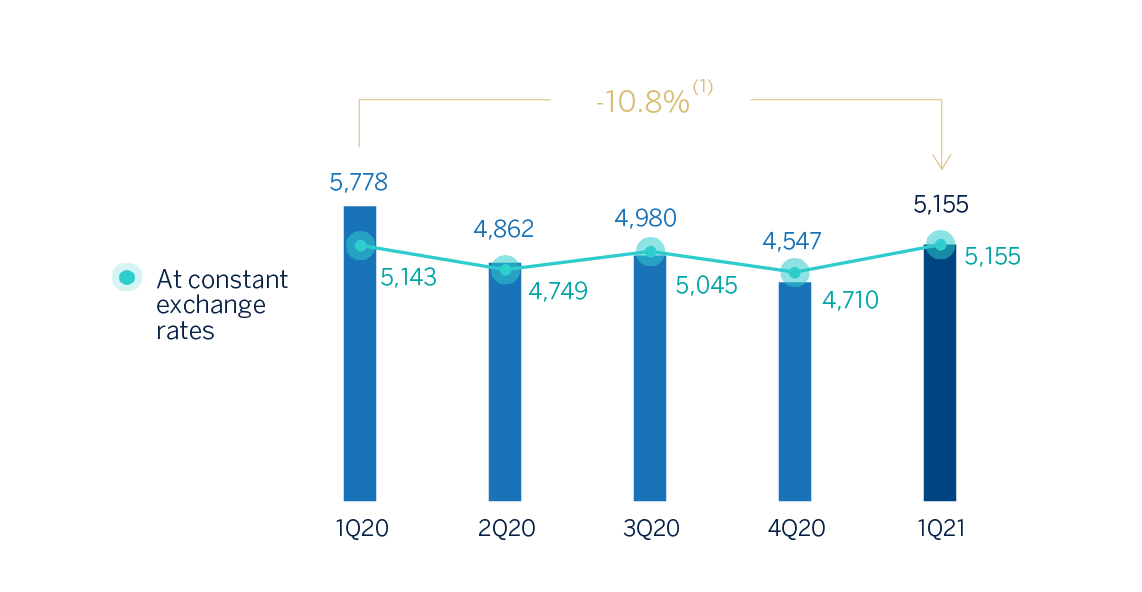

Gross income

Gross income showed year-on-year growth of 0.2%, underpinned by good performance in fees and NTI, which more than offset the negative evolution of net interest income. Conversely, the other operating income and expenses line recorded a loss of €11m, which contrasts negatively with last year's positive results due to the higher negative adjustment for inflation in Argentina in this line in the first quarter of 2021.

GROSS INCOME (MILLIONS OF EUROS)

(1) At constant exchange rates: +0.2%.

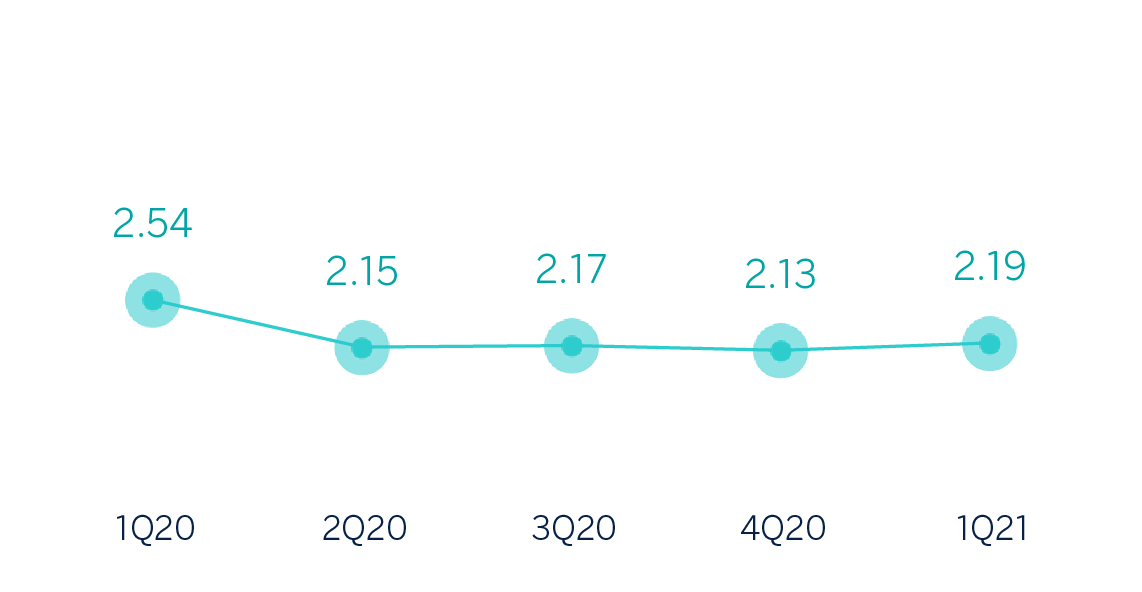

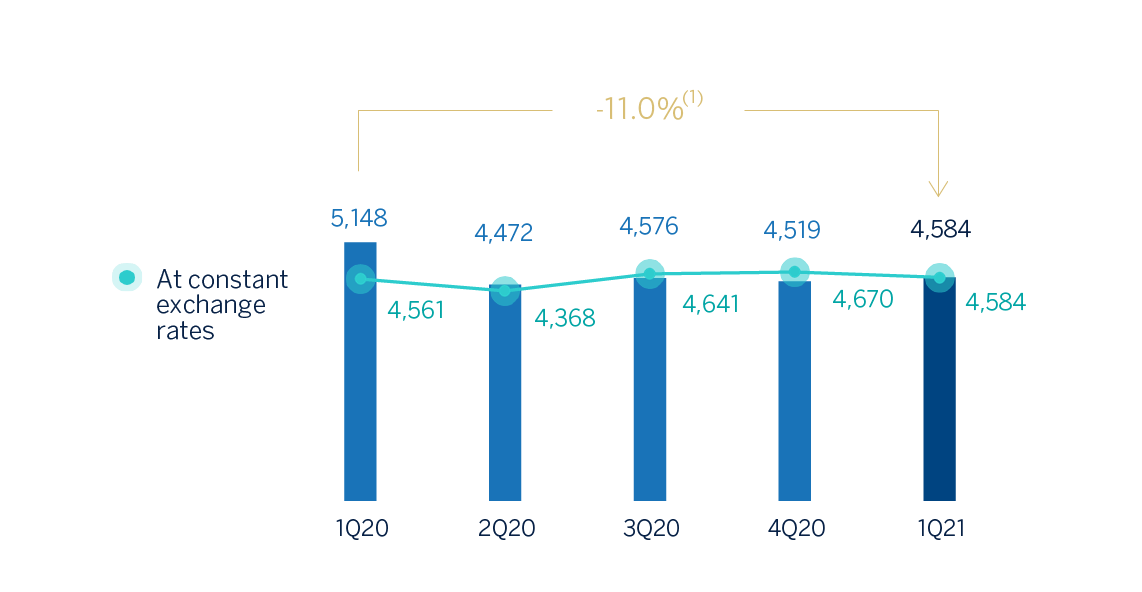

Net interest income income showed a year-on-year decline of 2.3%, impacted by the low interest rate environment.

Net fees and commissions howed good performance in all geographic areas, except for Rest of Business, which compares positively with the first quarter of 2020 (up 10.0%), as this line was barely affected by the outbreak of the COVID-19 pandemic.

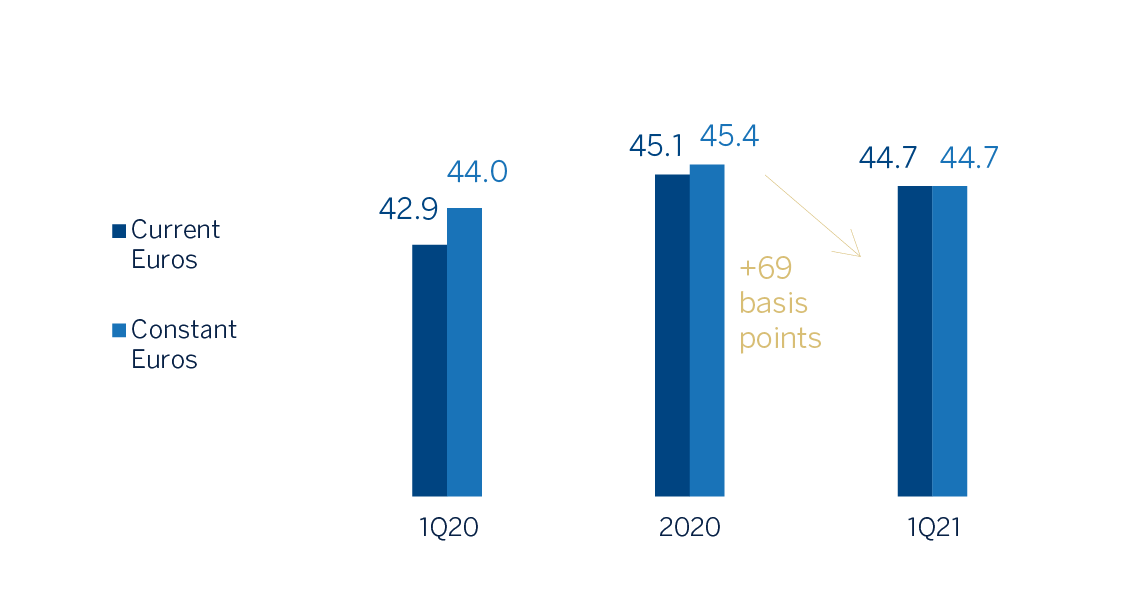

NET INTEREST INCOME/ATAS(1) (PERCENTAGE)

Excluding BBVA USA and the rest of the Group's companies in the United States included in the sale agreement signed with PNC.

NET INTEREST INCOME PLUS FEES AND COMMISSIONS (MILLIONS OF EUROS)

(1) At constant exchange rates: +0.5%.

NTI recorded excellent performance in all areas, with the exception of Mexico, where it fell slightly. For the Group as a whole, NTI recorded year-on-year growth of 16.1%.

The other operating income and expenses line recorded a fall of €-11m at the end of March 2021, compared to the positive results of €86m in the same period last year, due to the higher adjustment for hyperinflation in Argentina and the lower contribution of the insurance business in Spain and Mexico.

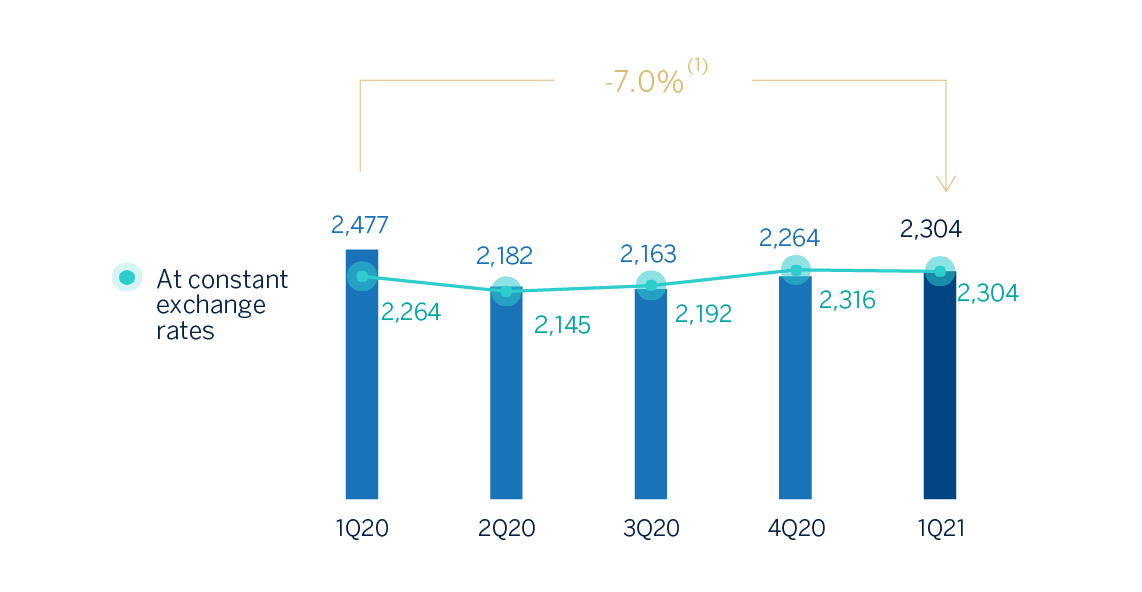

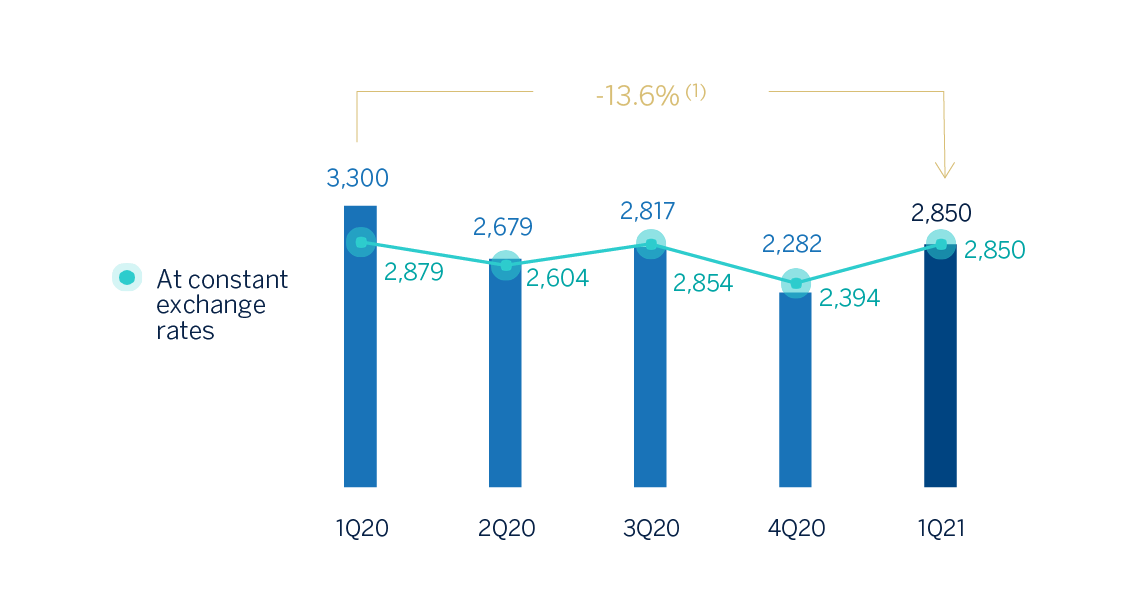

Operating income

Operating expenses increased 1.8% compared to the first quarter of 2020, showing an increase in all areas except for Spain and Rest of Business. Expenses remained controlled in the Corporate Center.

OPERATING EXPENSES (MILLIONS OF EUROS)

(1) At constant exchange rates: +1.8%.

As a result, the efficiency ratio stood at 44.7% as of March 31, 2021, with a slight increase compared to the ratio achieved a year earlier (44.0%), though it still remains low.

The performance of gross income and expenses led to a negative operating income variation of -1.0% year-on-year.

EFFICIENCY RATIO (PERCENTAGE)

OPERATING INCOME (MILLIONS OF EUROS)

(1) At constant exchange rates: -1.0%.

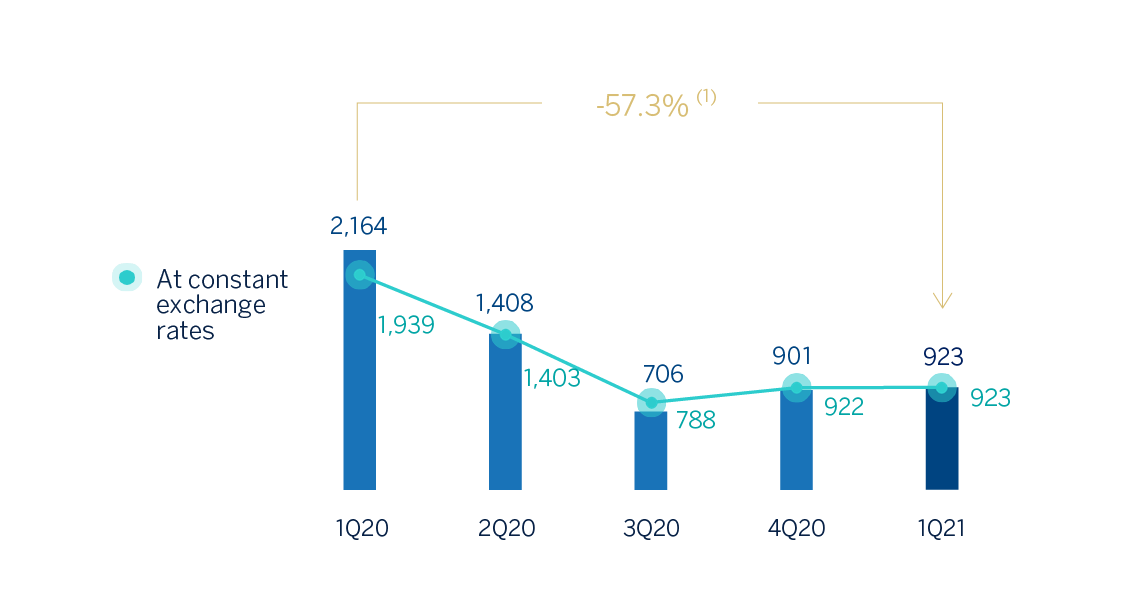

Provisions and other

At the end of March 2021, impairment on financial assets not measured at fair value through profit and loss (impairment on financial assets) was significantly below the figure recorded in the previous year (down 52.4%), mainly due to the negative impact of the worsening macroeconomic scenario in March 2020 as a result of the outbreak of the COVID-19 pandemic.

IMPAIRMENT ON FINANCIAL ASSESTS (MILLIONS OF EUROS)

(1) At constant exchange rates: -52.4%.

Provisions or reversal of provisions (hereinafter provisions) closed the first quarter of 2021 with a negative net balance of €151m, 47.8% lower than the loss recorded in March last year, mainly due to higher provisions in Spain in the first quarter of last year.

The other gains (losses) line closed March 2021 with a negative balance of €17m, 42.1% below the previous year.

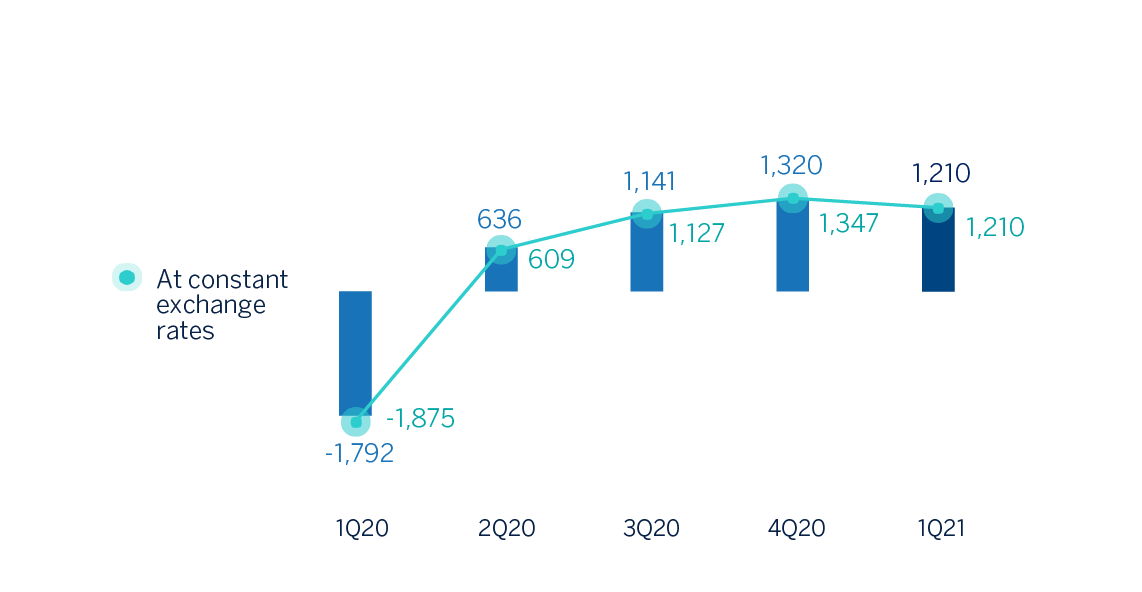

Results

As a result, the BBVA Group generated profit/(loss) after tax from continued operations of €1,270m between January and March 2021, representing a year-on-year change of +173.4%.

For its part, the results generated by the Group's businesses in the United States, inclued in the sale agreement with PNC and classified as discontinued operations, generated €177m, which compares very positively with the losses of €2,224m last year, which included the impact of the goodwill impairment in the country. As previously mentioned, these results are recorded in the Corporate Center under the results from discontinued operations line.

The Group's net attributable profit in the first quarter of 2021 therefore amounted to €1,210m. Excluding the results from discontinued operations, net attributable profit stood at €1,033m, representing year-on-year growth of 206.5%.

NET ATTRIBUTABLE PROFIT (MILLIONS OF EUROS)

NET ATTRIBUTABLE PROFIT EXCLUDING DISCONTINUED OPERATIONS(1) AND CORPORATE OPERATIONS 2 (MILLIONS OF EUROS)

(1)Results generated by BBVA USA and the rest of Group´s companies in the United States included in the sale agreement signed with PNC. These results include the goodwill impairment in the United States in 1Q20 amounting to €-2,084m.

(2) Net profit before tax from the sale to Allianz of half plus one share of the company created to jointly promote non-life insurance business in Spain, excluding the health insurance line.

(3) At constant exchange rates: +206.5%.

Net attributable profit, in millions of euros, accumulated at the close of March 2021 for the various business areas that comprise the Group was as follows: 381 in Spain, 493 in Mexico, 191 in Turkey, 104 in South America and 75 in Rest of Business.

TANGIBLE BOOK VALUE PER SHARE AND DIVIDENDS (1) (EUROS)

(1) Replenishing dividends paid in the period.

EARNING PER SHARE (1) (EUROS)

(1) Adjusted by additional Tier 1 instrument remuneration.

(2) Excluding discontinued and corporate operations.

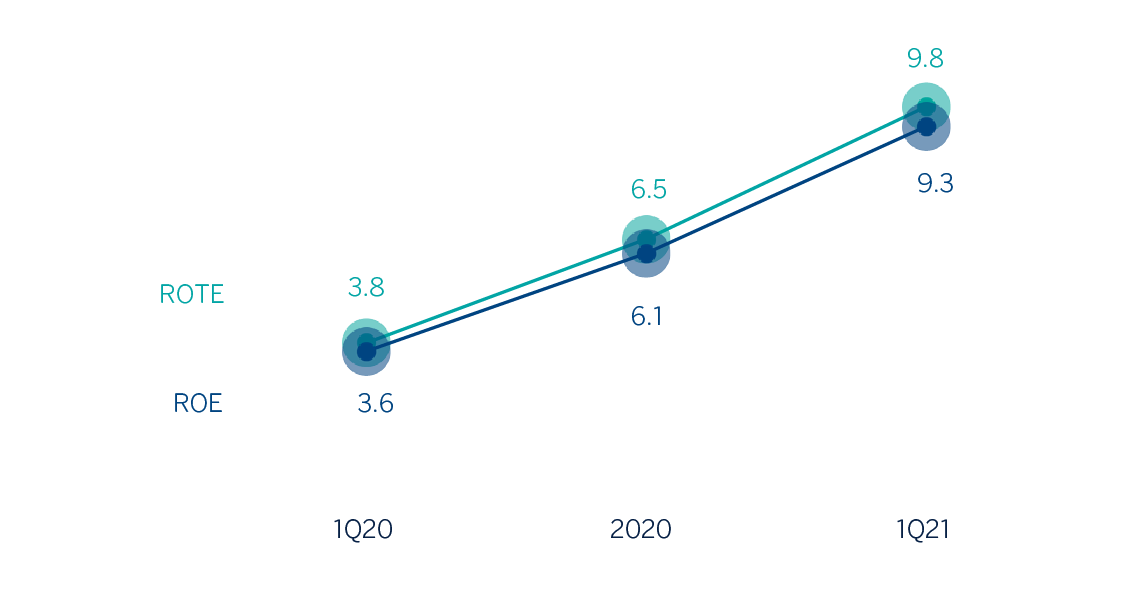

ROE AND ROTE (1) (PERCENTAGE)

(1) Ratios excluding profit after tax from discontinued operations in 1Q20, 2020 and 1Q21 and the net capital gain from the bancassurance operation with Allianz in 2020.

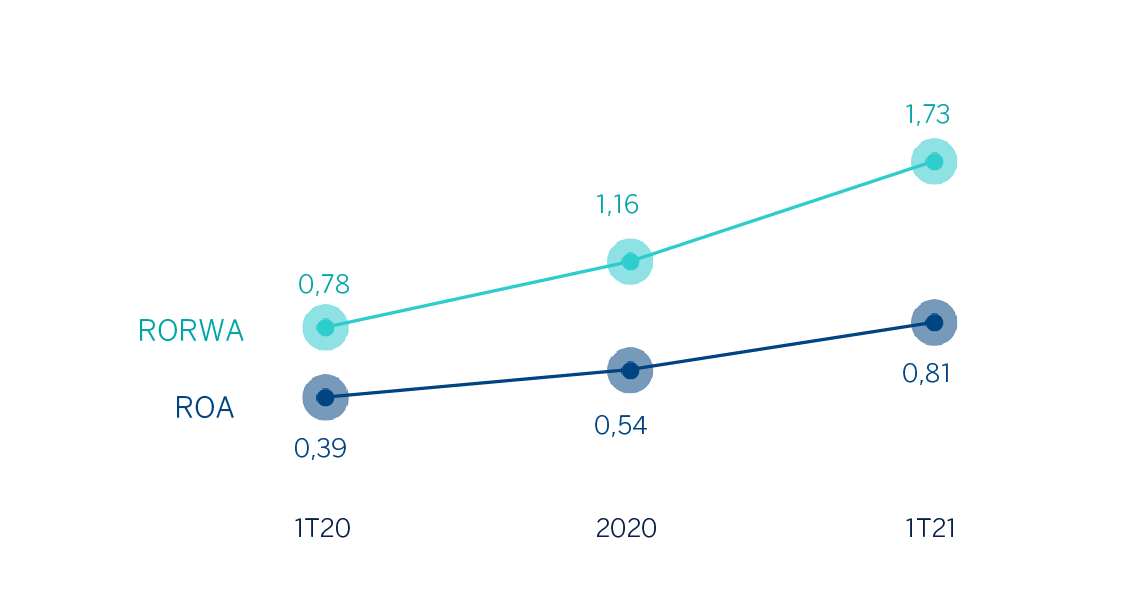

ROA AND RORWA (1) (PERCENTAGE)

(1) Ratios excluding profit after tax from discontinued operations in 1Q20, 2020 and 1Q21 and the net capital gain from the bancassurance operation with Allianz in 2020.