Solvency

Capital base

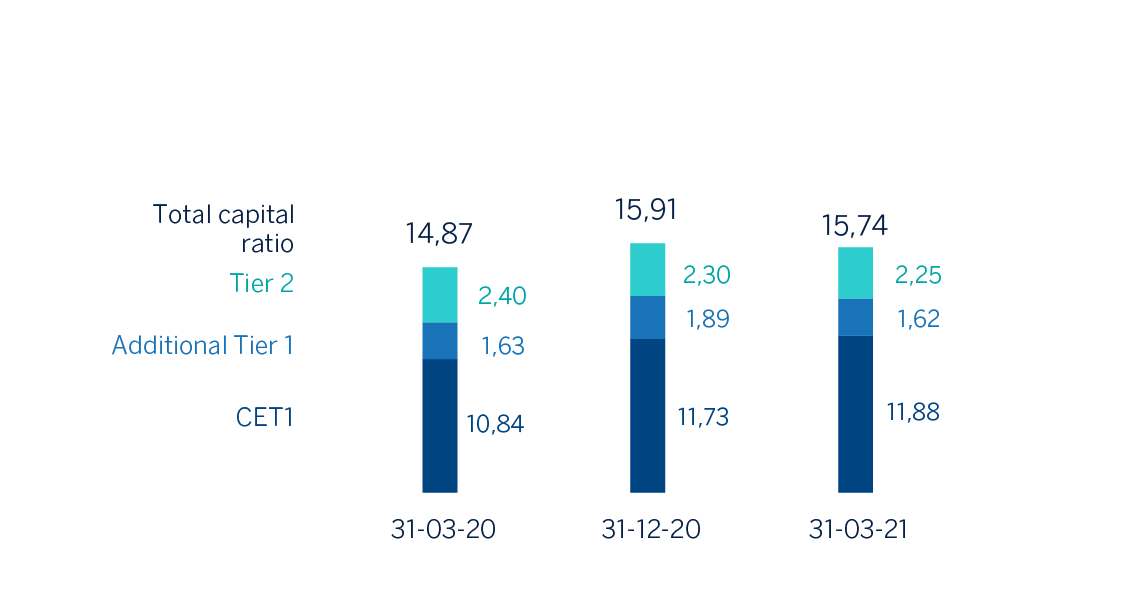

At the end March 2021, BBVA's fully-loaded CET1 ratio stood at 11.88%, within the range of the Group's management objective to maintain a ratio of between 11.5% and 12.0%, increasing the distance from the minimum requirement (currently in 8.59%) to 329 basis points. This ratio includes the positive effect of closing the sale of BBVA Paraguay by approximately 6 basis points. However, this ratio does not include the positive impact of the sale of BBVA USA and other companies in the United States with activities related to this banking business, which, according to the current estimate and taking the capital level of March 2021 as a reference, would place the fully-loaded CET1 ratio at 14.58%.

During the quarter, the fully-loaded CET1 ratio has increased by 15 basis points, mainly driven by the high organic capital generation (up 17 basis points net of accrued dividends and remuneration of AT1 instruments). Moreover, the impacts derived from the market evolution (down 13 basis points mostly related to the valuation of the portfolio at fair value) and those derived from the consideration of the Targeted Review of Internal Models (TRIM) carried out by the European Central Bank on the low default portfolio (which net of the release of the prudential buffer accrued in 2020 for this purpose, has had an impact of approximately -9 basis points), have been partially offset by the positive impact from the sale of BBVA Paraguay and the activity performance during the quarter in some geographical areas.

Fully-loaded risk-weighted assets (RWA) grew during the quarter by approximately €1,800m, including the effect of exchange rates, the sale of BBVA Paraguay and the aforementioned impact of the TRIM review on the low default portfolio.

Fully-loaded additional Tier 1 capital (AT1) stood at 1.62% at the end of March 2021. In this respect, in January 2021, early redemption options were implemented for two preferential issuances, issued by BBVA International Preferred, Caixa Sabadell Preferents and Caixa Terrassa Societat de Participacions Preferents, for £31m, €90m and €75m respectively. On April 14, BBVA executed the early redemption of an issuance of preferred securities that can be converted into BBVA ordinary shares (Contingent Convertible bonds, also known as CoCos) dating from 2016 for €1,000m and a coupon of 8.875%. It should be noted that this issuance did not need to be refinanced due to the Group's current capital strength. As of March 31, 2021, this issuance is no longer considered in the Group's capital adequacy ratios.

The fully-loaded Tier 2 ratio stood at 2.25% on March 31. BBVA Uruguay issued the first sustainable bond on the Uruguayan financial market in February for USD 15m at an initial interest rate of 3.854%.

The phased-in CET1 ratio stood at 12.20% at the end of March 2021, taking into account the transitional treatment of the IFRS 9 standard. AT1 stood at 1.61% and Tier 2 at 2.34%, resulting in a total capital adequacy ratio of 16.16%.

In regards to shareholder remuneration, a cash amount of €0.059 per share was distributed from BBVA's share premium account on April 29, 2021, as approved by the General Shareholders' Meeting on April 20, 2021.

SHAREHOLDER STRUCTURE (31-03-2021)

| Shareholders | Shares | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 500 | 356,931 | 41.1 | 66,867,844 | 1.0 |

| 501 to 5,000 | 403,495 | 46.4 | 703,337,365 | 10.5 |

| 5,001 to 10,000 | 58,193 | 6.7 | 409,802,697 | 6.1 |

| 10,001 to 50,000 | 45,687 | 5.3 | 874,377,516 | 13.1 |

| 50,001 to 100,000 | 3,301 | 0.4 | 224,600,541 | 3.4 |

| 100,001 to 500,000 | 1,483 | 0.2 | 268,505,348 | 4.0 |

| More than 500,001 | 288 | 0.0 | 4,120,395,269 | 61.8 |

| Total | 869,378 | 100.0 | 6,667,886,580 | 100.0 |

FULLY-LOADED CAPITAL RATIOS (PERCENTAGE)

CAPITAL BASE (MILLIONS OF EUROS)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 31-03-21 (1) (2) | 31-12-20 | 31-03-20 | 31-03-21 (1) (2) | 31-12-20 | 31-03-20 | |

| Common Equity Tier 1 (CET 1) | 43,234 | 42,931 | 40,854 | 42,092 | 41,345 | 39,986 |

| Tier 1 | 48,955 | 49,597 | 46,974 | 47,818 | 48,012 | 45,981 |

| Tier 2 | 8,294 | 8,547 | 9,757 | 7,959 | 8,101 | 8,852 |

| Total Capital (Tier 1 + Tier 2) | 57,249 | 58,145 | 56,731 | 55,778 | 56,112 | 54,833 |

| Risk-weighted assets | 354,342 | 353,273 | 368,666 | 354,433 | 352,622 | 368,839 |

| CET1 (%) | 12.20 | 12.15 | 11.08 | 11.88 | 11.73 | 10.84 |

| Tier 1 (%) | 13.82 | 14.04 | 12.74 | 13.49 | 13.62 | 12.47 |

| Tier 2 (%) | 2.34 | 2.42 | 2.65 | 2.25 | 2.30 | 2.40 |

| Total capital ratio (%) | 16.16 | 16.46 | 15.39 | 15.74 | 15.91 | 14.87 |

- (1) As of March 31, 2021, the difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS 9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR and the subsequent amendments introduced by the Regulation (EU) 2020/873).

- (2) Preliminary data.

With regard to MREL (Minimum Requirement for own funds and Eligible Liabilities) requirements, BBVA issued preferred senior debt for an amount of €1,000m in March 2021 with the aim of strengthening the eligible liabilities for compliance with the MREL ratio and mitigating the loss of eligibility of two senior preferred and one senior non-preferred issuances issued during 2017 that matures in one year. The term of the operation is 6 years with an early redemption option in the fifth year and a coupon of 0.125%, the lowest coupon paid on such a product in BBVA’s history, implying practically a zero share premium thanks to the high demand of 1.5 times oversubscription.

The Group estimates that, following the entry into force of Regulation (EU) No. 2019/877 of the European Parliament and of the Council of May 20, 2020 (which, among other matters, establishes the MREL in terms of RWAs and sets new maturities and transition periods, which the Group believes will apply to its MREL requirement), the current structure of own funds and eligible liabilities enables compliance with its MREL requirement.

Finally, the Group's leverage ratio maintained a solid position, at 6.5% fully-loaded (6.7% phased-in). These figures include the effect of the temporary exclusion of certain positions with the central bank provided for in the "CRR-Quick fix."

Ratings

In the first four months of 2021, BBVA's rating has continued to demonstrate its stability and all rating agencies have continued to maintain BBVA's rating in category A. On March 31, 2021, the agency DBRS confirmed both BBVA's A (high) rating and its stable outlook.

The following table shows the credit ratings granted by rating agencies.

Ratings

| Rating agency | Long term (1) | Short term | Outlook |

|---|---|---|---|

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s | A3 | P-2 | Stable |

| Standard & Poor’s | A- | A-2 | Negative |

- (1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating respectively, to BBVA’s long term deposits.