Solvency

Capital base

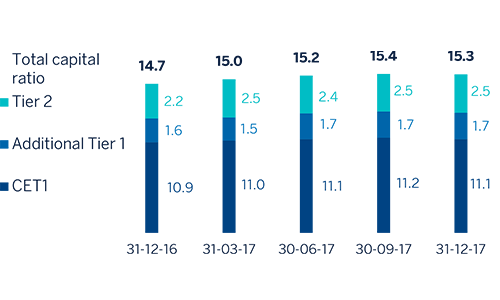

The BBVA Group's fully-loaded CET1 ratio stood at 11.1% at the end of December 2017, in line with the target of 11%. This ratio has increased by 18 basis points since the end of 2016, leveraged on organic earning generation and reduction of RWA capital consumption.

During 2017, the capital ratio was affected by the acquisition of an additional 9.95% stake in Garanti and the sale of CNCB. These transactions have had a combined negative effect on the ratio of 13 basis points. In addition, the Group also recognized losses of €1,123m in 2017 as a result of the impairment losses from its stake in Telefónica. However, this impact does not affect the capital base, as these losses are deducted from the Group's capital.

RWAs declined year-on-year, largely due to the depreciation of currencies against the euro (in particular, the Turkish lira and U.S. dollar).

BBVA S.A. carried out two capital issuances classified as additional tier 1 (AT1) capital (contingent convertible), for €500m and USD 1 billion, respectively (the latter in the U.S. market, with a prospectus registered with the SEC and not yet calculated in the Group's Tier 1 as of 31-Dec-2017). As Tier 2 level, BBVA S.A. issued subordinated debt during the year for a total of approximately €1.5 billion; and in Turkey, Garanti issued USD 750m.

Finally, with respect to capital distribution, the last "dividend-option" program was completed in April, with holders of 83.28% of rights choosing to receive new shares. On October 10, an interim dividend for 2017 was distributed at €0.09 per share.

As of 31-Dec-2017 the CET1 phased-in capital ratio stood at 11.7%, the Tier 1 ratio at 13.0% (13.3% taking into account the AT1 issuance of USD 1 billion on the U.S. market in the fourth quarter of 2017) and the Tier 2 ratio of 2.5%, resulting in a total capital ratio of 15.5% (15.8% taking into account the AT1 issuance mentioned above). These levels are above the requirements established by the regulator in its SREP letter and the systemic buffers applicable to BBVA Group for 2017 (7.625% for the phased-in CET1 ratio and 11.125% for the total capital ratio). Starting on January 1, 2018, the requirement has been established at 8.438% for the phased-in CET1 ratio and 11.938% for the total capital ratio. The change with respect to 2017 is due to the progressive implementation of the capital conservation buffers and the buffer related to other systemically important banks. The regulatory requirement for 2018 in fully-loaded terms remains unchanged (CET1 of 9.25% and total ratio of 12.75%) compared with the previous year.

Finally, the Group maintains a sound leverage ratio: 6.6% under fully-loaded criteria (6.7% phased-in), which continues to be the highest in its peer group.

Evolution of fully-loaded capital ratios (1) (Percentage)

(1) As of 31-12-2017 it includes update of the calculation on Structural FX RWA, pending confirmation by ECB. Additionally, it includes the AT2 issuance by Garanti, pending approval by ECB for the purpose of computability in the Group's ratio.

Capital base (1, 2) (Million euros)

| CRD IV phased-in (1) | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 31-12-2017 (3) | 31-12-16 | 30-09-17 | 31-12-2017 (3) | 31-12-16 | 30-09-17 | |

| Common Equity Tier 1 (CET 1) | 42,337 | 47,370 | 43,393 | 40,058 | 42,398 | 40,899 |

| Tier 1 | 46,977 | 50,083 | 47,983 | 46,313 | 48,459 | 47,138 |

| Tier 2 | 8,798 | 8,810 | 9,237 | 8,624 | 8,739 | 8,953 |

| Total Capital (Tier 1 + Tier 2) | 55,775 | 58,893 | 57,219 | 54,937 | 57,198 | 56,091 |

| Risk-weighted assets | 361,686 | 388,951 | 365,314 | 361,686 | 388,951 | 365,314 |

| CET1 (%) | 11.7 | 12.2 | 11.9 | 11,1 | 10.9 | 11.2 |

| Tier 1 (%) | 13.0 | 12.9 | 13.1 | 12.8 | 12.5 | 12.9 |

| Tier 2 (%) | 2.5 | 2.3 | 2.5 | 2.5 | 2.2 | 2.4 |

| Total capital ratio (%) | 15.5 | 15.1 | 15.7 | 15.3 | 14.7 | 15.4 |

- (1) The capital ratios are calculated under CRD IV from Basel III regulation, applying a 80% phase-in for 2017 and a 60% for 2016.

- (2) As of 31-12-2017 it includes update of the calculation on Structural FX RWA, pending approval by ECB. Additionally, it includes the AT2 issuance by Garanti, pending approval by ECB for the purpose of computability in the Group's ratio.

- (3) Preliminary data.

Ratings

In 2017, Standard & Poor's (S&P) raised its outlook for BBVA to positive from stable as a result of a similar improvement in Spain's sovereign rating outlook, with both ratings being maintained at BBB+. Scope Ratings raised BBVA's long-term rating one notch from A to A+, and the short-term rating from S-1 to S-1+, both with a stable outlook. The rest of the credit rating agencies did not change either BBVA's rating or its outlook in 2017.

Ratings

| Rating agency | Long term | Short term | Outlook |

|---|---|---|---|

| DBRS | A | R-1 (low) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s (1) | Baa1 | P-2 | Stable |

| Scope Ratings | A+ | S-1+ | Stable |

| Standard & Poor’s | BBB+ | A-2 | Positive |

- (1) Additionally, Moody’s assigns an A3 rating to BBVA’s long-term deposits.