The BBVA share

Global economic growth held steady at around 1% quarter-on-quarter in the first nine months of 2017, and latest available indicators suggest that this momentum continued into the final part of the year. Confidence data continues to improve, accompanied by a recovery in world trade and the industrial sector, while private consumption remains robust in developed countries. This positive trend reflects improved economic performance in all regions: in contrast to other post-financial crisis periods, there has been a global synchronous recovery.

With respect to the main stock-market indices, in Europe the Stoxx 50 and Euro Stoxx 50 closed the year with gains of 5.6% and 6.5% respectively. In Spain the Ibex 35 fell back slightly over the last three months by 3.3%, but its cumulative performance for the year has remained positive, recording a gain of 7.4%. In the United States, the S&P 500 index performed very positively during the year, with a gain of 19.4% since December 2016.

The banking sector in Europe has also performed positively in 2017. The European bank index Stoxx Banks, which includes British banks, gained 8.1%, while the Eurozone bank index, the Euro Stoxx Banks, was up 10.9% in the same period. In the United States the S&P Regional Banks index gained 6.0% over the year compared to the closing data as of the end of 2016.

The BBVA share closed 2017 at €7.11, a cumulative gain of 10.9% since December 2016. This represents a relatively better performance than the European banking sector and the Ibex 35.

BBVA share evolution compared with European indices

(Base índice 100=31-12-2016)

The BBVA share and share performance ratios

| 31-12-17 | 31-12-16 | |

|---|---|---|

| Number of shareholders | 891,453 | 935,284 |

| Number of shares issued | 6,667,886,580 | 6,566,615,242 |

| Daily average number of shares traded | 35,820,623 | 47,180,855 |

| Daily average trading (million euros) | 252 | 272 |

| Maximum price (euros) | 7.93 | 6.88 |

| Minimum price (euros) | 5.92 | 4.50 |

| Closing price (euros) | 7.11 | 6.41 |

| Book value per share (euros) | 6.96 | 7.22 |

| Tangible book value per share (euros) | 5.69 | 5.73 |

| Market capitalization (million euros) | 47,422 | 42,118 |

| Yield (dividend/price; %) (1) | 4.2 | 5.8 |

- (1) Calculated by dividing shareholder remuneration over the last twelve months over the closing price at the end of the period.

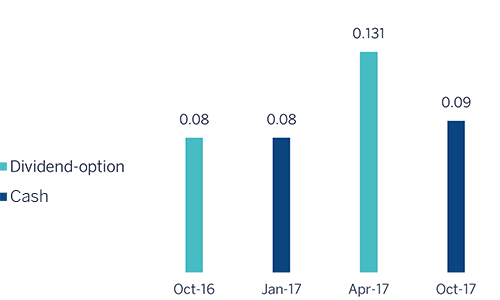

In the Significant Event published on February 1, 2017, BBVA announced its intention of modifying its shareholder remuneration policy to one of a fully cash payment. This policy will be formed each year of an interim dividend (which is expected to be paid in October) and a final dividend (which will be paid out upon completion of the final year and following approval of the application of the result, foreseeably in April). These payouts will be subject to appropriate approval by the corresponding governing bodies. It is expected to be proposed for the consideration of the competent governing bodies a cash payment in a gross amount of euro 0.15 per share to be paid in April as final dividend for 2017.

Shareholder remuneration

(Euros-gross-/share)

As of December 31, 2017, the number of BBVA shares was still 6,668 million and the number of shareholders was 891,453. Investors resident in Spain holded 43.44% of share capital, while non-resident shareholders holded the remaining 56.56%.

Shareholder structure (31-12-2017)

| Numbers of shares |

Shareholders | Shares | ||

|---|---|---|---|---|

| Number | % | Number | % | |

| Up 150 | 184,797 | 20.7 | 13,171,010 | 0.2 |

| 151 to 450 | 182,854 | 20.5 | 49,996,632 | 0.7 |

| 451 to 1,800 | 279,883 | 31.4 | 272,309,651 | 4.1 |

| 1,801 to 4,500 | 128,005 | 14,4 | 364,876,715 | 5.5 |

| 4,501 to 9,000 | 59,585 | 6.7 | 375,424,611 | 5.6 |

| 9,001 to 45,000 | 49,938 | 5.6 | 869,649,638 | 13.0 |

| More than 45,001 | 6,391 | 0.7 | 4,722,458,323 | 70.8 |

| Total | 891,453 | 100.0 | 6,667,886,580 | 100.0 |

BBVA shares are listed on the main stock market indices, such as the Ibex 35, Euro Stoxx 50 and Stoxx 50, with a weighting of 8.9%, 2.0% and 1.3% respectively. They are also listed on several sector indices, including the Euro Stoxx Banks, with a weighting of 8.7%, and the Stoxx Banks, with a weighting of 4.3%.

Finally, BBVA maintains a significant presence on a number of international sustainability indices or ESG (environmental, social and governance) indices, which evaluate the performance of companies in this area, as summarized in the table below.

Sustainability indices on which BBVA is listed as of 31-12-2017 (1)

(1)The inclusion of BBVA in any MSCI index, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement or promotion of BBVA by MSCI or any of its affiliates. The MSCI indices are the exclusive property of MSCI. MSCI and the MSCI index names and logos are trademarks or service marks of MSCI or its affiliates.