Solvency

Capital base

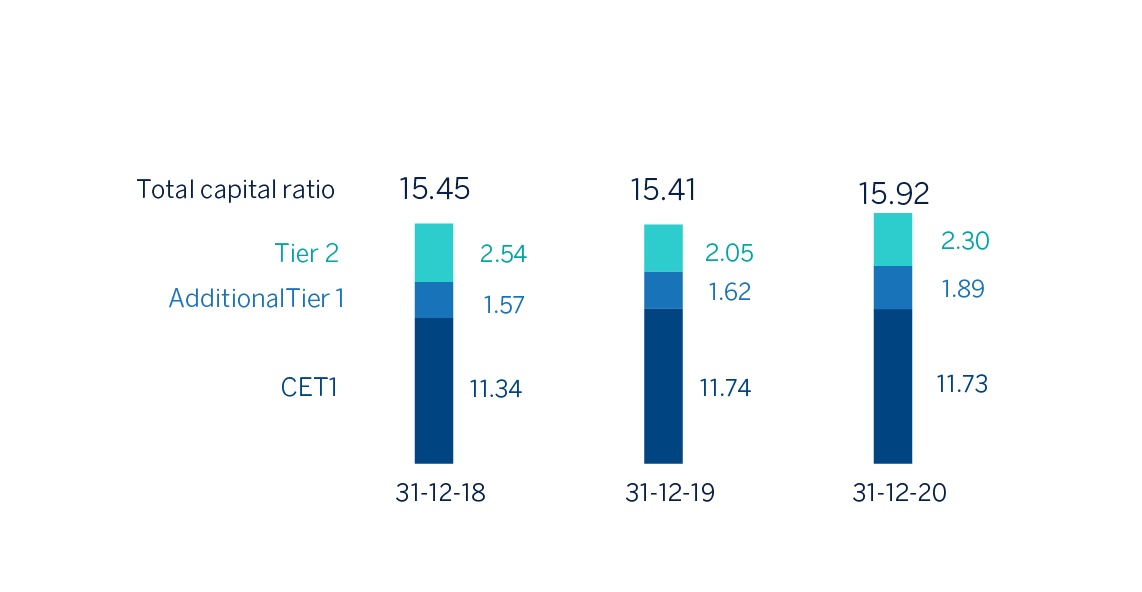

BBVA's fully-loaded CET1 ratio stood at 11.73% at the end of December 2020. From 2021 onwards the BBVA Group sets the target to keep the CET1 fully-loaded ratio between 11.5%-12.0% increasing the distance to the minimum requirement (currently at 8.59%) to 291-341 basis points. At the end of 2020 financial year the CET1 fully-loaded ratio is already within this target management range.

In the last quarter of 2020, the CET1 fully-loaded ratio stood 21 basis points above the previous quarter. This increase includes a positive impact of +7 basis points due to the execution of the agreement reached with Allianz to jointly boost the non-life insurance business in Spain, excluding the health insurance line. The corresponding amount to €0.059 (gross) per share as shareholder remuneration allowed by the ECB recommendation has been already deduced from the capital base. This ratio does not include the positive impact of the sale of BBVA USA and other companies in the United States with activities related to said banking business, which, according to the current estimate and using as a reference the capital level in December 2020, would place the fully-loaded CET1 ratio at 14.58%. Additionally, it does not include the effect from the closing of the BBVA Paraguay sale, which would have a positive impact of approximately +6 basis points and which will be registered in the first quarter of 2021.

Furthermore, the profit generated in the period, excluding the gains generated by the operation with Allianz, has contributed +30 basis points, while the other elements of the capital ratios has contributed to a total net impact of -16 points, being the most significant component the growth in risk-weighted assets, and, conversely, the good market performance recorded in equity instruments measured at fair value through accumulated other comprehensive income. It also includes the positive effect on the regulatory deduction of software, following the publication of Delegated Regulation 2020/2176 on December 22 concerning the prudential treatment of software.

Fully-loaded additional Tier 1 capital (AT1) stood at 1.89% at the end of December 2020. In this regard, the world's first green CoCo for a financial institution was issued in July 2020 for €1,000m, a coupon of 6% and with an early amortization option from five and a half years, allowing all requirements at this tier to be fulfilled, including those from the tiering of Pillar 2 and therefore the distance to MDA to be increased. Moreover, a CoCo of €1,500m (coupon of 6.75%) was amortized in February, on the first date of the early amortization option; in January 2021, the early amortization options were implemented for two preferential issuances, issued by BBVA International Preferred and Caixa Sabadell Preferents for 31 million pounds sterling and €90m respectively; and finally, for a third preferential issuance issued by Caixa Terrassa Societat de Participacions Preferents, the bondholders' meeting has approved its early amortization on January 29, 2021 (versus the amortization option date of August 10, 2021). As of December 31, 2020, these issuances do not form part of the Group's capital adequacy ratios.

The fully-loaded Tier 2 ratio stood at 2.30% on December 31. Two Tier 2 issuances were issued in 2020: an issuance of €1,000m in January, with a maturity of 10 years and an amortization option from the fifth year, with a coupon of 1%; and another issuance of 300 million pounds sterling in July, with a maturity of 11 years and with an early amortization option from the sixth year, with a coupon of 3.104%, thereby diversifying the investment base and improving the price compared to an equivalent issuance in euros.

The phased-in CET1 ratio stood at 12.15% at the end of December 2020, taking into account the transitory effect of the IFRS 9 standard. AT1 stood at 1.89% and Tier 2 at 2.42%, resulting in a total capital adequacy ratio of 16.46%.

Regarding shareholder remuneration, on April 9, 2020, a cash payment was made for a supplementary dividend for the 2019 financial year for the gross amount of €0.16 per share, according to the approved at the General Shareholders' Meeting on March 13, 2020. This amounted to €1,067m. Thus, the total dividend for the 2019 financial year amounts to €0.26 gross per share. This distribution had no impact on the evolution of the capital adequacy ratio since it had already accrued at the end of 2019.

BBVA has announced its intention to return in 2021 to its shareholders remuneration policy, communicated through a relevant event on February 1, 2017, consisting of distributing annually between 35% and 40% of the profits resulting of each financial year entirely in cash through two distributions (predictably in October and April and subject to relevant approvals) when the current ECB recommendation applicable on the date of publication of this report is revoked and there are no additional restrictions or limitations. (For more information see the “Pronouncements of regulatory bodies and supervisors” paragraph, included in the “Highlights” section).

SHAREHOLDER STRUCTURE (31-12-2020)

| Shareholders | Shares | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 500 | 361,681 | 41.1 | 67,754,273 | 1.0 |

| 501 to 5,000 | 406,886 | 46.3 | 710,105,474 | 10.6 |

| 5,001 to 10,000 | 59,129 | 6.7 | 416,320,737 | 6.2 |

| 10,001 to 50,000 | 46,362 | 5.3 | 888,242,755 | 13.3 |

| 50,001 to 100,000 | 3,366 | 0.4 | 229,327,509 | 3.4 |

| 100,001 to 500,000 | 1,513 | 0.2 | 273,726,222 | 4.1 |

| More than 500,001 | 289 | 0.0 | 4,082,409,610 | 61.2 |

| Total | 879,226 | 100.0 | 6,667,886,580 | 100.0 |

FULLY-LOADED CAPITAL RATIOS (PERCENTAGE)

CAPITAL BASE (MILLIONS OF EUROS)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 31-12-20 (1) (2) | 30-09-20 | 31-12-19 | 31-12-20 (1) (2) | 30-09-20 | 31-12-19 | |

| Common Equity Tier 1 (CET 1) | 42,931 | 41,231 | 43,653 | 41,368 | 39,651 | 42,856 |

| Tier 1 | 49,597 | 48,248 | 49,701 | 48,035 | 46,550 | 48,775 |

| Tier 2 | 8,549 | 9,056 | 8,304 | 8,103 | 8,628 | 7,464 |

| Total Capital (Tier 1 + Tier 2) | 58,147 | 57,305 | 58,005 | 56,138 | 55,178 | 56,240 |

| Risk-weighted assets | 353,272 | 343,923 | 364,448 | 352,679 | 344,215 | 364,942 |

| CET1 (%) | 12.15 | 11.99 | 11.98 | 11.73 | 11.52 | 11.74 |

| Tier 1 (%) | 14.04 | 14.03 | 13.64 | 13.62 | 13.52 | 13.37 |

| Tier 2 (%) | 2.42 | 2.63 | 2.28 | 2.30 | 2.51 | 2.05 |

| Total capital ratio (%) | 16.46 | 16.66 | 15.92 | 15.92 | 16.03 | 15.41 |

- (1) As of December 31, 2020, the difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS 9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR and the subsequent amendments introduced by the Regulation (EU) 2020/873).

- (2) Preliminary data.

Regarding the MREL (Minimum Requirement for own funds and Eligible Liabilities) requirements, BBVA has continued its issuance plan during 2020 by closing two public issuances of non-preferred senior debt, one in January 2020 for €1,250m with a maturity of seven years and a coupon of 0.5%, and another in February 2020 for CHF 160m with a maturity of six and a half years and a coupon of 0.125%. In May 2020, the first issuance of a COVID-19 social bond by a private financial institution in Europe was completed. This is a five-year senior preferred bond, for €1,000m and a coupon of 0.75%. Finally, in order to optimize the MREL requirement, in September BBVA issued preferred senior debt of USD 2,000m in two tranches, with maturities of three and five years, for USD 1,200m and USD 800m and coupons of 0.875% and 1.125% respectively.

The Group estimates that, following the entry into force of Regulation (EU) No. 2019/877 of the European Parliament and of the Council of May 20 (which, among other matters, establishes the MREL in terms of RWAs and new periods for said requirement's transition and implementation), the current structure of shareholders’ funds and admissible liabilities enables compliance with the MREL.

Finally, the Group's leverage ratio maintained a solid position, at 6.5% fully-loaded (6.7% phased-in). These figures include the effect of the temporary exclusion of certain positions with the central bank provided for in the "CRR-Quick fix."

Ratings

In a year marked by the COVID-19 pandemic, BBVA’s has maintained its rating during 2020 in the single A space for senior preferred debt granted by all agencies. DBRS confirmed BBVA’s rating at A (high) with a stable outlook on April 1, and on April 29 S&P confirmed BBVA’s rating (A-) and its outlook (negative) in a joint action with the rest of the Spanish banks, in which the agency also assigned a negative outlook to the majority of the Spanish banks. In the month of July, as a consequence of the economic uncertainty caused by COVID-19 in the countries where BBVA is present, the rating agency Fitch downgraded its rating by one notch to A- with a stable outlook. For its part, Moody’s has maintained BBVA’s rating at A3 with a stable outlook. These ratings, together with their corresponding outlooks, are shown in the following table:

Ratings

| Rating agency | Long term (1) | Short term | Outlook |

|---|---|---|---|

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s | A3 | P-2 | Stable |

| Standard & Poor’s | A- | A-2 | Negative |

- (1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating respectively, to BBVA’s long term deposits.