Results

The BBVA Group generated a net attributable profit of €1,305m during 2020, in a year marked by several factors that influenced the income statement:

- First, the outbreak of the COVID-19 pandemic, the main impacts of which were the increased impairment on financial assets and higher provisions.

- Secondly, the goodwill impairment in the United States recorded in the first quarter of 2020, amounting to €2,084m, also as a result of the pandemic.

- Lastly, and to a lesser extent, the execution of the agreement reached with Allianz, once all required authorizations were received, which had a net capital gain of €304m.

CONSOLIDATED INCOME STATEMENT: QUARTERLY EVOLUTION (MILLIONS OF EUROS)

| 2020 | 2019 | |||||||

|---|---|---|---|---|---|---|---|---|

| 4Q | 3Q | 2Q | 1Q | 4Q | 3Q | 2Q | 1Q | |

| Net interest income | 4,038 | 4,109 | 4,097 | 4,556 | 4,709 | 4,473 | 4,544 | 4,398 |

| Net fees and commissions | 1,173 | 1,143 | 1,043 | 1,258 | 1,290 | 1,273 | 1,256 | 1,214 |

| Net trading income | 213 | 372 | 512 | 594 | 490 | 351 | 116 | 426 |

| Other operating income and expenses | (157) | 38 | (91) | 75 | (89) | 22 | (18) | 8 |

| Gross income | 5,266 | 5,663 | 5,561 | 6,484 | 6,400 | 6,120 | 5,897 | 6,046 |

| Operating expenses | (2,674) | (2,570) | (2,594) | (2,918) | (3,082) | (2,946) | (2,952) | (2,922) |

| Personnel expenses | (1,420) | (1,356) | (1,342) | (1,532) | (1,637) | (1,572) | (1,578) | (1,553) |

| Other administrative expenses | (892) | (848) | (884) | (988) | (1,039) | (971) | (976) | (977) |

| Depreciation | (362) | (366) | (369) | (397) | (406) | (403) | (398) | (392) |

| Operating income | 2,593 | 3,093 | 2,967 | 3,566 | 3,317 | 3,174 | 2,945 | 3,124 |

| Impairment on financial assets not measured at fair value through profit or loss | (834) | (928) | (1,571) | (2,575) | (1,169) | (1,172) | (731) | (1,001) |

| Provisions or reversal of provisions | (144) | (60) | (228) | (312) | (243) | (113) | (117) | (144) |

| Other gains (losses) | (83) | (128) | (101) | (29) | (126) | (4) | (3) | (22) |

| Profit/(loss) before tax | 1,532 | 1,978 | 1,066 | 649 | 1,778 | 1,886 | 2,095 | 1,957 |

| Income tax | (407) | (524) | (269) | (186) | (430) | (488) | (595) | (541) |

| Profit/(loss) after tax | 1,125 | 1,454 | 798 | 463 | 1,349 | 1,398 | 1,500 | 1,416 |

| Goodwill impairment in the United States and corporate operations (1) | 304 | - | - | (2,084) | (1,318) | - | - | - |

| Profit/(loss) for the year | 1,430 | 1,454 | 798 | (1,621) | 31 | 1,398 | 1,500 | 1,416 |

| Non-controlling interests | (110) | (312) | (162) | (172) | (186) | (173) | (241) | (234) |

| Net attributable profit/(loss) | 1,320 | 1,141 | 636 | (1,792) | (155) | 1,225 | 1,260 | 1,182 |

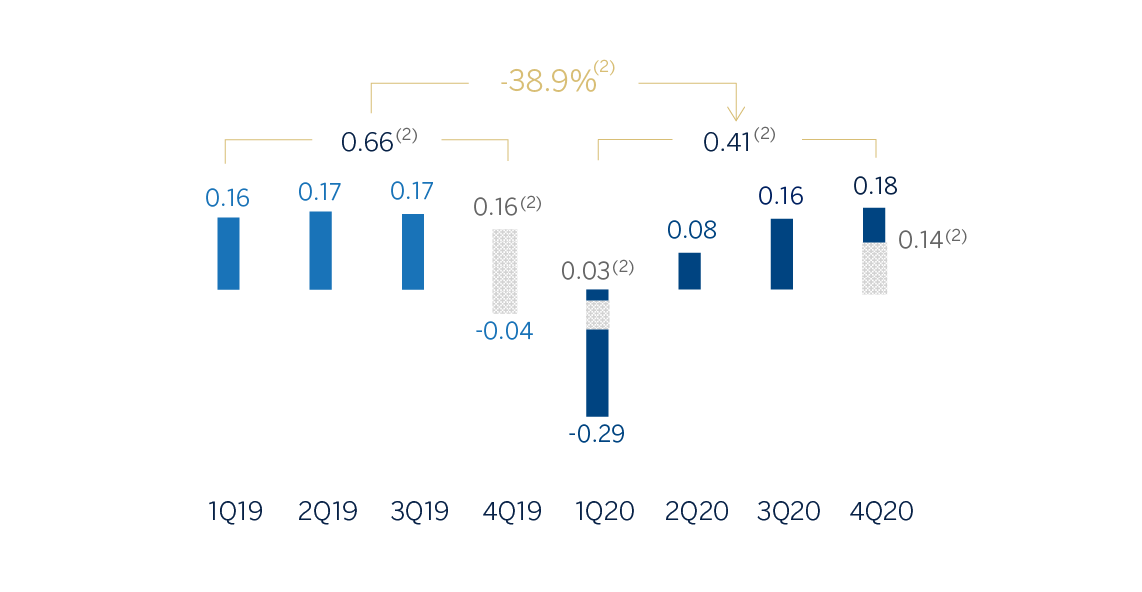

| Earning per share (euros) (2) | 0.18 | 0.16 | 0.08 | (0.29) | (0.04) | 0.17 | 0.17 | 0.16 |

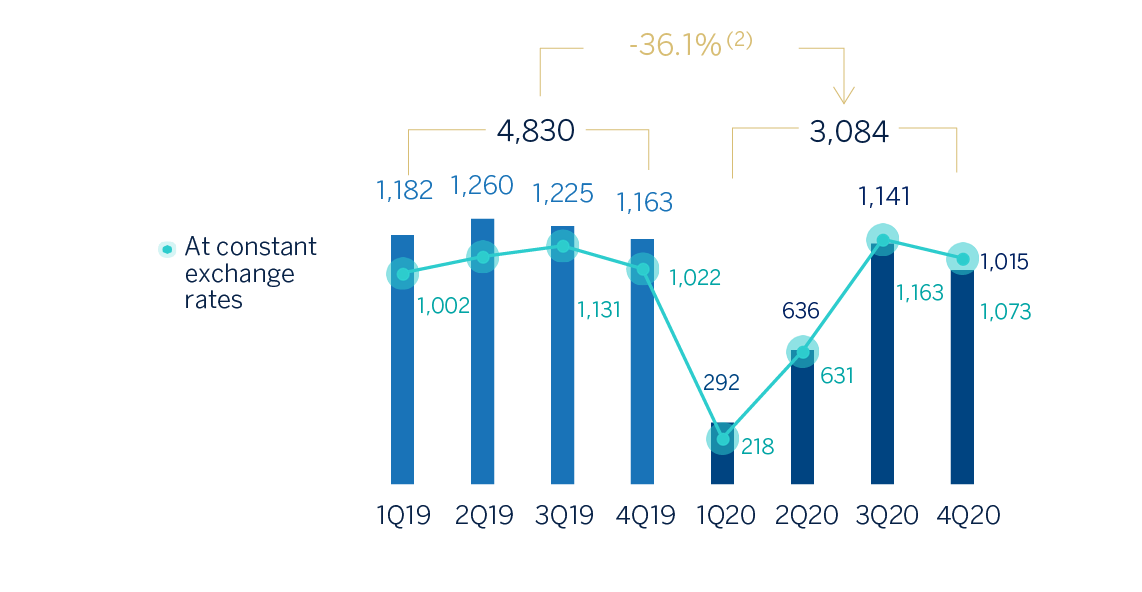

| Net attributable profit/(loss) excluding the goodwill impairment in the United States and corporate operations (1) | 1,015 | 1,141 | 636 | 292 | 1,163 | 1,225 | 1,260 | 1,182 |

| Earning per share excluding the goodwill impairment in the United States and corporate operations (euros) (1)(2) | 0.14 | 0.16 | 0.08 | 0.03 | 0.16 | 0.17 | 0.17 | 0.16 |

- General note: as a result of the interpretation issued by the International Financial Reporting Standards Interpretations Committee (IFRIC) regarding the collecting of interests of written-off financial assets for the purpose of IFRS 9, those collections are presented as reduction of the credit allowances and not as a higher interest income, recognition method applied until December 2019. Therefore, and in order to make the information comparable, the quarterly information of the 2019 income statements has been restated.

- (1) Include the net capital gain from the sale to Allianz the half plus one share of the company created to jointly develop the non-life insurance business in Spain, excluding the health insurance line.

- (2) Adjusted by additional Tier 1 instrument remuneration.

CONSOLIDATED INCOME STATEMENT (MILLIONS OF EUROS)

| 2020 | ∆% | ∆% at constant exchange rates |

2019 | |

|---|---|---|---|---|

| Net interest income | 16,801 | (7.3) | 3.6 | 18,124 |

| Net fees and commissions | 4,616 | (8.3) | (0.4) | 5,033 |

| Net trading income | 1,692 | 22.3 | 37.6 | 1,383 |

| Other operating income and expenses | (135) | 76.2 | 46.3 | (77) |

| Gross income | 22,974 | (6.1) | 4.5 | 24,463 |

| Operating expenses | (10,755) | (9.6) | (2.6) | (11,902) |

| Personnel expenses | (5,650) | (10.9) | (4.4) | (6,340) |

| Other administrative expenses | (3,612) | (8.9) | (0.8) | (3,963) |

| Depreciation | (1,494) | (6.6) | 0.0 | (1,599) |

| Operating income | 12,219 | (2.7) | 11.7 | 12,561 |

| Impairment on financial assets not measured at fair value through profit or loss | (5,908) | 45.1 | 67.3 | (4,073) |

| Provisions or reversal of provisions | (744) | 20.7 | 33.0 | (617) |

| Other gains (losses) | (341) | 119.4 | 117.0 | (155) |

| Profit/(loss) before tax | 5,225 | (32.3) | (21.9) | 7,716 |

| Income tax | (1,385) | (32.5) | (22.4) | (2,053) |

| Profit/(loss) after tax | 3,840 | (32.2) | (21.7) | 5,663 |

| Goodwill impairment in the United States and corporate operations (1) | (1,780) | 35.0 | 35.0 | (1,318) |

| Profit/(loss) for the year | 2,060 | (52.6) | (42.6) | 4,345 |

| Non-controlling interests | (756) | (9.3) | 13.0 | (833) |

| Net attributable profit/(loss) | 1,305 | (62.9) | (55.3) | 3,512 |

| Earning per share (euros) (1) | 0.14 | 0.47 | ||

| Net attributable profit/(loss) excluding the goodwill impairment in the United States and corporate operations (1) | 3,084 | (36.1) | (27.2) | 4,830 |

| Earning per share excluding the goodwill impairment in the United States and corporate operations (euros) (1) (2) | 0.41 | 0.66 |

- General note: as a result of the interpretation issued by the International Financial Reporting Standards Interpretations Committee (IFRIC) regarding the collecting of interests of written-off financial assets for the purpose of IFRS 9, those collections are presented as reduction of the credit allowances and not as a higher interest income, recognition method applied until December 2019. Therefore, and in order to make the information comparable, the information of the 2019 income statements has been restated.

- (1) Include the net capital gain from the sale to Allianz the half plus one share of the company created to jointly develop the non-life insurance business in Spain, excluding the health insurance line.

- (2) Adjusted by additional Tier 1 instrument remuneration.

Unless expressly indicated otherwise, to better understand the changes under the main headings of the Group's income statement, the year-on-year percentage changes provided below refer to constant exchange rates.

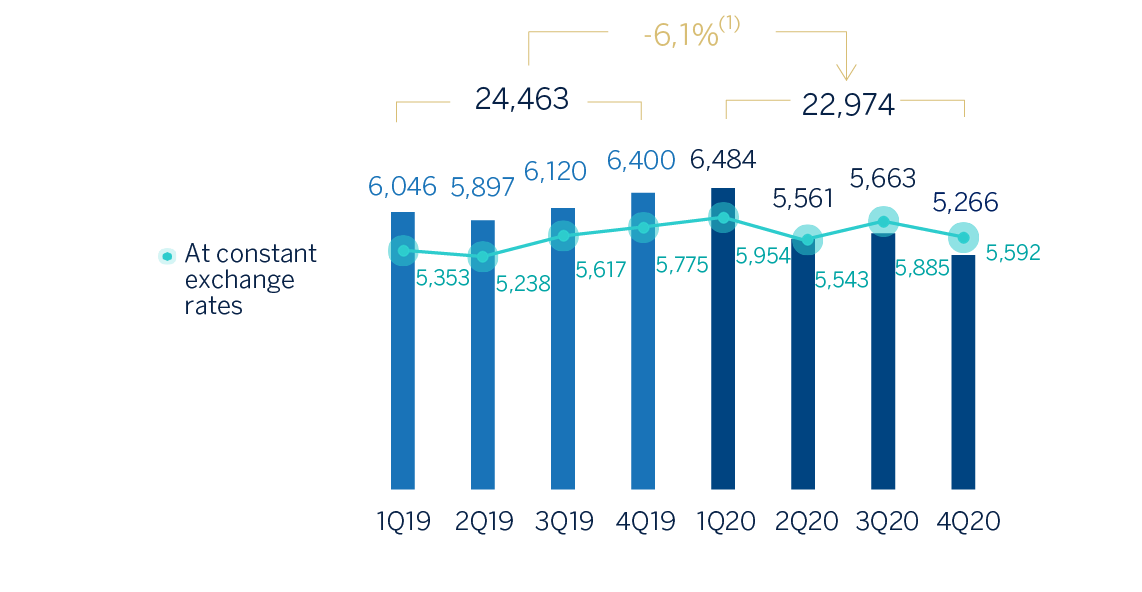

Gross income

Gross income grew 4.5% year-on-year, supported by the favorable evolution of net interest income and NTI, which offset the flat performance of fees and commissions and a greater negative impact of the other operating income and expenses line compared to 2019.

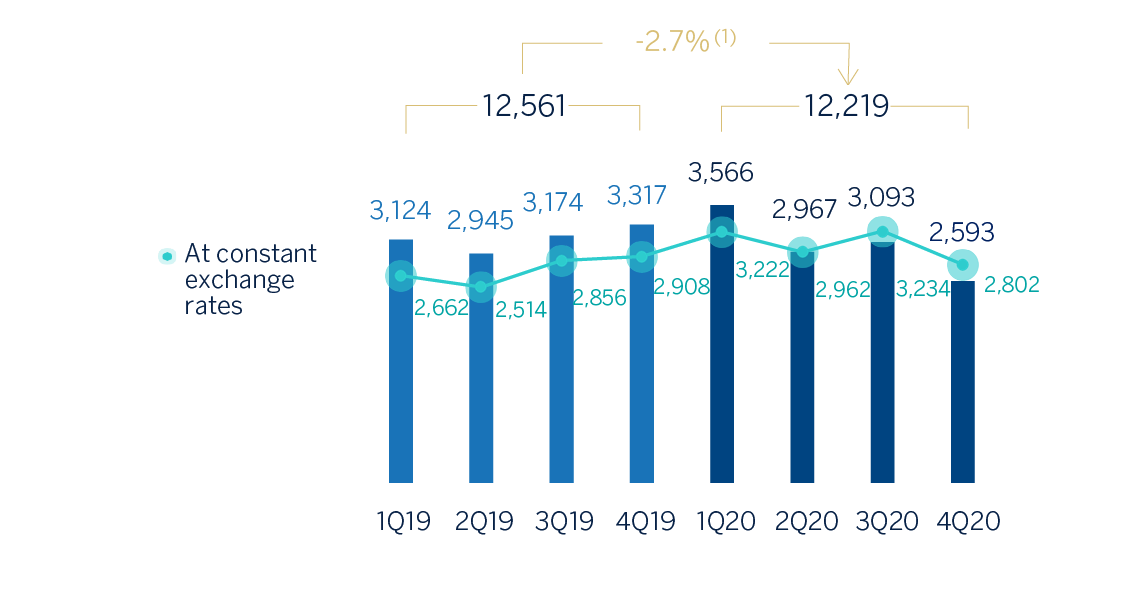

GROSS INCOME (MILLIONS OF EUROS)

(1) At constant exchange rates: +4.5%.

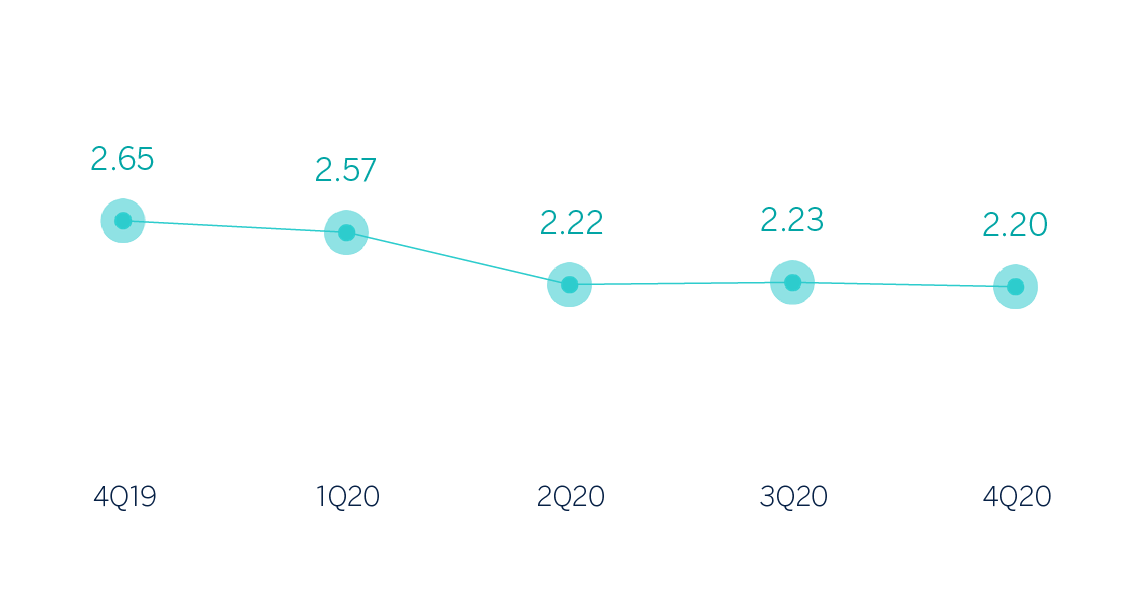

Net interest income grew by 3.6% year-on-year, supported by the good performance, mainly, from Turkey and the Rest of Eurasia and, to a lesser extent, South America, which offset the smaller contribution from the United States and Mexico, as a result of the cuts in the benchmark interest rates by the banking authorities in these countries. Spain was also affected by an environment of falling rates and showed flat performance.

Net fees and commissions were affected by the lower activity as a result of the pandemic. The areas that showed year-on-year reductions were Mexico and Turkey; the latter was also affected by changes in regulations on fees and commissions charged, which have been in application since March 2020. In Spain, the United States, Rest of Eurasia and South America, the net fees and commissions showed year-on-year increase, despite not charging certain fees and commissions as a measure to support customers during the worst moments of the pandemic.

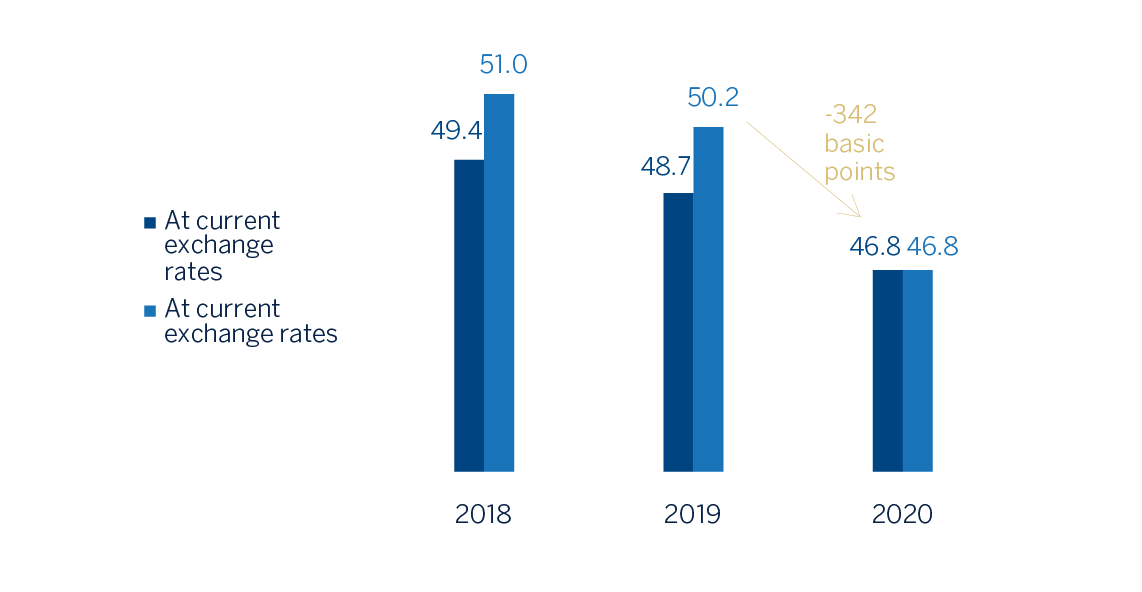

NET INTEREST INCOME/ATAS (PERCENTAGE)

NET INTEREST INCOME PLUS FEES AND COMMISSIONS (MILLIONS OF EUROS)

(1) At constant exchange rates: +2.7%.

The NTI was up 37.6% year-on-year, primarily due to the exchange rate hedging gains, recorded in the Corporate Center and the increase in the results generated throughout the year by all the business areas, except for South America, due to the positive effect from selling the stake in Prisma Medios de Pago S.A. on the results of the previous year, and except for Spain, where the negative results generated in the fourth quarter hindered positive evolution throughout the year.

The other operating income and expenses line posted €-135m in 2020 compared to the €-77m posted 12 months earlier. This unfavorable evolution is due to a lower contribution by the insurance business in Spain and Mexico, as well as BBVA's increased contributions to the public bank deposit protection schemes in said countries. Both effects offset the positive impact of Argentina's lower hyperinflation adjustment.

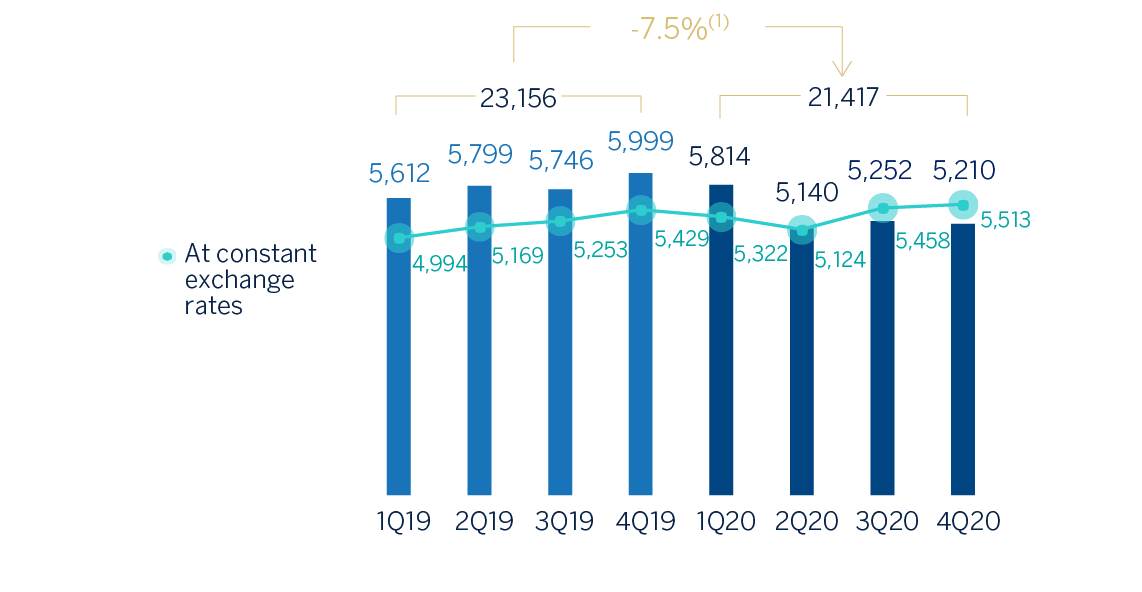

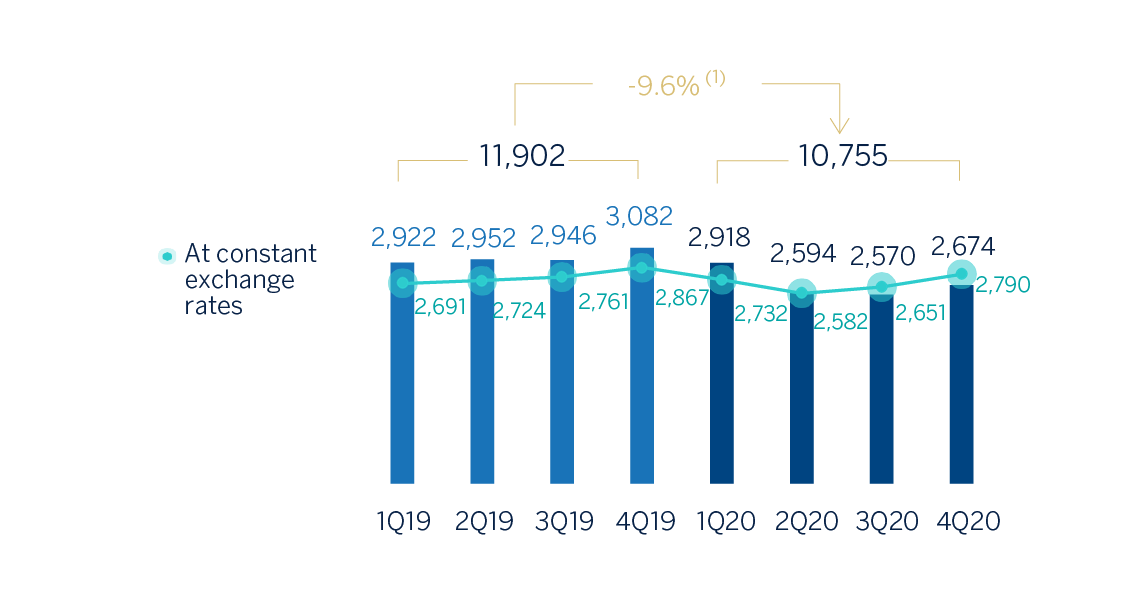

Operating income

Operating expenses fell by 2.6% year-on-year as a result of the containment plans implemented by all business areas and also due to the lesser execution of some discretionary expenses since the beginning of the pandemic. The expenses reduction is remarkable in Spain and the Corporate Center.

OPERATING EXPENSES (MILLIONS OF EUROS)

(1) At constant exchange rates: -2.6%.

As a result, the efficiency ratio stood at 46.8% as of December 31, 2020, significantly below the level recorded one year earlier (50.2%), and operating income recorded a year-on-year growth of 11.7%.

EFFICIENCY RATIO (PERCENTAGE)

OPERATING INCOME (MILLIONS OF EUROS)

(1) At constant exchange rates: +11.7%.

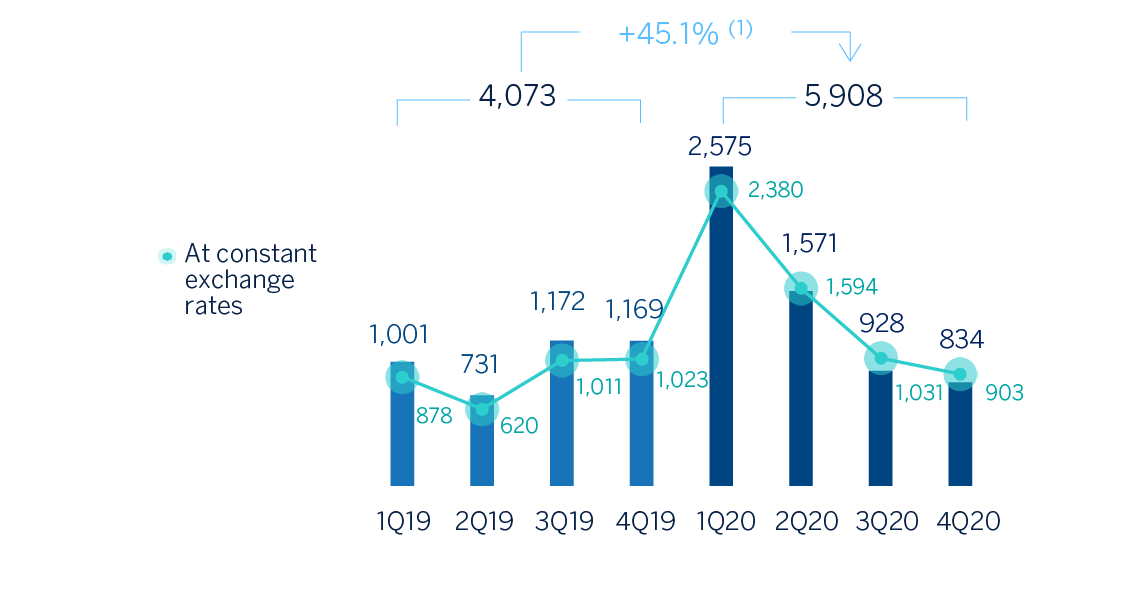

Provisions and other

The impairment on financial assets not measured at fair value through profit and loss (impairment on financial assets) closed December 67.3% above the figure recorded in the previous year, as a result of the negative impacts of COVID-19, mainly due to the worsening macroeconomic scenario.

IMPAIRMENT ON FINANCIAL ASSESTS (MILLIONS OF EUROS)

(1) At constant exchange rates: +67.3%.

Provisions or reversal of provisions (hereinafter provisions) closed December with a cumulative negative balance of €744m, 33.0% higher than the loss recorded in the previous year, mainly due to higher provisions in Spain.

The other gains (losses) line was 117.0% more negative compared to the previous year.

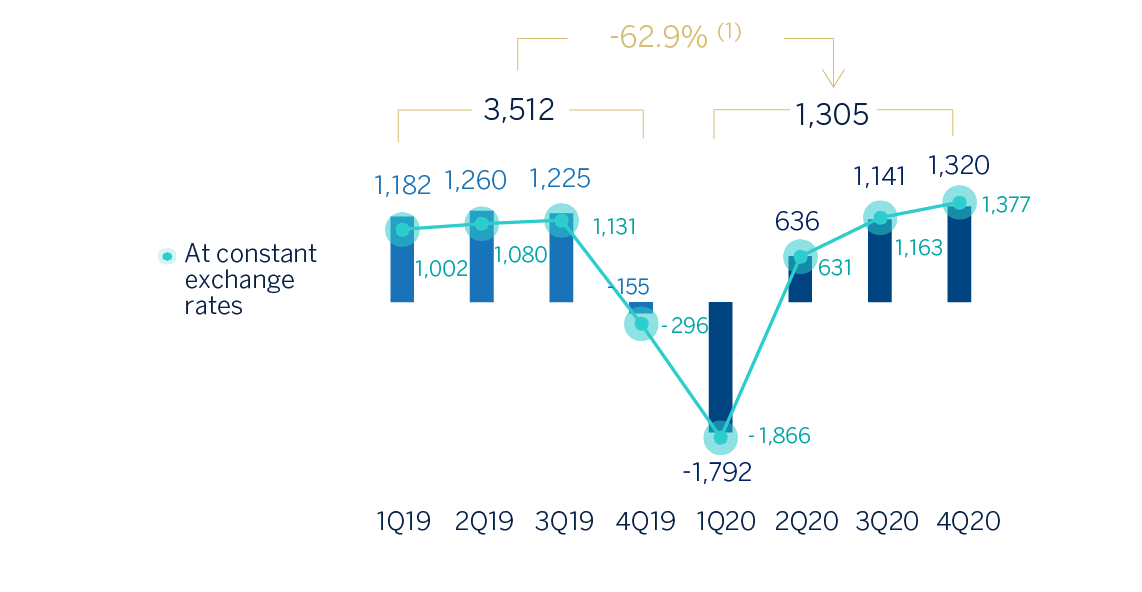

Results

As a result of the above, the cumulative net attributable profit of the BBVA Group in 2020 was €1,305m, which includes results from corporate operations derived from the net capital gain of €304m, generated by the transfer to Allianz of half plus one share of the company created to jointly develop the non-life insurance business in Spain, excluding the health insurance line, and the goodwill impairment in the United States of €2,084m. This result is 55.3% less than the €3,512m posted the previous year in a comparison also influenced by the goodwill impairment in the United States in 2019.

The Group's net attributable profit, when adjusted to exclude the goodwill impairment in the United States and the results from corporate operations in 2020, stood at €3,084m, which is 27.2% lower than the result in 2019, also excluding the goodwill impairment in the United States.

NET ATTRIBUTABLE PROFIT (MILLIONS OF EUROS)

(1) At constant exchange rates: -55.3%.

NET ATTRIBUTABLE PROFIT EXCLUDING THE UNITED STATES GOODWILL IMPAIRMENT AND CORPORATE OPERATIONS 2 (MILLIONS OF EUROS)

(1) Net profit before tax because of the sale to Allianz of half plus one share of the company created to jointly promote non-life insurance business in Spain, excluding the health insurance line.

(2) At constant exchange rates: -27.2%.

The cumulative net attributable profit, in millions of euros at the close of December 2020 for the different business areas that make up the Group were: 606 in Spain, 429 in the United States, 1,759 in Mexico, 563 in Turkey, 446 in South America and 137 in the Rest of Eurasia.

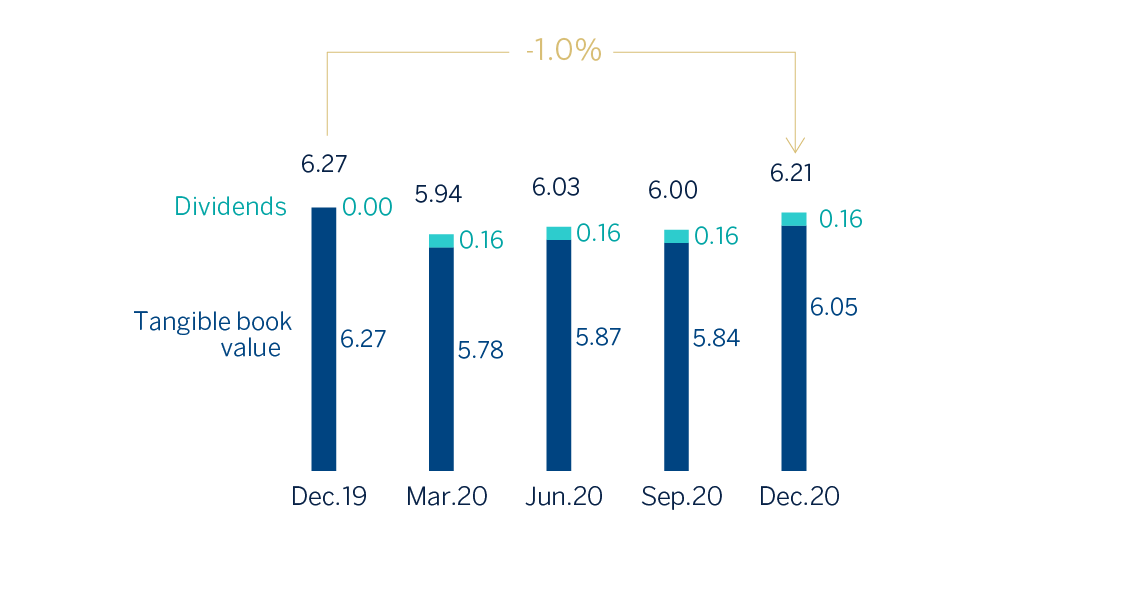

TANGIBLE BOOK VALUE PER SHARE AND DIVIDENDS (1) (EUROS)

(1) Replenishing dividends paid in the period.

EARNING PER SHARE (1) (EUROS)

(1) Adjusted by additional Tier 1 instrument remuneration.

(2) Excluding the goodwill impairment in the United States, registered in 2019 and 2020 and the net capital gain from the bancassurance operation in 2020.

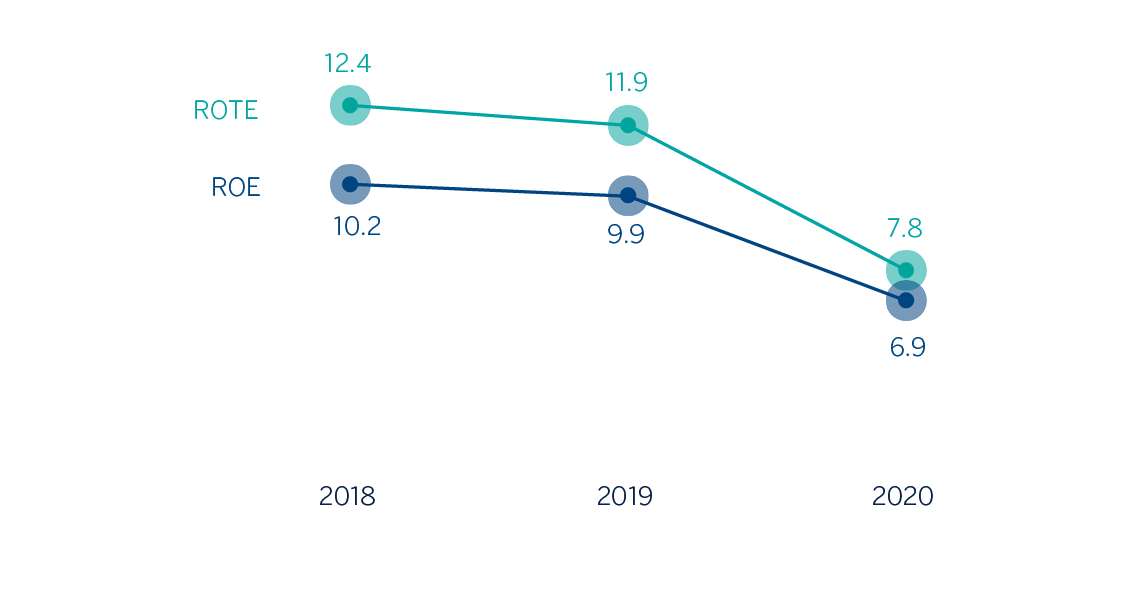

ROE AND ROTE (1) (PERCENTAGE)

(1) Ratios excluding BBVA Chile in 2018, the goodwill impairment in the United States in 2019 and 2020 and the net capital gain from the bancassurance operation in 2020 .

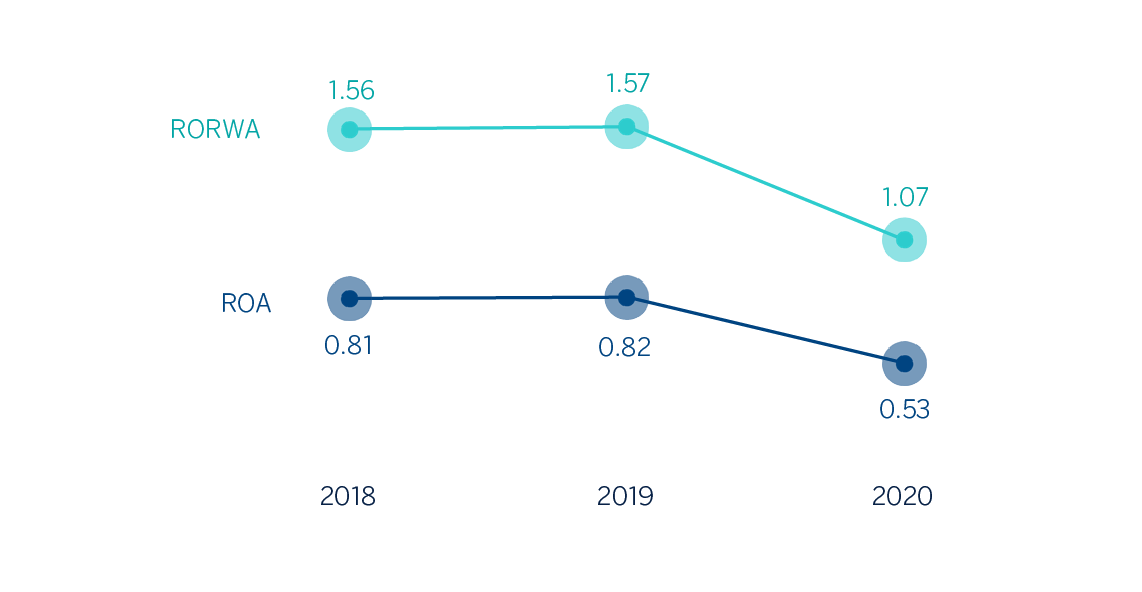

ROA AND RORWA (1) (PERCENTAGE)

(1) Ratios excluding BBVA Chile in 2018, the goodwill impairment in the United States in 2019 and 2020 and the net capital gain from the bancassurance operation in 2020.