Risk management

Credit risk

The local authorities of the countries in which the Group operates have initiated economic support measures including the granting of relief measures in terms of temporary payments deferrals for customers affected by the pandemic, as well as the granting of loans, especially to companies and SMEs, with public guarantees. The amount of current payment deferrals granted by the Group was €6,803m at December 31, 2020.

These measures are supported by the rules issued by the authorities of the geographical areas where the Group operates as well by certain industry agreements and should help to ease the temporary liquidity needs of the customers. The classification of the customers’ credit quality and the calculation of the expected credit loss, once the credit quality of those customers have been reviewed under the new circumstances, will depend on the effectiveness of these relief measures. In any case, the incorporation of public guarantees is considered to be a mitigating factor in the estimation of the expected credit losses.

For the purposes of classifying exposures based on their credit risk, the Group has maintained a rigorous application of IFRS9 at the time of the granting of the moratoriums and has reinforced the procedures to monitor credit risk both during their validity and upon their expiration. In this sense, additional indicators have been introduced to identify the significant increase in risk that may have occurred in some operations or a set of them and, where appropriate, proceed to its classification in the corresponding risk stage.

Likewise the indications provided by the European Banking Authority (EBA) have been taken into account to not consider refinancing the moratoriums that meet a series of requirements, without prejudice to keeping the exposure classified in the corresponding risk stage or its consideration as refinancing if it was previously so qualified.

In relation to the payment deferrals for customers affected by the pandemic, and with the goal of mitigating as much as possible the impact of these measures in the Group, due to the high concentration of its maturities over time, BBVA has worked on an anticipation plan based on some basic lines of action, supported by the following pillars:

- Diagnose: portfolio segmentation.

- Strategy: value offering and action protocols by segment.

- Operationality: equipment and channel sizing.

These lines of action have made it possible to advance the management actions to be carried out with customers according to their level of involvement and local legislation.

Calculation of expected losses due to credit risk

To respond to the circumstances generated by the global COVID-19 pandemic in the macroeconomic environment, characterized by a high level of uncertainty regarding its intensity, duration and speed of recovery, forward-looking information has been updated in the IFRS 9 models to incorporate the best information available at the date of publication of this report. The estimation of the expected losses has been calculated for the different geographical areas in which the Group operates, with the best information available for each of them, considering both the macroeconomic perspectives and the effects on specific portfolios, sectors or specific accredited. The scenarios used consider the various economic measures that have been announced by governments as well as monetary, supervisory and macroprudential authorities around the world. However, the final magnitude of the impact of this pandemic on the Group's business, financial situation and results, which could be material, will depend on future and uncertain events, including the intensity and persistence over time of the consequences derived from the pandemic in the different geographical areas in which the Group operates.

The expected losses calculated according to the methodology provided by the Group, including macroeconomic projections, have been supplemented with additional amounts that have been considered necessary to collect the particular characteristics of specific accredited sectors or portfolios and that may not be identified in the general process. Of the complementary amounts recognized throughout the year, at the end of 2020 there remains a €244m pending allocation to specific accredited portfolios, mainly in Spain and to a lesser extent in the United States.

These lines show the evolution of the exposure of corporate banking clients to the sectors that have been considered most vulnerable in the COVID-19 pandemic environment:

EXPOSURE AT DEFAULT TO MOST VULNERABLE SECTORS (MILLIONS OF EUROS)

| 31-12-20 | 30-09-20 (1) | 30-06-20 (1) | 31-03-20 (1) | 31-12-19 | |

|---|---|---|---|---|---|

| Leisure (2) | 9,279 | 9,237 | 9,383 | 8,781 | 8,077 |

| Real estate sector (3) | 12,806 | 13,247 | 13,686 | 13,405 | 13,150 |

| Retailers (4) | 4,982 | 5,073 | 5,427 | 4,821 | 4,390 |

| Upstream & Oildfield services | 2,413 | 2,229 | 2,682 | 2,558 | 2,431 |

| Air transportation | 965 | 1,111 | 1,061 | 566 | 580 |

| Total | 30,445 | 30,897 | 32,239 | 30,131 | 28,628 |

- General note: data excluding BBVA USA and the rest of Group's companies included in the sale agreement signed with PNC for all periods.

- (1) Data of Turkey as of December, 2019.

- (2) Among others; includes hotels, restaurants, travel agencies and gaming.

- (3) Includes real estate developers.

- (4) Non-food.

Credit risk indicators of the BBVA Group

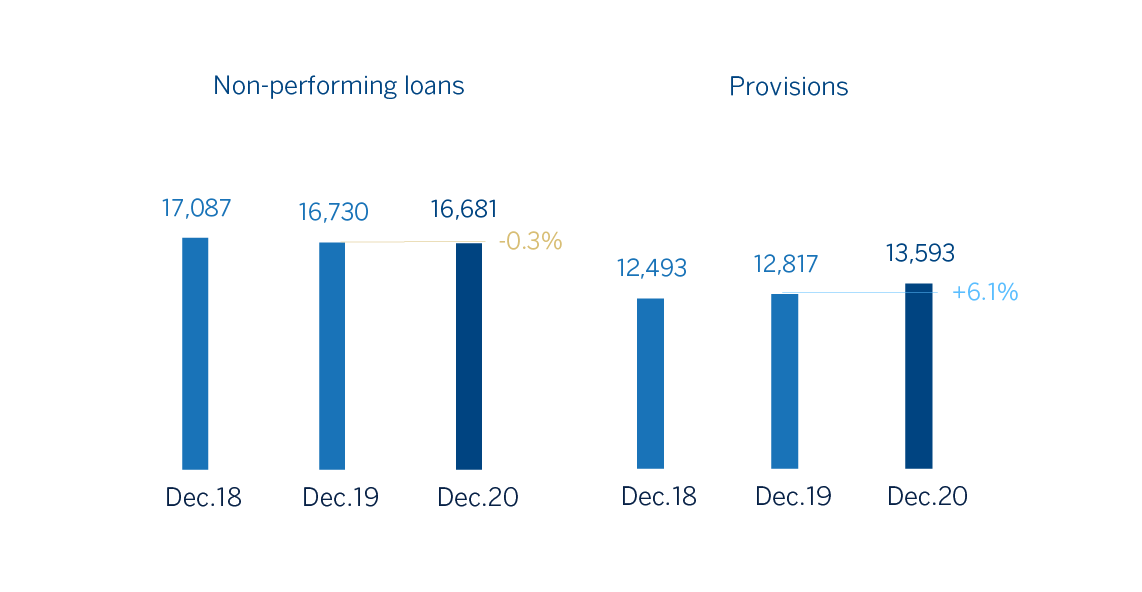

BBVA Group's main risk indicators evolved during 2020 as described below, as a result, among other reasons, of the situation generated by the pandemic:

- Credit risk decreased by 4.6% (up 1.8% at constant exchange rates) during 2020. In the last quarter of the year, this metric remained almost flat, in both current and constant exchange rates, as the growth in Spain, Turkey and South America was offset by a contraction in the United States and Rest of Eurasia. Mexico’s growth in the last quarter was driven by the evolution of the exchange rate.

- The balance of non-performing loans was lower than at the end of December of the previous year, although it increased in the last quarter of the year (up 2.7% at current exchange rates, up 2.9% at constant exchange rates), mainly because of the entries into default of the retail portfolios in Mexico.

- The NPL ratio stood at 4.0% at the end of December, above the end of the previous year and the end of the third quarter.

- Loan-loss provisions fell by 1.9% in the quarter. Compared to December 2019, they were 6.1% higher due to the provisions made in the first half of the year as a result of the negative effects of COVID-19.

- The NPL coverage ratio closed at 81% from 85% in the previous quarter, due to the increase in the balance of non-performing loans and with a significant improvement of 488 basis points compared to the end of 2019.

The cumulative cost of risk at December 31, 2020 stood at 1.51%, compared to a cumulative 1.69% at the end of September and following the strong growth registered in March related to the significant increase in the loan loss allowances in the first quarter.

NON-PERFORMING LOANS AND PROVISIONS (MILLIONS OF EUROS)

CREDIT RISK (1) (MILLIONS OF EUROS)

| 31-12-19 | 30-09-20 | 30-06-20 | 31-03-20 | 31-12-19 | |

|---|---|---|---|---|---|

| Credit risk | 421,432 | 422,868 | 446,623 | 442,648 | 441,964 |

| Non-performing loans | 16,681 | 16,241 | 16,385 | 15,998 | 16,730 |

| Provisions | 13,593 | 13,859 | 13,998 | 13,748 | 12,817 |

| NPL ratio (%) | 4.0 | 3.8 | 3.7 | 3.6 | 3.8 |

| NPL coverage ratio (%)(2) | 81 | 85 | 85 | 86 | 77 |

- General note: figures without considering the classification of BBVA USA and the rest of Group's companies in the United States included in the sale agreement signed with PNC and BBVA Paraguay as Non-current Assets and Liabilities Held for Sale as of 31-12-2020, and BBVA Paraguay as Non-current Assets and Liabilities Held for Sale for the rest of periods.

- (1) Include gross loans and advances to customers plus guarantees given.

- (2) The NPL coverage ratio includes the valuation adjustments for credit risk during the expected residual life of those financial instruments which have been acquired (mainly originated from the acquisition of Catalunya Banc, S.A.). Excluding these allowances, the NPL coverage ratio would stand at 79% as of December 31, 2020 and 74% as of December 31, 2019.

NON-PERFORMING LOANS EVOLUTION (MILLIONS OF EUROS)

| 4Q20 (1) | 3Q20 | 2Q20 | 1Q20 | 4Q19 | |

|---|---|---|---|---|---|

| Beginning balance | 16,241 | 16,385 | 15,998 | 16,730 | 17,092 |

| Entries | 2,989 | 2,273 | 2,221 | 2,049 | 2,484 |

| Recoveries | (1,312) | (1,183) | (1,149) | (1,366) | (1,509) |

| Net variation | 1,676 | 1,091 | 1,072 | 683 | 975 |

| Write-offs | (1,211) | (613) | (834) | (944) | (1,074) |

| Exchange rate differences and other | (25) | (622) | 149 | (471) | (262) |

| Period-end balance | 16,681 | 16,241 | 16,385 | 15,998 | 16,730 |

| Memorandum item: | |||||

| Non-performing loans | 15,914 | 15,469 | 15,683 | 15,291 | 16,000 |

| Non performing guarantees given | 767 | 771 | 702 | 708 | 731 |

- General note: figures without considering the classification of BBVA USA and the rest of Group's companies in the United States included in the sale agreement signed with PNC and BBVA Paraguay as Non-current Assets and Liabilities Held for Sale as of 31-12-2020, and BBVA Paraguay as Non-current Assets and Liabilities Held for Sale for the rest of periods.

- (1) Preliminary data.

Structural risks

Liquidity and funding

Management of liquidity and funding at BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of financing. In this context, it is important to notice that, given the nature of BBVA's business, the funding of lending activity is fundamentally carried out through the use of stable customer funds.

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolution strategy: the parent company sets the liquidity policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity (taking deposits or accessing the market with their own rating), without fund transfers or financing occurring between either the parent company and the subsidiaries or between the different subsidiaries. This strategy limits the spread of a liquidity crisis among the Group's different areas, and ensures that the cost of liquidity and financing is correctly reflected in the price formation process.

During of 2020, liquidity conditions have remained comfortable across all countries in which the BBVA Group operates. Since the beginning of March, the global crisis caused by COVID-19 had a significant impact on financial markets. The initial effects of this crisis on the Group's balance sheets have fundamentally been felt through increased drawdown of credit facilities by wholesale customers in the face of worsening funding conditions in the markets, with no significant effect in the retail world. These drawdowns were largely returned throughout the following quarters. Given this initial uncertainty, the different central banks provided a joint response through specific measures and programs to facilitate the funding of the real economy and the provision of liquidity in the financial markets, increasing liquidity buffers in almost all geographical areas.

BBVA Group maintains a solid liquidity position in every geographical area with liquidity ratios comfortably above the minimum required:

- The BBVA Group's liquidity coverage ratio (LCR) remained significantly above 100% during 2020 and stood at 149% as of December 31, 2020. For the calculation of this ratio, it is assumed that there is no transfer of liquidity among subsidiaries; i.e. no kind of excess liquidity levels in foreign subsidiaries are considered in the calculation of the consolidated ratio. When considering these excess liquidity levels, the BBVA Group's LCR would stand at 185%.

- The Net Stable Funding Ratio (NSFR), defined as the ratio between the amount of stable funding available and the amount of stable funding required, is one of the Basel Committee's essential reforms, whose transposition under CRR II will become effective in June 2021, and requires banks to maintain a stable funding profile in relation to the composition of their assets and off-balance sheet activities. This ratio should be at least 100% at all times. At the BBVA Group, the NSFR, calculated according to the Basel requirements, stood at 127% as of December 31, 2020.

These ratios in the main geographical areas in which the Group operates are shown below:

LCR AND NSFR RATIOS (PERCETANGE. 31-12-20)

| Eurozone (1) | The United States | Mexico | Turkey | South America | |

|---|---|---|---|---|---|

| LCR | 173 | 144 (2) | 196 | 183 | All countries >100 |

| NSFR | 121 | 126 | 138 | 154 | All countries >100 |

- (1) Perimeter: Spain + Rest of Eurasia.

- (2) Calculated according to local regulation (Fed Modified LCR).

The most relevant aspects related to the main geographical areas are the following:

- In the Eurozone, BBVA’s liquidity situation remains comfortable with a high quality ample liquidity buffer that has been strengthened during the year as a result of the management measures implemented and the actions of the European Central Bank (ECB) which have led to an increase of liquidity in the system. In the wake of the COVID-19 crisis, there was initially a higher demand for lending through increased drawdowns of credit facilities by the Corporate & Investment Banking wholesale business, which was also accompanied by growth in customer deposits. Subsequently, in the following of the year there were partial repayments of the aforementioned drawdowns, while deposits have continued to grow. In addition, it is important to mention the measures implemented by the ECB in order to face the crisis, which have included different actions, such as: the expansion of asset purchase programs, in particular through the Pandemic Emergency Purchase Programme (PEPP) for €750,000m in a first tranche announced in March extended with a second tranche for a further €600,000m until June 2021, or until the ECB considers the crisis to be over and with a third tranche for €500,000m until at least the end of March 2022 ; the coordinated action by Central Banks for the provision of US dollars; a package of temporary collateral easing measures affecting eligibility for use in funding operations and the easing and improvement of the conditions for the TLTRO III program and the creation of the new program of long-term , refinancing operations without specific emergency objective (Pandemic emergency longer-term refinancing operations, PELTRO). In March and June, BBVA took part in the TLTRO III liquidity windows (with an amount drawn at the end of December of €35,000m) due to its favorable cost and maturity conditions, and repaid the corresponding part of the TLTRO II program.

- BBVA USA also maintains a strong liquidity buffer consisting of high-quality assets, which has been strengthened during 2020. As in the Eurozone, there was an increase in loans toward the end of the first quarter of 2020, mainly due to a rise in the drawing down of credit facilities by wholesale customers and the US government's stimulus program for SMEs and self-employed workers (Paycheck Protection Program). In the following quarters, there were repayments that have now brought the credit facility usage percentage back to pre-pandemic levels. In addition, deposits have grown very significantly during the year, reflecting the high level of liquidity in the system as a result of the stimulus programs established by the government and the Fed.

- At BBVA Mexico, the liquidity position has remained strong during 2020. Following the COVID-19 crisis, the lending gap increased in the first quarter of the year due to increased drawdowns of credit facilities. However in the second quarter, the success of the commercial actions and the normalization of lending growth led to a reduction in the lending gap compared to December 2019 levels. During the third and fourth quarter of the year, the reduction in the lending gap has been exacerbated, driven by a reduction in loans and a growth in deposits, despite the progressive ending of the commercial policies implemented to attract deposits, creating a comfortable position in liquidity ratios. Regarding the measures taken by Banxico over the year, in addition to reducing the monetary policy rate, it announced a reduction in the Monetary Regulation Deposit and the start of auctions of US dollars with credit institutions (swap line with the Fed) in which BBVA Mexico participated in April, in the amount of USD 1,250m, partially renewing that position from June to September for USD 700m. Likewise, it has participated in the Banxico 7 and 8 facilities (measures to direct funds to micro m small and medium-sized companies, as well as individuals affected by the pandemic).

- At Garanti BBVA, the liquidity situation remained comfortable during the 2020, with a contraction of loans and a growth of deposits in foreign currency, as well as higher growth of loans than deposits in local currency. As a result of the COVID-19 crisis, an increase in collateral requirements was seen due to the credit risk in Turkey (Credit Default Swaps) to cover derivative valuations and wholesale funding. Moreover, Turkey's regulator established the so-called asset ratio to encourage banks, to increase lending and avoid the accumulation of deposits, which caused an increase in the lending gap. This was covered by the bank's excess liquidity. Later, the asset ratio requirement was reduced in the third quarter (from 100% to 90%) and it was eliminated in December. In the face of contractionary policies, The Central Bank of the Republic of Turkey (CBRT) increased the reserve requirement rates, and during the second semester of the year the cost of lending and the base rate has progressively increased. In addition, the Credit Default Swap returns to previous levels to COVID-19 pandemic. With all this, during the year, Garanti BBVA has shown a good liquidity buffer.

- In South America, an adequate liquidity situation prevails throughout the region, helped by the support of various central banks and governments which, in order to mitigate the impact of the COVID-19 crisis, have acted by implementing measures to stimulate economic activity and provide greater liquidity in financial systems. In Argentina, US dollar deposit outflows in the banking system slowed down to show growth in the fourth quarter, although BBVA Argentina continues to maintain a strong liquidity position with comfortable liquidity ratios. In Colombia, after the adjustment of the excess liquidity carried out in the third quarter by reducing wholesale deposits, a comfortable liquidity position has been maintained, as well as BBVA Perú, where the liquidity position has been reinforced by the increase in the volume of deposits during the second quarter, as well as by the funds from the Central Bank´s support programs.

The wholesale funding markets in which the Group operates, after two months of great stability at the start of 2020, were followed by a strong correction as a result of the crisis of COVID-19 and the limited access to the primary market. This situation has been stabilizing, marked by the evolution of the pandemic, the vaccines development, various geopolitical events and the actions of Central Banks. Secondary market levels ended the year reaching January 2020 levels, while primary market volumes have been reactivating, reducing the issue premiums.

The main transactions carried out by the companies that form part of the BBVA Group in 2020 are:

- During the first quarter of 2020, BBVA, S.A. carried out two issuances of senior non-preferred debt by a total approximate amount of €1,400m and a Tier 2 issuance totaling €1,000m. In the second quarter of 2020, it issued preferred senior debt totaling €1,000m as a COVID-19 social bond, the first of its kind from a private financial institution in Europe. In the third quarter, it carried out three public issues: the first is the first green convertible bond (CoCo) ever issued by a financial institution worldwide in the amount of €1,000m; a subordinated Tier 2 debt issuance in Pounds sterling, for the amount of 300m; and the third is a preferred debt issue filed with the U.S. Securities and Exchange Commission (SEC), in two tranches over three and five years, in a total amount of USD 2,000m. On the other hand, in February 2020 a CoCo of €1,500m was amortized and in January 2020 three preferential issues were amortized in advance (For more information about these transactions, see the "Solvency" chapter of this report).

- In Mexico, a local senior issuance was successfully carried out in February for MXN 15,000m (€614m) in three tranches. Two tranches in Mexican pesos over 3 and 5 years (one for MXN 7,123m at the Interbank Equilibrium Interest Rate (TIIE) 28 + 5 basis points and another for MXN 6,000m at TIIE 28 + 15 basis points, respectively), and another tranche in US dollars over 3 years (USD 100m at 3-month Libor + 49 basis points). The purpose of this issuance was to bring forward the refinancing of maturities in the year, taking advantage of the good market conditions, as well as to strengthen the liquidity situation by offsetting the seasonal outflows of deposits in the early months of the year. In September, it carried out an international issuance of unsecured 5-year senior debt in an amount of USD 500m at a rate of 1.875%, which represents the lowest ever for a financial institution in Mexico and the lowest of any of Latin America's private financial institutions. This issue is the second under BBVA Mexico's Global Issuer Program, which has a value of up to USD 10,000m.

- In Turkey, the issues have not been fully renewed by the foreign currency gap reduction in 2020 Garanti BBVA carried out a Tier 2 issuance for TRY 750m in the first quarter. In the second quarter, Garanti BBVA partially renewed a syndicated loan of USD 699m by issuing the first green syndicated loan for a bank indexed to sustainability criteria, and in whose renovation the EBRD (European Bank for Reconstruction and Development) and the IFC (International Finance Corporation) participated. In the fourth quarter, Garanti renewed another syndicated loan, by an amount of USD 636m, in two tranches and with a maturity of 367 days (a tranche by USD 267.5m at up 2.50% Libor and another tranche by €312m at Euribor up 2.25%).

- In the United States and in South America, there have been no material issuances in 2020.

Foreign exchange

Foreign exchange risk management of BBVA's long-term investments, principally stemming from its overseas franchises, aims to preserve the Group's capital adequacy ratio and ensure the stability of its income statement.

BBVA has maintained its policy of actively hedging its main investments in emerging markets, covering on average between 30% and 50% of annual earnings and around 70% of the CET1 capital ratio excess. Based on this policy, the sensitivity of the CET1 ratio to a depreciation of 10% against the euro of the main emerging-market currencies stood at -5 basis points for the Mexican peso and -2 basis points for the Turkish lira. In the case of the US dollar, the sensitivity to a depreciation of 10% against the euro is approximately +9 basis points. The transactional foreign currency risk associated with the sale of the subsidiary in the United States is managed in a way to minimize negative impacts at the level of net profit and capital ratio (after sales). At the end of December, the coverage level for expected earnings for 2021 was at levels close to 50% in the case of Turkey, 40% for Mexico, 50% for Peru and 40% for Colombia.

Interest rate

The aim of managing interest-rate risk is to limit the sensitivity of the balance sheets to interest rate fluctuations. BBVA carries out this work through an internal procedure following the guidelines established by the European Banking Authority (EBA), which measures the sensitivity of net interest income and economic value to determine the potential impact of a range of scenarios on the Group's different balance sheets.

The model is based on assumptions intended to realistically mimic the behavior of the balance sheet. Assumptions regarding the behavior of accounts with no explicit maturity and prepayment estimates are of particular relevance. These assumptions are reviewed and adapted at least once a year to take into account any changes in behavior.

At the aggregate level, BBVA continues to maintain a moderate risk profile, in accordance with the established target, showing a net interest income position which would be favored by an increase in interest rates. The effective management of structural balance sheet risk has allowed it to mitigate the negative impact of the downward trend in interest rates and the volatility experienced as a result of the effects of COVID-19, and is reflected in the soundness and recurrence of net interest income.

By area, the main features are:

- Spain and the United States have balance sheets characterized by a high proportion of variable-rate loans in the loan portfolio (basically mortgages in Spain and corporate lending in both countries) and liability composed mainly of customer deposits. The ALCO portfolios act as hedging for the bank's balance sheet, mitigating its sensitivity to interest rate fluctuations. The profile of both balance sheets has remained stable during 2020. In Spain the sensitivity of the net interest income has increased in the year due the higher volume of sensitive balances (liquid short-term assets) as a result of the liquidity generated by the balance and the additional TILTRO III financing, as well as the maturity of a part of the mortgage portfolio coverage.

In addition, following a slightly downward trend at the start of the year for European benchmark interest rates (Euribor), there was a rebound of around 20–30 basis points (depending on the maturity) in mid-March. This was a result of an adjustment in expectations after the ECB held the marginal deposit facility rate at -0.50% when the market had discounted a fall, and an increase in the required credit spread in the light of the COVID-19 crisis. However, since May, Euribor has fallen between -35 and -45 basis points, reaching record lows, mainly due to the easing of credit spreads and the ECB's monetary stimulus measures. In the United States, base rates (Libor) have maintained a downward trend during the year (falling around 165 basis points in the main terms), in line with the Fed's rate cuts in the first quarter of the year. - Mexico continues to show stability between the balance sheet items benchmarked at fixed and variable interest rates. In terms of assets that are most sensitive to interest rate fluctuations, the corporate portfolio stands out, while consumer loans and mortgages are mostly at a fixed rate. The ALCO portfolio is used to neutralize the longer duration of customer deposits. The sensitivity of net interest income continues to be limited and stable in 2020, considering the new interest rate scenario that emerged in March, with a downward trend in benchmark rates throughout 2020 compared to expectations at the beginning of the year. In this regard, the monetary policy rate at the end of December stood at 4.25%, which has meant a reduction of -300 basis points during 2020.

- In Turkey, the interest-rate risk (broken down into Turkish lira and US dollars) is limited. In terms of assets, the sensitivity of lending, which is mostly fixed-rate, but with relatively short maturities, and the ALCO portfolio, including inflation-linked bonds, are balanced by the sensitivity of deposits on the liability side, which are repriced in the short term. The sensitivity of net interest income on the currency balance sheets increased due to the establishment of the asset ratio in the second quarter of 2020. In relation to the benchmark rates, the strong increase since August reverted the decreases of the previous quarters, ending the year with an increase of 500 basis points above the level of December 2019.

- In South America, the risk profile for interest rates remains low as most countries in the area have a fixed/variable composition and maturities that are very similar for assets and liabilities, with a low and small variations net interest income sensitivity throughout 2020. In addition, in balance sheets with several currencies, interest-rate risk is managed for each of the currencies, showing a very low level of risk. The measures promoted by central banks have helped the downward trend of the benchmark interest rates (-250 basis points in Colombia and -200 basis points in Peru during the year) at minimum levels below that expected at the beginning of the year.