Highlights

COVID-19 pandemic

- The COVID-19 pandemic has affected and is expected to continue to adversely affect the world economy, leading many countries in which the Group operates into economic recession. This recession is expected to be followed by a high level of activity, but uneven by sectors and geographical areas in 2021.

Results

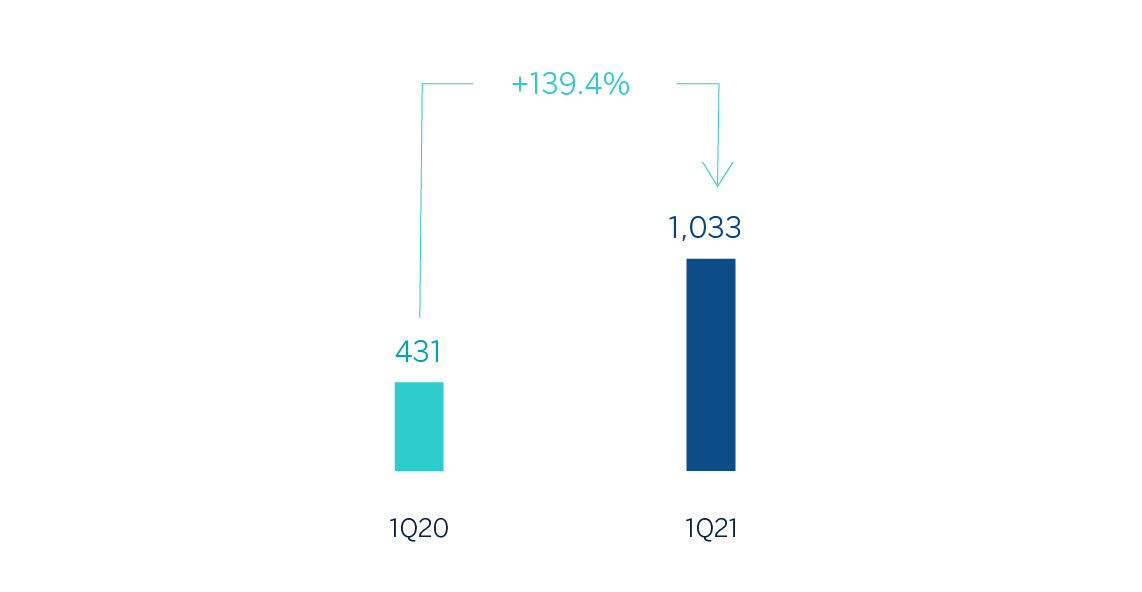

- The Group’s net attributable profit for the first three months of 2021, excluding the results from discontinued operations (i.e. without considering the results generated by the Group’s businesses in the United States subject to the agreement with PNC), amounted to €1,033m, with a year-on-year growth of 139.4%.

- The BBVA Group generated a net attributable profit of €1,210m during the first three months of 2021, which compares very positively with the accumulated losses in March 2020, when the outbreak of the pandemic resulted in strong provisions for impairment on financial assets, as well as the goodwill impairment in the United States amounting to €-2,084m.

- Despite the complex environment and at constant exchange rates, the good performance in commissions and fees, the evolution of net trading income (NTI) and lower provisions for impairment on financial assets are noteworthy.

NET ATTRIBUTABLE PROFIT (1) (MILLIONS OF EUROS)

(1) Excluding profit after tax from discontinued operations, which includes the goodwill impairment in the United States in 1Q20, amounting to €-2,084m.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1) (PERCENTAGE. 2020)

(1) Excludes the Corporate Center.

Business areas

- BBVA Group’s business areas reporting structure differs from the one presented at the end of 2020, mainly as a consequence of the disappearance of the United States as a business area, derived from the sale agreement reached with PNC. Most of the businesses in the United States excluded from this agreement, together with those of the former business area “Rest of Eurasia”, constitute a new area called “Rest of business”. Further detail on this new reporting structure can be found in the “Business areas introduction” on this report.

- On April 13, 2021, BBVA informed the employees’ legal representatives about its intention to initiate a procedure for collective redundancies within BBVA, S.A. in Spain, which will affect both the central services and the branch network.

Balance sheet and business activity

- The figure for loans and advances to customers (gross) registered a slight decrease of 0.1%, mainly as a result of Spain´s deleveraging.

- Customer funds fell by 1.7%, due to the performance of customer deposits, which contracted by 3.4% in the quarter.

Liquidity

- The availability of substantial liquidity buffers in each of the geographical areas in which the BBVA Group operates and their management, have allowed, once again, internal and regulatory ratios to be maintained well above the minimums required.

Solvency

- BBVA’s CET1 fully-loaded ratio stood at 11.88% at the end of March 2021, within the Group’s management target which is to maintain the ratio between 11.5% and 12.0%, increasing the distance to the minimum requirement (currently at 8.59%) to 329 basis points. This ratio does not include the positive impact of the sale of BBVA USA and other companies in the United States with activities related to this banking business, which according to the current estimate and taking as a reference the capital level as of March 2021, would place the CET1 fully-loaded ratio at 14.58%.

CAPITAL AND LEVERAGE RATIOS (PERCENTAGE AS OF 31-03-21)

Annual General Meeting

- On April 20, 2021, BBVA Group held its Annual General Meeting in a fully-remote format, in light of the exceptional circumstances brought about by the COVID-19 pandemic and in order to protect the health and safety of shareholders, employees and all other individuals involved. With respect to shareholder’s remuneration, on April 29, 2021, BBVA distributed a cash amount of €0.059 per share from BBVA’s share premium account, as approved by the Annual General Meeting held on April 20, 2021. In addition, and with the aim of effectively implementing a repurchase program of ordinary shares, BBVA has approved the reduction of the outstanding share capital up to a maximum of 10% through the redemption of own shares purchased by BBVA and by any mechanism for the purpose of being redeemed, being subject the aforementioned repurchase program to the provisions of the legislation or regulation in force, as well as the share price, among other factors.

Risk management

- The calculation of expected credit losses accumulated in the first quarter of 2021 incorporates:

- The update of the forward-looking information in the IFRS 9 models in order to reflect the circumstances created by the COVID-19 pandemic.

- The granting of relief measures and guarantee lines or public guarantee facilities for customers affected by the pandemic, as well as the option to grant lending with a public guarantee facility. In addition, quantitative management adjustments are included in order to take into account issues that might imply a potential impairment which due to its nature is not included in the model and which will be assigned to specific operations in case this impairment materializes (e.g, sectors and collectives more affected by the crisis).

- The behaviour of the main credit risk indicators of the Group, excluding the balances of discontinued operations, at the end of the first quarter of 2021 were:

- The NPL ratio stood at 4.3%.

- The NPL coverage ratio closed at 81%.

- The cumulative cost of risk at the end of March stood at 1.17%.

NPL(1) AND NPL COVERAGE(1) RATIOS AND COST OF RISK (PERCENTAGE)

(1) Excluding BBVA USA and the rest of Group's companies in the United States included in the sale agreement signed with PNC

Security, business continuity and support measures taken by BBVA

From the outset, BBVA has adopted a series of measures to support its main stakeholders. The main business continuity measures taken are:

- In order to serve customers, and since financial services are legally considered an essential service in most of the countries in which the Group operates, BBVA maintains its branch network operational, with dynamic management considering the evolution of the pandemic and activity. In addition, digital channels have been reinforced, given the increasing preference of customers for these channels. The data indicates that the COVID-19 crisis is accelerating digitization: At Group level, excluding the United States, and in cumulative terms, digital sales (measured in units) stood at 67.8% in December 2020, and at 69.5% at the end of March 2021. Also, at the end of the first quarter of 2021, BBVA's digital customers, excluding the United States, accounted for 64.7% of the total and customers operating with the bank through their mobile phones accounted for 60.7% across the entire Group.

DIGITAL AND MOBILE CUSTOMERS (MILLIONS)

General note: March 2021 data excluding BBVA USA and the rest of Group's companies in the United States included in the sale agreement signed with PNC

- With employees, recommendations from health authorities have been followed, including taking an early stance on promoting working from home. The priority for BBVA is to protect the health of the employees, customers and society in general. The crisis is being handled dynamically; adapting the procedures in each geographical area which the Group is present to the current situation, based on the latest data available regarding the evolution of the pandemic, the business and the level of customer service, in addition to the guidelines set by local authorities.

- In terms of cybersecurity, the increase in remote work and digital transactions as a result of the coronavirus crisis has led to an increase in the risk of cyber attacks. To ensure data and corporate information protection, BBVA has established the appropriate measures and continues to strengthen its prevention and monitoring efforts, thus mitigating the possible associated risks.

- The banks are a key part of the solution to the COVID-19 crisis and BBVA will continue to support its customers throughout the pandemic and also during the recovery phase.

Pronouncements of regulatory bodies and supervisors

- With the aim of mitigating the impact of COVID-19, various European and international bodies made pronouncements during 2020 aimed at allowing greater flexibility in the implementation of the accounting and prudential frameworks. The BBVA Group has taken these pronouncements into consideration which remain in force as of March 31, 2021.

- In addition, the European Commission published a specific consultation in January 2021, on the bank crisis management and deposit insurance framework of the European Union. The results of this consultation will be included in the Commission work in order to make this framework more consistent and solid. The consultation is focused on three legislative texts of the EU: the Bank Recovery and Resolution Directive (BRRD), the Single Resolution Mechanism Regulation (SRMR) and the Deposit Guarantee Scheme Directive (DGSD).