3.2.1. Scope and nature of the credit risk measurement and reporting systems

Credit risk arises from the probability that one party to a financial instrument will fail to meet its contractual obligations for reasons of insolvency or inability to pay and cause a financial loss for the other party. This includes management of counterparty risk, issuer credit risk, liquidation risk and country risk.

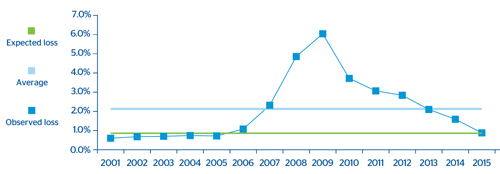

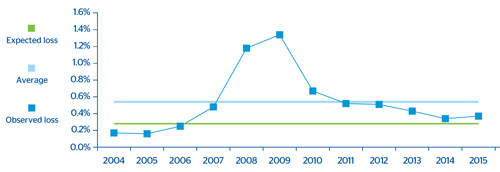

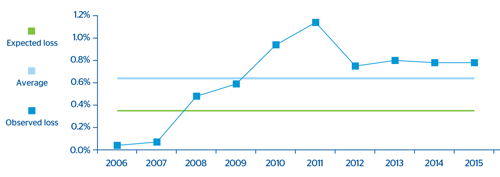

For managing risks and capital, BBVA quantifies its credit risk using two main metrics: expected loss (EL) and economic capital (EC). The expected loss reflects the average value of losses and is considered a business cost. Economic capital is the amount of capital considered necessary to cover unexpected losses if actual losses are greater than expected losses.

These risk metrics are combined with information on profitability in value-based management, thus building the profitability- risk binomial into decision-making, from the definition of business strategy to approval of individual loans, price setting, assessment of non-performing portfolios, incentives to areas in the Group, etc.

There are three essential parameters in the process of calculating the EL and EC measurements: the probability of default (PD), loss given default (LGD) and exposure at default (EAD). These are generally estimated using historical information available in the systems. They are assigned to operations and customers according to their characteristics.

In this context, the credit rating tools (ratings and scorings) assess the risk in each transaction/customer according to their credit quality by assigning them a score. transaction seasoning, loan to value ratio, customer segment, etc.

Section 3 of this document details the definitions, methods and data used by the Group to determine the capital requirements for estimating and validating the parameters of probability of default (PD), loss given default (LGD) and exposure at default (EAD).

The credit risk for the BBVA Group’s global portfolio is measured through a Portfolio Model that includes the effects of concentration and diversification. The aim is to study the loan book as a whole, and to analyze and capture the effect of the interrelations between the different portfolios.

In addition to enabling a more comprehensive calculation of economic capital needs, this model is a key tool for credit risk management, as it establishes loan limits based on the contribution of each unit to total risk in a global, diversified setting.

The Portfolio Model considers that risk comes from various sources (it is a multi- factor model). This feature implies that economic capital is sensitive to geographic diversification, a crucial aspect in a global entity like BBVA.

These effects have been made more apparent against the current backdrop in which, despite the stress undergone by some economies, the BBVA Group’s presence in different geographical areas, subject to different shocks and different moments in the cycle, have contributed to bolster the bank’s solvency. In addition, the tool is sensitive to concentration in certain credit exposures of the entity’s large clients.

Lastly, the results of the Portfolio Model are integrated into management within the framework of the Asset Allocation project, where business concentrations are analyzed in order to establish the entity’s risk profile.

The analysis of the entity’s RWA structure shows that 88% corresponds to Credit Risk (including the surcharge for CVA).

3.2.2. Definitions and accounting methodologies

3.2.2.1. Definitions of non-performing assets and impaired positions

The classification of financial assets impaired for reasons of customer default is done in an objective way and on an individual basis according to the following criterion:

- The total amount of debt instruments, irrespective of the holder and the guarantee involved, with an amount past due for more than ninety days for principal, interest or contractually agreed expenses, unless they should be classified directly as write-offs.

- Contingent liabilities in which the guaranteed party has incurred default. Debt instruments classified as impaired through the accumulation of balances in default for an amount exceeding 25% of the overall amounts pending collection.

Classification of financial assets impaired for reasons other than customer default is done individually for all risks whose individual amount is significant and for which there is a reasonable doubt about their total reimbursement under the terms and conditions agreed by contract, since they show objective evidence of impairment that negatively affects the cash flows expected from a financial instrument. Objective evidence of impairment of a financial asset or group of financial assets includes observable data about the following aspects:

- Significant financial difficulties on the part of the obligor.

- Continued delays in payment of interest or principal.

- Refinancing for the counterparty’s lending conditions.

- Bankruptcy and other types of reorganization/winding-up is likely.

- Disappearance of a financial asset from an active market due to financial difficulties.

- Observable data that suggest a reduction in future flows since the initial recognition, such as:

a. Adverse changes in the counterparty’s payment status (delays in payments, drawdowns on credit cards up to the limit, etc.).

b. Domestic or local economic conditions correlated with default (unemployment, fall in property prices, etc.).

Write-off risks are those debt instruments whose recovery is deemed remote and should be classified as final write-offs.

3.2.2.2. Methods for determining value adjustments for impairment of assets and provisions

The impairment on financial assets is calculated by type of instrument and other circumstances that may affect it, taking into account the guarantees received by the holders of the instruments to assure (fully or partially) the performance of the transactions. The BBVA Group recognizes impairment charges directly against the impaired asset when the likelihood of recovery is deemed remote, and uses an offsetting or allowance account when it records provisions made to cover estimated losses on their full value.

The amount of the deterioration of debt instruments valued at their amortized cost is calculated by whether the impairment losses are determined individually or collectively.

3.2.2.2.1. Impairment losses determined individually

The amount of impairment losses recorded by these instruments coincides with the positive difference between their respective book values and the present values of future cash flows. These cash flows are discounted at the instrument’s original effective interest rate. If a financial instrument has a variable interest rate, the discount rate for measuring any impairment loss is the current effective rate determined under the contract.

As an exception to the rule described above, the market value of quoted debt instruments is deemed to be a fair estimate of the present value of their future cash flows. The estimation of future cash flows for debt instruments considers the following:

- All sums expected to be recovered during the remaining life of the instrument, including those that may arise from collateral and credit enhancements, if any (once deduction has been made of the costs required for their foreclosure and subsequent sale). Impairment losses include an estimate of the possibility of collecting of the accrued, past-due and uncollected interest.

- The various types of risk to which each instrument is subject.

- The circumstances under which the collections will foreseeably take place.

With respect to impairment losses resulting from the materialization of insolvency risk of the obligors (credit risk), a debt instrument is impaired when:

- There is evidence of a reduction in the obligor’s capacity to pay, whether manifestly by default or for other reasons; and/or.

- Country-risk materializes, understood as the common risk among debtors who are resident in a particular country as a result of factors other than normal commercial risk, such as sovereign risk, transfer risk or risks derived from international financial activity.

The BBVA Group has developed policies, methods and procedures to calculate the losses that it may incur as a result of its credit risks, whether attributable to the insolvency of counterparties or to country risk. These policies, methods and procedures are applied to the arrangement, study and documentation of debt instruments, risks and contingent commitments, as well as the detection of their deterioration and in the calculation of the amounts needed to cover the estimated losses.

3.2.2.2.2. Impairment losses determined collectively

The collectively determined losses are deemed to be equivalent to the portion of losses incurred on the date that the accompanying consolidated financial statements are prepared that has yet to be allocated to specific transactions.

Through statistical procedures using its historical experience and other specific information, the Group calculates the losses that, having occurred on the date of preparation of the accompanying consolidated financial statements, will become clear individually after the date the information is presented.

Quantification of losses incurred takes into account three basic factors: exposure at default, probability of default and loss given default.

- Exposure at default (EAD) is the amount of risk exposure at the date of default by the counterparty.

- Probability of default (PD) is the probability of the counterparty failing to meet its principal and/or interest payment obligations.

- Loss given default (LGD) is the estimate of the loss arising in the event of default. It depends mainly on the characteristics of the counterparty and the valuation of the guarantees or collateral associated with the operation.

To calculate the LGD at each date in the balance sheet, the cash flows from the sale of collateral are estimated by calculating its sale price (in the case of real-estate collateral, the reduction it may have suffered in value is taken into account) and its cost. In the event of default, the property right is acquired contractually at the end of the foreclosure process or when the assets of borrowers in difficulty are purchased, and this right is recognized in the financial statements. After the initial recognition, these assets classified as “Non-current assets held for sale” or “Inventory” (see Notes 2.2.4 and 2.2.6 to the Group’s Annual Consolidated Financial Statements) are valued by the fair value corrected for the estimated cost of their sale or their book value, whichever is lower.

3.2.2.2.3. Methods used for provisioning for contingent exposures and commitments

Non-performing contingent exposures and commitments, except for letters of credit and other guarantees, are to be provisioned for an amount equal to the estimation of the sums expected to be disbursed that are deemed to be non-recoverable, applying criteria of valuation prudence. When calculating the provisions, criteria similar to those established for non-performing assets for reasons other than customer default are applied.

In any event, letters of credit and other guarantees provided which are classified as non-performing will be covered by applying similar criteria to those set out in the preceding section on value adjustments for impairment of assets.

Likewise, the inherent loss associated with letters of credit and other guarantees provided that are in force and not impaired is covered by applying similar criteria to those set out in the preceding section on impairment losses determined collectively.

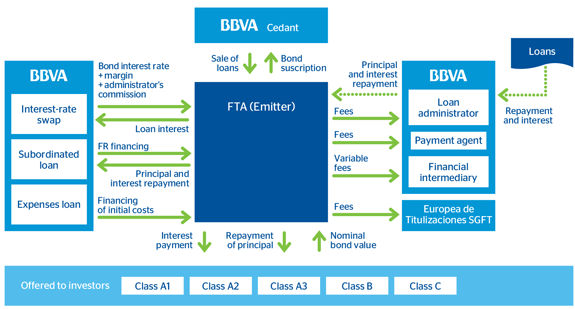

3.2.2.3. Criteria for removing or maintaining assets subject to securitization on the balance sheet

The accounting procedure for the transfer of financial assets depends on the manner in which the risks and benefits associated with securitized assets are transferred to third parties.

Financial assets are only removed from the consolidated balance sheet when the cash flows they generate have dried up or when their implicit risks and benefits have been substantially transferred out to third parties.

Group is considered to substantially transfer the risks and benefits when these account for the majority of the overall risks and benefits of the securitized assets.

When the risks and benefits of transferred assets are substantially conveyed to third parties, the financial asset transferred is removed from the consolidated balance sheet, and any right or obligation retained or created as a result of the transfer is simultaneously recognized.

In many situations, it is clear whether the entity has substantially transferred all the risks and benefits associated with the transfer of an asset or not. However, when it is not sufficiently clear if the transfer took place or not, the entity evaluates its exposure before and after the transfer by comparing the variation in the amounts and the calendar of the net cash flows of the transferred asset. Therefore, if the exposure to the variation in the current value of the net cash flows of the financial asset does not significantly change as a result of the transfer, it is understood that the entity has not substantially transferred all the risks and benefits associated with the ownership of the asset.

When the risks and/or benefits associated with the financial asset transferred are substantially retained, the asset transferred is not removed from the consolidated balance sheet and continues to be valued according to the same criteria applied prior to the transfer.

In the specific case of securitization funds to which Group institutions transfer their loan- books, existing contractual rights other than voting rights are to be considered with a view to analyzing their possible consolidation. It is also necessary to consider the design and purpose of each fund, as well as the following factors, among others:

- Evidence of the practical ability to direct the relevant activities of the funds according to the specific needs of the business (including the decisions that may arise in particular circumstances only).

- Possible existence of special relationships with the funds.

- The Group’s implicit or explicit commitments to back the funds.

Whether the Group has the capacity to use its power over the funds to influence the amount of the returns to which it is exposed.

Thus, there are cases where the Group is highly exposed to the existing variable returns and retains decision-making powers over the institution, either directly or through an agent. In these cases, the securitization funds are consolidated with the Group.

3.2.2.4. Criteria for the recognition of earnings in the event of the removal of assets from the balance sheet

In order for the Group to recognize the result generated on the sale of financial instruments, the sale has to involve the corresponding removal from the accounts, which requires the fulfillment of the requirements governing the substantial transfer of risks and benefits as described in the preceding point.

The result will be reflected on the income statement, being calculated as the difference between the book value and the net value received including any new additional assets obtained minus any liabilities assumed.

When the amount of the financial asset transferred matches the total amount of the original financial asset, the new financial assets, financial liabilities and liabilities for the provision of services, as appropriate, that are generated as a result of the transfer will be recorded according to their fair value.

3.2.2.5. Key hypothesis for valuing risks and benefits retained on securitized assets

The Group considers that a substantial withholding is made of the risks and benefits of securitizations when the subordinated bonds of issues are kept and/or it grants subordinated finance to the securitization funds that mean substantially retaining the credit losses expected from the loans transferred.

The Group currently has traditional securitizations only, and no synthetic securitizations.

3.2.3. Information on credit risks

3.2.3.1. Exposure to credit risk

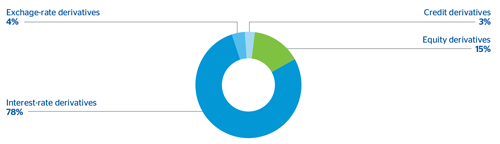

Pursuant to Article 5 of the Solvency Regulations, with respect to the capital requirements for credit risk, exposure is understood to be any asset item and all items included in the Group’s memorandum accounts involving credit risk and not deducted from the Group’s eligible capital. Accordingly, inclusion is made mainly of customer lending items, with their corresponding undrawn balances, letters of credit and guarantees, debt securities and capital instruments, cash and deposits in central banks and credit institutions, assets purchased or sold under a repurchase agreement (asset and liability repos), financial derivatives (nominal) and fixed assets.

Below is a presentation of the balance of the original exposure and the allowances under the advanced measurement and standardized approaches as of December 31, 2015 and 2014. In accordance with Article 444 e) of the Solvency Regulations, only the exposure net of allowances is presented for those exposures calculated under the standardized approach.

Table 8. Exposure to credit risk

2015

(Million euros)

|

|

|

|

|

Exposure after applying conversion factors | |||||

|---|---|---|---|---|---|---|---|---|---|

| Category of exposure | Original exposure (1) | Provisions | Exposure Net of provisions (2) | On-balance-sheet exposure after mitigation techniques (3a) | Off-balance-sheet exposure after mitigation techniques (3b) | Fully Adjusted Value of the exposure (4) | EAD (5)(6) | RWA (7) | RWA Density |

| Central governments or central banks | 139,910 | (17) | 139,894 | 137,534 | 3,530 | 141,063 | 138,669 | 35,174 | 25% |

| Regional governments or local authorities | 7,050 | (7) | 7,043 | 6,589 | 387 | 6,977 | 6,807 | 2,996 | 44% |

| Public sector entities | 5,211 | (15) | 5,195 | 2,474 | 613 | 3,087 | 2,616 | 1,349 | 52% |

| Multilateral Development banks | 39 | () | 39 | 38 | 0 | 39 | 38 | 25 | 67% |

| International organizations | 9 | () | 9 | 9 | 0 | 9 | 9 | - | 0% |

| Institutions | 33,594 | (26) | 33,568 | 18,453 | 11,072 | 29,525 | 19,555 | 5,730 | 29% |

| Corporates | 155,351 | (2,198) | 153,153 | 85,531 | 57,689 | 143,219 | 105,263 | 101,195 | 96% |

| Retail | 76,212 | (537) | 75,674 | 49,848 | 23,848 | 73,696 | 52,632 | 36,929 | 70% |

| Secured by mortgages on immovable property | 54,979 | (239) | 54,740 | 53,051 | 221 | 53,272 | 53,158 | 20,497 | 39% |

| Exposures in default | 9,745 | (4,960) | 4,785 | 4,186 | 263 | 4,449 | 4,371 | 4,706 | 108% |

| Items associated with particularly high risk | 258 | (7) | 251 | 151 | 51 | 202 | 154 | 143 | 93% |

| Covered bonds | 846 | - | 846 | 839 | - | 839 | 839 | 393 | 47% |

| Short-term claims on institutions and corporate | 2,364 | - | 2,364 | 2,364 | - | 2,364 | 2,364 | 727 | 31% |

| Collective investments undertakings (CIU) | 605 | () | 605 | 108 | 353 | 461 | 293 | 67 | 23% |

| Other exposures | 27,690 | (86) | 27,605 | 31,994 | 4,029 | 36,023 | 34,081 | 18,806 | 55% |

| Securitized positions | 3,370 | (12) | 3,358 | 3,358 | - | 3,358 | 3,358 | 1,049 | 31% |

| TOTAL STANDARDIZED APPROACH | 517,235 | (8,104) | 509,131 | 396,528 | 102,056 | 498,584 | 424,207 | 229,787 | 57% |

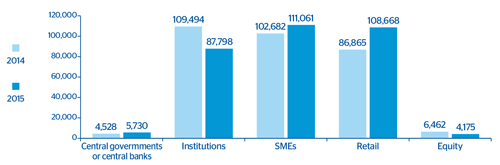

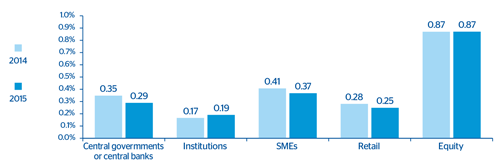

| Central governments or central banks | 4,475 | (19) | - | 5,333 | 785 | 6,118 | 5,730 | 224 | 4% |

| Institutions | 90,651 | (106) | - | 84,612 | 5,646 | 90,259 | 87,798 | 10,826 | 12% |

| Corporates | 140,200 | (5,976) | - | 82,591 | 56,021 | 138,613 | 111,061 | 63,607 | 57% |

| Retail | 125,898 | (2,510) | - | 104,862 | 21,005 | 125,867 | 108,669 | 23,180 | 21% |

| Of which: Secured by real estate collateral | 97,099 | (1,533) | - | 90,326 | 6,746 | 97,072 | 90,441 | 12,411 | 14% |

| Of which: Qualifying revolving retail | 19,507 | (462) | - | 6,324 | 13,184 | 19,507 | 9,433 | 7,420 | 79% |

| Of which: Other retail assets | 9,291 | (515) | - | 8,212 | 1,075 | 9,287 | 8,795 | 3,349 | 38% |

| Securitized positions | 982 | (3) | - | 982 | - | 982 | 982 | 345 | 35% |

| TOTAL ADVANCED MEASUREMENT APPROACH | 362,206 | (8,614) | - | 278,381 | 83,457 | 361,838 | 314,241 | 98,182 | 31% |

| TOTAL CREDIT RISK DILUTION AND DELIVERY | 879,441 | (16,719) | 509,131 | 674,908 | 185,514 | 860,422 | 738,447 | 327,969 | 44% |

| Equity | 9,418 | (163) | - | 9,028 | - | 9,028 | 9,418 | 19,522 | 207% |

| Simple Method | 4,853 | 293 | - | 4,853 | - | 4,853 | 4,853 | 11,993 | 247% |

| Non-trading equity instruments in sufficiently diversified portfolios | 4,554 | 310 | - | 4,554 | - | 4,554 | 4,554 | 11,065 | 243% |

| Exchange-traded equity instruments | 299 | (17) | - | 299 | - | 299 | 299 | 928 | 311% |

| PD/LGD Method | 4,175 | (426) | - | 4,175 | - | 4,175 | 4,175 | 6,230 | 149% |

| Internal Models | 390 | (29) | - | - | - | - | 390 | 1,299 | 333% |

| TOTAL CREDIT RISK | 888,859 | (16,881) | 509,131 | 683,936 | 185,514 | 869,450 | 747,865 | 347,491 | 46% |

2014

(Million euros)

|

|

|

|

|

Exposure after applying conversion factors | |||||

|---|---|---|---|---|---|---|---|---|---|

| Category of exposure | Original exposure (1) | Provisions | Exposure Net of provisions (2) | On-balance-sheet exposure after mitigation techniques (3a) | Off-balance-sheet exposure after mitigation techniques (3b) | Fully Adjusted Value of the exposure (4) | EAD (5)(6) | RWA (7) | RWA Density |

| Central governments or central banks | 103,926 | (18) | 103,909 | 106,406 | 2,498 | 108,904 | 107,683 | 29,850 | 28% |

| Regional governments or local authorities | 7,482 | (15) | 7,467 | 7,236 | 151 | 7,387 | 7,320 | 3,300 | 45% |

| Public sector entities | 5,524 | (29) | 5,496 | 2,181 | 918 | 3,099 | 2,532 | 1,338 | 53% |

| Multilateral Development banks | 93 | – | 93 | 92 | 0 | 93 | 92 | 25 | 27% |

| International organizations | 16 | – | 16 | 16 | 0 | 16 | 16 | – | 0% |

| Institutions | 20,366 | (22) | 20,344 | 10,337 | 10,040 | 20,377 | 11,461 | 2,638 | 23% |

| Corporates | 107,908 | (163) | 107,744 | 59,464 | 42,678 | 102,143 | 71,340 | 66,397 | 93% |

| Retail | 59,973 | (467) | 59,506 | 40,604 | 16,581 | 57,185 | 43,338 | 30,725 | 71% |

| Secured by mortgages on immovable property | 54,500 | (353) | 54,147 | 51,750 | 732 | 52,482 | 52,109 | 19,763 | 38% |

| Exposures in default | 9,311 | (3,440) | 5,870 | 5,181 | 63 | 5,244 | 5,224 | 5,450 | 104% |

| Items associated with particularly high risk | 380 | (31) | 349 | 174 | 35 | 208 | 176 | 150 | 85% |

| Covered bonds | 605 | – | 605 | 605 | – | 605 | 605 | 125 | 21% |

| Short-term claims on institutions and corporate | 2,063 | – | 2,063 | 1,834 | – | 1,834 | 1,834 | 425 | 23% |

| Collective investments undertakings (CIU) | 124 | – | 124 | 46 | 4 | 51 | 50 | 13 | 26% |

| Other exposures | 27,105 | (84) | 27,020 | 30,801 | 667 | 31,468 | 31,329 | 17,225 | 55% |

| Securitized positions | 2,723 | (18) | 2,705 | 2,705 | – | 2,705 | 2,705 | 1,063 | 39% |

| TOTAL STANDARDIZED APPROACH | 402,098 | (4,639) | 397,459 | 319,432 | 74,369 | 393,801 | 337,815 | 178,487 | 53% |

| Central governments or central banks | 3,001 | (4) |

|

4,153 | 749 | 4,902 | 4,529 | 376 | 8% |

| Institutions | 112,235 | (78) |

|

105,642 | 6,338 | 111,981 | 109,494 | 12,425 | 11% |

| Corporates | 130,154 | (6,711) |

|

75,120 | 53,389 | 128,508 | 102,682 | 60,998 | 59% |

| Retail | 96,276 | (1,620) |

|

83,698 | 12,577 | 96,276 | 86,866 | 21,059 | 24% |

| Of which: Secured by real estate collateral | 70,113 | (721) |

|

69,880 | 233 | 70,113 | 69,892 | 10,420 | 15% |

| Of which: Qualifying revolving retail | 17,943 | (516) |

|

6,377 | 11,566 | 17,943 | 9,134 | 7,203 | 79% |

| Of which: Other retail assets | 8,219 | (384) |

|

7,441 | 778 | 8,219 | 7,839 | 3,436 | 44% |

| Securitized positions | 1,042 | (21) | – | 1,042 | – | 1,042 | 1,042 | 712 | 68% |

| TOTAL ADVANCED MEASUREMENT APPROACH | 342,708 | (8,434) | – | 269,655 | 73,054 | 342,708 | 304,612 | 95,570 | 31% |

| TOTAL CREDIT RISK DILUTION AND DELIVERY | 744,807 | (13,073) | 397,459 | 589,087 | 147,423 | 736,510 | 642,427 | 274,057 | 43% |

| Equity | 10,696 | (61) | – | 10,442 | – | 10,442 | 10,696 | 21,866 | 204% |

| Simple Method | 3,980 | (40) | – | 3,980 | – | 3,980 | 3,980 | 9,840 | 247% |

| Non-trading equity instruments in sufficiently diversified portfolios | 3,712 | (34) | – | 3,712 | – | 3,712 | 3,712 | 9,002 | 243% |

| Exchange-traded equity instruments | 268 | (6) | – | 268 | – | 268 | 268 | 838 | 312% |

| PD/LGD Method | 6,462 | – | – | 6,462 | – | 6,462 | 6,462 | 10,417 | 161% |

| Internal Models | 254 | (21) | – | – | – | – | 254 | 1,609 | 634% |

| TOTAL CREDIT RISK | 755,503 | (13,134) | 397,459 | 599,529 | 147,423 | 746,952 | 653,124 | 295,925 | 45% |

3.2.3.2. Average value of the exposures throughout 2015 and 2014

The table below shows the average value of exposure to credit risk in 2015 and 2014 for both the advanced measurement and standardized approaches for each one of the exposure categories:

Table 9. Average value of the exposures throughout 2014 and 2015

(Million euros)

| Category of exposure | Original average exposure for the period | |

|---|---|---|

|

|

2015 | 2014 |

| Central governments or central banks | 122,926 | 96,222 |

| Regional governments or local authorities | 7,446 | 6,575 |

| Public sector entities | 5,531 | 6,059 |

| Multilateral Development banks | 66 | 91 |

| International organizations | 1,584 | 10 |

| Institutions | 35,855 | 20,217 |

| Corporates | 132,916 | 100,720 |

| Retail | 65,913 | 58,305 |

| Secured by mortgages on immovable property | 53,696 | 54,005 |

| Exposures in default | 9,327 | 10,776 |

| Items associated with particularly high risk | 270 | 454 |

| Covered bonds | 2,492 | 4,481 |

| Short-term claims on institutions and corporate | 2,237 | 2,040 |

| Collective investments undertakings (CIU) | 388 | 169 |

| Other exposures | 26,582 | 25,388 |

| TOTAL STANDARDIZED APPROACH | 467,229 | 385,512 |

| Central governments or central banks | 3,769 | 2,495 |

| Institutions | 94,492 | 96,324 |

| Corporates | 138,628 | 123,953 |

| Retail | 119,200 | 101,774 |

| Of which: Secured by real estate collateral | 91,049 | 70,895 |

| Of which: Qualifying revolving retail | 19,207 | 17,827 |

| Of which: Other retail assets | 8,945 | 6,526 |

| TOTAL ADVANCED MEASUREMENT APPROACH | 356,089 | 324,546 |

| TOTAL CREDIT RISK DILUTION AND DELIVERY (5) | 823,318 | 710,058 |

| Securitized positions | 4,222 | 3,573 |

| Of which: Standardized Approach | 3,236 | 2,539 |

| Of which: Advanced Measurement Approach | 985 | 1,034 |

| Equity | 9,835 | 10,414 |

| Of which: Simple Method | 4,365 | 4,053 |

| Equity instruments in sufficiently diversified portfolios | 1,283 | 696 |

| Exchange Traded equity instruments | 3,160 | 3,357 |

| Of which: PD/LGD Method | 5,002 | 5,901 |

| Of which: Internal Models | 468 | 460 |

| TOTAL CREDIT RISK | 837,375 | 724,045 |

3.2.3.3. Distribution by geographical area

The following chart shows the distribution by geographical area of the original exposure based on the obligor’s country. The breakdown includes exposure under the standardized and advanced measurement approaches, without including positions in securitizations or equity.

Table 10. Distribution by geographical area of exposure to credit risk

2015

(Million euros)

| Category of exposure | Total | Spain | Turkey | Eurasia | Mexico | The United States |

South America | Rest of the world |

|---|---|---|---|---|---|---|---|---|

| Central governments or central banks | 139,910 | 69,189 | 19,837 | 10,379 | 16,441 | 10,821 | 13,243 | 0 |

| Regional governments or local authorities | 7,050 | 1,755 | 11 | 237 | - | 4,945 | 102 | 0 |

| Public sector entities | 5,211 | 395 | 2 | 201 | 2,911 | 310 | 1,391 | - |

| Multilateral Development banks | 39 | 0 | - | - | - | - | 38 | - |

| International organizations | 9 | 0 | - | 9 | - | - | - | - |

| Institutions | 33,594 | 12,586 | 2,847 | 9,773 | 3,112 | 2,495 | 2,753 | 27 |

| Corporates | 155,351 | 6,149 | 40,627 | 10,350 | 18,955 | 55,622 | 23,339 | 308 |

| Retail | 76,212 | 11,878 | 27,892 | 2,086 | 6,920 | 8,428 | 18,948 | 59 |

| Secured by mortgages on immovable property | 54,979 | 5,528 | 8,493 | 3,127 | 9,845 | 15,747 | 12,187 | 52 |

| Exposures in default | 9,745 | 4,816 | 1,588 | 1,041 | 434 | 643 | 1,193 | 30 |

| Items associated with particularly high risk | 258 | 254 | - | 4 | - | - | - | - |

| Covered bonds | 846 | 0 | - | - | 846 | - | - | - |

| Short-term claims on institutions and corporate | 2,364 | 174 | - | 20 | 288 | 1,684 | 197 | - |

| Collective investments undertakings (CIU) | 605 | 197 | - | 217 | 0 | 187 | 4 | - |

| Other exposures | 27,690 | 13,243 | 2,162 | 1,102 | 6,242 | 1,381 | 3,411 | 149 |

| Securitized positions | 3,370 | 686 | - | - | 413 | 2,271 | - | - |

| TOTAL CREDIT RISK BY THE STANDARDIZED APPROACH | 517,235 | 126,849 | 103,461 | 38,547 | 66,408 | 104,535 | 76,807 | 627 |

| Central governments or central banks | 4,475 | 57 | 1 | 263 | 132 | 3,008 | 480 | 533 |

| Institutions | 90,651 | 43,646 | 5 | 42,969 | 577 | 1,910 | 296 | 1,249 |

| Corporates | 140,200 | 65,425 | 568 | 38,098 | 17,561 | 12,766 | 3,086 | 2,694 |

| Retail | 125,898 | 110,287 | 0 | 445 | 15,061 | 33 | 49 | 23 |

| Securitized positions | 982 | 982 | - | - | - | - | - | - |

| TOTAL CREDIT RISK BY THE ADVANCED MEASUREMENT APPROACH | 362,206 | 220,397 | 574 | 81,776 | 33,331 | 17,717 | 3,911 | 4,500 |

| TOTAL CREDIT RISK DILUTION AND DELIVERY | 879,441 | 347,247 | 104,035 | 120,323 | 99,739 | 122,252 | 80,718 | 5,126 |

2014

(Million euros)

| Category of exposure | Total | Spain | Turkey | Eurasia | Mexico | The United States |

South America | Rest of the world |

|---|---|---|---|---|---|---|---|---|

| Central governments or central banks | 103,926 | 52,352 | 5,633 | 8,749 | 12,913 | 5,663 | 18,617 | – |

| Regional governments or local authorities | 7,482 | 1,597 | 13 | 310 | 1,014 | 4,461 | 86 | – |

| Public sector entities | 5,524 | 86 | – | 344 | 3,148 | 236 | 1,710 | – |

| Multilateral Development banks | 93 | – | – | 38 | – | 12 | 42 | – |

| International organizations | 16 | – | – | 16 | – | – | – | – |

| Institutions | 20,366 | 8,206 | 724 | 5,256 | 1,542 | 1,883 | 2,685 | 70 |

| Corporates | 107,908 | 4,686 | 9,172 | 5,144 | 16,159 | 49,601 | 22,853 | 292 |

| Retail | 59,973 | 11,217 | 5,273 | 3,408 | 5,915 | 7,302 | 26,826 | 32 |

| Secured by mortgages on immovable property | 54,500 | 12,952 | 1,857 | 2,937 | 9,799 | 14,024 | 12,926 | 5 |

| Exposures in default | 9,311 | 5,341 | 350 | 913 | 947 | 528 | 1,224 | 8 |

| Items associated with particularly high risk | 380 | 380 | – | – | – | – | – | – |

| Covered bonds | 605 | – | – | – | 605 | – | – | – |

| Short-term claims on institutions and corporate | 2,063 | 211 | – | – | 0 | 1,238 | 614 | – |

| Collective investments undertakings (CIU) | 124 | 106 | – | 7 | 0 | 7 | 5 | – |

| Other exposures | 27,105 | 12,397 | 425 | 1,729 | 6,559 | 1,491 | 4,494 | 9 |

| Securitized positions | 2,723 | 867 | – | – | 188 | 1,666 | – | 1 |

| TOTAL CREDIT RISK BY THE STANDARDIZED APPROACH | 402,098 | 110,399 | 23,447 | 28,850 | 58,790 | 88,112 | 92,082 | 418 |

| Central governments or central banks | 3,001 | 149 | 3 | 296 | 113 | 1,619 | 464 | 358 |

| Institutions | 112,235 | 53,478 | 18 | 54,021 | 540 | 3,276 | 172 | 730 |

| Corporates | 130,154 | 66,208 | 347 | 36,104 | 15,408 | 7,558 | 2,546 | 1,983 |

| Retail | 96,276 | 82,134 | – | 17 | 14,111 | 2 | 8 | 4 |

| Securitized positions | 1,042 | 1,006 | – | – | – | 34 | – | 2 |

| TOTAL CREDIT RISK BY THE ADVANCED MEASUREMENT APPROACH | 342,709 | 202,974 | 368 | 90,438 | 30,172 | 12,489 | 3,191 | 3,077 |

| TOTAL CREDIT RISK DILUTION AND DELIVERY | 744,807 | 313,373 | 23,815 | 119,288 | 88,962 | 100,601 | 95,273 | 3,494 |

Chart 4. Distribution by geographical area of exposure to credit risk

As can be seen from the above table, the original exposure in Europe under advanced credit risk models accounts for over 50% of the total, while in the remaining countries the percentage is around 50%.

It also shows graphically the distribution of original exposure by geographical area, revealing the Group’s high level of geographical diversification, which constitutes one of the key levers for its strategic growth.

The next table shows the distribution by geographical area of the book balances of the allowances for financial and non- financial asset losses and for contingent liabilities.

Table 11. Distribution by geographical area of the book balances of the non-performing and impaired exposures of financial assets and contingent liabilities

2015

(Million euros)

|

|

Total | Spain | Turkey | Eurasia | Mexico | The United States |

South America |

Rest of the world |

|---|---|---|---|---|---|---|---|---|

| Non-performing and impaired exposures | 24,860 | 20,311 | 1,219 | 986 | 539 | 537 | 1,140 | 128 |

2014

(Million euros)

|

|

Total | Spain | Turkey | Eurasia | Mexico | The United States |

South America |

Rest of the world |

|---|---|---|---|---|---|---|---|---|

| Non-performing and impaired exposures | 24,970 | 19,937 | 350 | 1,308 | 1,271 | 576 | 1,501 | 26 |

The next table shows the distribution by geographical area of the book balances of the allowances for financial asset losses and for contingent liabilities.

Table 12. Distribution by geographical area of the book balances of the value adjustments for impairment of financial assets and contingent liabilities

2015

(Million euros)

|

|

Total | Spain | Turkey | Eurasia | Mexico | The United States |

South America |

Rest of the world |

|---|---|---|---|---|---|---|---|---|

| Value adjustments and provisions | 19,515 | 14,110 | 1,751 | 886 | 1,361 | 319 | 1,059 | 29 |

2014

(Million euros)

|

|

Total | Spain | Turkey | Eurasia | Mexico | The United States |

South America |

Rest of the world |

|---|---|---|---|---|---|---|---|---|

| Value adjustments and provisions | 15,254 | 11,357 | 312 | 754 | 1,486 | 242 | 1,093 | 10 |

3.2.3.4. Distribution by sector

Below is the distribution by economic sector (standardized and advanced measurement approaches) of the original exposure, excluding equity positions.

Table 13. Distribution by sector of exposure to credit risk

2015

(Million euros)

|

|

Distribution by sector of exposure to credit risk | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Category of exposure | Total | Credit institutions, insurance and brokerage |

Public sector |

Agriculture | Industry | Construction | Commercial | Individuals | Other sectors |

| Central governments or central banks | 139,910 | 0.54% | 96.69% | 0.02% | 0.49% | 0.13% | 0.42% | 0.94% | 0.78% |

| Regional governments or local authorities | 7,050 | 7.84% | 51.87% | 0.23% | 7.16% | 1.84% | 6.13% | 13.67% | 11.26% |

| Public sector entities | 5,211 | 1.99% | 87.77% | 0.06% | 1.82% | 0.47% | 1.56% | 3.47% | 2.86% |

| Multilateral Development Banks | 39 | 59.56% | 8.80% | 0.18% | 5.62% | 1.45% | 4.82% | 10.73% | 8.85% |

| International organizations | 9 | 0.00% | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Institutions | 33,594 | 92.22% | 1.69% | 0.03% | 1.08% | 0.28% | 0.93% | 2.07% | 1.70% |

| Corporates | 155,351 | 1.73% | 1.64% | 0.58% | 22.53% | 6.06% | 32.99% | 1.96% | 32.49% |

| Retail | 76,212 | 0.84% | 0.98% | 0.81% | 9.81% | 2.55% | 5.07% | 52.05% | 27.89% |

| Secured by mortgages on immovable property | 54,979 | 1.23% | 1.49% | 0.54% | 3.96% | 2.48% | 12.58% | 46.99% | 30.73% |

| Exposures in default | 9,745 | 3.45% | 4.25% | 0.40% | 10.93% | 12.54% | 14.49% | 26.64% | 27.30% |

| Items associated with particularly high risk | 258 | 1.94% | 0.01% | 0.98% | 10.61% | 9.18% | 10.17% | 24.40% | 42.71% |

| Covered bonds | 846 | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Short-term claims on institutions and corporate | 2,364 | 14.38% | 3.12% | 0.06% | 2.00% | 0.51% | 72.96% | 3.81% | 3.14% |

| Collective investments undertakings (CIU) | 605 | 99.01% | 0.13% | 0.00% | 0.09% | 0.02% | 0.07% | 0.16% | 0.51% |

| Other exposures | 27,690 | 4.02% | 4.98% | 0.11% | 3.08% | 0.84% | 3.11% | 6.89% | 76.97% |

| Securitized positions | 3,370 | 60.59% | 38.58% | 0.00% | 0.00% | 0.00% | 0.83% | 0.00% | 0.00% |

| TOTAL CREDIT RISK BY THE STANDARDIZED APPROACH | 517,235 | 7.92% | 30.14% | 0.37% | 9.21% | 2.80% | 12.94% | 14.52% | 22.10% |

| Central governments or central banks | 4,475 | 0.00% | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Institutions | 90,651 | 70.84% | 6.25% | 0.13% | 3.99% | 1.03% | 3.42% | 7.62% | 6.28% |

| Corporates | 140,200 | 5.18% | 0.13% | 0.81% | 38.28% | 7.85% | 13.57% | 0.70% | 32.57% |

| Retail | 125,898 | 0.02% | 0.00% | 0.19% | 1.05% | 0.73% | 1.59% | 95.23% | 1.20% |

| Securitized positions | 982 | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| TOTAL CREDIT RISK BY THE ADVANCED MEASUREMENT APPROACH | 362,206 | 20.72% | 2.69% | 0.41% | 16.08% | 3.52% | 6.57% | 35.08% | 14.43% |

| TOTAL CREDIT RISK | 879,441 | 13.19% | 18.83% | 0.39% | 12.04% | 3.09% | 10.32% | 22.99% | 18.94% |

2014

(Million euros)

|

|

Distribution by sector of exposure to credit risk | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Category of exposure | Total | Credit institutions, insurance and brokerage |

Public sector |

Agriculture | Industry | Construction | Commercial | Individuals | Other sectors |

| Central governments or central banks | 103,926 | 0.44% | 97.41% | 0.02% | 0.34% | 0.11% | 0.36% | 0.81% | 0.52% |

| Regional governments or local authorities | 7,482 | 7.09% | 58.11% | 0.38% | 5.43% | 1.71% | 5.83% | 13.06% | 8.38% |

| Public sector entities | 5,524 | 1.21% | 92.88% | 0.07% | 0.92% | 0.29% | 0.99% | 2.22% | 1.42% |

| Multilateral Development Banks | 93 | 31.25% | 14.53% | 0.60% | 8.46% | 2.67% | 9.09% | 20.34% | 13.06% |

| International organizations | 16 | 0.00% | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Institutions | 20,366 | 36.56% | 13.41% | 0.55% | 7.81% | 2.46% | 8.39% | 18.77% | 12.04% |

| Corporates | 107,908 | 2.49% | 3.57% | 2.68% | 16.28% | 6.96% | 44.69% | 4.58% | 18.75% |

| Retail | 59,973 | 2.24% | 1.60% | 1.25% | 5.84% | 3.00% | 9.14% | 60.93% | 16.01% |

| Secured by mortgages on immovable property | 54,500 | 1.42% | 1.74% | 0.50% | 2.46% | 1.32% | 4.38% | 61.16% | 27.01% |

| Exposures in default | 9,311 | 1.95% | 2.52% | 1.51% | 5.89% | 9.74% | 10.46% | 32.64% | 35.31% |

| Items associated with particularly high risk | 380 | 0.74% | 0.02% | 0.84% | 9.96% | 6.73% | 7.67% | 34.57% | 39.48% |

| Covered bonds | 605 | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Short-term claims on institutions and corporate | 2,063 | 2.57% | 3.09% | 0.84% | 1.88% | 0.93% | 66.25% | 4.33% | 20.10% |

| Collective investments undertakings (CIU) | 124 | 96.68% | 0.70% | 0.03% | 0.41% | 0.13% | 0.44% | 0.98% | 0.63% |

| Other exposures | 27,105 | 5.79% | 5.43% | 0.24% | 3.30% | 1.00% | 3.71% | 7.67% | 72.86% |

| Securitized positions | 2,723 | 7.74% | 76.83% | 0.00% | 0.00% | 0.00% | 15.43% | 0.00% | 0.00% |

| TOTAL CREDIT RISK BY THE STANDARDIZED APPROACH | 402,098 | 4.00% | 30.61% | 1.07% | 6.55% | 2.99% | 15.54% | 21.37% | 17.87% |

| Central governments or central banks | 3,001 | 0.00% | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Institutions | 112,235 | 76.92% | 4.88% | 0.20% | 2.84% | 0.90% | 3.05% | 6.83% | 4.38% |

| Corporates | 130,154 | 4.99% | 0.32% | 0.68% | 37.13% | 8.84% | 13.48% | 1.01% | 33.55% |

| Retail | 96,276 | 0.01% | 0.00% | 0.11% | 0.65% | 0.25% | 0.91% | 97.42% | 0.64% |

| Securitized positions | 1,042 | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| TOTAL CREDIT RISK BY THE ADVANCED MEASUREMENT APPROACH | 342,708 | 27.39% | 2.60% | 0.36% | 15.21% | 3.72% | 6.37% | 29.99% | 14.35% |

| TOTAL CREDIT RISK | 744,807 | 14.76% | 17.72% | 0.74% | 10.54% | 3.33% | 11.32% | 25.34% | 16.25% |

The following table shows the distribution by counterparty of the book balances of the nonperforming and impaired exposures of financial assets and contingent liabilities.

Table 14. Distribution by sector of the book balances of the non-performing and impaired exposures of financial assets and contingent liabilities

2015

(Million euros)

|

|

Total | Credit institutions, insurance and brokerage |

Public sector |

Corporates | Retail | Other sectors |

|---|---|---|---|---|---|---|

| Non-performing and impaired exposures | 24,860 | 0.81% | 2.43% | 52.35% | 33.40% | 11.01% |

2014

|

|

Total | Credit institutions, insurance and brokerage |

Public sector |

Corporates | Retail | Other sectors |

|---|---|---|---|---|---|---|

| Non-performing and impaired exposures | 24,970 | 1.01% | 1.39% | 60.44% | 30.81% | 6.35% |

The next table shows the distribution by counterparty of the book balances of allowances for financial asset losses and for contingent exposures.

Table 15. Distribution by sector of the book balances of the value adjustments for impairment of financial assets and contingent liabilities

2015

(Million euros)

|

|

Total | Credit institutions, insurance and brokerage |

Public sector |

Corporates | Retail | Other sectors |

|---|---|---|---|---|---|---|

| Value adjustments and provisions | 19,515 | 1.51% | 0.86% | 46.67% | 33.33% | 12.13% |

2014

|

|

Total | Credit institutions, insurance and brokerage |

Public sector |

Corporates | Retail | Other sectors |

|---|---|---|---|---|---|---|

| Value adjustments and provisions | 15,254 | 2.13% | 1.02% | 58.94% | 27.72% | 10.18% |

3.2.3.5. Distribution by residual maturity

The following table shows the distribution of original exposure by residual maturity, broken down by category of exposure under the standardized and advanced measurement approaches, excluding positions in equity.

Table 16. Distribution by residual maturity of exposure to credit risk

2015

(Million euros)

|

|

Original exposure by residual maturity | |||

|---|---|---|---|---|

| Category of exposure | Total | Less than 1 year | Between 1 and 5 years | Over 5 years |

| Central governments or central banks | 139,910 | 74,340 | 33,644 | 31,926 |

| Regional governments or local authorities | 7,050 | 2,957 | 1,575 | 2,518 |

| Public sector entities | 5,211 | 1,227 | 537 | 3,446 |

| Multilateral Development Banks | 39 | 21 | 12 | 6 |

| International organizations | 9 | - | 9 | 0 |

| Institutions | 33,594 | 18,954 | 8,224 | 6,417 |

| Corporates | 155,351 | 51,930 | 60,521 | 42,900 |

| Retail | 76,212 | 35,968 | 24,386 | 15,858 |

| Secured by mortgages on immovable property | 54,979 | 7,300 | 8,731 | 38,948 |

| Exposures in default | 9,745 | 3,987 | 2,841 | 2,917 |

| Items associated with particularly high risk | 258 | 49 | 48 | 161 |

| Covered bonds | 846 | - | 846 | - |

| Short-term claims on institutions and corporate | 2,364 | 1,844 | 114 | 405 |

| Collective investments undertakings (CIU) | 605 | 345 | 228 | 33 |

| Other exposures | 27,690 | 11,330 | 8,071 | 8,289 |

| Securitized positions | 3,370 | 336 | 514 | 2,520 |

| TOTAL CREDIT RISK BY THE STANDARDIZED APPROACH | 517,235 | 210,590 | 150,301 | 156,344 |

| Central governments or central banks | 4,475 | 387 | 451 | 3,637 |

| Institutions | 90,651 | 51,221 | 17,809 | 21,621 |

| Corporates | 140,200 | 49,175 | 52,876 | 38,149 |

| Retail | 125,898 | 11,279 | 18,632 | 95,987 |

| Securitized positions | 982 | 57 | 40 | 885 |

| TOTAL CREDIT RISK BY THE ADVANCED MEASUREMENT APPROACH | 362,206 | 112,120 | 89,808 | 160,278 |

| TOTAL CREDIT RISK DILUTION AND DELIVERY | 879,441 | 322,709 | 240,109 | 316,622 |

2014

(Million euros)

|

|

Original exposure by residual maturity | |||

|---|---|---|---|---|

| Category of exposure | Total | Less than 1 year | Between 1 and 5 years | Over 5 years |

| Central governments or central banks | 103,926 | 48,471 | 29,950 | 25,506 |

| Regional governments or local authorities | 7,482 | 1,974 | 1,542 | 3,966 |

| Public sector entities | 5,524 | 742 | 1,042 | 3,740 |

| Multilateral Development Banks | 93 | 5,141 | 6,526 | (11,574) |

| International organizations | 16 | 2 | 13 | 1 |

| Institutions | 20,366 | (1,016) | 13,298 | 8,084 |

| Corporates | 107,908 | 20,525 | 49,438 | 37,945 |

| Retail | 59,973 | 24,052 | 21,151 | 14,770 |

| Secured by mortgages on immovable property | 54,500 | 3,157 | 6,896 | 44,447 |

| Exposures in default | 9,311 | 2,649 | 3,374 | 3,288 |

| Items associated with particularly high risk | 380 | 54 | 77 | 249 |

| Covered bonds | 605 | - | 605 | - |

| Short-term claims on institutions and corporate | 2,063 | 43 | 999 | 1,020 |

| Collective investments undertakings (CIU) | 124 | 111 | 2 | 11 |

| Other exposures | 27,105 | 7,711 | 9,823 | 9,571 |

| Securitized positions | 2,723 | 3 | 186 | 2,534 |

| TOTAL CREDIT RISK BY THE STANDARDIZED APPROACH | 402,098 | 113,617 | 144,922 | 143,558 |

| Central governments or central banks | 3,001 | 883 | 231 | 1,887 |

| Institutions | 112,235 | 72,927 | 16,934 | 22,374 |

| Corporates | 130,154 | 51,038 | 44,782 | 34,335 |

| Retail | 96,276 | 1,492 | 4,328 | 90,456 |

| Securitized positions | 1,042 | - | 714 | 328 |

| TOTAL CREDIT RISK BY THE ADVANCED MEASUREMENT APPROACH | 342,709 | 126,340 | 66,989 | 149,380 |

| TOTAL CREDIT RISK DILUTION AND DELIVERY | 744,807 | 239,957 | 211,911 | 292,938 |

3.2.3.6. Value adjustments for impairment losses and allowances for contingent risks and commitments

The following table presents the movement recorded in the years 2015 and 2014 in the value adjustments for allowances and impairment losses of financial assets on the balance sheet and for contingent risks and commitments, including country risk, generic and specific funds.

Table 17. Value adjustments for impairment losses and allowances for contingent risks and commitments

(Million euros)

| Item | Value adjustments and provisions |

Provisions for contingent liabilities and commitments |

Total |

|---|---|---|---|

| BALANCE AT START OF YEAR | 14,850 | 404 | 15,254 |

| Increase in impairment charged to income | 7,175 | 78 | 7,253 |

| Decrease in impairment credited to income | –2,143 | –76 | –2,219 |

| Institutions acquired by the Group during the year | 6,572 | 307 | 6,879 |

| Institutions disposed of during the year | 0 | 0 | 0 |

| Transfers to written-off loans | –5,239 | –26 | –5,265 |

| Exchange differences and others | –2,404 | 17 | –2,387 |

| BALANCE AT END OF YEAR | 18,811 | 704 | 19,515 |

| Of which: |

|

|

|

| For impaired portfolio | 14,540 | 370 | 14,911 |

| For current non-impaired portfolio | 4,271 | 333 | 4,604 |

3.2.3.7. Total impairment losses for the period

The following table shows details of impairment losses and allowances on financial assets and contingent risks and commitments, as well as derecognition of losses recognized previously in asset write-offs recorded directly in the income statement in 2015 and 2014.

Table 18. Total impairment losses for the period

(Million euros)

| Items | 2015 | 2014 |

|---|---|---|

| Financial assets | 4,495 | 4,401 |

| Of which: |

|

|

| Recovery of written-off assets | 490 | 443 |

| Contigent exposure and commitments (recoveries) | 8 | 15 |

| TOTAL IMPAIRED ASSETS | 4,503 | 4,417 |

3.2.4. Information on the standardized approach

3.2.4.1. Identification of external rating agencies

The external credit assessment institutions (ECAIs) appointed by the Group to determine the risk weightings applicable to its exposures are the following: Standard&Poor’s, Moody’s, Fitch and DBRS.

The exposures for which the ratings of each ECAI are used are those corresponding to the wholesale portfolios, basically involving “Central governments or central banks” in developed countries, and “Financial Institutions”.

In cases where a counterparty has ratings by different ECAIs, the Group follows the procedure laid down in Article 261 of the Solvency Regulations, which specifies the order of priority to be used in the assignment of ratings.

When two different credit ratings made by designated ECAIs are available for a rated exposure, the higher risk weighting will be applied. However, when there are more than two credit ratings for the same rated exposure, use is to be made of the two credit ratings that provide the lowest risk weightings. If the two lowest risk weightings coincide, then that weighting will be applied; if they do not coincide, the higher of the two will be applied.

3.2.4.2. Assignment of the credit ratings of public share issues

The number of cases and the amount of these assignments is not relevant for the Group in terms of admission and management of issuer credit risk.

3.2.4.3. Exposure values before and after the application of credit risk mitigation techniques

The following table presents the amounts for net exposure, prior to the application of credit risk mitigation techniques, for different risk weightings and for the different exposure categories that correspond to the standardized method, excluding securitization positions:

Table 19. Standardized approach: Exposure values before the application of credit risk mitigation techniques

2015

(Million euros)

| Category of exposure | Exposure net of allowances for losses Risk weighting |

Total | ||||||

|---|---|---|---|---|---|---|---|---|

|

|

0% | 20% | 35% | 50% | 75% | 100% | 150% |

|

| Central governments or central banks | 93,471 | 5,326 | 0 | 25,502 | 0 | 9,785 | 5,809 | 139,894 |

| Regional governments or local authorities | 1,367 | 1,754 | 0 | 2,468 | 0 | 1,453 | 0 | 7,043 |

| Public sector entities | 155 | 3,174 | 0 | 525 | 0 | 1,206 | 136 | 5,195 |

| Multilateral Development Banks | 0 | 4 | 0 | 20 | 0 | 15 | 0 | 39 |

| International organizations | 9 | 0 | 0 | 0 | 0 | 0 | 0 | 9 |

| Institutions | 6,221 | 19,807 | 1 | 5,385 | 21 | 2,000 | 132 | 33,568 |

| Corporates | 2,283 | 1,327 | 0 | 1,995 | 3,874 | 143,429 | 244 | 153,153 |

| Retail | 0 | 0 | 0 | 0 | 74,970 | 705 | 0 | 75,674 |

| Secured by mortgages on immovable property | 0 | 0 | 43,939 | 8,598 | 0 | 2,204 | 0 | 54,740 |

| Exposures in default | 0 | 0 | 0 | 0 | 0 | 3,991 | 794 | 4,785 |

| Items associated with particularly high risk | 0 | 15 | 0 | 0 | 39 | 197 | 0 | 251 |

| Covered bonds | 0 | 95 | 0 | 751 | 0 | 0 | 0 | 846 |

| Short-term claims on institutions and corporate | 0 | 2,050 | 0 | 0 | 0 | 309 | 5 | 2,364 |

| Collective investments undertakings (CIU) | 0 | 553 | 0 | 0 | 0 | 53 | 0 | 605 |

| Other exposures | 7,142 | 832 | 0 | 0 | 41 | 19,589 | 0 | 27,605 |

| TOTAL(1) | 110,650 | 34,936 | 43,940 | 45,244 | 78,946 | 184,936 | 7,120 | 505,773 |

2014

(Million euros)

| Category of exposure | Exposure net of allowances for losses Risk weighting |

Total | ||||||

|---|---|---|---|---|---|---|---|---|

|

|

0% | 20% | 35% | 50% | 75% | 100% | 150% |

|

| Central governments or central banks | 78,440 | 1,009 | 0 | 6,194 | 0 | 5,223 | 13,043 | 103,909 |

| Regional governments or local authorities | 32 | 4,321 | 0 | 1,303 | 0 | 1,811 | 0 | 7,467 |

| Public sector entities | 115 | 286 | 0 | 3,275 | 0 | 1,820 | 0 | 5,496 |

| Multilateral Development Banks | 50 | 1 | 0 | 29 | 0 | 13 | 0 | 93 |

| International organizations | 16 | 0 | 0 | 0 | 0 | 0 | 0 | 16 |

| Institutions | 2,839 | 15,018 | 0 | 1,734 | 0 | 664 | 89 | 20,344 |

| Corporates | 0 | 7,649 | 0 | 1,730 | 3,972 | 94,321 | 73 | 107,744 |

| Retail | 0 | 0 | 0 | 0 | 59,369 | 137 | 0 | 59,506 |

| Secured by mortgages on immovable property | 0 | 0 | 46,118 | 6,262 | 0 | 1,768 | 0 | 54,147 |

| Exposures in default | 0 | 0 | 0 | 0 | 0 | 5,359 | 512 | 5,870 |

| Items associated with particularly high risk | 0 | 32 | 0 | 0 | 68 | 249 | 0 | 349 |

| Covered bonds | 0 | 605 | 0 | 0 | 0 | 0 | 0 | 605 |

| Short-term claims on institutions and corporate | 0 | 1,765 | 0 | 5 | 0 | 289 | 3 | 2,063 |

| Collective investments undertakings (CIU) | 0 | 120 | 0 | 0 | 0 | 5 | 0 | 124 |

| Other exposures | 8,178 | 600 | 0 | 0 | 31 | 18,198 | 14 | 27,020 |

| TOTAL(1) | 89,669 | 31,406 | 46,118 | 20,532 | 63,439 | 129,856 | 13,733 | 394,754 |

The tables below show exposure amounts after the application of credit risk mitigation techniques, for different risk weightings and for the different categories of risk that correspond to the standardized method, excluding securitization positions:

Table 20. Standardized approach: Exposure values after the application of credit risk mitigation techniques

2015

(Million euros)

| Category of exposure | Fully adjusted value of the exposure (1) Risk weighting |

Total | ||||||

|---|---|---|---|---|---|---|---|---|

|

|

0% | 20% | 35% | 50% | 75% | 100% | 150% |

|

| Central governments or central banks | 93,273 | 6,399 | 0 | 25,798 | 0 | 9,785 | 5,807 | 141,063 |

| Regional governments or local authorities | 1,367 | 1,688 | 0 | 2,468 | 0 | 1,453 | 0 | 6,977 |

| Public sector entities | 855 | 568 | 0 | 525 | 0 | 1,004 | 136 | 3,087 |

| Multilateral Development Banks | 0 | 4 | 0 | 20 | 0 | 15 | 0 | 39 |

| International organizations | 9 | 0 | 0 | 0 | 0 | 0 | 0 | 9 |

| Institutions (3) | 3,912 | 19,529 | 0 | 4,101 | 20 | 1,830 | 132 | 29,525 |

| Corporates | 2,283 | 1,203 | 0 | 1,993 | 3,024 | 134,484 | 232 | 143,219 |

| Retail | 0 | 0 | 0 | 0 | 72,999 | 697 | 0 | 73,696 |

| Secured by mortgages on immovable property | 0 | 0 | 43,038 | 8,549 | 0 | 1,685 | 0 | 53,272 |

| Exposures in default | 0 | 0 | 0 | 0 | 0 | 3,709 | 740 | 4,449 |

| Items associated with particularly high risk | 0 | 15 | 0 | 0 | 35 | 152 | 0 | 202 |

| Covered bonds | 0 | 89 | 0 | 751 | 0 | 0 | 0 | 839 |

| Short-term claims on institutions and corporate | 0 | 2,050 | 0 | 0 | 0 | 309 | 5 | 2,364 |

| Collective investments undertakings (CIU) | 0 | 450 | 0 | 0 | 0 | 11 | 0 | 461 |

| Other exposures | 16,167 | 1,298 | 0 | 0 | 41 | 18,516 | 0 | 36,023 |

| TOTAL(2) | 117,867 | 33,292 | 43,038 | 44,206 | 76,120 | 173,651 | 7,051 | 495,226 |

2014

(Million euros)

| Category of exposure | Fully adjusted value of the exposure (1) Risk weighting |

Total | ||||||

|---|---|---|---|---|---|---|---|---|

|

|

0% | 20% | 35% | 50% | 75% | 100% | 150% |

|

| Central governments or central banks | 82,210 | 2,235 | 0 | 6,194 | 0 | 5,223 | 13,043 | 108,904 |

| Regional governments or local authorities | 32 | 4,242 | 0 | 1,302 | 0 | 1,811 | 0 | 7,387 |

| Public sector entities | 675 | 392 | 0 | 659 | 0 | 1,374 | 0 | 3,099 |

| Multilateral Development Banks | 50 | 1 | 0 | 29 | 0 | 13 | 0 | 93 |

| International organizations | 16 | 0 | 0 | 0 | 0 | 0 | 0 | 16 |

| Institutions (3) | 2,832 | 15,049 | 0 | 1,639 | 0 | 768 | 89 | 20,377 |

| Corporates | 0 | 7,668 | 0 | 1,723 | 3,183 | 89,500 | 68 | 102,143 |

| Retail | 0 | 0 | 0 | 0 | 57,049 | 135 | 0 | 57,185 |

| Secured by mortgages on immovable property | 0 | 6 | 45,002 | 6,197 | 0 | 1,278 | 0 | 52,482 |

| Exposures in default | 0 | 0 | 0 | 0 | 0 | 4,781 | 463 | 5,244 |

| Items associated with particularly high risk | 0 | 15 | 0 | 0 | 59 | 134 | 0 | 208 |

| Covered bonds | 0 | 605 | 0 | 0 | 0 | 0 | 0 | 605 |

| Short-term claims on institutions and corporate | 0 | 1,765 | 0 | 5 | 0 | 61 | 3 | 1,834 |

| Collective investments undertakings (CIU) | 0 | 46 | 0 | 0 | 0 | 5 | 0 | 51 |

| Other exposures | 13,371 | 1,042 | 46 | 0 | 31 | 16,965 | 14 | 31,468 |

| TOTAL(2) | 99,185 | 33,065 | 45,047 | 17,748 | 60,322 | 122,048 | 13,680 | 391,096 |

The following table presents the main variations in the period in terms of RWAs for the Credit Risk standardized approach.

Table 21. Variations in the period in terms of RWAs for the Credit Risk standardized approach

(Million euros)

| Credit Risk (SA) | ||

|---|---|---|

| RWAs Dec 14 |

|

177,425 |

| Effects | Asset size | 27,598 |

| Model updates | –3,957 | |

| Acquisitions and disposals | 56,421 | |

| Foreign exchange movements | –30,271 | |

| Others | 1,521 | |

| RWAs Dec 15 |

|

228,737 |

The increase in RWAs for credit risk in the standardized model is due mainly to:

- Asset size: Increased activity in the emerging countries in which the Group operates, as well as in the United States.

- Model updating: Transfer of the portfolio from the merged company Unnim to IRB models.

- Acquisitions and disposals: Garanti’s global consolidation following the purchase of a 14.89% stake in its share capital, bringing the Group’s holding to 39.9%, which has caused an increase of approximately 48,800 million euros. In addition, the purchase of Catalunya Banc, which has meant an increase of around 7,500 million euros.

- Exchange rate fluctuations: Caused to a great extent by the conversion of the Venezuelan currency at the closing exchange rate, resulting in an impact of around 28,500 million euros.

The table below shows the balances of specific, generic and country risk allowances for losses, by exposure categories, as of December 31, 2015 and 2014:

Table 22. Balance of specific, generic and country risk allowances for losses, by exposure category (Standardized approach)

|

|

Loan-loss provisions |

|---|---|

| Category of exposure | 2015 |

| Central governments or central banks | 17 |

| Regional governments or local authorities | 7 |

| Public sector entities | 15 |

| Multilateral Development Banks | 0 |

| International organizations | 0 |

| Institutions | 26 |

| Corporates | 2,198 |

| Retail | 537 |

| Secured by mortgages on immovable property | 239 |

| Exposures in default | 4,960 |

| Items associated with particularly high risk | 7 |

| Covered bonds | - |

| Short-term claims on institutions and corporate | - |

| Collective investments undertakings (CIU) | 0 |

| Other exposures | 86 |

| TOTAL | 8,092 |

3.2.5. Information on the IRB method

3.2.5.1. General information

3.2.5.1.1. Authorization by the supervisor for the use of the IRB method

The following is a list of the models authorized by the supervisor for the purpose of their use in the calculation of capital requirements.

Table 23. Models authorized by the supervisor for the purpose of their use in the calculation of capital requirements

| Institution Portfolio | Portfolio |

|---|---|

| BBVA S.A.* | Financial institutions |

| Public institutions | |

| Specialized finance | |

| Developers | |

| Small Corporates | |

| Medium-sized Corporates | |

| Large Corporates | |

| Mortgages | |

| Consumer finance | |

| Credit cards | |

| BBVA Ireland | Financial institutions |

| Large Corporates | |

| BBVA Bancomer | Retail Revolving (Credit Cards) |

| Large Corporates | |

| Medium-sized Corporates | |

| BBVA Group | Equity |

The approval of the models by the supervisor includes both own estimations of the probability of default (PD), loss given default (LGD) and the internal estimation of credit conversion factors (CCFs).

The Group maintains its calendar for receiving approval for additional advanced internal models in different types of risks and geographical areas.

3.2.5.1.2. Structure of internal rating systems and relationship between internal and external ratings

The Group has rating tools for each one of the exposure categories listed in the Basel Accord.

The retail portfolio has scoring tools for determining the credit quality of transactions on the basis of information on the transaction itself and on the customer. The scoring models are algorithms estimated using statistical methods that score each transaction. This score reflects the transaction’s level of risk and is in direct relation to its probability of default (PD).

These decision models are the basic tool for deciding who should receive a loan and the amount to be granted, thereby contributing to both the arrangement and management of retail type loans.

For the wholesale portfolio, the Group has rating tools that, as opposed to scorings, do not assess transactions but rather, customers. The Group has different tools for rating the various customer segments: small companies, corporates, government and other government agencies, etc. In those wholesale portfolios where the number of defaults is very low (sovereign risks, corporates, financial institutions) the internal information is supplemented by the benchmarks of external rating agencies.

The PD estimates made by the Group are transferred to the Master Scale, enabling a comparison to be made with the scales used by external agencies. This is shown below.

Table 24. Master Scale of BBVA’s rating

|

|

|

Probability of default (basic points) | ||

|---|---|---|---|---|

| External Rating Standard & Poor’s List |

Internal Rating Reduced List (22 groups) |

Average | Minimun from >= |

Maximum |

| AAA | AAA | 1 | - | 2 |

| AA+ | AA+ | 2 | 2 | 3 |

| AA | AA | 3 | 3 | 4 |

| AA- | AA- | 4 | 4 | 5 |

| A+ | A+ | 5 | 5 | 6 |

| A | A | 8 | 6 | 9 |

| A- | A- | 10 | 9 | 11 |

| BBB+ | BBB+ | 14 | 11 | 17 |

| BBB | BBB | 20 | 17 | 24 |

| BBB- | BBB- | 31 | 24 | 39 |

| BB+ | BB+ | 51 | 39 | 67 |

| BB | BB | 88 | 67 | 116 |

| BB- | BB- | 150 | 116 | 194 |

| B+ | B+ | 255 | 194 | 335 |

| B | B | 441 | 335 | 581 |

| B- | B- | 785 | 581 | 1,061 |

| CCC+ | CCC+ | 1,191 | 1,061 | 1,336 |

| CCC | CCC | 1,500 | 1,336 | 1,684 |

| CCC- | CCC- | 1,890 | 1,684 | 2,121 |

| CC+ | CC+ | 2,381 | 2,121 | 2,673 |

| CC | CC | 3,000 | 2,673 | 3,367 |

| CC- | CC- | 3,780 | 3,367 | 4,243 |

3.2.5.1.3. Use of internal estimations for purposes other than the calculation of capital requirements

The Group’s internal estimations are a vital component of management based on value creation, giving rise to criteria for assessing the risk-return trade-off.

These measures have a broad range of uses, from the adoption of strategic business decisions through to the individual admission of transactions.

Specifically, internal estimates are used in everyday business in support of credit risk management through their inclusion in admission and monitoring processes, as well as in the pricing of transactions.

The management use of performance metrics that consider expected loss, economic capital and risk-adjusted return enables the monitoring of portfolios and the assessment of non-performing positions, among others.

3.2.5.1.4. Process for managing and recognizing the effects of credit risk mitigation

The Group uses risk mitigation techniques for exposures pertaining to the wholesale portfolio by replacing the obligor’s PD with that of the guarantor, in those cases in which the latter is eligible and their PD is lower than the obligor’s.

Regarding processes of retail admission, the scoring contains the effect of the guarantor, and the recovery flows that are forthcoming throughout the cycle reflect the recoveries related to the guarantees associated with the contracts. This means that the effect of the guarantees is taken into account in the actual estimation of the loss given default for retail portfolios.

3.2.5.1.5. Mechanisms used for controlling internal rating systems

The entity carries out the control and monitoring of the rating systems and metrics for risk management for private individuals, SMEs and the self-employed, corporates and institutions. The activities are carried out, within certain analytical and qualitative fields, by realizing periodic 360º monitoring of all impacts of the tools as well as their internal function in terms of efficiency and effectiveness.

Global understanding of the systems allows action plans to be established, with a follow-up to ensure their proper execution. The weaknesses of the rating tools are thus identified and managed. The monitoring function is the main driving force of new developments and evolving maintenance, which allow the business interests of the entity to be aligned with regulatory requirements and management needs within a framework of analytical, technical and technological capacities.

In general, there is a series of corporate management programs that establish the main lines and minimum contents determining the management and/or supervision of the different credit risk models, as well as defining the metrics for their correct control.

More specifically, these corporate management programs will be adjusted to each of the rating tools of a business area within a time horizon adapted to the nature of the tool.

Periodically, an overall monitoring and review of compliance with the thresholds agreed under the management program will be carried out to detect situations that could potentially require an adjustment to the models and/or credit policies and to take early corrective actions to minimize the impact of such situations.

Analysis, in the methodological sphere, is defined as the monitoring of the predictive capabilities of the models, backtesting calibration of the parameters, proper granularity and concentration, sample stability of input, as well as traceability, integrity and consistency.

The use of rating systems by the different areas is overseen from the context of integration in management. This context defines parameter sensitivity tests, stress- tests of estimates, proper use of the parameters in the portfolio management to facilitate decision-making, control of exposure without rating, risk policies and the framework for delegating tasks, structures of decision-making committees, implementation risk evaluation, proper technological environment, evaluation of the inclusion of the parameters in corporate applications, proper follow-up of the training of users to guarantee its proper implementation and full comprehension, follow-up of the correct structure and quality of documentation, as well as all other activities that ensure the proper use of management metrics.

Apart from the corporate management programs mentioned above, access to the internal rating systems is based on IT system- authorized profiles that ensure only the customer loan management supervisors can see the scoring and rating.

Control of the capital process is performed by risk units that are independent of the units that calculate the scoring and rating and which, therefore, are users of the internal rating system. These control mechanisms are established at different levels of the process, such as at input, execution and final outputs, and involve both the integrity of the data and their accuracy and correctness.

3.2.5.1.6. Description of the internal rating process

There follows a description of the internal classification processes according to each customer category:

- Central banks and central governments: For this segment, the assignment of ratings is made by the Risk units appointed for this purpose, which periodically analyze this type of customers, rating them according to the parameters included in the corresponding rating model. There are 3 different methods currently in use for assigning country ratings: (i) ratings from external agencies, used for developed nations, emerging countries with elevated incomes and emerging countries where the Group has little risk, (ii) internal rating based on a proprietary tool used for emerging countries where the Group has an appreciable risk, and lastly (iii) the country risk ratings published by the Belgian export credit agency (which manages the quantitative model used by the OECD to assign its country risk ratings) for countries of marginal importance for the Group that have no external qualifications. Sovereign ratings are generated in local and foreign currency for all the tools, as well as a transfer rating, which evaluates the risk of inconvertibility/transfer restrictions.

In the case of emerging countries with presence of BBVA subsidiaries or branches, the rating in local currency is adjusted to that obtained by the emerging countries tool under the authorization of the Risk Committee assigned for this purpose.

- Institutions: The rating of Public Institutions is generally provided by the risk units responsible for their approval, on a yearly basis, coinciding with the review of customer risk or with the reporting of their accounts.

In the case of Financial Institutions, the Risk unit responsible makes a regular assessment of this type of customer, continuously monitoring their evolution on domestic and international markets. External ratings are a key factor in assigning ratings for financial institutions.

- Large Companies: Includes the rating of exposures with corporate business groups. The result is affected both by indicators of business risk (evaluation of the competitive environment, business positioning, regulation, etc.) and financial risk indicators (size of the group by sales, cash generation, levels of debt, financial flexibility, etc.).

In accordance with the characteristics of the large companies segment, the rating model is global in nature with specific algorithms by sector of activity and geographical adaptations. The rating of these customers is generally calculated within the framework of the annual risk review process, or the admission of new operations.

The responsibility for the assessment lies with the units originating the risk, while those approving it validate it when the decision is taken.

- Medium-sized companies: This segment also takes into account quantitative factors derived from economic and financial information, and qualitative factors that are related to the age of the company, the sector, management quality, etc. and alert factors derived from risk monitoring.

As in the Corporate segment, the rating tends to run parallel to the admission process, so the responsibility for rating lies with the unit proposing the risk, while the decision-making level is in charge of validating it.

- Small Businesses: As in the case of medium-sized companies, this segment also takes into account quantitative factors derived from economic and financial information, and qualitative factors that are related to the age of the company, the sector, management quality, etc. and alert factors derived from risk monitoring. Similarly, the rating tends run parallel with the admission process, so the responsibility for rating is with the unit proposing the risk, while the decision-making level is in charge of validating it.

- Specialized Finance: For classifying this segment, the Group has chosen to apply the supervisory slotting criteria approach, as included in the Basel Accord of June 2004 and in the Solvency Regulations.

- Developers: The rating of real-estate developers allows the rating of both the customers who are developers and the individual real-estate projects. Its use makes it easier to monitor and rate projects during their execution phase, as well as enriching the admission processes.

- BBVA Bancomer companies: This segment also takes into account quantitative factors derived from economic and financial information and bureau information, as well as qualitative factors related to the age of the company, the sector, the quality of its management, etc. The rating tends to run parallel to the admission process, so that responsibility for the rating is with the unit originating the risk, while the decision-making body validates it.

In general in the wholesale area, the rating of customers is not limited to admission, as the ratings are updated according to new information available at any time (economic and financial data, changes in the company, external factors, etc.)

- Retail: This has been broken down into each one of the exposure categories referred to by the correlations provided for in the sections defined in the Solvency Regulations.

One of the most important processes in which scoring is fully integrated at the highest level and in all decision-making areas is the Group’s process for approving retail transactions. Scoring is an important factor for the analysis and resolution of transactions and it is a mandatory requirement to include it in decision- making on risk in those segments for which it has been designed. In the process of marketing and approving retail transactions, the manager is responsible for marketing management, the quality of the risk and the return, in other words, the customer’s comprehensive management, attending to the processes of admission, monitoring and control.

The rating process is as follows for each specific category of retail exposure:

a. Mortgages, consumer finance and retail credit cards - Spain: The manager collects data on the customer (personal, financial, banking relationship information) and on the operation (LTV, amount, maturity, destination etc.) and calculates the rating of the transaction with the scoring. The decision of whether it is approved is made based on the results issued by the model.

b. Autos Finanzia: The financing application may enter through the call center or be directly recorded in Finanzianet by our authorized dealers. The necessary information on the customer (personal, financial information, authorization of the consult from the external bureau of credit) and on the transaction (maturity, amount, etc.) is recorded to rate the transaction with the scoring. Once the validity of the information provided is obtained, the decision of whether to approve it is made based on the results issued by the model.

c. Retail Revolving (BBVA Bancomer credit cards): The manager or specialist party gathers the necessary information on the customer (personal, financial information and authorization of the consult from the external bureau of credit) and on the transaction (limit requested) to rate the transaction with the scoring. There are additional processes for validating and checking this information through the back office or operational support areas. The decision of whether it is approved is made based on the results issued by the model.

d. Proactive - Spain: Each month all the customers who have asset positions in credit cards, consumer finance or mortgages and liabilities positions in credit cards and consumer finance, are rated according to information on their behavior.

- Equity: For its portfolio position registered as equity, the Group is applying the rating obtained for customers as a result of their classification in the lending process.

3.2.5.1.7. Definitions, methods and data for estimating and validating risk parameters

The estimation of the parameters is based on the uniform definition of default established at Group level. Specifically, for a contract or customer to be considered in a situation of default, the provisions of section 4.1.1 must be met, in line with current regulations.

Specifically, there are two approaches within the Group for considering default and estimating parameters:

- The contract-level approach is applied within the sphere of retail risk. Each customer transaction is dealt with as an independent unit in terms of credit risk. Therefore, non-compliance with credit obligations to the bank is handled at the transaction level, regardless of the behavior of the customer with respect to other obligations.

- The customer-level approach is applied to the remainder of the portfolio. The significant unit for defining default is the customer’s sum of contracts, which enter a situation of default en masse when the customer defaults.

In addition, to avoid including defaults for small amounts in the estimations, defaulted volumes are to pass through a materiality filter that depends on the type of customer and transaction.

Estimating parameters

In the case of Spain and Mexico, the Group has an RAR information system that reflects exposure to credit risk in the Group’s different portfolios included in advanced internal models.