3.5.1. Scope and nature of the exchange-rate risk measurement and reporting systems

In BBVA Group, structural currency risk arises mainly from the consolidation of holdings in subsidiaries with functional currencies other than the euro. Its management is centralized in order to optimize the joint handling of permanent foreign currency exposures, taking into account the diversification.

The GRM corporate area acts as an independent unit that is responsible for monitoring and analyzing risks, standardizing risk management metrics and providing tools that can anticipate potential deviations from targets.

It also monitors the level of compliance of established risk limits, and reports regularly to the Global Risk Management Committee (GRMC), the Board of Directors’ Risks Committee and the Executive Committee, particularly in the case of deviation or tension in the levels of risk assumed.

The Corporate Balance Sheet Management unit, through ALCO, designs and executes the hedging strategies with the main purpose of controlling the potential negative effects of exchange-rate fluctuations on capital ratios, as well as assuring the equivalent value in euros of the foreign-currency earnings of the Group’s subsidiaries, considering the transactions according to market expectations and their costs.

The risk tracking metrics in the limits are integrated in the management and supplemented with additional evaluation indicators. Within the corporate scope, they are based on probabilistic metrics that measure the maximum deviation in capital, CET1 (“Common Equity Tier 1”) ratio, and attributable profit. Probabilistic metrics enable an estimation of the overall impact of the exposure on the various currencies, considering the broad variability in listed currencies and their correlations.

The benefits of these metrics on the risk estimate is regularly reviewed through backtesting exercises. A structural currency risk control is supplemented with an analysis of scenarios and stress with a view to proactively identifying possible future threats to the future compliance of risk appetite levels to enable the adoption, as the case may be, of the pertinent preventive actions. The scenarios are based on historical and risk model-simulated situations, and the risk scenarios provided by BBVA Research.

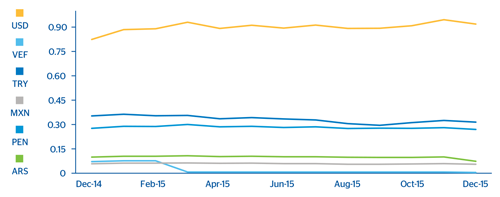

As a result of the foregoing, there is an upturn in volatility on the foreign-exchange markets for emerging currencies. Also worth mentioning is the significant adjustment in the Argentinean and Venezuelan currencies, affected by the imbalances in both economies.

The level of exposure to the structural currency risk at the Group has decreased since the end of 2014 following the sale of stake in the Citic Group and the increase in hedging, focused on the Mexican peso. Thus, the risk mitigation level of the book value of BBVA Group’s holdings in foreign currency remained at 70% on average at the end of the year and coverage of earnings in foreign currencies in 2015 reached 46%. Sensitivity of the CET1 ratio to a 1% appreciation in the euro’s exchange rate against each foreign currency is: US dollar: +1.2 pbs; Mexican peso -0.4 pbs; Turkish lira -0.3 pbs; remaining currencies: -0.1 pbs.

Below is a visual display of the changes in the main currencies that make up the Group’s structural currency risk and that explain the trends in the exposure and RWAs of foreign companies due to the effect of changing currency prices.

As regards the exchange rate changes in the market, in 2015, the strength of the United States dollar steady continuance of the trend began in 2014 was the most prominent aspect on the marketplace, together with the weakness of the currencies of the emerging economies, which have substantially depreciated against the dollar, affected by the falling commodity prices, particularly of oil, and the uncertainty surrounding the growth of those economies following the change in the Federal Reserve’s monetary policies and the slowdown in China.

The variations in terms of RWAs are due to the trend in structural positions and increased hedging on those positions.

Chart 24. Trends in the main currencies compromising the Group's exposure to structural exchange-rate risk