Spain highlights in the first quarter

- Favorable positioning in the sector’s restructuring.

- Increased financial deleveraging.

- Revenue stability.

- Cost containment.

Industry Trends

In the first quarter of 2012 the credit institutions operating in the Spanish market were under a great deal of pressure, mainly as a result of:

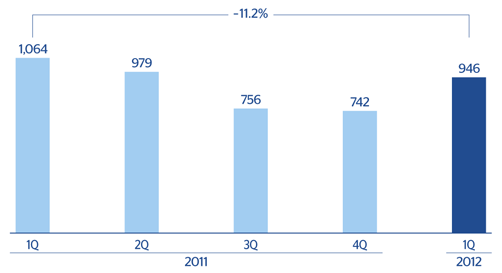

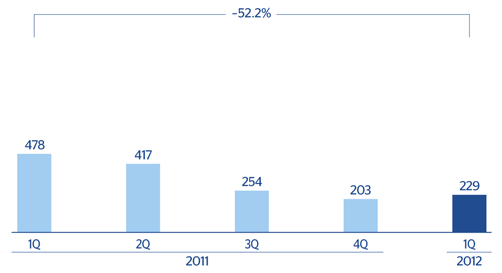

- Weak economic growth, which is having a major impact on the business volumes of banking activity.

- The necessary financial deleveraging process underway which in the first months of the year is taking place both in households and in companies, together with an environment of low credit demand.

- A changing model: As a result of the economic situation, and particularly lower demand for credit, banks are focusing on management of liability products, particularly household savings, and on advisory.

-

Regulatory changes in the sector: The most important changes in the quarter are:

- The coming into force of the new Royal Decree Law 02/2012, which aims to tackle one of the main elements affecting market confidence: the exposure of the financial system to the real-estate sector. The improvement in credibility and confidence in the sector promoted by the new law will require a major effort in terms of provisions and capital for the system over the whole year. This effort will not be the same for all the banks, and may lead to significant differentiation and a major acceleration in the restructuring process.

- The approval by the Government of a Royal Decree to protect mortgage debtors without means. The Royal Decree is fundamentally based on a code of good banking practice, which banks can freely subscribe to.

- Progress in restructuring in the sector, which could speed up in an environment of greater pressure from regulations and of increased impact on the income statements of the banks in the system. The main operations within this consolidation process in the quarter were:

- The acquisition of Unnim by BBVA.

- The acquisition of Banca Civica by Caixa

- The acquisition of Caja3 by Ibercaja.