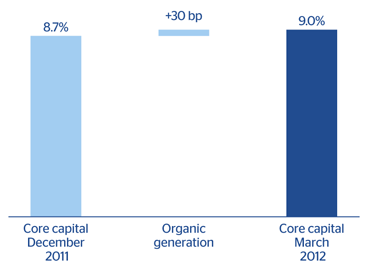

The main highlight in the first quarter of 2012 was compliance with the EBA capital recommendations, which means a core capital ratio of 9% according to the EBA criteria. The outstanding pending amount as of December 2011 of approximately €1,000m, equivalent to 30 basis points, has been attained through organic generation of capital, as communicated at the time. It should be noted that the Group was able to comply without having to sell any assets, without having to resort to public aid, and without any variation in the current dividend policy.

The capital base according to Basel II criteria stood at €43,531m, 1.0% up on the figure at the close of 2011. The increase, as explained above, was attained through organic generation of capital via earnings.

Risk-weighted assets (RWA) amounted to €329,557m, and remain at the levels of December 2011, like total Group assets.

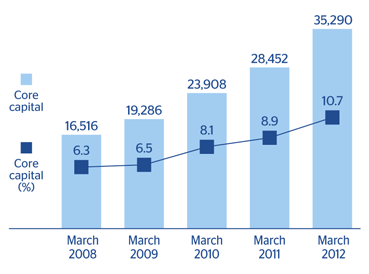

Regarding the components of the capital base, as of 31-Mar-2012 core capital stood at €35,290m, an increase of €1,129m over the quarter, and a ratio of 10.7%, comparing favorably with the figure of 10.3% in December 2011. Tier I capital is evolving in the same direction as core capital and also stood at 10.7% as of 31-Mar-2012.

Other eligible capital (Tier II) totaled €8,241m, a slight decrease from the figure in December 2011 due to the greater value of investments and the lower balance of unrealized gains.

Finally, the BIS ratio as of March 31 stood at 13.2% (12.9% as of 31-Dec-2011).