Shareholders, trading and share price

In the first quarter of 2014, the world economy continued to show signs of recovery. In the United States the recovery is consolidating and the Federal Reserve has continued with the gradual withdrawal of monetary stimulus actions initiated at the end of 2013. In Europe, the ECB is maintaining the base rate at all-time lows and while in emerging economies the situation seems to be stabilizing after the significant devaluation of some currencies.

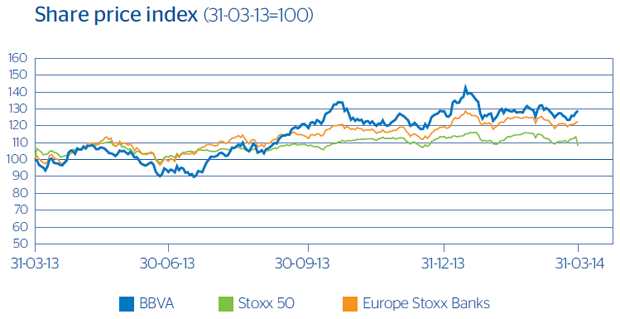

In financial markets, the Stoxx 50 general European index closed the month of March with a quarterly revaluation of 1.7%. The Ibex 35 closed with a 4.3% revaluation. The banking index for the euro zone (Euro Stoxx Banks) rose 9.8%.

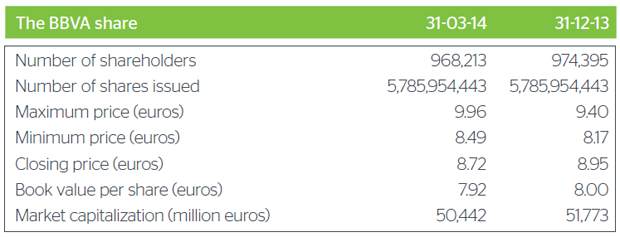

BBVA results for the fourth quarter of 2013 have been positively evaluated by equity analysts, especially in light of the quality and solidity of the capital and the evolution of net interest income and credit quality in Spain. The BBVA share price saw a reduction of 2.6% during the quarter. This price is equivalent to a market capitalization of 50,442 million euros and implies a P/B value factor of 1.1, a 15 times PER and a dividend yield of 4.2%.