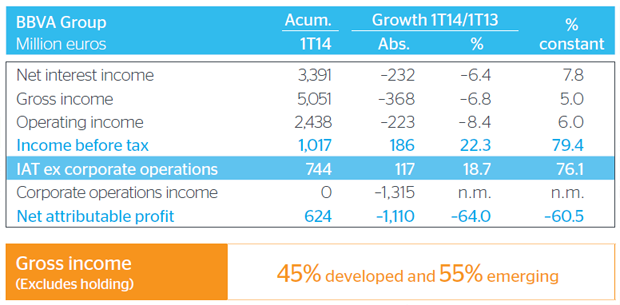

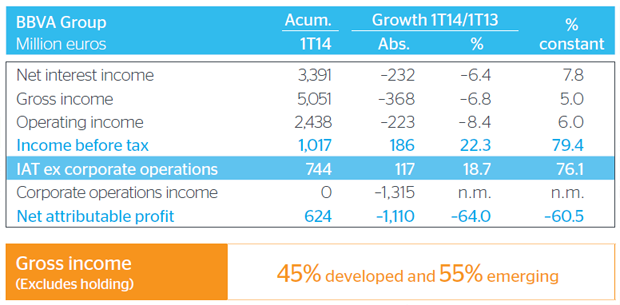

The first quarter of 2014 saw the start of a new growth cycle for BBVA operating results. Profits after taxes, excluding corporate operations, grew by 18.7% (+76.1% discounting the exchange rate effect) with respect to the first quarter of 2013, to 744 million euros. Net attributable profit reached 624 million euros, or 64% less than the same period the previous year due to corporate operations accounted for in the first three months of 2013.

The cost control policy implied a reduction of spending by 4% lower than both revenue and average inflation in the geographical areas where BBVA is active. This explains the net profit increase by 6.0% at constant exchange rates, to 2,438 million euros. BBVA is again the most profitable financial entity with a net profit margin on total average assets of 1.65%, over double that of its competitors' average (0.70%).

The improvement in credit quality also made it possible to reduce loan and real estate loss provisions.

Geographical diversification

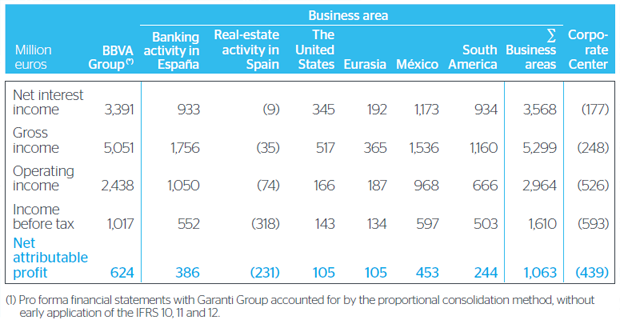

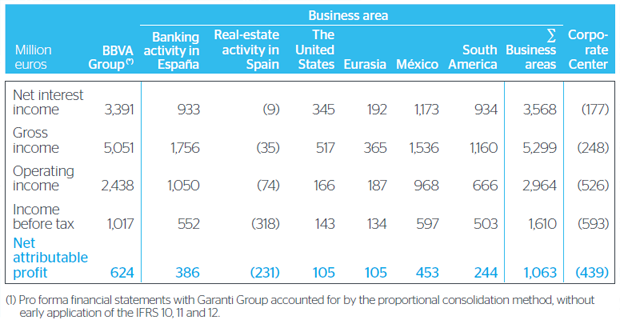

Banking activity in Spain: Saw an improvement of results based on the start of the economic recovery as well as progress in the area of customer spread. A reduction in new non-performing operations as well as the beginning of greater demand for loans also took place. Investment continued to decrease (–8.4% year-on-year), and customer deposits were up 12.8%. The NPA ratio stood at 6.4% and the coverage ratio at 41%. Net attributable profit from banking activity was 386 million euros.

Real estate activity in Spain: Net exposure to the sector continued to decline (down 21% since December 2011). Net attributable profit in this area decreased by 231 million euros.

Main items on the income statement by business area (1Q14)

United States: Intense rhythm in activity. Both the loan-book (up 14.7%) and customer deposits increased (up 4.4%). Exceptional credit quality (1% default ratio and 160% coverage ratio). Earned 105 million euros (+16.1% (1)). BBVA Compass surpassed the resistance tests carried out in the US without objectives from the Federal Reserves.

Eurasia: Garanti demonstrated that it is the best bank in Turkey with strong results in a complex environment that put pressure on margins. Macroeconomic prospects are better for the medium term and the financial sector continues to have great potential. The area earned 105 million euros (+3.1% (1)

Mexico: Maintained strong business activity, in both lending (+10.4%) and customer deposits (12.2%). Garanti generated a net attributable profit of 453 million euros (+14.7% (1)).

South America: Saw the most business activity. Both the loan-book and customer deposits increased by over 25%. The default ratio was 2.2% and the coverage ratio 136%. Results were affected by the devaluation of the Argentine peso and the use in Venezuela of the so-called SICAD I exchange rate. Net attributable profit was 244 million euros (+16% (1)).

(1) Constant exchange rates.

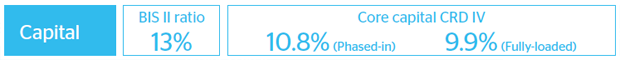

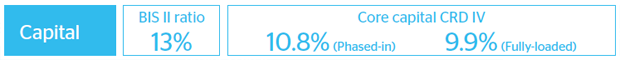

Solvency and liquidity

The new CRD IV regulation that came into effect in January 2014 has had only limited impact on the solvency ratios, which are currently at far higher levels than required and comparing very favorably with those in the reference group.

Two share issues were held of 1,500 million euros each, reinforcing the Group's capital base under CRD IV.

Real estate reached 4.6% in March, with a coverage ratio of 59%.

The total default rate of the BBVA Group was 6.6%, 18 basis points less than last December, the first drop to occur since 2011, with a coverage ratio of 60%.

(1) Real-estate activity in Spain excluded.

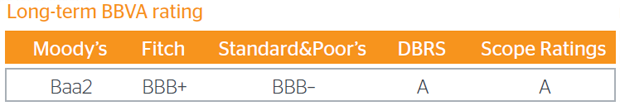

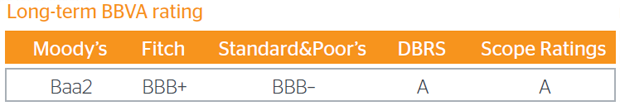

Credit rating agencies

On 4 March Moody’s raised the BBVA rating by one grade, from Baa3 to Baa2 and the prospects from stable to positive, as a results of the strength of BBVA's fundamental indicators and the improvement of the rating of the Kingdom of Spain. A rating upgrade by Moody's had not occurred in seven years.

Highlights of the quarter