The trends in BBVA Group’s balance sheet and business activity at the close of the first quarter of 2014 were as follows:

- A significant negative year-on-year impact in the quarter from exchange rates. The effect is also negative against the close of 2013, mainly due to the depreciation of the Argentinean peso and the application of SICAD I (rather than Cadivi) to the exchange rate of the Venezuelan bolivar.

- Stability. The Group’s balance sheet closed as of 31-Mar-2014 with €599 billion in total assets, a figure that is practically the same as of 31-Mar-2013 (up 0.6%), excluding the effect of the different currencies.

- Loans and advances to customers (gross) is stable over 12 months (down 0.5% at constant exchange rates) and up 1.6% over the quarter, also at constant exchange rates. Once more, South America, Mexico and the United States performed well. In Eurasia there was stability in the volume of credit with wholesale clients, as well as some slowdown in the growth of Garanti’s loan portfolio. In Spain the deleveraging process continued, although at a more moderate pace than in previous quarters, as the flow of new credit transactions has begun to grow in some segments.

- Favorable trend in non-performing loans in the quarter, due to a decline in the number of non-performing loans between January and March of 2014, basically in Spain. The year-on-year rise is largely due to the classification of refinanced loans in Spain in the third quarter of 2013.

- Deposits from customers have performed well in all geographical areas, above all lower-cost deposits with year-on-year growth of 10.4% (up 3.1% in the quarter) at constant exchange rates.

- Off-balance-sheet funds continued strong, both over the last 12 months and over the quarter. There was outstanding growth in mutual funds in Spain, due to the commercial campaigns launched by the area and increased demand by customers for investment products that are alternatives to term deposits, in a context of falling returns.

Consolidated balance sheet (1)

(Million euros)

|

|

31-03-14 | Δ % | 31-03-13 | 31-12-13 |

|---|---|---|---|---|

| Cash and balances with central banks | 27,546 | (8.8) | 30,208 | 37,064 |

| Financial assets held for trading | 76,433 | 0.9 | 75,750 | 72,301 |

| Other financial assets designated at fair value | 3,385 | 9.9 | 3,079 | 2,734 |

| Available-for-sale financial assets | 88,236 | 19.0 | 74,135 | 80,848 |

| Loans and receivables | 360,938 | (6.9) | 387,551 | 363,575 |

| Loans and advances to credit institutions | 21,441 | (18.7) | 26,383 | 24,203 |

| Loans and advances to customers | 334,698 | (6.4) | 357,490 | 334,744 |

| Debt securities | 4,799 | 30.4 | 3,678 | 4,628 |

| Held-to-maturity investments | - | n.m. | 9,734 | - |

| Investments in entities accounted for using the equity method | 1,319 | (81.1) | 6,991 | 1,497 |

| Tangible assets | 7,474 | (4.6) | 7,831 | 7,723 |

| Intangible assets | 8,139 | (9.1) | 8,952 | 8,165 |

| Other assets | 25,666 | (11.0) | 28,842 | 25,611 |

| Total assets | 599,135 | (5.4) | 633,072 | 599,517 |

| Financial liabilities held for trading | 48,976 | (10.8) | 54,894 | 45,782 |

| Other financial liabilities at fair value | 3,040 | 1.3 | 3,001 | 2,772 |

| Financial liabilities at amortized cost | 476,656 | (4.5) | 499,077 | 480,307 |

| Deposits from central banks and credit institutions | 84,461 | (7.5) | 91,277 | 87,746 |

| Deposits from customers | 309,817 | 1.7 | 304,613 | 310,176 |

| Debt certificates | 62,892 | (25.0) | 83,813 | 65,497 |

| Subordinated liabilities | 12,123 | 0.9 | 12,009 | 10,579 |

| Other financial liabilities | 7,363 | (0.0) | 7,364 | 6,309 |

| Liabilities under insurance contracts | 10,102 | (2.1) | 10,314 | 9,844 |

| Other liabilities | 16,306 | (15.1) | 19,215 | 15,962 |

| Total liabilities | 555,079 | (5.4) | 586,500 | 554,667 |

| Non-controlling interests | 1,863 | (21.1) | 2,362 | 2,371 |

| Valuation adjustments | (3,636) | 261.5 | (1,006) | (3,831) |

| Shareholders’ funds | 45,830 | 1.4 | 45,216 | 46,310 |

| Total equity | 44,056 | (5.4) | 46,572 | 44,850 |

| Total equity and liabilities | 599,135 | (5.4) | 633,072 | 599,517 |

| Memorandum item: |

|

|

|

|

| Contingent liabilities | 34,878 | (8.7) | 38,195 | 36,437 |

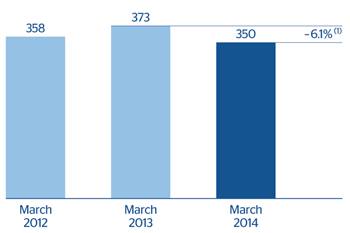

Loans and advances to customers

(Billon euros)

Loans and advances to customers

(Million euros)

|

|

31-03-14 | Δ % | 31-03-13 | 31-12-13 |

|---|---|---|---|---|

| Domestic sector | 168,461 | (12.5) | 192,543 | 167,670 |

| Public sector | 23,962 | (7.1) | 25,799 | 22,128 |

| Other domestic sectors | 144,499 | (13.3) | 166,744 | 145,542 |

| Secured loans | 91,858 | (11.1) | 103,373 | 93,446 |

| Other loans | 52,641 | (16.9) | 63,371 | 52,095 |

| Non-domestic sector | 156,233 | (1.5) | 158,640 | 156,615 |

| Secured loans | 63,391 | (2.2) | 64,809 | 62,401 |

| Other loans | 92,842 | (1.1) | 93,831 | 94,214 |

| Non-performing loans | 25,033 | 16.7 | 21,448 | 25,826 |

| Domestic sector | 20,356 | 25.8 | 16,184 | 20,985 |

| Non-domestic sector | 4,677 | (11.1) | 5,263 | 4,841 |

| Loans and advances to customers (gross) | 349,726 | (6.1) | 372,630 | 350,110 |

| Loan-loss provisions | (15,028) | (0.7) | (15,140) | (15,366) |

| Loans and advances to customers | 334,698 | (6.4) | 357,490 | 334,744 |

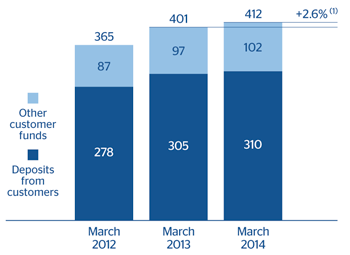

Customer funds

(Billon euros)

Customer funds

(Million euros)

|

|

31-03-14 | Δ % | 31-03-13 | 31-12-13 |

|---|---|---|---|---|

| Deposits from customers | 309,817 | 1.7 | 304,613 | 310,176 |

| Domestic sector | 150,415 | 2.8 | 146,359 | 151,070 |

| Public sector | 18,160 | (16.1) | 21,646 | 14,435 |

| Other domestic sectors | 132,255 | 6.0 | 124,713 | 136,635 |

| Current and savings accounts | 53,150 | 10.1 | 48,290 | 53,558 |

| Time deposits | 68,676 | 2.8 | 66,789 | 69,977 |

| Assets sold under repurchase agreement and other | 10,428 | 8.2 | 9,634 | 13,100 |

| Non-domestic sector | 159,402 | 0.7 | 158,254 | 159,106 |

| Current and savings accounts | 98,402 | 1.0 | 97,419 | 101,515 |

| Time deposits | 51,473 | (3.8) | 53,514 | 49,266 |

| Assets sold under repurchase agreement and other | 9,527 | 30.1 | 7,321 | 8,325 |

| Other customer funds | 102,128 | 5.6 | 96,729 | 99,213 |

| Spain | 62,263 | 17.3 | 53,095 | 59,490 |

| Mutual funds | 23,783 | 23.5 | 19,259 | 22,298 |

| Pension funds | 20,994 | 10.4 | 19,019 | 20,428 |

| Customer portfolios | 17,486 | 18.0 | 14,817 | 16,763 |

| Rest of the world | 39,865 | (8.6) | 43,634 | 39,723 |

| Mutual funds and investment companies | 21,759 | (8.7) | 23,837 | 21,180 |

| Pension funds (1) | 4,331 | 15.2 | 3,761 | 4,234 |

| Customer portfolios | 13,775 | (14.1) | 16,036 | 14,309 |

| Total customer funds | 411,945 | 2.6 | 401,342 | 409,389 |