At the close of the first quarter of 2014, the changes in the Group’s main asset quality indicators have been positive:

- A reduction in the NPA ratio in Spain (including real-estate activity) to 10.0% from 10.3% in December 2013, as a result of a decline in non-performing assets of €610m, with credit risk remaining stable. The coverage ratio improved slightly on the close of 2013.

- Asset quality indicators improve in the United States.

- Stability in Eurasia and Mexico.

- Good risk indicators in South America.

As of 31-Mar-2014, the Group’s credit risks with customers (including contingent liabilities) fell back over the quarter by 0.5% as a result of the exchange-rate effect (particularly the depreciation of the Argentinean peso and the application of the SICAD I system to the Venezuelan bolivar). Excluding the exchange-rate effect, total risks increased 1.1% in the last 3 months (3.3% in Mexico, 4.6% in the US, 3.4% in South America and 2.4% in Turkey).

Credit risk management (1)

(Million euros)

|

|

31-03-14 | 31-12-13 | 30-09-13 | 30-06-13 | 31-03-13 |

|---|---|---|---|---|---|

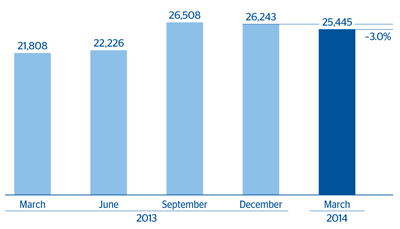

| Non-performing assets | 25,445 | 26,243 | 26,508 | 22,226 | 21,808 |

| Credit risks | 384,577 | 386,401 | 393,556 | 401,794 | 410,840 |

| Provisions | 15,372 | 15,715 | 15,777 | 15,093 | 15,482 |

| Specific | 12,752 | 13,030 | 12,439 | 11,084 | 10,578 |

| Generic and country-risk | 2,620 | 2,684 | 3,338 | 4,009 | 4,904 |

| NPA ratio (%) | 6.6 | 6.8 | 6.7 | 5.5 | 5.3 |

| NPA coverage ratio (%) | 60 | 60 | 60 | 68 | 71 |

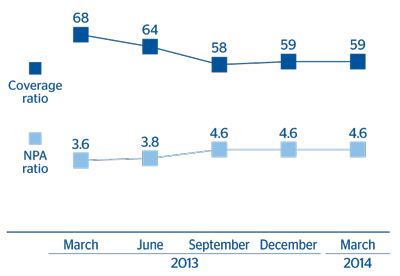

| NPA ratio (%) (excluding real-estate activity in Spain) | 4.6 | 4.6 | 4.6 | 3.8 | 3.6 |

| NPA coverage ratio (%) (excluding real-estate activity in Spain) | 59 | 59 | 58 | 64 | 68 |

The balance of non-performing assets also fell over the quarter thanks to the good performance of additions to NPA in Spain, above all in real-estate activity, and the improvement in asset quality in the United States and Mexico.

In terms of variation in NPA, gross additions declined below the level of the first quarter of 2013 and the quarterly average of 2013 (removing the effect of the classification in the third quarter of refinanced loans as non-performing). Recoveries were in line with those of the first quarter of 2013. As a result, the ratio of recoveries to gross additions to NPA was 78.0% in the quarter, a significant improvement on the figure of 69.5% in the fourth quarter of 2013.

Non-performing assets evolution

(Million euros)

|

|

1Q14 | 4Q13 | 3Q13 | 2Q13 | 1Q13 |

|---|---|---|---|---|---|

| Beginning balance | 26,243 | 26,508 | 22,226 | 21,808 | 20,603 |

| Entries | 2,190 | 3,255 | 7,094 | 4,075 | 3,603 |

| Recoveries | (1,708) | (2,261) | (1,956) | (1,964) | (1,659) |

| Net variation | 482 | 993 | 5,138 | 2,112 | 1,944 |

| Write-offs | (1,248) | (1,102) | (817) | (1,282) | (655) |

| Exchange rate differences and other | (32) | (155) | (39) | (412) | (84) |

| Period-end balance | 25,445 | 26,243 | 26,508 | 22,226 | 21,808 |

| Memorandum item: |

|

|

|

|

|

| Non-performing loans | 25,032 | 25,826 | 26,109 | 21,810 | 21,448 |

| Non-performing contingent liabilities | 413 | 418 | 399 | 416 | 361 |

Non-performing assets

(Million euros)

The Group’s NPA ratio ended March 2014 at 6.6% (4.6% excluding real-estate activity in Spain), a reduction of 18 basis points over the quarter. This is mainly the result of the fall in the non-performing portfolio mentioned above. The NPA ratio of the banking business in Spain stands at 6.4%, a slight decrease of 2 basis points over the quarter. The ratio in real-estate activity in Spain declined to 54.2% (55.5% as of 31-Dec-2013). The ratio in Eurasia remained stable, closing March at 3.4%. It improved in the United States to 1.0% and Mexico to 3.4%. Lastly, in South America the NPA ratio was 2.2% (2.1% as of December 2013).

Finally, coverage provisions for risks with customers totaled €15,372m as of 31-Mar-2014, with a fall of 2.2% on the figure for December 2013, although the Group’s coverage ratio remains stable at 60%. By business areas, the ratio increased in the United States from 134% to 160%, remained practically stable in Eurasia at 88%, increased slightly to 114% in Mexico (110% in December 2013), while in South America it fell back from 141% to 136%. Finally, in Spain it has improved slightly on the figure at the close of 2013, from 61% in 31-Dec-2013 to 63%, thanks to the increase recorded in real-estate activity. In banking activity the ratio (41%) remains at the same level as at the close of the previous year.

NPA and coverage ratios (1)

(Percentage)