The BBVA share

Global growth slowed throughout 2019 to 3.0%, down from 3.7% in 2018. However, this more stable environment, supported by the counter-cyclical economic policies announced last year and the reduction in trade tensions, has changed since March 2020 as a result of the COVID-19 pandemic. To contain this health crisis, most countries have put in place strong social distancing measures. At the time of publication of this report, it is unclear how long these will last for and how quickly they will be relaxed. However, they will undoubtedly have a severe impact on activity through the supply, demand and financial channels, despite the economic stimulus measures announced.

Therefore, a severe global recession seems inevitable in 2020, although the level of uncertainty on around the forecasts is very high. BBVA Research's baseline scenario works on the assumption that the confinement measures will generally last for about six weeks, and that they will be relaxed slowly to prevent new waves of infections. This will result in a sharp contraction in activity in the first half of 2020 and a rebound in the third quarter, but which will not be sufficient to compensate for the previous decline. The economic policy measures should prevent a deeper recession and support a partial recovery in 2021. However, the forecast is that the global GDP will shrink by about 2.5% in 2020, and that it will rebound to about 5% in 2021, although the risks for these forecasts are on the downside.

In terms of economic policy, the stimuli in the major economies have generally been large and have been adopted relatively quickly. In the United States, a significant fiscal package of about 12% of the GDP has been announced to cover health expenditures and mitigate the effects of rising unemployment through financial support to households and businesses. The Federal Reserve (hereafter the Fed), for its part, has cut interest rates by a total of 150 basis points in March to around 0%-0.25%, relaunched its program of quantitative easing, and put in place credit and liquidity facilities (up to USD 2.3 billion, which represents 11% of the GDP).

In Europe, the member states of the European Union (EU) are implementing support packages aimed at guaranteeing credit for businesses, along with discretionary fiscal stimuli as a supplement to the automatic stabilizers. Despite differences between countries, at an aggregate level the fiscal stimulus would account for about 2% of the EU’s GDP, and the liquidity facilities would account for 15%. These national measures are supplemented by the approval of a supranational emergency package of about 4% of the GDP to cover healthcare costs, implement a framework to support employment and increase the funds available from the European Investment Bank to support funding for companies. For its part, the European Central Bank (hereafter the ECB) will make purchases of assets for the value of €1,050 billion (8% of the GDP) until the end of 2020, after approving a new extraordinary program (Pandemic Emergency Purchase Programme or PEPP) of €750 billion and increasing the Expanded Asset Purchase Programme (APP) by €120 billion, which is in addition to the monthly purchases of €20 billion. Moreover, the European monetary authority has adopted temporary measures to support the liquidity of the banks, especially by relaxing the requirements for the collateral accepted in their transactions, and has acted in a coordinated manner with the Fed for the supply of US dollars.

In this context, interest rates will remain low in the major economies for a longer time than previously anticipated, while many emerging countries have recently cut interest rates to mitigate the effects of the pandemic.

As for the banking system, in an environment where much of the economic activity is paralyzed, banking services are of fundamental importance for three reasons: first, families and businesses need to make payments and authorize charges to maintain activity; second, a new loan or the renewal of a maturing loan can help families and businesses manage the shock to their income. In the current situation, it is very important to ensure that the temporary liquidity problems faced by companies do not become solvency problems, thus jeopardizing their survival and the jobs they create. To this end, the support provided by banks and public guarantees is essential. Third, banking has become the only source of financing for most companies in light of the turbulence on the financial markets.

While in profitability terms the European and Spanish banks are still far from the levels seen before the financial crisis, due mainly to the low interest rate environment we have been experiencing for some time now, the financial institutions are facing this challenge from a position of financial strength since their solvency has been constantly improving since the 2008 financial crisis, with increased capital and liquidity buffers and therefore a greater capacity to lend.

The main stock market indexes have been strongly impacted during the first quarter of 2020, due to irruption of the COVID-19 global crisis. In Europe, the Stoxx Europe 600 index decreased by -23.0% as of March 2020. In Spain, the decline of the Ibex 35 was more pronounced, down -28.9%. In the United States, the S&P 500 index fell -20.0% during the period.

With regard to the banking sector indexes, particularly in Europe, their performance in the first quarter of 2020 was worse than that of the general market indexes. The Stoxx Europe 600 Banks index, which includes banks in the United Kingdom, and the Euro Stoxx Banks, the banks index for the Eurozone, by -38.7% and -43.8%, respectively. In the United States, the S&P Regional Banks Select Industry Index decreased by -43.9%.

For its part, the BBVA share price decreased by -41.5% in the first quarter, closing March 2020 at €2.92.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-19)

BBVA

Stoxx Europe 600

Stoxx Banks

The BBVA share and share performance ratios

| 31-03-20 | 31-12-19 | |

|---|---|---|

| Number of shareholders | 876,785 | 874,148 |

| Number of shares issued (millions) | 6,668 | 6,668 |

| Closing price (euros) | 2.92 | 4.98 |

| Book value per share (euros) | 6.80 | 7.32 |

| Tangible book value per share (euros) | 5.78 | 6.27 |

| Market capitalization (millions of euros) | 19,440 | 33,226 |

| Yield (dividend/price; %) (1) | 8.9 | 5.2 |

(1) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

In terms of shareholder remuneration, on April 9, 2020 BBVA paid in cash a gross amount of €0.16 per share as a final dividend for the 2019 fiscal year, in accordance with the resolution approved at the Annual General Meeting held on March 13, 2020. Therefore, the total shareholder remuneration for 2019 amounts to €0.26 (gross) per share.

Shareholder remuneration

(Euros per share)

Cash

With regard to the payment of dividends, on March 27 the European Central Bank recommended that credit institutions should refrain from distributing dividends or making irrevocable commitments to distribute them, and from repurchasing shares to remunerate shareholders, until October 1, 2020 at the earliest. Consequently, the Board of Directors of BBVA has agreed to modify, for the financial year 2020, the Group’s shareholder remuneration policy, which was announced through the Relevant Event notification of February 1, 2017, establishing a new policy for 2020 of not making any dividend payment for the 2020 financial year until the uncertainties caused by COVID-19 are resolved and, in any case, not before the end of the financial year.

As of March 31, 2020, the number of BBVA shares remained at 6,668 billion, held by 876,785 shareholders, of which 43.78% are Spanish residents and the remaining 56.22% are non-residents.

BBVA shares are included on the main stock market indexes, including the Ibex 35, and the Stoxx Europe 600 index, with a weighting of 5.5% and 0.3%, respectively at the end of March of 2020. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 3.6% and the Euro Stoxx Banks index for the eurozone with a weighting of 8,3%.

Finally, BBVA maintains a significant presence on a number of international sustainability indexes or Environmental, Social and Governance (ESG) indexes, which evaluate companies' performance in these areas. In September of 2019, BBVA continued to be included in the Dow Jones Sustainability Index (DJSI), the markets leading benchmark index, which measures the economic, environmental and social performance of the most valuables companies by market capitalization of the world, achieving the highest score in financial inclusion and occupational health and safety and the highest score in climate strategy, environmental reporting and corporate citizenship and philanthropy.

Group information

- Good performance of gross income, with year-on-year growth in all its components: recurring income (net interest income and fees and commissions), which grew in most geographical areas, net trading income (NTI), and the other operating income/expenses line.

- Operating expenses closed in line with the same quarter of the previous year.

- As a result of the above, the efficiency ratio improved.

- Impairment on financial assets increased mainly due to the deterioration of the macroeconomic scenario resulting mostly from the impacts of COVID-19, which have amounted to €1,433m at the Group level.

- As a result of the valuation of the goodwill of its subsidiaries, the Group has estimated that there is an impairment in the United States which has been recorded in the line item “Other results” of the Consolidated income statement as of March 31, 2020. This impairment represents an impact of €-2,084m in the net attributable profit and is mainly due to the negative impact of the update of the macroeconomic scenario affected by the COVID-19 pandemic. This impact does not affect the tangible net equity, the capital, or the liquidity of BBVA Group and is included in the line item other gains (losses) of the income statement of the Corporate Center.

- The net attributable loss stood at €-1,792m. If the goodwill impairment in the United States is excluded from the year-on-year comparison, the Group's net attributable profit decreased 75.3% compared to the first quarter of 2019 and stood at €292m.

Net attributable profit (Millions of Euros)

(1) Excluding the goodwill impairment in the United States.

(1) Excluding the goodwill impairment in the United States.

- The figure for loans and advances to customers (gross) remained stable compared to December 2019 (up 0.3%), with increases in the commercial portfolio which offsets the deleveraging in the rest of the portfolios.

- Customer funds fell in the quarter (down 2.1%) as a result of the negative impact on mutual and pension funds due to the market instability caused by COVID-19.

- The availability of ample liquidity buffers in each of the geographical areas in which the BBVA Group operates and their management have allowed internal and regulatory ratios to remain comfortably above the minimum levels required.

- The BBVA Group has set the objective to maintain a buffer on its CET1 capital ratio requirement (currently, at 8.59%) between 225 and 275 basis points. As of March 31, 2020, the CET1 fully-loaded ratio stood at 10.84%.

Capital and leverage ratios (Percentage as of 31-03-20)

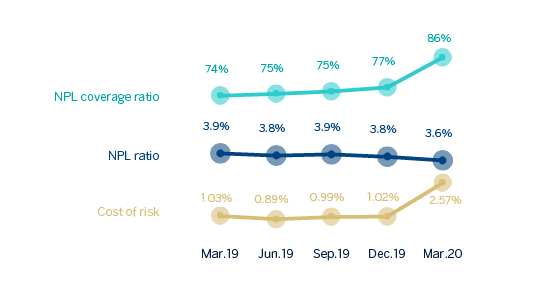

- The calculation of the expected credit losses at the end of March includes the update of the forward looking information in the models under IFRS 9 in order to reflect the circumstances created by the COVID-19 pandemic in the macroeconomic environment, which is characterized by a high degree of uncertainty regarding its intensity and duration.

NPL and NPL coverage ratios and cost of risk (Percentage)

- On April 27, 2020, BBVA reached an agreement with Allianz, Compañía de Seguros y Reaseguros, S.A. in order to create a bancassurance partnership, for the purpose of developing the non-life insurance business in Spain, excluding the health insurance line. On the closing date of the transaction, BBVA Seguros will transfer 50% plus one share of this new company to Allianz for an initial fixed price of approximately €277m, which will be adjusted based on the variation in the company’s shareholders equity between signing and closing date. Excluding a variable part of the price (up to €100m related to achieving specific business goals and certain milestones), it is estimated that the transaction will generate a profit net of taxes amounting to approximately €300m, and that the positive impact on the fully-loaded CET1 capital ratio of the BBVA Group will be approximately 7 basis points. The closing of the transaction is subject to obtaining the required regulatory authorizations.

In response to the COVID-19 pandemic, BBVA has focused on guaranteeing the security and the continuity of the business operations as a priority, and on closely monitoring the impact on the Group’s business and risks. Additionally, BBVA adopted from the outset a number of measures to support its main stakeholders, acting with the utmost responsibility and taking a step forward. The main business continuity measures taken are:

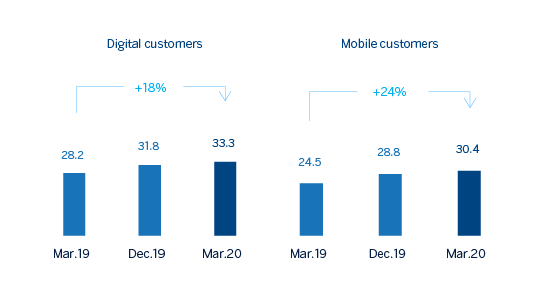

- In order to serve customers, and since financial services are legally considered an essential service in most of the countries where the Group operates, the branch network remains operational, with dynamic management of the network and with information about branches and opening times on the website. In addition, customers are using the digital channels and their remote agents as the recommended option. BBVA is therefore trying to minimize the number of employees who need to provide services at the branches, trying to limit the risk of contagion as much as possible and protecting the health of its employees, customers and society in general.

Digital and mobile customers (Millions)

- With employees, the measures established by the health authorities have been implemented, including taking an early stance on promoting working from home. At the beginning of April 2020, the proportion of the Group’s employees working from home stood at 95% for central service employees and 71% for the branch network.

Other support and responsibility measures taken are the following:

- The banks are a key part of the solution to the COVID-19 crisis. Specifically, BBVA has activated support initiatives with a focus on those customers affected the most affected, regardless of whether they are companies, SMEs, self-employed workers or private individuals. The following are just some of those initiatives:

- In Spain, credit facilities for SMEs and self-employed workers of up to €25,000m, deferment of mortgage loan repayments for individuals and self-employed workers, and early payment of pensions, with free cash withdrawals for pensioners at the nearest ATM;

- In the United States, flexibility in the repayment of loans for small businesses and for consumer finance, and the removal of certain fees for individual customers;

- In Mexico, a repayment deferment of up to four months on various credit products, fixed payment plan to reduce monthly credit card charges and interruption of Point of Sale (POS) fees to support retailers with lower turnover;

- In Turkey, delay of loan repayments, penalty-free interest and repayments for individual customers, and deferment for up to six months of loan capital repayments for companies;

- In South America, some countries such as Argentina have provided a credit facility for micro-SMEs to help them purchase remote work equipment; Colombia has frozen repayments for up to six months on loans to individuals and companies, and is offering a special working capital facility for companies; and in Peru, a loan facility has been approved to support SMEs.

- On the occasion of the 2020 Annual General Meeting, held on March 13 in Bilbao, BBVA exceptionally extended the deadlines for exercising shareholders' rights to information, delegation and remote voting, and recommended them to avoid physical assistance to the event and to follow it remotely on streaming. The quorum has been the highest in the Bank's history, 66.83%.

- The Bank's senior management has decided to give up all of their variable compensation for the year 2020. This measure, globally and in the different countries, applies to more than 300 people in the Group.

- To support society in its fight against the COVID-19 pandemic, BBVA is committed to making a global donation of €35m to support health authorities and social organizations and to promote scientific research.

- Regarding suppliers, BBVA has supported the closest ones with protection schemes for employees and companies, and advanced payment of bills without waiting until the agreed payment date.

Business areas

Spain

€1,506 Mill.*

+2.2%

Millions of euros and year-on-year changes. Balances as of 31-03-20.

Highlights

- Positive evolution in the consumer and corporate banking portfolios in the quarter.

- Year-on-year growth in recurring income.

- Reduction of operating expenses.

- Net attributable profit affected by the significant increase in the impairment on financial assets line.

Results

Net interest income

873Gross income

1,506Operating income

728Net attributable profit

-141Activity (1)

Performing loans and advances to customers under mangement

-0.6%Customers funds under management

-0.3%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

The United States

€814 Mill.*

-1.7%

Millions of euros and year-on-year changes at constant exchange rate. Balances as of 31-03-20.

Highlights

- Activity driven by the dynamic performance of the commercial portfolio and corporate banking in the quarter.

- Net interest income affected by the Fed’s rate cuts.

- Good performance of fees and commissions and excellent NTI results.

- Net attributable profit affected by the significant increase in the impairment on financial assets line.

Results

Net interest income

549Gross income

814Operating income

315Net attributable profit

-100Activity (1)

Performing loans and advances to customers under mangement

+10.8%Customers funds under management

+6.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rate.

Mexico

€1,991 Mill.*

+6.0%

Millions of euros and year-on-year changes at constant exchange rate. Balances as of 31-03-20.

Highlights

- Good performance of lending activity, supported by the strength of the wholesale portfolio.

- Positive evolution of customer funds, both demand and time deposits.

- Strong operating income.

- Net attributable profit affected by the significant increase in the impairment on financial assets line.

Results

Net interest income

1,545Gross income

1,991Operating income

1,330Net attributable profit

372Activity (2)

Performing loans and advances to customers under mangement

+14.0%Customers funds under management

+14.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(2) Excluding repos.

(1) Year on year changes at constant exchange rate.

Turkey

€1,073 Mill.*

+34.4%

Millions of euros and year-on-year changes at constant exchange rate. Balances as of 31-03-20.

Highlights

- Activity has performed well, in both Turkish lira and US dollars.

- Positive evolution of customer funds, especially from demand deposits.

- Good NTI performance and operating expenses growing below inflation.

- Net attributable profit affected by the significant increase in the impairment on financial assets line.

Results

Net interest income

819Gross income

1,073Operating income

763Net attributable profit

129Activity (1)

Performing loans and advances to customers under mangement

+8.3%Customers funds under management

+16.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rate.

South America

€863 Mill.*

+2.4%

Millions of euros and year-on-year changes at constant exchange rates. Balances as of 31-03-20.

Highlights

- Growth in lending, driven by the wholesale portfolio.

- Year-on-year increase of net interest income.

- Lower contribution from NTI.

- Net attributable profit affected by the increase in the impairment on financial assets line.

Results

Net interest income

763Gross income

863Operating income

473Net attributable profit (3)

70Activity (1)

Performing loans and advances to customers under mangement

+10.4%Customers funds under management

+9.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rates.

Rest of Eurasia

€126 Mill.*

+21.6%

Millions of euros and year-on-year changes. Balances as of 31-03-20.

Highlights

- Good performance of lending activity.

- Increased recurring revenues resulting from positive transactional and investment banking and the good performance of NTI.

- Contained growth of operating expenses.

- Improved risk indicators.

Results

Net interest income

47Gross income

126Operating income

53Net attributable profit

44Activity (1)

Performing loans and advances to customers under mangement

+22.4%Customers funds under management

+2.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

* Gross income

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email