Solvency

Capital base

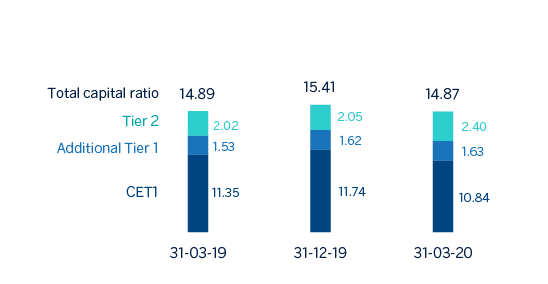

BBVA's fully-loaded CET1 ratio has decreased by 90 basis points in the first quarter of 2020 to 10.84%. It should be noted that the impairment of goodwill recorded by BBVA in the United States at the end of 2019 and the first quarter of 2020, for the amount of €1,318m and €2,084m, respectively, has not had an impact on capital at the consolidated level.

The uncertainty caused by the COVID-19 pandemic has led to a significant fluctuation in asset prices in the financial markets, accompanied by a sharp increase in volatility. The stock exchanges have experienced falls in response to the impact of the crisis on corporate earnings and the increase in risk aversion that has also spread to the debt markets, as well as the evolution of exchange rates. All of this has had a negative impact on the Group's capital base, particularly with regard to the value of financial assets not valued at fair value through profit and loss, due mainly to the negative impact of the deterioration in the macroeconomic scenario resulting from COVID-19.

The national and supranational authorities are responding to this adverse economic situation by taking steps to mitigate its effects. In the area of prudential regulation, the main measures include the announcements by the European Banking Authority that have focused on making the regulatory framework more flexible, especially in relation to the treatment of public and private moratorium measures for prudential purposes, and the guarantees granted by the different authorities.

As a result of all of the above, risk-weighted assets (RWA) increased by approximately €3,884m in the first quarter of the year. Isolating the effect of exchange rates, mainly due to the depreciation of the Mexican peso and the emerging currencies, it would result in a growth of €16,065m. This reflects the strength of the activity in the first two months of the year, as well as the increased demand for credit and drawing down of funding facilities resulting from the COVID-19 situation.

The fully loaded Additional Tier 1 capital (AT1) stood at 1.63% at the end of March 2020. In February, we saw the early amortization of the issue of CoCos worth €1,500m and with a coupon of 6.75%, issued in February 2015, which since December 2019 no longer computed in the capital adequacy ratio.

In terms of the issues eligible as Tier 2 capital, in January 2020, BBVA, S.A. issued €1,000m of Tier 2 subordinated debt over a ten-year period, with an option for early amortization in the fifth year, and a coupon of 1% in January 2020.

With regard to the rest of the Group's subsidiaries, Garanti BBVA carried out a Tier 2 issue in February for TRY 750m (€114m) at TLREF (Turkish Lira Overnight Reference Rate) plus 250 basis points.

All of this, together with the evolution of the remaining elements computable as Tier 2 capital, has placed the fully loaded Tier 2 ratio at 2.40% as of March 31, 2020.

Moreover, at the supervisory level, the European Central Bank, in its announcement on March 12, has allowed the banks to operate temporarily below the capital level defined by the Pillar II Guide (P2G), the Capital Conservation Buffer (CCB) and the Liquidity Coverage Ratio (LCR). In addition to the above, the banks are allowed to use additional Tier 1 and Tier 2 capital instruments to meet the Pillar II Requirements (P2R). These measures are reinforced by the relaxation of the Countercyclical Capital Buffer (CCyB) announced by various national macroprudential authorities and by other complementary measures published by the European Central Bank. All of this has resulted in a reduction of 68 basis points in the fully loaded CET1 requirement for BBVA, with that requirement standing at 8.59%. The reduction in the requirement at the total ratio level is only around 2 basis points, as a result of the lower applicable countercyclical buffer.

As a result, it has been agreed to modify the CET1 capital target in line with the new situation, which has been set as a management buffer between 225 to 275 basis points to the CET1 requirements. This range is the one used as a reference for determining the previous CET1 capital target (under fully-loaded view) of between 11.5% and 12%, which means that the new target maintains an equivalent distance in terms of CET1. At the end of March, the management buffer of the fully-loaded CET1 would amount to 225 basis points.

The phased-in CET1 ratio stood at 11.08% at the end of March 2020, taking into account the transitory effect of the IFRS 9 standard. AT1 stood at 1.66% and Tier 2 at 2.65%, resulting in a total capital ratio of 15.39%. The current management buffer at the CET1 level would therefore be 249 basis points.

Regarding shareholder remuneration, on April 9 a cash payment was made for a supplementary dividend for the 2019 financial year for the gross amount of €0.16 per share, in line with that approved at the General Meeting of Shareholders on March 13. This amounted to €1,067m. Thus, the total dividend for the 2019 financial year amounts to €0.26 gross per share.

In addition, in accordance with recommendation ECB/2020/19 issued by the ECB on March 27, 2020, on dividend distributions during the COVID-19 pandemic, and the subsequent notifications clarifying the treatment of dividend accruals by financial institutions under its supervision, the Board of Directors of BBVA has agreed to modify, for the financial year 2020, the Group’s shareholder remuneration policy, which was announced through the Relevant Event notification of February 1, 2017, establishing a new policy for 2020 of not making any dividend payment for the 2020 financial year until the uncertainties caused by COVID-19 are resolved and, in any case, not before the end of the financial year.

Shareholder structure (31-03-2020)

| Shareholders | Shares | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 500 500 | 360,533 | 41.1 | 67,493,011 | 1.0 |

| 501 to 5,000 | 405,879 | 46.3 | 707,872,492 | 10.6 |

| 5,001 to 10,000 | 58,796 | 6.7 | 413,591,321 | 6.2 |

| 10,001 to 50,000 | 46,208 | 5.3 | 886,021,853 | 13.3 |

| 50,001 to 100,000 | 3,455 | 0.4 | 235,353,161 | 3.5 |

| 100,001 to 500,000 | 1,606 | 0.2 | 289,282,093 | 4.3 |

| More than 500,001 | 308 | 0.0 | 4,068,272,649 | 61.0 |

| Total | 876,785 | 100.0 | 6,667,886,580 | 100.0 |

Fully-loaded capital ratios (Percentage)

Capital base (Millions of euros)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 31-03-20 (1) (2) | 31-12-19 | 31-03-19 | 31-03-20 (1)(2)(3) | 31-12-19 | 31-03-19 | |

| Common Equity Tier 1 (CET 1) | 40,852 | 43,653 | 41,784 | 39,984 | 42,856 | 40,975 |

| Tier 1 | 46,972 | 49,701 | 47,455 | 45,979 | 48,775 | 46,503 |

| Tier 2 | 9,753 | 8,304 | 7,341 | 8,848 | 7,464 | 7,286 |

| Total Capital (Tier 1 + Tier 2) | 56,725 | 58,005 | 54,797 | 54,827 | 56,240 | 53,789 |

| Risk-weighted assets | 368,654 | 364,448 | 360,679 | 368,827 | 364,942 | 361,173 |

| CET1 (%) | 11.08 | 11.98 | 11.58 | 10.84 | 11.74 | 11.35 |

| Tier 1 (%) | 12.74 | 13.64 | 13.16 | 12.47 | 13.37 | 12.88 |

| Tier 2 (%) | 2.65 | 2.28 | 2.04 | 2.40 | 2.05 | 2.02 |

| Total capital ratio (%) | 15.39 | 15.92 | 15.19 | 14.87 | 15.41 | 14.89 |

- (1) As of March 31, 2020, the difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR).

- (2) Provisional data.

- (3) As of March 31, 2020 the fully-loaded capital ratios include the positive impact of +2 basis points due the reduction of the limit of share buybacks which is pending to be approved by the ECB.

Regarding the MREL (Minimum requirement for own funds and eligible liabilities) requirements, BBVA has continued its issuance plan during 2020 by closing two public issues of non-preferred senior debt, one in January 2020 for €1,250m over seven years and one coupon of 0.5%, and another in February 2020 for CHF 160m over six and a half years and a coupon of 0.125%.

The supervisor has also made announcements regarding the fulfillment of this MREL requirement, with a delay to be expected in the timetable for its entry into force.

The Group finds that the present structure of shareholders’ funds and admissible liabilities, together with the proposed plan for issuances, should enable it to comply with the MREL by the date of entry into force of the requirement.

Finally, the Group's leverage ratio maintained a solid position, at 6.2% fully loaded (6.4% phased-in), which remains the highest among its peer group.

Ratings

The rating agencies have kept BBVA's rating unchanged during the first quarter of the year. As a result of the uncertainty generated by the COVID-19 pandemic, on March 27 Fitch decided to change BBVA's outlook to Rating Watch Negative in a joint action that affected 17 Spanish banking groups. This resulted from a review of financial institutions in several European countries. On April 1, 2020, DBRS reported the result of its annual review of BBVA, confirming the rating of A (high). Moody's and S&P have held BBVA's rating at A3 and A-, respectively. These ratings, together with their corresponding outlooks, are shown in the following table:

Ratings

| Rating agency | Long term (1) | Short term | Outlook |

|---|---|---|---|

| Axesor Rating | A+ | n/a | Stable |

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A | F-1 | Rating Watch Negative |

| Moody’s | A3 | P-2 | Stable |

| Standard & Poor’s | A- | A-2 | Negative |

- (1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A rating respectively, to BBVA’s long term deposits.