The share

The Global economy is recovering from the crisis caused by the COVID-19 pandemic, which resulted in a fall of around 3.2% of global GDP in 2020. Improved activity in the first half of 2021 was primarily due to the increasing rollout of coronavirus vaccines—which has allowed a relatively rapid reopening of the economy—as well as to strong monetary and fiscal stimuli. Similarly, recovery in global growth has been accompanied by higher pressure on prices than expected, mainly in the United States, where consumer inflation reached 5.4% in June 2021.

It is hoped that increased vaccination will enable greater control of the pandemic and that economic policy will remain focused on supporting economic activity. Economic recovery is therefore most likely to continue. According to BBVA Research, global GDP will increase by around 6.3% in 2021 and 4.7% in 2022, inflation will gradually moderate in the coming quarters as the supply of products and services reacts to the recent increase in demand, and monetary policy benchmark interest rates will remain at all-time lows in the United States, where growth will reach 6.7% in 2021 and 4.8% in 2022. Meanwhile, several factors, such as the United States Federal Reserve's withdrawal of monetary stimuli, more persistent inflation, or new coronavirus variants, are contributing to uncertainty remaining exceptionally high and pose a risk to the expected economic recovery scenario.

With regard to the banking system, in an environment in which much of the economic activity has been at a partial standstill for several quarters, the services it provides have played an essential role. There are two main reasons for this: first, the banks have ensured the proper functioning of collections and payments for households and companies, thereby contributing to the maintenance of economic activity; second, the granting of new credit or the renewal of existing credit has reduced the impact of the economic slowdown on household and business incomes. The support provided by the banks over the months of lockdown and public guarantees have been essential in softening the impact of the crisis on companies' liquidity and solvency, meaning that banking has become the main source of funding for most companies.

In terms of profitability, European banks (including Spanish banks) have deteriorated from the outset of the crisis, primarily because many entities made high allocations for provisions for financial asset impairment in the first half 2020 as a result of the worsening macroeconomic environment following the pandemic outbreak. However, the profitability of European banks recovered strongly in the first quarter of 2021. According to data published by the Risk Dashboard of the European Banking Authority (hereinafter "EBA"), the average ROE for the major EU banking groups (covering approximately 80% of the banking business in Europe) rose from 1.9% in 2020 to 7.6% in the first quarter of 2021, due to the widespread signs of economic recovery. Furthermore, the accumulation of capital by banks and the very low interest-rate environment we have found ourselves in for several years will continue to put pressure on bank profitability. Nevertheless, European entities are facing this situation from a healthy position and with solvency that has been constantly increasing since the 2008 crisis, with reinforced capital and liquidity buffers and, therefore, with a greater capacity to lend.

The main stock market indexes continued their upward trend for another quarter. In Europe, the Stoxx Europe 600 index increased by 5.4% compared to the end of March, and in Spain the Ibex 35 rose 2.8% during the quarter. In The United States, the S&P 500 index increased by 8.2% in the period.

With regard to the banking sector indexes, their performance was in line with the general indexes during the first quarter of 2021. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased by 3.9% and 6.3% respectively, meanwhile in The United States, the S&P Regional Banks sectoral index performed worse, decreasing by -1.1% in the period.

For its part, the BBVA share performed much better than its sectoral index, with an increase of 18.1% during the quarter and closed the month of June at €5.23.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-20)

BBVA

Stoxx Europe 600

Stoxx Banks

The BBVA share and share performance ratios

| 30-06-21 | 31-03-21 | |

|---|---|---|

| Number of shareholders | 849,605 | 869,378 |

| Number of shares issued (millions) | 6,668 | 6,668 |

| Closing price (euros) | 5.23 | 4.43 |

| Book value per share (euros) | 6.69 | 6.80 |

| Tangible book value per share (euros) | 6.34 | 6.15 |

| Market capitalization (millions of euros) | 34,860 | 29,512 |

| Yield (dividend/price; %) (1) | 1.1 | 3.6 |

(1) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

Regarding shareholder remuneration, on April 29, 2021, a cash amount of €0.059 per share was distributed against the share premium account, as approved at the Annual General Meeting held on April 20, 2021. In addition, in order to effectively implement a share repurchase program, it was approved that BBVA's share capital could be reduced up to a maximum of 10% of the current share capital through the redemption of treasury shares acquired through any mechanism with the purpose of being redeemed, with the execution of the repurchase program and the redemption of the shares acquired being subject to obtaining the corresponding regulatory authorizations and also being subject, among other factors, to the share price.

As of June 30, 2021, the number of BBVA shares was 6,668 billion, and the number of shareholders reached 849,605. By type of investor, 60.72% of the capital is held by institutional investors and the remaining 39.28% by retail shareholders.

BBVA shares are included on the main stock market indexes, including the Ibex 35, and the Stoxx Europe 600 index, with a weighting of 7.20% and 0.35%, respectively at the closing of June 2021. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 4.80% and the Euro Stoxx Banks index for the eurozone with a weighting of 8.73%.

Finally, BBVA maintains a significant presence on a number of international sustainability indexes or Environmental, Social and Governance (ESG) indexes, which evaluates companies' performance in these areas. For further information, refer to the chapter “Sustainability and Responsible Banking” of the Quarterly Report 2Q21.

Group's information

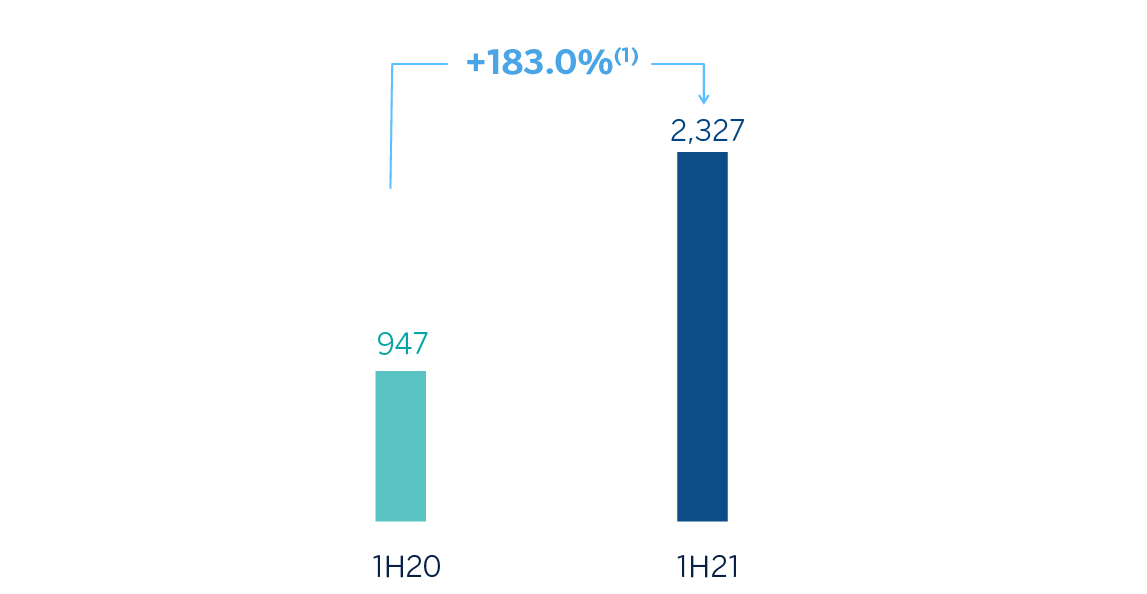

The BBVA Group generated a net attributable profit, excluding non-recurring impacts of €2,327m between January and June 2021, a year-on-year increase of +183,0% at constant exchange rates.

Including these non-recurring impacts —namely the €+280m profit generated by the Group's businesses in the United States until the closing of its sale to PNC on June 1, 2021 and the €-696m net cost related to the restructuring process (which will affect 2,935 employees and will result in the closure of 480 offices in Spain)— the Group's net attributable profit amounts to €+1,911m, which compares very positively with the €-1,157m in the same period of 2020, which was severely affected by the effects of the COVID-19 pandemic. For more information on these non-recurring impacts, see the "Non-performing impacts" bullet at the end of this section.

In year-on-year terms and at constant exchange rates, it is worth highlighting the good performance of the gross income and especially the recurring income (i.e. net interest income and fees), which grew by 5.0%, and the positive evolution (+14.8%) of net trading income (hereinafter NTI) mainly due to the good performance of the Global Markets unit in Spain and the revaluations of the Group stake on industrial and financial portfolio.

Also worth mentioning is the continuous focus on efficiency and operating expenses control which resulted in a 5.1%, in year- on-year growth in operating expenses at constant exchange rates, which is lower than the average inflation rate in the countries where BBVA operates.

Lastly, with respect to the Group results, the lower provisions for impairment on financial assets (-52.3% in year-on-year terms and at constant exchange rates), were mainly due to the strong impact of provisions for COVID-19 in the first half of 2020.

Net attributable profit (1)(Millions of Euros)

General note: excludes(I) BBVA USA and the rest of the Group's companies in the United States sold to PNC on June 1, 2021, as of 1H21 and 1H20 and (II) the net cost related to the restructuring process as of 1H21.

(1) At constant exchange rates.

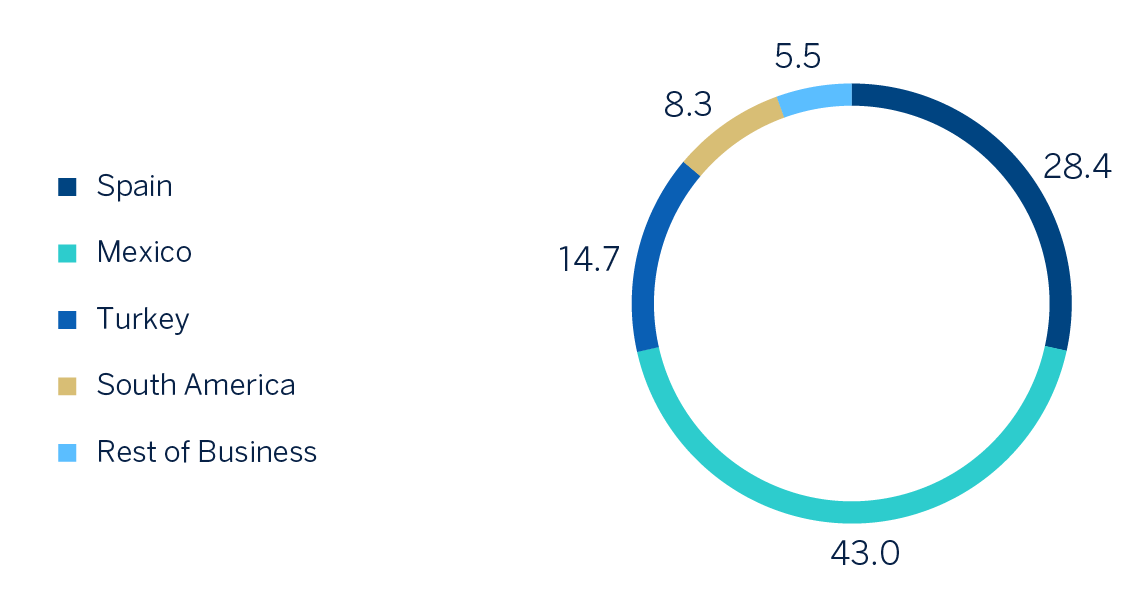

Net attributable profit breakdown (1) (Percentage. 1H21)

(1) Excludes the Corporate Center.

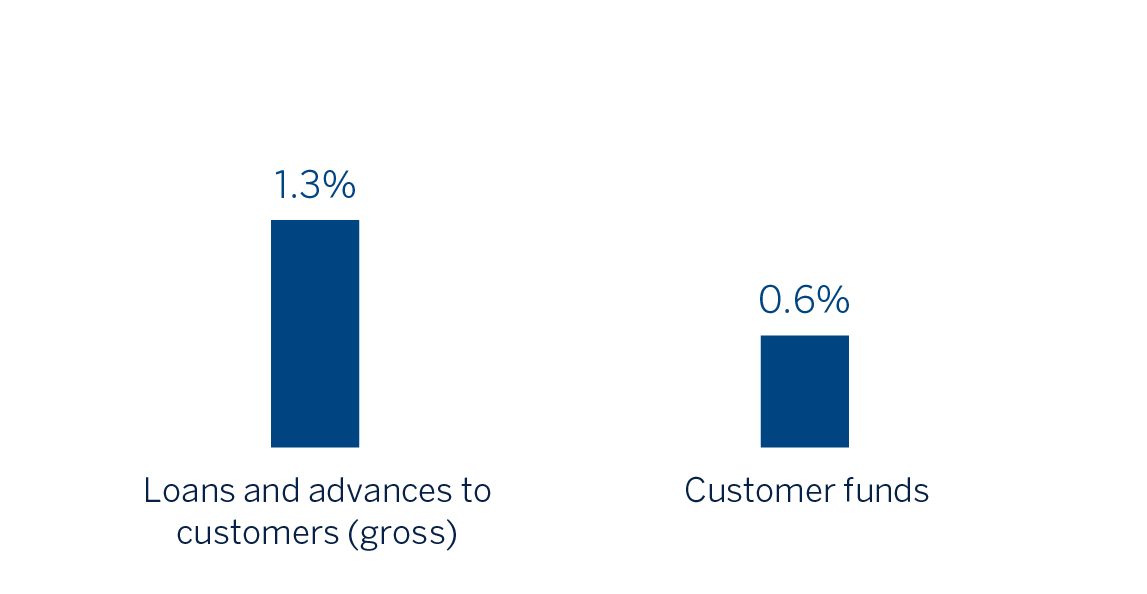

- Loans and advances to customers (gross) registered an increase of 1.3% compared to the end of December 2020. In terms of business areas, the dynamic lending activity in Turkey, Spain and Mexico should be highlighted. By segments, new loan production in the retail segment, above the pre-pandemic levels, and the gradual recovery of commercial activity are notable.

- Customer funds registered a slight increase of 0.6% compared to the end of December 2020, due to the performance of customer deposits, which contracted by 1.1% in the first half, and the positive performance (up 6.5%) of other customer funds, which managed to offset the deposits' decline in the same period of time.

LOANS AND ADVANCES TO CUSTOMERS (GROSS) AND CUSTOMER FUNDS (YEAR-TO-DATE CHANGE)

BBVA's strategy has been reinforced as a result of the acceleration of some of the trends caused by the COVID-19 pandemic, such as digitization or the commitment to more sustainable and inclusive development. The anticipation of these trends in the Group strategy has allowed BBVA to promote progress in the execution of its six strategic priorities..

In the first half of 2021, BBVA has continued to help its clients improve their financial health thanks to innovative solutions. The Group has made progress in developing an extensive catalog of experiences and digital tools that allow it to provide its clients with personalized, proactive and actionable advice for day-to-day control, debt management, savings or financial planning.

Advice that is appreciated by BBVA clients, which is reflected in a better Net Promoter Score among users of the financial health functionalities in Spain in the last quarter, which is 10 percentage points higher than that of other customers. Likewise, these financial advisory functionalities have been a key element for the contracting of products. Thus, in Spain, they have contributed 40% of all investment fund contracts, 28.6% of mortgage contracts or 12.7% of car loans in the first half of the year.

Likewise, the Group has reaffirmed its commitment to sustainability, to help its clients in the transition towards a sustainable future. Between 2018 and June 2021, BBVA has originated a total of €67,116m in sustainable financing. Among them, the issuance of the Central American Bank for Economic Integration (CABEI) stands out, for a total amount of 5,000 million Mexican pesos. It is the first COVID social bond and the largest social issue in the Mexican market, in which BBVA acted as a placement agent.

Sustainable financing by BBVA has grown 53% above forecast, well above the initial target. For this reason, in July 2021, BBVA announced that it doubles its objective of channeling sustainable financing to €200,000m.

But beyond financing, BBVA wants to provide a comprehensive support service to its retail and wholesale customers, including also advisory so that they can take advantage of investment opportunities in sustainability and the technologies of the future, and be more efficient and competitive. To this end, the Group has continued to promote the development of sustainable solutions. In April, BBVA achieved its goal of offering a sustainable alternative to its products in Spain, both for retail and wholesale.

Regarding the management of the impact of the activity and the integration of sustainability risk in the Bank's processes, during the first half of 2021 BBVA announced two very relevant milestones:

- It will reduce its exposure to coal-related activities to zero, ceasing to finance companies in these activities before 2030 in developed countries and before 2040 in the rest of the countries where BBVA Group operates.

- It has adopted the commitment to be neutral in net greenhouse gas emissions by 2050, taking into account the emissions of its clients in addition to direct emissions, and has joined the Net Zero Banking Alliance promoted by the United Nations as a founding member. This is a very relevant milestone that implies alignment with the most ambitious scenario of the Paris Agreement, that is, limiting the increase in temperatures to 1.5ºC compared to levels prior to the industrial revolution. With this, BBVA anticipates in 20 years the base scenario of the Paris Agreement of 2ºC.

Likewise, in its commitment to the community, BBVA works to contribute to a more sustainable and inclusive development. In the first half of 2021, BBVA allocated €38m, from which more than 17 million people benefited, to support the inclusive growth of the societies in which the Group is present, with a focus on reducing inequality and supporting entrepreneurship, providing opportunities through education and promoting local knowledge and culture. Among the initiatives of the first half of 2021, the following stands out:

- The "Educación conectada" project, promoted by BBVA and the Fundación de Ayuda contra la Drogadicción (FAD), whose priority is to alleviate the serious consequences of the COVID-19 crisis by reducing the digital divide.

- The celebration, in May 2021, of the 4 thsummit of the BBVA Center for Financial Education and Capacities (Edufin Summit), which had approximately 400 attendees from 40 countries.

- The national call for the access to education program "Chavos que inspiran" in Mexico, aimed at students who require financial support to continue their high school studies.

For all this, BBVA is the most sustainable European bank, according to the Dow Jones Sustainability Index, and the second in the world. An acknowledgement shared by Euromoney, which has named BBVA the best bank in corporate social responsibility inWestern Europe in 2021, recognizing BBVA's commitment to improve social, economic and environmental conditions in the region.

(1) Cumulative origination until June 2021

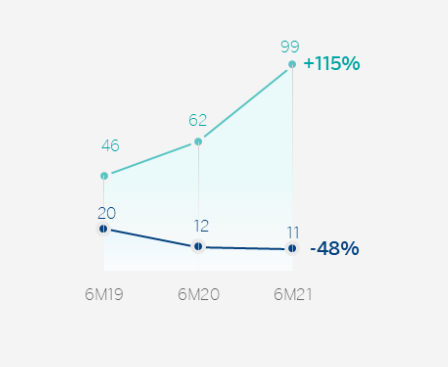

On the other hand, the Group has continued to grow in customers, especially through digital channels. The acquisition of customers through digital channels has increased by 45% in the last twelve months (comparing the data at the end of June 2021 and the end of June 2020), reaching 37% of new customers in the period. Something that has also been reflected in digital sales which, in cumulative terms and at the end of June, already represented 54% of the Group's total sales in PRV1.

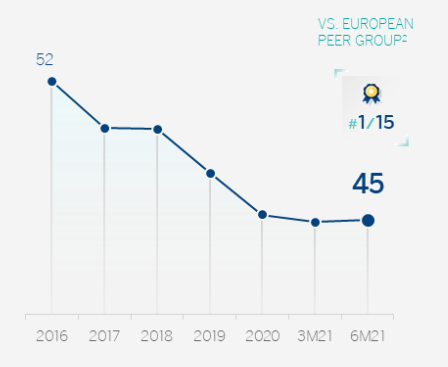

BBVA's commitment to innovative and globally scalable solutions also allows the Group to advance in operational excellence, such as the BBVA App, which is a leader and means that 62% of the Bank's active customers already use mobile channels and that the Bank's digital transactions have increased by 115% in Spain over the last two years. As a result, BBVA's efficiency ratio stands at 45%, outperforming to the average of its European competitors.

(1) Product Relative Value is a proxy used for the economic representation of the sale of units

/CUSTOMER TRANSACTIONS

(MILLION TRANSACTIONS1 IN SPAIN: 6M19-6M21 CHANGE %)

(1) Includes monetary and nonmonetary transactions related to servicing, it excludes sales of financial products and informations inquiries.

/ EFFICIENCY RATIO

%2

(2) European Peer Group: BARC, BNPP, CASA, CMZ, CS, DB, HSBC, ISP, LBG, NWG, SAN, SG, UBS, UCG. Peers data as of 3M21, BBVA data as of 6M21.

The Group puts the best and most engaged team at the center of its strategic priorities. For this reason, BBVA is one of the 30 companies worldwide awarded with the acknowledgement “Exceptional Workplace 2021” by the American consulting firm Gallup. This award distinguishes organizations committed to developing the human potential of their staff.

Likewise, the Group's commitment to inclusion and diversity and the initiatives developed in this regard has led BBVA to be included for the fourth consecutive year in the Bloomberg Gender-Equality Index, a ranking that includes the 100 global companies with the best practices in gender diversity. BBVA is also a signee of the Charter of Diversity at the European level and the Women's Empowerment Principles of the United Nations.

And for all this, the Group relies on data and technology, on distinctive digital capabilities, which it has been working on for more than a decade and which have allowed it to be leader in the transformation of the financial industry. An example is the progress in the development of an integrated big data platform, in which more than 1,600 data scientists, developers and specialists are involved, or the increasing use of other technologies such as the cloud, blockchain or artificial intelligence.

- On June 1, BBVA made public that, once the mandatory authorizations were obtained, the sale of 100% of the capital stock of BBVA USA Bancshares, Inc, the company that in turn owns all of the capital stock of the bank BBVA USA, was completed in favor of PNC (The PNC Financial Services Group, Inc). The accounting of the results generated by BBVA USA since the announcement of the operation in November 2020, as well as the closing of the sale on June 1, 2021, has generated a result net of taxes of €582m, which is included in the line "Profit/(loss) after tax from discontinued operations" of the consolidated income statement and of the Corporate Center income statement.

- Regarding the collective layoff process in BBVA, S.A. in Spain, announced on April 13, 2021, on June 8 the Group made public that it has reached an agreement with the legal representation of the workers. The agreement takes into account the layoff of 2,935 employees, as well as the closure of 480 branches. The net cost related to this procedure has been recorded in the results of the second quarter of 2021 of the BBVA Group and have amounted to €-696m, of which, before taxes, €-754m correspond to the collective layoff and €-240m to the closing of offices.

For management information purposes, considered to be a strategic decision, these impacts have been assigned to the Corporate Center. This process will generate estimated savings of approximately €250m per year from 2022 before taxes, of which approximately €220m correspond to personnel expenses. In 2021 the estimated savings will be approximately €65m before taxes.

- BBVA has voluntarily adhered to the Code of Good Practices approved by the Government of Spain on May 11 for clients who have benefited from financing with public endorsement since March 17, 2020. By joining this code, BBVA assumes, among other commitments, extend the expiration date of operations with public endorsement (normally from the Official Credit Institute, hereinafter ICO) that meet the established requirements, to continue supporting both companies and the self-employed.

- Regarding capital, the Group’s fully-loaded CET1 ratio as of June 30, 2021, reached 14.17 percent, which represents a new level of capital strength, providing an ample strategic optionality. This ratio includes the positive impact of 260 basis points from the sale of the United States subsidiary (from a total of 284 bps generated by the sale) and the negative impact of 25 basis points from Spain’s restructuring plan. This comfortable capital position will allow BBVA to increase shareholder remuneration.

- Regarding shareholder remuneration, on July 23, 2021, the European Central Bank (hereinafter ECB) made public that it had approved a new recommendation replacing recommendation ECB/2020/62 and to be in force as of September 30, 2021. The ECB indicates in its latter recommendation that it will assess the capital, dividend distribution and share buyback plans of each entity in the context of its ordinary supervisory process, replacing all the restrictions regarding dividends and share buybacks contained in recommendation ECB/2021/31. Once recommendation ECB/2021/31 has been released, BBVA intends to reintroduce its dividend policy announced on February 1, 2017 by the release of relevant information, that consist in the distribution of an annual payout of between 35% and 40% of the profits obtained in each financial year fully in cash in two different payments (expected for October and April, subject to the applicable authorizations) as from September 30, 2021.

Business areas

Spain

€3,057 Mill.*

+5.1%

Highlights

- Growth in lending activity and slight decline in customer funds.

- Improvement in the efficiency ratio and cost of risk.

- Favorable year-on-year evolution of the main margins.

- Decrease in the impairment on financial assets, compared to the first half of 2020 which was strongly affected by the pandemic.

Results

Net interest income

1,762Gross income

3,057Operating income

1,557Net attributable profit

745Activity (1)

Variation compared to 31-12-20

Performing loans and advances to customers under mangement

+1.1%

Customers funds under management

-0.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

Mexico

€3,064 Mill.*

-+3.3%

Highlights

- Growth in lending activity during the first half of the year, driven by the retail portfolio.

- Customer funds performed well, with growth in demand deposits and a shift from time deposits toward mutual funds.

- Increase in recurring income and strong operating income.

- Lower impairment losses on financial assets, due to the additional provisions for COVID-19 made in the first half of 2020.

Results

Net interest income

2,771Gross income

3,604Operating income

2,337Net attributable profit

1,127Activity (2)

Variation compared to 31-12-20

Performing loans and advances to customers under mangement

+1.8%

Customers funds under management

+4.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(2) Excluding repos.

(1) Year on year changes at constant exchange rate.

Turkey

1,571 Mill.*

+6.9%

Highlights

- Activity growth driven by Turkish lira loans and deposits.

- Outstanding performance of NTI and net fees.

- Operating expenses growth in line with the average inflation.

- Net attributable profit growth driven by lower impairment losses on financial assets in a comparative heavily affected by the effects of the pandemic in 2020.

Results

Net interest income

1,036Gross income

1,571Operating income

1,073Net attributable profit

384Activity (1)

Variation compared to 31-12-20

Performing loans and advances to customers under mangement

+10.8%

Customers funds under management

+16.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rate.

South America

€1,480 Mill.*

+7.7%

Highlights

- Growth in lending activity in the first half of the year, with greater dynamism between April and June.

- Reduction in higher-cost customer funds.

- Year-on-year increase in recurring income and NTI and higher adjustment for inflation in Argentina.

- Year-on-year comparison influenced by net attributable profit as a result of the increase in the impairment on financial assets line in 2020 due to the outbreak of the pandemic.

Results

Net interest income

1,328Gross income

1,480Operating income

797Net attributable profit

218Activity (1)

Variation compared to 31-12-20

Performing loans and advances to customers under mangement

+4.7%

Customers funds under management

+3.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rates.

Excludes BBVA Paraguay.

(3) At constant exchange rates excluding BBVA

Paraguay.

Rest of business

€400 Mill.*

-8.4%

Highlights

- Slight increase in lending and decrease in customers funds in the quarter.

- NPL ratio contained.

- Good performance of the Net interest income from the branches in Asia.

- Year-on-year increase of the Net attributable profit, compared with the first half of 2020, which was strongly affected by the COVID-19 pandemic in relation to the impairment of financial assets.

Results

Net interest income

140Gross income

400Operating income

173Net attributable profit

145Activity (1)

Variation compared to 31-12-20

Performing loans and advances to customers under mangement

+0.1%

Customers funds under management

-26.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

(3) At constant exchange rates excluding BBVA Paraguay.

Regarding the business areas it is worth mentioning:

- Spain: BBVA in Spain generated a net attributable profit of €745m during the first half of 2021, well above the €108m achieved in the same period of the previous year, mainly due to the provisions for impairment on financial assets made between January and June 2020 due to the outbreak of COVID-19, the greater contribution of fees and commissions line and NTI, as well as lower operating expenses in 2021.

- Mexico: BBVA in Mexico achieved a net attributable profit of €1,127m in the first half of 2021, i.e. an increase of 75.0% compared to the same period of the previous year, at constant exchange rate. This evolution is supported by a 5.8% growth (at constant exchange rates) in recurring income (net interest income and, net fees and commissions), as well as lower provisions for impairment on financial assets compared to the first half of 2020, which was greatly affected by the COVID-19 pandemic.

- Turkey: The net attributable profit generated by Turkey in the first half of 2021 stood at €384m, 92.1% (at constant exchange rates) above the figure achieved in the same period of the previous year, which registered a strong increase in the impairment on financial assets derived from the outbreak of the COVID-19 pandemic in March 2020. Thus, the lower provisions for impairment on financial assets, together with the growth of net fees and commissions line and NTI, would explain the growth of the results of Turkey in the first half of 2021.

- South America: South America generated a cumulative net attributable profit of €218 m between January and June 2021, which, at constant exchange rates and excluding BBVA Paraguay in 2020, represents a year-on-year variation of +110.1%, mainly due to the better evolution of recurring income and NTI between January and June 2021 (+17.8%) and lower provisions for impairment on financial assets than those registered in the first half of 2020, as a result of the outbreak of the pandemic in March 2020.

-

Other Businesses: At the end of the first half of 2021, the net attributable profit for the area stood at €145m (+36.7% year-on-year, at constant exchange rates). It is worth mentioning that this area mainly incorporates the wholesale business developed in Europe (excluding Spain) and in the United States, as well as the banking business developed through the 5 BBVA branches in Asia.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email