The share

In 2021 the global economy has grown significantly, recovering in part from the crisis caused by the pandemic, which caused a sharp fall in global GDP in 2020. The significant upturn in global growth has been due to progress in the vaccination against COVID-19 and important economic stimuli adopted by public authorities.

Activity indicators show, however, that the economic recovery process has lost momentum in recent months. The recent slowdown in economic growth is taking place in an environment marked by a sharp increase in infections caused by new variants of the COVID-19, although the increasing immunization of the world population has helped to generally prevent the adoption of mobility restrictions, which would have had a greater impact on the economy.

The effects of reduced production due to the pandemic and its persistence, coupled with fiscal stimuli and strong demand for goods, once restrictions have been lifted, contribute to maintaining the problems in global supply chains observed since the beginning of 2021 which, in addition to negatively affecting economic activity, generate significant upward pressure on prices. Against this backdrop, annual inflation in December 2021 stood at 7.0% in the United States and 5.0% in the Eurozone. In both geographical areas, long-term inflation expectations from markets and surveys have been adjusted upwards, although in the case of the Eurozone they remain generally below the European Central Bank’s (hereinafter, ECB) 2% target.

High inflation rates and their increased persistence have put pressure on central banks to withdraw monetary stimuli earlier than they had originally anticipated. The United States Federal Reserve, in particular, has begun the rollback in its bond-buying program and has suggested that monetary policy interest rates will adjust upwards earlier and faster than expected by financial markets and financial analysts, and also that a downsizing of its balance sheet may soon begin. In the Eurozone, the ECB will complete the pandemic emergency purchase program (PEPP) in March 2022. Although the asset purchase program (APP) is maintained, asset purchases will be moderated over the course of 2022. However, unlike the Federal Reserve, the ECB has continued to maintain that it rules out an increase in benchmark interest rates in 2022.

According to BBVA Research, the global economic recovery process is expected to continue in the coming months, albeit at a slightly slower pace than expected in autumn of 2021, due to the persistence of the pandemic, but also due to a higher-than-estimated impact of supply chain problems and inflationary pressures. All this against a background of reduced fiscal and monetary stimulus. GDP growth would therefore moderate, from an estimated 5.6% in 2021 to about 4.2% in 2022 in the United States, from 5.1% in 2021 to 3.7% in 2022 in the Eurozone and from 8.0% in 2021 to 5.2% in 2022 in China. The likely rise in monetary policy interest rates in the United States, which could reach 1.25% by the end of 2022, as well as a progressive control of the pandemic and a moderation of supply chain problems, would allow inflation to be moderated throughout the year; although inflation is expected to remain high, particularly in the United States. Risks arising from this economic scenario expected by BBVA Research are significant and are biased downwards in the case of activity, and include more persistent inflation, financial turbulence caused by a more aggressive withdrawal of monetary stimuli, the emergence of new variants of the coronavirus that bypass current vaccines, a more intense slowdown in the Chinese economy, as well as social and geopolitical tensions.

The main stock market indexes have shown a positive performance in 2021. In Europe, the Stoxx Europe 600 index increased by +22.2% compared to the end December of previous year, and in Spain the Ibex 35 rose 7.9% in the same period, showing a worse relative performance. In the United States, the S&P 500 index also increased by +26.9%.

With regard to the banking sector indexes, their performance during the year was better than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased by +34.0% and +36.2% respectively, while in the United States, the S&P Regional Banks sectoral index increased by +36.6% in the period.

For its part, the BBVA share price increased by +30.1% during the year, a little lower than its sectoral index, closing the month of December at €5.25 euros.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-20)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 31-12-21 | 30-09-21 | |

|---|---|---|

| Number of shareholders | 826,835 | 836,979 |

| Number of shares issued (millions) | 6,668 | 6,668 |

| Closing price (euros) | 5.25 | 5.72 |

| Book value per share (euros) (2) (3) | 6.86 | 6.76 |

| Tangible book value per share (euros) (2) (3) | 6.52 | 6.41 |

| Market capitalization (millions of euros) | 35,006 | 38,120 |

| Yield (dividend/price; %) (1) | 2.6 | 1.0 |

(1) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

(2) For the adjusted earning (loss) per share and earning (loss) per share calculation the additional Tier 1 instrument remuneration is adjusted. As of 31-12-21, 112 million shares acquired within the share buyback program between November 22 and December 31, 2021 were considered.

(3) The estimated number of shares pending from buyback as of December 31, 2021 of the first tranche approved by the BBVA Board of Directors in October 2021 (€1,500m), in process at the end of the year 2021, was included.

Regarding shareholder remuneration, after the lifting of restrictions by the European Central Bank, the Boards of Directors of BBVA approved on September 30, a cash interim dividend payment of €0.08 (gross) per share for the 2021 fiscal year. The dividend was paid on October 12, 2021.

Furthermore, on October 29, 2021, BBVA announced that it had received the required authorization from the European Central Bank for the buyback of up to 10% of its share capital for a maximum amount of 3,500 million euros over a maximum period of 12 months.

On November 18, 2021, the group announced that the Board of Directors of BBVA had agreed change the Group’s shareholder remuneration policy in force until then, establishing a new shareholder remuneration policy of distributing between 40% and 50% of the consolidated profits obtained for each year, as oppose to the previous policy that established a distribution between 35% and 40%. Payments under the new dividend policy will be made in cash and could be combined with share buybacks, all of which are subject to obtaining the corresponding authorizations and approvals applicable in each moment.

As of December 31, 2021, the number of BBVA shares was 6,668 billion, and the number of shareholders reached 826,835. By type of investor, 62.59% of the capital is held by institutional investors and the remaining 37.41% by retail shareholders.

BBVA shares are included on the main stock market indexes, among them the Euro Stoxx 50, of which BBVA returned to on September 20th, only one year after its exit, due to the good performance of the share. This milestone -exit and re-enter the following year- has not been achieved by any company at least in the last decade. BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

At the closing of December 2021, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 7.33%, 1.08% and 0.32%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 4.45% and the Euro Stoxx Banks index for the eurozone with a weighting of 7.48%.

Group's information

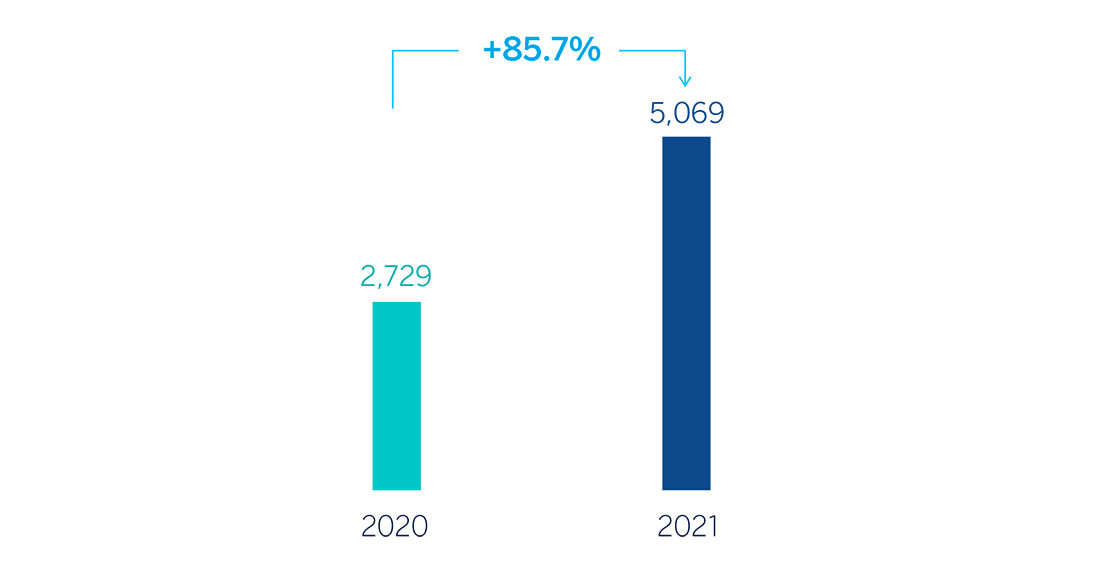

The BBVA Group generated a net attributable profit, excluding non-recurring impacts, of €5,069m in 2021, representing a year-on-year increase of +85.7%.

Taking into account the non-recurring impacts —namely the €280m corresponding to the profit generated by BBVA USA and the rest of companies included in the sale agreement to PNC until the closing date of the operation on June 1, 2021, and the €-696m of net costs related to the restructuring process— the Group's net attributable profit amounted to €4,653m, which compares very positively with the €1,305m in the same period of the previous year, which included the capital gains of €304m from the implementation of the bancassurance agreement reached with Allianz, in addition to the result generated by BBVA USA in 2020.

In a complex environment, the Group's results in 2021 were influenced by the Good performance in recurring income from the banking business, i.e. net interest income and net fees and commissions, as well as by a higher contribution of net trading income (NTI), so that gross income closed the year with a growth of 9.7%, at constant exchange rates.

Operating expenses increased (+8.5% in year-on-year terms) and excluding the exchange rate effect in all areas except Spain, where they remained contained and Rest of Business, where they decreased. This growth is framed within an environment of activity recovery and high inflation.

Thus, the efficiency ratio stood at 45.2% as of December 31, 2021, with an improvement of 53 basis points compared to the figure at the end of December 2020, placing BBVA in a leading position among its European peer group 1.

The lower provisions for impairment on financial assets stand out (-38.7% in year-on-year terms and at constant exchange rates), mainly due to the strong impact of provisions for COVID-19 in 2020.

In 2021, provisions were lower (-62.8% at constant exchange rates) than the previous year, due to provisions made in 2020 in Spain and Turkey.

Finally, in terms of results, the other gains line closed 2021 with a positive balance, which is an improvement over the previous year, which reflected the impairment of investments in subsidiaries, joint ventures or associates.

Net attributable profit (loss)(MILLIONS OF EUROS)

General note: excludes (I) BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021; (II) the net cost related to the restructuring process in 2021; and (III) the net capital gain from the bankassurance operation with Allianz in 2020.

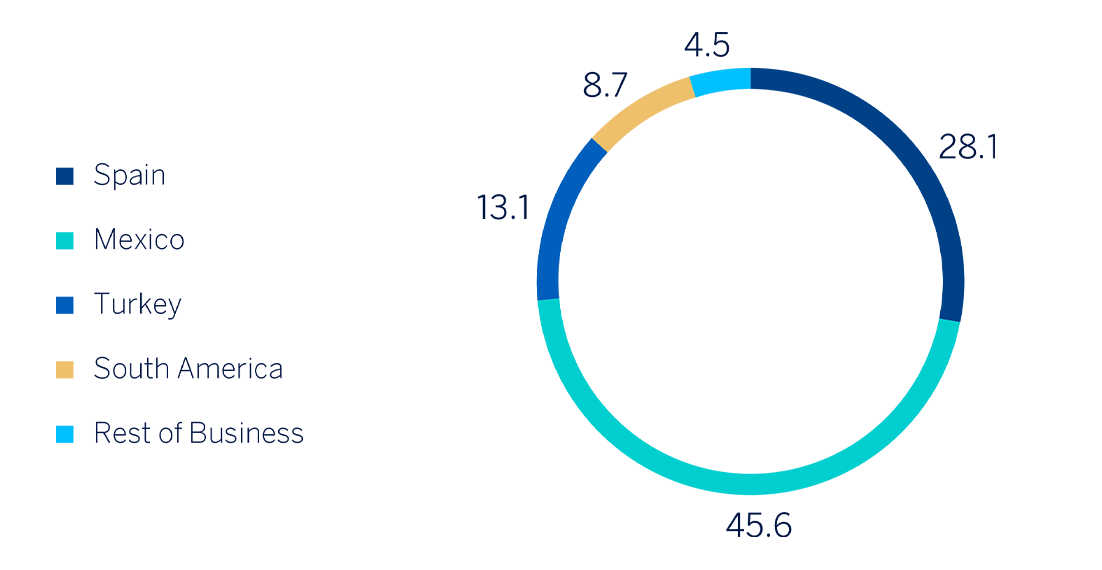

Net attributable profit breakdown (1) (PERCENTAGE.2021)

(1) Excludes the Corporate Center.

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander Société Générale, UBS, Unicredit. Data of European peer group at the end of September 2021. BBVA data at the end of December 2021.

In June 2021, BBVA and the majority of the labor union representatives reached an agreement on the restructuring plan of BBVA S.A. in Spain, which includes redundancies of 2,935 employees in total (divided into 2,725 layoffs and 210 leaves of absence, about 10% of the Group's total workforce in Spain) and an outplacement program for all interested employees. The process has been characterized by an attitude of dialogue between the parties and it has been carried out with a clear interest in voluntary acceptance. As of December 31, 2021, a total of 2,888 employees have already signed the exit of BBVA S.A. (some of them effectively left the Bank on January 1, 2022). Additional employee departures from the branches are expected to occur during January and February to complete the full scope of the agreement, which could be extended until March 31, 2022. Regarding the branches, most of the 480 included in the agreement were closed by the end of 2021.

On June 1, BBVA made public that, once the mandatory authorizations were obtained, the sale 100% of the capital stock of BBVA USA Bancshares, Inc, the company that in turn owns all of the capital stock of the bank BBVA USA, has been completed in favor of PNC (The PNC Financial Services Group, Inc). The accounting of the results generated by BBVA USA since the announcement of the operation in November 2020, as well as the closing of the sale on June 1, 2021, generated a result net of taxes of €582m, which is entirely included in the line "Profit/ (loss) after tax from discontinued operations" of the consolidated income statement and of the Corporate Center income statement. These impacts were included in the Group's cumulative results at the end of June 2021.

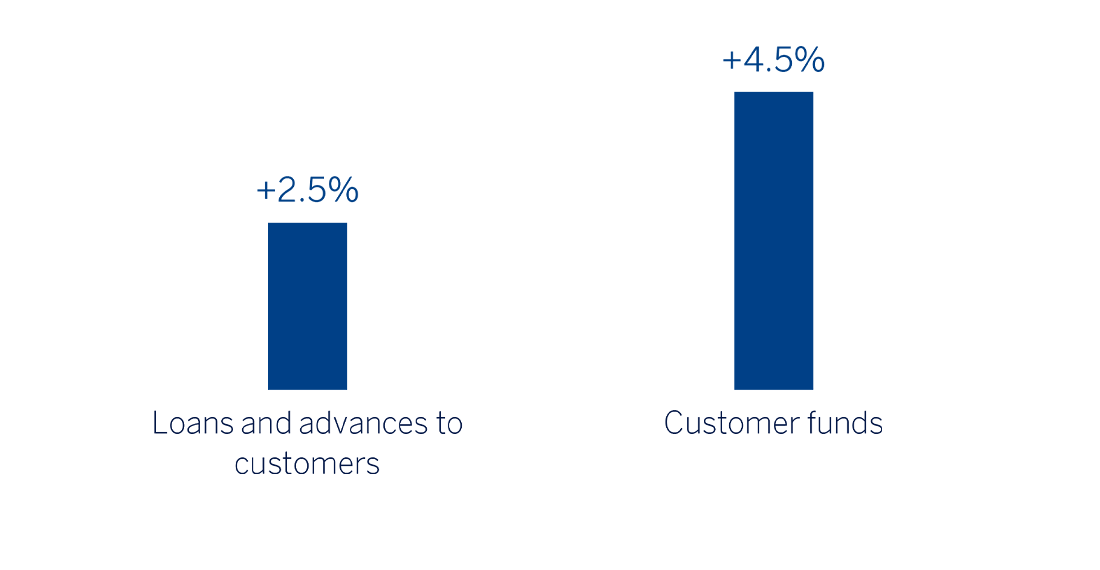

Loans and advances to customers recorded a growth of 2.5% compared to the end of December 2020, mainly due to the performance of business loans (+3.0%) and, to a lesser extent, loans to individuals (+1.5% in the year), which were strongly supported by consumer loans and credit cards (+5.7 overall).

Customer funds showed an increase of 4.5% compared to the end of December 2020, thanks to the good performance of both deposits from customers (+2.1%) and off-balance sheet funds (+12.5%). The interest rate situation has led to customers' preference for demand deposits and mutual funds (which grew by 15.3% compared to the end of the previous year) over time deposits (which decreased by 27.2% compared to December 2020).

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-20)

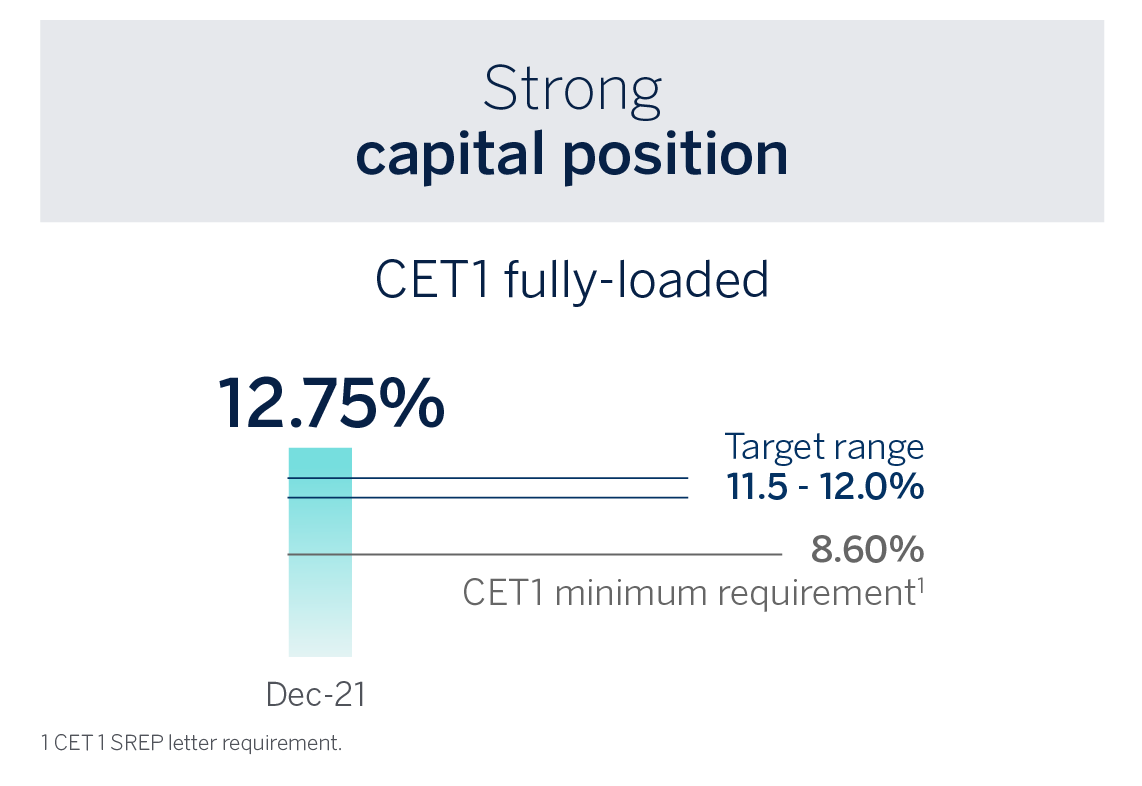

The Group's CET1 Fully-loaded ratio stood at 12.75% as of December 31, 2021, which represents a decrease in in the quarter (-173 basis points), although it maintains a large management buffer on the Group's capital requirements and is above the management target, which is to be within the range of 11.5-12% CET1. This CET1 level includes the deduction of the total amount of the share buyback program authorized by the supervisor, amounting to maximum €3.500m and representing an impact of approximately -130 basis points. For more information on the Group' share buyback program, please see "Share Buyback” section.

Regarding the Group’s shareholder remuneration policy in force, on November 18, 2021, the Group announced that the Board of Directors of BBVA has agreed to modify the Group’s shareholder distribution policy in force at that time, establishing a new policy consisting in an annual distribution of between 40% and 50% of the consolidated ordinary profit of each year (excluding amounts and items of an extraordinary nature included in the consolidated profit and loss account), compared to the previous policy of distributing between 35% and 40%.

This policy will be implemented through the distribution of an interim dividend for the year (expected to be paid in October of each year) and a final dividend (to be paid once the year has ended and the allocation of the year-end profit has been approved, expected to take place in April of each year), with the possibility of combining cash distributions with share buybacks (the execution of the shares buyback program is considered to be an extraordinary shareholder distribution and is therefore not included in the scope of the policy), all subject to the relevant authorizations and approvals applicable at any given time.

Regarding shareholder remuneration, on October 12, 2021, a payment in cash of €0.08 per share was made, as gross interim dividend against 2021 results. In addition, on February 3, 2022 it was announced that a cash distribution in the amount of €0.23 gross per share was expected to be submitted to the relevant governing bodies for consideration. If approved, the total cash distributions would amount to €0.31 gross per share. Therefore, the total shareholder remuneration will be the result of the cash payments discussed and the share buyback programs described in "Share buyback".

On October 26, 2021, BBVA received the required authorization from the ECB for the buyback of up to 10% of its share capital for a maximum sum of €3,500m, in one or several tranches.

Upon receiving the authorization from the ECB, BBVA Board of Directors at its meeting of October 28, 2021, resolved to carry out a framework share buyback program, to be executed in various tranches up to a maximum amount of €3.5 billion, with the aim of reducing BBVA's share capital as well as to carry out a first share buyback program within the framework program, the first tranche, which was notified as Privileged Information on October 29, 2021.

With regard to the first tranche, BBVA announced on November 19, 2021, that it would be implemented externally through a lead manager (J. P. Morgan AG) and would have a maximum amount of €1.500m, with a maximum number of shares to be acquired equal to 637,770,016 own shares, representing approximately 9.6% of BBVA’s current share capital, and that the opening of the first tranche would take place on November 22, 2021 and shall end not earlier than February 16, 2022, and not later than April 5, 2022, and, in any event, when the maximum monetary amount is reached or the maximum number of shares is acquired within that period1. With regard to the operations carried out in the context of the implementation of the first tranche, between November 22 and December 31, J. P. Morgan AG, as lead manager, acquired 112,254,236 BBVA shares covered by the share buyback program. Between January 1 and January 31, 2022, it acquired 58.951.275.

In addition, BBVA announced on February 3, 2022 that BBVA Board of Directors has agreed, within the framework program, to carry out a second program for the buyback of shares aimed at reducing BBVA’s share capital, for a maximum amount of 2,000 million Euros and a maximum number of shares to be acquired equal to the result of subtracting from 637,770,016 own shares (9.6% of BBVA’s share capital at this date) the number of own shares finally acquired in execution of the first tranche. The implementation of the second tranche, which will also be executed externally, through a lead-manager, will begin after the end of the implementation of the first tranche and shall end no later than October 15, 2022. BBVA will carry out a separate communication prior to the commencement of the execution of the Second Tranche with its specific terms and conditions.

1 However, the Company reserves the right to temporarily suspend the First Tranche or to early terminate it in the event of any circumstance that so advises or requires.

Business areas

Spain

€5,925 Mill.*

+6.4%

Highlights

- Growth in lending activity throughout the year

- Favorable performance of recurring income, driven by commissions

- Improvement in the efficiency ratio and outstanding gross income growth

- Decrease in impairment on financial assets, compared to a 2020 that was strongly affected by the pandemic, resulting in a lower cost of risk

Results

Net interest income

3,502Gross income

5,925Operating income

2,895Net attributable profit

1,581Activity (1)

Variation compared to 31-12-20.

Balances as of 31-12-21.

Performing loans and advances to customers under mangement

+1.7%

Customers funds under management

+2.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

Mexico

€7,603 Mill.*

-+5.8%

Highlights

- Growth in lending activity in the year driven by the continued acceleration in the retail portfolio segment since the second quarter of 2021

- Increase in demand deposits and therefore improvement in the funding mix

- Growth in recurring income and strength of operating income throughout the year

- Better performance of impairment on financial assets in 2021

Results

Net interest income

5,836Gross income

7,603Operating income

4,944Net attributable profit

2,568Activity (1)

Variation compared to 31-12-20 at constant exchange

rate.

Balances as of 31-12-21.

Performing loans and advances to customers under mangement

+5.1%

Customers funds under management

+11.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

3,422 Mill.*

+25.0%

Highlights

- Activity driven by Turkish lira loans and deposits

- Year-on-year growth in recurring income and NTI

- Year-on-year decrease in the cost of risk

- Net attributable profit growth driven by higher revenues and lower impairment on financial assets

Results

Net interest income

2,370Gross income

3,422Operating income

2,414Net attributable profit

740Activity (1)

Variation compared to 31-12-20 at constant exchange

rate.

Balances as of 31-12-21.

Performing loans and advances to customers under mangement

+39.7%

Customers funds under management

+65.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€3,162 Mill.*

+8.1%

Highlights

- Increase in lending activity in 2021, with growth in both retail and commercial segments

- Reduction in higher-cost customer funds

- Favorable year-on-year evolution of recurring income and higher adjustment for inflation in Argentina

- Reduction in the impairment on financial assets line as 2020 was affected by the outbreak of the pandemic

Results

Net interest income

2,859Gross income

3,162Operating income

1,661Net attributable profit

491Activity (1)

Variation compared to 31-12-20 at constant exchange

rates. It excludes the balances of BBVA Paraguay as of

31-12-20.

Balances as of 31-12-21.

Performing loans and advances to customers under mangement

+10.3%

Customers funds under management

+5.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos and BBVA Paraguay figures as of

31-12-20.

(2) Year-on-year changes at constant exchange

rates.

(3) At constant exchange rates excluding BBVA

Paraguay.

Rest of business

€741 Mill.*

-12.3%

Highlights

- Increase in lending due to evolution in the second half of the year and decrease in customer funds in 2021

- Good performance of recurring income in the fourth quarter

- Favorable evolution of risk indicators in the quarter

- Reversal in the impairment on financial assets line, which contrasts with provisions made in 2020

Results

Net interest income

281Gross income

741Operating income

291Net attributable profit

254Activity (1)

Variation compared to 31-12-20 at constant exchange

rates.

Balances as of 31-12-21.

Performing loans and advances to customers under mangement

+10.2%

Customers funds under management

-33.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

(3) At constant exchange rates excluding BBVA Paraguay.

Data at the end of December 2021. Those countries in which BBVA has no legal entity or the volume of activity is not significant, are not included.

As for the business areas, the provisions for impairment on financial assets decreased in all of them, compared to 2020 which was impacted by the outbreak of the pandemic. In addition, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain: BBVA in Spain achieved a net attributable profit of €1,581m in 2021, with a year-on- year increase of +142.6%, mainly due to the growth in recurring income from net fees and commissions and NTI in 2021.

- Mexico: BBVA in Mexico generated a net attributable profit of €2,568m during 2021, representing an increase of 42.6% compared to 2020. This evolution is driven by a 6.4% growth in recurring income and by the strength of the operating income (+3.3%).

-

Turkey: The net attributable profit generated by Turkey in 2021 stood at €740m, 71.4% above the figure achieved in the previous year, supported by a higher contribution from recurring income and NTI.

With regard to this business area, on November 18, 2021, BBVA Group submitted to the Capital Markets Board of Turkey the application for authorization of the voluntary takeover bid (hereinafter referred to as the Voluntary Takeover Bid) for the entire share capital of Garanti BBVA not already owned, once all relevant regulatory approvals have been obtained. Given the deadlines and the need to receive approval from all relevant regulatory bodies, BBVA estimates that the closing of the Voluntary Takeover Bid will take place in the first quarter of 2022. - South America: All the countries of the region where BBVA has a presence generated a cumulative net attributable profit of €491m in 2021, which, excluding BBVA Paraguay in 2020, represents a year-on-year variation of +30.3%, due to a better evolution of recurring income in 2021 (+21.0%), partially offset by a higher inflation adjustment in Argentina in 2021.

-

Rest of Business: This area, which mainly incorporates the Group's wholesale business developed in Europe (excluding Spain) and in the United States, as well as the banking business developed through the BBVA branches in Asia, achieved a net attributable profit of €254m (+13.2% year-on-year) in 2021.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email