The share

In 2021, the global economy grew significantly, partly recovering from the pandemic-generated crisis, which led to a sharp drop in global GDP in 2020. The significant rebound in global growth was due to progress in vaccination against COVID-19 and the significant economic stimuli adopted by the authorities.

Activity indicators show that, despite a clear trend of moderation, economic growth remained at relatively high levels during the first half of 2022. The savings previously accumulated, the normalization of activity following the restrictions and disruptions generated by the pandemic, as well as the dynamism of labor markets, have contributed significantly the performance of private consumption and the service sector.

The relative resilience of demand, the persistence of disruptions in global supply chains and, mainly, the impact of the war in Ukraine on commodity prices have all reinforced pressures on inflation. This has caused inflation to continue to surprise on the upside (8.6% in the Eurozone and 9.1% in the US as of June 2022). Inflationary presures are not only more persistent, but have spread to more types of goods and services in recent months.

Against this backdrop, central banks have responded by paving the way for aggressive tightening of monetary conditions in the future. In particular, the US Federal Reserve (“the Fed”) has raised policy rates by 150 basis points since the beginning of the year to 1.75% in June and started selling assets to reduce the size of its balance sheet. The Fed has also announced that interest rates will continue to rise in the coming months. According to BBVA Research, they are expected to reach around 4.0% by the beginning of 2023. In the Eurozone, the ECB at its monetary policy meeting in July, decided to raise official interest rates by 50 basis points. Refinancing rates are expected to converge to levels close to 2.0% in the coming months. The ECB's monetary tightening would therefore be less significant than what is expected to be implemented by the Fed. This is partly due to the fact that current demand pressures are lower in the Eurozone, where there are also concerns regarding financial fragmentation.

Although the current economic outlook is highly uncertain, BBVA Research's central scenario estimates that the global economy will slow down significantly in the near future, with possible episodes of recession in the United States and the Eurozone. The tightening on monetary conditions would be the main contributor to this slowdown in growth in a environment where commodity price and supply disruptions will continue to weigh negatively on activity.

According to BBVA Research, after rising 6.2% in 2021, global GDP will grow 3.4% in 2022 and 2.5% in 2023, down 0.6 and 1.1 percentage points, respectively, from the previous estimate three months ago. In the US, growth would slow to 2.7% in 2022 and 0.7% in 2023, when strong monetary tightening would generate a mild recession. In the Eurozone, GDP is expected to see slight falls in the coming quarters, mainly due to the disruptions caused by the war in Ukraine, including energy shortages. Annual growth in the region would be 2.7% in 2022 and 0.6% in 2023. China's economy is expected to grow at a moderate pace of 4.5% in 2022 and 5.2% in 2023. However, the continued implementation of strict measures to contain the spread of Coronavirus could lead to further restrictions on mobility, which could weigh on economic growth.

The risks around this central scenario are significant and have a downward bias on BBVA Research's growth forecasts. In particular, sustained inflation could trigger even stronger interest rates hikes and a deeper and more widespread recession, as well as financial crises and volatility.

The main stock market indexes have shown a fall during the second quarter of 2022. In Europe, the Stoxx Europe 600 index decreased by -10.7% compared to the end of March 2022, and in Spain the Ibex 35 fell by -4.1% in the same period, showing a better relative performance. In the United States, the S&P 500 index also decreased strongly in the quarter, by -16.4%.

With regard to the banking sector indexes, their performance during the second quarter was in line with the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, decreased by -8.6% and -11.8% respectively, while in the United States, the S&P Regional Banks sectoral showed a better performance, decreasing by -15.7% in the period.

For its part, the BBVA share price fell by -16.9% during the quarter, closing the month of June at €4.33 euros.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-21)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 30-06-22 | 31-06-22 | |

|---|---|---|

| Number of shareholders | 821,537 | 815,233 |

| Number of shares issued (millions) | 6,387 | 6,668 |

| Closing price (euros) | 4.33 | 5.21 |

| Book value per share (euros) (1) | 7.55 | 6.92 |

| Tangible book value per share (euros) (1) | 7.19 | 6.56 |

| Market capitalization (millions of euros) | 27,657 | 34,740 |

| Yield (dividend/price; %) (2) | 7.2 | 2.7 |

(1) As of 30-06-22, the shares acquired from the start of the share buyback program to June 30, 2022, are included, taking into account the redemption of shares carried out on June 15, 2022 and the shares pending from buyback corresponding to the second segment of the second share buyback tranche. As of 31-12-21, 112 million shares acquired from the start of the share buyback program to the end of the period and the estimated number of shares pending from buyback as of December 31, 2021 of the first tranche, in process at the end of that date, were included.

(2) Calculated by dividing the dividends paid in the last twelve months by the closing price of the period.

Regarding shareholder remuneration, on April 8, 2022, a cash payment of €0.23 (gross) per share was made, as approved by resolution of the General Shareholders’ Meeting held on March 18, 2022. Consequently, the total cash distribution for the financial year 2021 was €0.31 (gross) per share, the highest in the last 10 years.

Thus, BBVA’s payout was 43% of the consolidated profits at year-end 2021, aligned with the Group’s shareholder remuneration policy, which establishes an annual distribution between 40% and 50% of the consolidated profits of each year.

The total shareholder remuneration also includes the extraordinary remuneration of the Buyback Program of up to the 10% of BBVA’s share capital for a maximum amount of 3,500 million euros. As for the first tranche, on March 3, 2022, BBVA announced the completion of its execution as the maximum monetary amount of 1,500 million euros had been reached.

After the redemption of 281,218,710 treasury shares acquired during the execution of the first tranche of the Buyback Program, on June 30, 2022 the number of BBVA shares was 6,386 billion, and the number of shareholders reached 821,537. By type of investor, 59.64% of the capital is held by institutional investors and the remaining 40.36% by retail shareholders.

With respect to the second tranche of the share repurchase program, on March 16, BBVA started the execution of the first segment for an amount of up to 1,000 million euros. The execution of this segment was completed on May 16, with a total of 206,554,498 shares.

Finally, on June 18, 2022, BBVA announced that it had agreed to complete the Program Scheme by executing the Second Segment of the second tranche for the purpose of reducing BBVA’s share capital, for a maximum amount of 1,000 million euros and a maximum number of BBVA shares to be acquired of 149,996,808.

BBVA shares are included on the main stock market indexes. At the closing of March 2022, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 6.40%, 1.04% and 0.30%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 3.97% and the Euro Stoxx Banks index for the eurozone with a weighting of 7.26%. Moreover BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

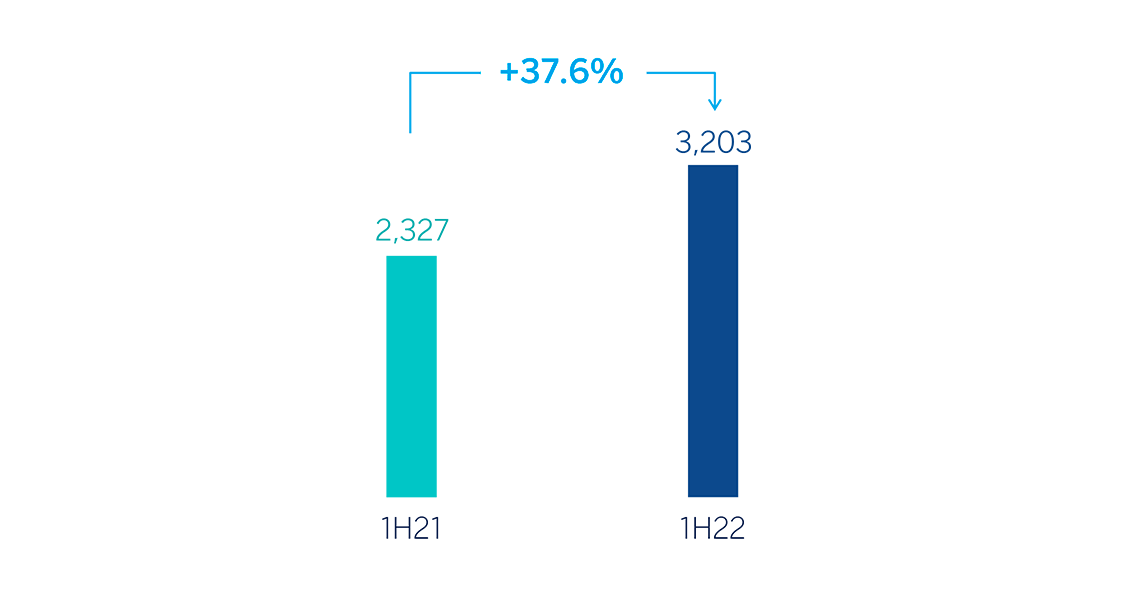

The BBVA Group generated a net attributable profit excluding non-recurring impacts of €3,203m in the first half of 2022, representing a year-on-year variation of +37.6%. Including those non-recurring impacts, i.e. €-201m from the purchase of offices in Spain from Merlin in June 2022 and €-416m from the results of discontinued operations and corresponding to BBVA USA and the rest of the companies sold to PNC on June 1, 2021, together with the net cost related to the restructuring process of the same year, the Group's net attributable profit registered a year-on-year increase of 57.1%. For more information on the operation with Merlin, see Business Areas - Spain, in the quarterly report.

The Group's net attributable profit for the first half of 2022 includes the application of IAS 291 "Financial Reporting in Hyperinflationary Economies" to the Group's entities in Turkey. For more information, see the section Business Areas - Turkey in the quarterly report.

Operating expenses increased at Group level (+12.0% in year-on-year terms and excluding the exchange rate effect), in an environment of high inflation in all countries in which BBVA operates.

Notwithstanding the above, thanks to the remarkable growth in gross income, fostered by the performance of the recurring income from banking activity (net interest income and fees and commissions), the efficiency ratio stood at 43.9% as of June 30, 2022, with an improvement of 203 basis points in constant terms, compared to the ratio at the end of December 2021, placing BBVA, once again, in a leading position among its European peer group2.

The provisions for impairment on financial assets decreased (-9.1% in year-on-year terms and at constant exchange rates), mainly due to decline in the main business areas excluding Turkey.

In the first half of 2022, provisions were lower than in the same period of the previous year.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: 1H22 excludes net impact arisen from the purchase of offices in Spain. 1H21 excludes BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 and the net cost related to the restructuring process.

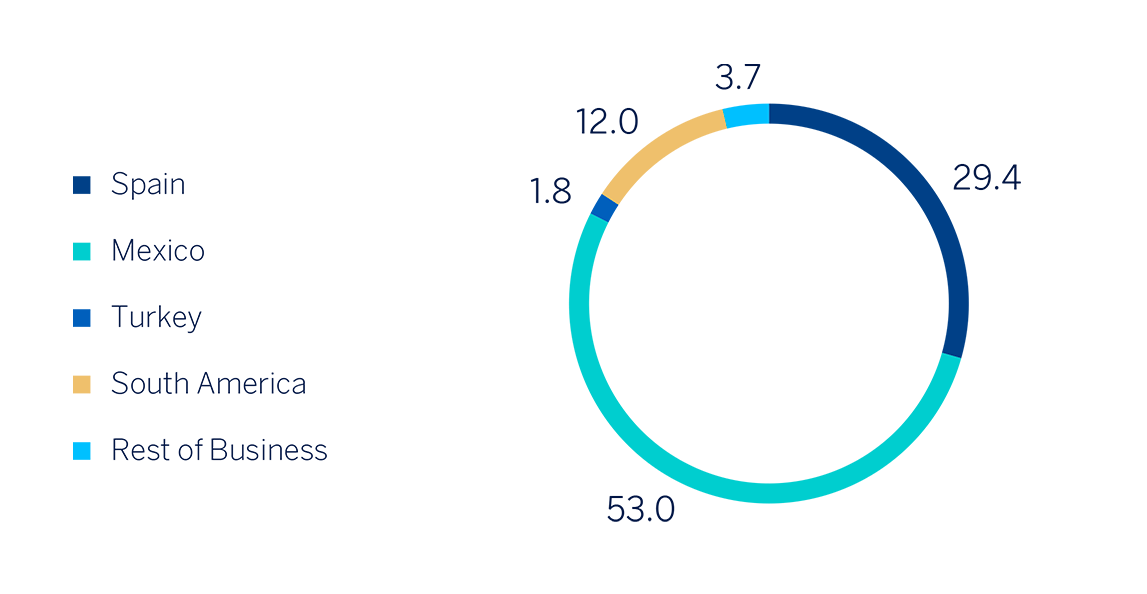

NET ATTRIBUTABLE PROFIT BREAKDOWN (1) (PERCENTAGE. 1H22)

(1) Excludes the Corporate Center and net impact arisen from the purchase of offices in Spain.

1 IAS 29 has not been applied to operations outside Turkey, in particular to the financial statements of Garanti Bank in Romania and Garanti Bank International N.V. in the Netherlands.

2 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, data at the end of March 2022.

Loans and advances to customers grew by 9.8% compared to the end of December 2021, strongly favored by the evolution of business loans in all business areas and, to a lesser extent, by the dynamism of retail loans.

Customer funds increased by 5.4% compared to the end of December 2021, thanks to the contribution of demand deposits (+6.1%) and time deposits (+17.5%).

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2021)

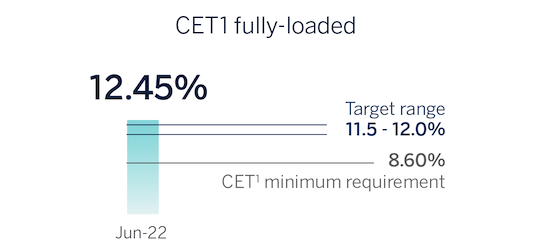

The Group's CET1 Fully-loaded ratio stood at 12.45% as of June 30, 2022, which allows to maintain a large management buffer over the Group's CET1 requirement (8.60%), and also above the Group's established target management range of 11.5-12% of CET1. This CET1 level includes the deduction of the total amount of the share buyback program authorized by the supervisor, amounting to maximum €3,500m that were already registered at the end of December 2021.

CAPITAL POSITION above the target range

1 CET 1 SREP letter requirement.

Regarding shareholder remuneration, on April 8, 2022 and as approved by the Annual General Meeting held on March 18, 2022 in its second item of the agenda, a cash gross payment of €0.23 was made against voluntary reserves for each outstanding share of BBVA as an additional shareholder remuneration for the year 2021. Thus, the total amount of cash distributions for the year 2021 was €0.31 gross per share, the largest distribution in 10 years.

The total shareholder remuneration includes, in addition to the aforementioned cash payments, the extraordinary remuneration resulting from the execution of the program scheme for the buyback of own shares announced on October 29, 2021 up to a maximum amount of €3,500m.

On October 29, 2021 BBVA announced the execution of the program for the buyback of own shares for a maximum amount of €3,500m to be executed in several tranches.

On November 19, 2021, BBVA announced that it had decided to execute the first tranche for a maximum amount of 1,500 million euros and with a maximum number of shares to be acquired of 637,770,016 shares, in turn communicating on March 3, 2022 the completion of the program, having reached the maximum monetary amount of €1,500m with the acquisition of 281,218,710 treasury shares which were amortized on June 15, 2022 charged to unrestricted reserves. After the effective amortization of the 281,218,710 own shares for a nominal amount of €137,797,167.90, the share capital of BBVA was set at the amount of €3,129,467,256.30, represented by 6,386,667,870 shares of €0.49 of face value each.

Likewise, on February 3, 2022, BBVA announced that it had agreed to carry out a second tranche for a maximum amount of 2,000 million euros and a maximum number of shares to be acquired based on the shares finally acquired in execution of the first tranche. In this regard, on March 16, 2022, the Bank announced the execution of the second tranche: (i) through the execution of a first segment for an amount of up to 1,000 million euros and with a maximum number of shares to be acquired of 356,551,306 treasury shares, which ended on May 16, 2022, having reached the maximum monetary amount of 1,000 million euros, having acquired 206,554,498 treasury shares; and (ii) once the execution of the first segment is completed, by executing a second segment that completes the program scheme.

Finally, on June 28, 2022, BBVA announced that it had agreed to execute the second segment for a maximum amount of 1,000 million euros and a maximum number of shares to be acquired of 149,996,808. As of June 30, 2022, BBVA's best estimate for this maximum amount is 610 million euros. From July 1 to July 21, 2022, Citigroup Global Markets Europe AG, acting as lead manager for the Second Segment, has acquired 63,750,000 BBVA shares.

Channeling sustainable financing

SUSTAINABLE FINANCING BREAKDOWN (PERCENTAGE. TOTAL AMOUNT MOBILIZED 2018-JUNE 2022)

BBVA has channeled a total of €111,700m in sustainable financing between 2018 and June 2022. Close to €14,500m were channeled this quarter, which represents an increase of 50% compared to the same period in 2021 and the quarter with the highest amount mobilized since 2018.

Thus, for example, the good performance of retail financing related to energy efficiency stands out, which has tripled in this quarter compared to the same quarter last year. The role of Turkey stands out in the second quarter of 2022, doubling its mobilization in energy efficiency compared to the first quarter of this year. The increase of 67% in retail financing related to sustainable mobility has also been relevant, with financing lines for the acquisition of hybrid and electric vehicles, which has already exceeded that of the same quarter of the previous year and where Colombia has been crucial by channeling more than a quarter of the total. Mexico stands out in financing companies in sustainable mobility, multiplying by 7 its mobilization compared to the same quarter of the previous year.

In inclusive growth, great progress has also been made, highlighting the financing of inclusive infrastructures, such as non-polluting public transportation, social housing or healthcare infrastructures, doubling the financing of the latter compared to the same quarter of 2021 and where Spain plays an important role with a contribution of 90% of overall channeling.

Finally, in corporate financing, channeling has also increased by more than 72% compared to the same quarter of the previous year. Likewise, the bond intermediation activity has increased about 65% compared to the same quarter of 2021.

Relevant advances in sustainability matters

- Risks

Beyond financing, BBVA wants to provide a comprehensive support service to its customers, retail and companies, including advice so that they can take advantage of investment opportunities in sustainability and future technologies, and be more efficient and competitive. To this end, different services and tools have been developed, such as the Transition Risk Indicator (TRi). The TRi is a transition risk indicator for corporate clients that allows assessing the client's current emissions profile and its decarbonization strategies. In this way, business can be promoted with well-positioned companies and risk mitigation measures can be applied to clients who are lagging behind. This quarter the steel sector has been incorporated into the sectors already included in the tool (automotive, energy and utilities), thus expanding the portfolio of clients to help in the transition towards low-carbon business models.

- Training

BBVA considers sustainability as a necessary strategic capability to meet the challenges which the society is facing. Therefore, the Entity provides general knowledge to the entire workforce about this topic, and has deployed different specific training itineraries and specific certifications to broaden this knowledge in the positions that require it.

As a result of all these initiatives, 80% of BBVA employees have received training in sustainability and more than 1,000 professionals in Spain have obtained specialized certification such as IASE (International Association For Sustainable Economy, certification recognized worldwide) and EFPA (European Financial Planning Association, certification recognized in Europe).

- Biodiversity and natural capital

BBVA actively participates in the main international working groups and has therefore joined the global initiative promoted by the Taskforce on Nature-related Financial Disclosures ("TNFD"), with BBVA being the first Spanish bank that joins this forum, which already includes more than 400 entities, organizations or regulators from all over the world. The TNFD aims to develop a framework for companies around the world to report and act on the evolution of their impacts, dependencies, as well as risks and opportunities related to nature, with the ultimate goal of supporting a change in global financial flows.

- Investments in innovation to accelerate the technological transition

BBVA wants to support its customers not only by providing financing, but also by investing in companies that are revolutionizing this transition and driving innovation. For this reason, BBVA has announced the first two investments in this field, the first in Lowercarbon Capital, one of the few venture capital funds specializing in innovative companies in the fields of climate change and decarbonization. The second in Fifth Wall, a fund specialized in investing in new green technologies that seek to decarbonize the real estate sector.

Business areas

Spain

€1,763 Mill.*

+0.1%

Highlights

- Growth in lending activity and stable customer funds in the quarter

- Solid asset quality indicators

- Significant improvement in efficiency

- Year-on-year decrease of impairment on financial assets during the semester

Results

(Millions of euros)

Net interest income

1,763Gross income

3,069Operating income

1,635Net attributable profit (3)

1,010Activity (1)

Variation compared to 31-12-21.

Balances as of 30-06-22.

Performing loans and advances to customers under mangement

+3.0%

Customers funds under management

-0.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

(3) The net attributable profit excludes the net impact arisen from the purchase of offices in Spain. Including this impact, the net attributable profit stands at €808m, representing a year-on-year increase of 11.5%.

Mexico

€3,684 Mill.*

+21.1%

Highlights

- Growth in lending activity in all segments during the first semester

- Improved customer spread, which is reflected in the net interest income

- Significant improvement in the efficiency ratio

- Loan-loss provisions in line with the first half of 2021

Results

(Millions of euros)

Net interest income

3,684Gross income

4,887Operating income

3,316Net attributable profit

1,821Activity (1)

Variation compared to 31-12-21 at constant exchange rate.

Balances as of 30-06-22.

Performing loans and advances to customers under mangement

+9.2%

Customers funds under management

+3.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

1,163 Mill.*

+104.2%

Highlights

- Growth in activity, again driven by loans and deposits in Turkish lira

- Year-on-year growth in recurring revenue and NTI

- Solid risk indicators

- Positive half-year net attributable profit

Results

(Millions of euros)

Net interest income

1,163Gross income

1,342Operating income

842Net attributable profit

62Activity (1)

Variation compared to 31-12-21 at constant exchange rate.

Balances as of 30-06-22.

Performing loans and advances to customers under mangement

+30.6%

Customers funds under management

+28.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€1,849 Mill.*

+39.8%

Highlights

- Growth in lending activity and customer funds

- Significant momentum in recurring income

- Stability in the efficiency ratio despite the growth in expenses in an inflationary environment

- Outstanding growth in net attributable profit in the quarter

Results

(Millions of euros)

Net interest income

1,849Gross income

1,975Operating income

1,052Net attributable profit

413Activity (1)

Variation compared to 31-12-21 at constant exchange rates.

Balances as of 30-06-22.

Performing loans and advances to customers under mangement

+6.9%

Customers funds under management

+7.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€155 Mill.*

-14.8%

Highlights

- Balanced growth in lending activity and in customer funds in the first half of 2022

- Strong net interest income

- The cost of risk remains at low levels

- Year-on-year growth in the net attributable profit of the European businesses

Results

(Millions of euros)

Net interest income

155Gross income

384Operating income

150Net attributable profit

128Activity (1)

Variation compared to 31-12-21 at constant exchange rates.

Balances as of 30-06-22.

Performing loans and advances to customers under mangement

+16.7%

Customers funds under management

+16.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

Data at the end of June 2022. Those countries in which BBVA has no legal entity or the volume of activity is not significant, are not included.

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain generated a net attributable profit of €1,010m during the first half of 2022, up 39.2% from the result achieved during the first half of the previous year, due to the strength of the gross income, driven by commissions and the significant reduction in personnel expenses, as well as lower loan-loss provisions and provisions. This result does not include the initial net impact of €-201m from the purchase of Merlin Properties, SOCIMI, S.A. (hereinafter Merlin) of 100% of the shares of Tree Inversiones Inmobiliarias Socimi, S.A. (hereafter Tree), owner of 662 offices leased to BBVA. Including this impact, the area's net attributable profit amounts to €808m, an increase of 11.5% compared to the net attributable profit of the same period of the previous year.

- In Mexico, BBVA achieved a net attributable profit of €1,821m between January and June 2022, representing an increase of 48.3% compared to the first half of 2021, mainly as a result of the good performance of recurring revenues, especially favored by the dynamism of the net interest income and contained loan-loss provisions, which compensated the increase in operating expenses.

-

Turkey generated a net attributable profit of €62m between January and June 2022. This result includes the impact of the application of IAS 29 to the Group's entities in Turkey previously mentioned.

With regard to this business area, after the end on May 18, 2022 of the acceptance period of the voluntary takeover bid, submitted by the BBVA Group for the entire share capital of Garanti BBVA not already owned, the Group's stake increased to 85.97% from the 49.85% prior to the voluntary takeover bid. - South America generated €413m in the first half of 2022, a year-on-year increase of +102.1%, mainly due to the improved performance of recurring income (+41.1%) and lower loan-loss provisions (-23.3%), which more than offset the growth of expenses (+32.6 %) in an environment of high inflation throughout the region.

-

Rest of Business achieved a net attributable profit of €128m accumulated at the end of the first half of 2022, 24.0% less than in the first half of the previous year, mainly due to the lower performance of the Group's broker dealer in the United States.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email