Results

Quarterly evolution of results

The result achieved by the BBVA Group in the second quarter of 2022 stood at €1,675m, 26.3% above the previous quarter 3, with the following trends standing out:

- Good performance in recurring income, which is the sum of the net interest income plus net fees and commissions, which together increased by 15.8% and compensated the lower NTI.

- Increase in operating expenses in an inflationary environment in all the countries where BBVA operates.

- Recording in the "Discontinued operations and Other" line the net impact of €-201m for the purchase of offices in Spain. Excluding this non-recurring impact, the Group's net attributable profit stands at €1,877m, 41.5% above that achieved in the previous quarter.

CONSOLIDATED INCOME STATEMENT: QUARTERLY EVOLUTION (MILLIONS OF EUROS)

| 2022 | 2021 | |||||

|---|---|---|---|---|---|---|

| 2Q | 1Q | 4Q | 3Q | 2Q | 1Q | |

| Net interest income | 4,602 | 3,949 | 3,978 | 3,753 | 3,504 | 3,451 |

| Net fees and commissions | 1,409 | 1,242 | 1,247 | 1,203 | 1,182 | 1,133 |

| Net trading income | 516 | 580 | 438 | 387 | 503 | 581 |

| Other operating income and expenses | (432) | (355) | (187) | (13) | (85) | (11) |

| Gross income | 6,094 | 5,416 | 5,477 | 5,330 | 5,104 | 5,155 |

| Operating expenses | (2,630) | (2,424) | (2,554) | (2,378) | (2,294) | (2,304) |

| Personnel expenses | (1,346) | (1,241) | (1,399) | (1,276) | (1,187) | (1,184) |

| Other administrative expenses | (944) | (870) | (850) | (788) | (800) | (812) |

| Depreciation | (340) | (313) | (305) | (314) | (307) | (309) |

| Operating income | 3,464 | 2,992 | 2,923 | 2,953 | 2,810 | 2,850 |

| Impairment on financial assets not measured at fair value through profit or loss | (704) | (737) | (832) | (622) | (656) | (923) |

| Provisions or reversal of provisions | (64) | (48) | (40) | (50) | (23) | (151) |

| Other gains (losses) | (3) | 20 | 7 | 19 | (7) | (17) |

| Profit (loss) before tax | 2,694 | 2,227 | 2,058 | 2,299 | 2,124 | 1,759 |

| Income tax | (697) | (904) | (487) | (640) | (591) | (489) |

| Profit (loss) for the period | 1,997 | 1,324 | 1,571 | 1,659 | 1,533 | 1,270 |

| Non-controlling interests | (120) | 3 | (230) | (259) | (239) | (237) |

| Net attributable profit (loss) excluding non-recurring impacts | 1,877 | 1,326 | 1,341 | 1,400 | 1,294 | 1,033 |

| Discontinued operations and Other (1) | (201) | - | - | - | (593) | 177 |

| Net attributable profit (loss) | 1,675 | 1,326 | 1,341 | 1,400 | 701 | 1,210 |

| Adjusted earning per share (euros) (2) | 0.28 | 0.19 | 0.19 | 0.20 | 0.18 | 0.14 |

| Earning per share (euros) (2)(3) | 0.25 | 0.19 | 0.20 | 0.20 | 0.09 | 0.17 |

- (1) Include: (I) the net impact arisen from the purchase of offices in Spain in 2022 for €-201m; (II) the net costs related to the restructuring process in 2021 for €-696m; and (III) the results generated by BBVA USA and the rest of the companies in the United States sold to PNC on June1, 2021 for €+280m.

- (2) Adjusted by additional Tier 1 instrument remuneration. In the first two quarters of 2022, the average number of shares acquired from the start of the share buyback program to their closing, was included, taking into account in the second quarter the redemption of shares carried out on June 15, 2022. In the fourth quarter of 2021, 112 million shares acquired from the start of the share buyback program to December 31, 2021 were included.

- (3) In the fourth quarter of 2021, the estimated number of shares pending from buyback as of December 31, 2021 of the first tranche (€1,500m), in process at the end of that year, was included.

Year-on-year performance of results

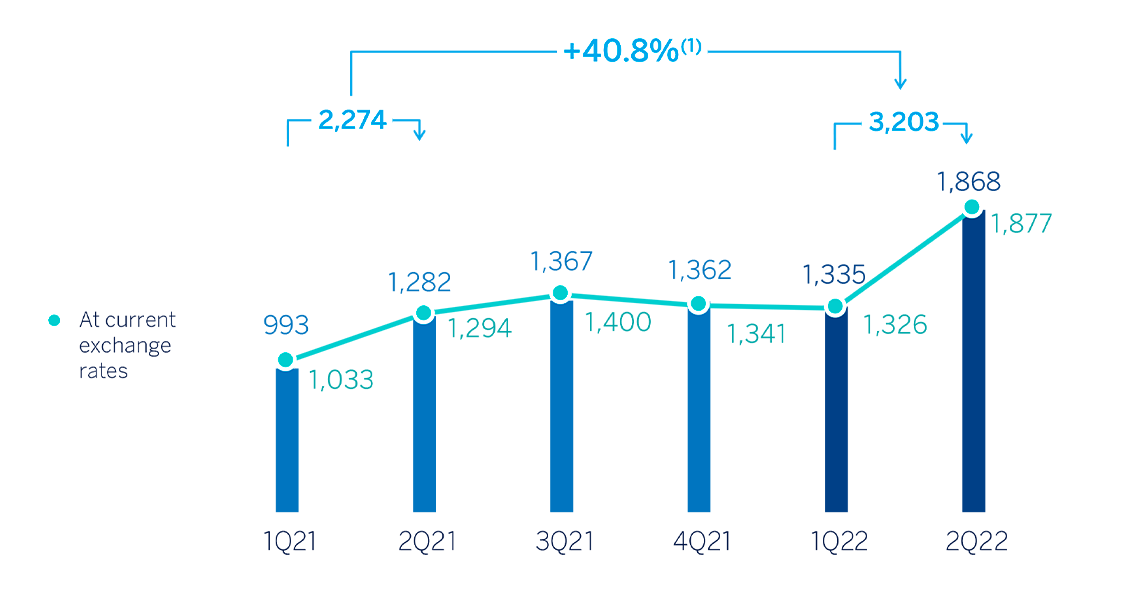

The BBVA Group generated a net attributable profit excluding non-recurring impacts of €3,203m in the first half of 2022, representing a year-on-year variation of +37.6%. Including those non-recurring impacts, i.e. €-201m from the purchase of offices in Spain from Merlin in June 2022 and €-416m from the results of discontinued operations and corresponding to BBVA USA and the rest of the companies sold to PNC on June 1, 2021, together with the net cost related to the restructuring process of the same year, the Group's net attributable profit registered a year-on-year increase of 57.1%.

The Group's net attributable profit for the first half of 2022 includes the application of IAS 29 "Financial Reporting in Hyperinflationary Economies" to the Group's entities in Turkey. For more information, see the section "Turkey" in business areas.

CONSOLIDATED INCOME STATEMENT (MILLIONS OF EUROS)

| 1H22 |

∆% |

∆% at constant exchange rates |

1H21 |

|

|---|---|---|---|---|

| Net interest income | 8,551 | 22.9 | 26.5 | 6,955 |

| Net fees and commissions | 2,650 | 14.5 | 17.8 | 2,315 |

| Net trading income | 1,095 | 1.0 | 5.5 | 1,084 |

| Other operating income and expenses | (787) | n.s. | n.s. | (95) |

| Gross income | 11,509 | 12.2 | 15.8 | 10,259 |

| Operating expenses | (5,054) | 9.9 | 12.0 | (4,598) |

| Personnel expenses | (2,587) | 9.1 | 12.3 | (2,371) |

| Other administrative expenses | (1,815) | 12.6 | 13.2 | (1,612) |

| Depreciation | (652) | 6.0 | 7.8 | (615) |

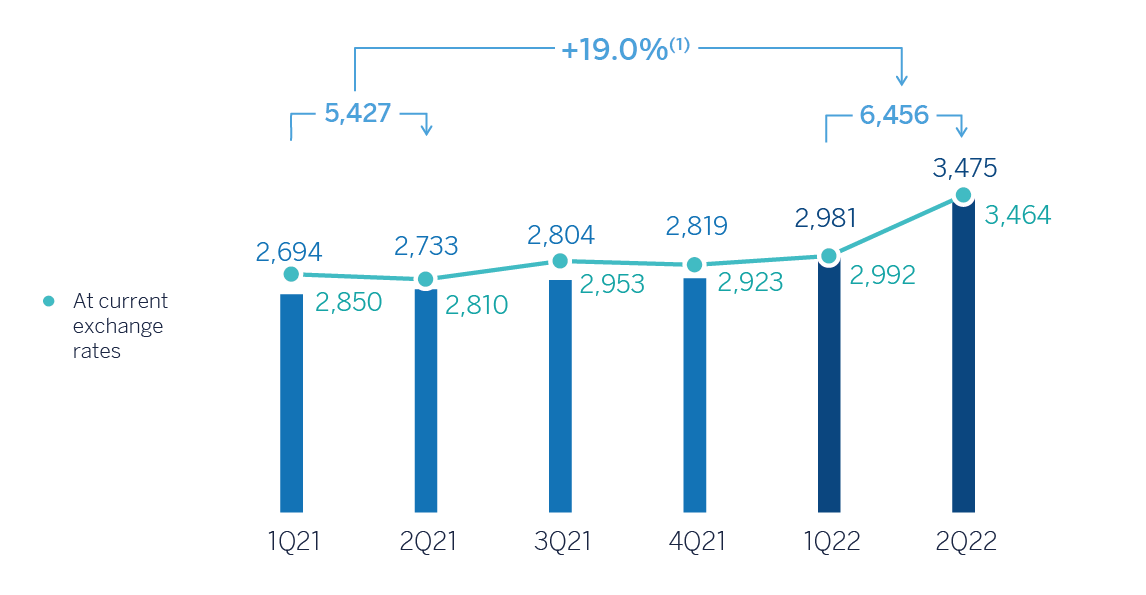

| Operating income | 6,456 | 14.0 | 19.0 | 5,661 |

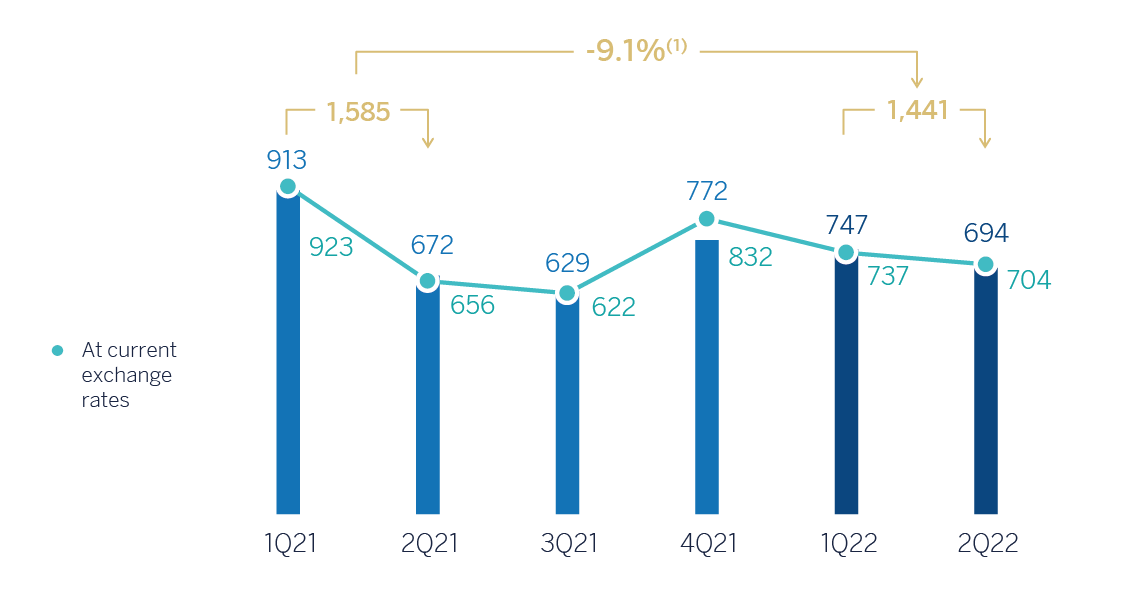

| Impairment on financial assets not measured at fair value through profit or loss | (1,441) | (8.8) | (9.1) | (1,580) |

| Provisions or reversal of provisions | (112) | (35.8) | (40.9) | (174) |

| Other gains (losses) | 18 | n.s. | n.s. | (24) |

| Profit (loss) before tax | 4,921 | 26.7 | 35.8 | 3,883 |

| Income tax | (1,601) | 48.2 | 52.4 | (1,080) |

| Profit (loss) for the period | 3,320 | 18.5 | 29.1 | 2,803 |

| Non-controlling interests | (117) | (75.3) | (60.5) | (476) |

| Net attributable profit (loss) excluding non-recurring impacts | 3,203 | 37.6 | 40.8 | 2,327 |

| Discontinued operations and Other (1) | (201) | (51.6) | (48.4) | (416) |

| Net attributable profit (loss) | 3,001 | 57.1 | 59.3 | 1,911 |

| Adjusted earning per share (euros)(2) | 0.48 | 0.32 | ||

| Earning (loss) per share (euros) (2) | 0.45 | 0.26 |

- (1) Include: (I) the net impact arisen from the purchase of offices in Spain in 2022 for €-201m; (II) the net costs related to the restructuring process in 2021 for €-696m; and (III) the results generated by BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 for €+280m.

- (2) Adjusted by additional Tier 1 instrument remuneration. In the first half of 2022, the average number of shares acquired from the start of the share buyback program to June 30, 2022 was included, taking into account the redemption of shares carried out on June 15, 2022.

Unless expressly indicated otherwise, to better understand the changes under the main headings of the Group's income statement, the year-on-year rates of change provided below refer to constant exchange rates. When comparing two dates or periods in this report, the impact of changes in the exchange rates against the euro of the currencies of the countries in which BBVA operates is sometimes excluded, assuming that exchange rates remain constant. For this purpose, the average exchange rate of the currency of each geographical area of the most recent period is used for both periods, except for those countries whose economies have been considered hyperinflationary, for which the closing exchange rate of the most recent period is used.

The accumulated net interest income as of June 30, 2022 was higher than in the same period of the previous year (+26.5%), due to the good performance in Mexico, Turkey and South America. These geographical areas compensated for the flat performance in Spain.

All areas, with the exception of Rest of Business, showed a positive performance in the net fees and commissions line compared to the accumulated amount reported at the end of June 2021 (+17.8% at Group level), which is partly explained by the increase in activity and higher fees from payment systems and deposits in the first half of 2022.

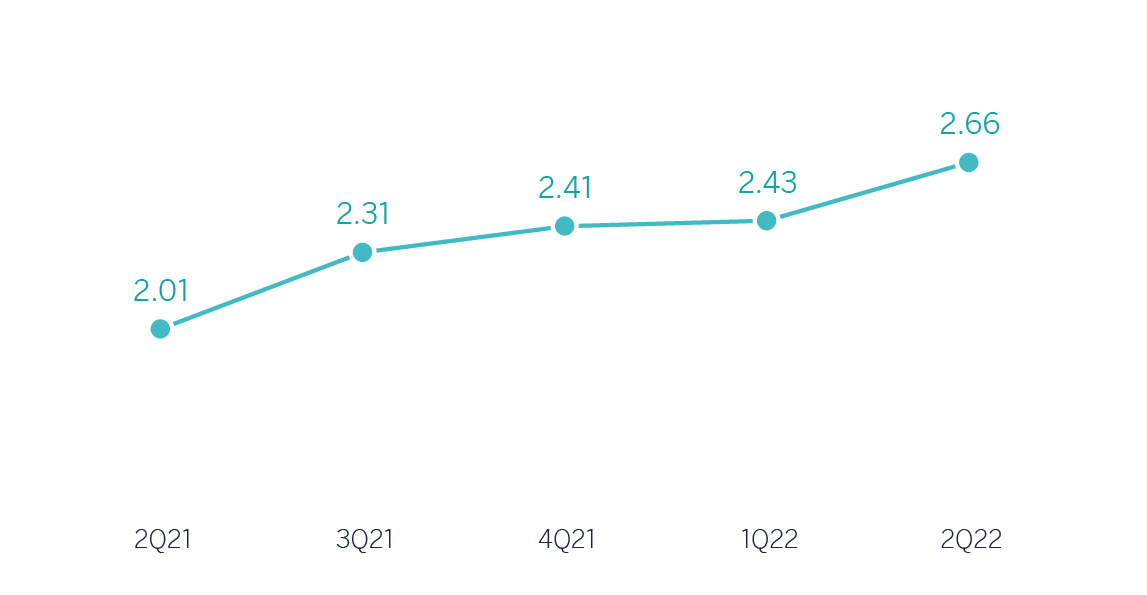

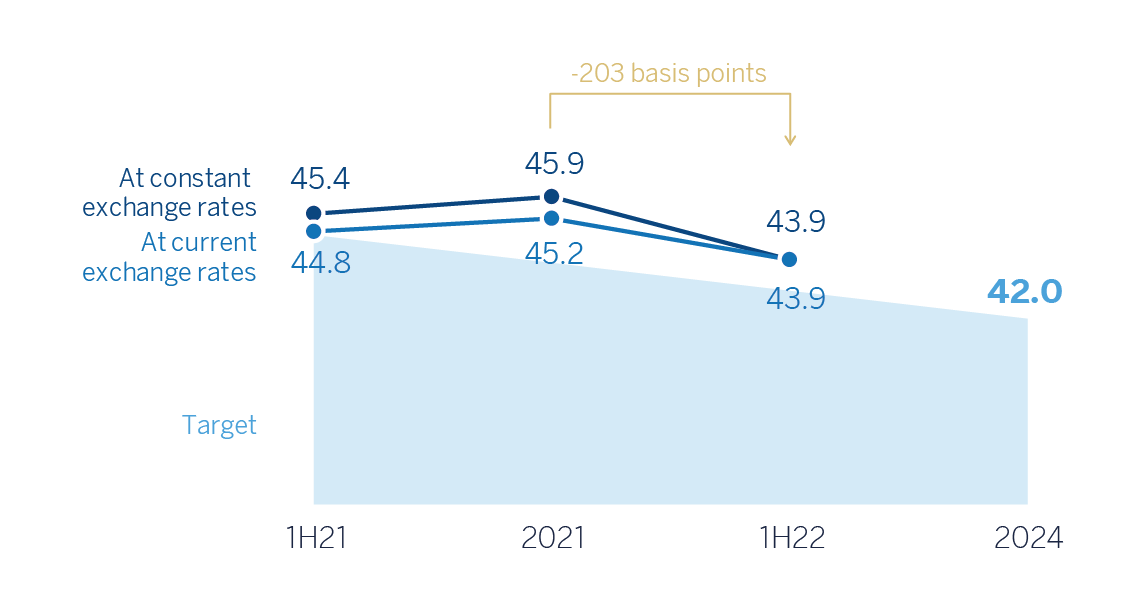

NET INTEREST INCOME/AVERAGE TOTAL ASSETS(1) (PERCENTAGE)

(1) Excluding BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 for the 2021 figures.

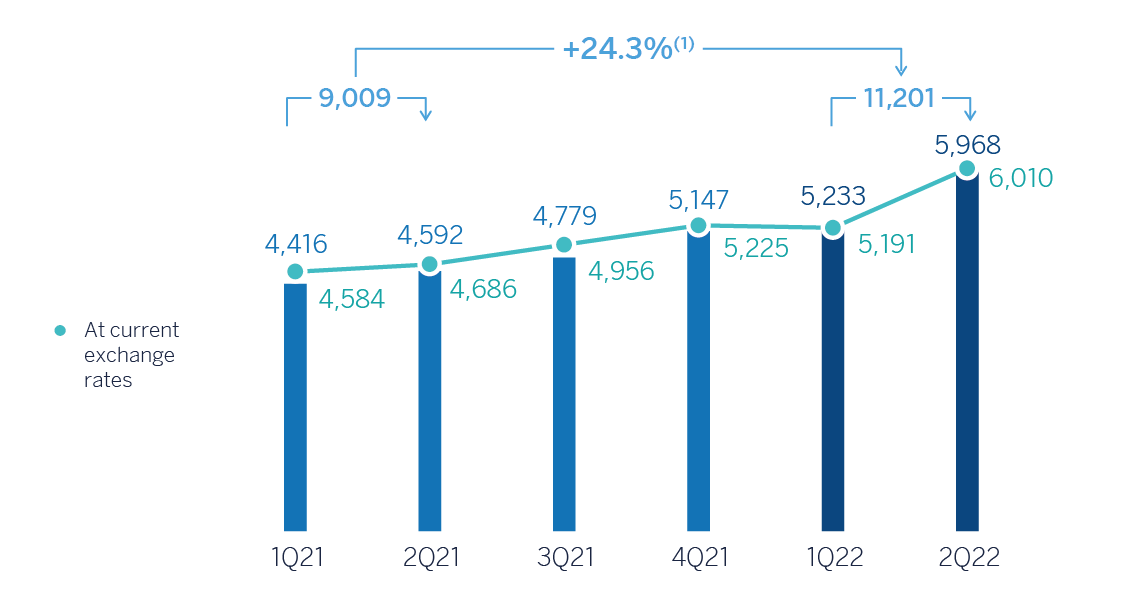

NET INTEREST INCOME PLUS NET FEES AND COMMISSIONS

(MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +20.8%

NTI showed a year-on-year variation of +5.5% at the end of June 2022, mainly due to the good performance of the Global Markets unit in Spain and Turkey, which offset the lower results recorded by Corporate Center.

The other operating income and expenses line accumulated a result of €-787m as of June 30, 2022, compared to €-95m in the same period last year, mainly due to the more negative adjustment for inflation in Argentina, the recording of this adjustment in the Group's entities in Turkey in 2022 and the higher contribution to the Single Resolution Fund ("SRF") in Spain.

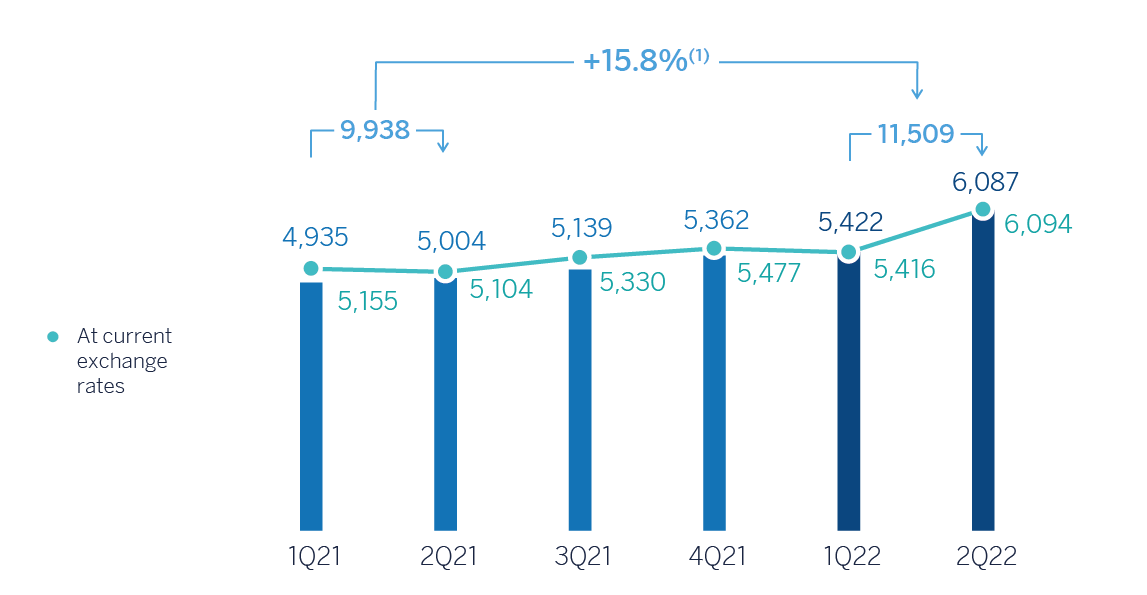

GROSS INCOME (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At constant exchange rates: +12.2%.

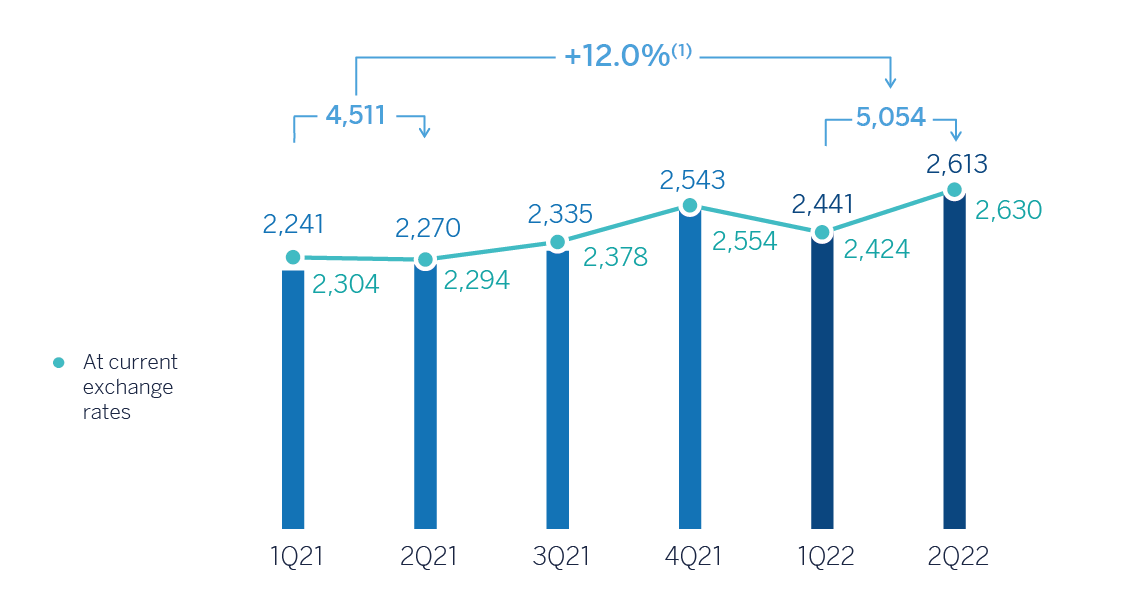

In year-on-year terms, operating expenses increased at the Group level (+12.0%), in an environment of high inflation in all countries in which BBVA operates. By areas, there was a year-on-year decrease in Spain, due to the lower headcount, and to a lesser extent, in the Corporate Center and in the aggregated Rest of Business.

Notwithstanding the above, thanks to the remarkable growth in gross income (+15.8%), the efficiency ratio stood at 43.9% as of June 30, 2022, with an improvement of 203 basis points compared to the ratio at the end of December 2021. All geographical areas recorded a favorable performance in terms of efficiency, except Turkey.

OPERATING EXPENSES (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +9.9%.

EFFICIENCY RATIO (PERCENTAGE)

Impairment on financial assets not measured at fair value through profit or loss (impairment on financial assets) closed June 2022 with a negative balance of €1,441m, lower than the previous year (-9.1%), despite the more unfavorable macroeconomic environment, with a decline in the main business areas excluding Turkey.

OPERATING INCOME (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +14.0%.

IMPAIRMENT ON FINANCIAL ASSESTS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: -8.8%.

The provisions or reversal of provisions line (hereinafter "provisions") accumulated a negative balance of €112m as of June 30, 2022, mainly due to provisions for legal contingencies in Spain and was 40.9% below the accumulated figure in the same period of the last year.

For its part, the other gains (losses) line closed June 2022 with a positive balance of €18m, which compares positively to the figure reached the previous year (€-24m).

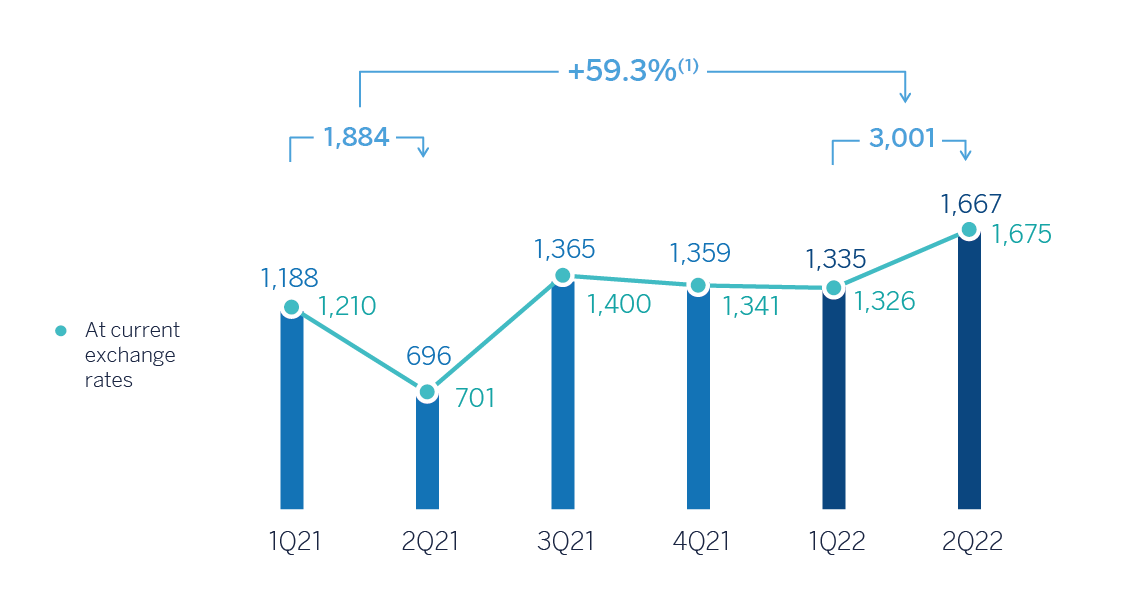

As a result of the above, the BBVA Group generated a net attributable profit excluding non-recurring impacts of €3,203m in the first half of 2022, representing a year-on-year increase of +40.8%. Taking into account the non-recurring impacts, registered within the line "Discontinued operations and Other," that is: (I) €-201m recorded in the second quarter of 2022 for the purchase of offices in Spain; (II) €280m for the results generated by BBVA USA and the rest of the companies sold to PNC on June 1, 2021; and (III) €-696m of the net costs associated with the restructuring process, the cumulative net attributable profit of the Group at the end of June 2022 stood at €3,001m, 59.3% higher than that achieved in the first semester of 2021.

The cumulative net attributable profits, in millions of euros, at the end of June 2022 for the various business areas that compose the Group were as follows: €1,010m in Spain (excluding the impact from the purchase of offices), €1,821m in Mexico, €62m in Turkey, €413m in South America and €128m in Rest of Business.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +57.1%.

NET ATTRIBUTABLE PROFIT (LOSS) EXCLUDING NON-RECURRING IMPACTS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

General note: non-recurring impacts include the net impact arisen from the purchase of offices in Spain in 2Q22, BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 for the periods 1Q21 and 2Q21 and the net cost related to the restructuring process in 2Q21.

(1) At current exchange rates: +37.6%.

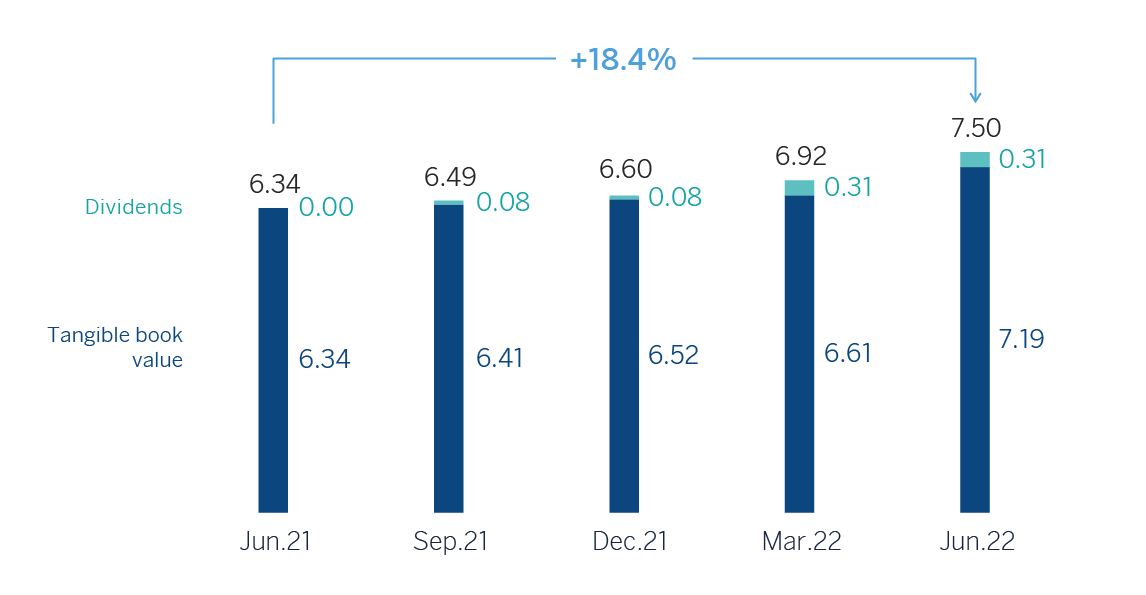

TANGIBLE BOOK VALUE PER SHARE(1) AND DIVIDENDS (EUROS)

General note: replenishing dividends paid in the period.

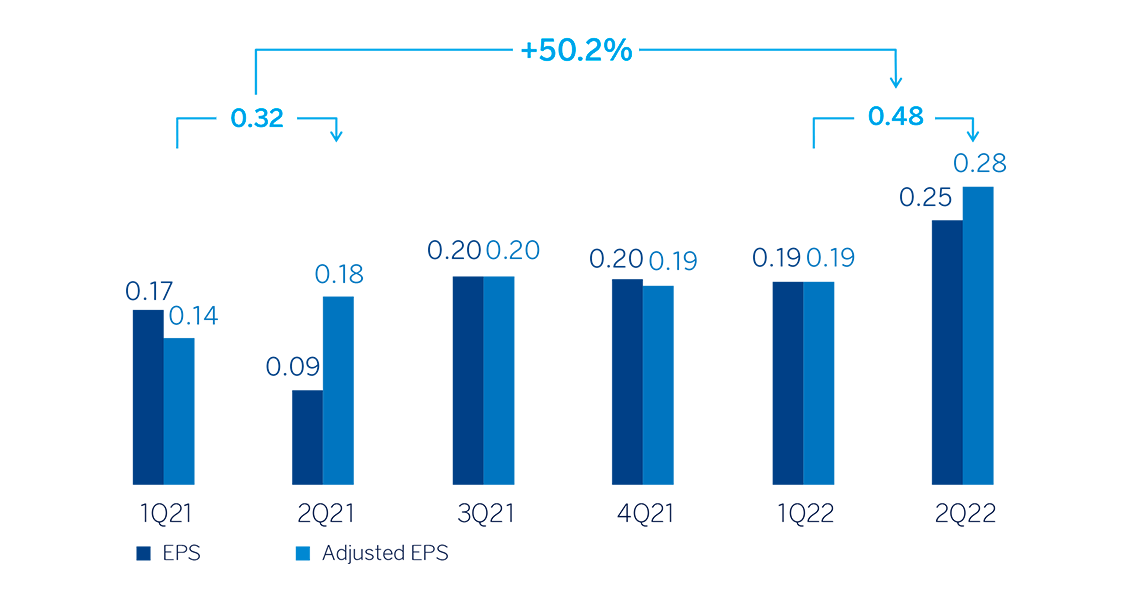

ADJUSTED EARNING PER SHARE (2) AND EARNING PER SHARE (2) (EUROS)

General note: adjusted earning per share excludes: (I) the net impact arisen from the purchase of offices in Spain in 2Q22;

(II) the net cost related to the restructuring process for the

period 2Q21; and (III) the profit (loss) after tax from

discontinued operations derived from the sale of BBVA USA and

the rest of the companies in the United States to PNC on June 1,

2021 for the periods 1Q21 and 2Q21.

(1) At the end of June 2022, the shares acquired as from the start of the share buyback program to June 30, 2022 were included, taking into account the redemption of shares carried out on June 15, 2022 and the shares pending from buyback corresponding to the second segment of the second share buyback tranche. At the end of March 2022 and December 2021, the shares acquired as from the start of the share buyback program until the end of their periods and the estimated number of shares pending from buyback of the tranches or segments, as appropiate, that were in process at the end of that date, were included.

(2) Adjusted by additional Tier 1 instrument remuneration. In 2Q22 and 1Q22, the average number of shares acquired as from the start of the share buyback program until the end of their periods, was taken into account. Additionally, for 2Q22, the redemption of shares carried out on June 15, 2022, was taken into account. In 4Q21, the shares acquired as from the start of the share buyback program until the end of the period were taken into account and, in addition, for the calculation of the earning (loss) per share, the estimated number of shares pending from buyback as of December 31, 2021 of the first tranche (€1,500m), in process at the end of that period, was included.

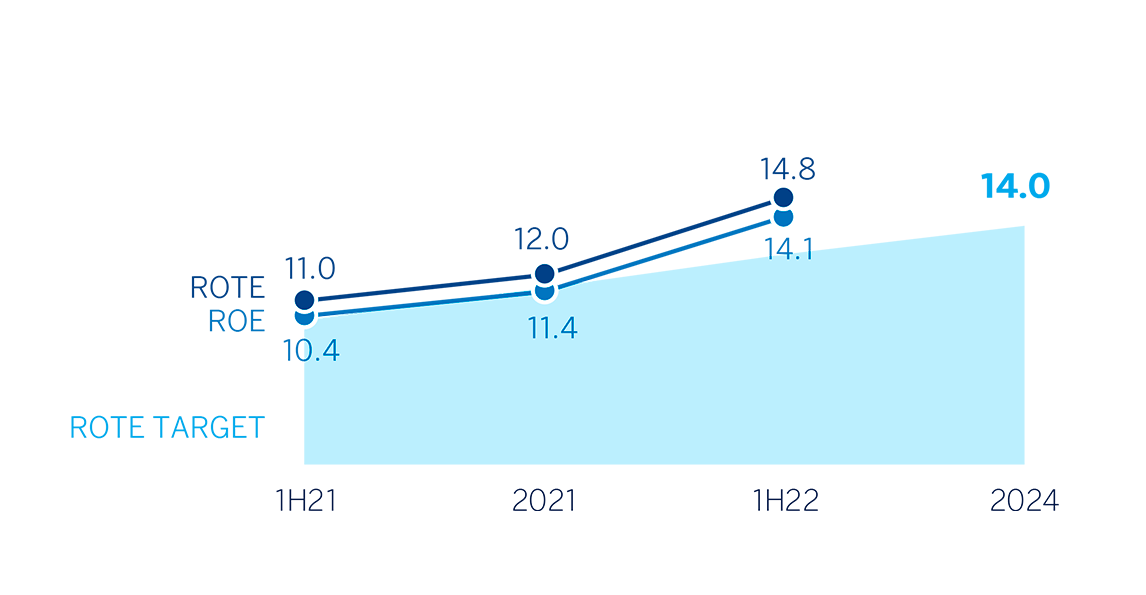

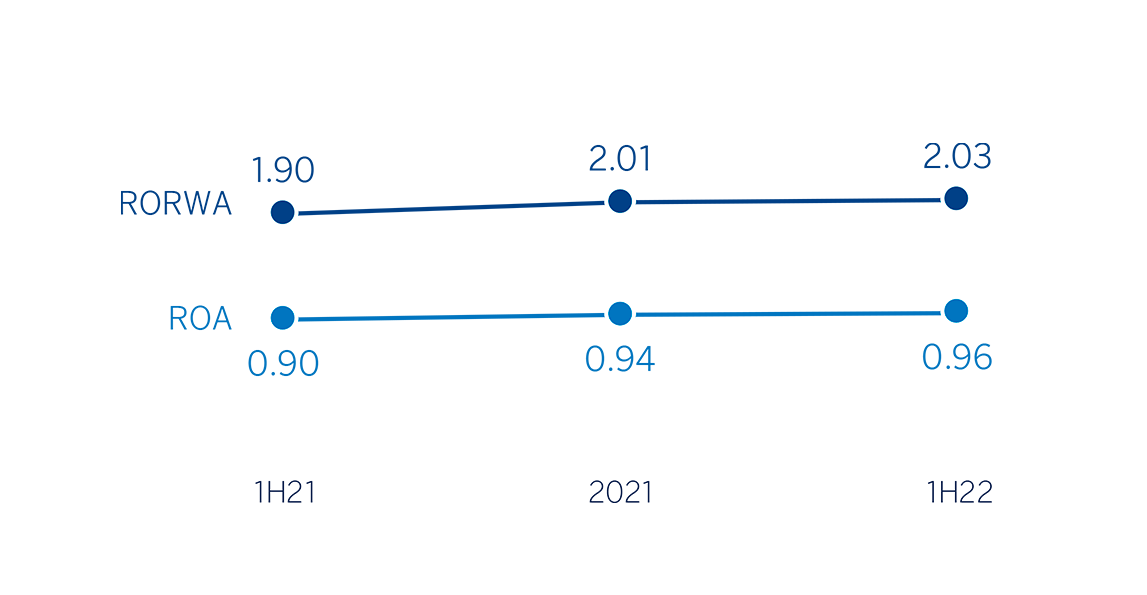

The Group’s profitability indicators improved in year on year terms, supported by the favorable performance of results.

ROE AND ROTE (1) (PERCENTAGE)

ROA AND RORWA (1) (PERCENTAGE)

(1) Excludes the net impact arisen from the purchase of offices in Spain in 1H22. Excludes BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 and the net cost related to the restructuring process for the periods 1H21 and 2021.

3 The Group's results for the first quarter of 2022 have been restated, reflecting the application to the Group's entities in Turkey of IAS 29, “Financial Reporting in Hyperinflationary Economies”. These results, already restated, can be seen in the table CONSOLIDATED INCOME STATEMENT: QUARTERLY EVOLUTION.