Solvency

Capital base

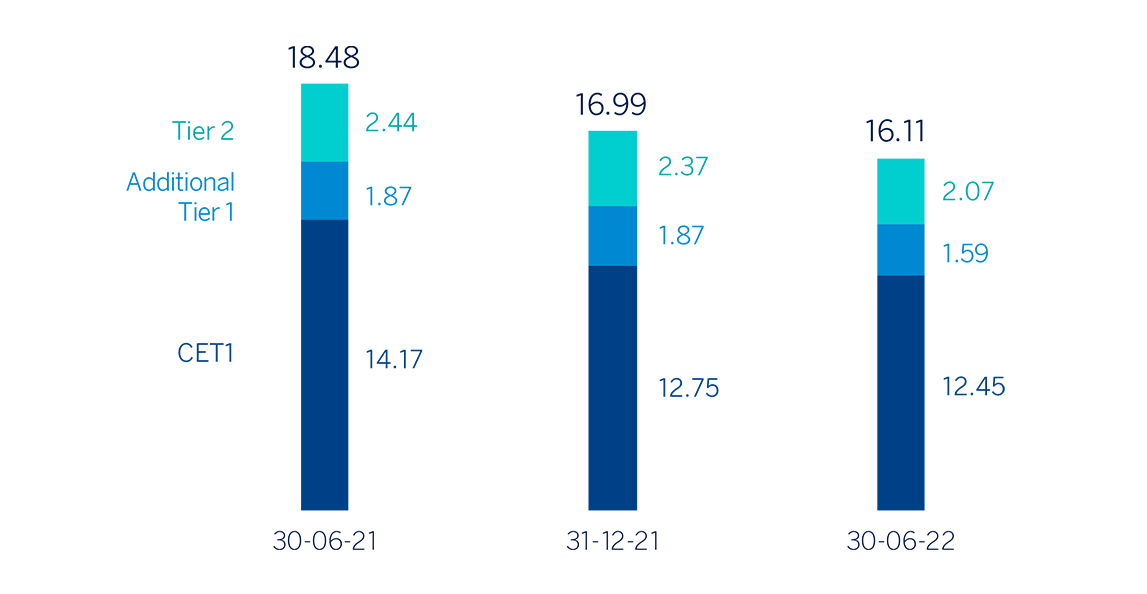

The Group's CET1 fully-loaded ratio stood at 12.45%4 as of June 30, 2022, maintaining a large management buffer over the Group's CET1 requirement (8.60%), and also above the Group's established target management range of 11.5-12% of CET1.

This ratio includes the effect of the operations carried out during the second quarter, with a combined impact of -30 basis points of CET1. These operations are the voluntary takeover bid for Garanti BBVA and the acquisition from Merlin of 100% of Tree, owner of 662 offices leased to BBVA.

Risk-weighted assets (RWA) fully-loaded increased approximately €14.5 billion euros in the quarter, mainly as a consequence of the organic capital generation and currency effect.

The consolidated fully-loaded additional Tier 1 capital (AT1) stood at 1.59% as of June 30, 2022, resulting in a -25 basis points decrease from the previous quarter. In this regard, on May 24, 2022, the Group early redeemed an issue of preferred shares eventually convertible into ordinary shares (CoCos) of BBVA, carried out on May 24, 2017, for a joint nominal amount of €500m. The impact of this amortization has been recorded in the second quarter of 2022, and has drawn down the fully loaded AT1 ratio by -15 basis points.

The consolidated fully-loaded Tier 2 ratio as of June 30, 2022 stood at 2.07%, a decrease of -10 basis points in the quarter. The total fully-loaded capital adequacy ratio stands at 16.11%.

Following the latest SREP (Supervisory Review and Evaluation Process) decision, received in February 2022 and with entry into force as from March 1, 2022, the ECB has informed the Group that the Pillar 2 requirement remains unchanged at 1.5% (of which at least 0.84% must be fulfilled with CET1). Therefore, BBVA must maintain a CET1 capital ratio of 8.60% and a total capital ratio of 12.76% at the consolidated level.

The phased-in CET1 ratio at the consolidated level stood at 12.56% as of June 30, 2022, considering the transitory effect of the IFRS 9 standard. AT1 reached 1.59% and Tier 2 reached 2.07%, resulting in a total capital adequacy ratio of 16.22%.

FULLY-LOADED CAPITAL RATIOS (PERCENTAGE)

CAPITAL BASE (MILLIONS OF EUROS)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 30-06-22 (1) (2) | 31-12-21 | 30-06-21 | 30-06-22 (1) (2) | 31-12-21 | 30-06-21 | |

| Common Equity Tier 1 (CET 1) | 41,555 | 39,949 | 43,903 | 41,173 | 39,184 | 43,306 |

| Tier 1 | 46,820 | 45,686 | 49,599 | 46,437 | 44,922 | 49,007 |

| Tier 2 | 6,833 | 7,383 | 7,688 | 6,832 | 7,283 | 7,466 |

| Total Capital (Tier 1 + Tier 2) | 53,653 | 53,069 | 57,287 | 53,269 | 52,205 | 56,473 |

| Risk-weighted assets | 330,819 | 307,795 | 305,599 | 330,589 | 307,335 | 305,543 |

| CET1 (%) | 12.56 | 12.98 | 14.37 | 12.45 | 12.75 | 14.17 |

| Tier 1 (%) | 14.15 | 14.84 | 16.23 | 14.05 | 14.62 | 16.04 |

| Tier 2 (%) | 2.07 | 2.40 | 2.52 | 2.07 | 2.37 | 2.44 |

| Total capital ratio (%) | 16.22 | 17.24 | 18.75 | 16.11 | 16.99 | 18.48 |

- (1) As of June 30, 2022, the difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS 9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR and the subsequent amendments introduced by the Regulation (EU) 2020/873).

- (2) Preliminary data.

Regarding shareholder remuneration, on April 8, 2022 and as approved by the Annual General Meeting held on March 18, 2022 in its second item of the agenda, a cash gross payment of €0.23 was made against voluntary reserves for each outstanding share of BBVA as an additional shareholder remuneration for the year 2021. Thus, the total amount of cash distributions for the year 2021 was €0.31 gross per share, the largest distribution in 10 years.

The total shareholder remuneration includes, in addition to the aforementioned cash payments, the extraordinary remuneration resulting from the execution of the program scheme for the buyback of own shares announced on October 29, 2021 up to a maximum amount of €3,500m.

After the effective redemption of the 281,218,710 treasury shares for a nominal amount of €137,797,167.90 acquired during the execution of the first tranche of the program scheme, BBVA's share capital has been set at €3,129,467,256.30, represented by 6,386,667,870 shares with a nominal value of €0.49 each.

In relation to the execution of the second tranche, on March 16, BBVA began the execution of its first segment of the second tranche, for a maximum amount of €1,000m or a maximum number of 356,551,306 shares. The execution of this segment ended on May 16, with the repurchase of a total of 206,554,498 shares for an amount of €1,000m.

Lastly, with regard to the program scheme for the buyback of shares on June 28, 2022, BBVA announced that it had agreed to execute the second segment for a maximum amount of 1,000 million euros and a maximum number of shares to be acquired of 149,996,808. As of June 30, 2022, BBVA's best estimate for this maximum amount is 610 million euros for the purpose of reducing BBVA's share capital, for a maximum amount of €1,000m and a maximum number of BBVA shares to be acquired of 149,996,808. As of June 30, 2022, BBVA's best estimate for this maximum amount is €610m. From July 1 to July 21, 2022, Citigroup Global Markets Europe AG, acting as lead manager for the Second Segment of the second tranche, has acquired 63,750,000 BBVA shares.

SHAREHOLDER STRUCTURE (30-06-22)

| Shareholders | Shares issued | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 500 | 334,912 | 40.8 | 62,899,496 | 1.0 |

| 501 to 5,000 | 380,195 | 46.3 | 676,839,209 | 10.6 |

| 5,001 to 10,000 | 57,109 | 7.0 | 402,543,605 | 6.3 |

| 10,001 to 50,000 | 44,420 | 5.4 | 850,276,426 | 13.3 |

| 50,001 to 100,000 | 3,159 | 0.4 | 215,009,771 | 3.4 |

| 100,001 to 500,000 | 1,454 | 0.2 | 263,184,961 | 4.1 |

| More than 500,001 | 288 | 0.04 | 3,915,914,402 | 61.3 |

| Total | 821,537 | 100 | 6,386,667,870 | 100 |

With regard to MREL (Minimum Requirement for own funds and Eligible Liabilities) requirements, BBVA must reach, by January 1, 2022, an amount of own funds and eligible liabilities equal to 21.46% of the total RWAs of its resolution group, at a sub-consolidated5 level (hereinafter, the "MREL in RWAs"). This MREL in RWA does not include the combined capital buffer requirement which, according to applicable regulations and supervisory criteria, would currently be 3.26%, and it is currently the most restrictive requirement for BBVA. Given the structure of own funds and admissible liabilities of the resolution group, as of June 30, 2022, the MREL ratio in RWAs stands at 26.28%6,7, complying with the aforementioned requirement.

With the aim of reinforcing compliance with these requirements, in January 2022, BBVA issued a €1,000m senior non-preferred bond, with a maturity of 7 years and the option for early redemption in the sixth year, with a coupon of 0.875% and in May 2022 a senior preferential double tranche for €1,250m at a fixed rate of 1.750% and €500m at a floating rate of 3-months Euribor plus 64 basis points (leaving a coupon of 3-months Euribor plus 100 basic points) at three years and a half, in addition to two private operations at two-year terms for €100m at a fixed 1% rate, in May, and €400m at the 3-months Euribor floating rate plus 70 basis points, in July, not being considered the last one in the MREL ratio as of June closing.

Lastly, as of June 30, 2022, the Group's fully-loaded leverage ratio stood at 6.2% (6.2% phased-in)8.

Ratings

During the first half of 2022, BBVA’s rating has continued to show its strength and all agencies have maintained their rating in the A category. In March, S&P changed the outlook of BBVA's rating from negative to stable (affirming the rating at A), after taking a similar action in the Spanish sovereign rating. Following annual reviews of BBVA, Fitch and DBRS Morningstar affirmed their ratings at A- (May) and A (high) (March), respectively, both with a stable outlook. For its part, Moody's has kept BBVA's rating unchanged in the semester at A3 (with a stable outlook). The following table shows the credit ratings and outlook assigned by the agencies:

Ratings

| Rating agency | Long term (1) | Short term | Outlook |

|---|---|---|---|

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s | A3 | P-2 | Stable |

| Standard & Poor’s | A | A-1 | Stable |

(1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating, respectively, to BBVA’s long term deposits.

4 This level of CET1 includes the deduction of the total amount of the share buyback program authorized by the supervisor for a maximum amount of €3,500m that were already registered as of December 2021.

5 In accordance with the resolution strategy MPE (“Multiple Point of Entry”) of the BBVA Group, established by the SRB, the resolution group is made up of Banco Bilbao Vizcaya

Argentaria, S.A. and subsidiaries that belong to the same European resolution group. As of June 30, 2021, the total RWAs of the resolution group amounted to €190,377m and the total exposure considered for the purpose of calculating the leverage ratio amounted to €452,275m.

6 Own resources and eligible liabilities to meet, both, MREL and the combined capital buffer requirement applicable.

7 As of June 30, 2022, the MREL ratio in Leverage Ratio stands at 10.25% and the subordination ratios in terms of RWAs and in terms of exposure of the leverage ratio, stand at 21.97% and 8.57%, respectively, being preliminary data.

8 The Group’s leverage ratio is provisional at the date of release of this report. On April, 1st 2022 ended the period of temporary exclusion of certain positions with the central banks.