Relevant events

Impact of the initial implementation of IFRS 9

- The figures corresponding to the first quarter of 2018 are prepared under IFRS 9, which entered into force on January 1, 2018. This new accounting standard does not require the comparative information under IFRS 9 for prior periods, so the corresponding quarters to the year 2017 have been prepared in accordance with the regulation in force at that time (IAS 39).

- The impacts derived from the first application of IFRS 9, as of January 1, 2018, have been registered with a charge to reserves, of approximately €900m, mainly due to the allocation of provisions based on expected losses, compared to the loss model incurred under the previous IAS 39.

- Reduction of 31 basis points in the fully-loaded CET1 ratio in December 2017.

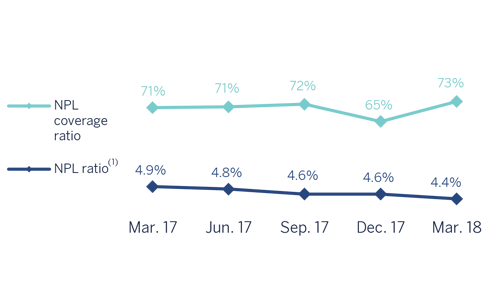

- In the risk metrics, there were very few changes in the exposure to non-performing risk with respect to Stage 3 (impaired loans); lending fell due to reclassification of portfolios; the NPL coverage ratio rose due to the increase in loan-loss provisions; and the NPL ratio rose as a result of the decline in lending mentioned above.

Results

- Generalized sustained growth in more recurrent sources of revenue in practically all geographic areas.

- Operating expenses remain under control, leading to an improvement in the efficiency ratio in comparison with the same period in 2017.

- Year-on-year reduction of impairment losses on financial assets not measured at fair value through profit or loss (hereinafter, "impairment losses on financial assets").

- As a result, the net attributable profit was €1,340m, 11.8% higher than the first quarter of 2017.

Net attributable profit (Million euros)

Net attributable profit breakdown (1) (Percentage. 1Q 2018)

(1) Excludes the Corporate Center.

(2) Includes the areas Banking activity in Spain and Non Core Real Estate.

Balance sheet and business activity

-

Loans and advances to customers (gross) continue to increase in emerging geographies but decline in Spain. The recovery that began in the second half of 2017 continues in the United States.

Non-performing loans continue to improve.

There was an increase in off-balance-sheet funds, mainly in mutual funds.

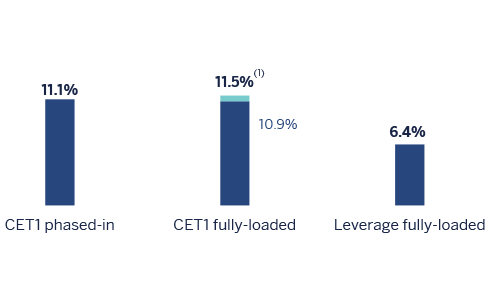

Solvency

- The capital position is above regulatory requirements.

- 13 basis points of fully-loaded CET1 were generated in the quarter, strongly supported by the earnings generated between January and March.

Capital and leverage ratios (Percentage as of 31-03-2018)

(1) Data pro-forma includes + 57 basis points of impacts from announced corporate transactions pending to be closed (sale of real-estate assets to Cerberus and BBVA Chile).

Risk management

- Good performance in the quarter of the main credit risk metrics: as of 31-March-2018, the NPL ratio closed at 4.4%, the NPL coverage ratio at 73% and the cumulative cost of risk at 0.85%.

NPL and NPL coverage ratios (Percentage)

Transformation

- The Group's digital and mobile customer base and digital sales continue to increase in all the geographic areas where BBVA operates.

Digital and mobile customers (Million)

Dividends

- On April 10th there was a cash payment of €0.15 gross per share, corresponding to the final dividend for 2017, approved by the General Shareholders' Meeting held on March 16, 2018.