The BBVA share

Global economic growth maintained a robust growth of approximately 3.6% in 2018, although slowed more than expected during the second half of 2018, due to both the poorer performance seen by retailers and the industrial sector along with a strong increase in financial tensions, especially in the developed economies, as a result of higher uncertainty. Poorer economic figures in Europe and China was accompanied by downwards trends in Asian countries and a cyclical deterioration in the United States. In this context, both the Federal Reserve (Fed) and the ECB have been more cautious and patient in the path towards monetary policy normalization and their decisions going forward will depend on the performance of the economy. The main short-term risk continues to be protectionism, not only because of the direct impact of the commercial channel, but also because its indirect effect on confidence and on financial volatility. Additionally, there are concerns about the intensity of the adjustment on economic activity during the following quarters, both in the United States and in China.

Most stock-market indices showed a downward trend during 2018. In Europe, the Stoxx 50 and the Euro Stoxx 50 fell by 13.1% and 14.3%, respectively. On the other hand, in Spain, the Ibex 35 lost 15.0% over the same period. Finally, in the United States the S&P 500 index fell 6.2% in the last twelve months, mainly due to the decline in the last quarter (down 14.0%).

In particular, the banking sector indices were notably more negative during 2018 than these general indices. The European Stoxx Banks index, which includes British banks, lost 28.0%, and the Eurozone bank index, the Euro Stoxx Banks, was down 33.3%, while in the United States the S&P Regional Banks index declined 20.5% in comparison at the close of 2017.

The BBVA share closed 2018 at €4.64, a fall of 34.8% for this year.

BBVA share evolution compared with European indices

(Base indice 100=31-12-17)

The BBVA share and share performance ratios

| 31-12-18 | 31-12-17 | |

|---|---|---|

| Number of shareholders | 902,708 | 891,453 |

| Number of shares issued | 6,667,886,580 | 6,667,886,580 |

| Daily average number of shares traded | 35,909,997 | 35,820,623 |

| Daily average trading (million euros) | 213 | 252 |

| Maximum price (euros) | 7.73 | 7.93 |

| Minimum price (euros) | 4.48 | 5.92 |

| Closing price (euros) | 4.64 | 7.11 |

| Book value per share (euros) | 7.12 | 6.96 |

| Tangible book value per share (euros) | 5.86 | 5.69 |

| Market capitalization (million euros) | 30,909 | 47,422 |

| Yield (dividend/price; %) (1) | 5.4 | 4.2 |

- (1) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

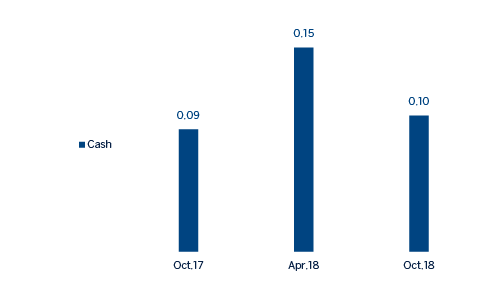

Regarding shareholder remuneration, on October 10, BBVA paid in cash a gross amount of €0.10 per share on account of the 2018 fiscal year. This payment is consistent with the shareholder remuneration policy announced by Relevant Event of February 1, 2017, that envisages, subject to the pertinent approvals by the corresponding corporate bodies, the payment of two dividends in cash, foreseeably on October and April of each year. It is expected to be proposed for the consideration of the competent governing bodies a cash payment in a gross amount of euro 0.16 per share to be paid in April 2019 as final dividend for 2018.

Shareholder remuneration

(Euros gross/share)

As of December 31, 2018, the number of BBVA shares remained at 6,668 million, and the number of shareholders was 902,708. By type of investor, residents in Spain held 44.82% of the share capital, while the remaining 55.18% was owned by non-resident shareholders.

Shareholder structure (31-12-2018)

| Numbers of shares |

Shareholders | Shares | ||

|---|---|---|---|---|

| Number | % | Number | % | |

| Up to 150 | 179,213 | 19.9 | 12,701,058 | 0.2 |

| 151 to 450 | 179,572 | 19.9 | 49,210,098 | 0.7 |

| 451 to 1,800 | 284,225 | 31.5 | 278,003,301 | 4.2 |

| 1,801 to 4,500 | 136,369 | 15.1 | 388,215,619 | 5.8 |

| 4,501 to 9,000 | 63,647 | 7.1 | 401.194.972 | 6.0 |

| 9,001 to 45,000 | 53,104 | 5.9 | 921,740,895 | 13.8 |

| More than 45,001 | 6,578 | 0.7 | 4,616,820,637 | 69.2 |

| Total | 902,708 | 100.0 | 6,667,886,580 | 100.0 |

BBVA shares are included on the main stock-market indices, including the Ibex 35, Euro Stoxx 50 and Stoxx 50, with a weighting of 7.0%, 1.4% and 0.9% respectively. They also form part of several sector indices, including the Euro Stoxx Banks, with a weighting of 8.3%, and the Stoxx Banks, with a weighting of 3.8%.

Finally, BBVA maintains a significant presence on a number of international sustainability indices or ESG (environmental, social and governance) indices, which evaluate the performance of companies in this area. In September 2018, BBVA joined the Dow Jones Sustainability Index (DJSI), benchmark in the market, which measures the performance of nearly 3,400 listed companies in environmental, social and corporate governance matters. Among the aspects most valued in BBVA's analysis are the fiscal strategy, the information security and cybersecurity policies, the management of environmental risks and opportunities, financial inclusion and, above all, Pledge 2025 announced this year (see responsible banking section).

Main sustainability indices on which BBVA is listed as of 31-12-2018

AAA Rating

Listed on the FTSE4Good Global Index Series

Listed on the Euronext Vigeo Eurozone 120 and Europe 120

Listed on the Ethibel Sustainability Excellence Europe and Eithebel Sustainability Excellence Global indices

In 2018, BBVA obtained a “B” rating

(1) The inclusion of BBVA in any MSCI index, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement or promotion of BBVA by MSCI or any of its affiliates. The MSCI indices are the exclusive property of MSCI. MSCI and the MSCI index names and logos are trademarks or service marks of MSCI or its affiliates.