Relevant events

Results

- Generalized growth in the more recurring revenue items for almost all business areas.

- Containment trend in operating expenses, whose performance is affected by exchange rates trends.

- Lower amount of impairment on financial assets not measured at fair value through profit or loss (hereinafter, "impairment on financial assets") affected by the negative impact of the recognition in the fourth quarter of 2017 of impairment losses, amounting €1,123m from BBVA’s stake in Telefónica, S.A.

- The financial statements of the Group for 2018 include, on one hand, the negative impact derived from the accounting for hyperinflation in Argentina (-€266m) in the net attributable profit, and on the other hand, the positive impact on equity of €129m.

- The result of corporate operations amounted to €633m and includes the capital gains (net of taxes) arising from the sale of BBVA's equity stake in BBVA Chile.

- The net attributable profit was €5,324m, 51.3% higher than in 2017.

- Net attributable profit excluding results from corporate operations stood at €4,691m, up 33.3% higher than the result reached in 2017.

Net attributable profit (Million of Euros)

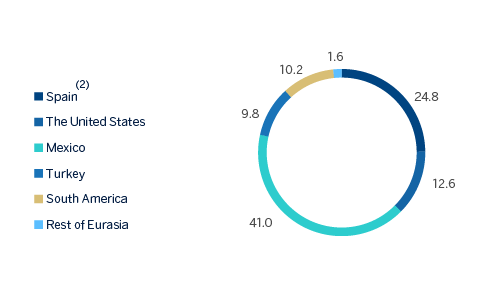

Net attributable profit breakdown (1) (Percentage. 2018)

(1) Excludes the Corporate Center.

(2) Includes the areas Banking activity in Spain and Non Core Real Estate.

Balance sheet and business activity

- Lower volume of loans and advances to customers (gross); however, by business areas, in the United States, Mexico, South America (excluding BBVA Chile) and Rest of Eurasia volumes increased.

- Non-performing loans continue to reduce in 2018.

- Within off-balance-sheet funds, mutual funds continue to perform positively.

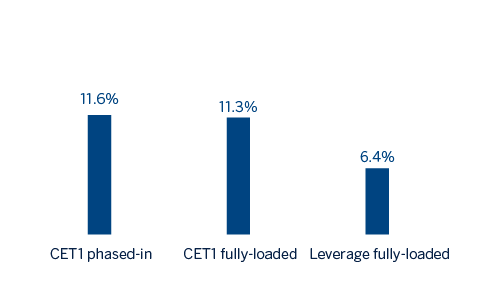

Solvency

- The capital position is above regulatory requirements.

- BBVA has once again excelled in EU-wide bank stress tests thanks to its resilience in the face of potential economic shocks. According to the exercise results, under the adverse scenario, BBVA is the second bank among its European peers with lower negative impact in CET1 fully-loaded capital ratio and one of the few banks with the ability to generate an accumulated profit in the three-year period under analysis (2018, 2019, and 2020), under this scenario.

Capital and leverage ratios (Percentage as of 31-12-18)

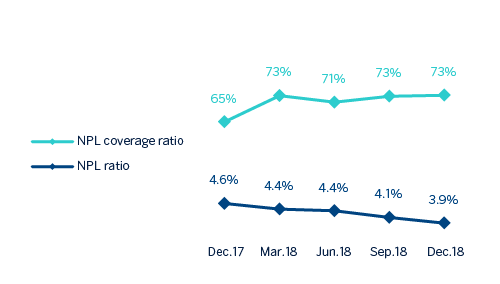

Risk management

- Solid indicators of the main credit-risk metrics: as of 31-December-2018, the NPL ratio closed at 3.9%, the NPL coverage ratio at 73% and the cumulative cost of risk at 1.01%.

NPL and NPL coverage ratios (Percentage)

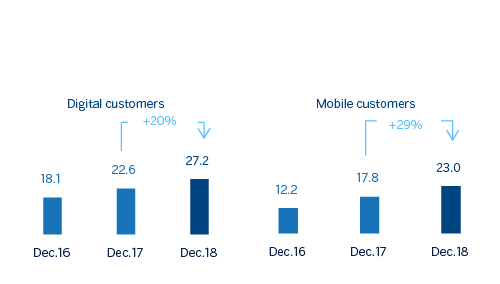

Transformation

- The Group's digital and mobile customer base and digital sales continue to increase in all the geographic areas where BBVA operates with a positive impact in efficiency.

Digital and mobile customers (Millions)

Appointments

- BBVA’s Board of Directors, in its meeting held on December 20, 2018, approved the succession plans for the Group Executive Chairman and for the Chief Executive Office and appointed Carlos Torres Vila as Executive Chairman of BBVA, replacing Francisco González Rodríguez and Onur Genç as member of the Board of Directors and as Chief Executive Officer of BBVA. The Board of Directors also approved organisational changes, which involve changes at the senior management level of BBVA Group. On December, 21st, BBVA received the required administrative authorisations to give full effect to the resolutions approved.

Other matters of interest

- On December, 26th, BBVA reached an agreement with Voyager Investing UK Limited Partnership, an entity managed by Canada Pension Plan Investment Board (“CPPIB”) for the transfer of a credit portfolio mainly composed by non-performing and defaulted mortgage loans. The closing of the Transaction will be completed as soon as the relevant conditions are fulfilled, which is expected to occur within the second quarter of 2019. In addition, it is expected that the impact in the Group’s attributable profit, which is currently expected to be positive by €150m, net of taxes and other adjustments, and the impact in the Common Equity Tier 1 (fully-loaded), which is expected to be slightly positive.

- Impact of the initial implementation of IFRS 9: The figures corresponding to 2018 are prepared under International Financial Reporting Standard 9 (IFRS 9), which entered into force on January 1, 2018. This new accounting standard did not require the restatement of comparative information from prior periods, so the comparative figures shown for the year 2017 have been prepared in accordance with the IAS 39 (International Accounting Standard 39) regulation applicable at that time. The impacts derived from the first application of IFRS 9, as of January 1, 2018, were registered with a charge to reserves of approximately €900m (net of fiscal effect) mainly due to the allocation of provisions based on expected losses, compared to the model of losses incurred under the previous IAS 39.

In capital, the impact derived from the first application of IFRS 9 has been a reduction of 31 basis points with respect to the fully-loaded CET1 ratio of December 2017. - IFRS 16 came into effect on January 1, 2019, a standard on leases introduces a single lessee accounting model and will require lessees to recognize assets and liabilities of all lease contracts. The main impact in the Group is the recognition of the right-of-use assets and lease liabilities in an approximate amount of €3,600m mainly coming from the Group’s activity in Spain and lease of premises of its branch network. The estimated impact in terms of capital for the Group amounts to approximately -12 basis points in terms of CET1.

- Banco Bilbao Vizcaya Argentaria, S.A. (“BBVA, S.A.”) stand-alone financial statements: BBVA has estimated that, mainly due to the depreciation of the Turkish lira, there is an impairment of its participation in Garanti Bank that only affects the stand-alone financial statements of BBVA, S.A. For this reason, a negative adjustment for a net amount of €1,517m has been registered in the income statement of BBVA, S.A. for the year 2018. Total equity for BBVA, S.A. as of December 31, 2018 has decreased by this same amount. The impact on the fully-loaded CET1 capital ratio of BBVA, S.A. is approximately -10 basis points.

It is important to note that the recognition of this accounting impact in the stand-alone financial statements of BBVA, S.A. does not generate any impact on the Consolidated Group (neither on the attributed profit, total equity or capital ratios), it does not generate any additional cash outflow and will not affect the proposal of a dividend distribution to shareholders.