Balance sheet and business activity

The most relevant aspects of the Group’s balance sheet and business activity as of March 31, 2019 is summarized below:

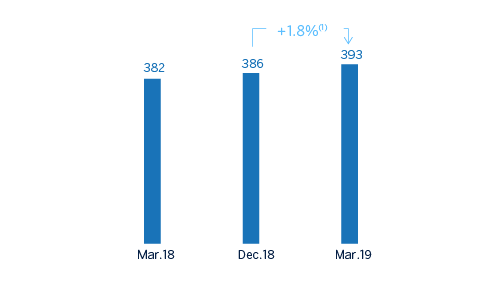

- Loans and advances to customers (gross) registered a growth of 1.8% in the quarter (up 1.4% at constant exchange rates), in all business areas, especially in Turkey, South America and Rest of Eurasia.

- Non-performing loans continued to decrease year-on-year (down 11.4%), thanks to the positive performance showed, especially in Spain and, to a lesser extent, Rest of Eurasia. However, there was a slight rebound of 1.2% in the quarter due to increases in the United States, Turkey and, to a lesser extent, South America.

- In terms of customer deposits, time deposits decreased by 3.3% in the quarter (down 12.6% year-on-year), offset by an increase of 2.7% in demand deposits in the quarter (up 10.7% year-on-year), particularly in Spain and, to a lesser extent, the United States.

- Within off-balance-sheet funds, both investment funds and pension funds showed a positive trend in this quarter.

- In tangible assets, the balance as of March 31, 2019 is affected by the impact of the implementation of IFRS 16 “Leases”, which entails an increase of 44.0% compared to the end of the previous fiscal year.

Consolidated balance sheet (Millions of euros)

| 31-03-19 | ∆% | 31-12-18 | 31-03-18 | |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 50,059 | (14.0) | 58,196 | 43,167 |

| Financial assets held for trading | 92,366 | 2.5 | 90,117 | 94,745 |

| Non-trading financial assets mandatorily at fair value through profit or loss | 5,535 | 7.8 | 5,135 | 4,360 |

| Financial assets designated at fair value through profit or loss | 1,311 | (0.2) | 1,313 | 1,330 |

| Financial assets at fair value through accumulated other comprehensive income | 60,204 | 6.9 | 56,337 | 59,212 |

| Financial assets at amortized cost | 433,008 | 3.2 | 419,660 | 417,646 |

| Loans and advances to central banks and credit institutions | 15,787 | 20.5 | 13,103 | 17,751 |

| Loans and advances to customers | 380,799 | 1.8 | 374,027 | 367,986 |

| Debt securities | 36,421 | 12.0 | 32,530 | 31,909 |

| Investments in subsidiaries, joint ventures and associates | 1,587 | 0.6 | 1,578 | 1,395 |

| Tangible assets | 10,408 | 44.0 | 7,229 | 7,238 |

| Intangible assets | 8,383 | 0.8 | 8,314 | 8,203 |

| Other assets | 28,338 | (1.6) | 28,809 | 48,392 |

| Total assets | 691,200 | 2.1 | 676,689 | 685,688 |

| Financial liabilities held for trading | 80,818 | 0.1 | 80,774 | 86,767 |

| Other financial liabilities designated at fair value through profit or loss | 7,846 | 12.2 | 6,993 | 6,075 |

| Financial liabilities at amortized cost | 520,464 | 2.2 | 509,185 | 497,298 |

| Deposits from central banks and credit institutions | 64,427 | 8.7 | 59,259 | 63,031 |

| Deposits from customers | 378,527 | 0.7 | 375,970 | 360,213 |

| Debt certificates | 62,365 | 2.1 | 61,112 | 60,866 |

| Other financial liabilities | 15,144 | 17.9 | 12,844 | 13,188 |

| Liabilities under insurance contracts | 10,577 | 7.6 | 9,834 | 9,624 |

| Other liabilities | 17,948 | 5.4 | 17,029 | 33,881 |

| Total liabilities | 637,653 | 2.2 | 623,814 | 633,645 |

| Non-controlling interests | 5,718 | (0.8) | 5,764 | 6,665 |

| Accumulated other comprehensive income | (6,656) | (7.8) | (7,215) | (6,195) |

| Shareholders’ funds | 54,485 | 0.3 | 54,326 | 51,573 |

| Total equity | 53,547 | 1.3 | 52,874 | 52,043 |

| Total liabilities and equity | 691,200 | 2.1 | 676,689 | 685,688 |

| Memorandum item: | ||||

| Guarantees given | 46,406 | (2.3) | 47,574 | 47,519 |

- General note: the application of accounting for hyperinflation in Argentina was performed for the first time in September 2018 with accounting effects on January 1, 2018, recording the impact of the nine months in the third quarter. In order to make the 2019 information comparable to 2018, the balance sheet of the first three quarters of 2018 has been reexpressed to reflect the impacts of inflation on its assets and liabilities.

Loans and advances to customers (Millions of euros)

| 31-03-19 | ∆% | 31-12-18 | 31-03-18 | |

|---|---|---|---|---|

| Public sector | 29,138 | 2.2 | 28,504 | 28,176 |

| Individuals | 171,947 | 0.8 | 170,501 | 169,541 |

| Mortgages | 111,772 | 0.2 | 111,528 | 112,979 |

| Consumer | 36,159 | 3.5 | 34,939 | 33,335 |

| Credit cards | 13,644 | 1.0 | 13,507 | 13,263 |

| Other loans | 10,371 | (1.5) | 10,527 | 9,963 |

| Business | 175,678 | 2.8 | 170,872 | 165,398 |

| Non-performing loans | 16,559 | 1.3 | 16,348 | 18,569 |

| Loans and advances to customers (gross) | 393,321 | 1.8 | 386,225 | 381,683 |

| Loan-loss provisions | (12,522) | 2.7 | (12,199) | (13,697) |

| Loans and advances to customers | 380,799 | 1.8 | 374,027 | 367,986 |

Loans and advances to customers (gross)

(Billions of euros)

(1) At constant exchange rates: +1.4%.

Customer funds

(Billions of euros)

(1) At constant exchange rates: +1.1%.

Customer funds

(Millions of euros)

| 31-03-19 | ∆% | 31-12-18 | 31-03-18 | |

|---|---|---|---|---|

| Deposits from customers | 378,527 | 0.7 | 375,970 | 360,213 |

| Of which current accounts | 267,614 | 2.7 | 260,573 | 239,360 |

| Of which time deposits | 104,698 | (3.3) | 108,313 | 113,469 |

| Other customer funds | 103,227 | 5.2 | 98,150 | 98,900 |

| Mutual funds and investment companies | 64,928 | 5.8 | 61,393 | 62,819 |

| Pension funds | 35,071 | 3.7 | 33,807 | 33,604 |

| Other off-balance sheet funds | 3,228 | 9.5 | 2,949 | 2,477 |

| Total customer funds | 481,754 | 1.6 | 474,120 | 459,113 |