Relevant events

Results

- In the first quarter of 2019, the overall growth of recurring income is maintained, with a positive evolution in terms of net interest income in most business areas.

- The trend of containing operating expenses and improving the efficiency ratio compared to the same period of the previous year continues.

- Higher impairment losses on financial assets (up 24.4% year-on-year), mainly as a result of the higher reserve requirements due to the impairment of specific portfolios and the updating of the macroeconomic scenarios in the United States and Turkey, were not offset by the lower needs in Spain. Nevertheless, the impairment on financial assets decreased by 24.3% compared to the last quarter of 2018.

- As a result, the net attributable profit was €1,164 million, 9.8% less than in the same period of the previous year.

Net attributable profit (Millions of euros)

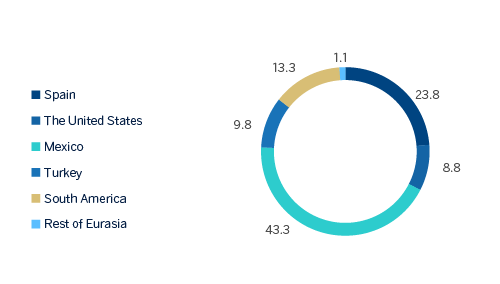

Net attributable profit breakdown (1) (Percentage. 1Q19)

(1) Excludes the Corporate Center.

Balance sheet and business activity

- As of March 31, 2019, the number of loans and advances to customers (gross) recorded a 1.8% growth with respect to December 31, 2018, with improved levels of activity in all business areas.

- Within off-balance-sheet funds, good development of investment funds and pension funds in the quarter.

Solvency

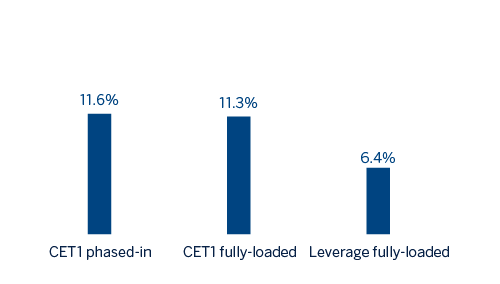

- Capital position above regulatory requirements, with a fully-loaded CET1 ratio at 11.3%, similar to the level at the end of December 2018, which absorbs the 11 basis points impact as a result of the implementation of IFRS 16 on January 1, 2019.

Capital and leverage ratios (Percentage as of 31-03-19)

Risk management

- Although the Non-performing loans showed a slight rebound in the quarter (up 1.2%), the indicators of the main credit risk metrics remain solid: as of March 31,2019, the NPL stood at 3.9%, coverage at 74% and the accumulated cost of risk at 1.06%.

NPL and NPL coverage ratios (Percentage)

Digital customers

- The Group's digital and mobile customer base and digital sales continue to increase in all the geographic areas where BBVA operates with a positive impact on efficiency.

Digital and mobile customers (Millions)

Dividends

- On April 10, 2019, there was a gross cash payment of €0.16 per share, corresponding to the supplementary dividend for 2018 that was approved at the General Shareholders' Meeting held on March 15.

Other matters of interest

- IFRS 16 'Leases' came into effect on January 1, 2019, a standard on leases that introduces a single lessee accounting model and will require lessees to recognize assets and liabilities of all lease contracts. The main impacts on the Group are the recognition of assets by right-of-use and liabilities per lease, amounting to €3,419m and €3,472m, respectively, and the above stated impact in terms of capital, both as of the effective date.

- In 2019, the balance sheets, income statements and ratios of the first three quarters of 2018 have been reexpressed for the Group and the business area of South America to reflect the impacts derived from the hyperinflation in Argentina as a result of the application of IAS 29 on the income and expenses as well as the assets and liabilities, in order to make the financial information of 2019 comparable to the one of 2018. This is due to the impact been registered for the first time in the third quarter 2018, with accounting effects as from January 1, 2018.